Our Portfolio Allocation Summary for October 2024.

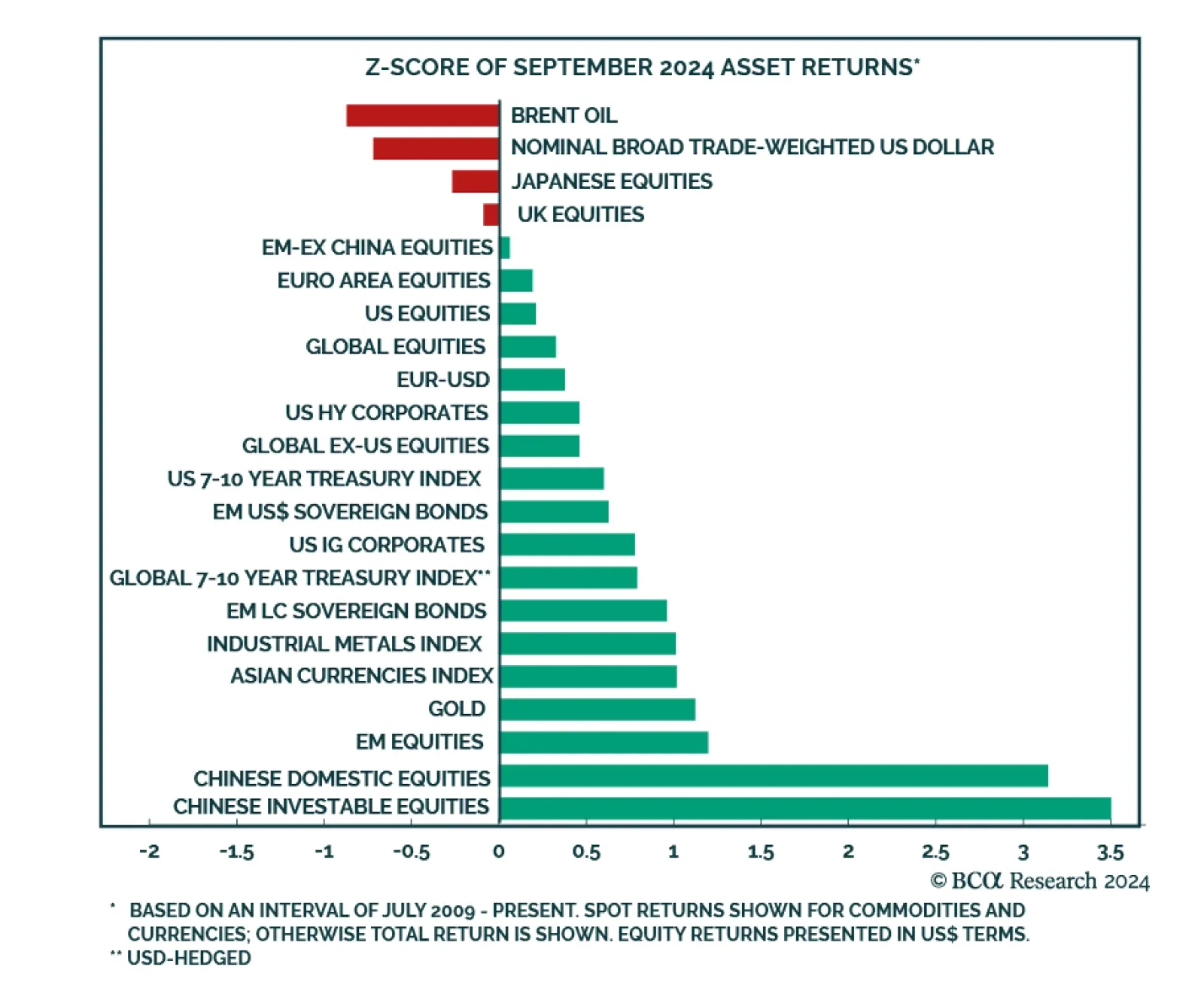

The Fed embarked on a new easing cycle with a bang and China delivered its largest stimulus since 2015, leading to a strengthening in the risk-on soft-landing narrative in September. Chinese and EM equities led the pack. We…

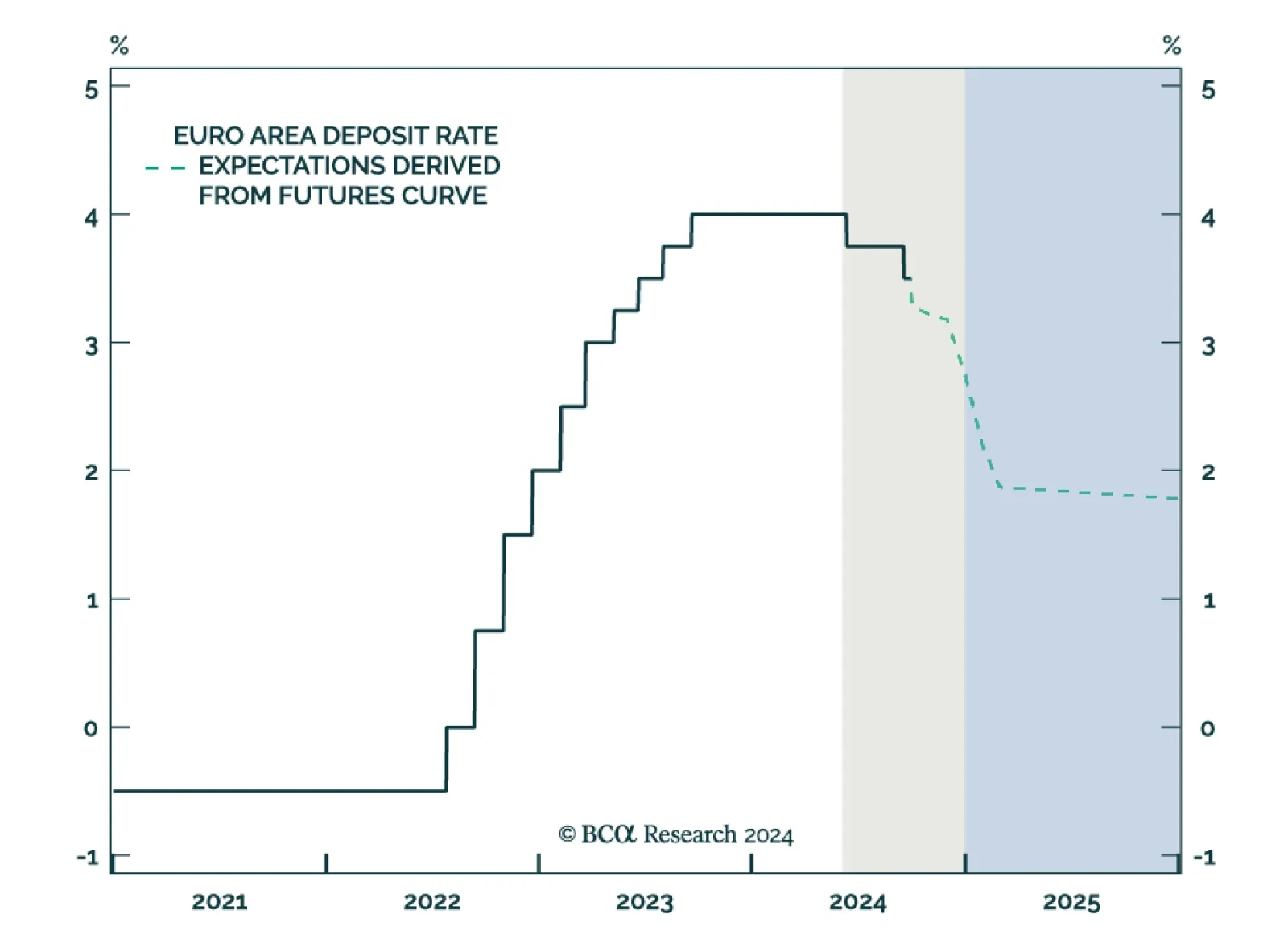

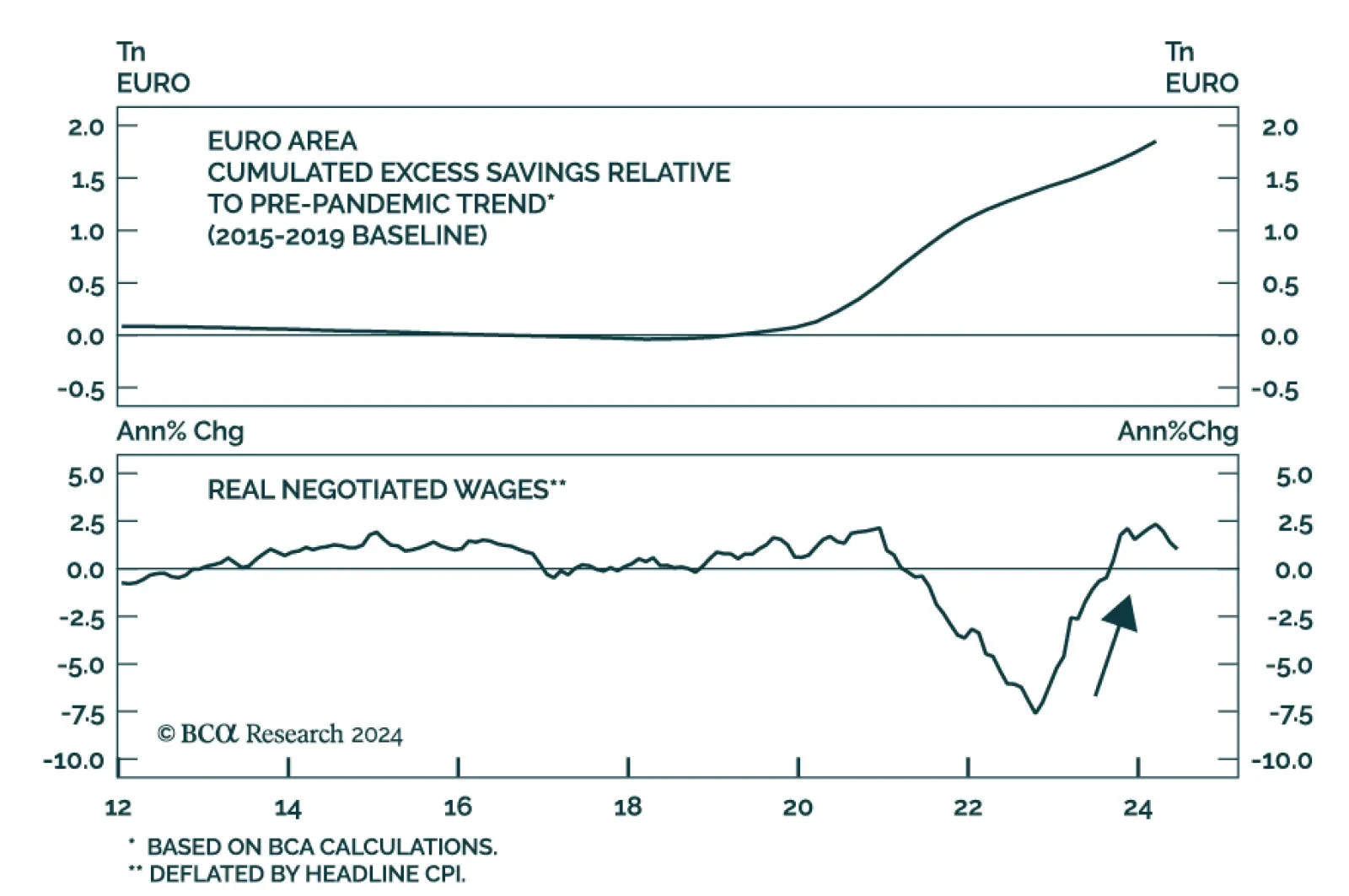

Preliminary estimates suggest that Eurozone headline and core CPI inflation decelerated from 2.2% to 1.8% y/y and from 2.8% to 2.7%, respectively, in September. The inflation data from individual Euro Area countries earlier last…

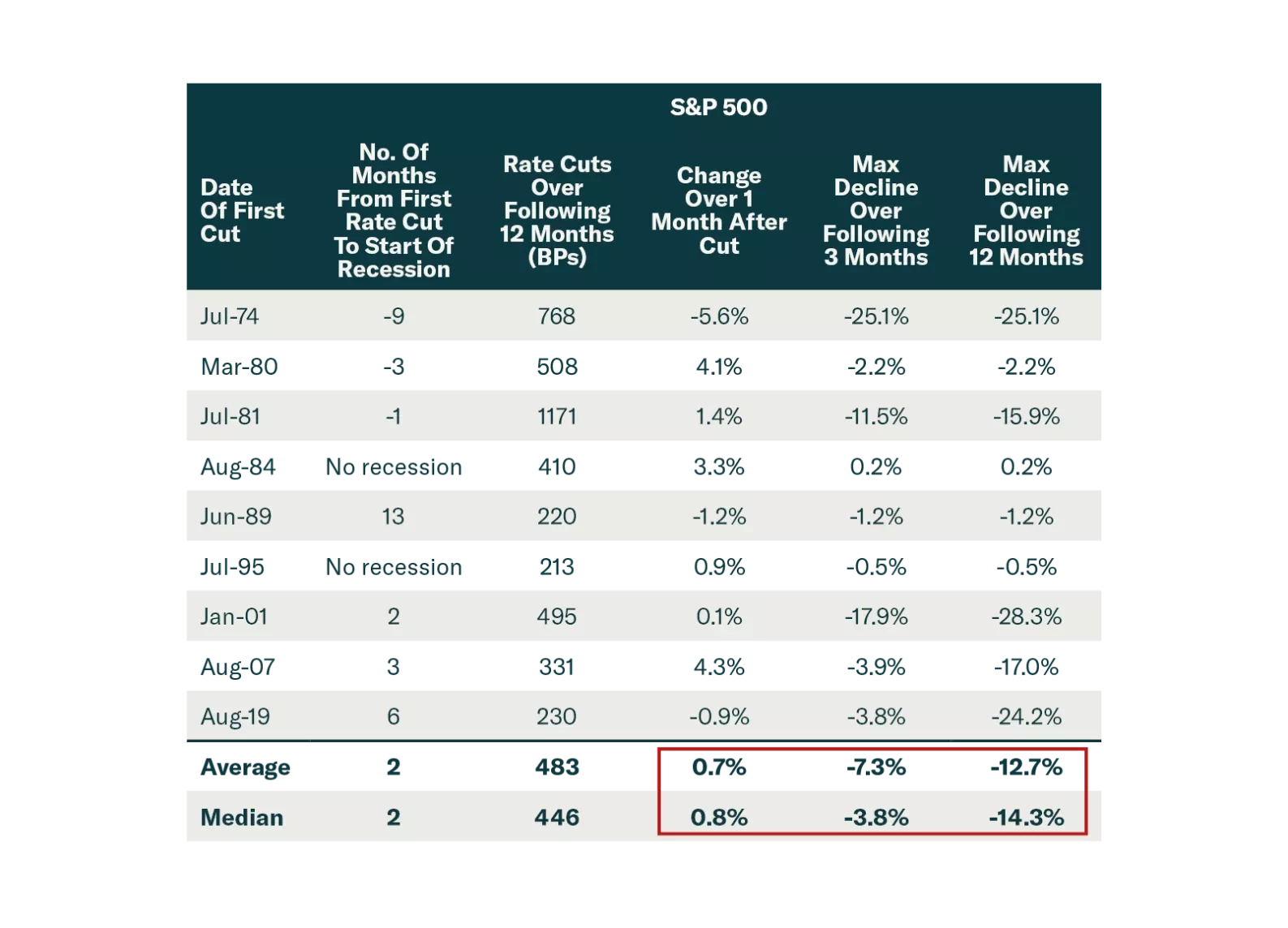

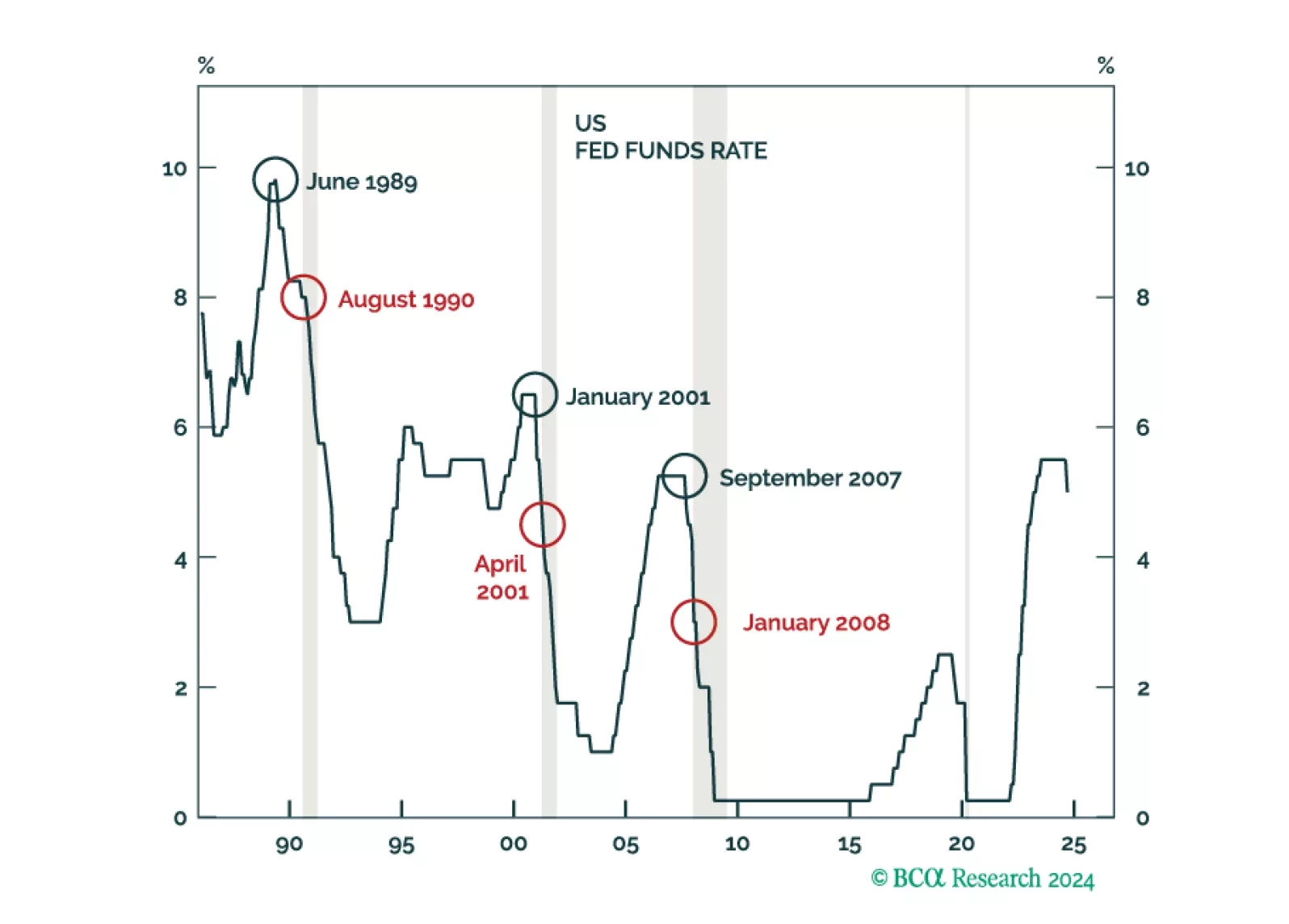

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

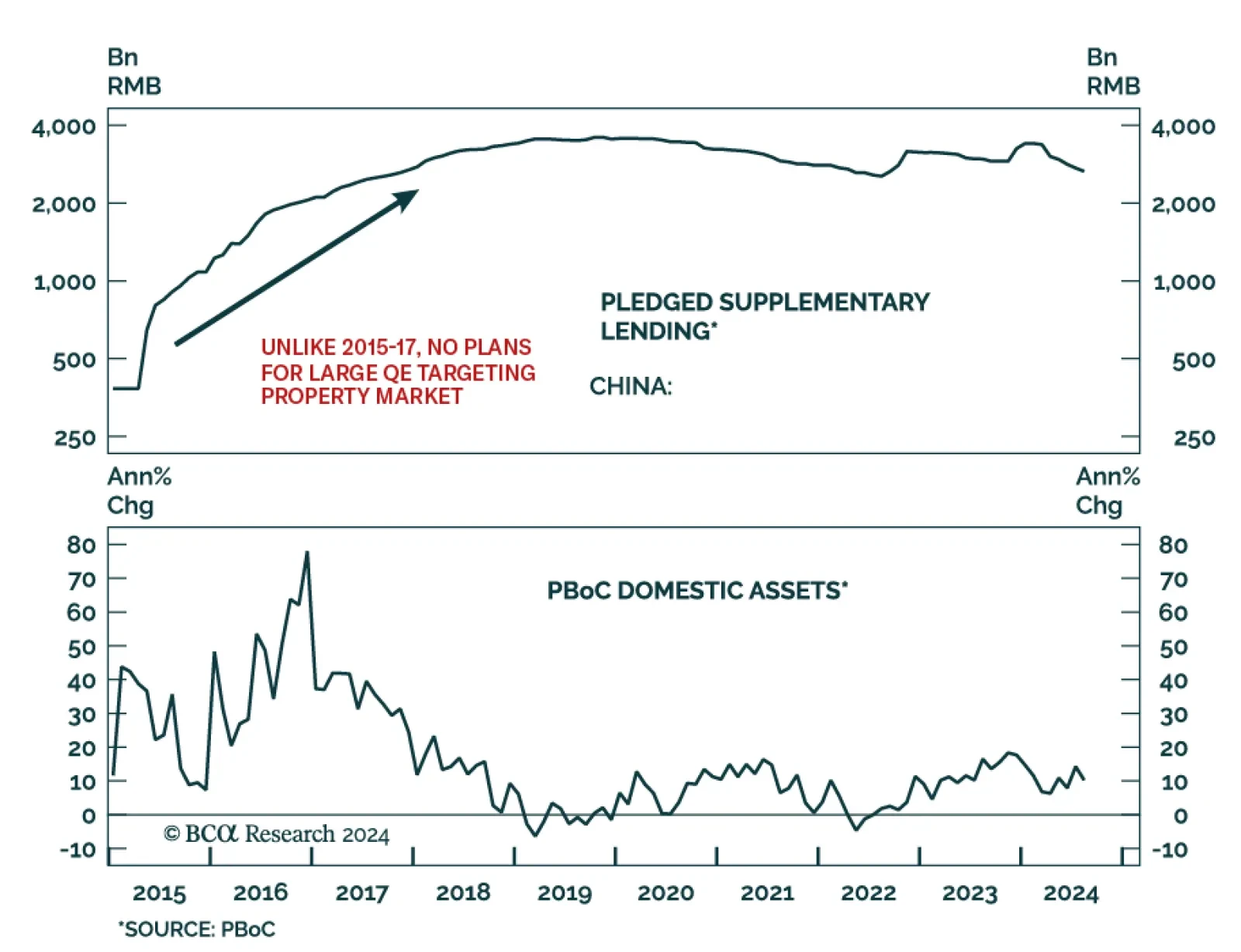

According to BCA Research’s Emerging Market Strategy service, the monetary and fiscal policies announced last week are unlikely to produce a meaningful business cycle recovery in China. Below are actions the authorities…

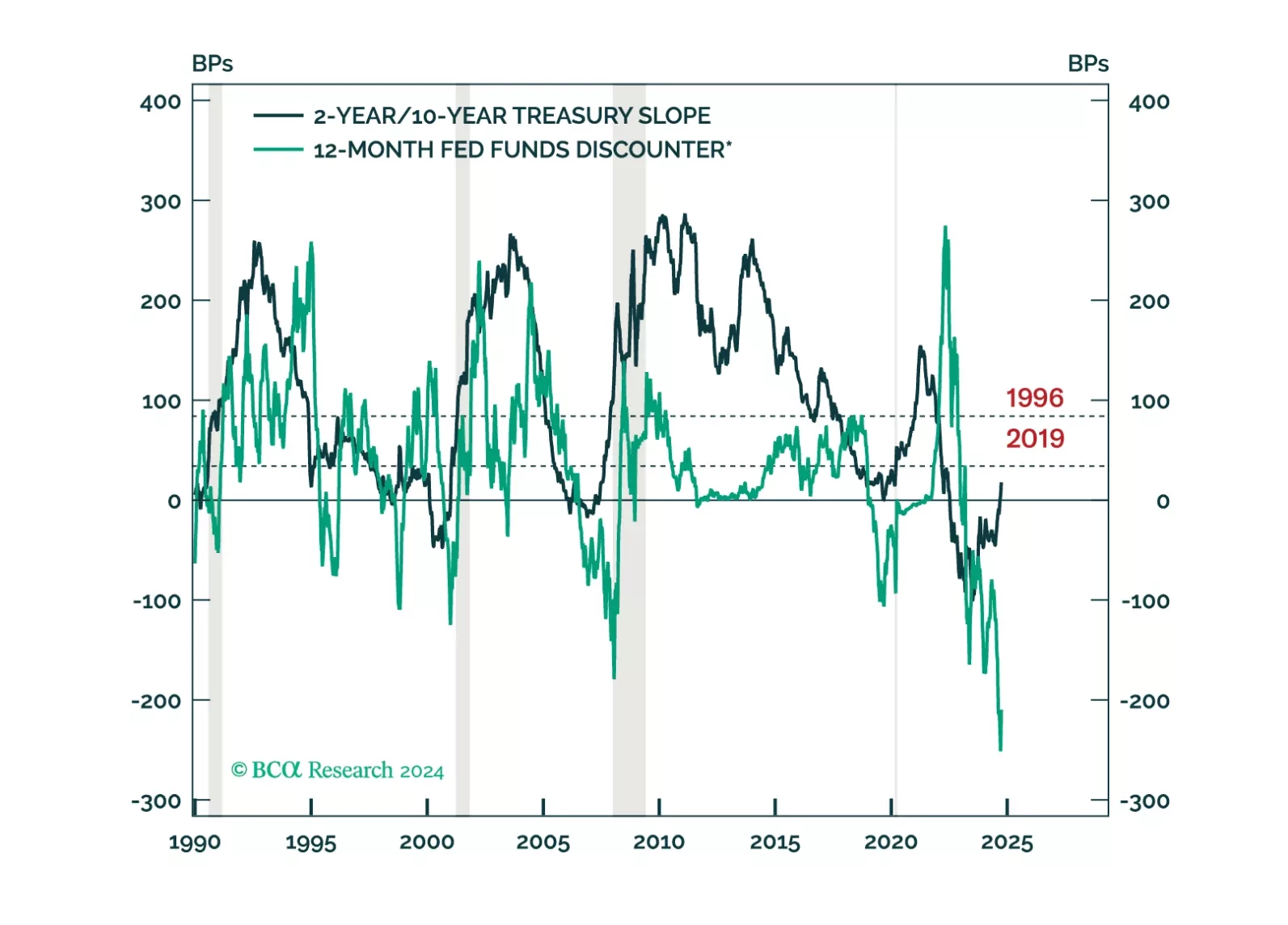

Our expectation that a looming US recession will morph into a global recession remains intact. US monetary easing will only take effect with a lag and current deteriorating economic conditions are the product of past…

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

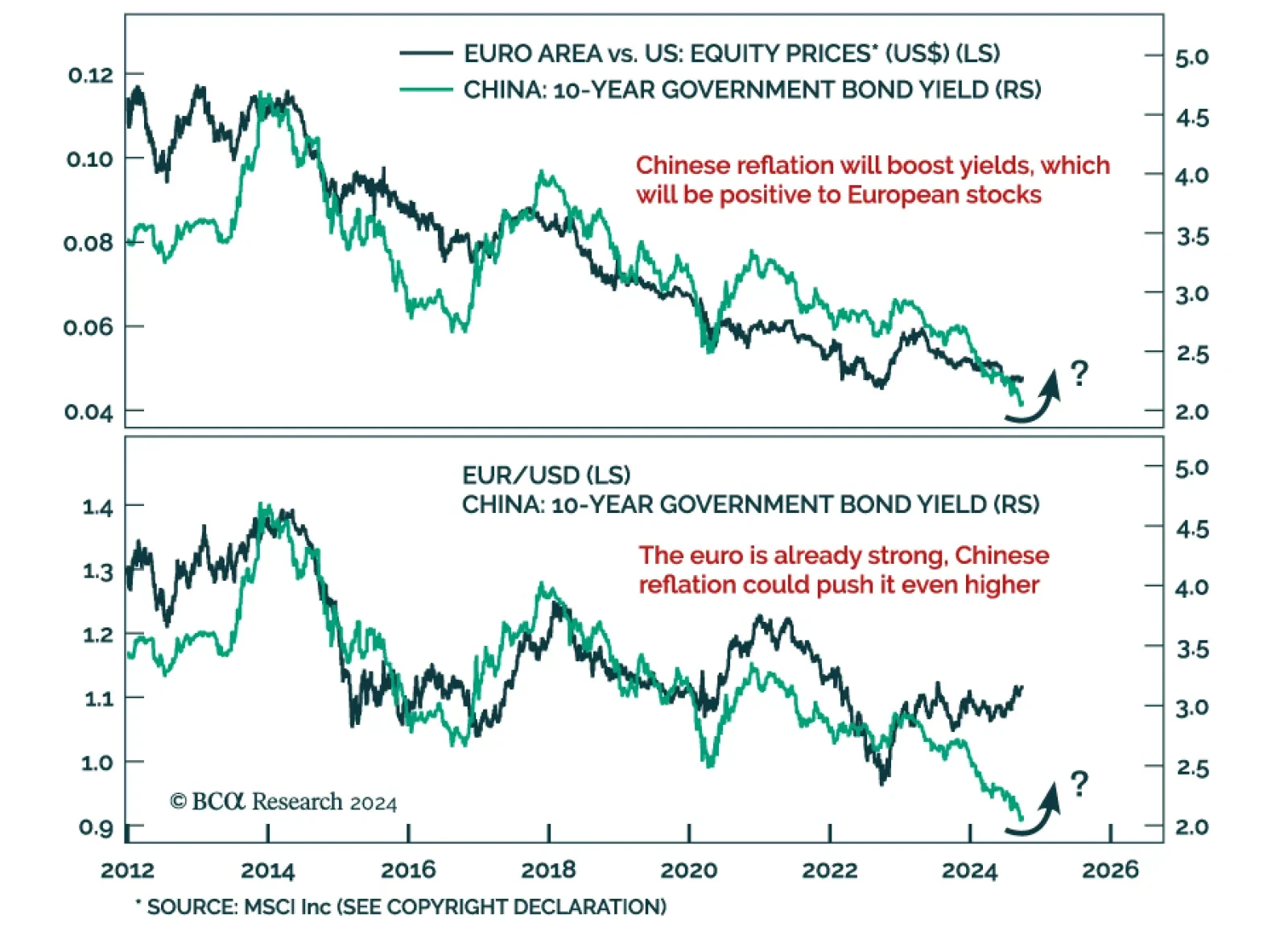

According to BCA Research’s European Investment Strategy service, the surprise fiscal announcement from China’s Politburo is a very different animal from previous stimulus attempts. Although the details are still…

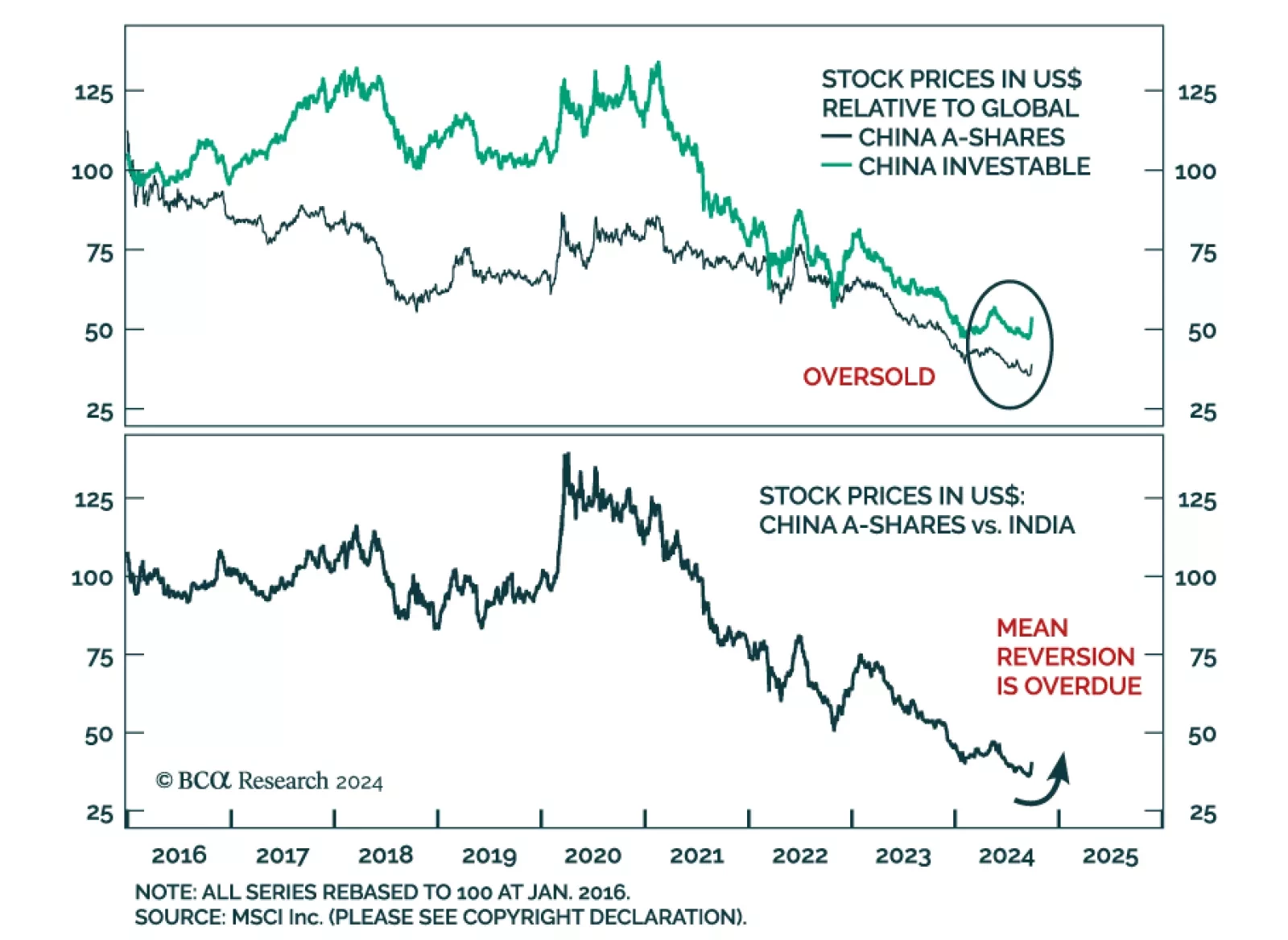

We highlighted last week that while the Politburo policy announcements are unlikely to produce a meaningful business cycle recovery in China, they nevertheless administered a shot of adrenaline to investor sentiment. Chinese…

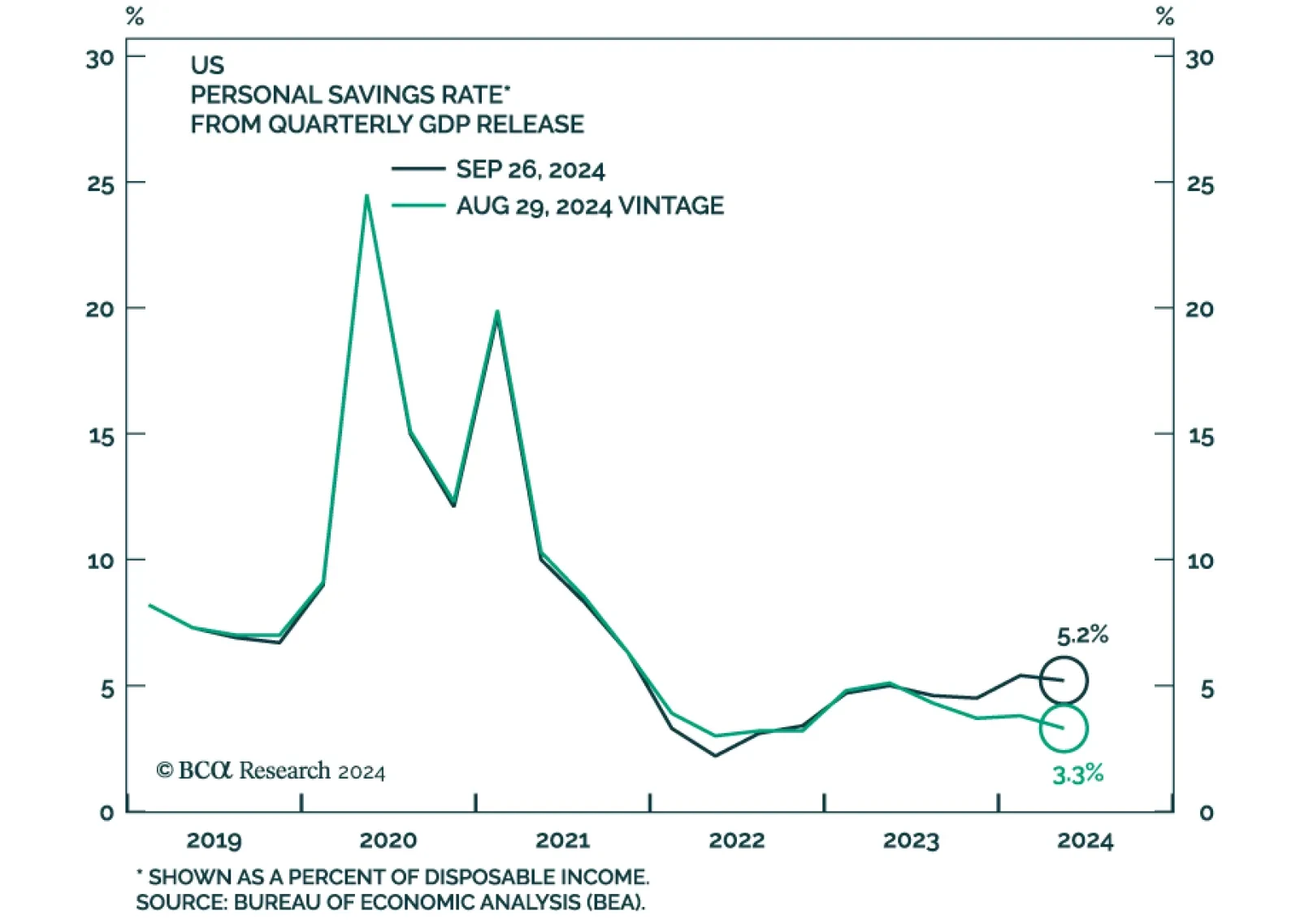

Annual BEA data revisions resulted in a significant upward revision in GDP growth since Q2 2020, led by stronger consumption growth and more robust real disposable income growth than previously believed. Revisions also show…