Highlights The August 1 deadline for Congress to raise the debt ceiling will come and go but the looming debt showdown will not replay the 2011-13 crisis. It is not a major risk to the bull market. The Biden administration still…

Highlights Global Yields: Falling global bond yields, led by US Treasuries, are an oversized response to some modest cooling of growth momentum. Global growth will remain above-trend over the next year, which will keep global inflation…

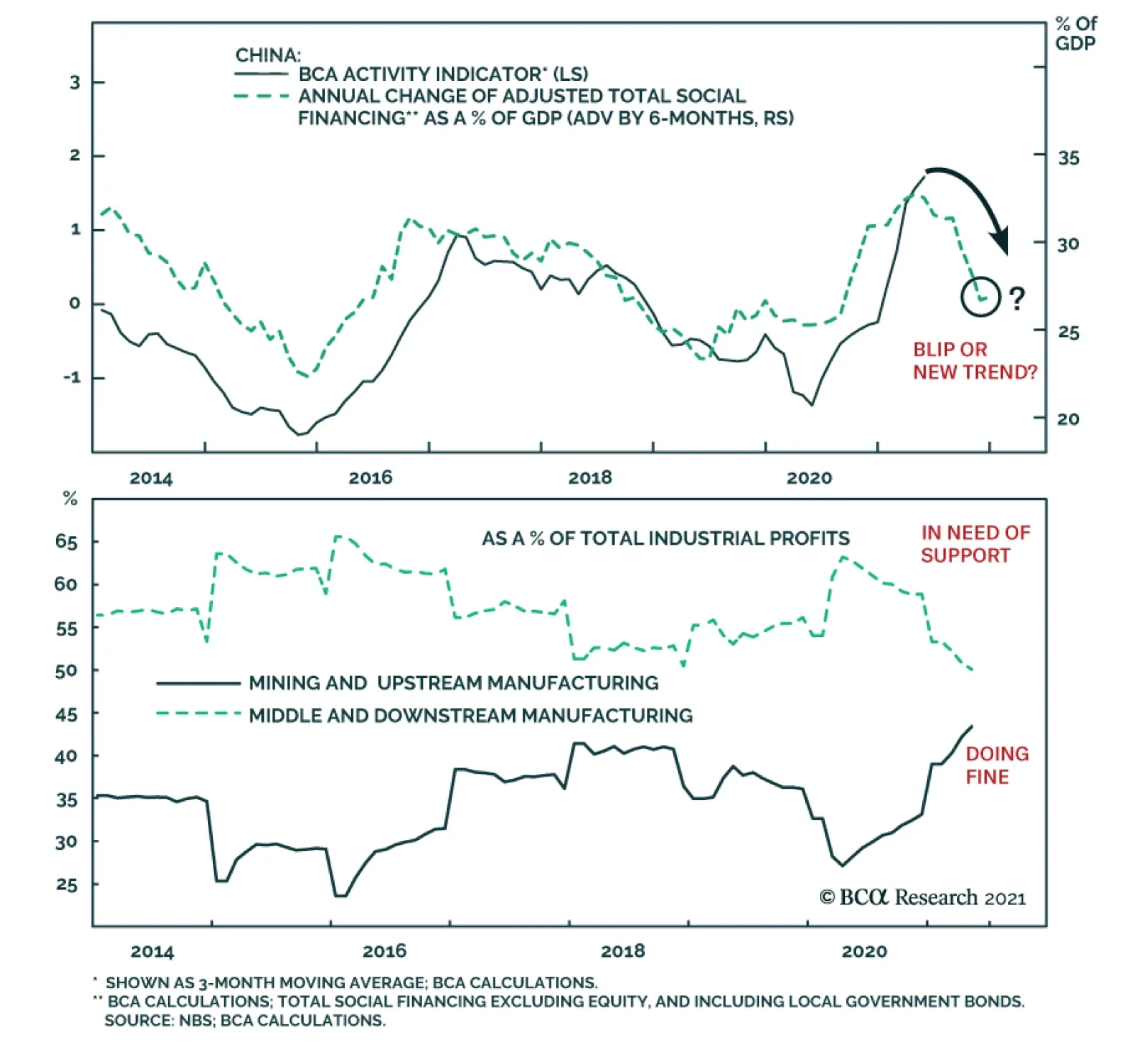

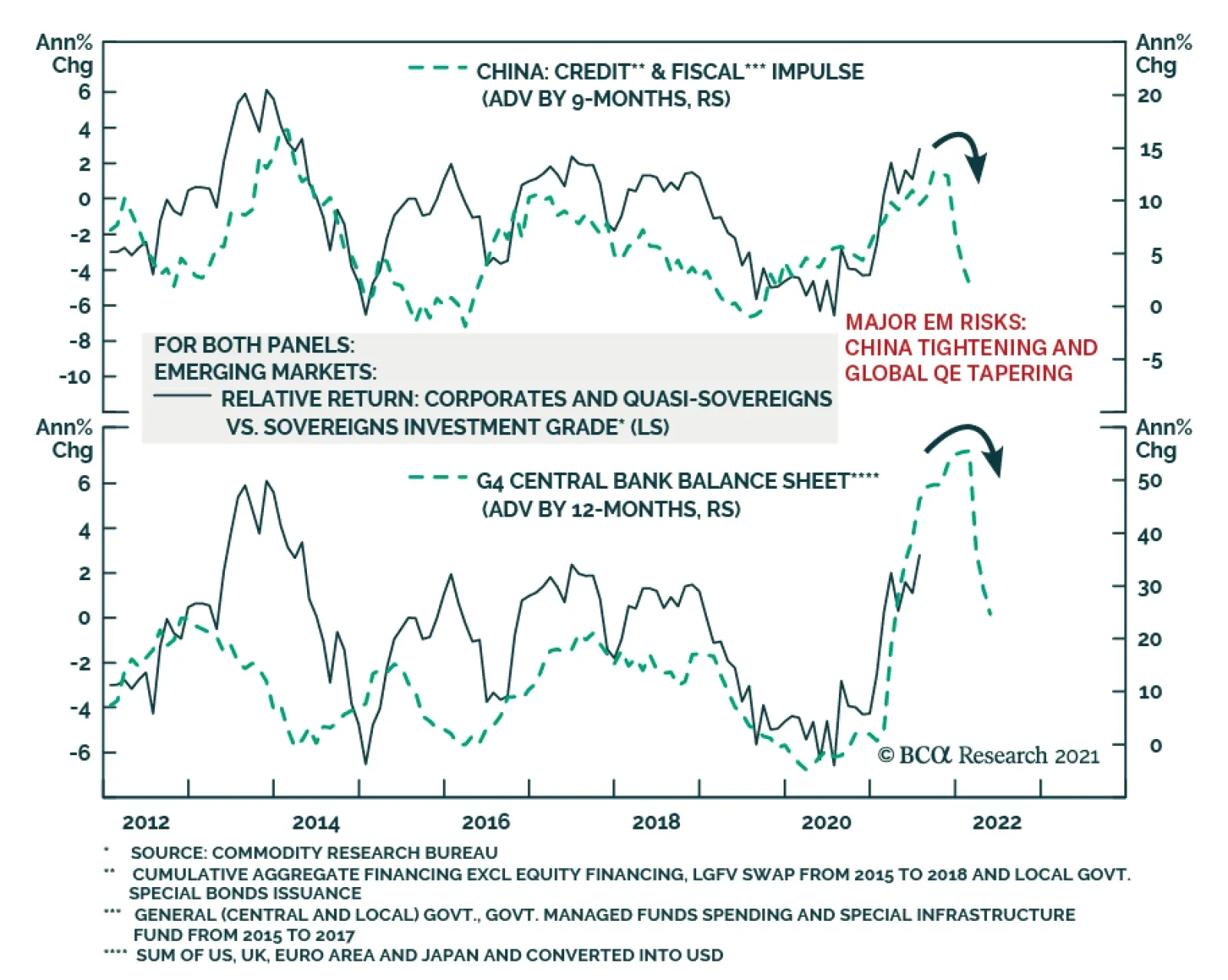

Highlights It is too early to conclude that the PBoC’s surprise rate cut last Friday to its reserve requirement ratio (RRR) marks the beginning of another policy easing cycle. Historically it took more than a single RRR…

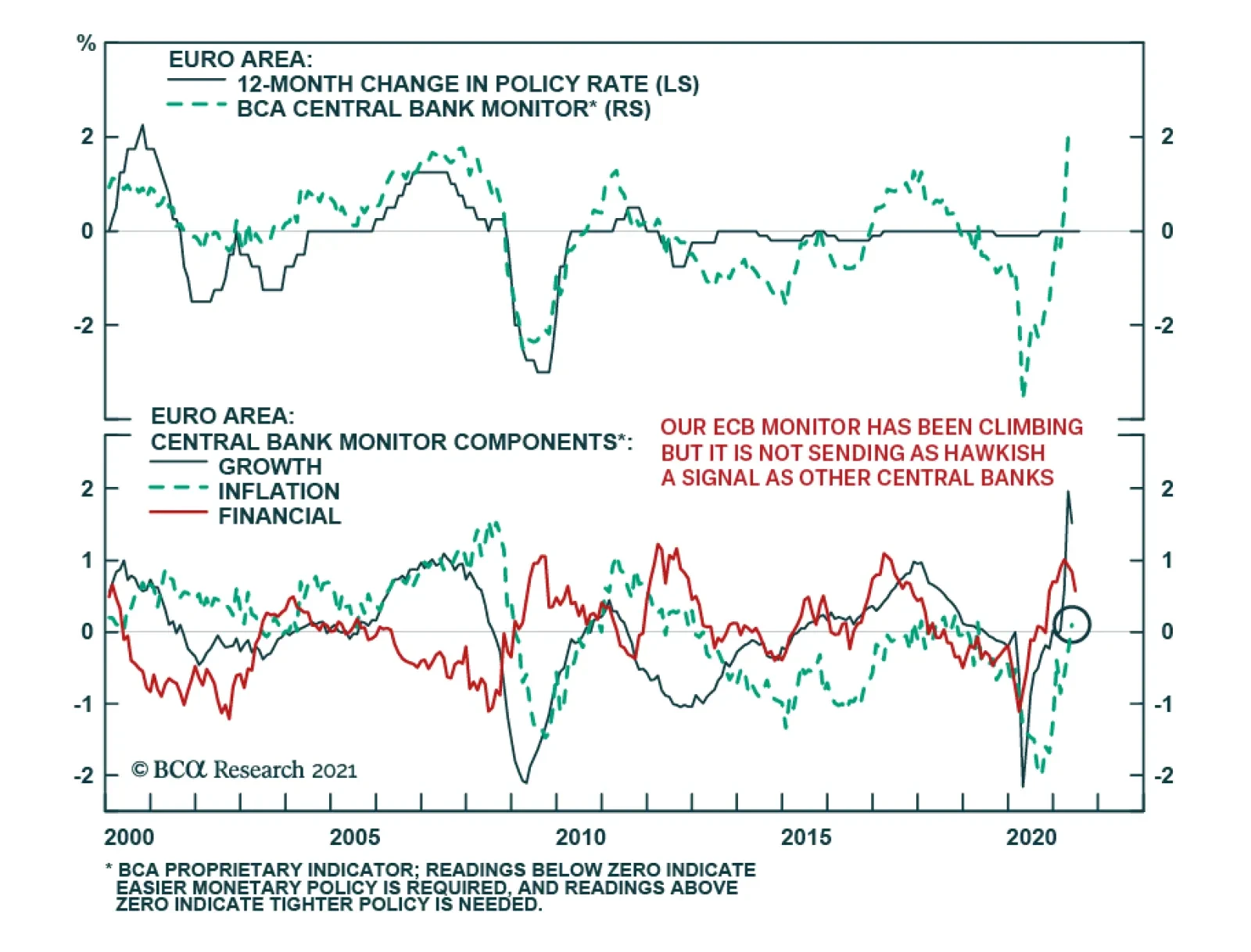

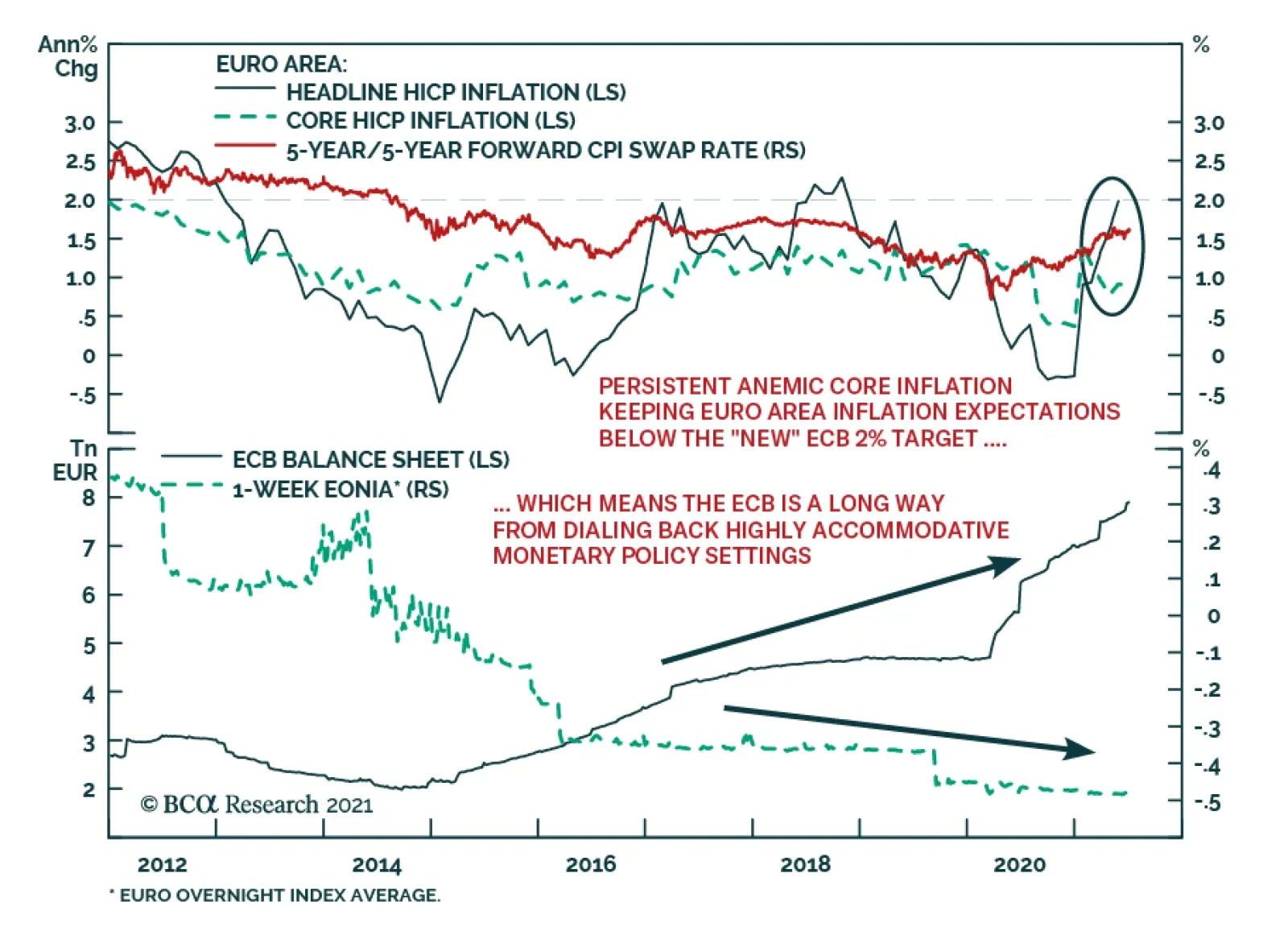

ECB messaging indicates that the central bank is in no rush to tighten policy. ECB President Christine Lagarde highlighted in a Bloomberg Television interview over the weekend that the pandemic remains a threat and that the…

Feature Since the end of the first quarter, the decline in Treasury yields has been the most important trend in global financial markets. It has contributed to the return of the outperformance of growth stocks relative to value stocks,…

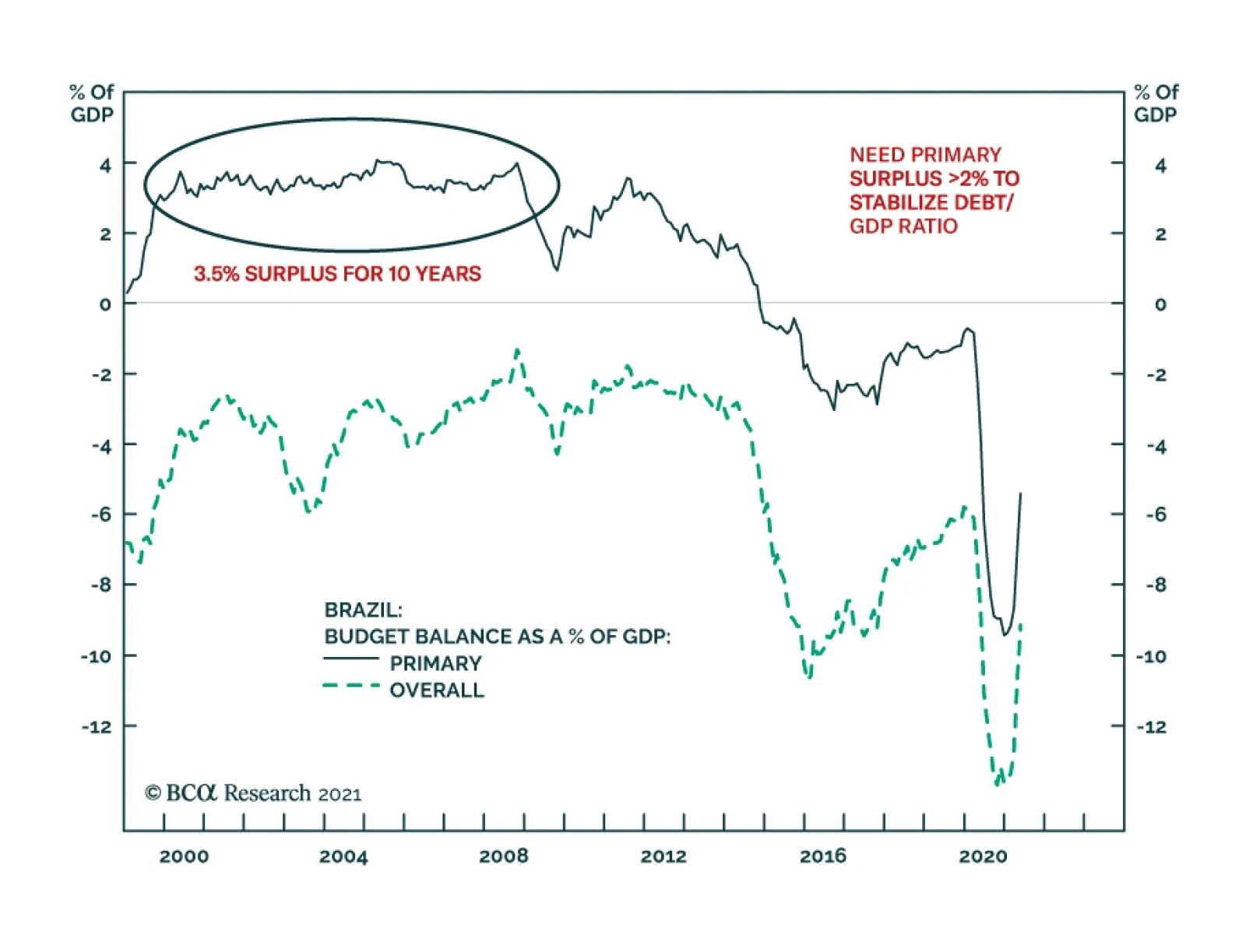

One of the structural challenges Brazil faces is its public debt overhang. The authorities have responded by periodically embarking on fiscal and monetary austerity. Yet, such austerity depresses nominal growth and has in fact…

Chinese credit numbers came in rather higher than expected. Total Social Finance (TSF) grew by RMB3.7 trillion in June, compared to RMB1.9 trillion in May and expectations of RMB2.9 trillion. At the same time, outstanding loan…

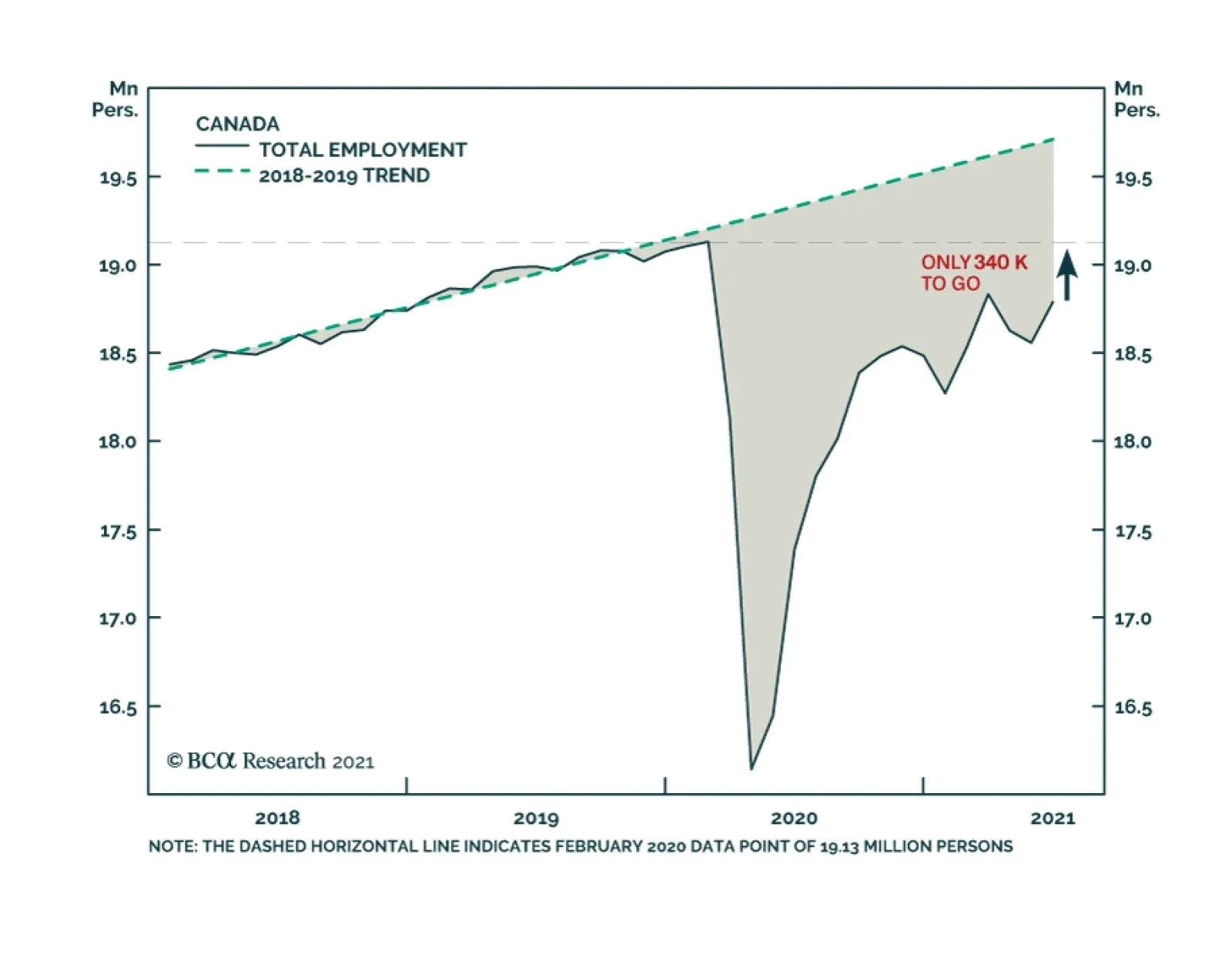

Canadian employment growth in June was robust at 231,000, a big improvement over the losses incurred over the prior two months. The latest month’s growth was driven mainly by a 264,000 increase in part-time jobs: full-time…

In their Q2/2021 model bond portfolio performance review, BCA Research’s Global Fixed Income Strategy team updated their recommended positioning for the next six months. Firstly, the team changed its US Treasury curve…

The ECB unveiled the results of its strategic review yesterday, with some noteworthy tweaks to the policy framework. The central bank shifted to a symmetric inflation target of 2%, a change from the prior goal of aiming for…