The US Federal Reserve has a test for when it will be appropriate to start tapering its asset purchases. It wants to see “substantial further progress” toward its maximum employment and price stability goals.…

Highlights China’s broad equity market performance since the PBoC cut its reserve requirement ratio (RRR) is consistent with our view. While the central bank’s policy tone remains dovish, a single reduction in the RRR rate…

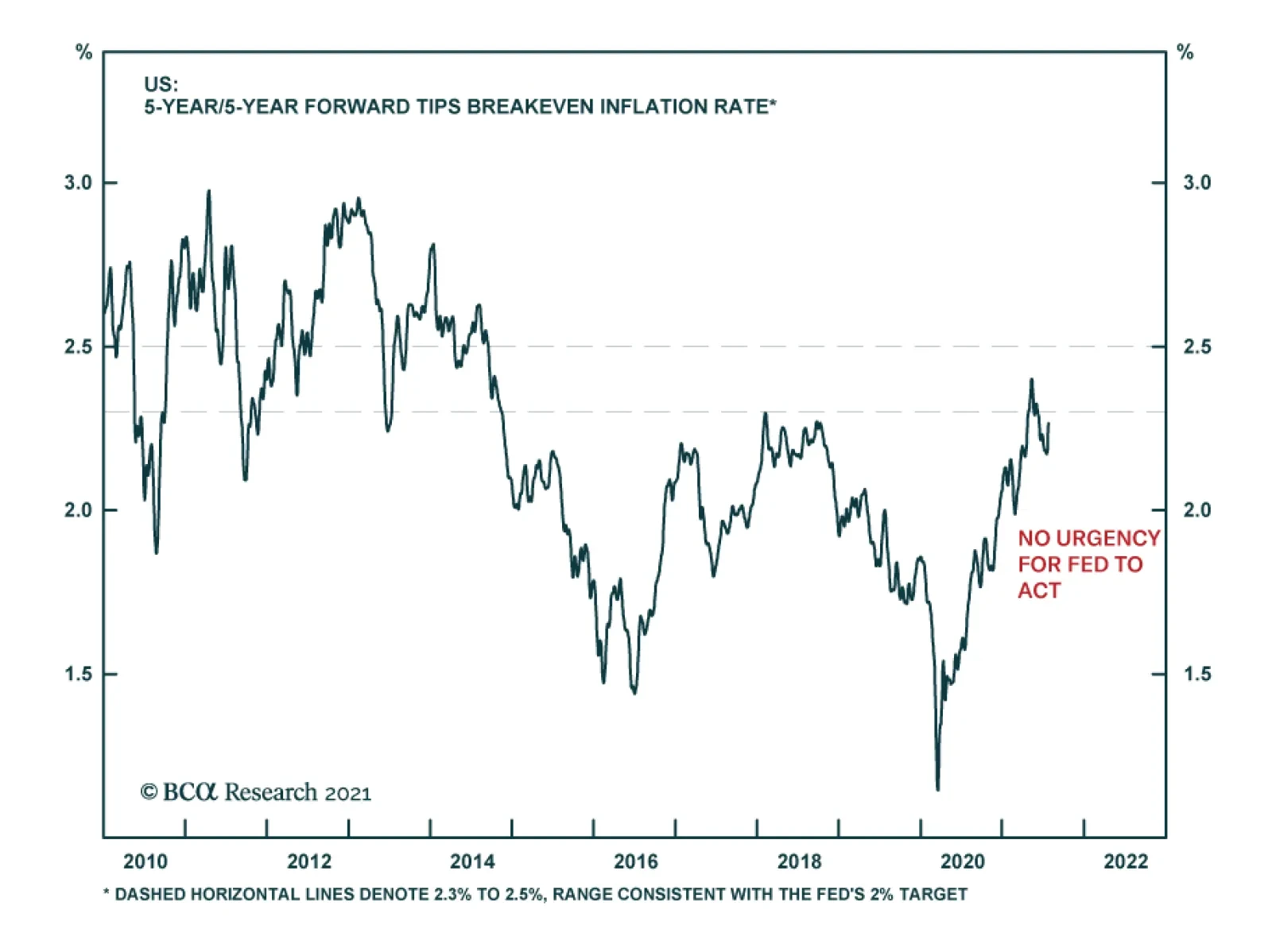

Highlights Portfolio Duration: The decline in US bond yields is overdone. We anticipate that strong US employment data will catalyze a jump in bond yields this fall and that the 10-year US Treasury yield will reach a range of 2% - 2.25…

Highlights The Delta variant will continue causing jitters but there is much greater evidence today than there was in early 2020 that humanity can curb the virus, both with vaccines and government stimulus. Delta jitters will…

Dear Client, We will be presenting our quarterly webcast next week, and, as a result, will not be publishing on 29 July 2021. We will cover our major calls for the quarter and provide a look-ahead. I look forward to…

Feature June’s economic data and second-quarter GDP indicate that China’s economic recovery may have peaked. Slight improvements in some sectors, including manufacturing investment, exports and consumption, were offset by…

Highlights The ECB has changed its inflation target, but its credibility remains weak. Inflation will not allow the ECB to tighten policy anytime soon. Instead, the ECB will have to add to its asset purchase program next year and may…