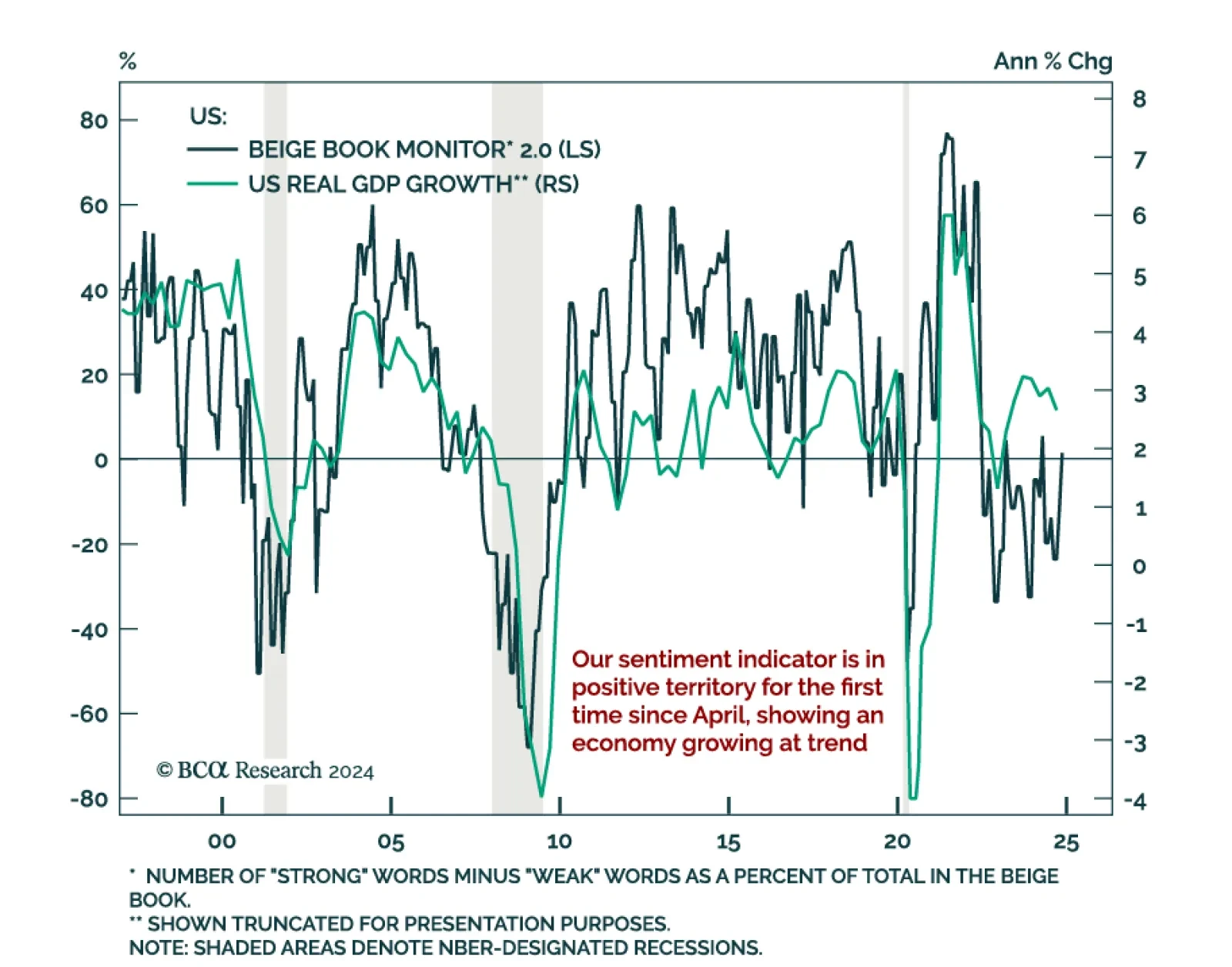

The Federal Reserve’s Beige Book shows a modestly growing economy imbued with post-election optimism, while highlighting some caution about employment. The latest Beige Book is in line with other sentiment indicators…

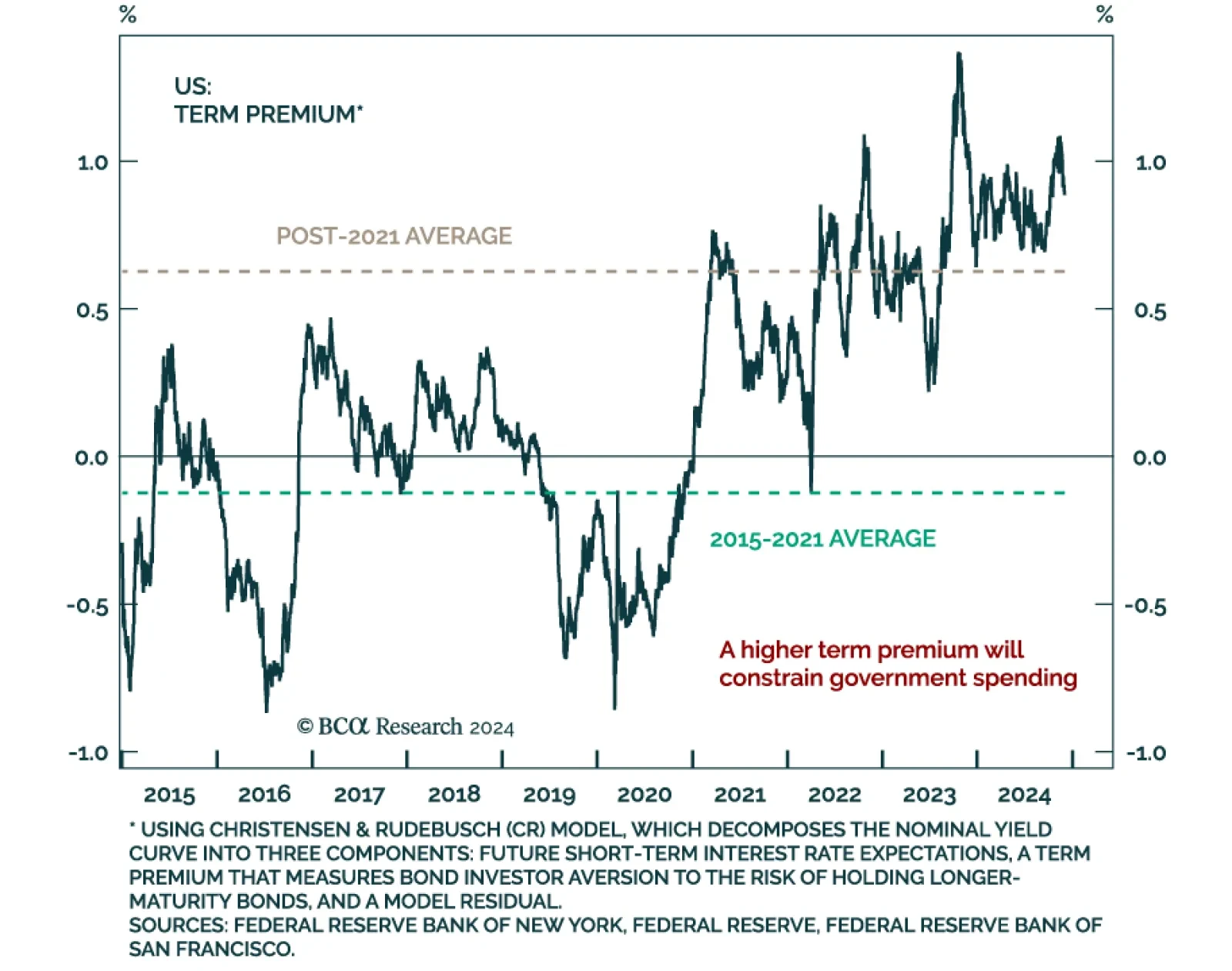

Our Global Asset Allocation strategists published their monthly tactical asset allocation report and foresee a change of trend for 2025. “Thin is back in” for government budgets, growth, and valuations. The post-…

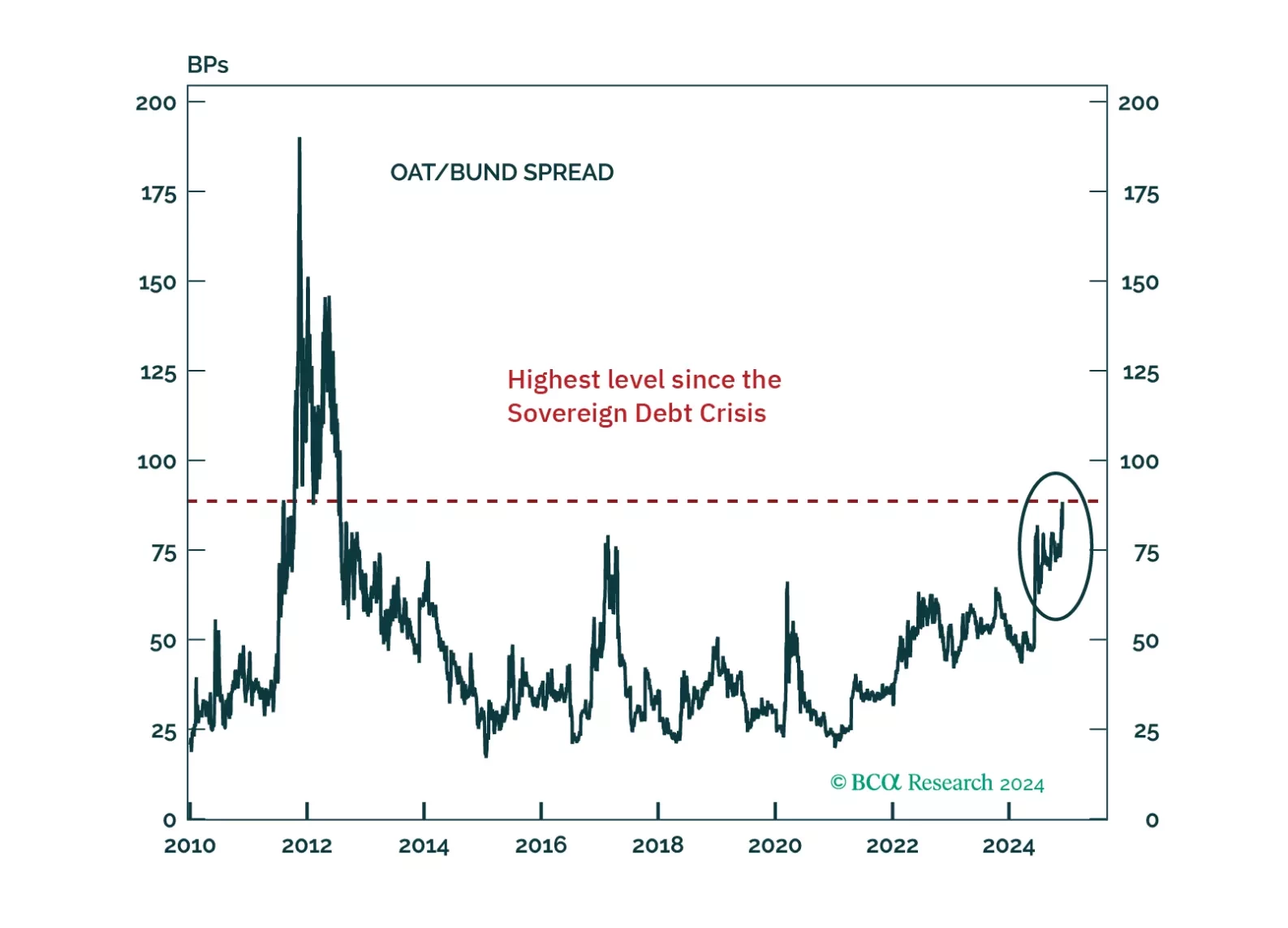

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

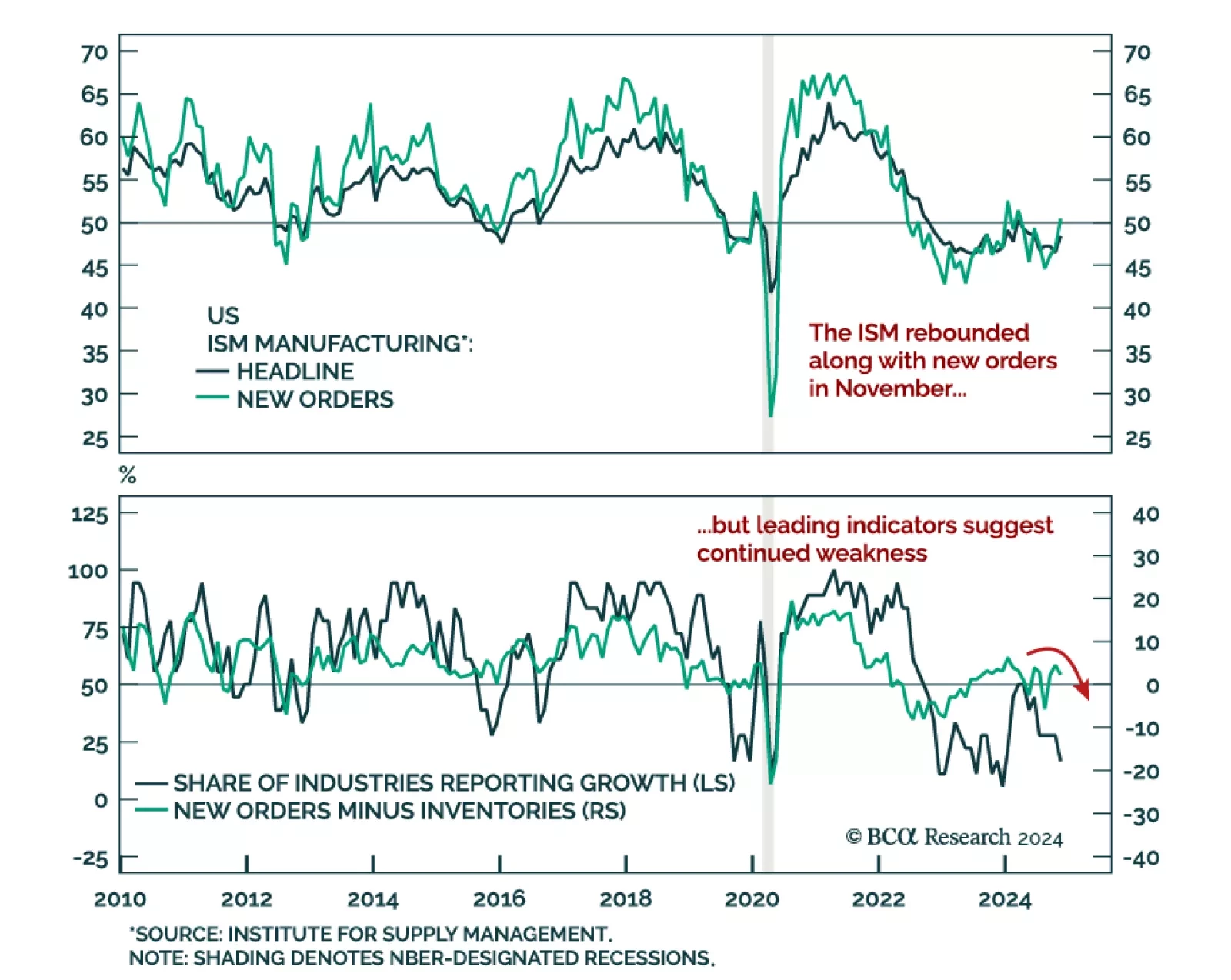

The November ISM Manufacturing index beat expectations, increasing to 48.4 from 46.5 in October. The improvement was partly driven by the new orders component, which increased to 50.4 from 47.1. Price pressures moderated.…

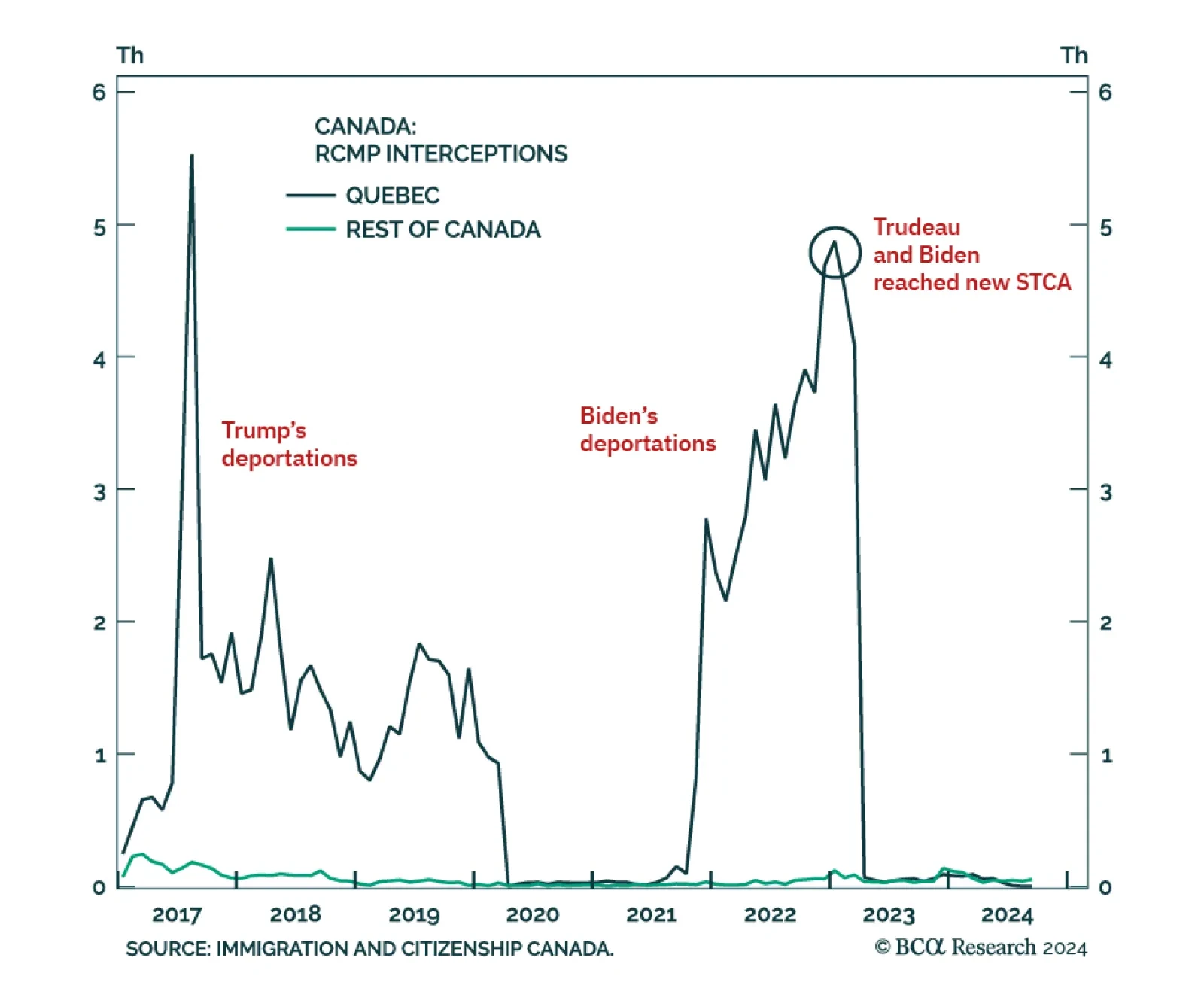

As 2024 closes out a busy electoral calendar for North America, our Geopolitical strategists look at Canada, where an election will be held by October 2025. Canada is poised for a likely change in leadership next year.…

The post-COVID recovery has been one of excesses. Government deficits have ballooned, tight labor markets have led to a windfall of consumer spending, and equity valuations have soared on the back of lofty growth expectations. But…

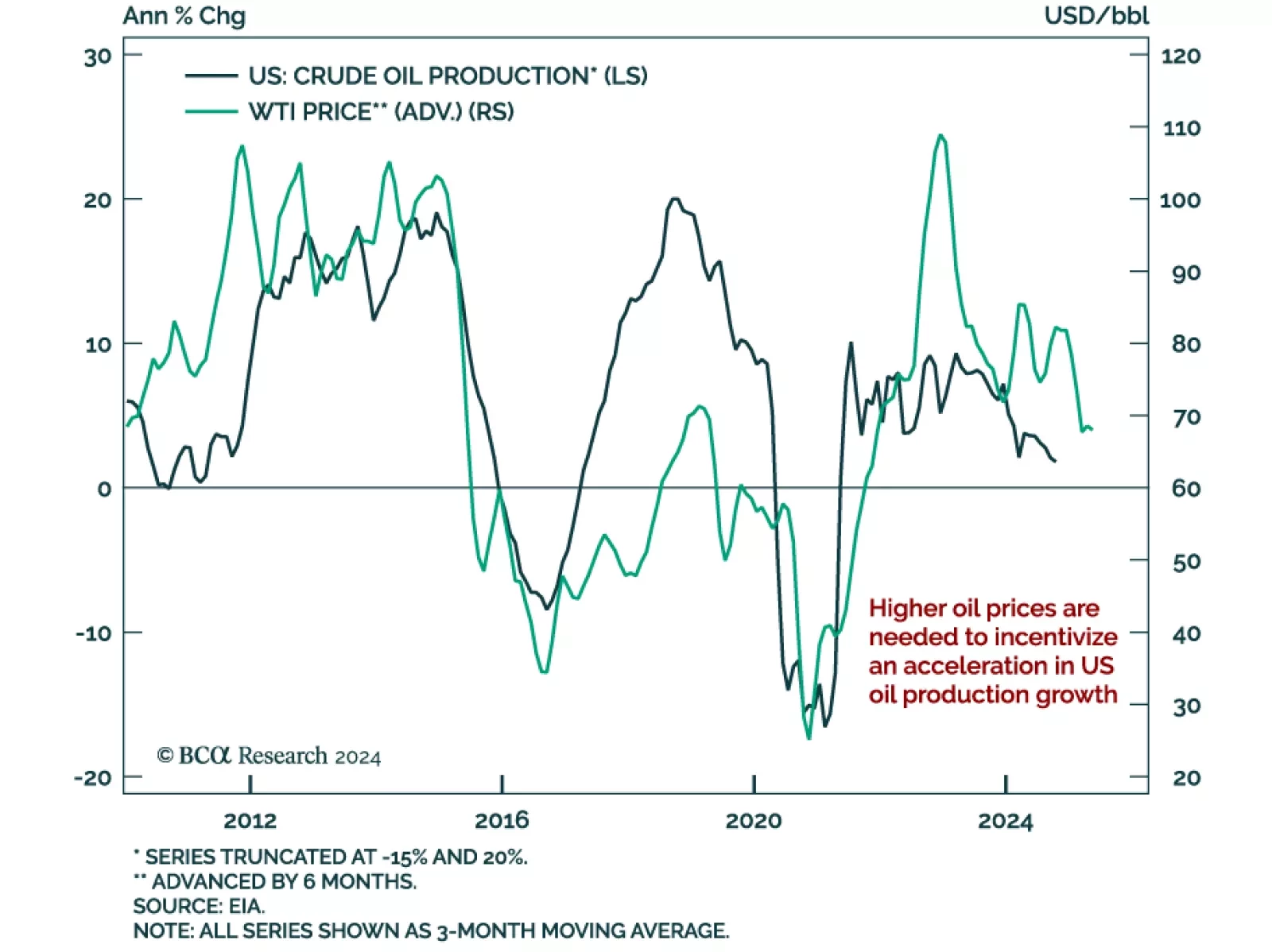

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…

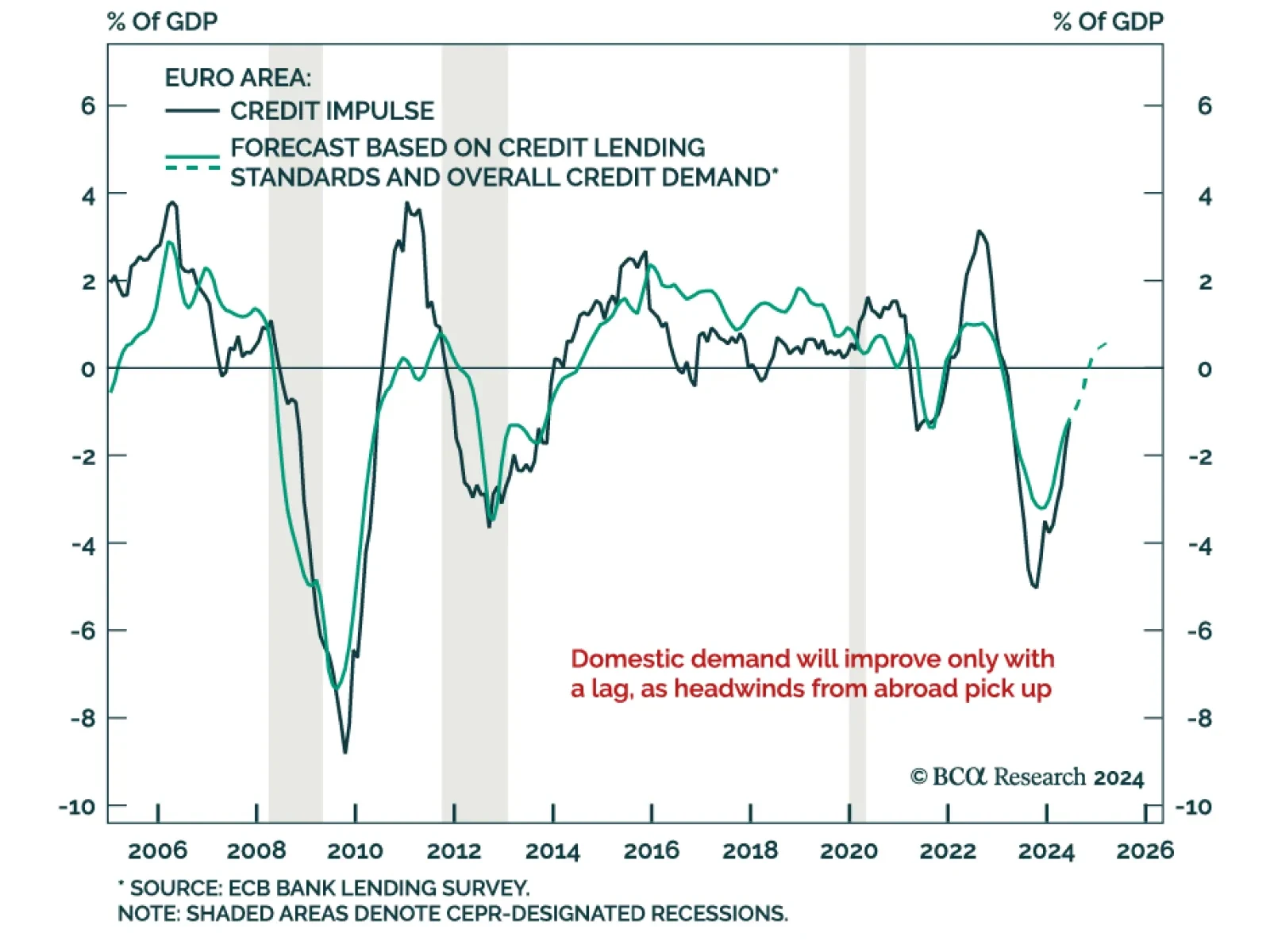

European monetary data printed in line with expectations in October, with M3 growing 3.4% y/y vs. 3.2% in September. Growth in private sector lending was unchanged at 1.2% y/y despite the recent easing in lending standards. We…