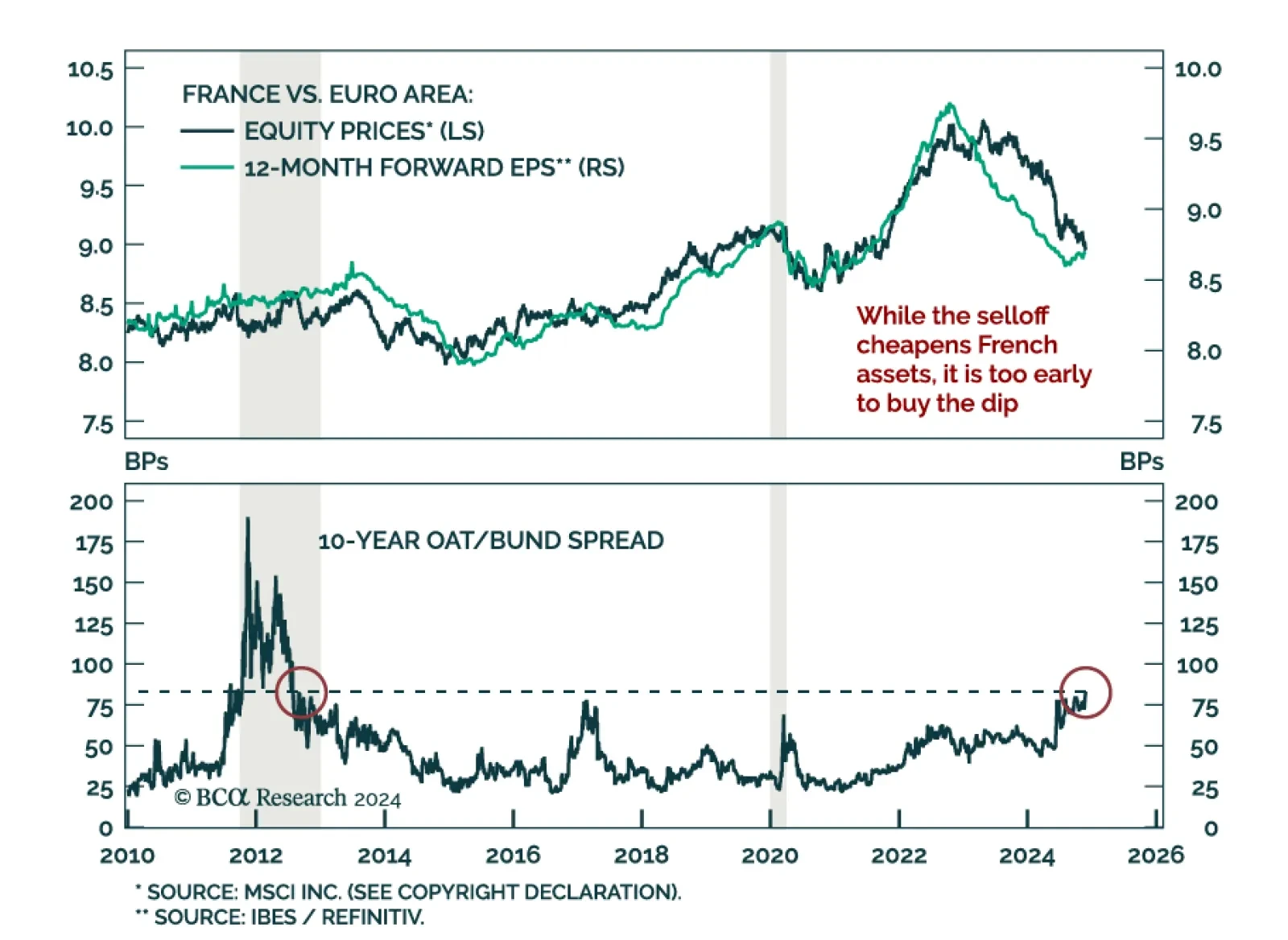

Investors focused on the flurry of cabinet nominations in the aftermath of the US election, but the US does not have a monopoly on political drama. France is going through turmoil of its own. This summer’s snap election…

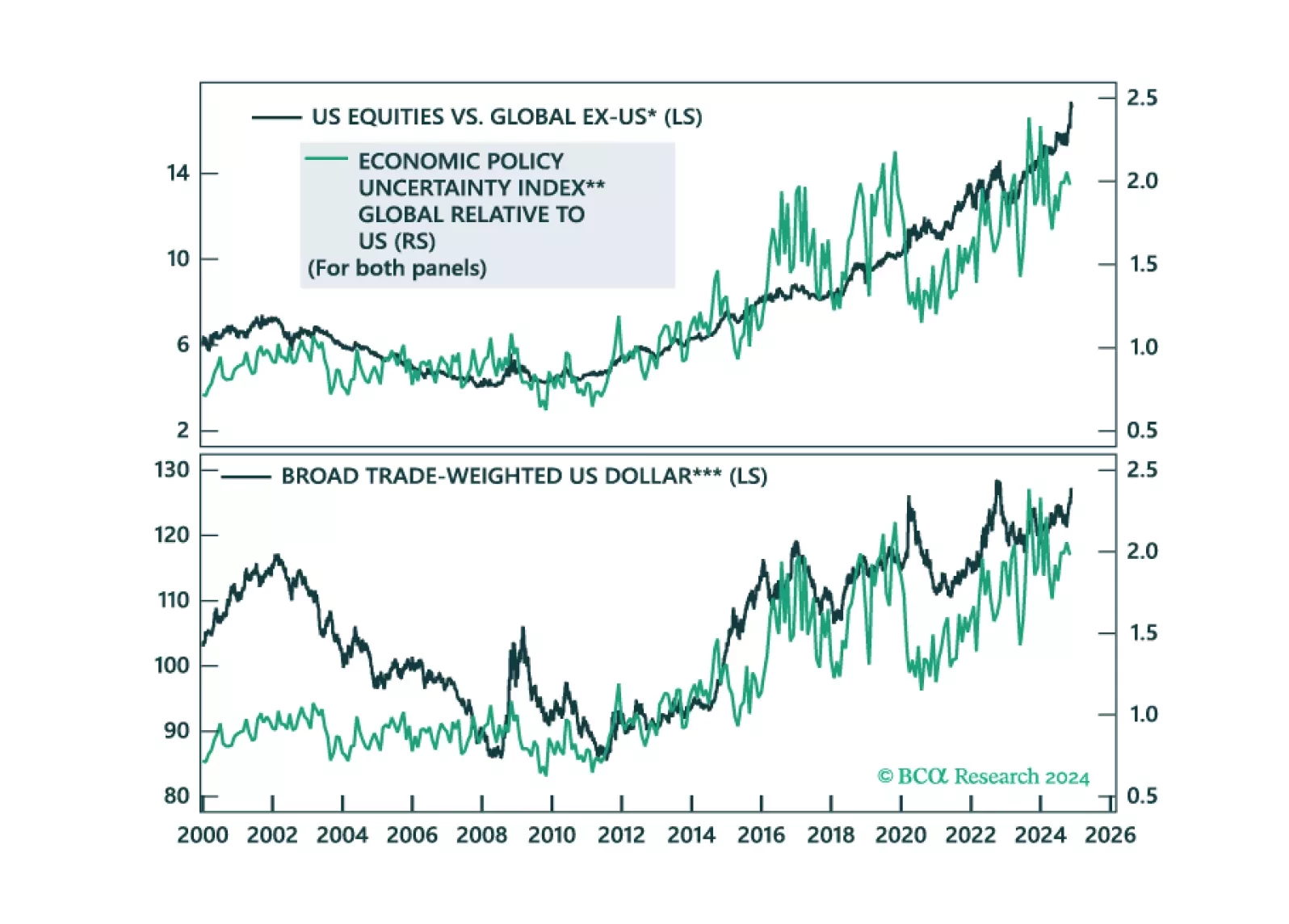

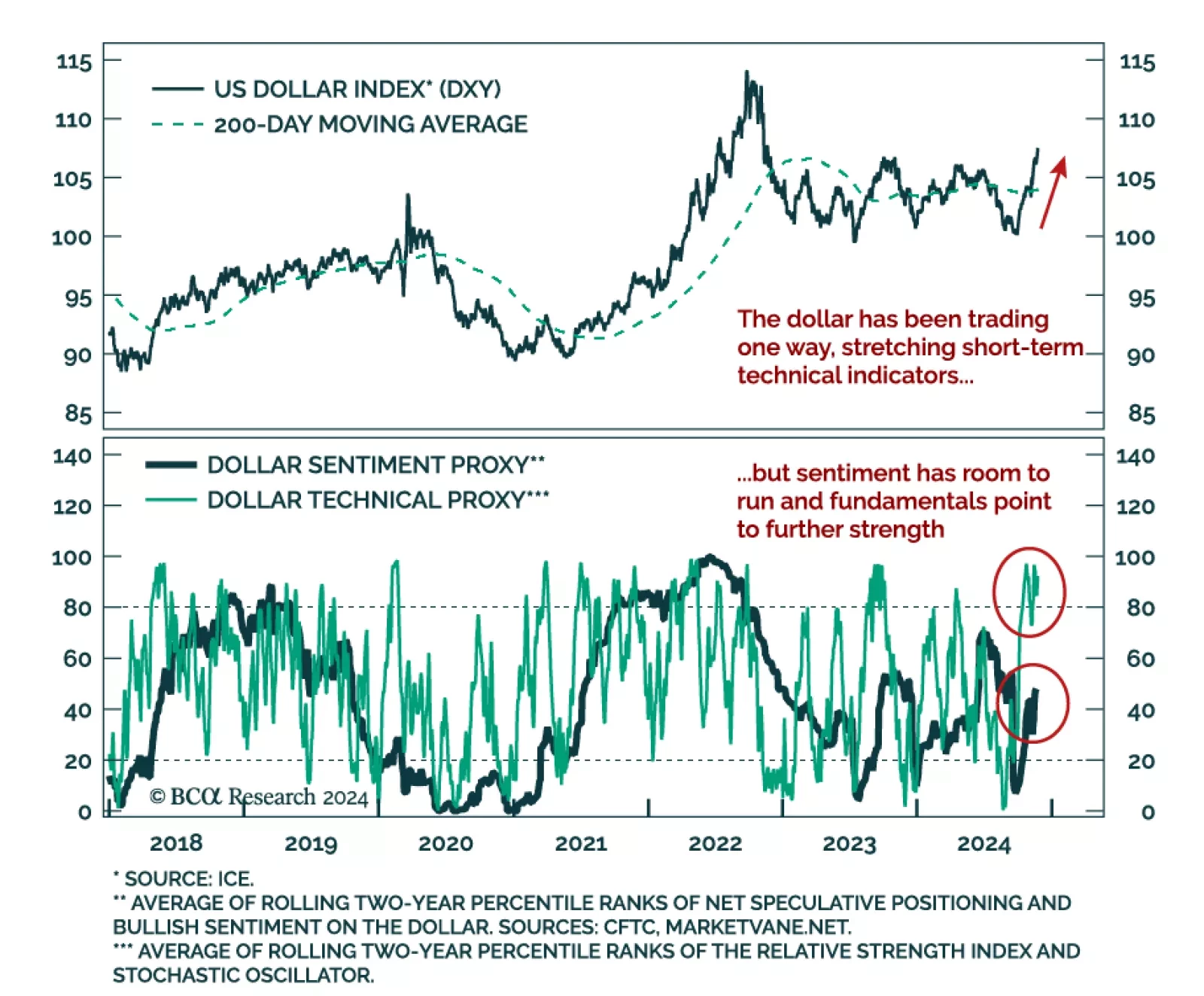

We used last Friday’s BCA Live & Unfiltered Meeting to assess our views on the US dollar after its recent bull run. While technical indicators may show short-term exhaustion, and Scott Bessent’s nomination for…

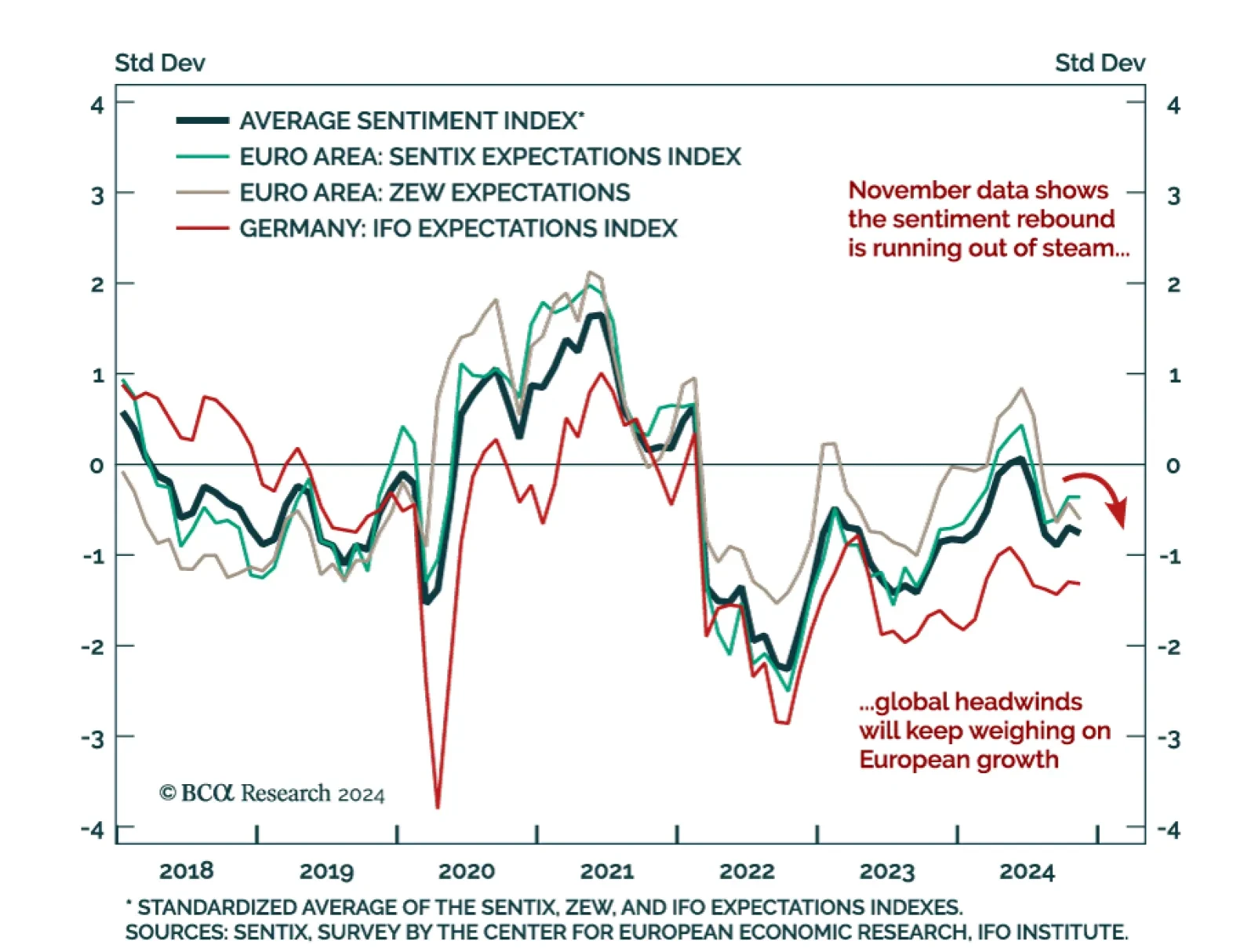

The November Ifo Business Climate index for Germany missed expectations, falling to 85.7 from 86.5 in October. Both subcomponents decreased, with the Current Assessment sliding 1.4 points to 84.3 and Expectations essentially flat…

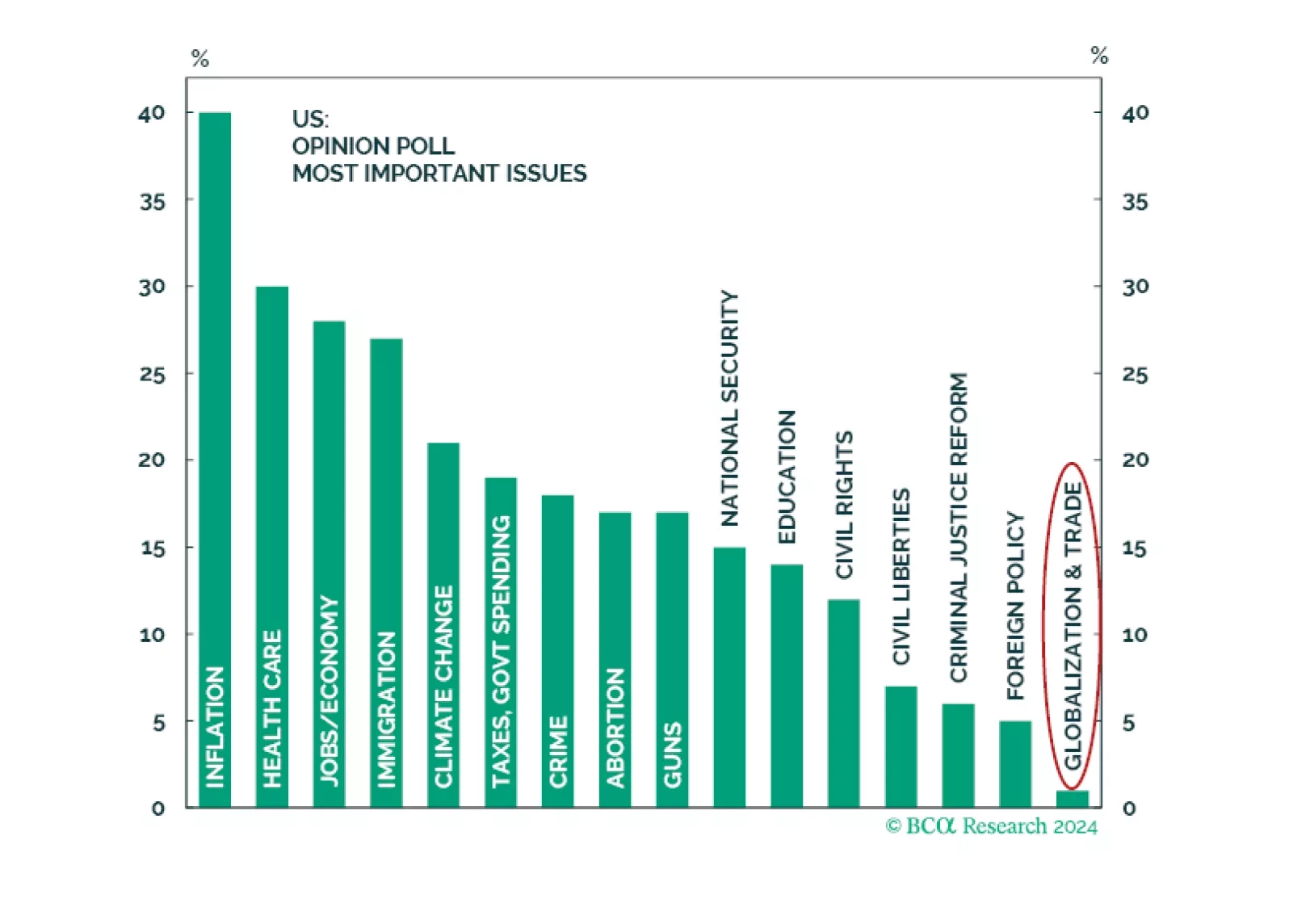

Executive Summary Political Uncertainty And The Dollar The consensus is that Republicans will blow out the budget deficit, leading to a higher fiscal risk premium on the dollar. That seems unlikely for now. If the deficit…

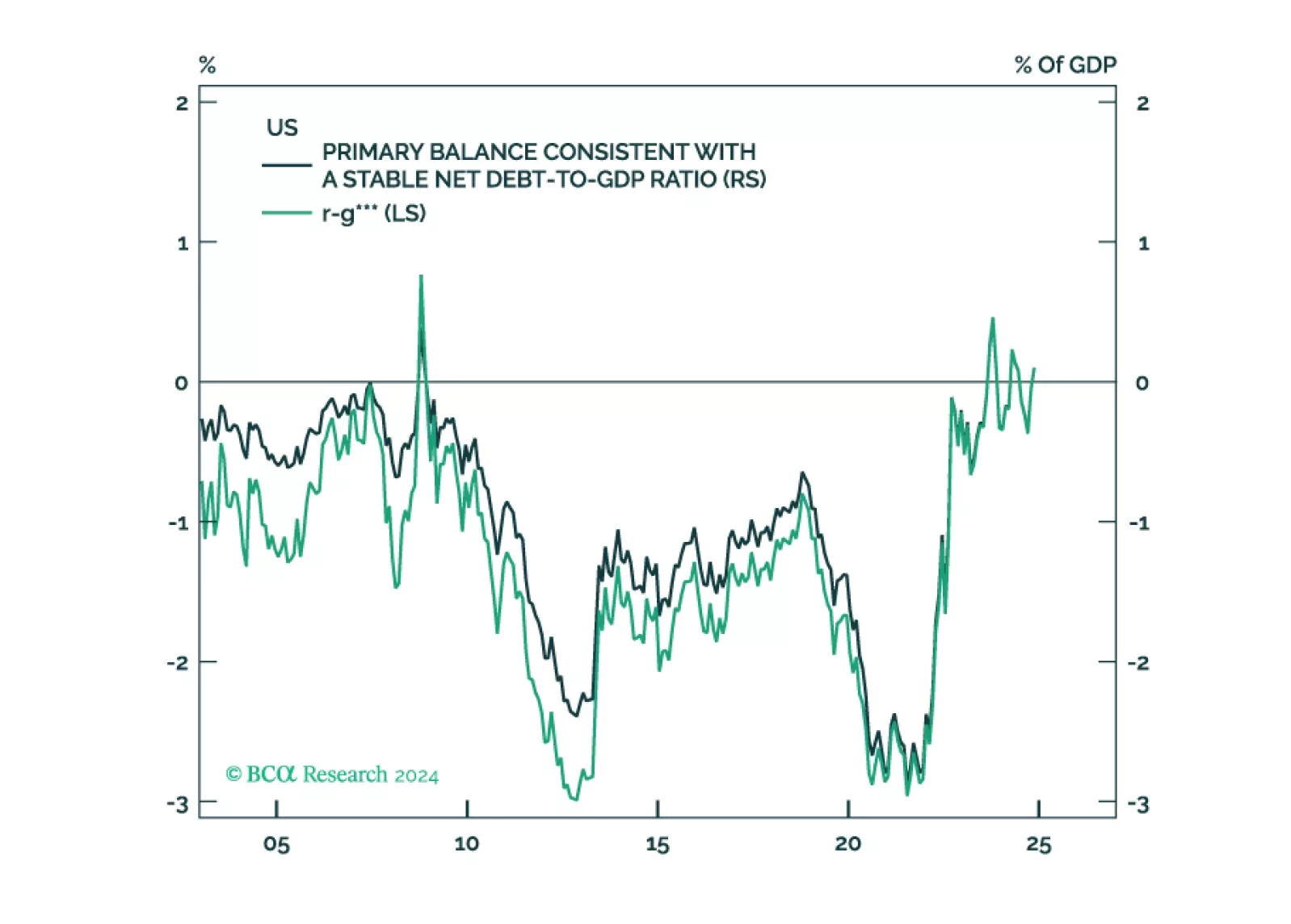

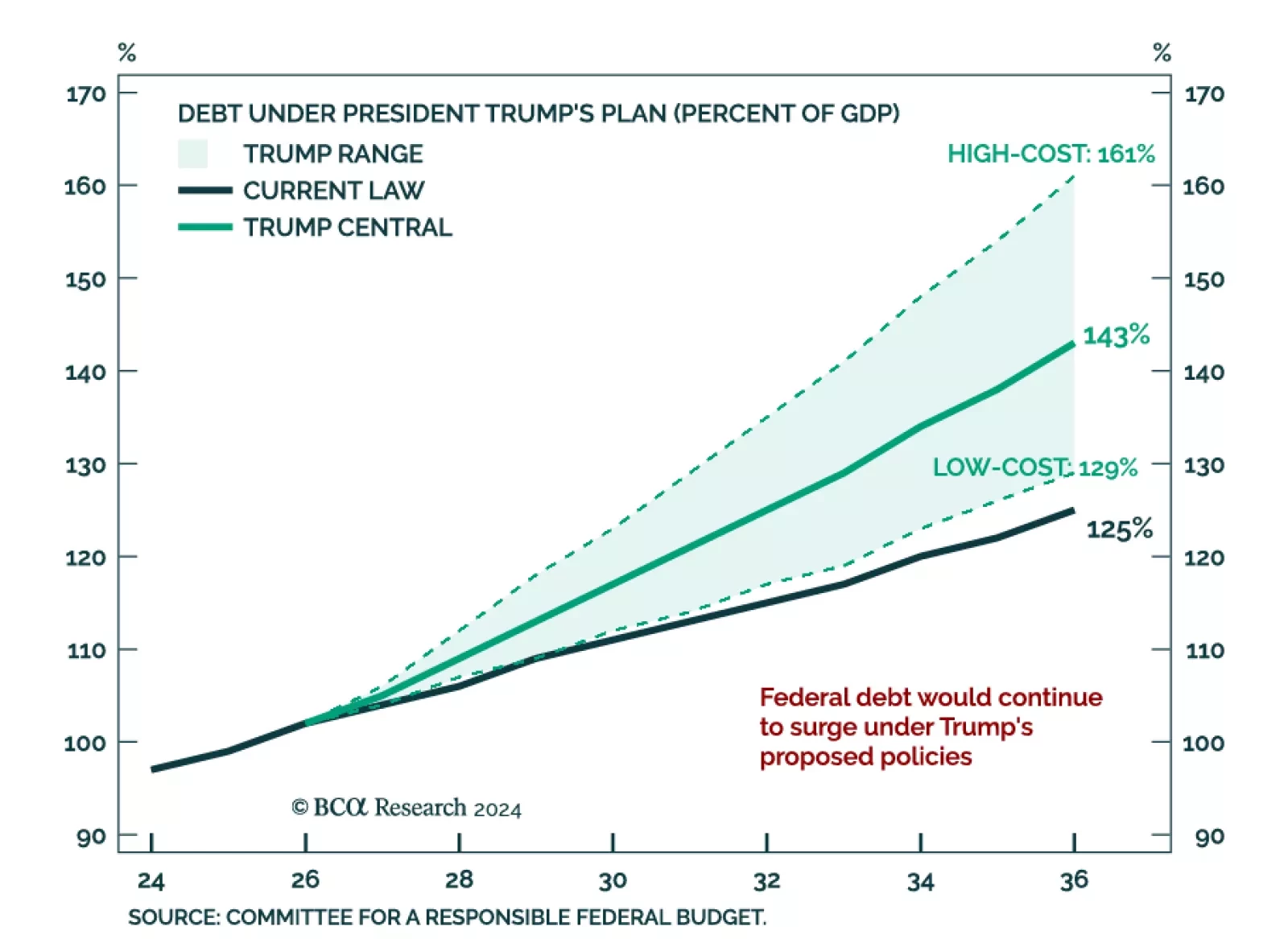

Our Global Investment Strategy team examined the risk of a fiscal crisis amid rising global debt levels. Stabilizing the US debt-to-GDP ratio would require a nearly 4% GDP improvement in the primary budget balance at…

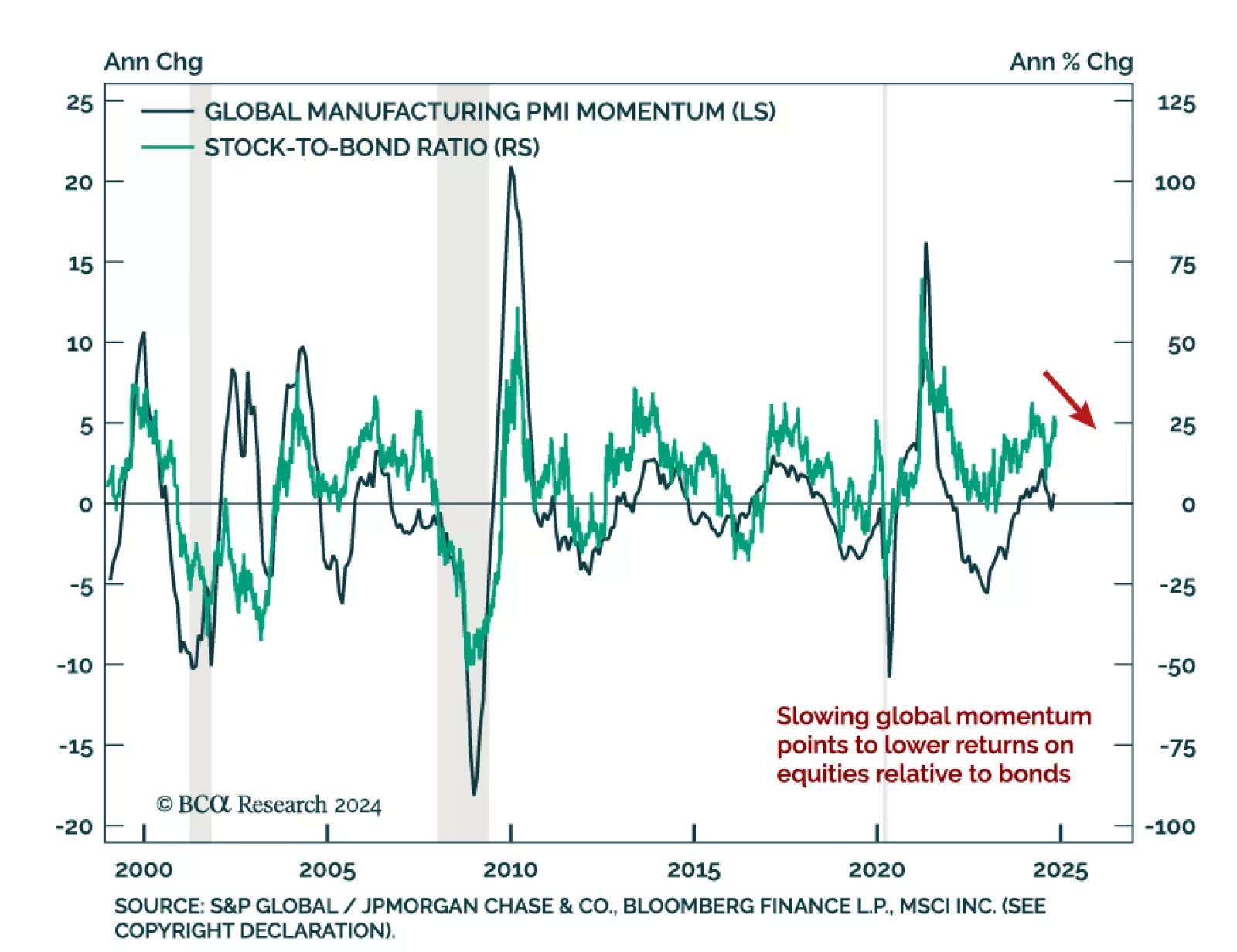

As talks of a market “meltup” abound, we used last Friday’s edition of our BCA Live & Unfiltered meeting to assess our asset allocation recommendations. Our House View has been underweight equities since…

Executive Summary The US Needs To Reduce Its Primary Budget Deficit By Nearly 4% Of GDP To Stabilize Debt Rising government debt in the US has heightened the risk of a fiscal crisis. If interest rates stay where they are, the US primary…

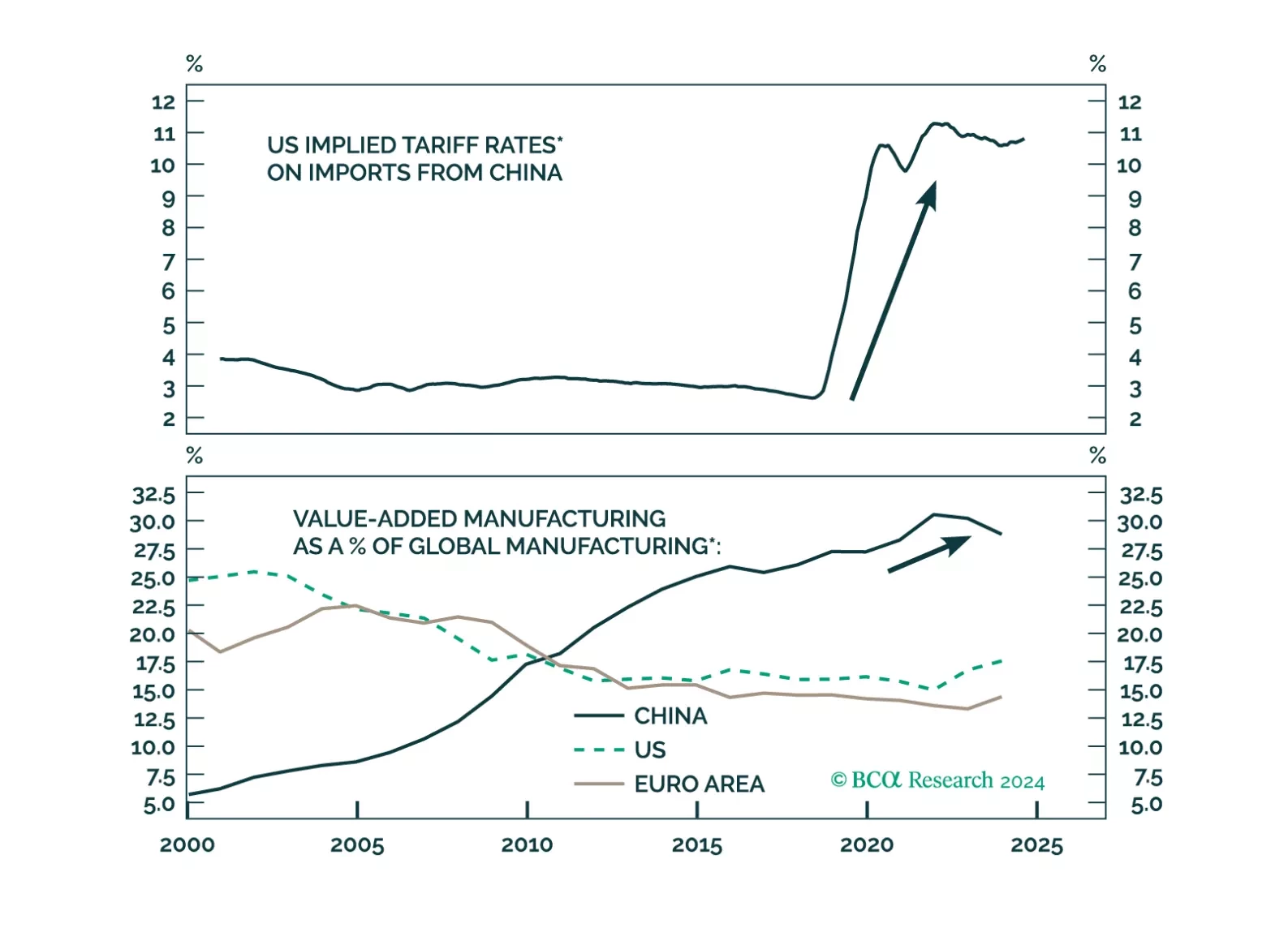

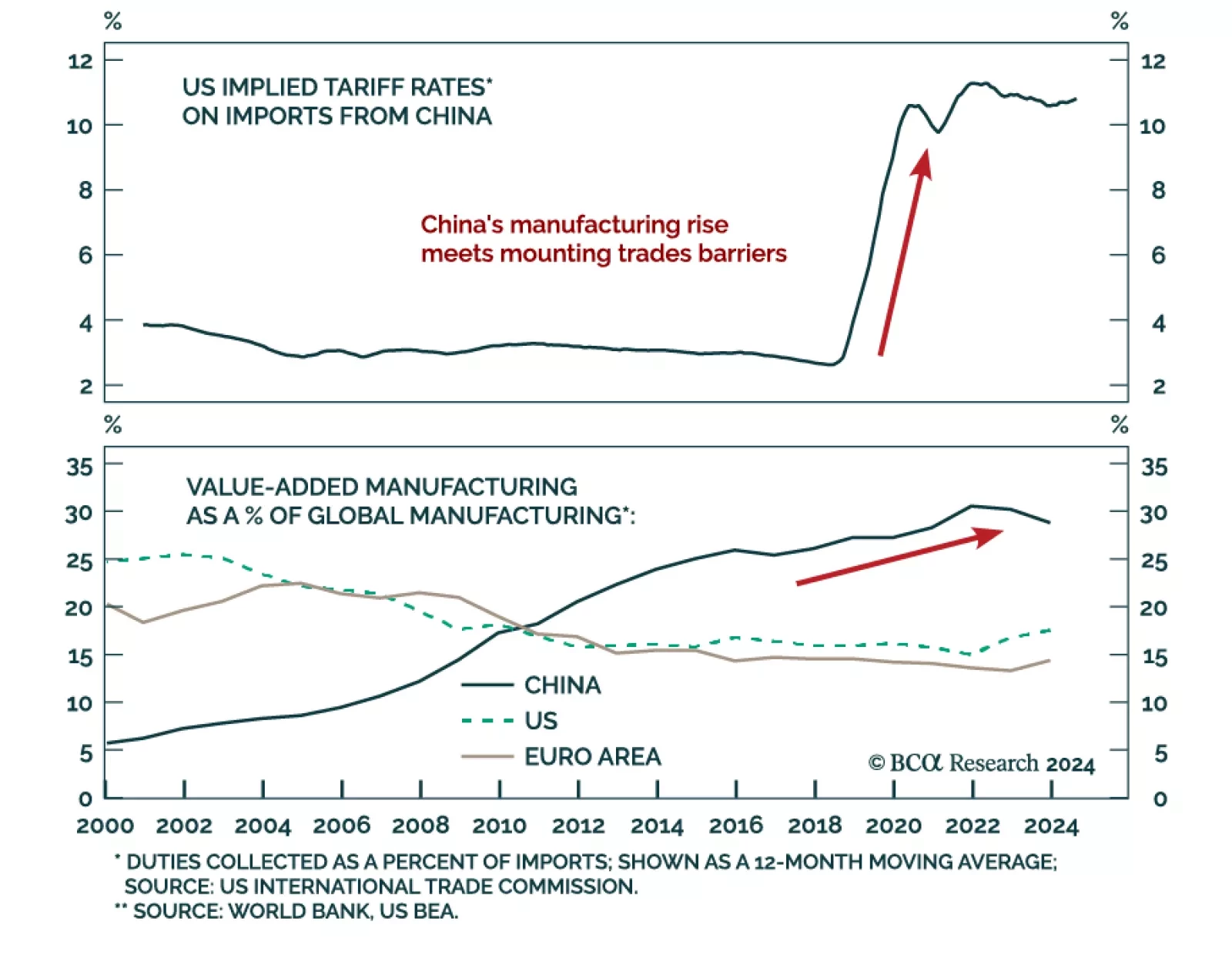

Our China Investment Strategy team assessed the country’s outlook in a context of underwhelming stimulus and rising trade tensions. Trump’s re-election raises the likelihood of tariff hikes on Chinese exports…

Trump's presidential re-election makes US tariff rate hikes on Chinese exports an imminent threat. Beijing has made extensive efforts to derisk the domestic economy and diversify trade away from the US. However, China is no better…