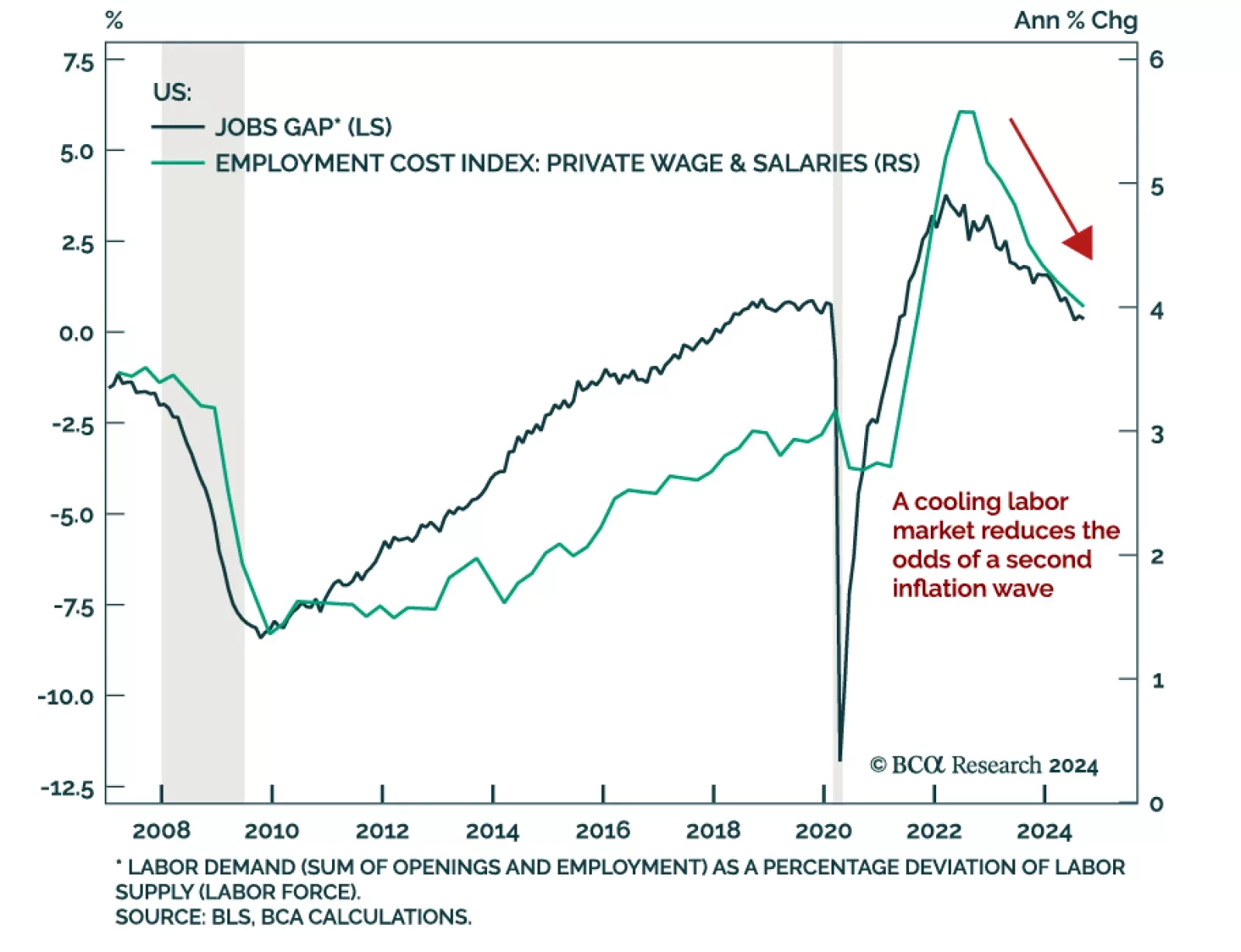

The Fed’s preferred measure of inflation, core PCE, met expectations of a reacceleration to 0.3% month-on-month, and reached 2.7% year-over-year. The rest of the Personal Income and Outlays report showed solid…

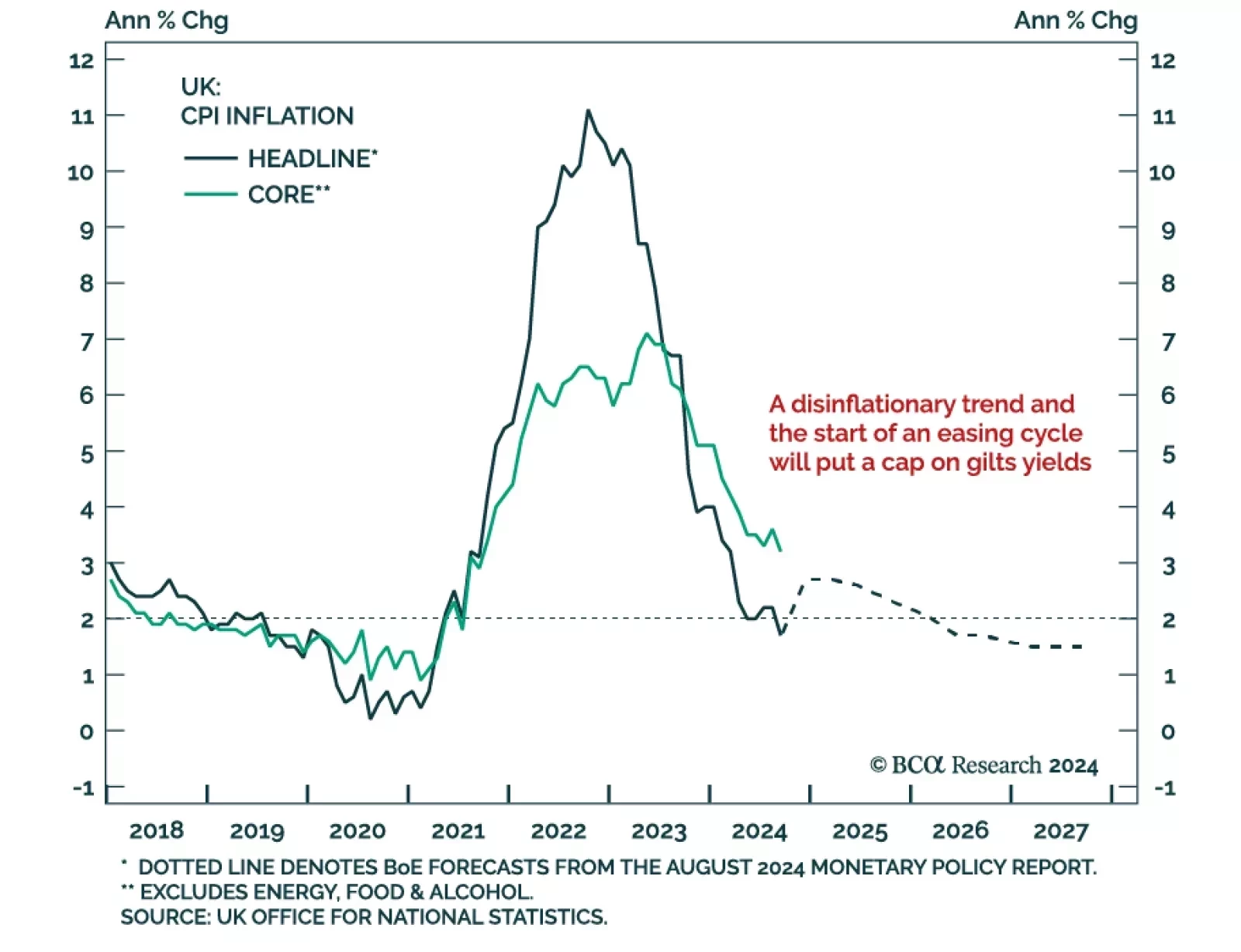

We recently pointed to the UK Budget announcement as a pivotal event for UK assets. Following an initially positive reception, the market has turned and priced in further fiscal premia in UK assets, with both gilts and the pound…

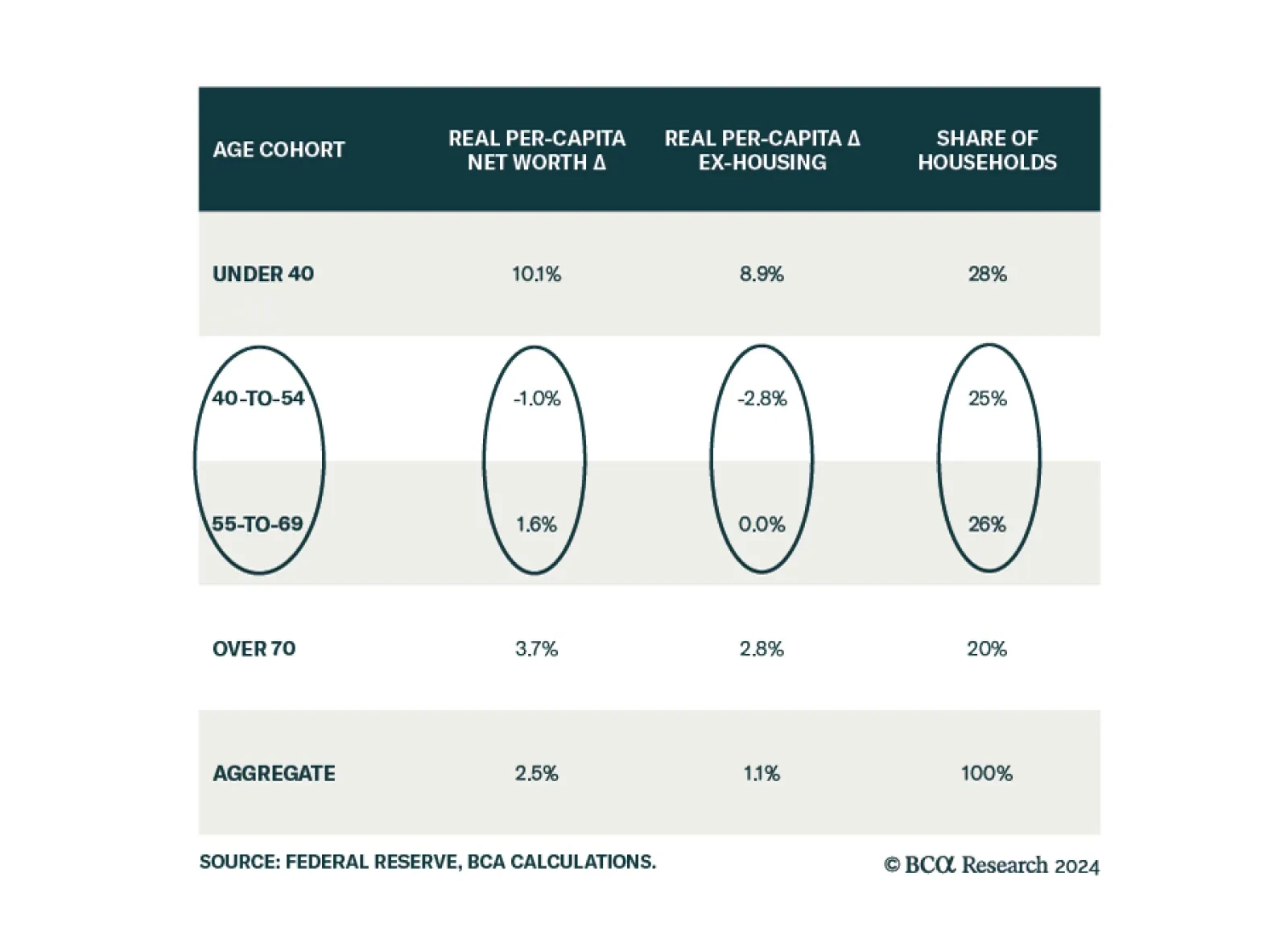

As US consumers remain one of the few engines of global growth, our US Investment Strategy colleagues took a deep dive on consumer trends, augmented with comments from US banks’ earnings calls. Middle-aged consumers have…

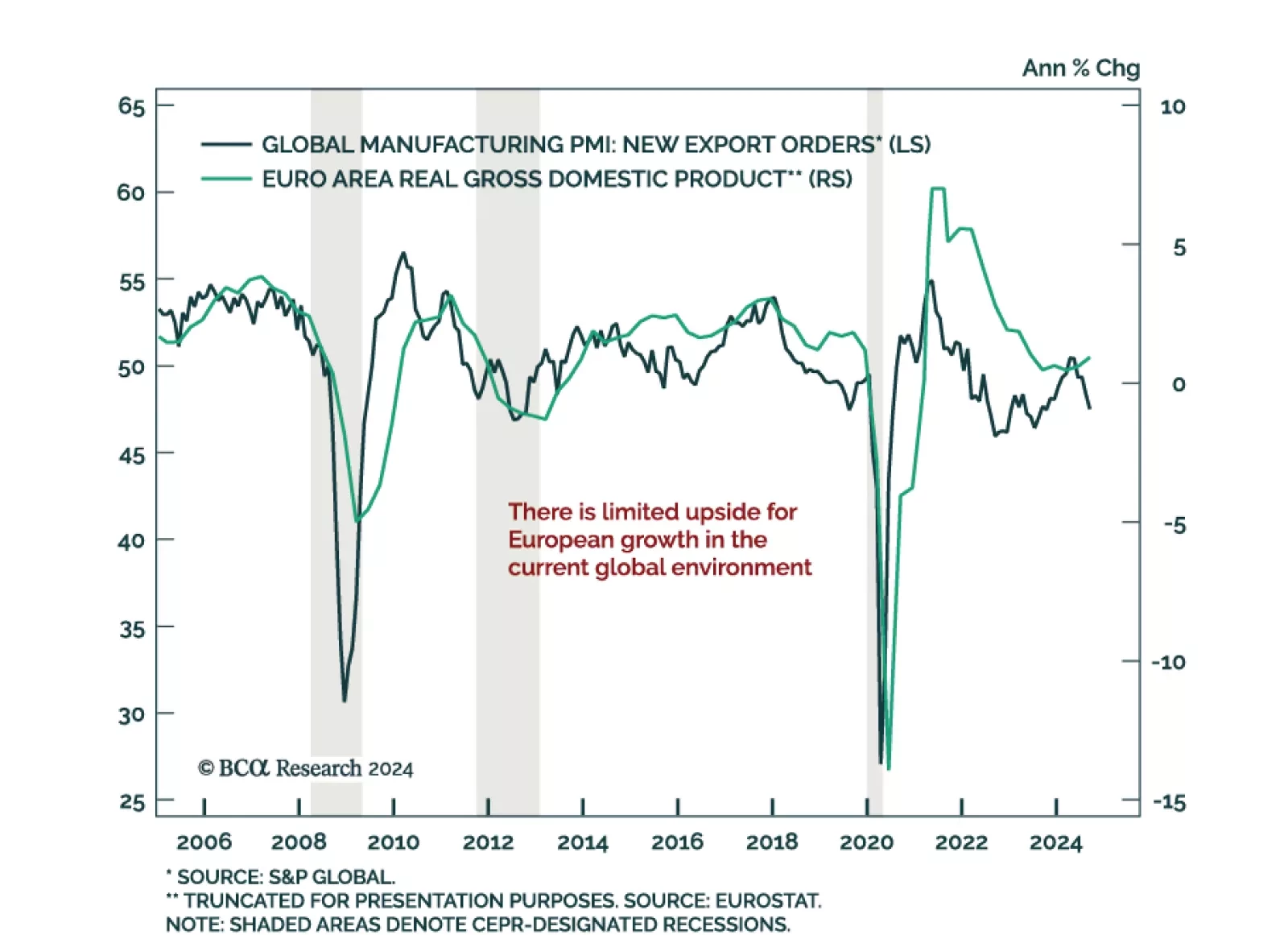

Flash Q3 GDP estimates for the Euro Area beat expectations, accelerating to 0.4% quarterly growth from 0.2% last quarter. The momentum was spread across major countries, except for Italy. Meanwhile, the European Commission’…

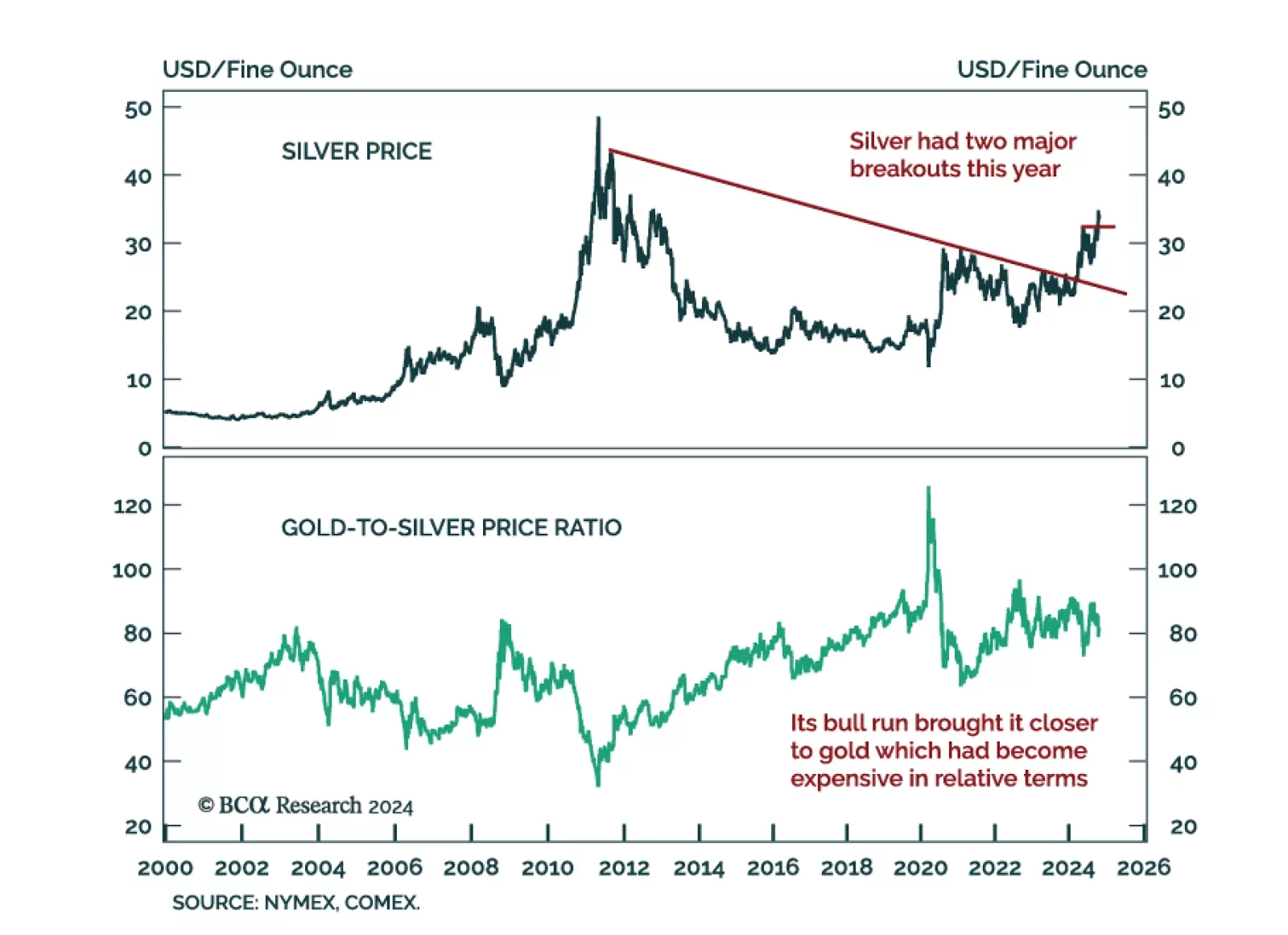

Silver has shone this year, especially after it breached a multi-decade downward slopping trendline. Silver is a precious metal, but its heavy usage in industrial processes makes us wonder whether it is sending a bullish message…

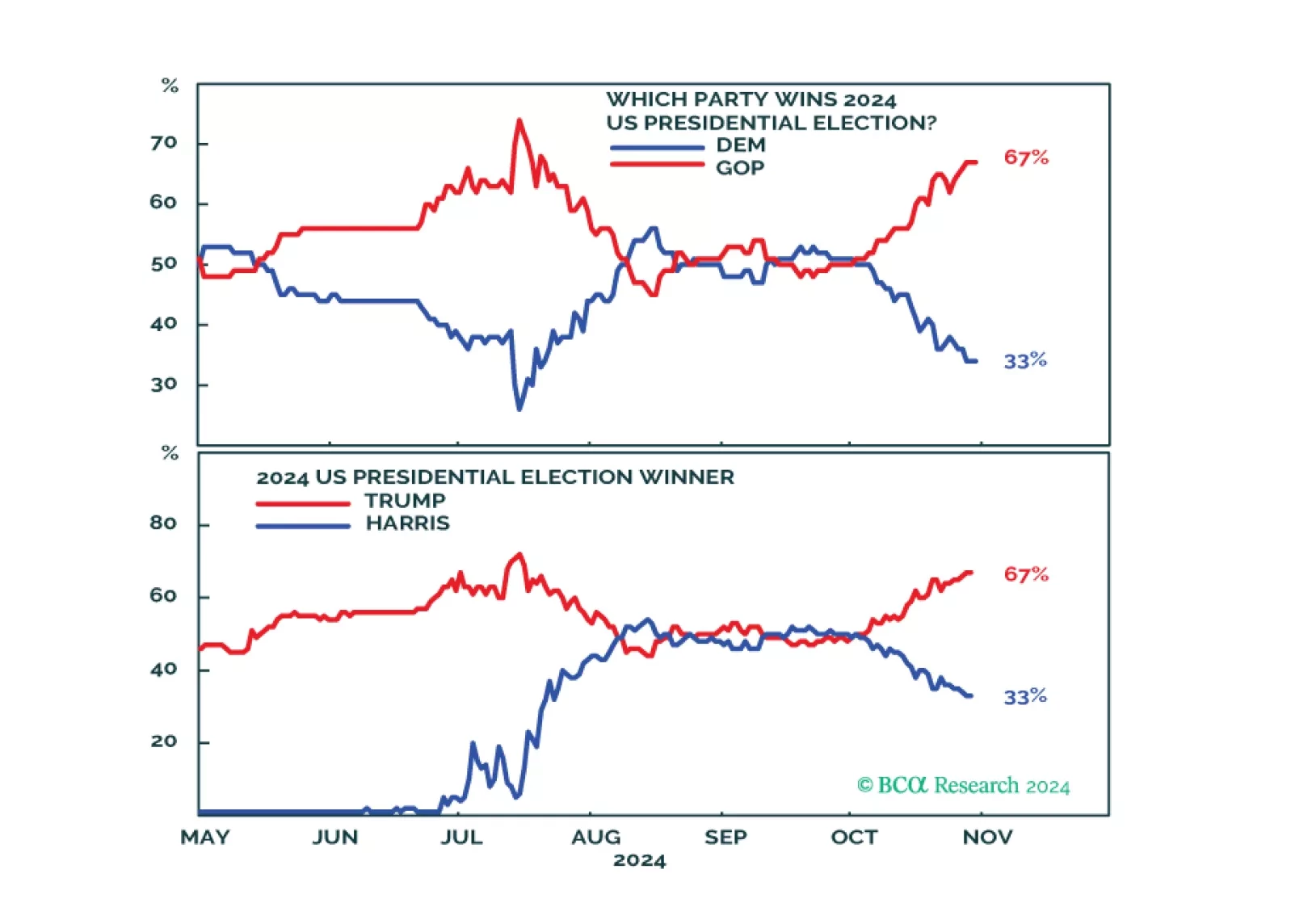

Trump may be favored, but Harris is now underrated. The Senate is highly likely to go Republican – Harris would be gridlocked if she pulled off a victory. If Trump wins it will be a full sweep. Expect volatility in the short term.

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.