Highlights The US is only one deflationary shock away from a European level of bond yields. On a multi-year horizon, a deflationary shock is a near-certainty. The shock will be deflationary, because even if it starts inflationary, it…

BCA Research’s Global Fixed Income Strategy service concludes that the Federal Reserve will not be the next central bank to taper the pace of bond buying. The team recently assessed the most important factors that could…

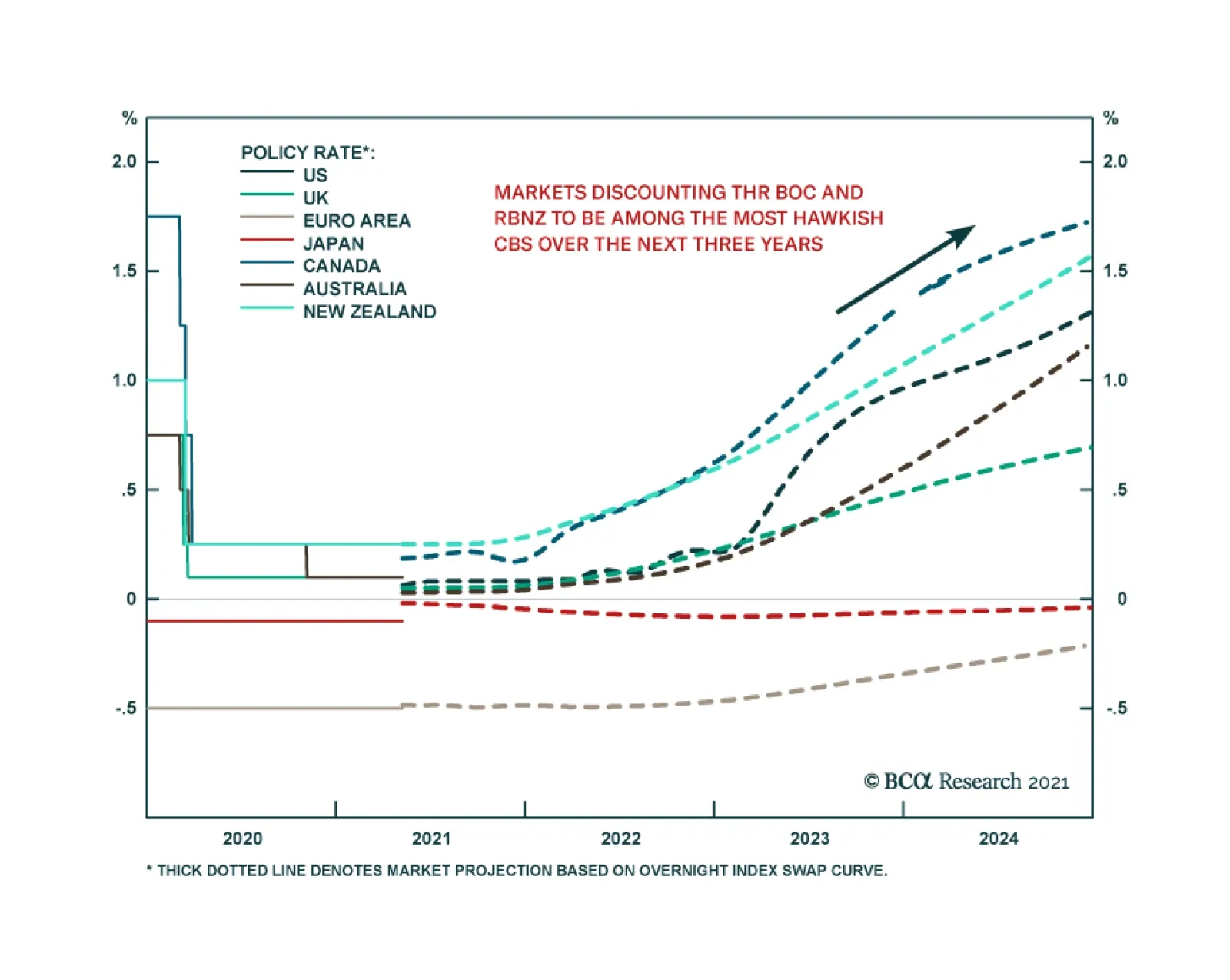

Highlights Global Tapering: The Bank of England has joined the Bank of Canada as central banks tapering the pace of bond buying. Markets are now trying to sort out who is next and concluding that it will not be the Federal Reserve,…

Highlights Important leading indicators of Eurozone activity point to record growth in the coming quarters. Progress on the vaccination front, global pent-up demand, and easing fiscal policy will fuel the Euro Area recovery. Consensus…

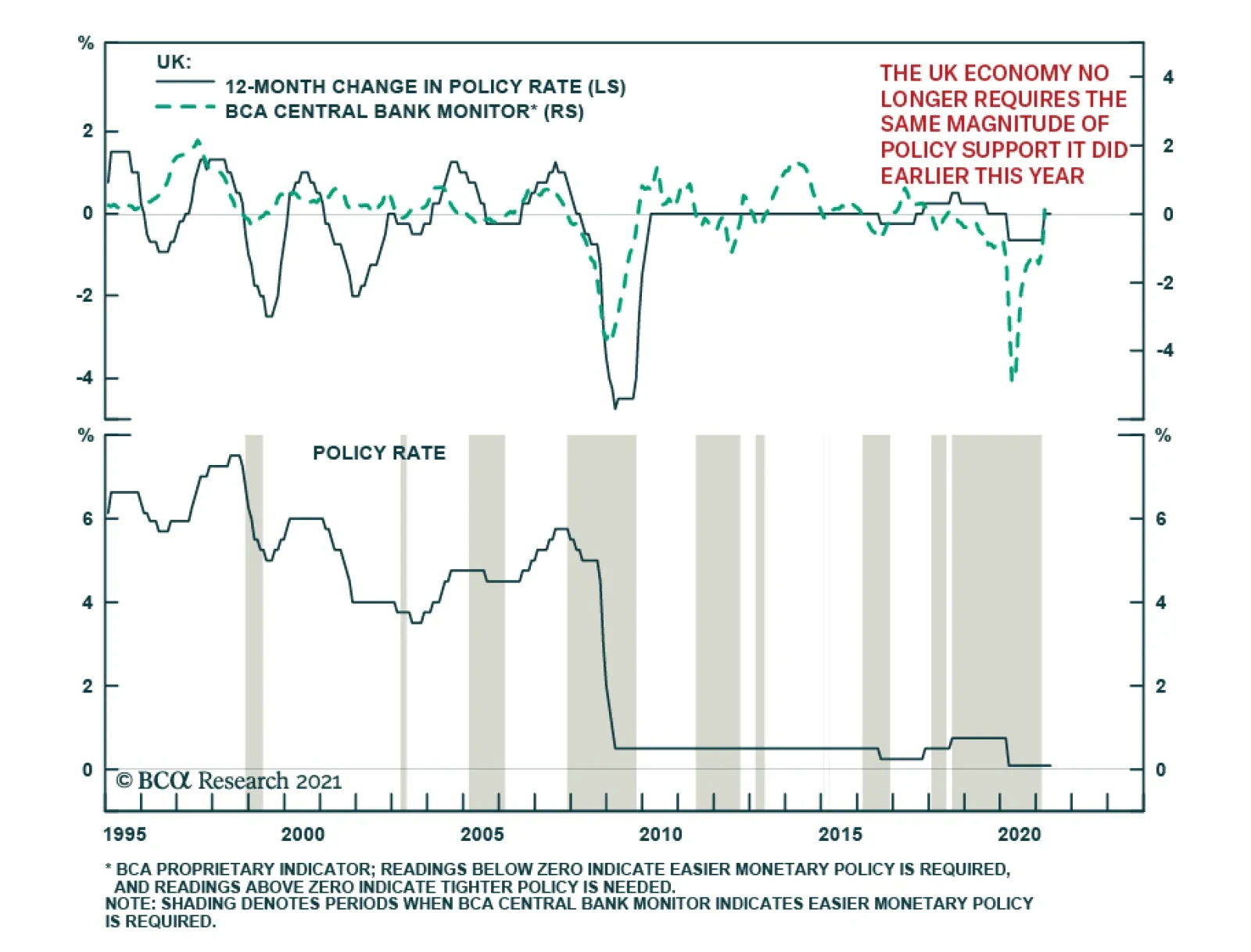

As expected, the Bank of England maintained the bank rate at 0.1% and kept the total target stock of asset purchases unchanged at its Thursday meeting. However, the central bank upgraded its growth outlook and now forecasts GDP…

Biden’s first 100 days can be summed up as the return of Big Government, i.e. “the Leviathan.” But markets are not afraid of one-off corporate tax hikes that only partially reverse the previous administration’s…

Highlights A slower money and credit growth in China will eventually generate disinflationary pressures by weighing on demand for commodities. The PBoC has shifted its inflation anchor and policy framework to target core CPI and the…

Highlights Sweden’s economic recovery is robust and will deepen. Policy is accommodative. Very few advanced economies will benefit as much from the global economic rebound. The labor market will tighten, capacity utilization…

Highlights The kiwi will continue to benefit from a pandemic-free recovery and normalization in monetary policy from the RBNZ. However, the kiwi is becoming expensive according to most of our models. This will begin to impact growth…