We look at the implications a various European central bank meetings this week, for currency strategy.

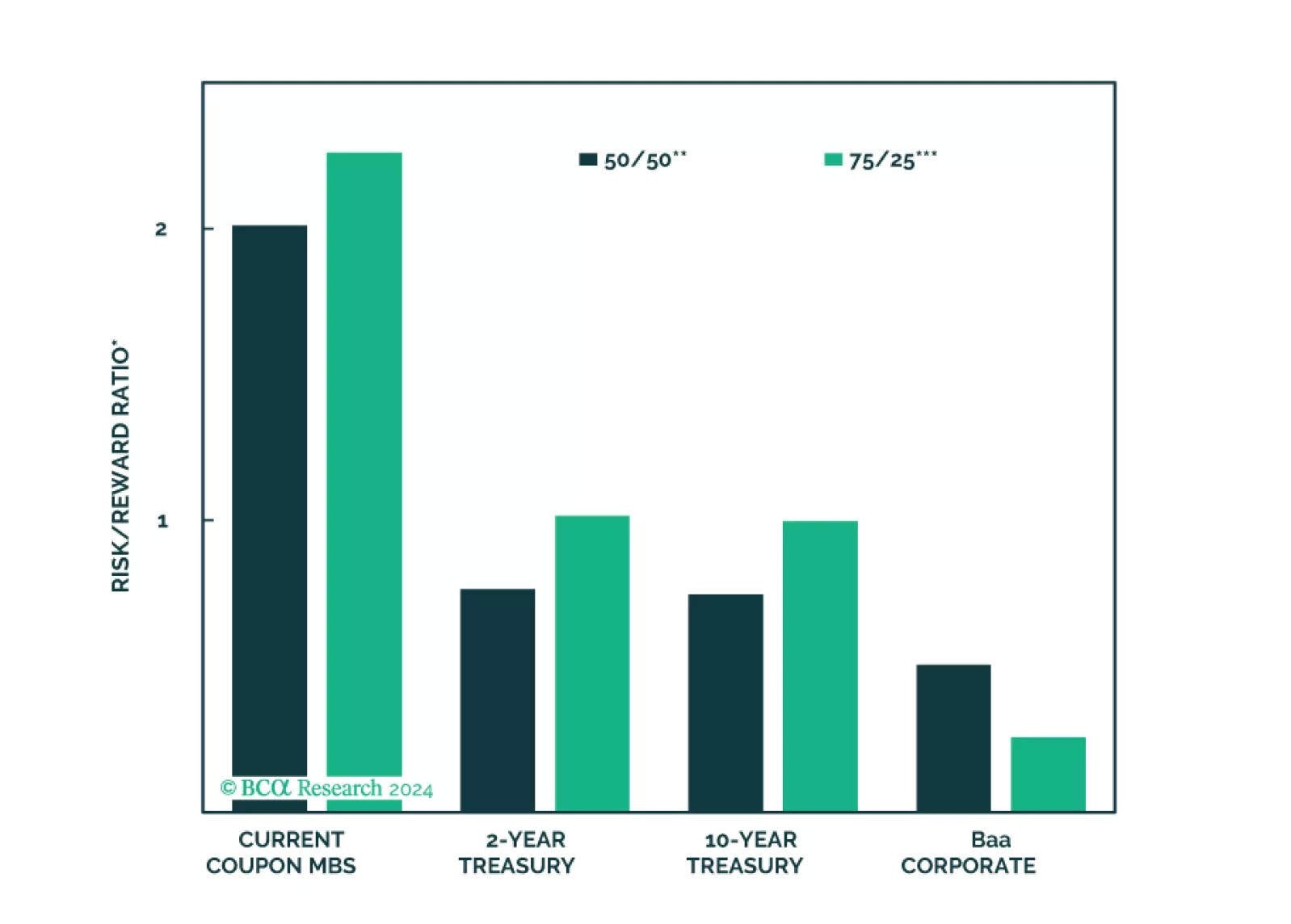

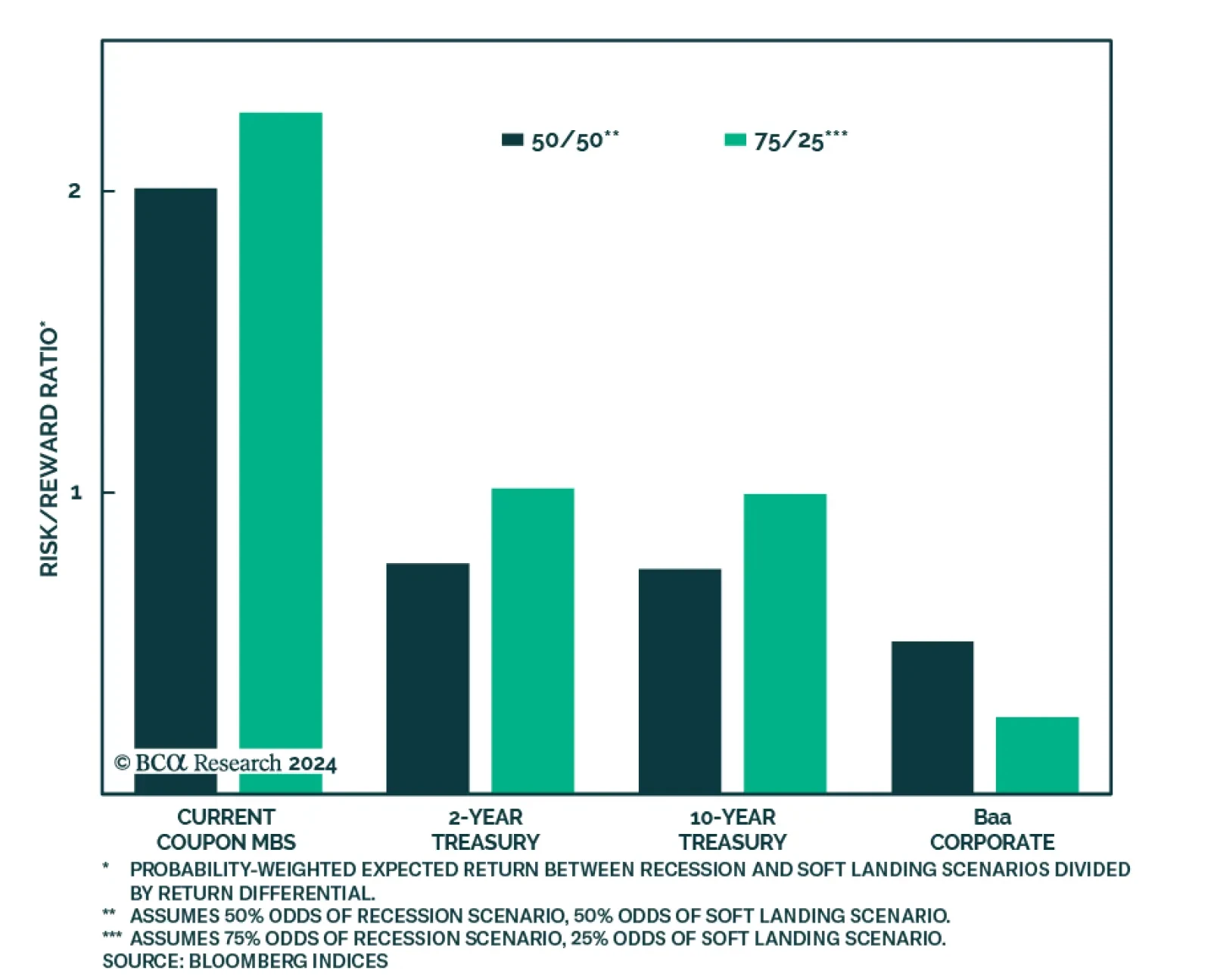

In its latest Special Report, BCA Research’s US Bond Strategy service considers the relative merits of four different fixed income investments in the current economic environment: 2-year Treasuries, 10-year Treasuries, Baa-…

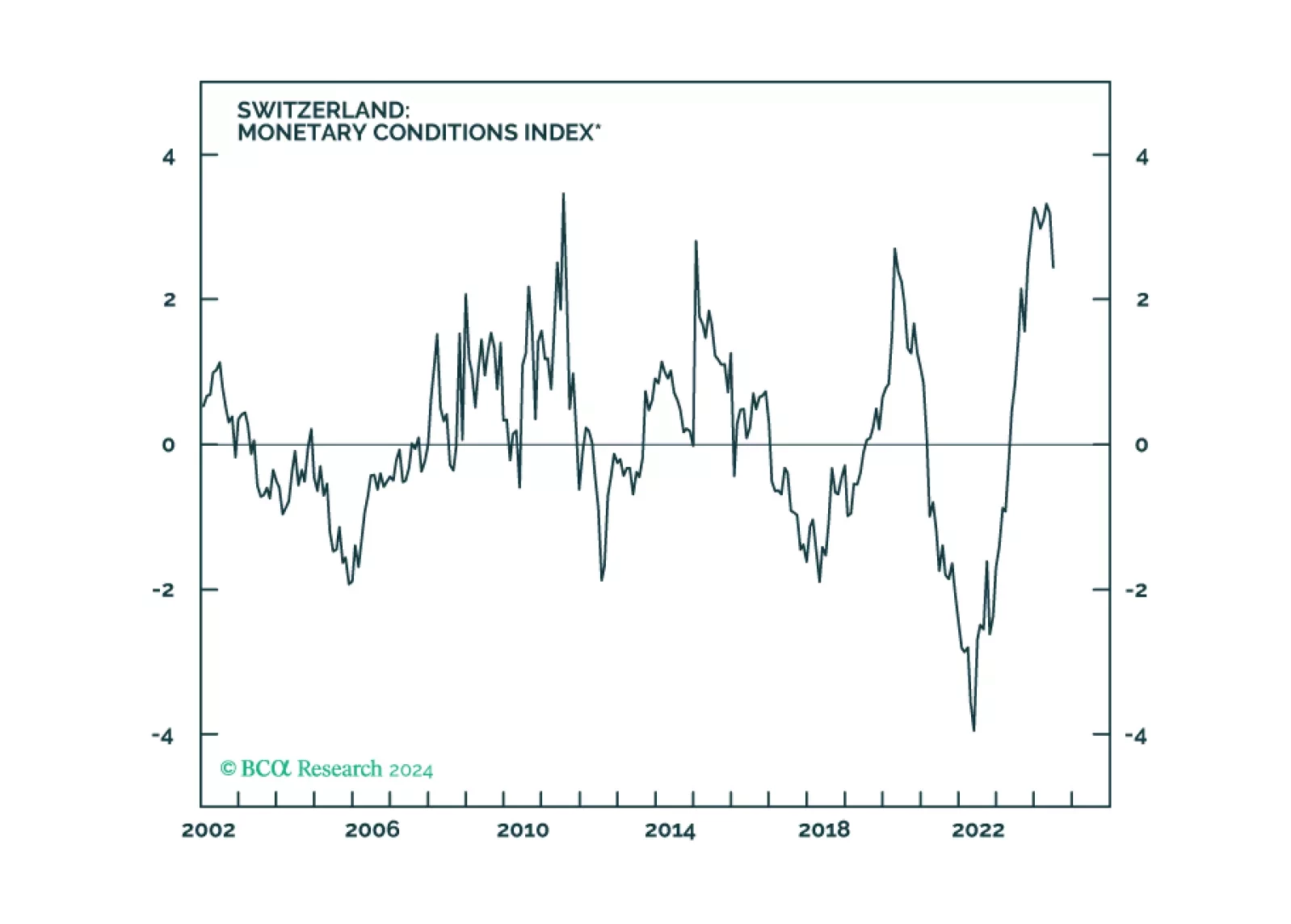

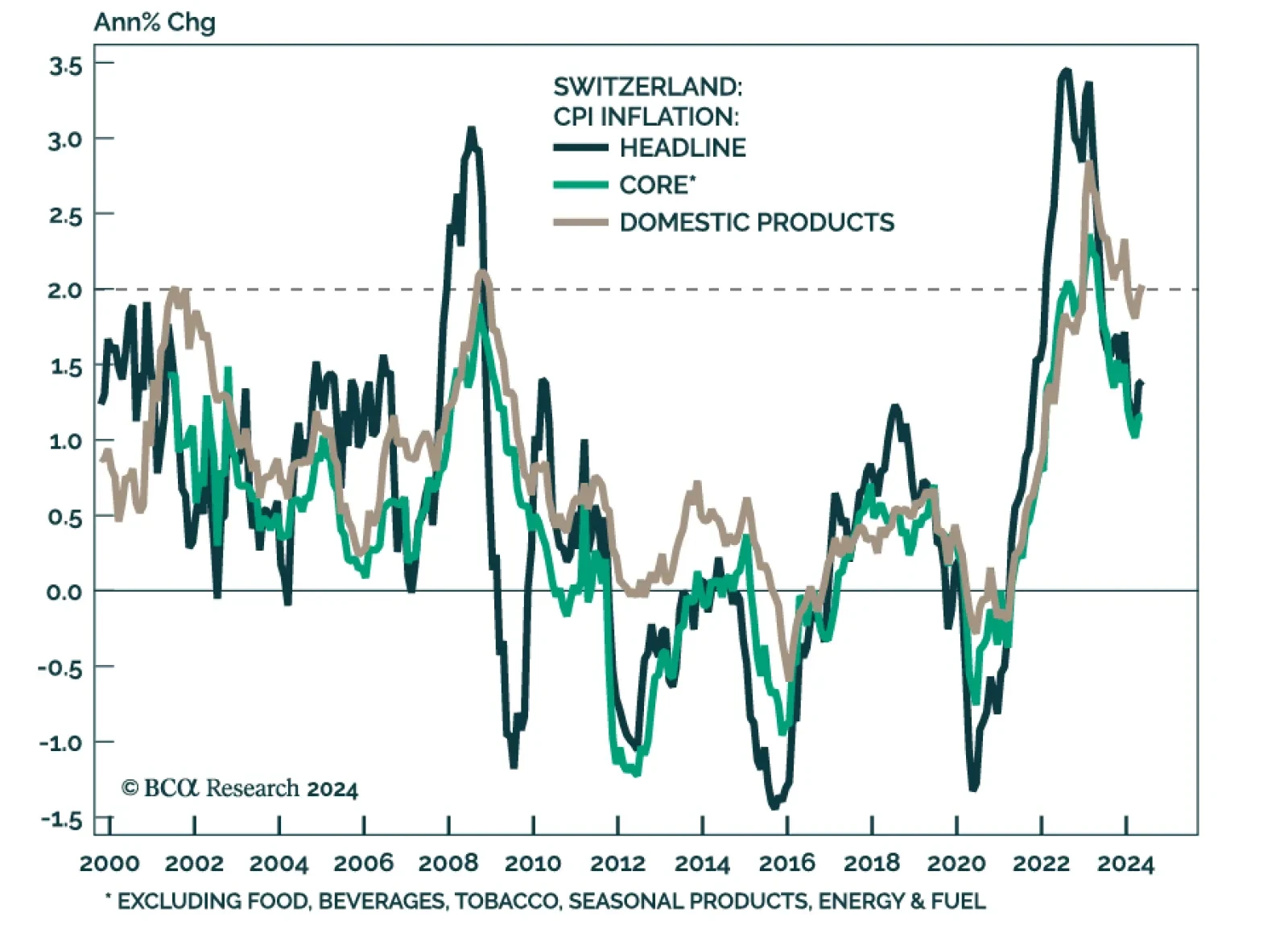

The Swiss National Bank (SNB) was the first major central bank to embark on a dovish pivot back in March. It lowered borrowing costs Thursday for a second consecutive meeting, from 1.5% to 1.25%, despite expectations that…

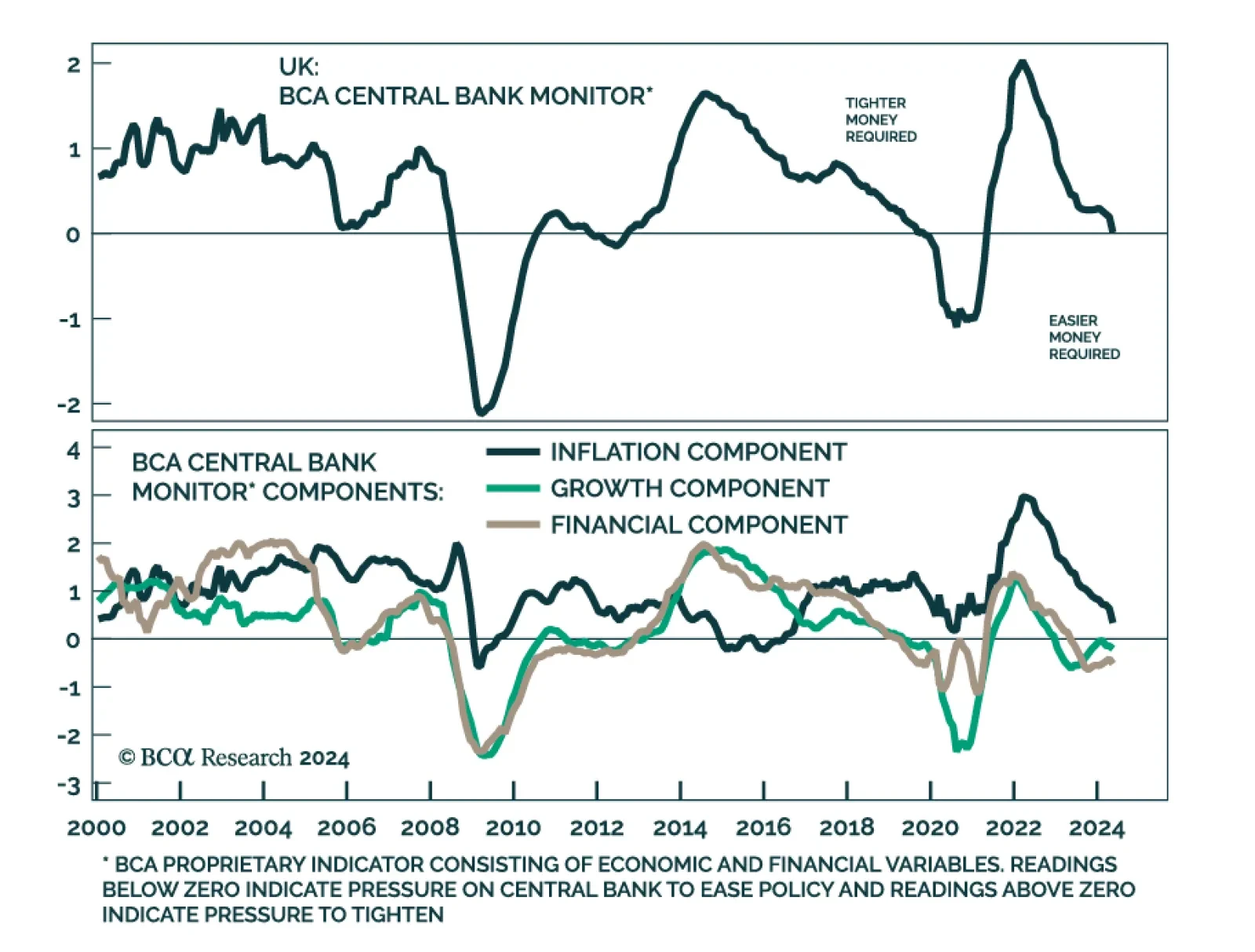

In a widely expected move, the Bank of England (BoE) kept its policy rate unchanged at 5.25% in June. Although MPC members voted seven-to-two in favor of not cutting rates, a tweak in communication noting that the decision was…

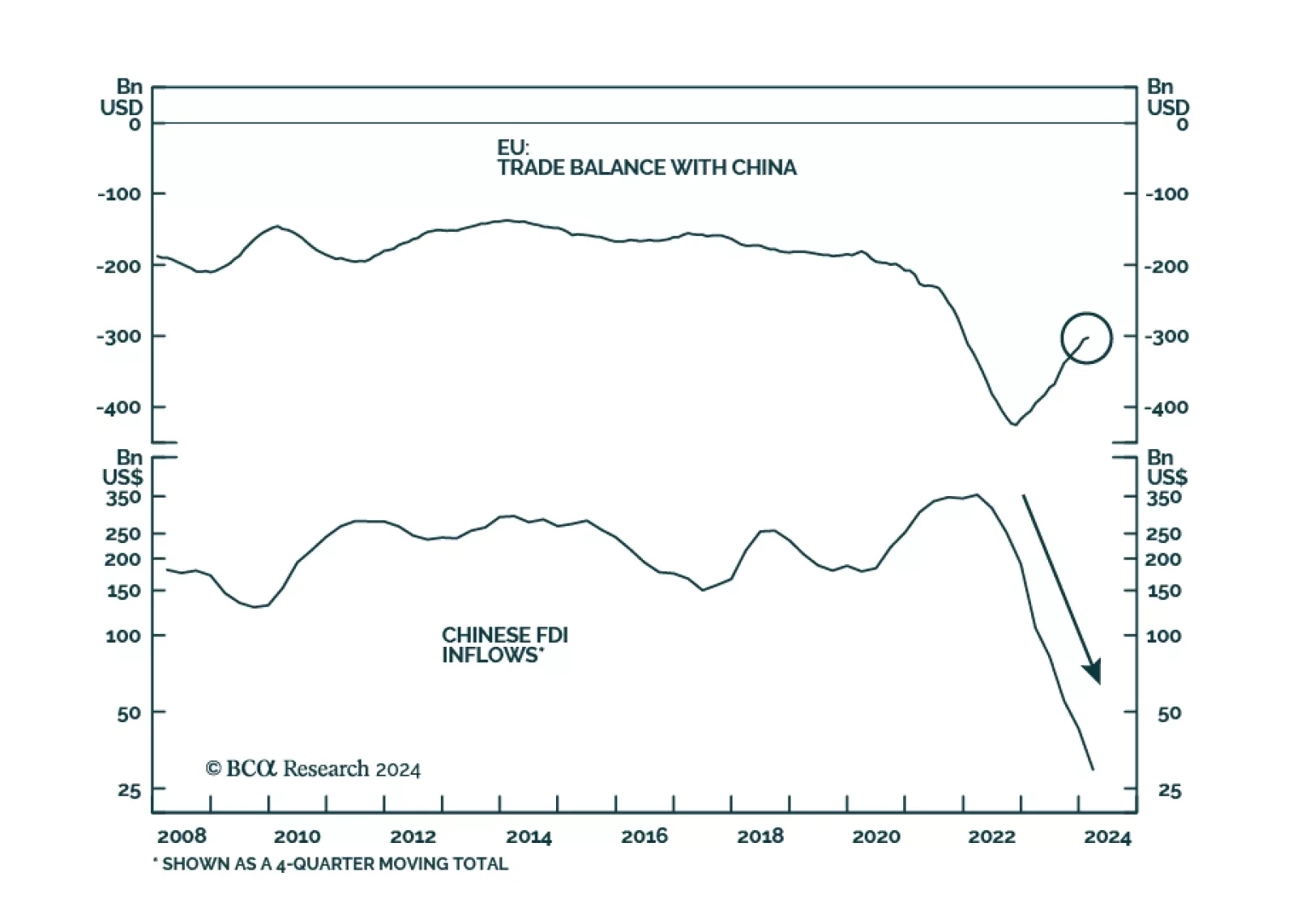

According to BCA Research’s China Investment Strategy service, Beijing will engage in ongoing negotiations with the EU regarding its import tax decision rather than impose meaningful retaliatory measures. The EU and…

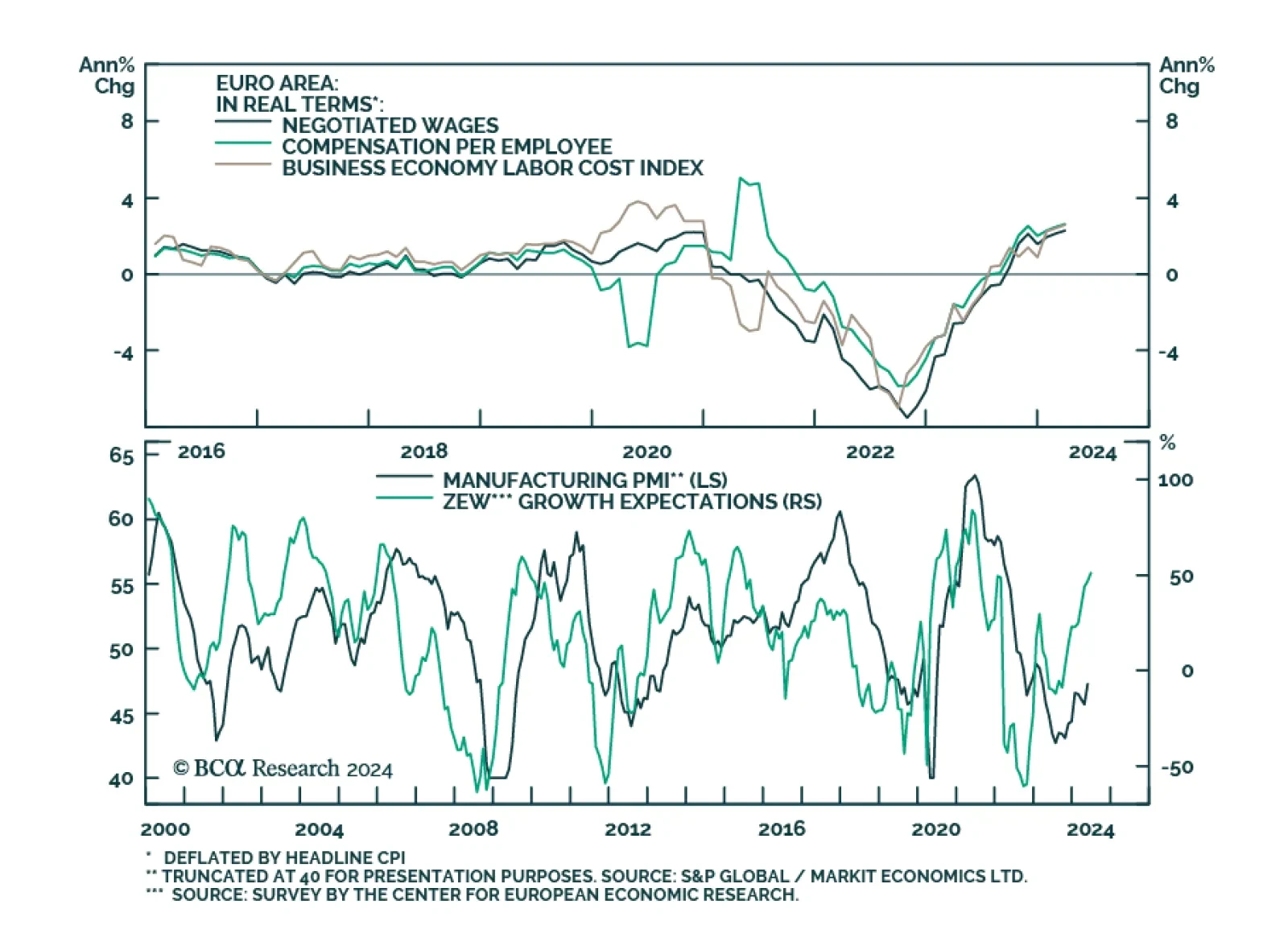

The ECB delivered its first rate cut in June, moderating the degree of restriction rather than pivoting outright to easy monetary policy settings. Indeed, the rate cut was accompanied by an upward revision of inflation and growth…

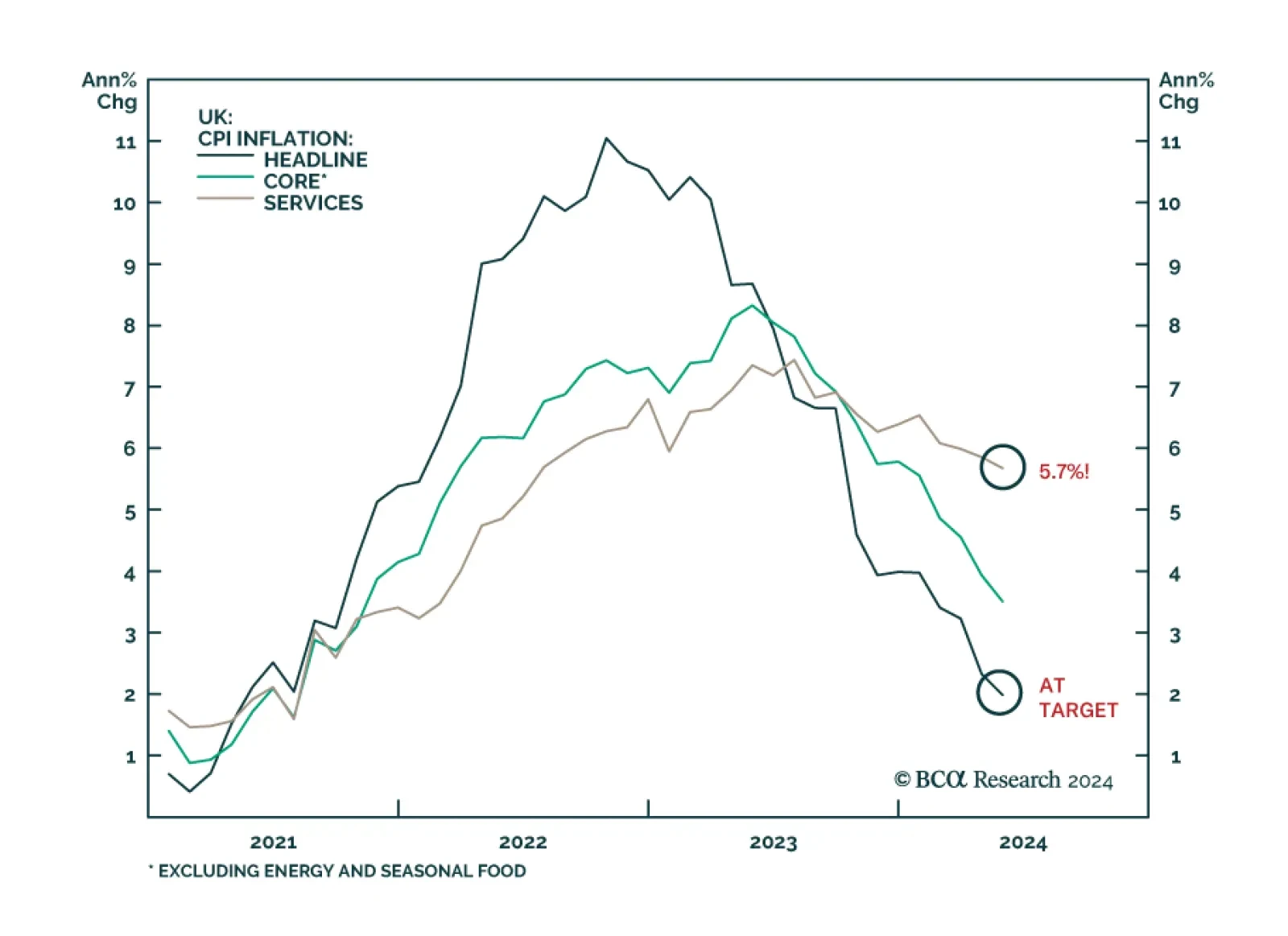

On the surface, UK inflation appears to be on the right track. The May CPI release came in broadly within expectations. Headline inflation eased from 2.3%y/y to 2.0%y/y – directly on the BoE’s target for the first…

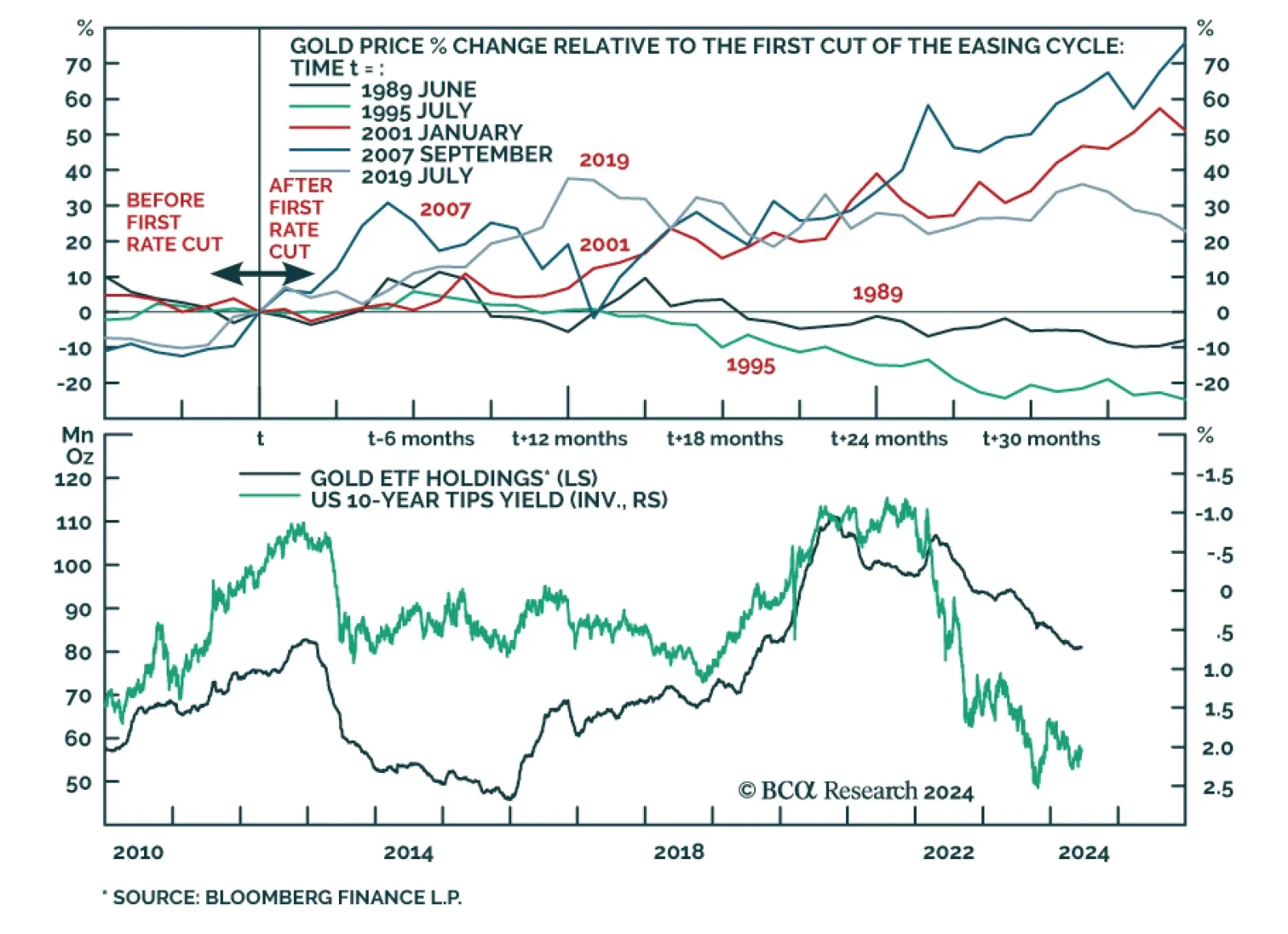

According to BCA Research’s Commodity & Energy Strategy service, a Fed pivot to rate cuts will provide gold prices with a tailwind. At first blush, the historical evidence is mixed. While gold rallied in the three…