Highlights Monetary Policy: The Fed will not immediately change its policy stance in response to rising inflation and inflation expectations. Rather, it will follow its current forward guidance and only lift rates off zero once the…

Highlights ECB Tapering?: Investor fears that the ECB could follow the Bank of Canada and Bank of England and begin to taper its bond buying sooner than expected – perhaps as soon as next month’s policy meeting – are…

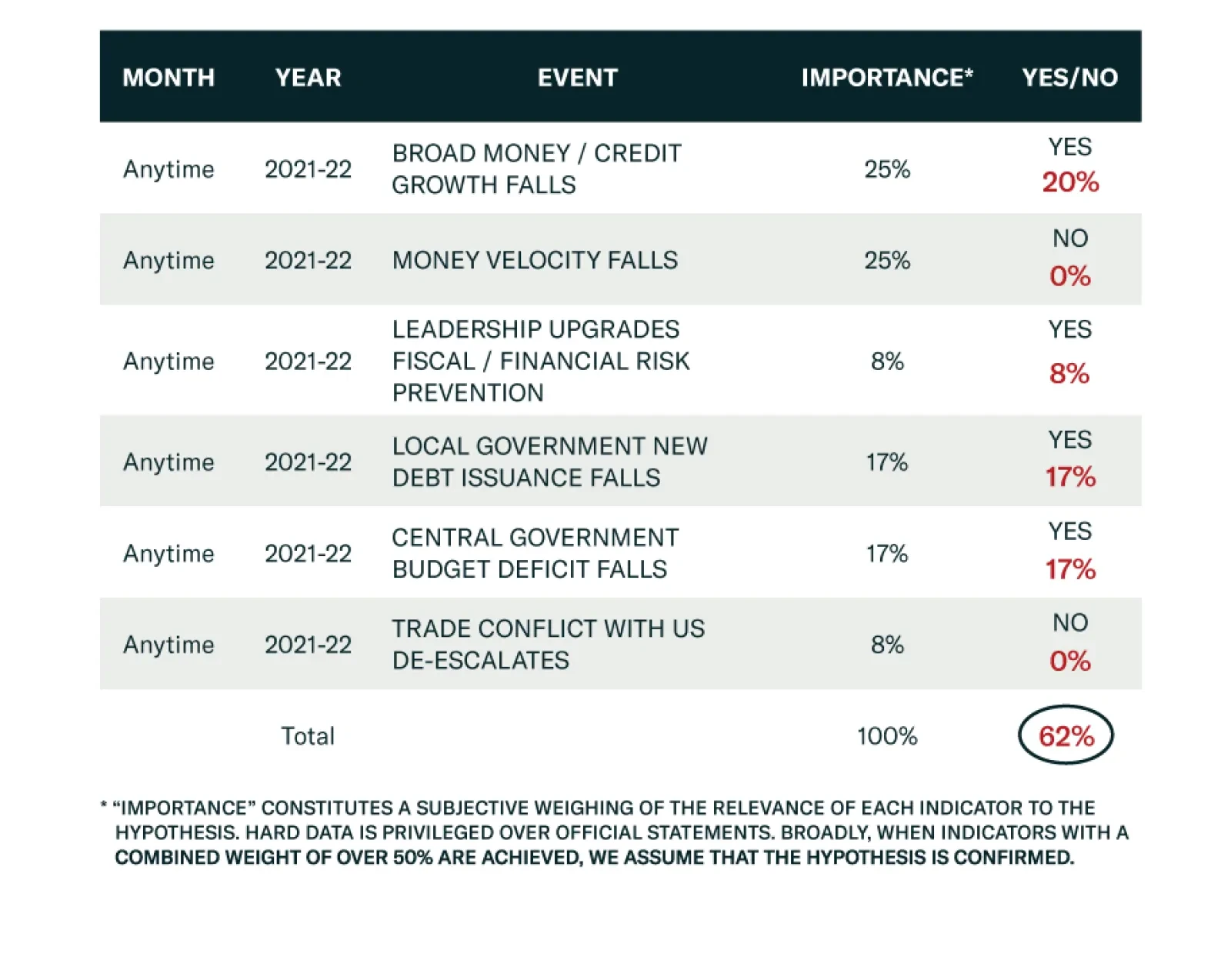

BCA Research’s Geopolitical Strategy service believes that global equities, commodities, and “China plays” are at risk of a substantial correction as a result of China’s policy tightening. China’s…

Highlights Global currencies are at a critical level versus the dollar. From a positioning standpoint today, a break below 89-90 on the DXY index will be extremely bearish, while a bounce from current levels should be capped in the 3-…

Highlights Global stocks are very vulnerable to a correction. But cyclically the Fed is committed to an inflation overshoot and the global economy is recovering. China’s fiscal-and-credit impulse fell sharply, which leaves global…

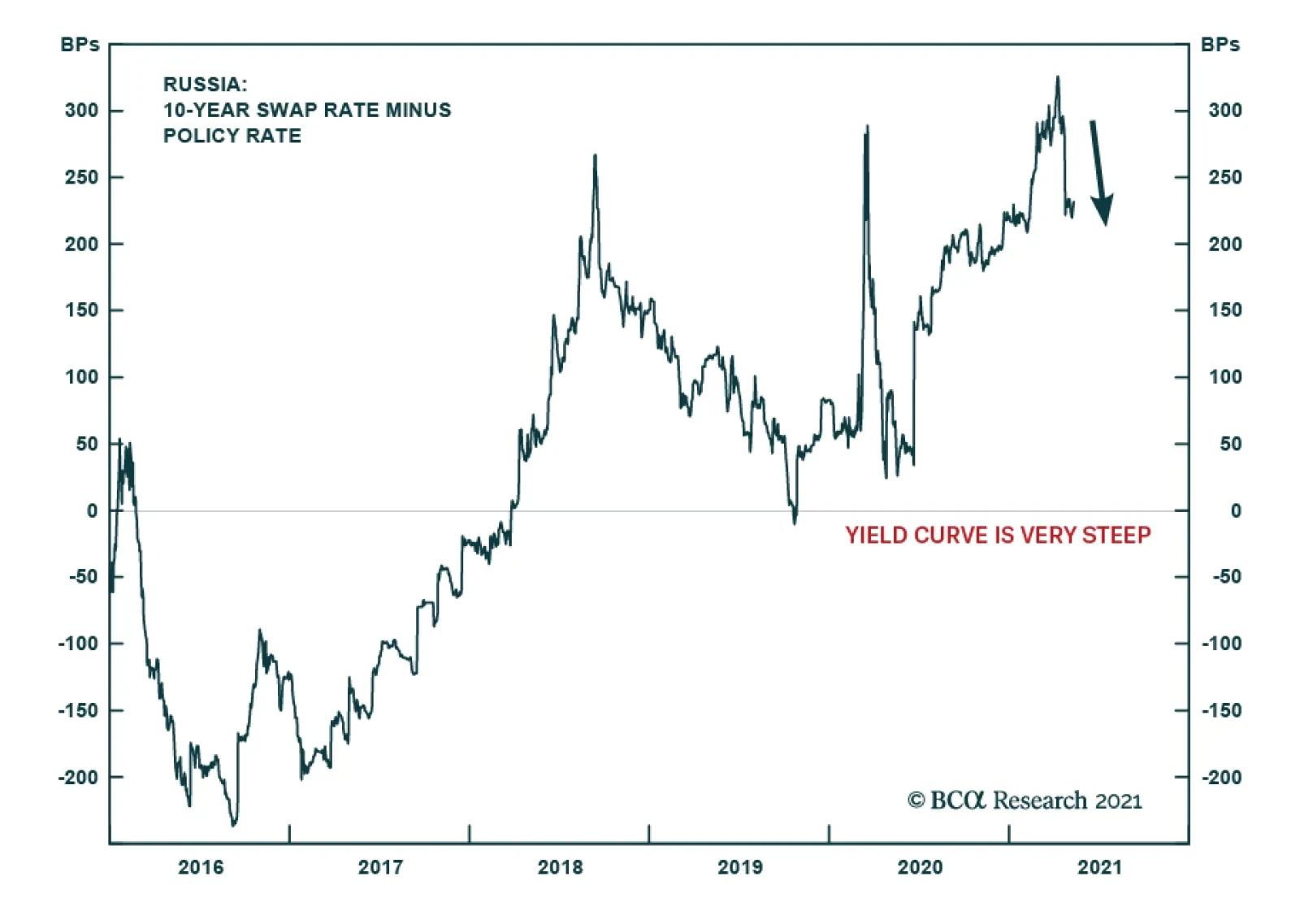

Rising consumer price inflation and inflation expectations have led the Central Bank of Russia (CBR) to hike interest rates from 4.25% to 5% over the past two months. This is a level of hawkishness that stands out globally, as…

Highlights Over the 2021-22 period, renewable capacity will account for 90% of global electricity-generation additions, per the IEA's latest forecast. This will follow the 45% surge (y/y) in renewable generation capacity added last…