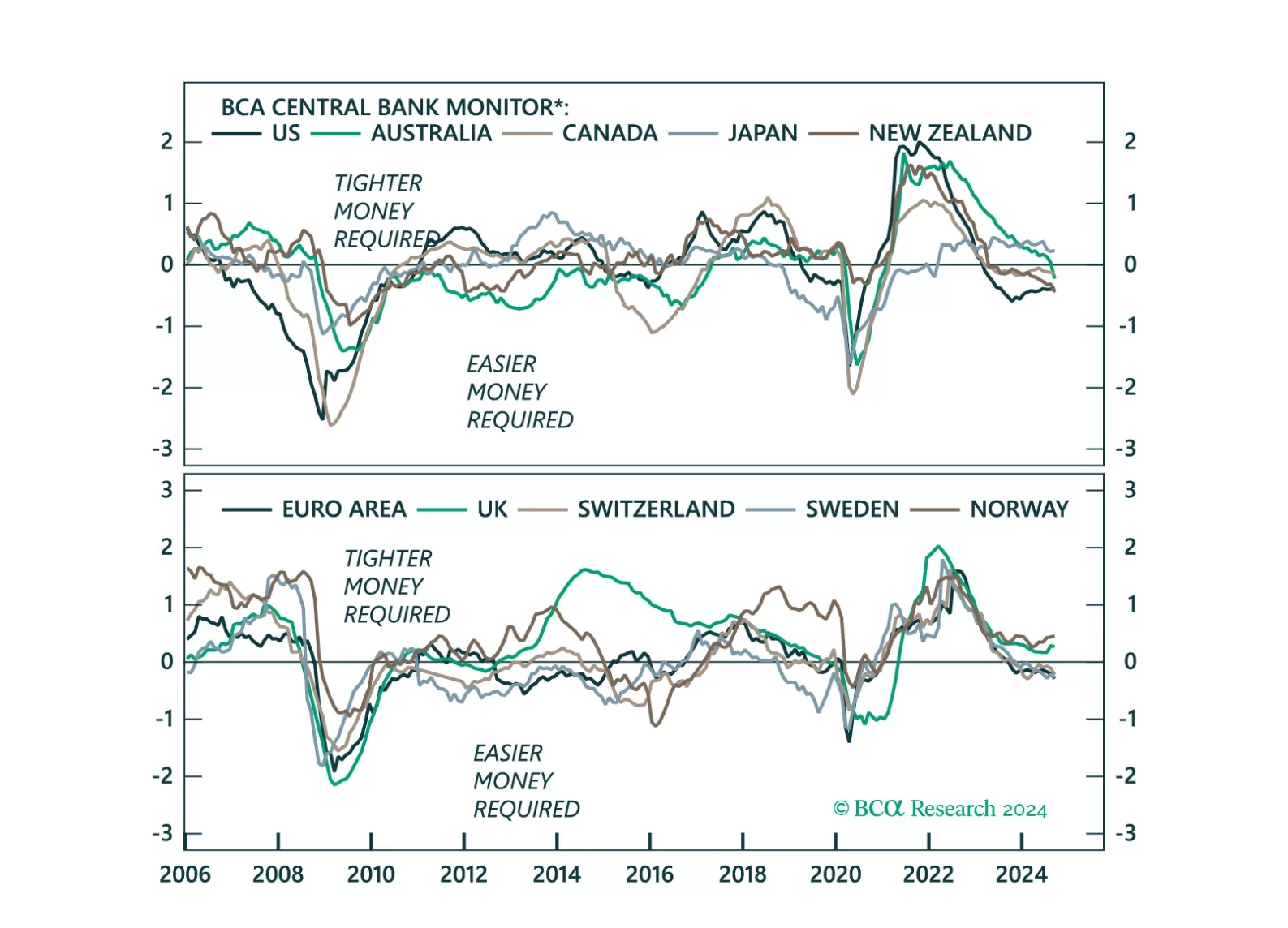

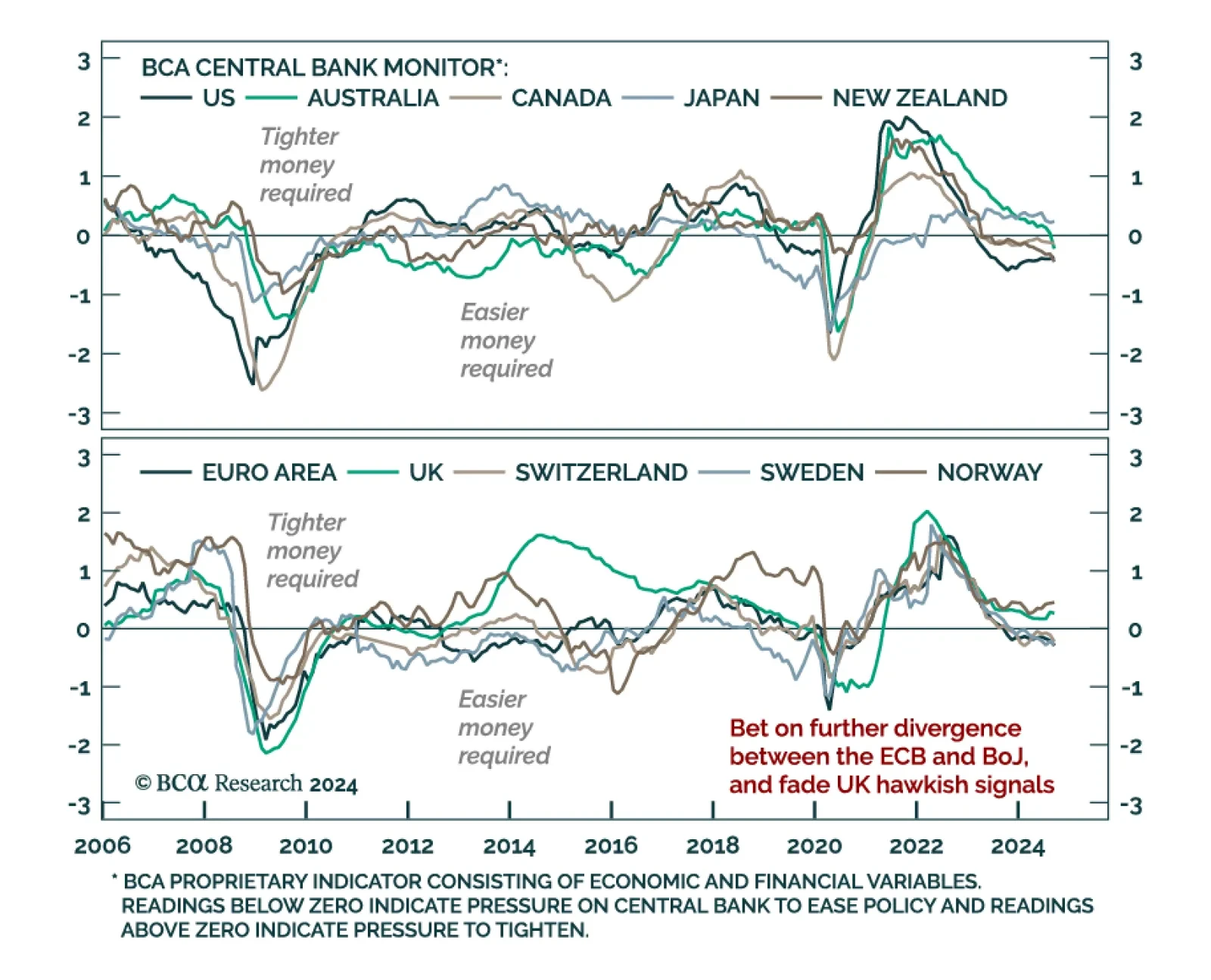

According to the latest update of the Central Bank Monitors from BCA’s Global Fixed Income strategists, economic weakness and diminishing inflation pressures warrant a shift towards easier global monetary conditions. The…

Our Portfolio Allocation Summary for November 2024.

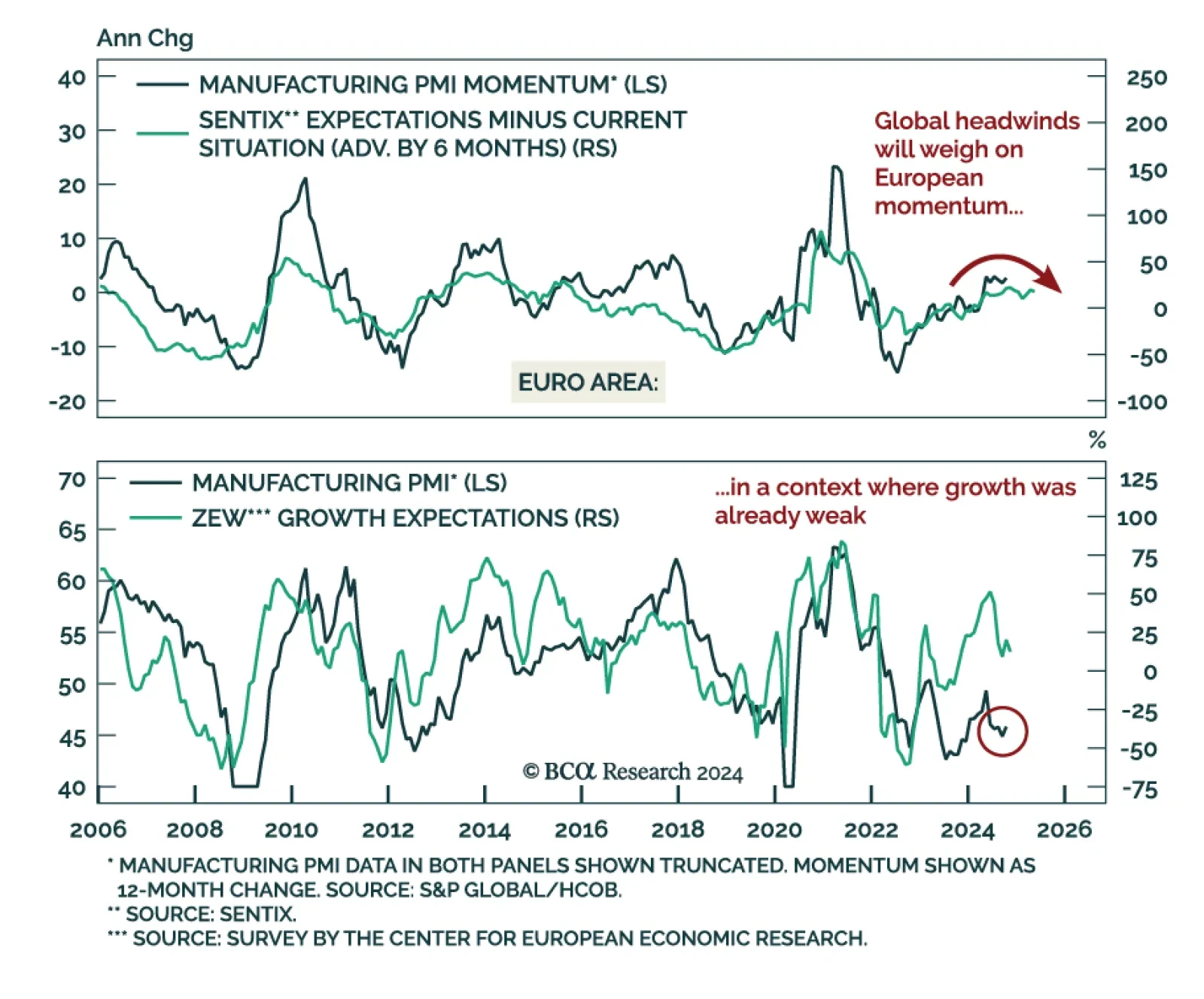

Economic expectations for Germany and the Eurozone disappointed, with the November ZEW decreasing to 12.5 from 20.1. The assessment of current conditions also worsened, implying the sentiment rebound from September will not be…

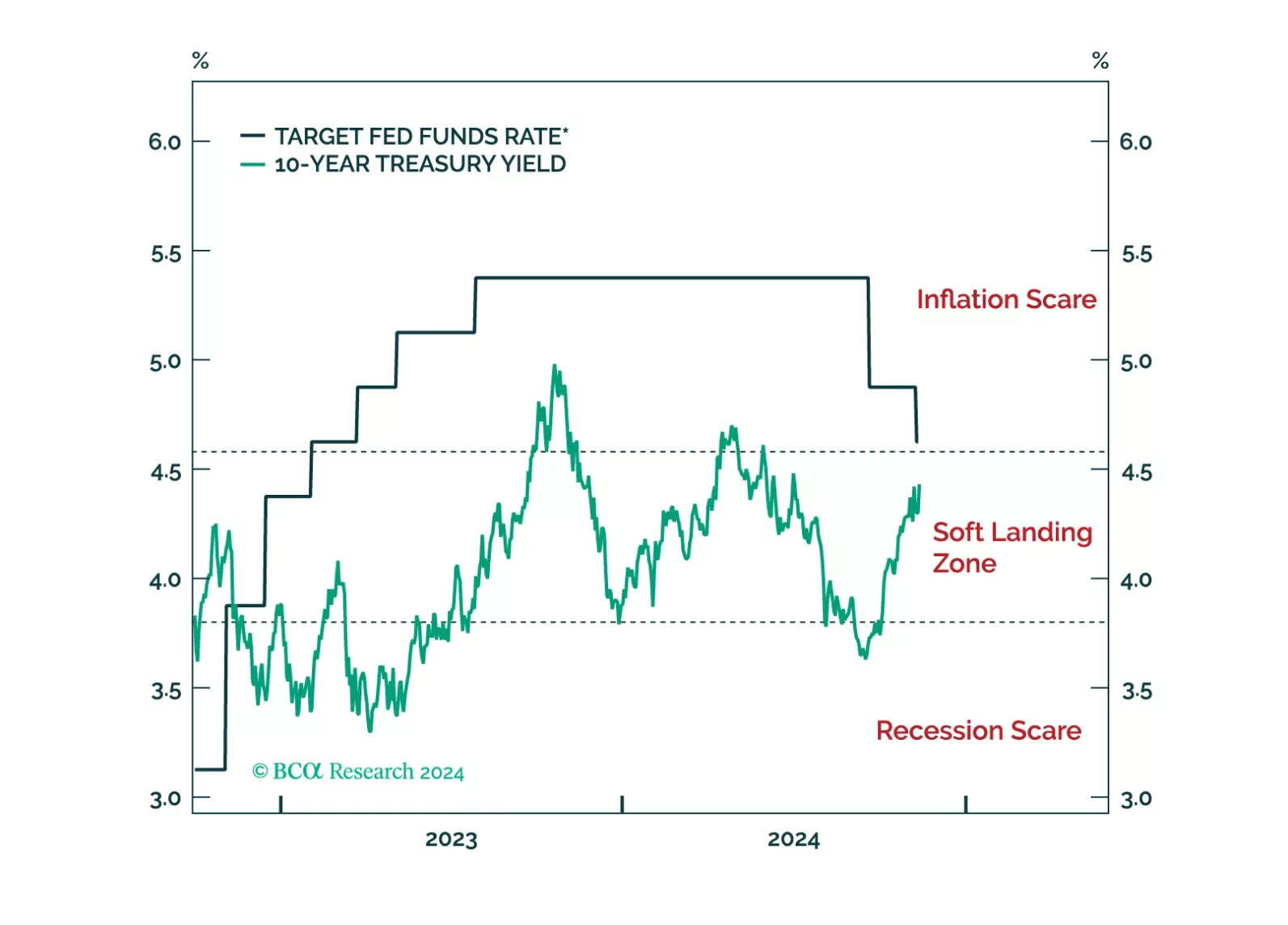

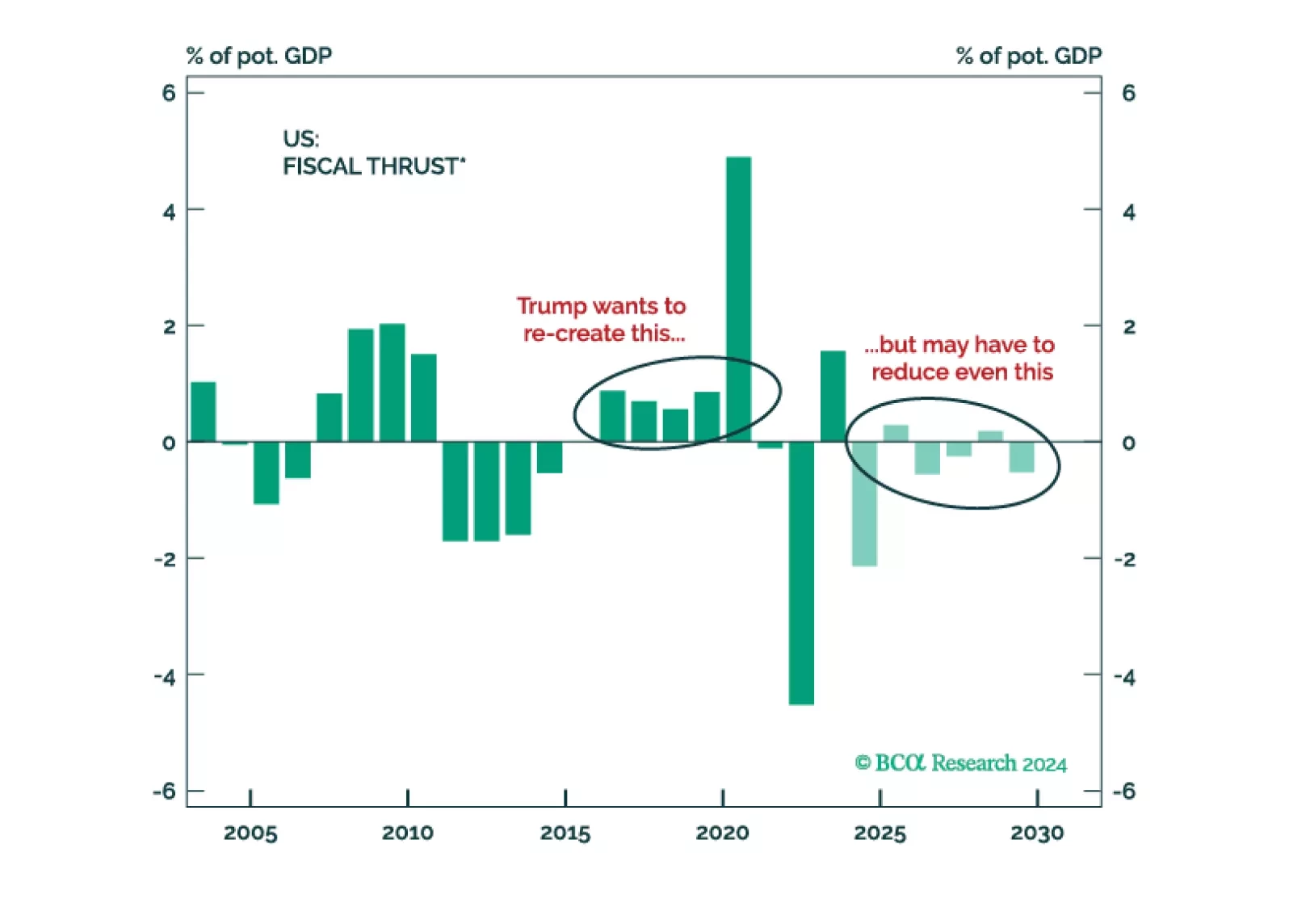

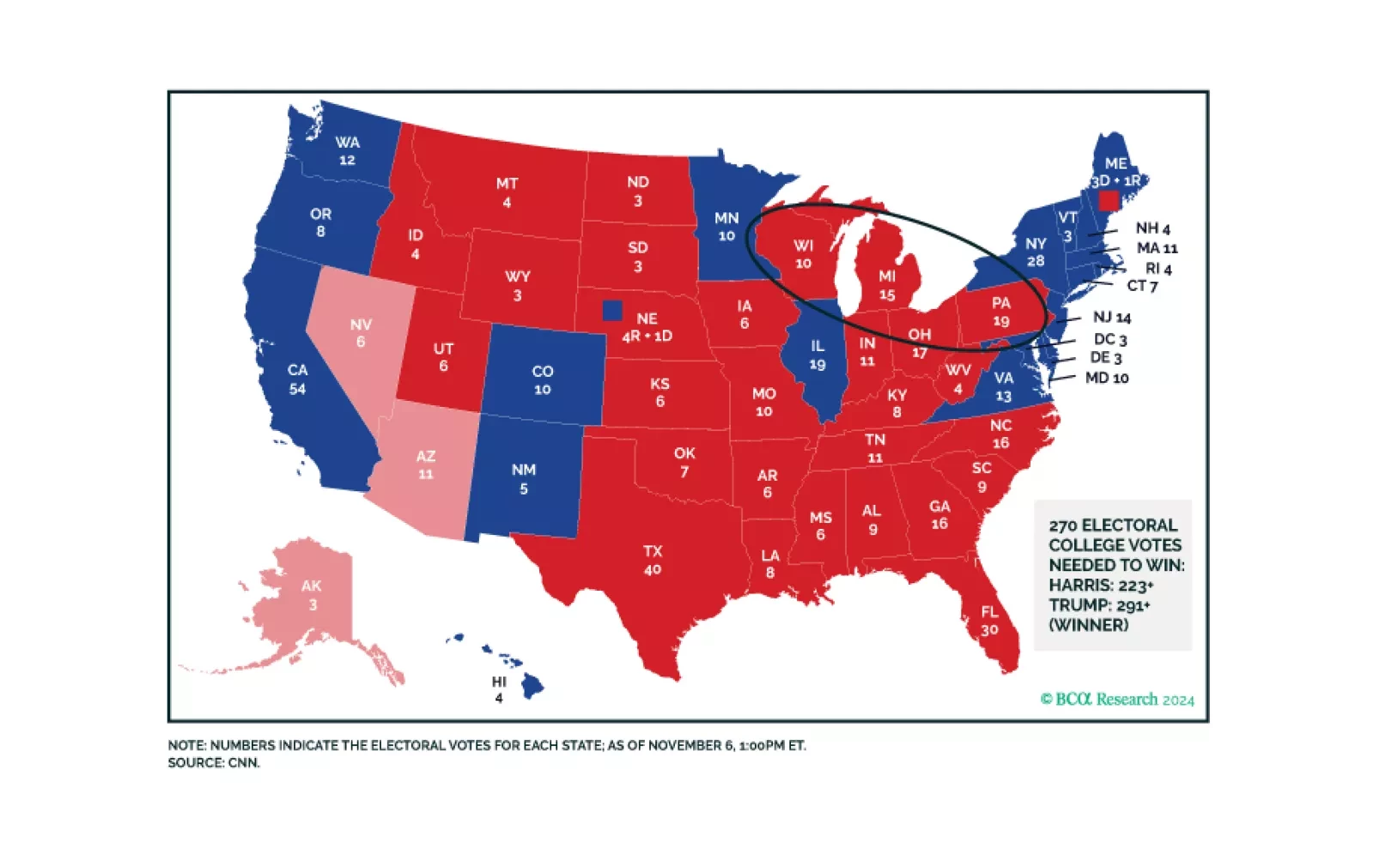

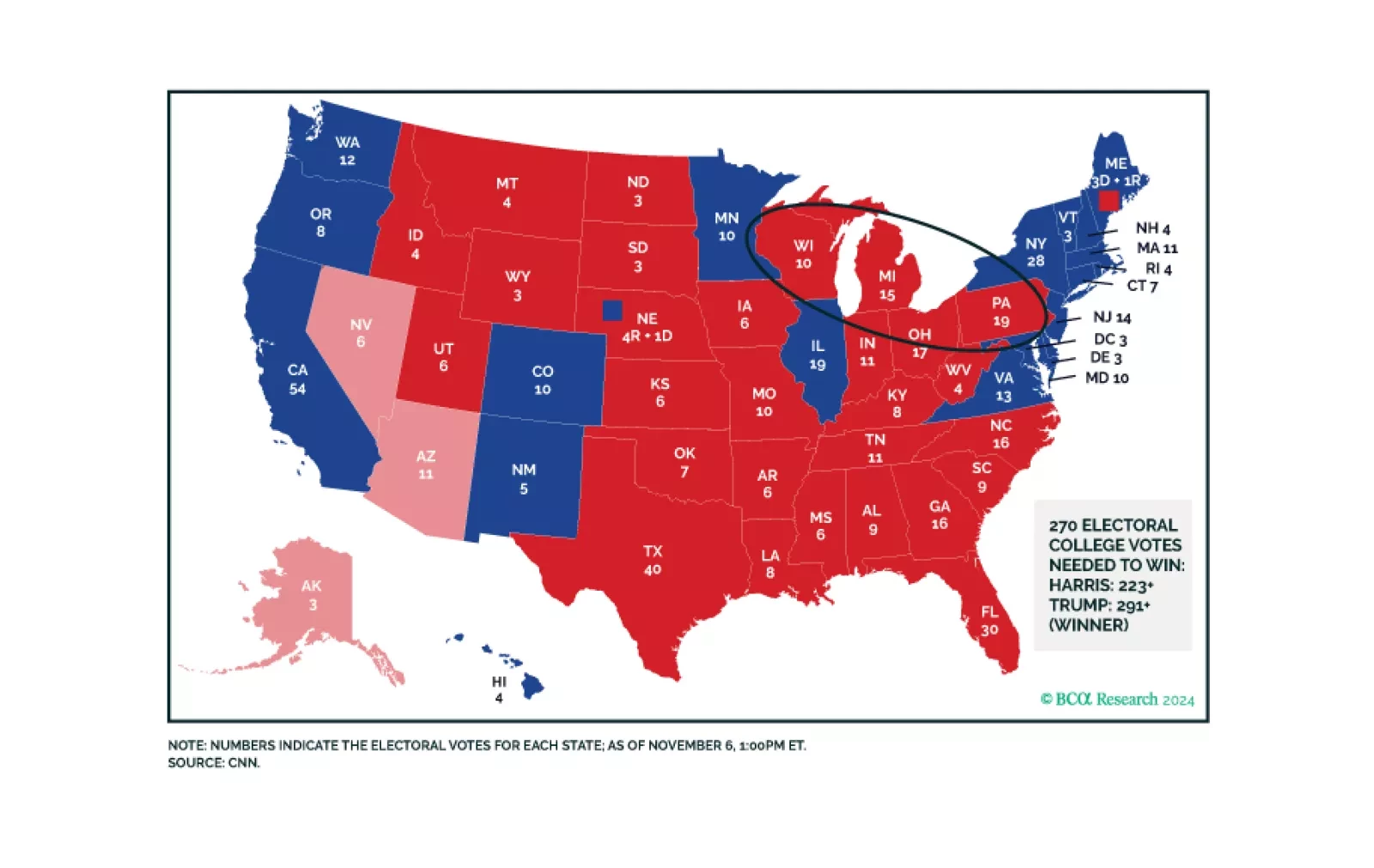

The month of November has brought us S&P 6,000! President Trump has won a “Red Sweep” (as we expected all year) and has ushered in a regime change in America. For now, we are open to chasing momentum. However, the biggest risk to…

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

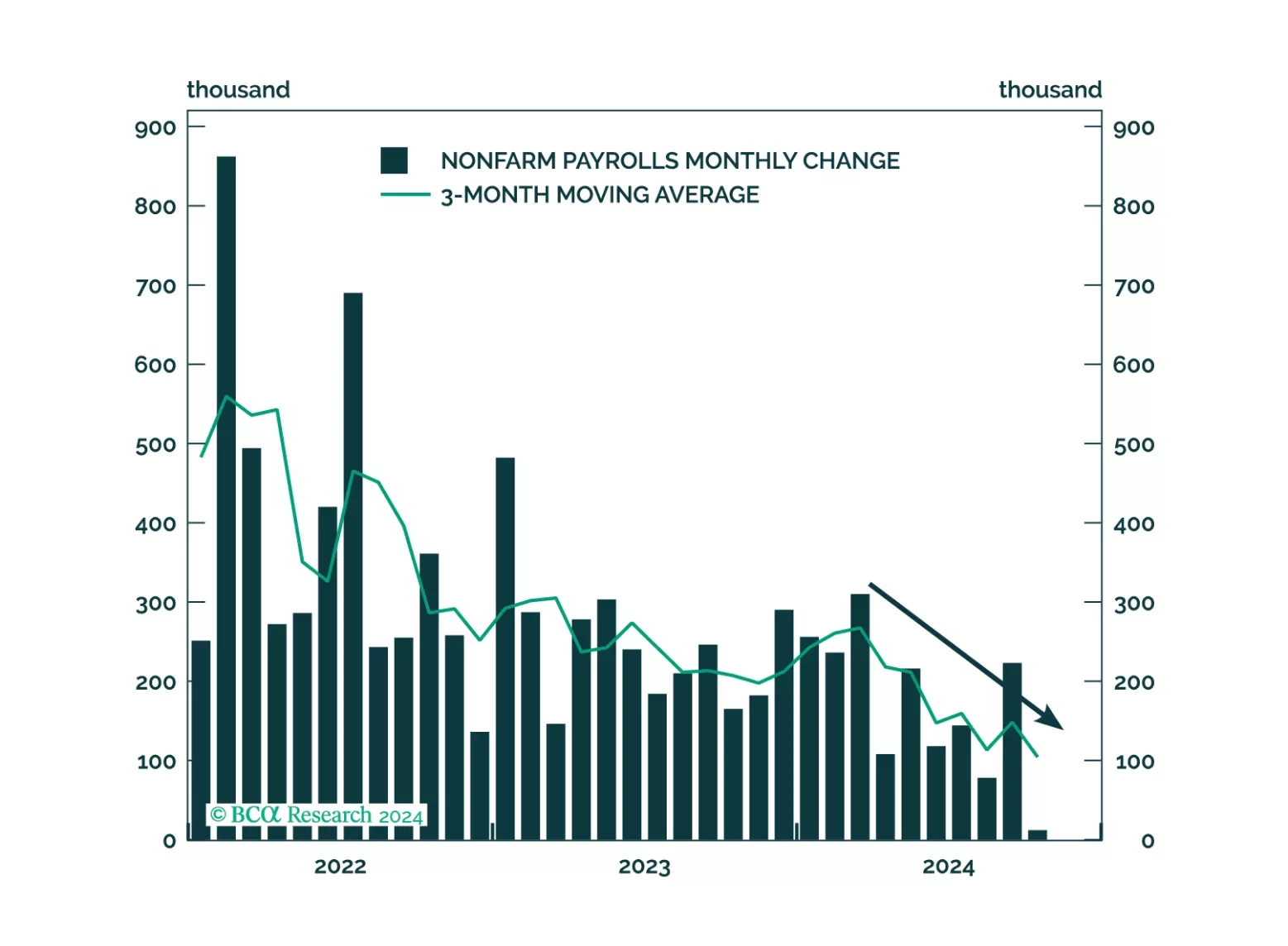

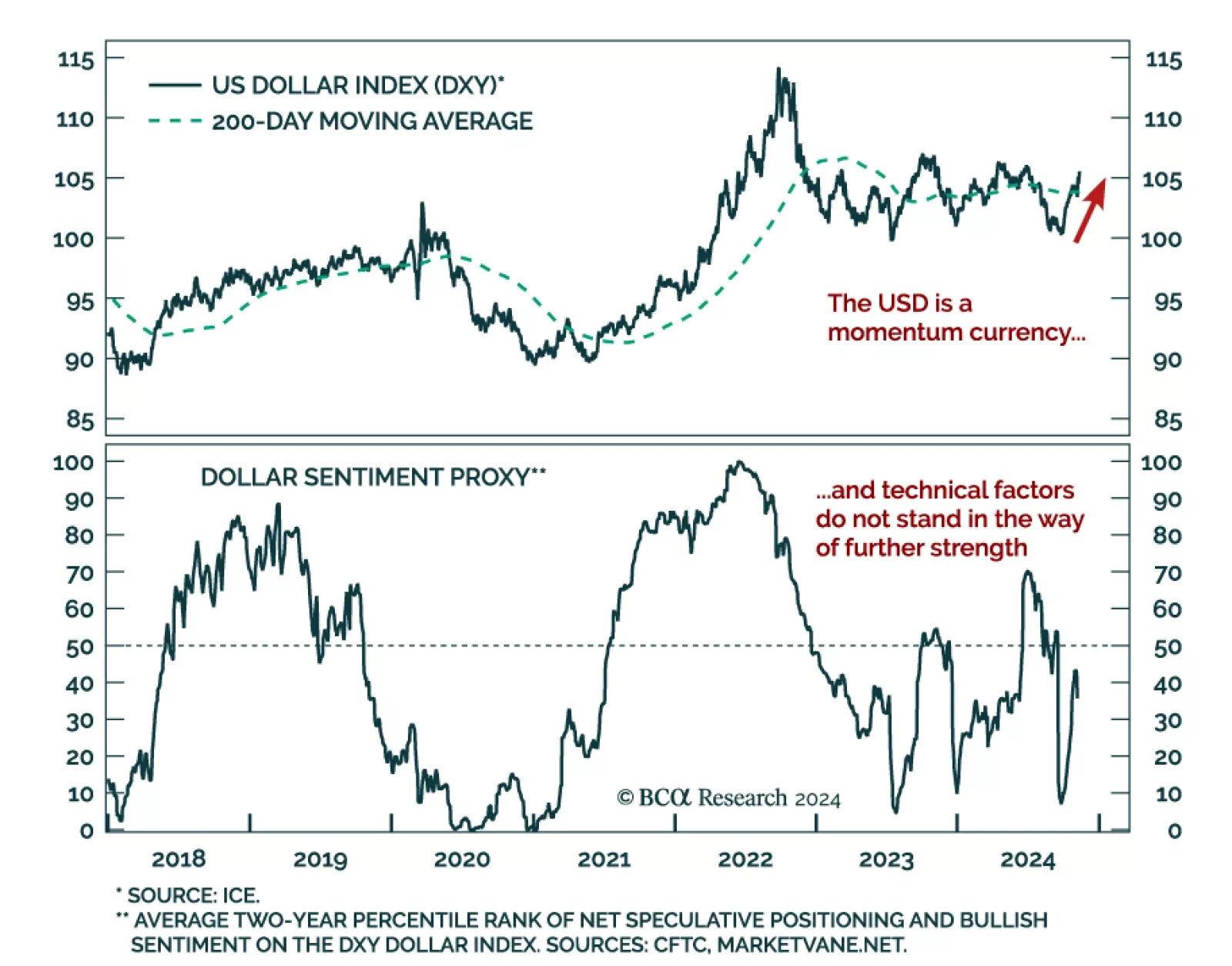

The US dollar steamrolled its peers since early October. After breaking out above its 200-day moving average, it is now fast approaching recent highs. Multiple factors drove this rally, among them are the stronger-than-expected…

The force of the post-election momentum leads us to believe we could be stopped out of our defensive positioning before the week is out, but we still believe in our recession call. If we are eventually stopped out, we will seek a…

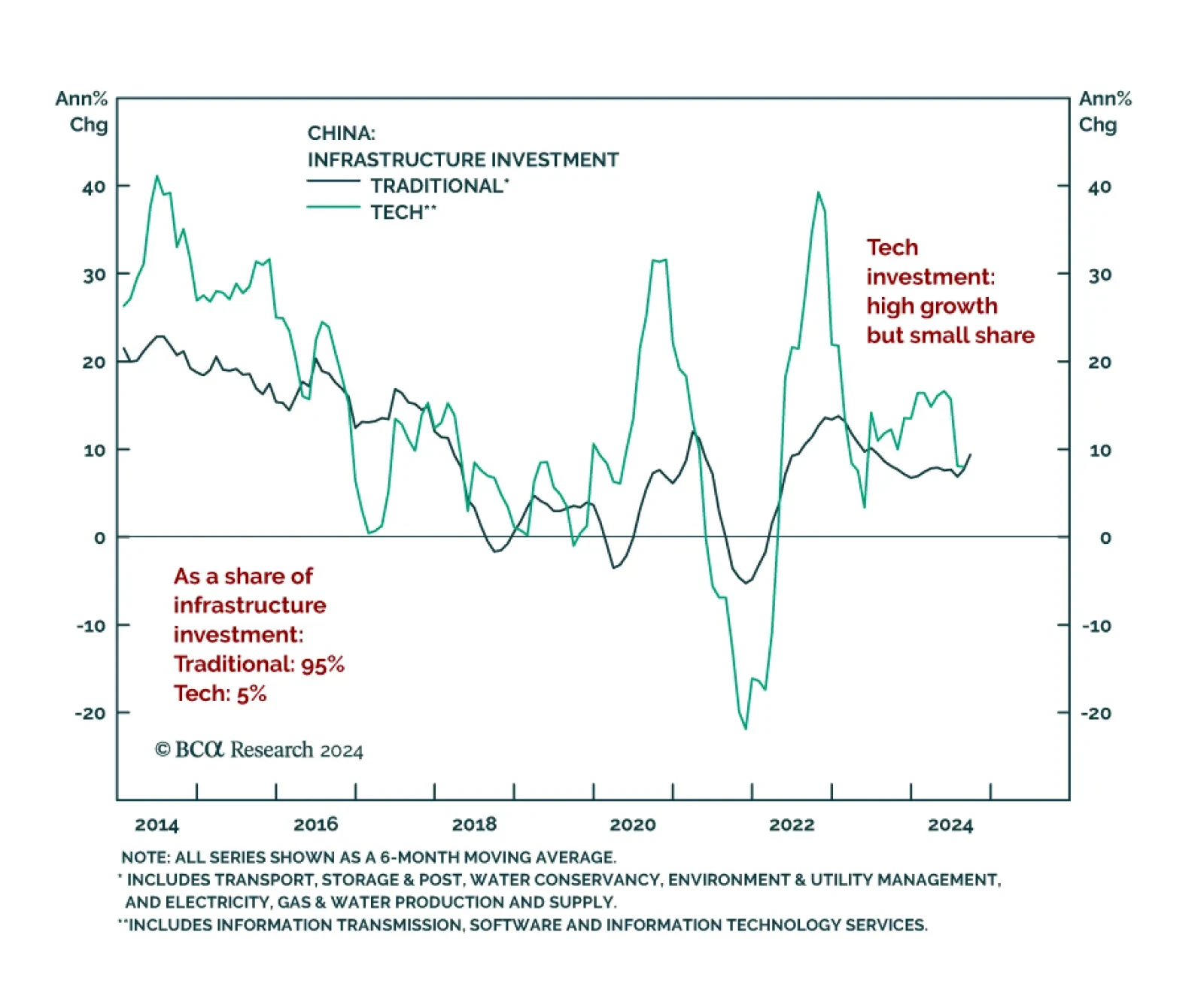

Our China Investment Strategy team recently met with clients in China to assess investor sentiment and discuss the outlook as Beijing unveils new stimulus measures. China’s economic recovery faces headwinds and is…