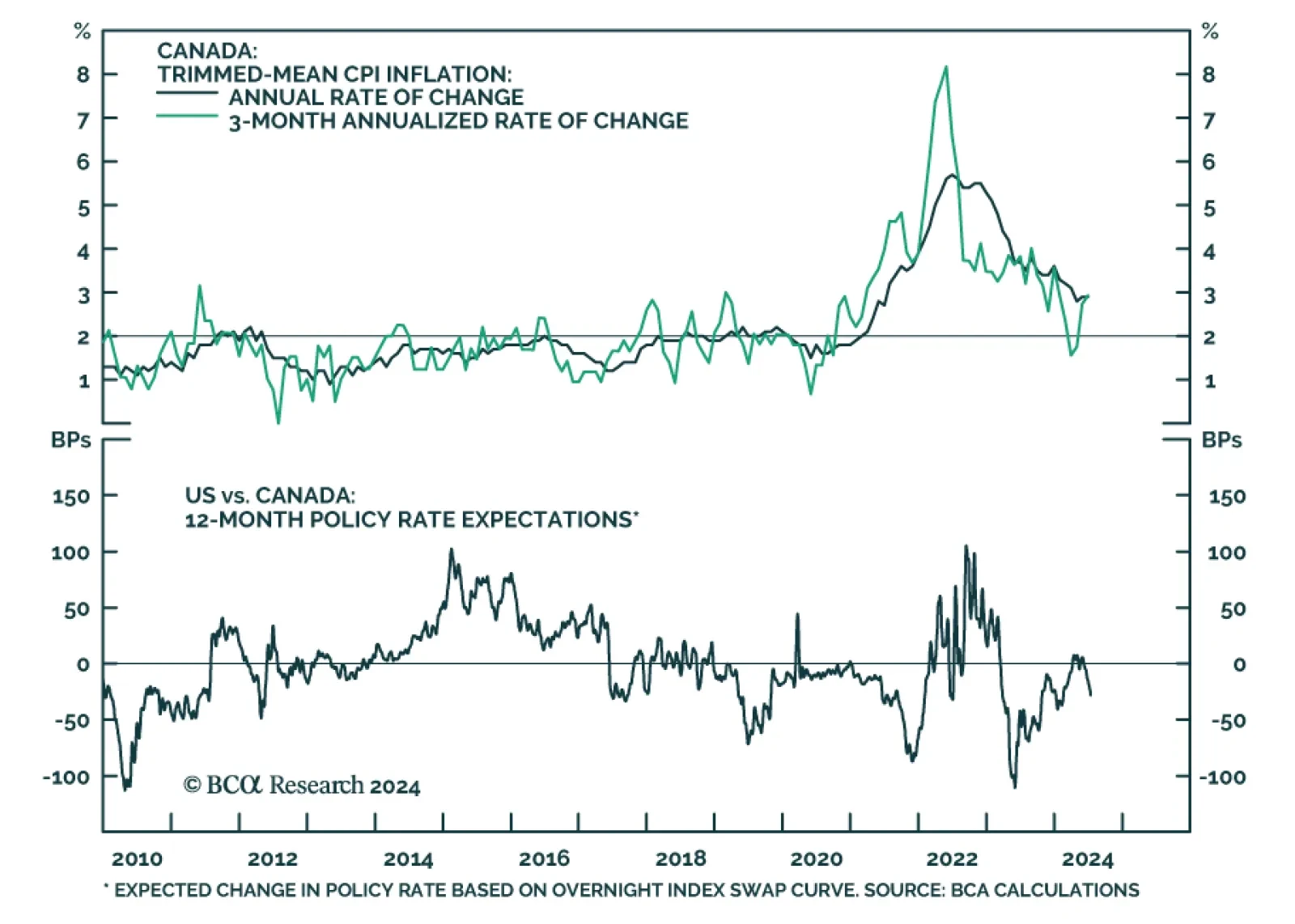

Markets had already been sussing out that the Bank of Canada (BoC) will cut rates for the second time when it meets next week, and this morning’s soft CPI report all but confirmed it. The last remaining obstacle in the…

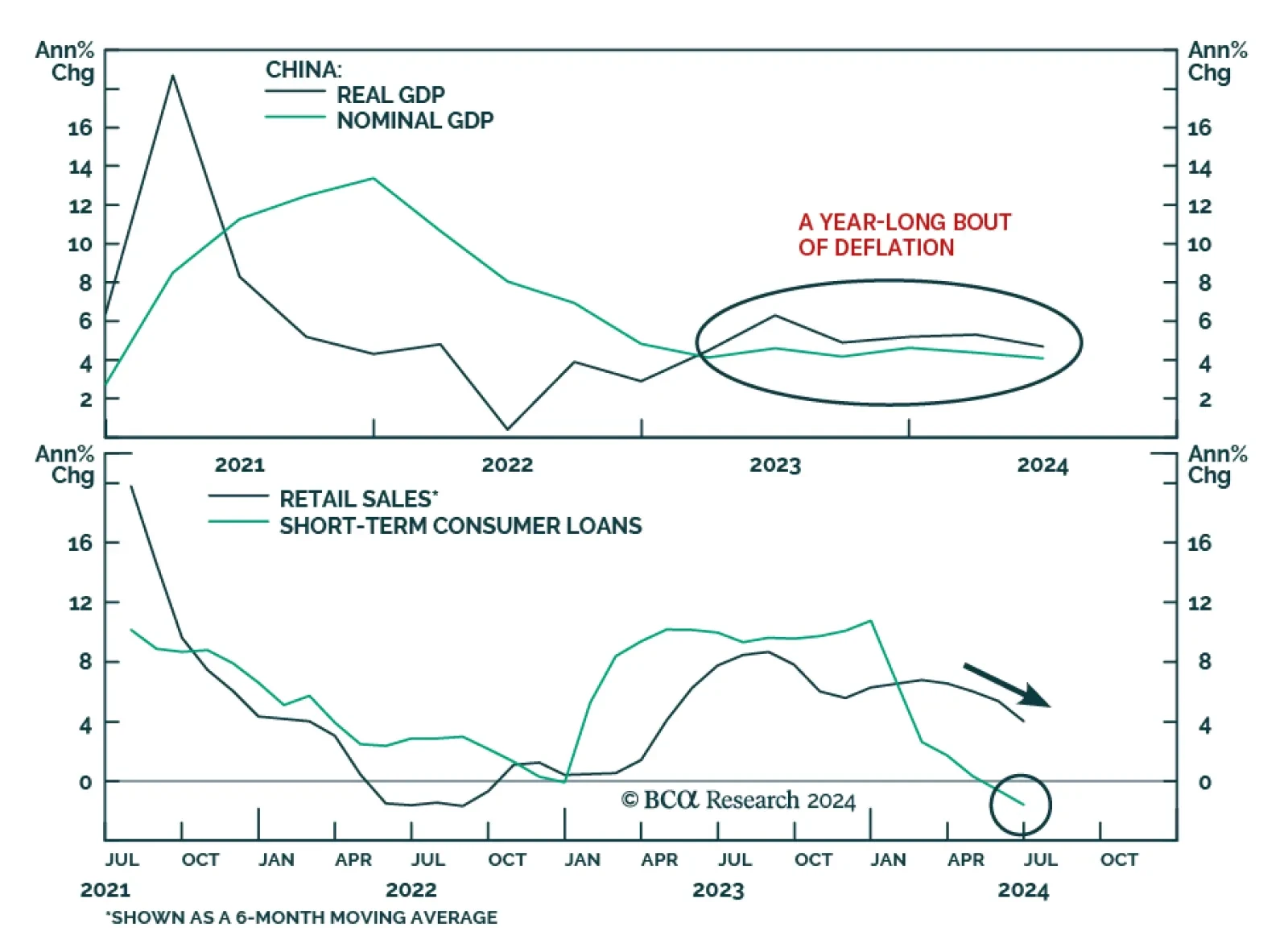

China's real GDP growth decelerated to 4.7% y/y in Q2, down from 5.3% in Q1 and below the consensus forecast of 5.1%. Domestic demand weakened, with retail sales growth sliding to 2% y/y in June, down from 3.7% in the…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

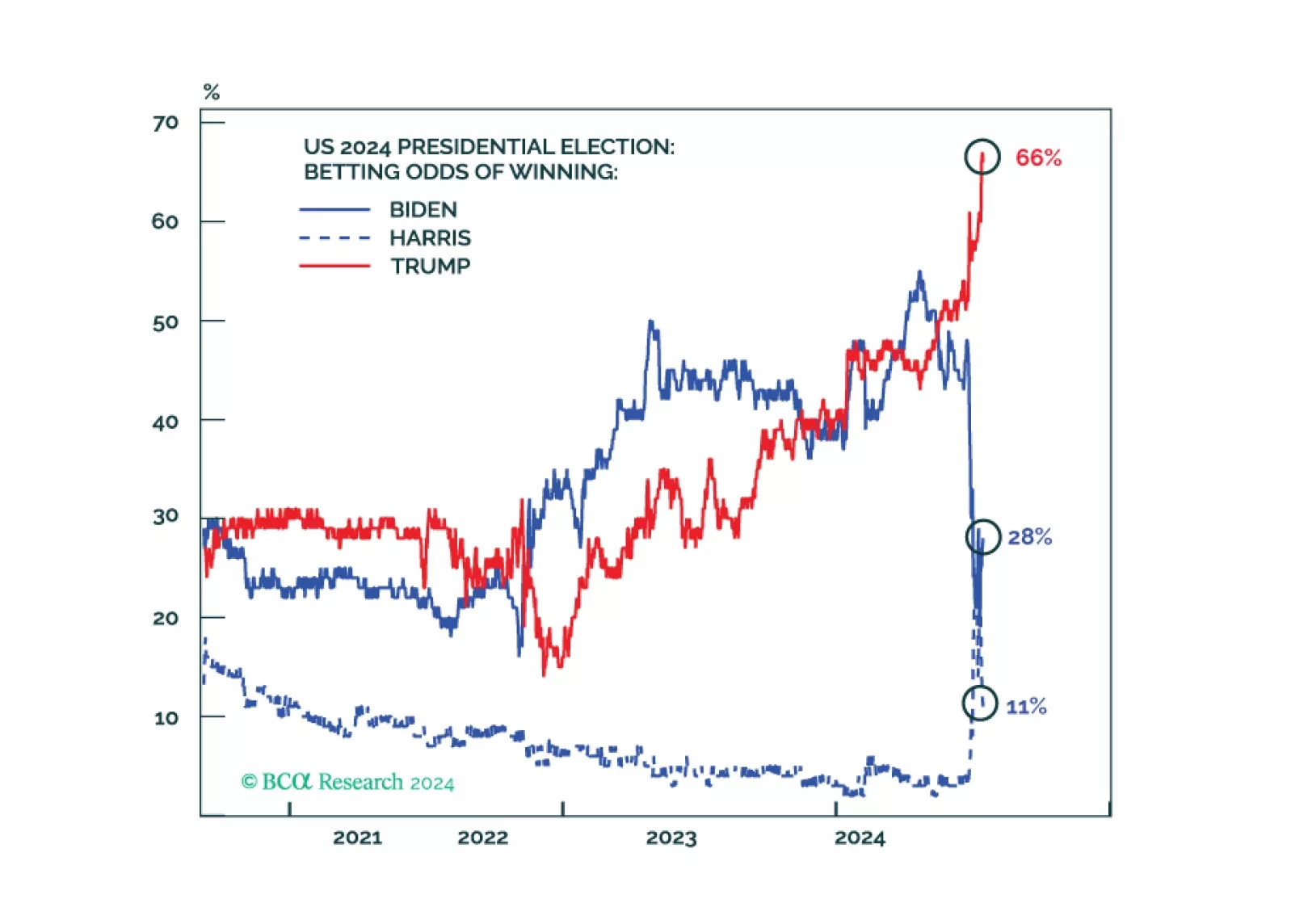

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

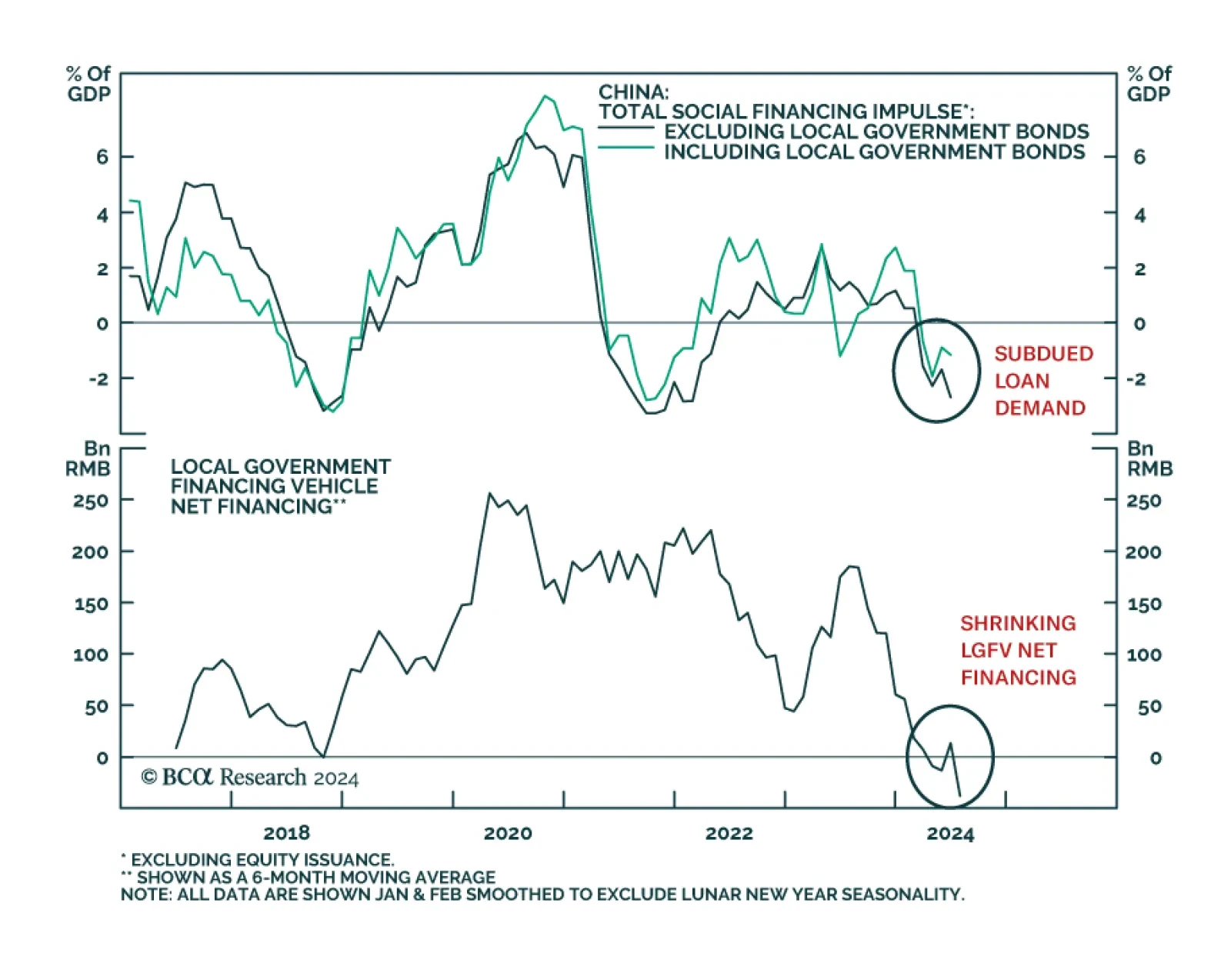

Subdued demand for credit among Chinese private-sector businesses and households persisted through June. The stock of outstanding bank loans grew by 8.3% year-on-year, marking the slowest pace since records began in 2003.…

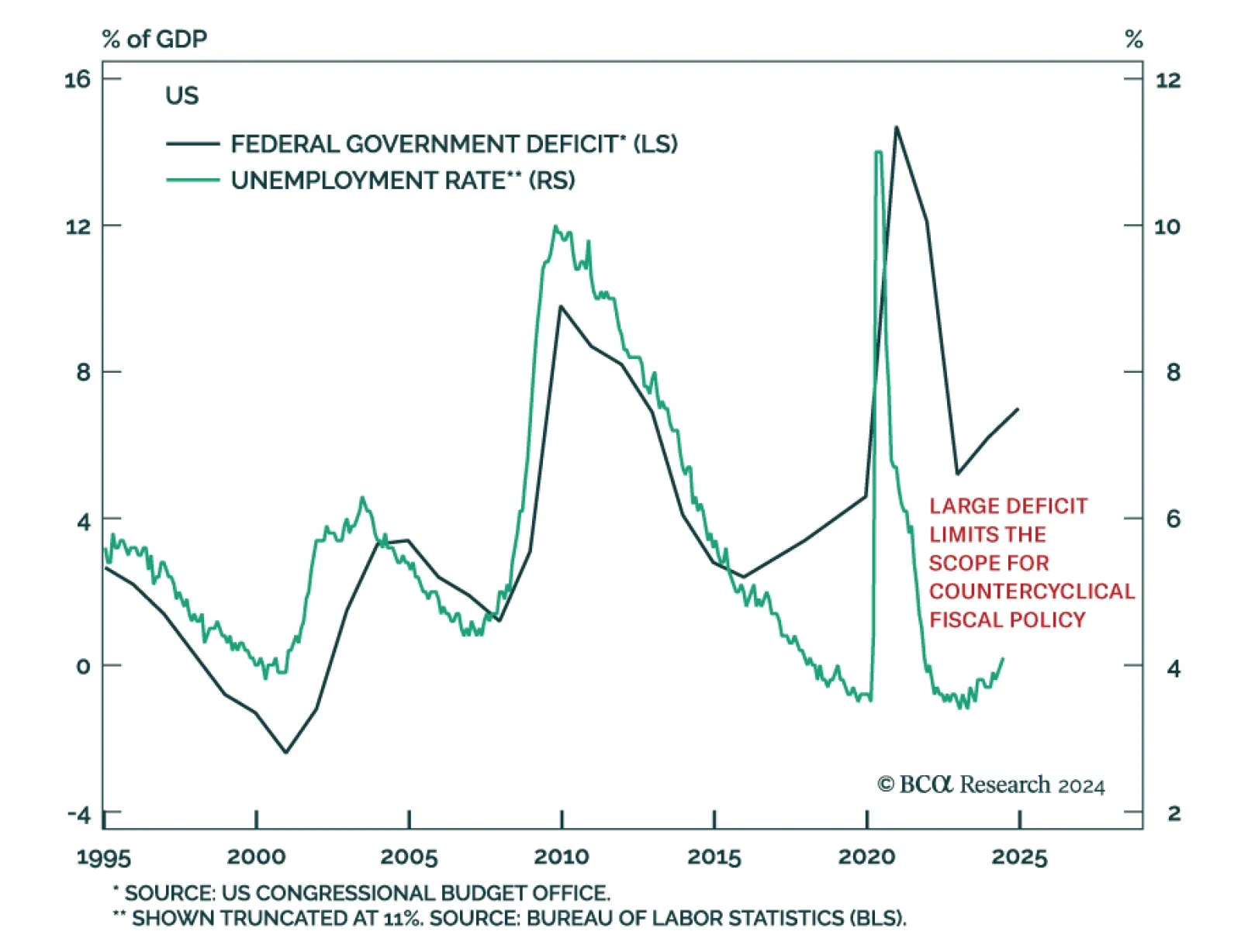

According to BCA Research’s Global Investment Strategy service, investors are overstating the degree to which bond yields will rise under a Trump presidency. For one thing, the team expects the US to fall into recession…

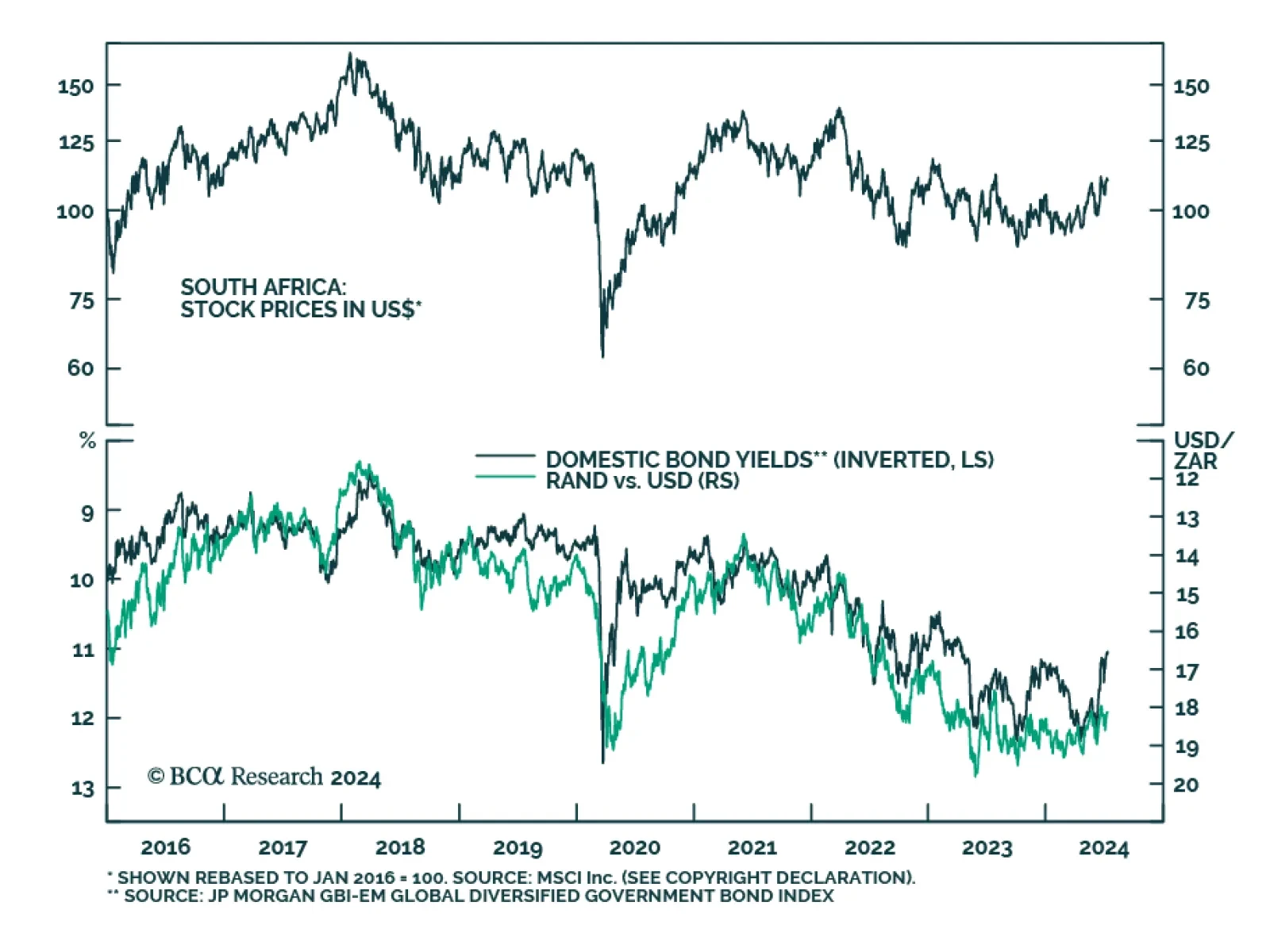

South African stocks, domestic bonds, and currency have all rallied since BCA’s Emerging Markets Strategy team upgraded South African assets last month following the formation of the new national unity government. The rally…

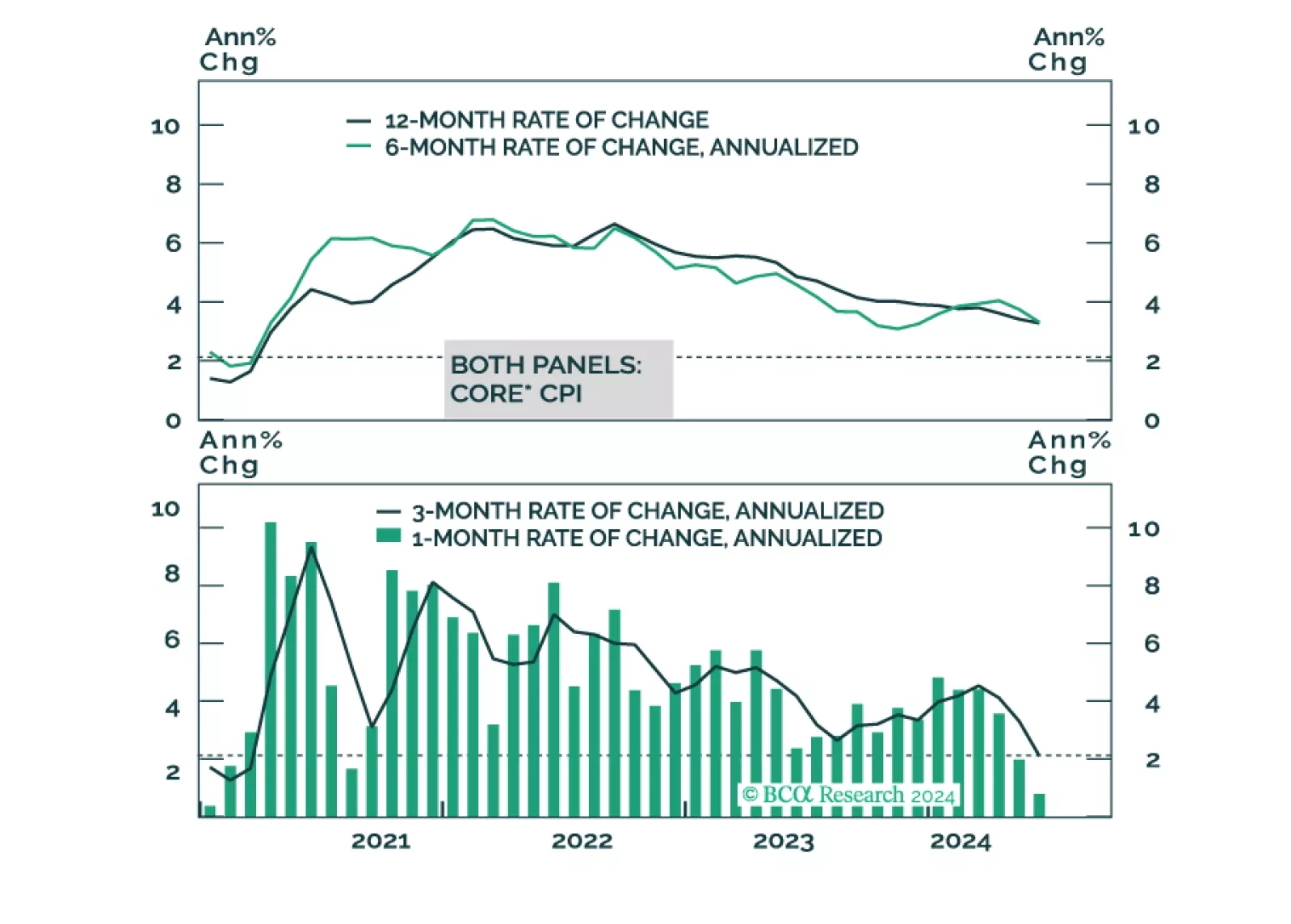

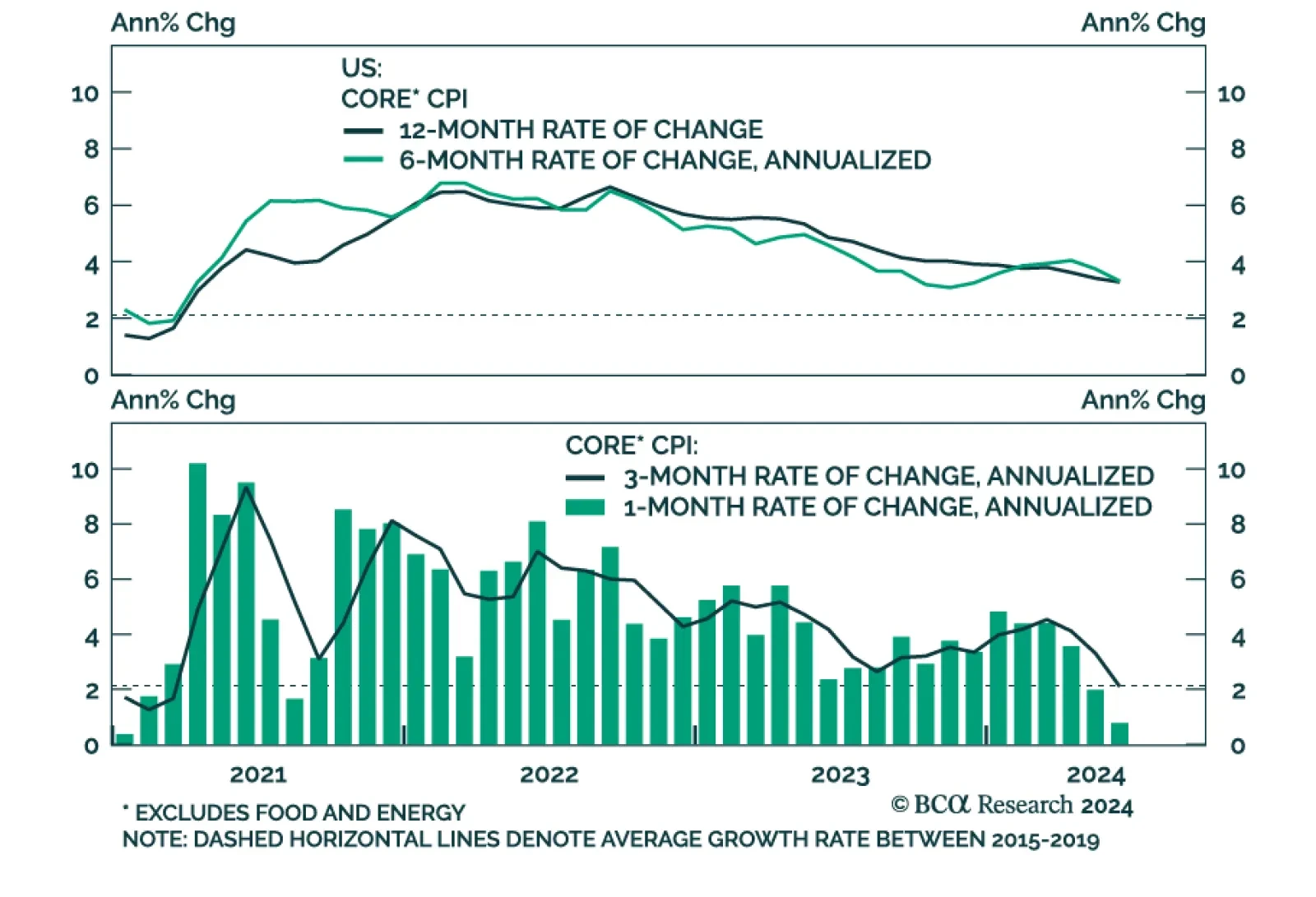

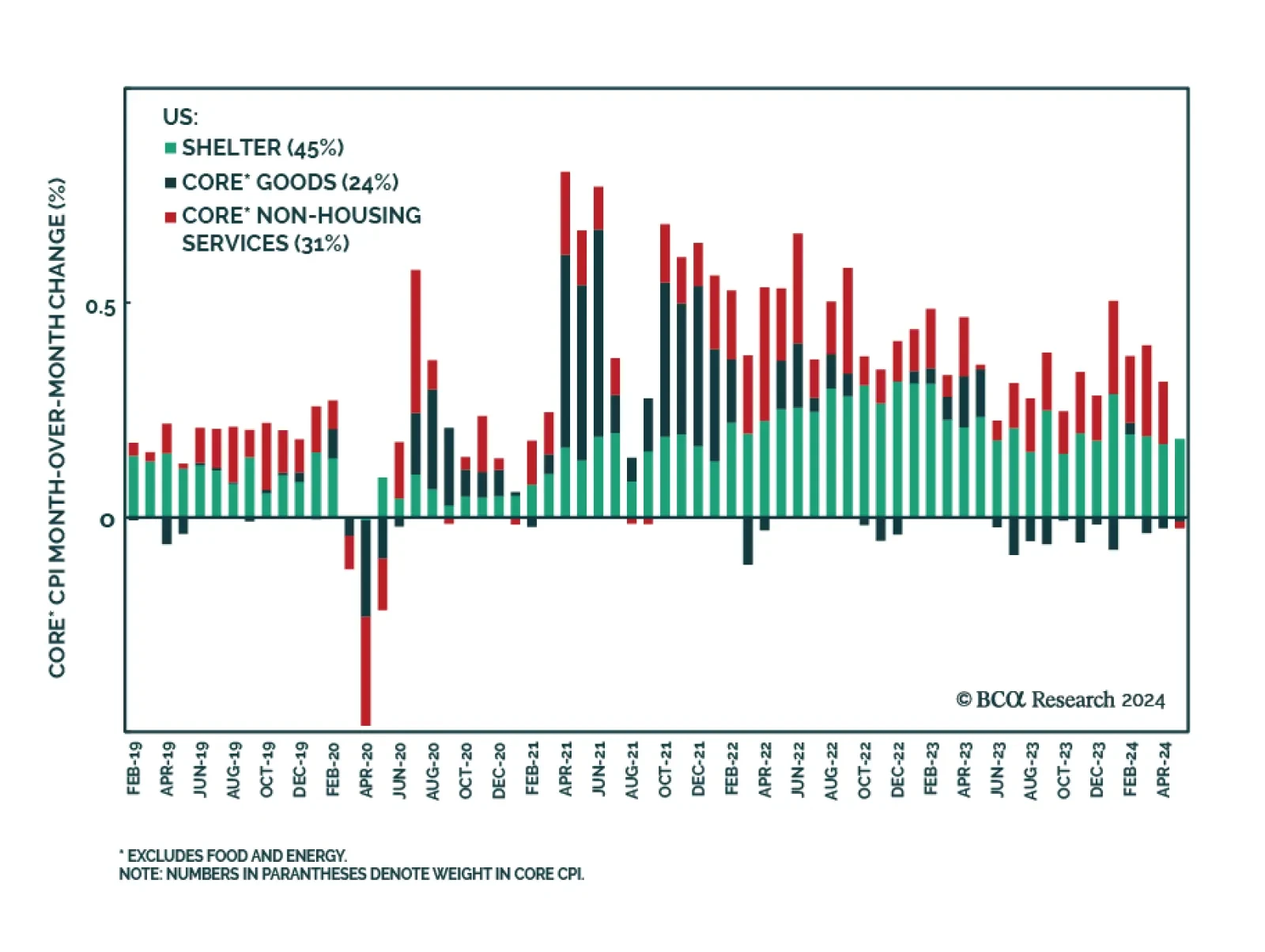

The disinflationary trend in US CPI continued in June as headline CPI dipped to 3% year-over-year, down from 3.3% in May, and core CPI declined by a tick to 3.3%. On a month-over-month basis, headline prices fell by 0.1% and core…

In light of last week’s employment report and this morning’s CPI, it’s time for the Federal Reserve to cut rates.

US Core CPI inflation has decelerated considerably from its year-over-year peak of 6.6% in September 2022 to 3.4% in May and the consensus expects it remained at 3.4% in June. The year-over-year number has come down continuously…