Our Portfolio Allocation Summary for January 2025.

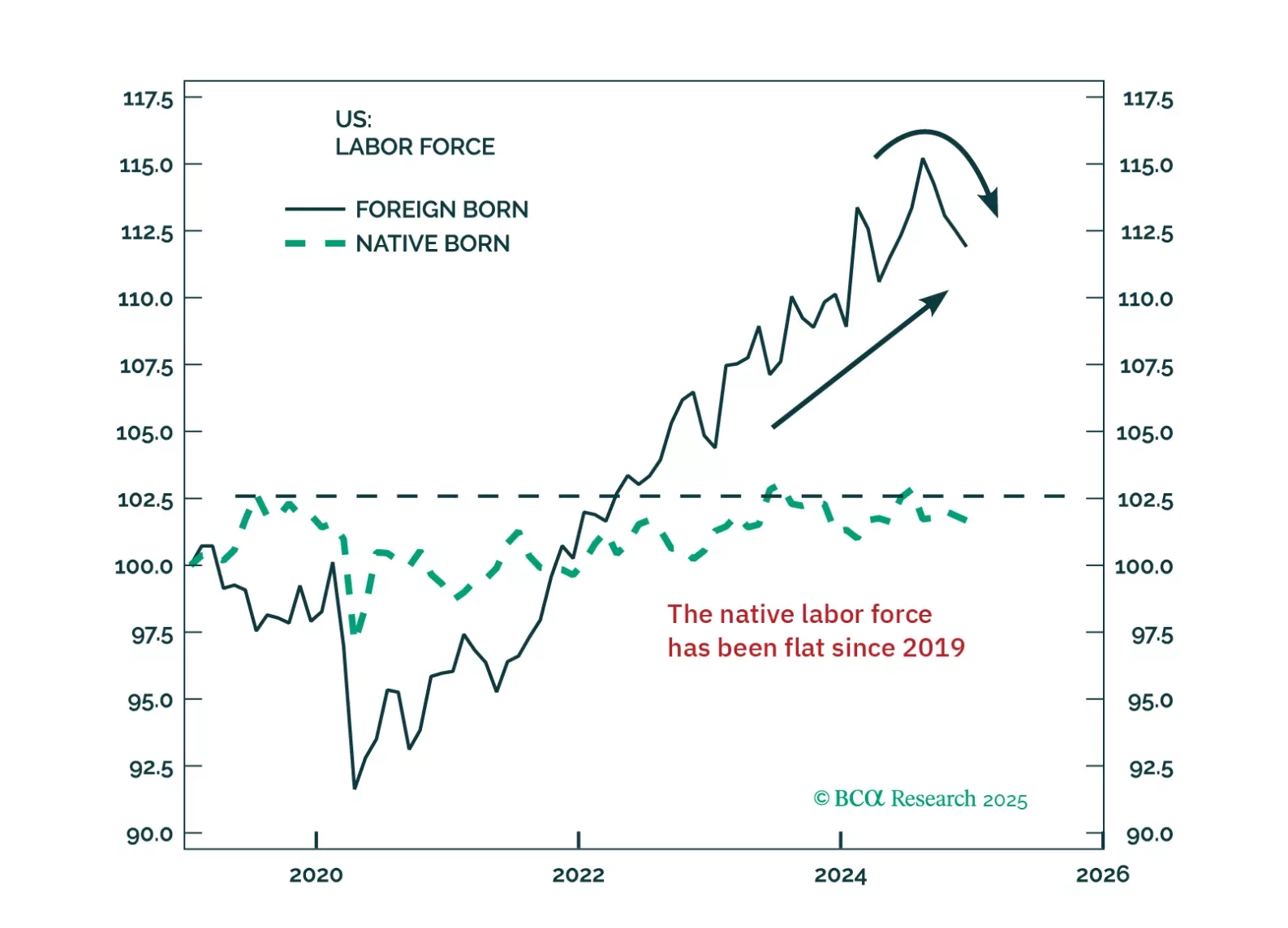

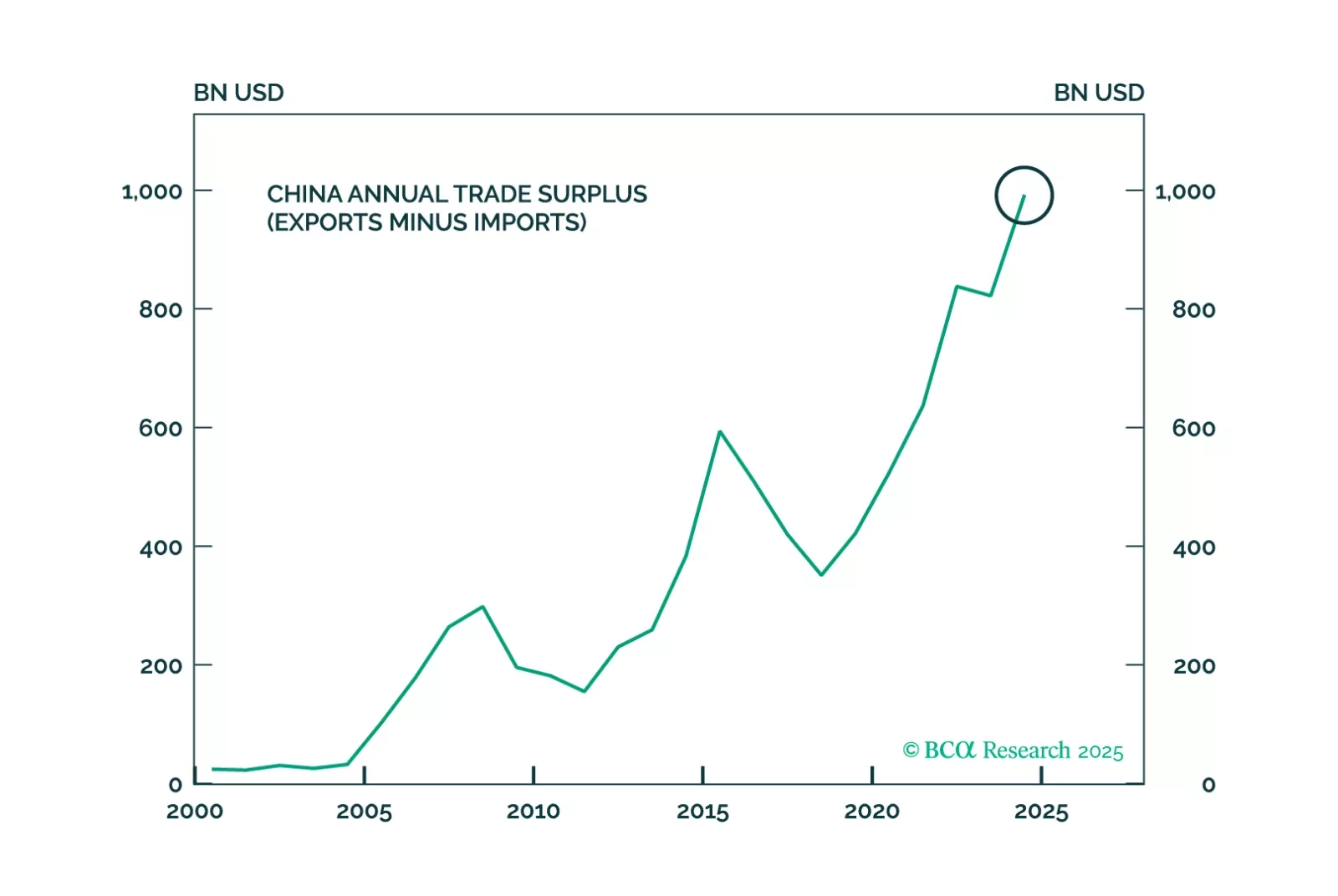

Trade tensions muddy the outlook for global central banks. The 2010s were an era of low growth and low inflation that called for easy monetary policy. The post-COVID era has been marked by overheating and high inflation calling for…

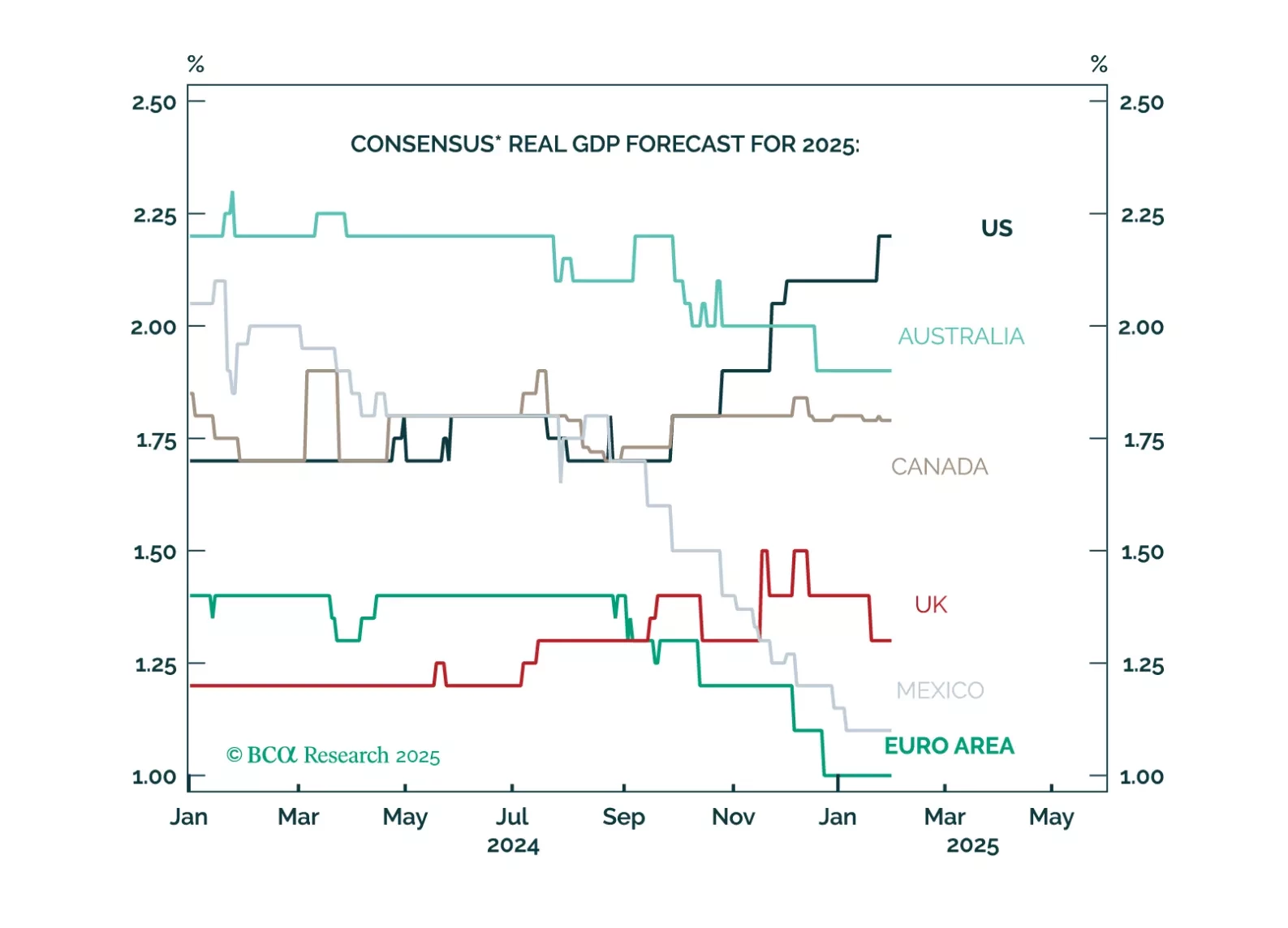

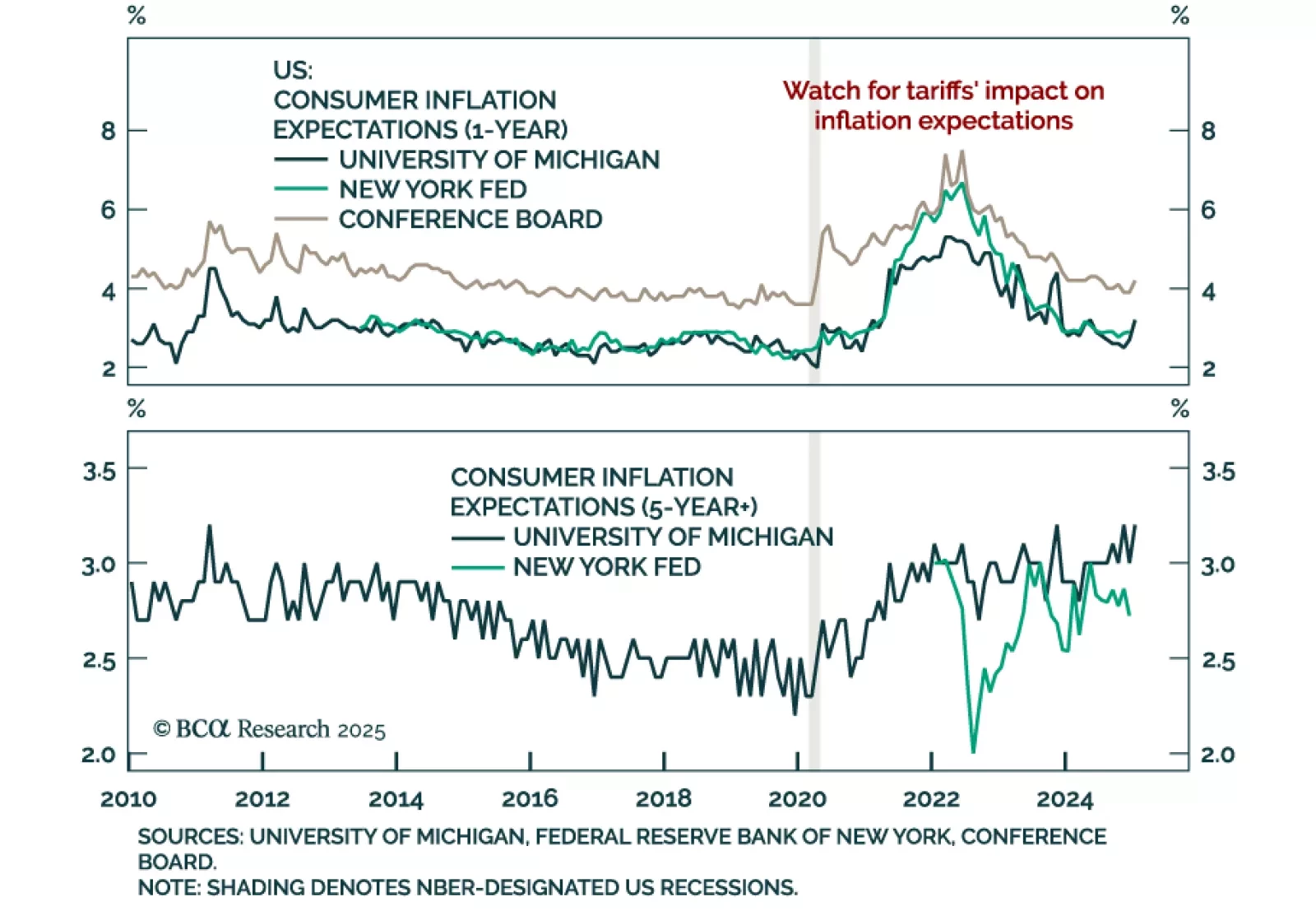

Markets and forecasters anticipate a “Golden Age” for Trump’s America, with US growth expectations soaring while the rest of the world lags. However, this extreme optimism means that there is a lot of room for disappointment. Cooling…

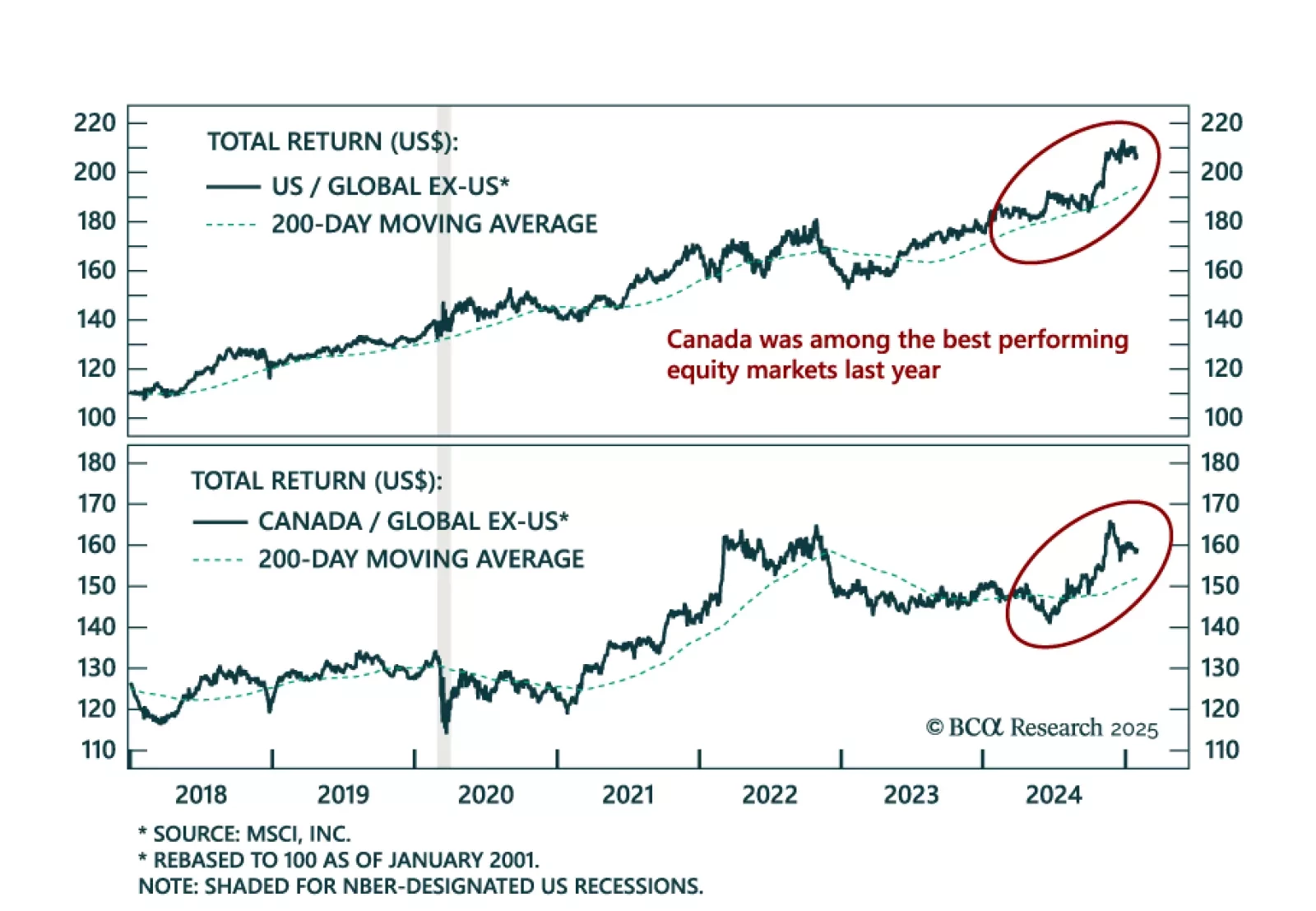

Our colleagues from The Bank Credit Analyst revisited the outlook for Canadian stocks after they outperformed global ex-US stocks in late 2024. The outperformance was driven by financials and tech. While Canadian tech gains were…

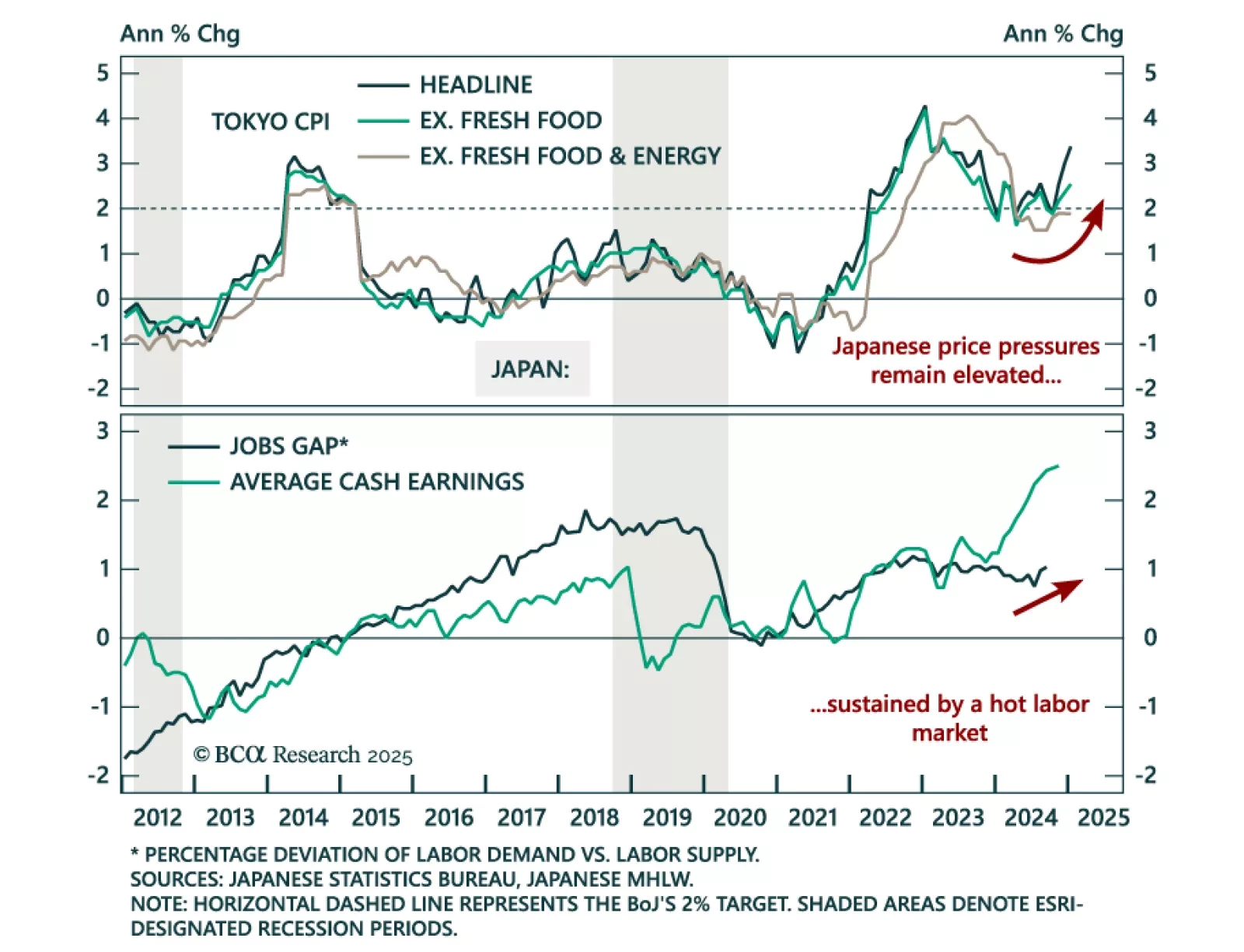

The January Tokyo CPI came in stronger than expected, with headline inflation accelerating to 3.4% y/y from 3.0%, and “core core” (ex. fresh food and energy) accelerating to 1.9% from 1.8%. The jobless rate also decreased 0.1% to 2.4…

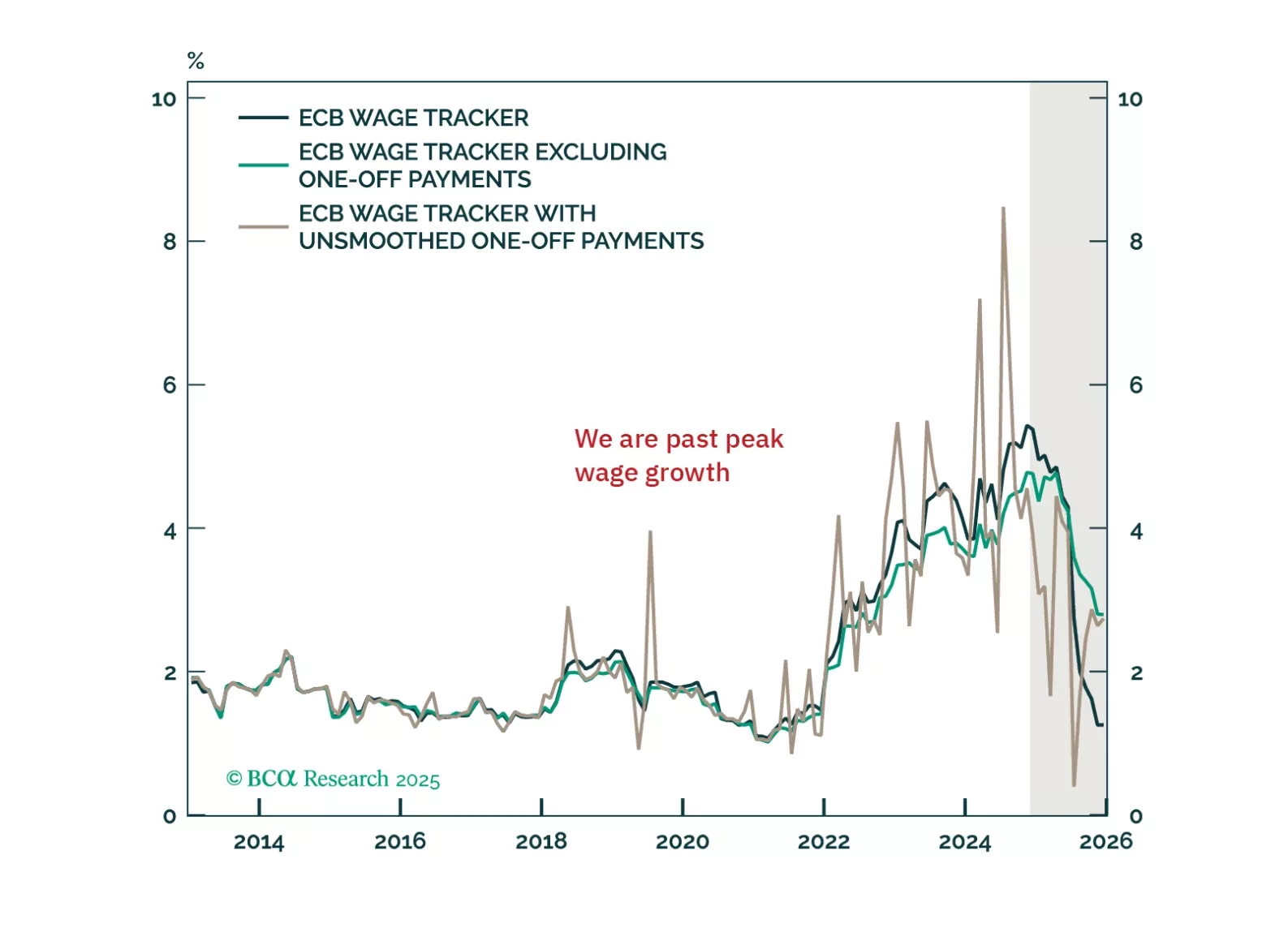

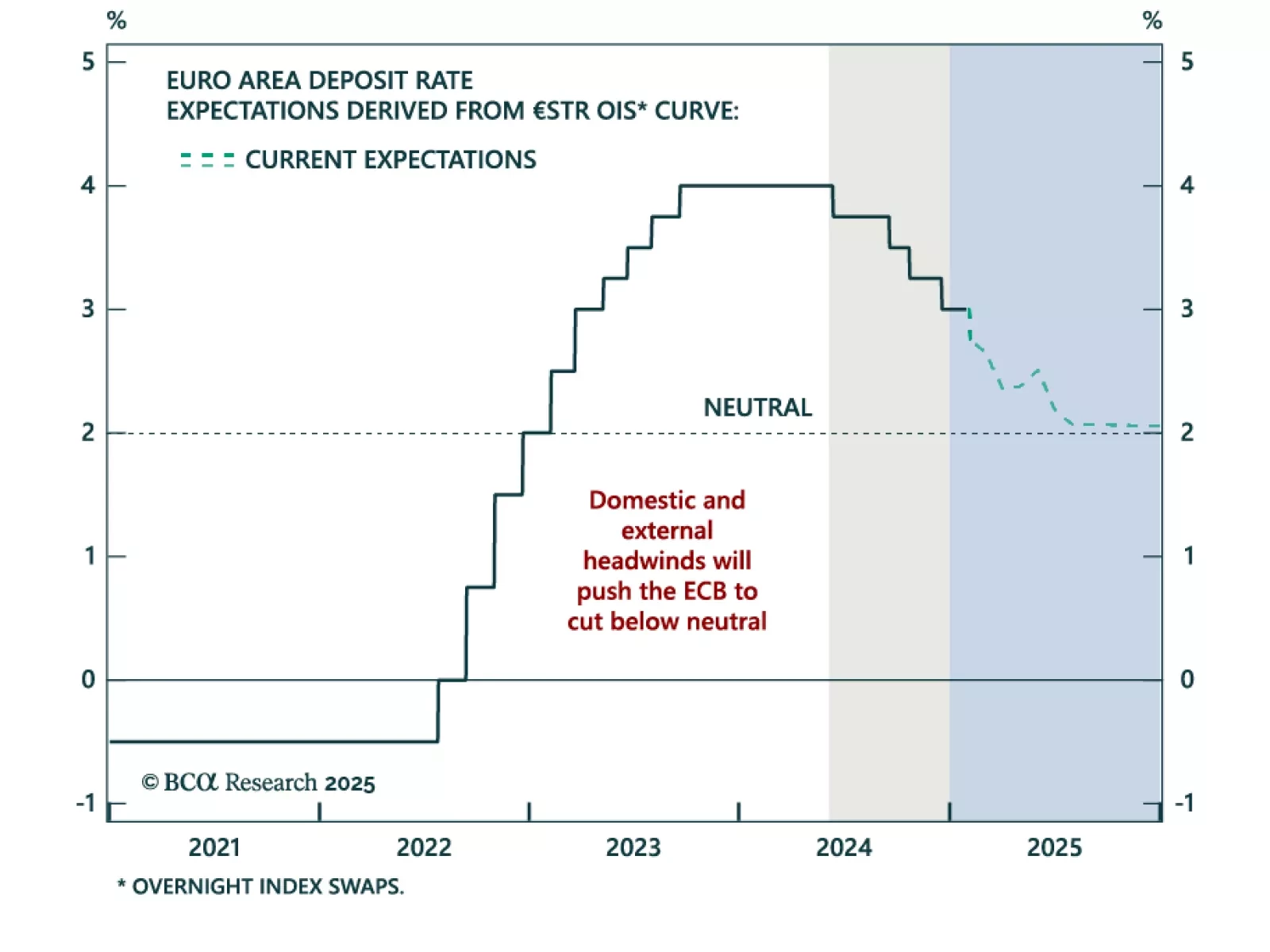

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

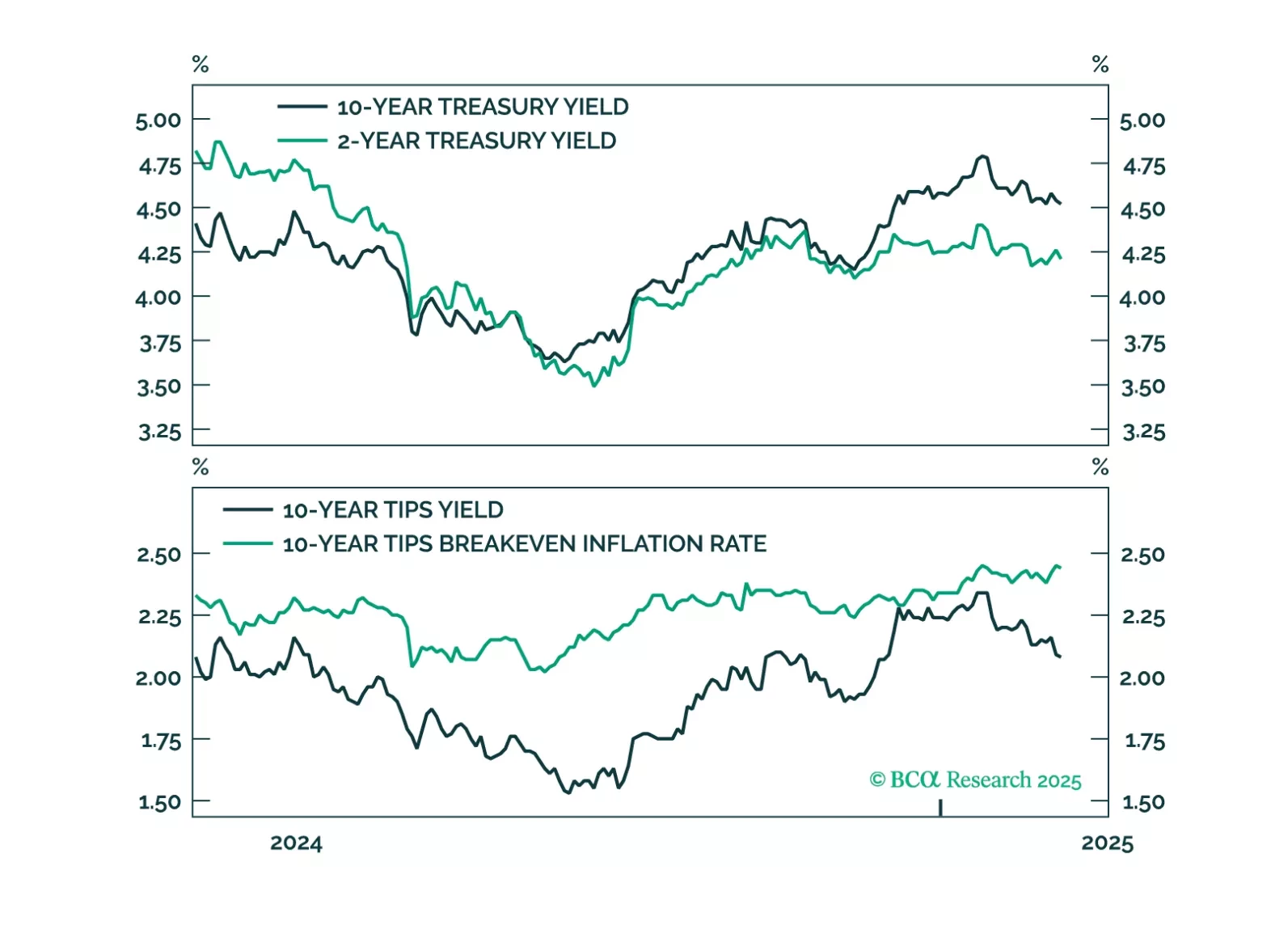

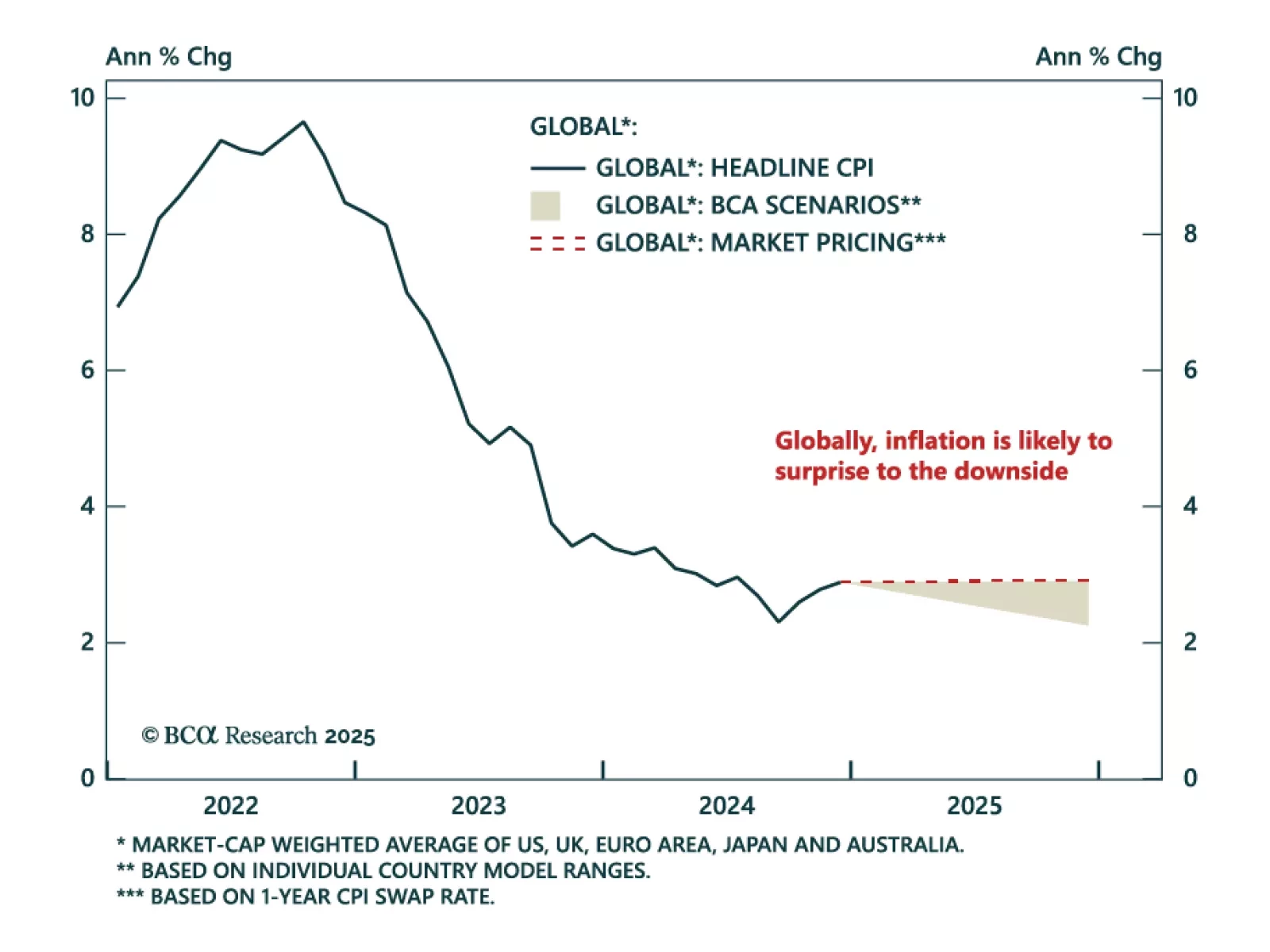

Our Global Fixed Income strategists assessed the risk of a second wave of inflation, and discussed the opportunities within the inflation-linked bond (ILB) market. Global disinflation remains on track, though energy prices and…

The ECB cut by 25 bps as expected, bringing the deposit facility rate to 2.75%. Despite avoiding committing to a path for policy, President Lagarde reiterated the disinflationary process is “well on track”, and did not push against…