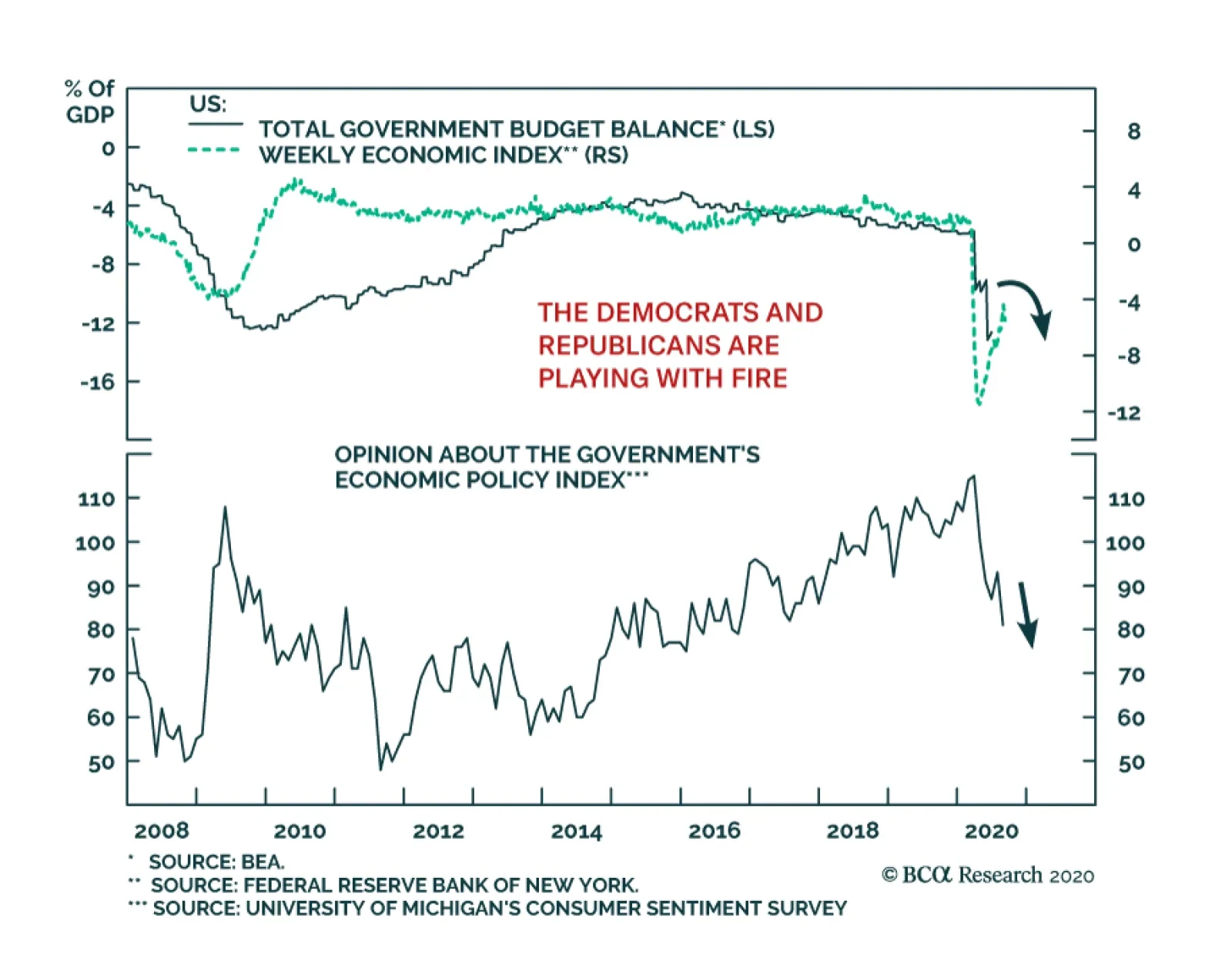

Although the Republican skinny bill failed last week, BCA Research's Geopolitical Strategy service believes that additional stimulus would ultimately pass. The key constraints are the following: House Democrats face an…

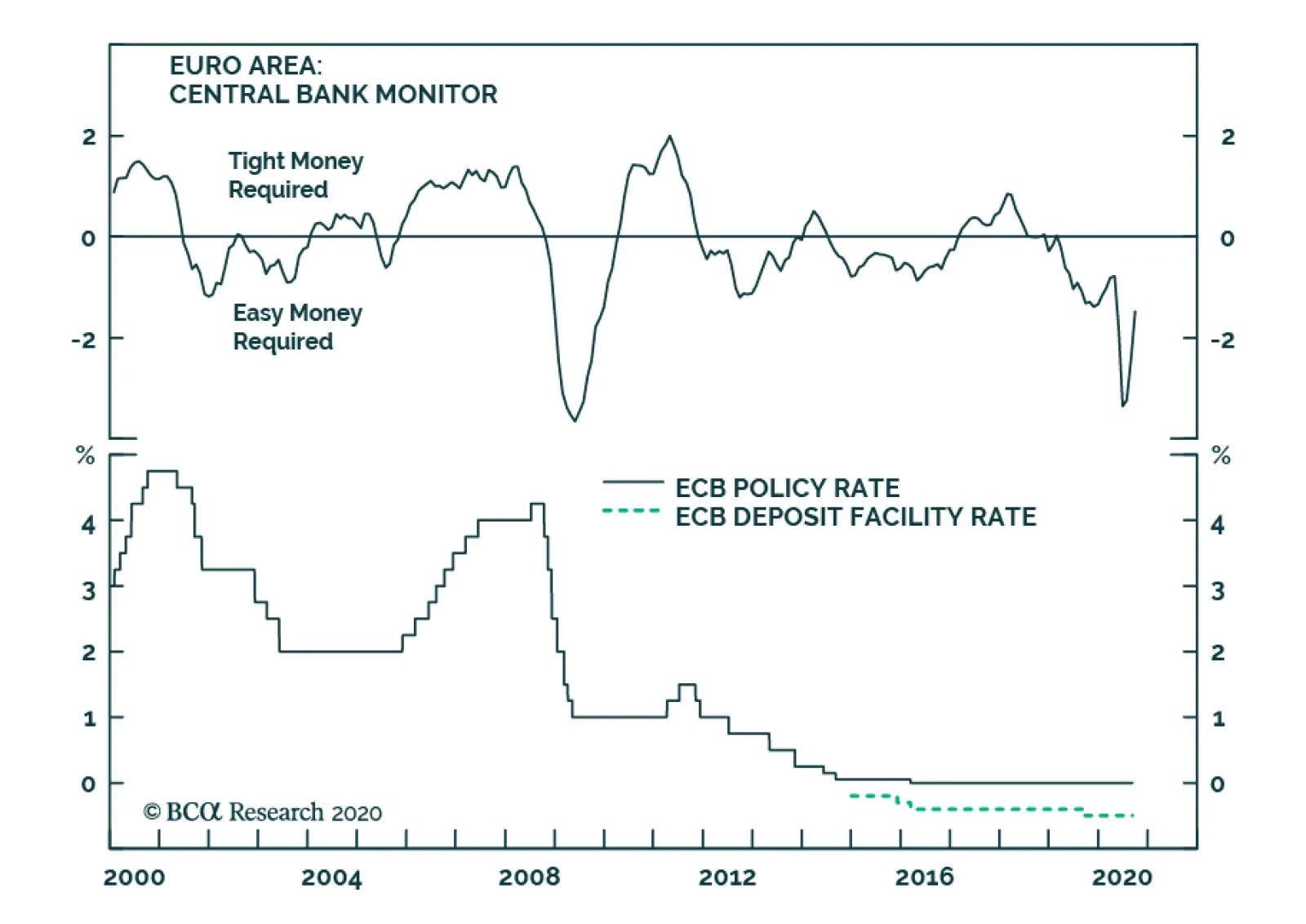

Yesterday, the European Central Bank left policy unchanged and the tone of the press conference that followed the meeting indicated that the ECB is comfortable with the evolution of the economic recovery in Europe. The upgrade of…

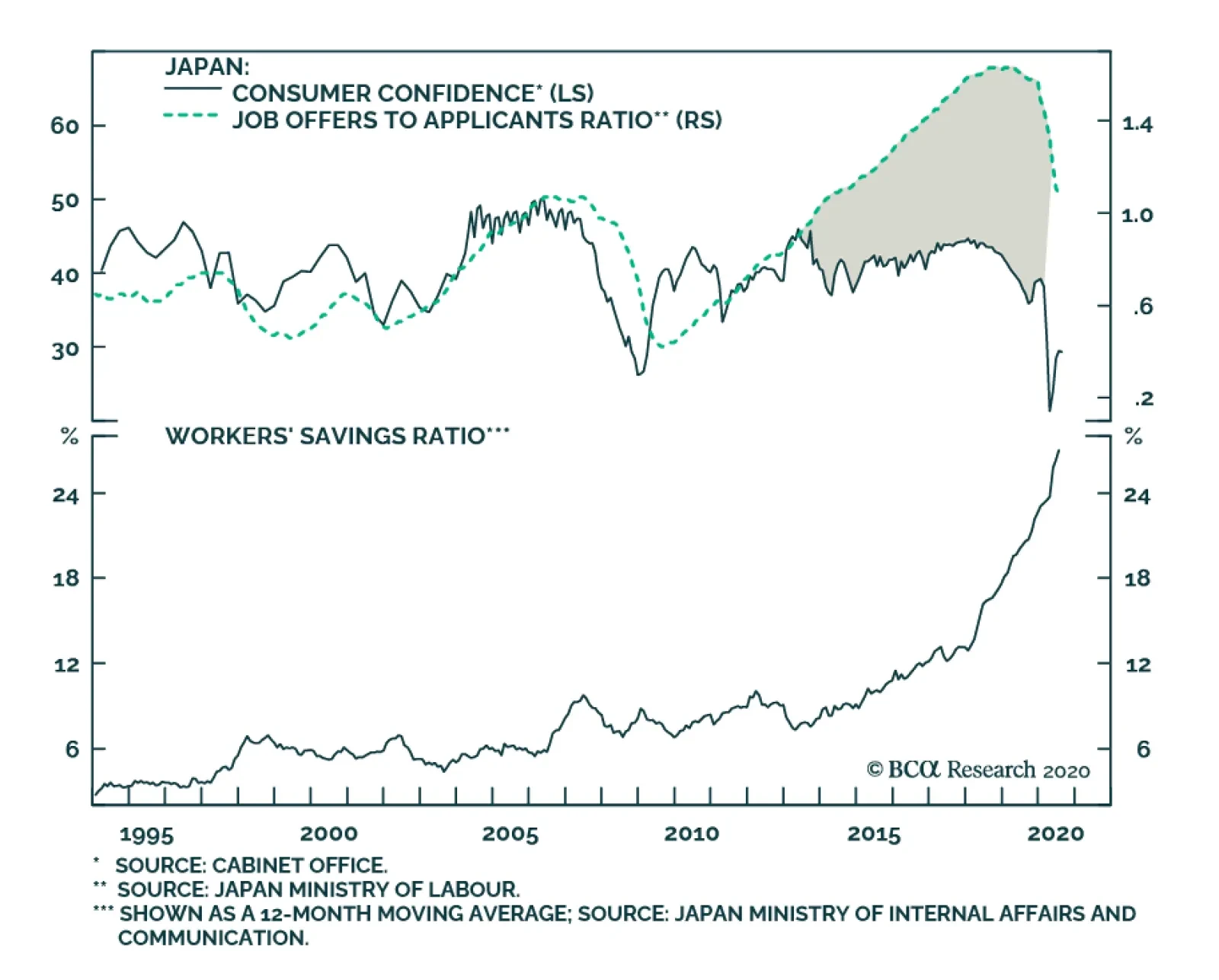

According to BCA Research's Foreign Exchange Strategy service, the yen remains an attractive portfolio hedge. This view rests on three pillars. First, Japan has one of the highest real rates in the G10, meaning outflows from…

To all clients, Next week, in lieu of publishing a regular report, I will be hosting a webcast on September 15th at 10 am EDT, discussing our latest views on global fixed income markets. Sign up details for the Webcast will…

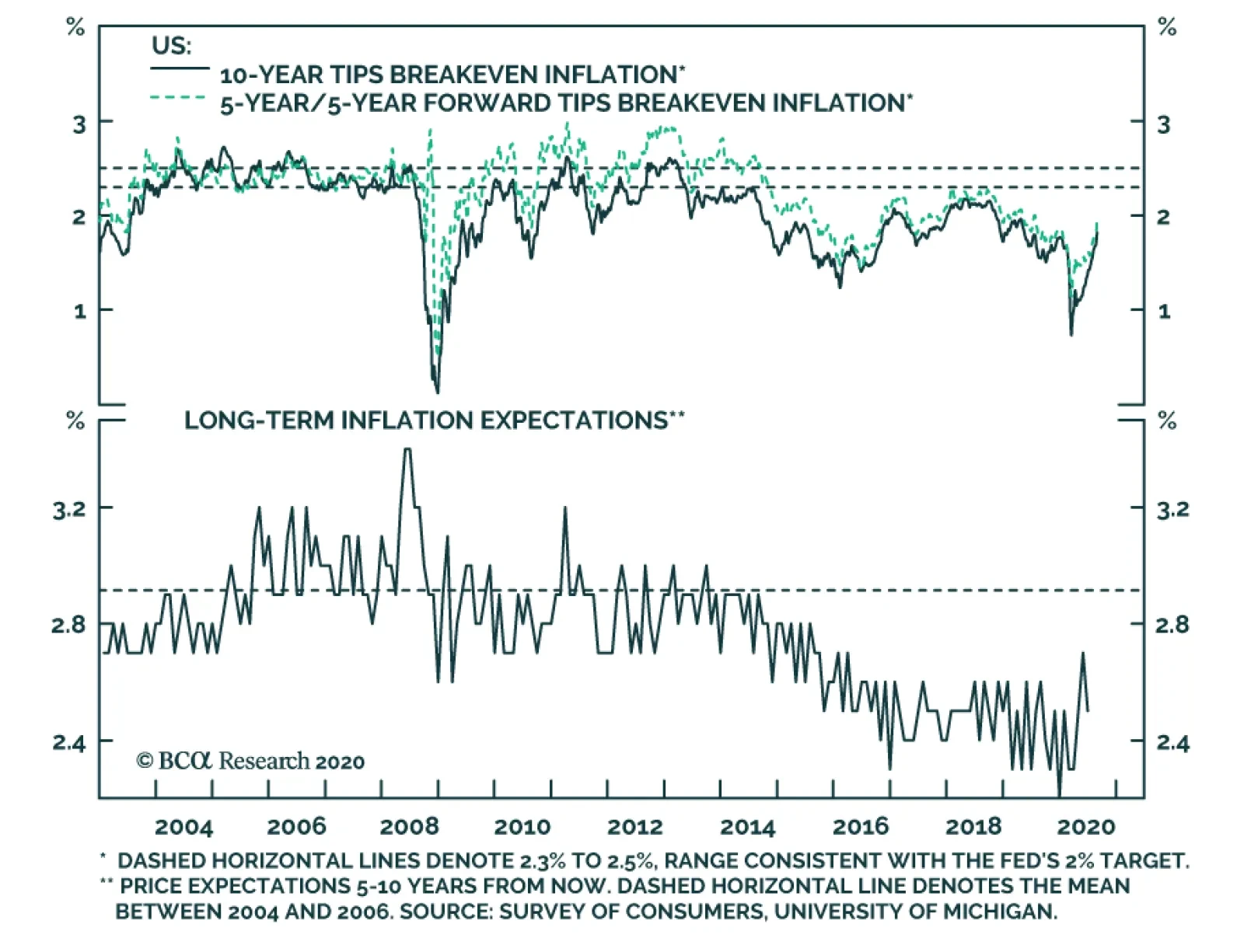

Highlights Chart 1Permanent Job Losses Still Rising The biggest event in bond markets last month was the Fed’s shift toward a regime of average inflation targeting. Treasuries sold off in the days following the…

Highlights Bygones will no longer be bygones for the Fed when it comes to inflation, … : It has yet to define the parameters of its new approach, but the Fed is promising a sizable break with the past by adopting an average…

Highlights Stocks, particularly tech stocks, are technically overbought and highly vulnerable to a further correction. Nevertheless, investors should continue to overweight global equities relative to bonds on a 12-month horizon, while…

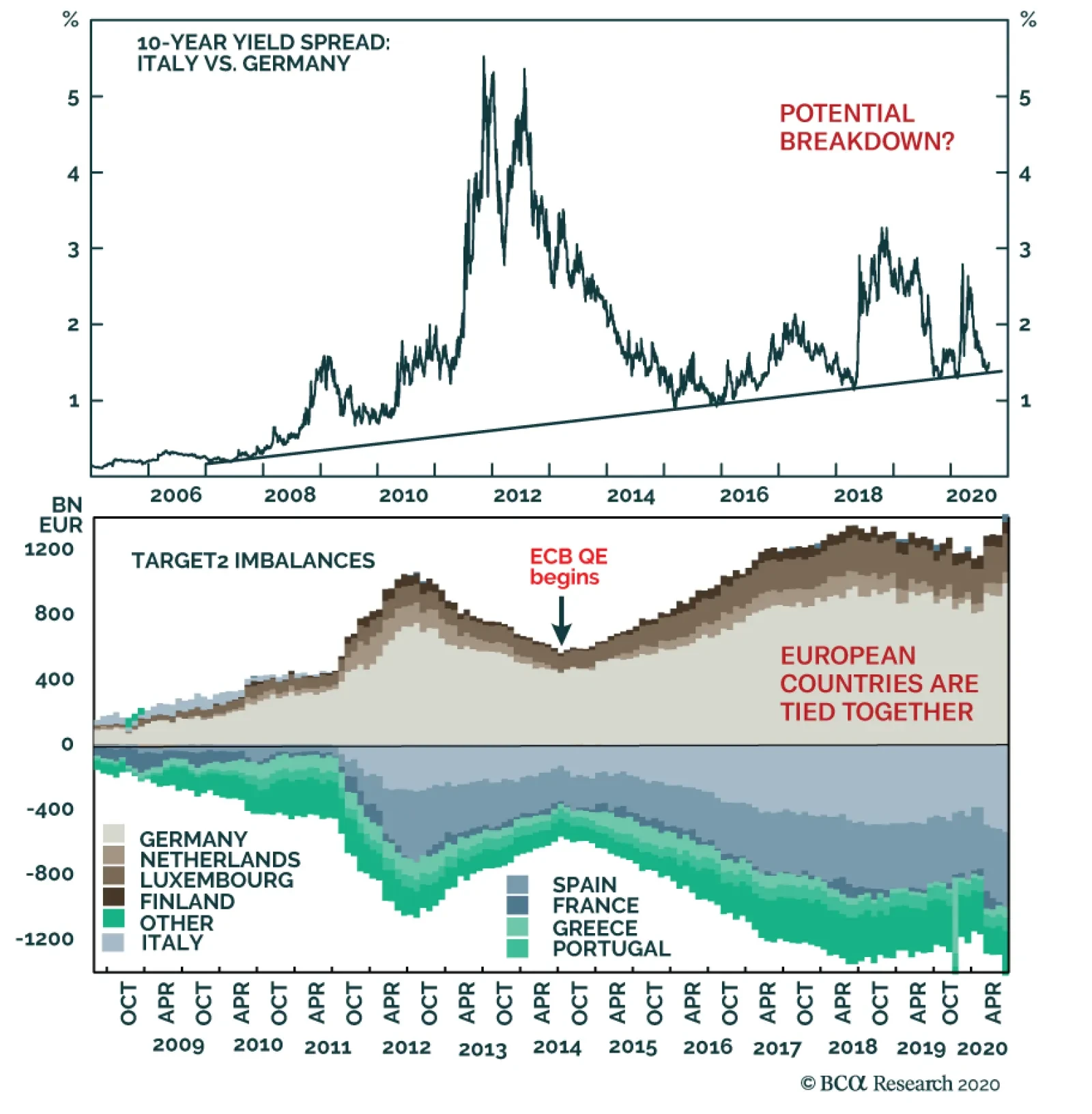

The European Central Bank has little scope to push German, French or Dutch yields much lower from current levels, especially as markets are already convinced that the ECB will not be able to raise interest rates for many years.…

BCA Research’s Global Fixed Income Strategy & US Bond Strategy service highlights that the official shift to an average inflation targeting regime represents a massive structural break relative to how the Fed conducted…