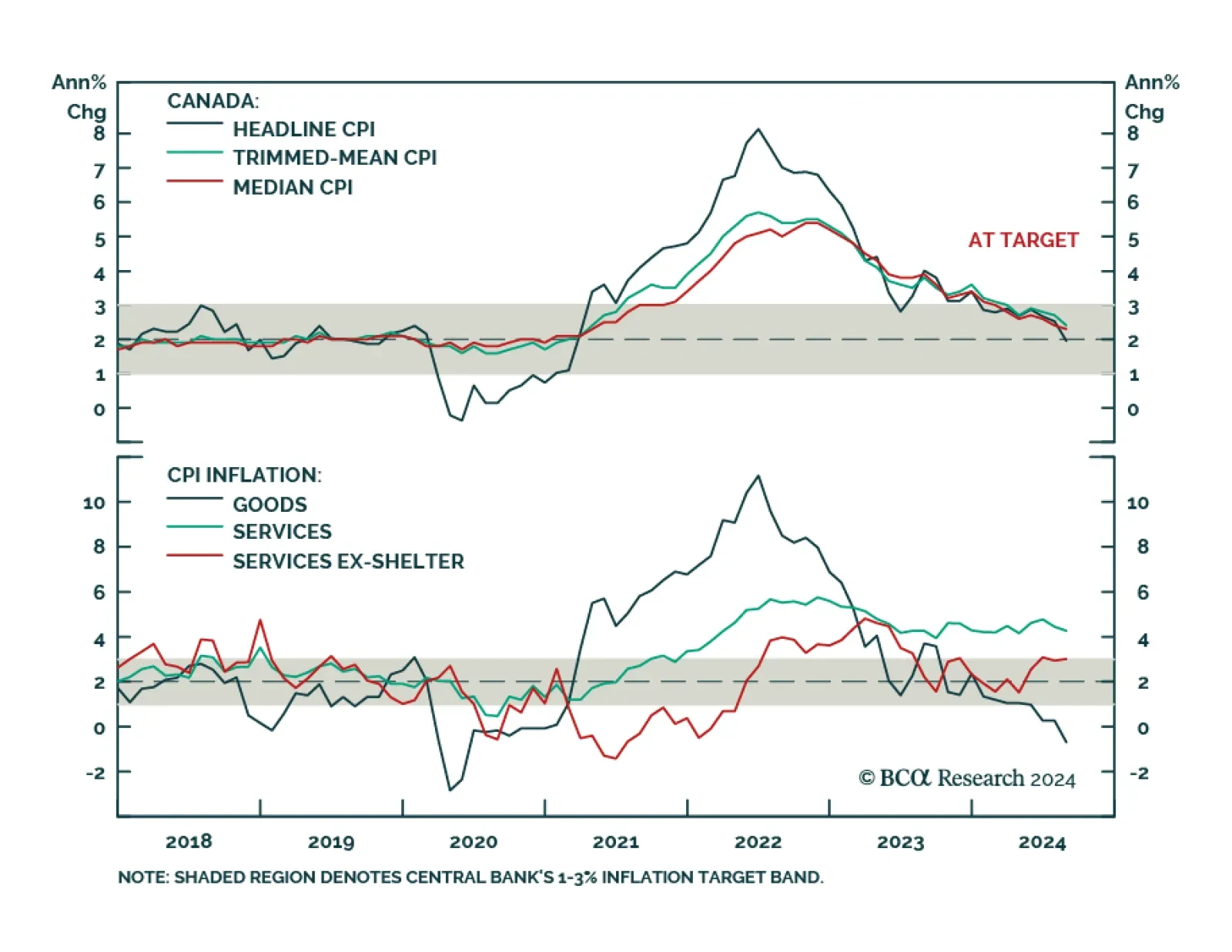

Canadian headline CPI inflation decelerated at a faster-than-anticipated pace from 2.5% y/y to 2.0% in August, the slowest since 2021. Notably, core median and trimmed-mean CPI ticked 0.1 ppt and 0.3 ppt lower to 2.3% and 2.4%,…

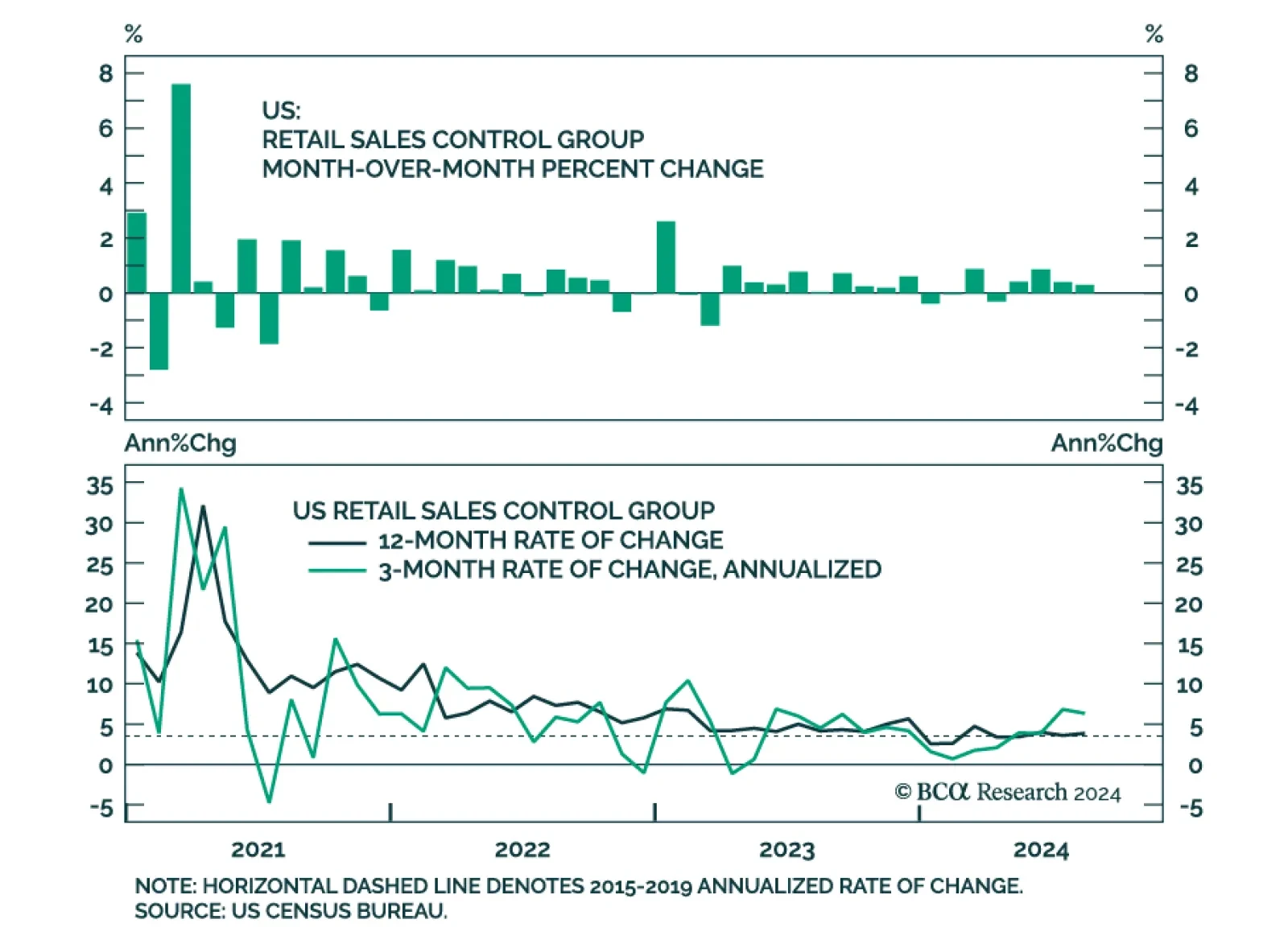

US retail sales grew 0.1% m/m in August and beat expectations of a 0.2% monthly contraction. The positive surprise seemingly spurred equity market gains on Tuesday morning. However, details do not paint as rosy a…

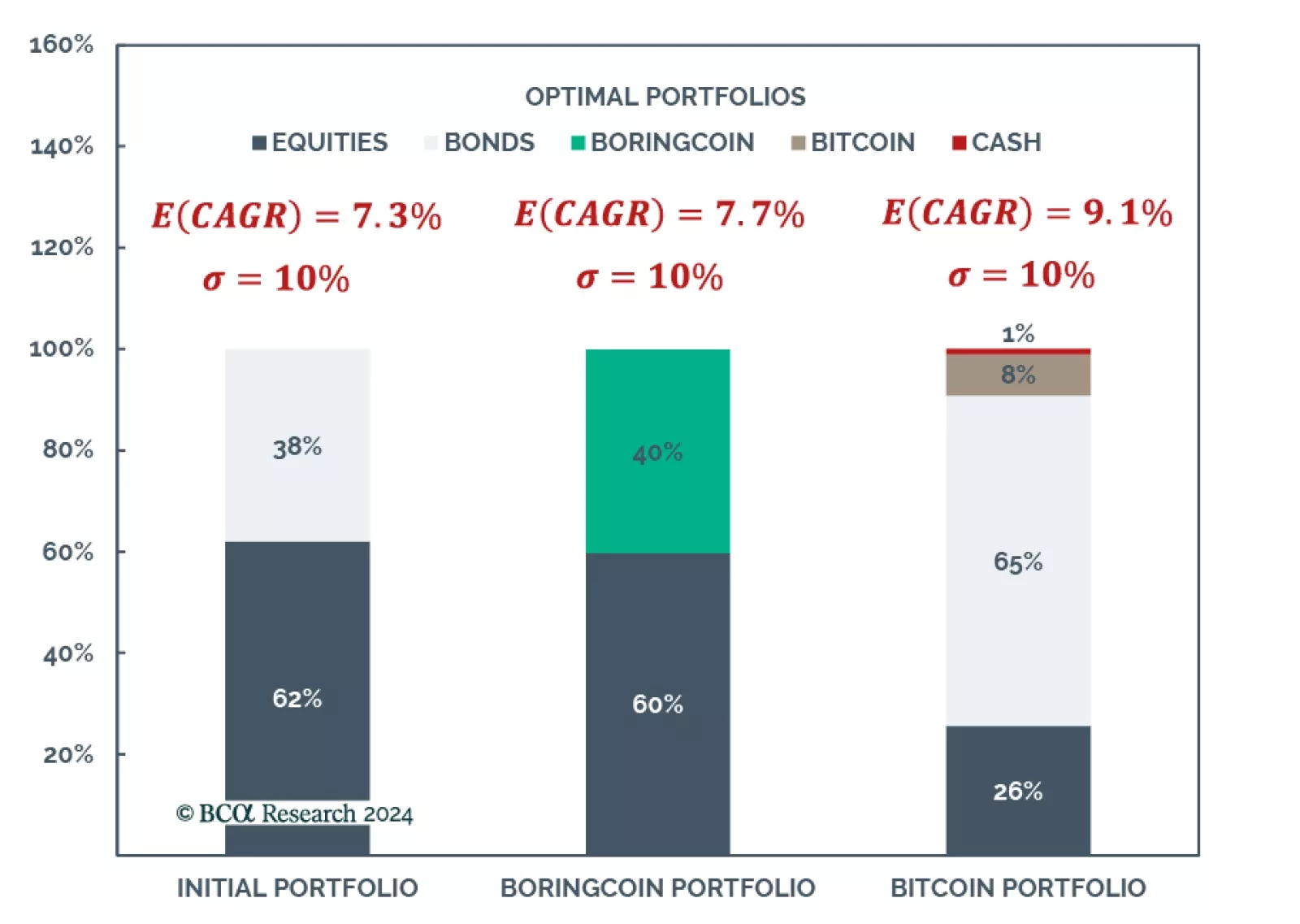

According to BCA Research’s Global Asset Allocation Strategy service, a common objection to buying Bitcoin raised by traditional investors is that it is too volatile. In the past it has been argued that this is irrelevant,…

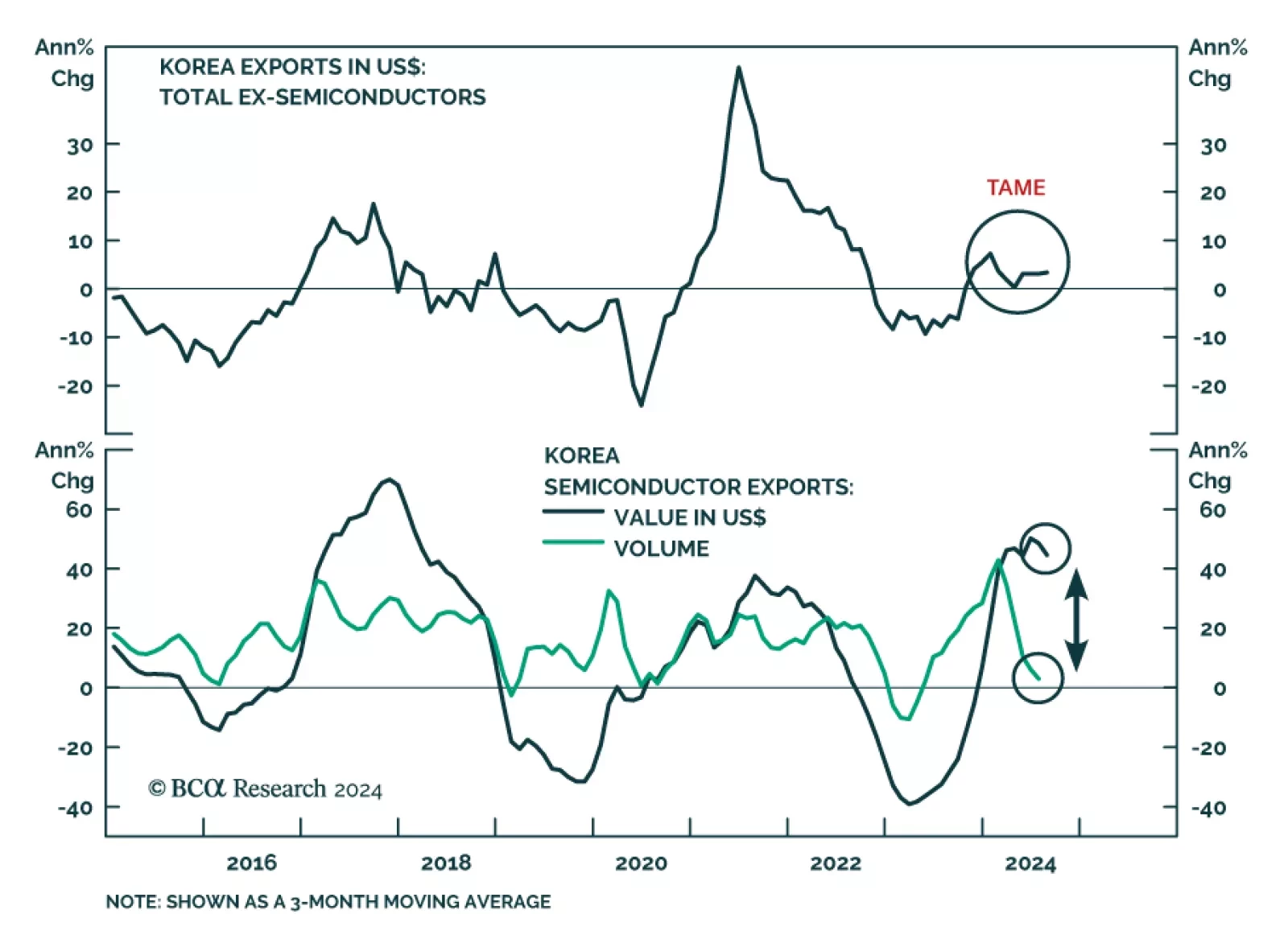

Trade data from small open economies act as a bellwether for global growth developments. In August, Korean exports expanded by 11.4% y/y in USD and 5.7% y/y in KRW terms, marking their eleventh and eighth consecutive month of…

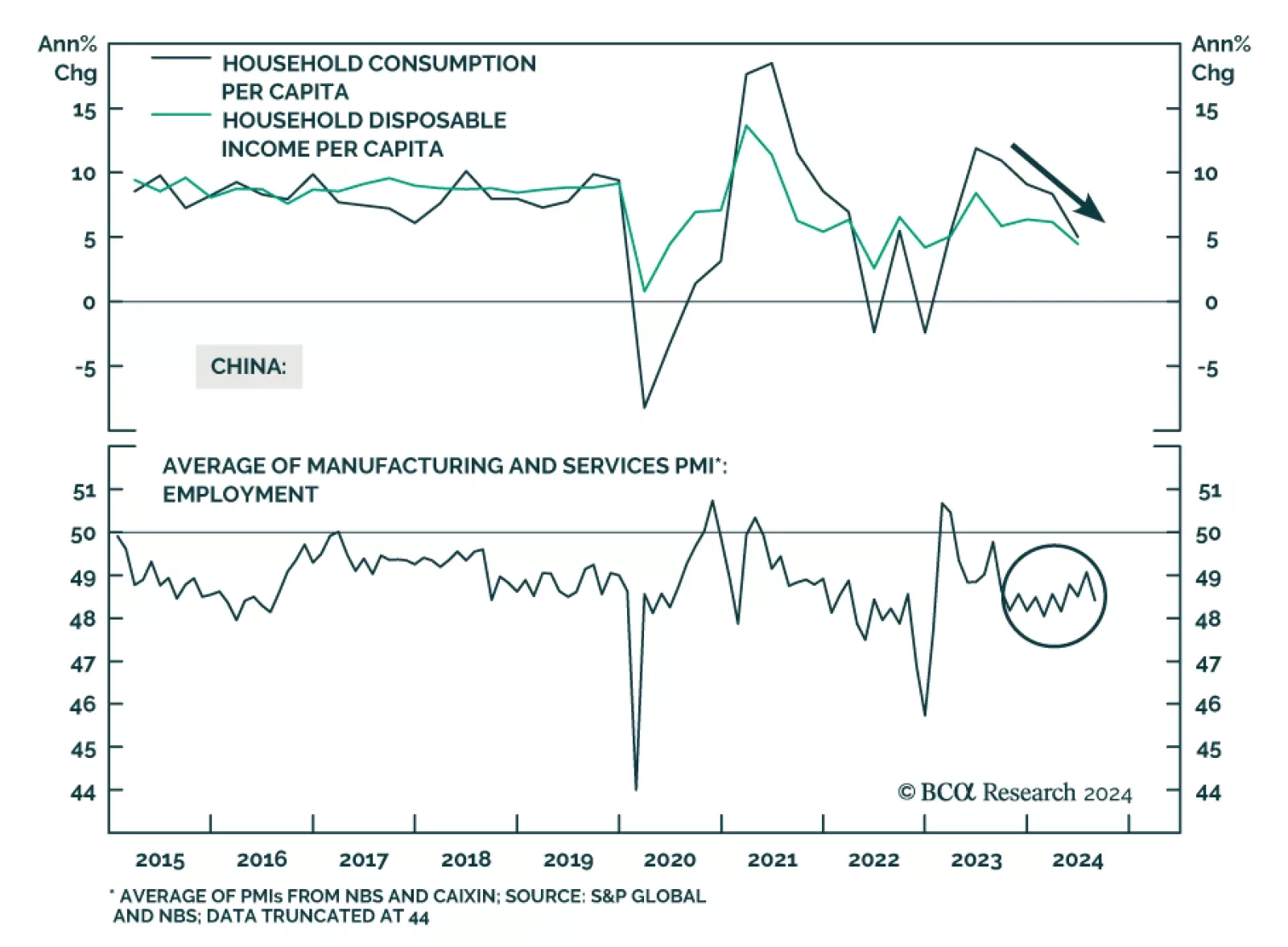

The Chinese economic data in its totality was uninspiring in August. Industrial production and retail sales growth decelerated year-on-year and corroborate the message from August’s import and credit growth data that…

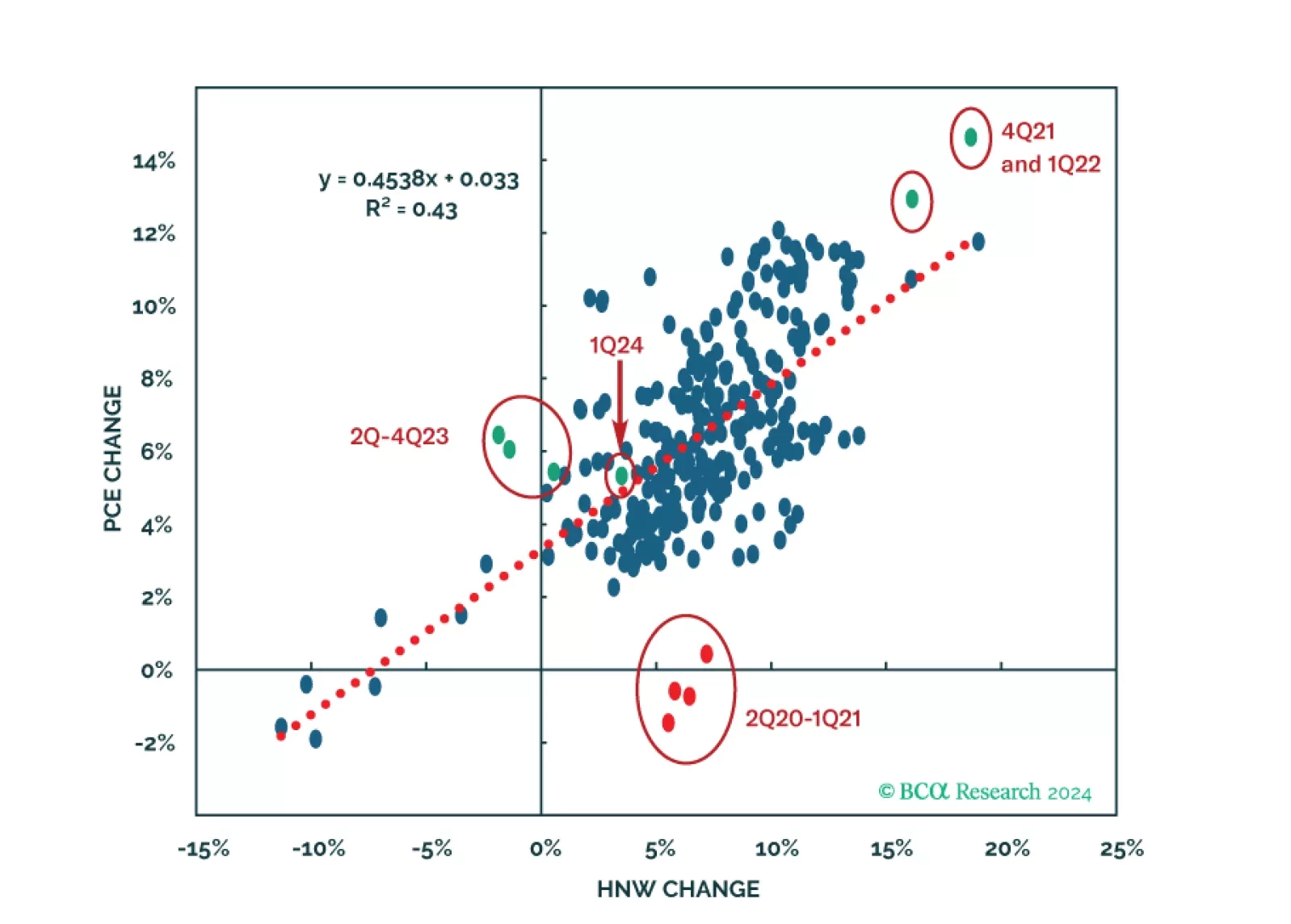

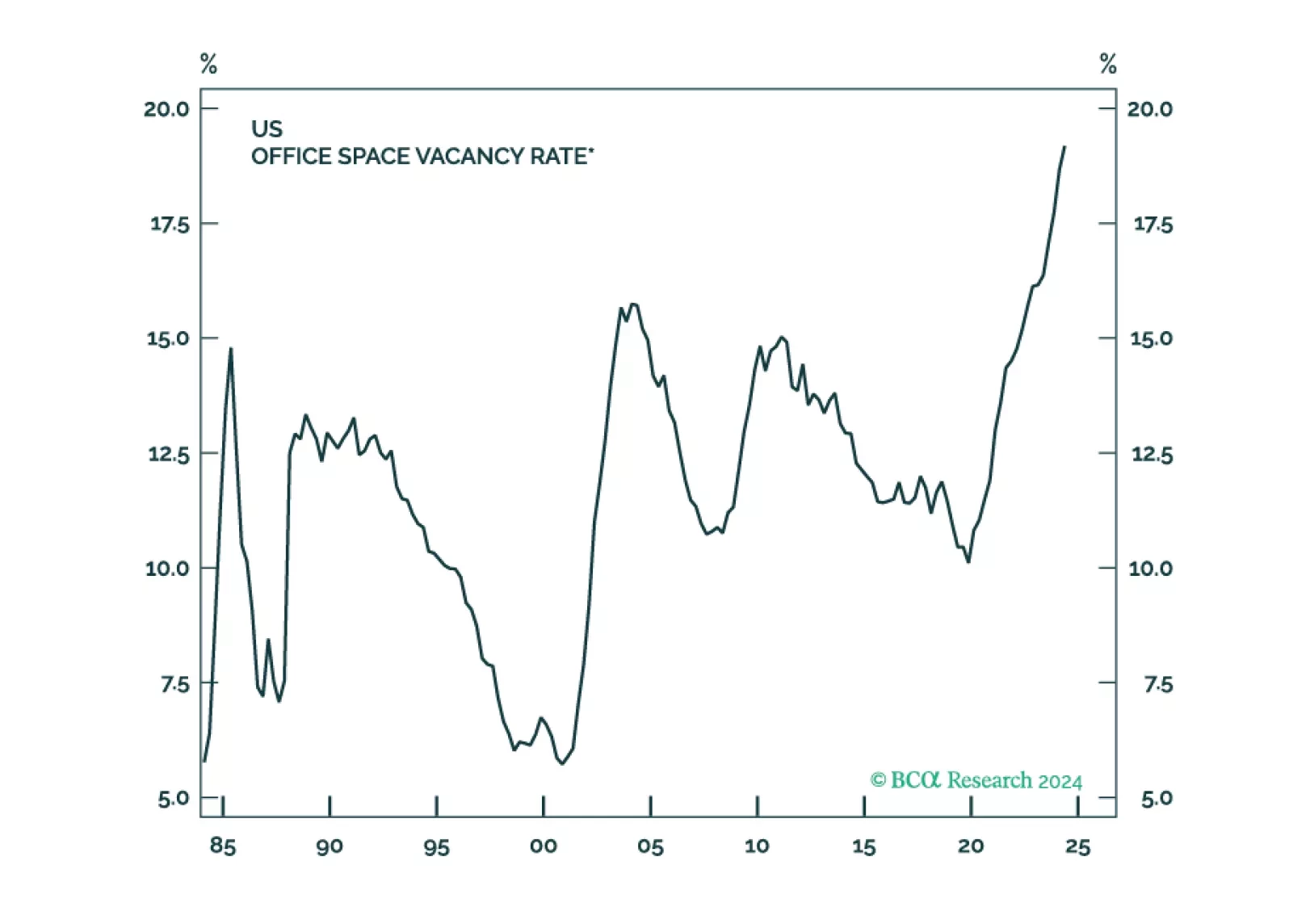

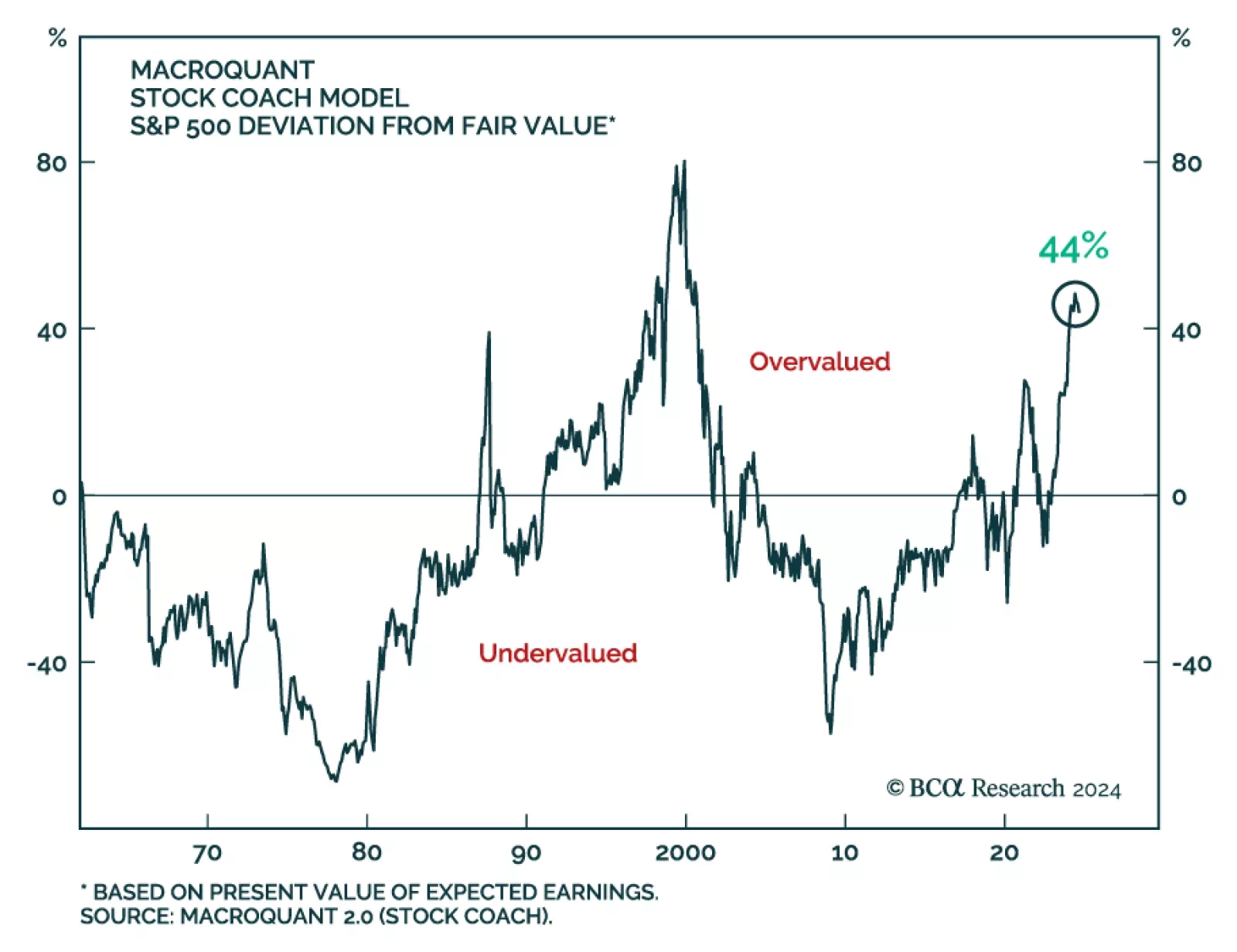

According to BCA Research’s Global Investment Strategy service, the imbalances in the US economy are sizeable enough to generate a mild recession. Unfortunately for equity investors, a mild recession would not preclude a…

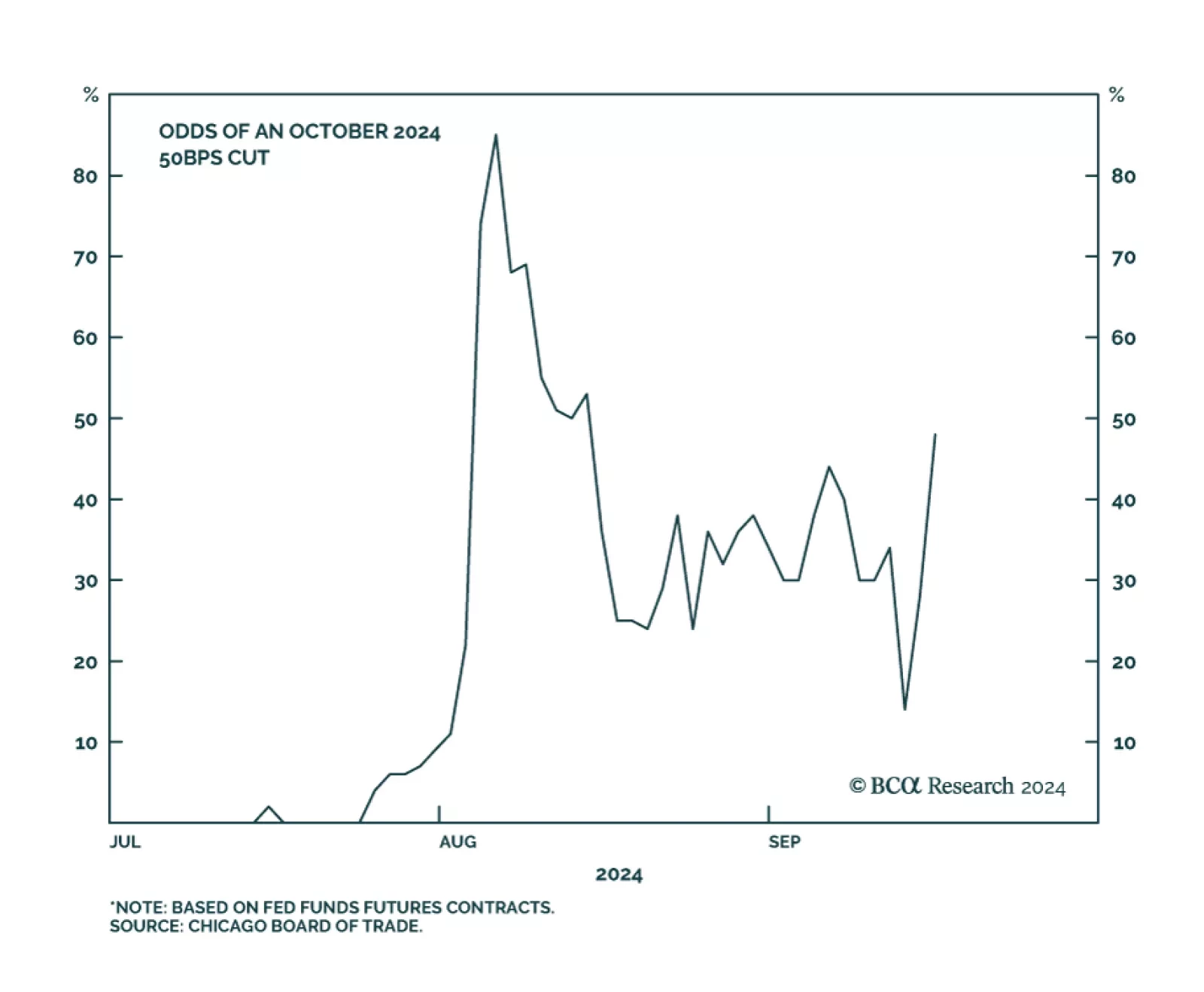

We noted earlier this month that the Fed would be unlikely to deliver a jumbo rate cut without telegraphing it first. President Williams' and Governor Waller’s September 6 speeches offered policymakers one last chance…

The US suffers from enough imbalances to produce a mild recession. Unfortunately, such a recession could lead to a significant bear market in stocks, just as it did during the very mild 2001 recession.

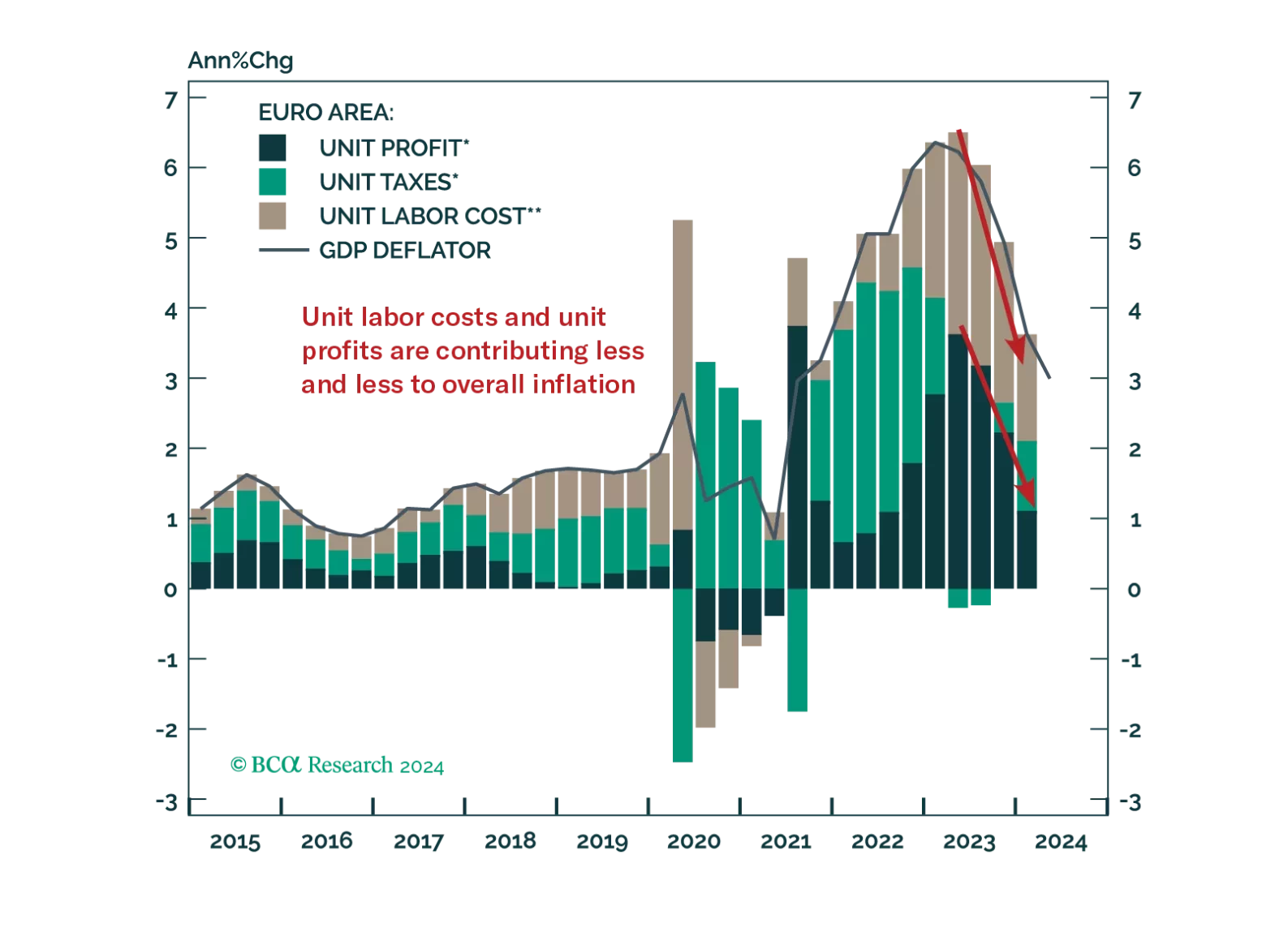

The ECB will cut rates once more this year; however, markets underprice how far it will ease next year.