Highlights The rising policy rate in the past couple months has been driven by a liquidity crunch, which is expected to ease in Q4. Government bond yields, which have been trending upwards since May, will also take a breather. The…

Highlights The global recovery has legs, but it will follow a stop-and-go pattern. Global fiscal policy will ultimately remain loose enough to create an appropriate counterweight to three major risks. Risk assets are still attractive…

Highlights Bank credit 6-month impulses are plunging, and the pandemic is resurging. Maintain an overweight to growth defensives (technology and healthcare). In the short term, profits will be more resilient in a resurgent pandemic.…

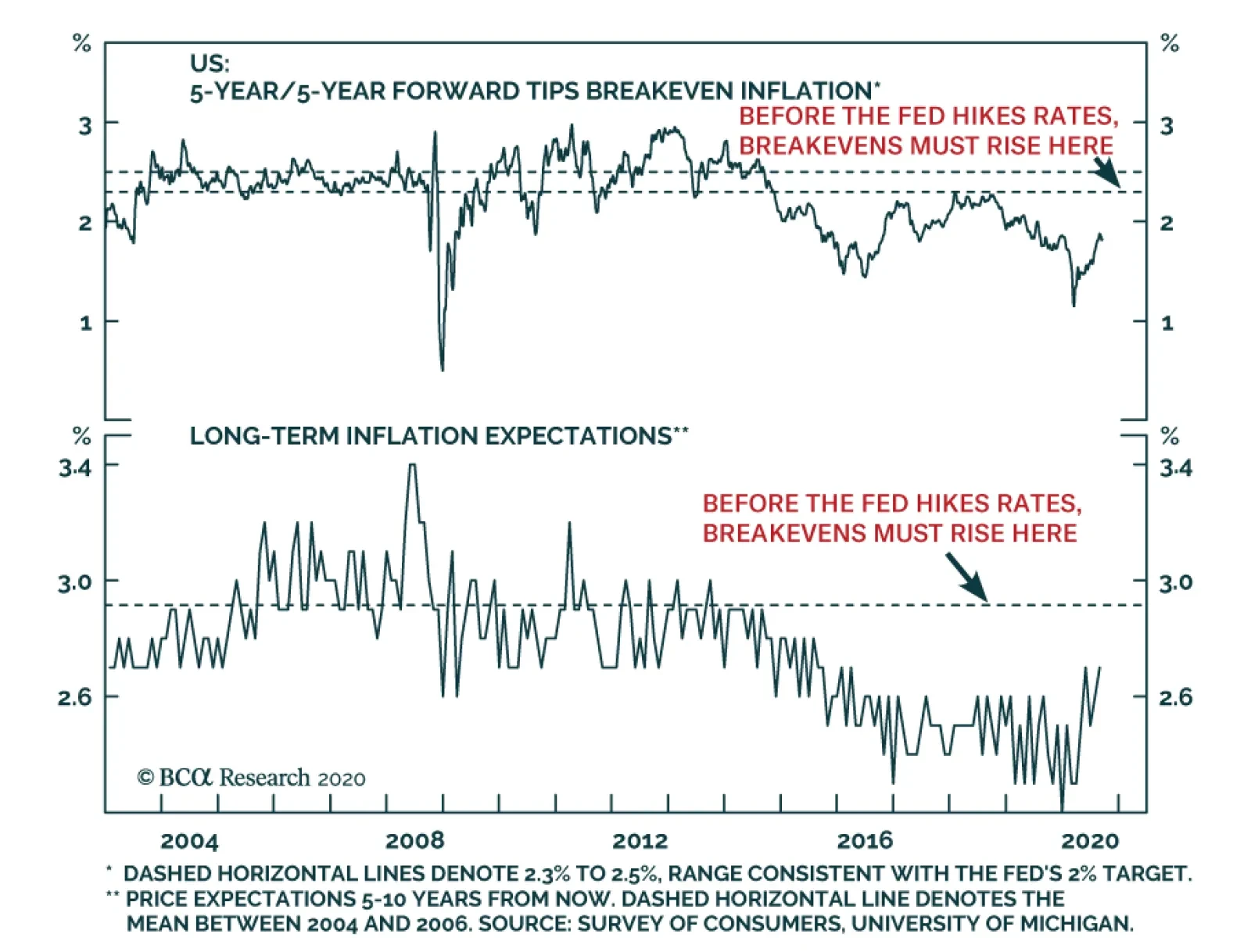

Highlights Monetary Policy: The Fed will keep rates at the zero bound at least until inflation is above 2% and it will maintain an accommodative policy stance until long-dated TIPS breakeven inflation rates move above 2.3%. Remain…

Feature In last week’s US Bond Strategy report, we presented the results of a scenario analysis on consumer spending.1 The goal of that analysis was to assess how much additional federal government income support is required to…

Highlights Consumers are the beating heart of the US economy, … : By showering cash on the newly unemployed, and issuing checks to more than half of all taxpayers, the CARES Act arrested April’s free fall in consumption…

Dear Client, We will be working on our Fourth Quarter Strategy Outlook next week, which will be published on Tuesday, September 29th. We will also be hosting a webcast on Thursday, October 1st at 10:00 AM EDT (3:00 PM BST, 4:00 PM…

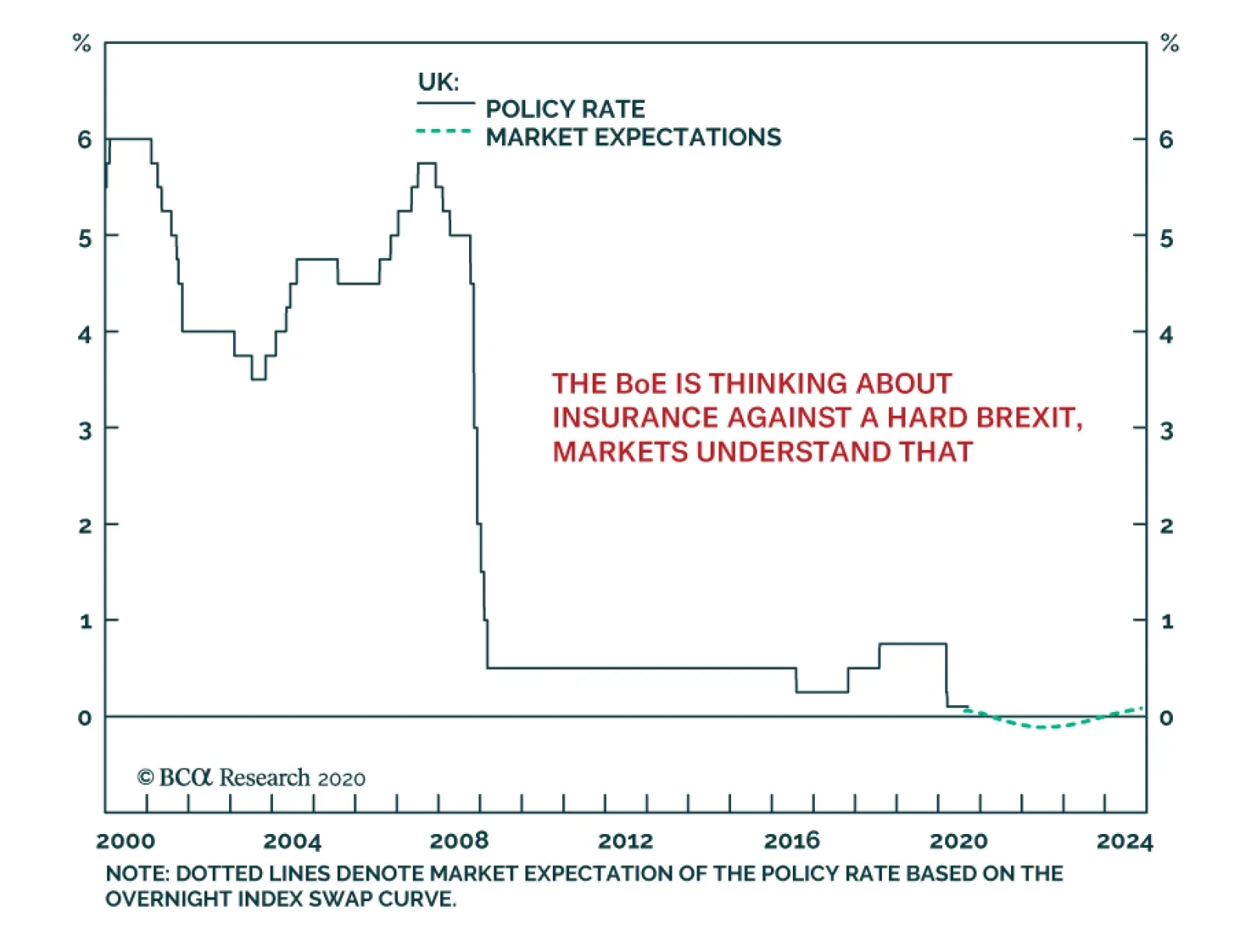

The Bank of England met yesterday and left policy unchanged. However, the meeting’s minutes revealed that the MPC is actively exploring the implementation of a negative Bank rate. So serious is the idea, the BoE is in talks…

While the Federal Reserve did not adjust policy on Wednesday, Fed Chair Powell set out to clarify the parameters surrounding policy tightening under the new average inflation framework announced at the Jackson Hole symposium.…

This report contains an error in the section related to consumer spending and fiscal policy. That error somewhat changes the conclusions from the report, and it particularly impacts Chart 3, Table 2 and Table 3. The attached note explains…