Highlights The US Innovation and Competition Act shows that the US is rediscovering industrial policy amid domestic populism and foreign geopolitical risk. Fiscal accommodation is a basis for the economy to improve, political…

Highlights Duration: The Fed will ignore inflation for the time being and focus on its “maximum employment” target to decide when to lift rates off the zero bound. As a result, bond investors should also ignore inflation…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…

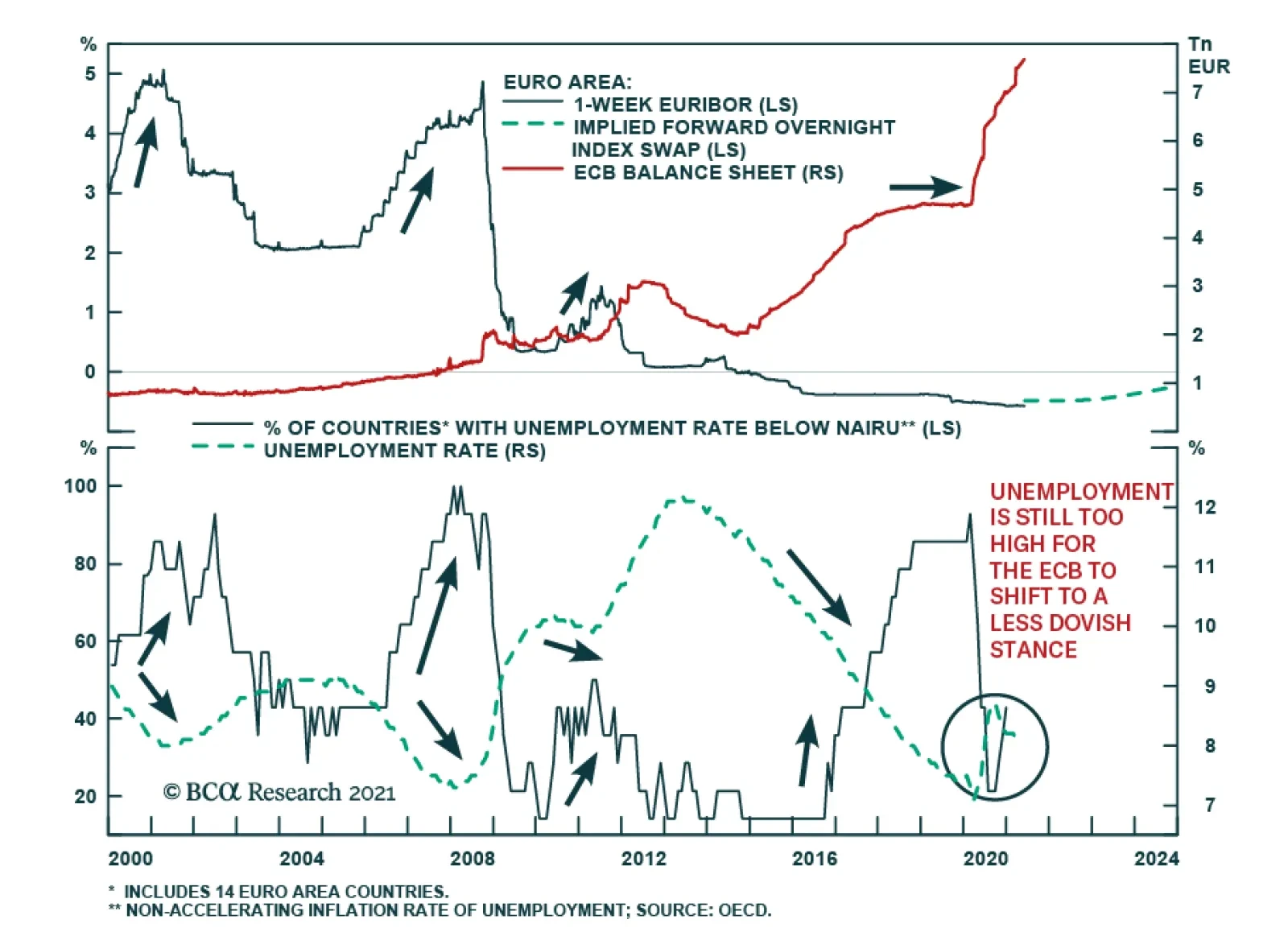

Even though the ECB revised up its GDP growth and inflation forecasts for 2021 and 2022 at its latest meeting on Thursday, it kept policy unchanged and did not signal a plan to taper purchases. Instead, the press statement…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

Highlights The Fed’s independence from politics is illusory. President Biden has the potential to reshape the Fed’s Board of Governors through three personnel picks, two of which are due by January 2022. While monetary…

Highlights Bond Market Performance: Government bonds in the developed economies are currently trapped in ranges, consolidating the sharp upward moves seen in the first quarter of 2021. This is only a pause in the broader cyclical…

Highlights Chart 1Tracking Nonfarm Payrolls With 12-month PCE inflation already above the Fed’s 2% target, it is progress toward the Fed’s “maximum employment” goal that will determine both the timing…