Highlights Fed: The Fed will be forced to clarify its definition of “maximum employment” in 2022, and the path of inflation will ultimately dictate how far the Fed tries to push the labor market. We expect Fed rate hikes to…

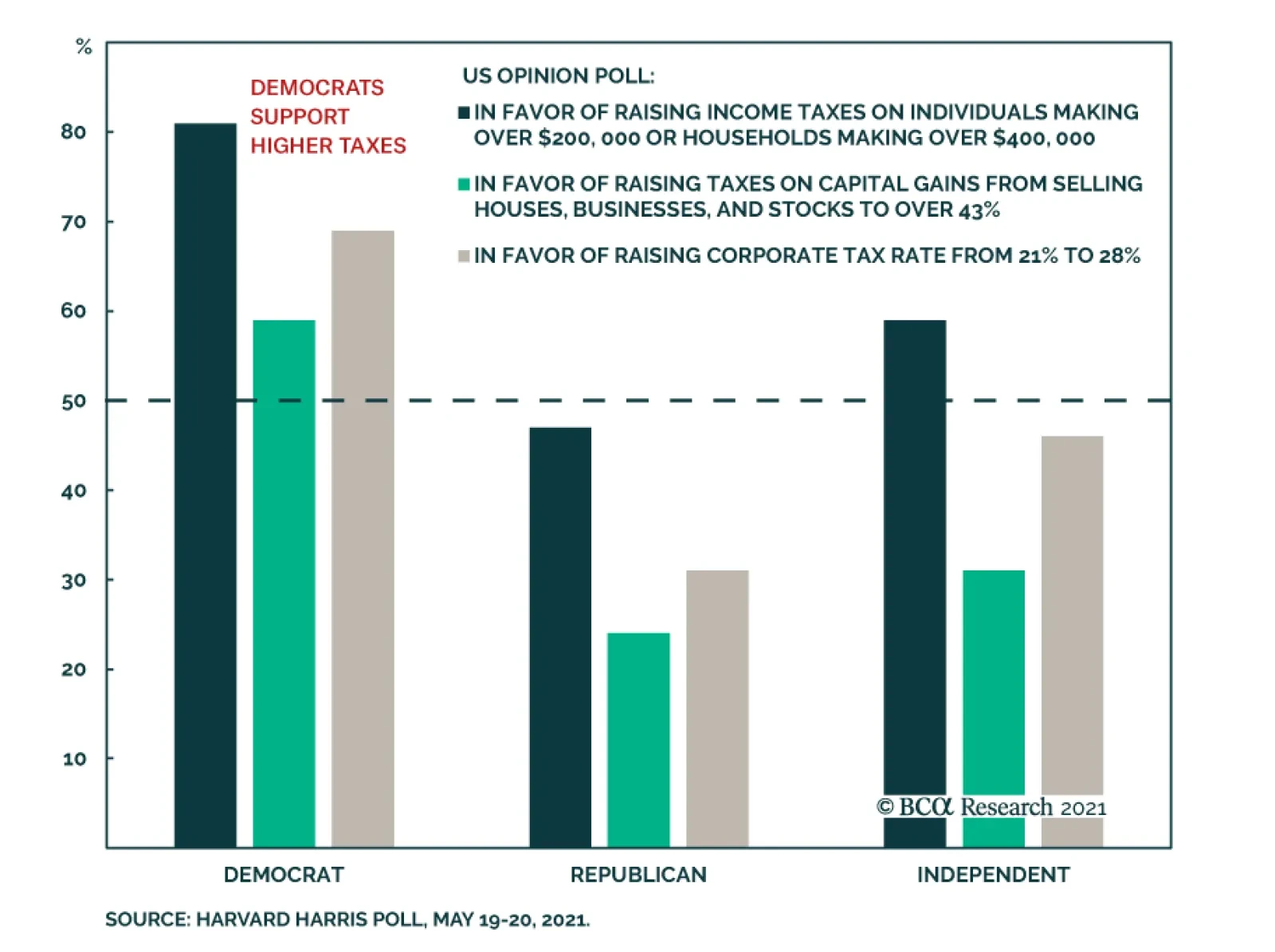

The House Ways and Means Committee delivered a positive surprise to President Biden’s tax plan. In a package released on Monday, the Committee increased the top corporate tax rate to 26.5% from 21% and raised the capital gains…

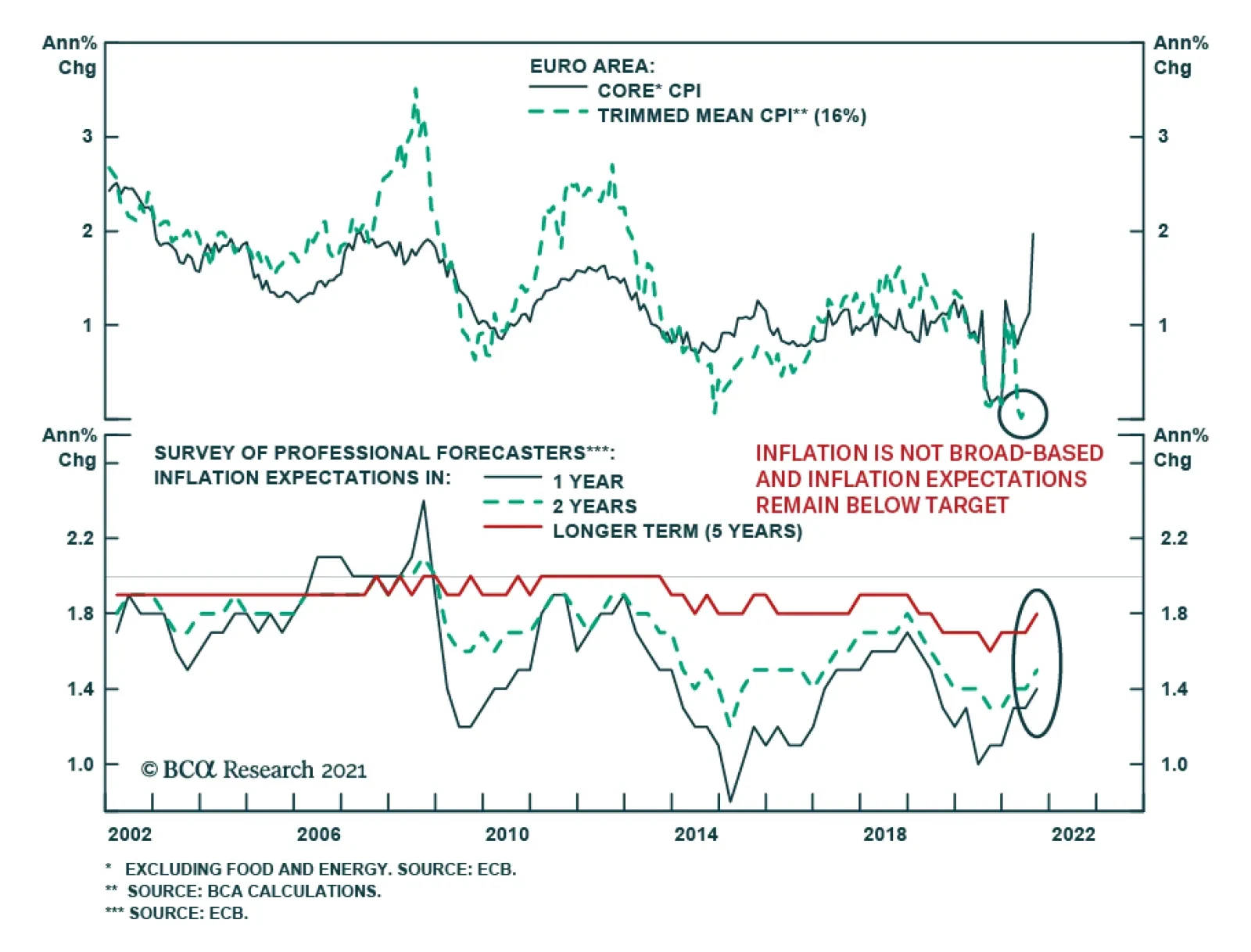

Thursday's ECB meeting concluded with a decision to "moderately" reduce the pace of asset purchases under the PEPP in the final quarter of 2021. The decision to pare back the pace of purchases is in line with the ECB's…

Highlights The equity risk premium has turned negative for the first time since 2002. It follows that any significant rise in bond yields will cause risk-asset prices to collapse, quickly flipping any incipient inflationary shock into…

Feature Chart 1Chinese Offshore Stocks Tumbled Amid Regulatory Crackdowns Relative to the global equity index, onshore and offshore Chinese stocks have fallen by 18% and 32%, respectively, since their peaks in mid-February (…

Highlights Economic policy uncertainty is rising in the US and will generate volatility this fall. But by the end of the year the result should be more fiscal reflation. Biden’s approval rating is now “underwater”…

Highlights Chart 1Employment Growth Will Rebound August’s weak employment growth reflects the surge of Delta variant COVID cases in the United States. This is evidenced by the fact that Leisure & Hospitality sector…

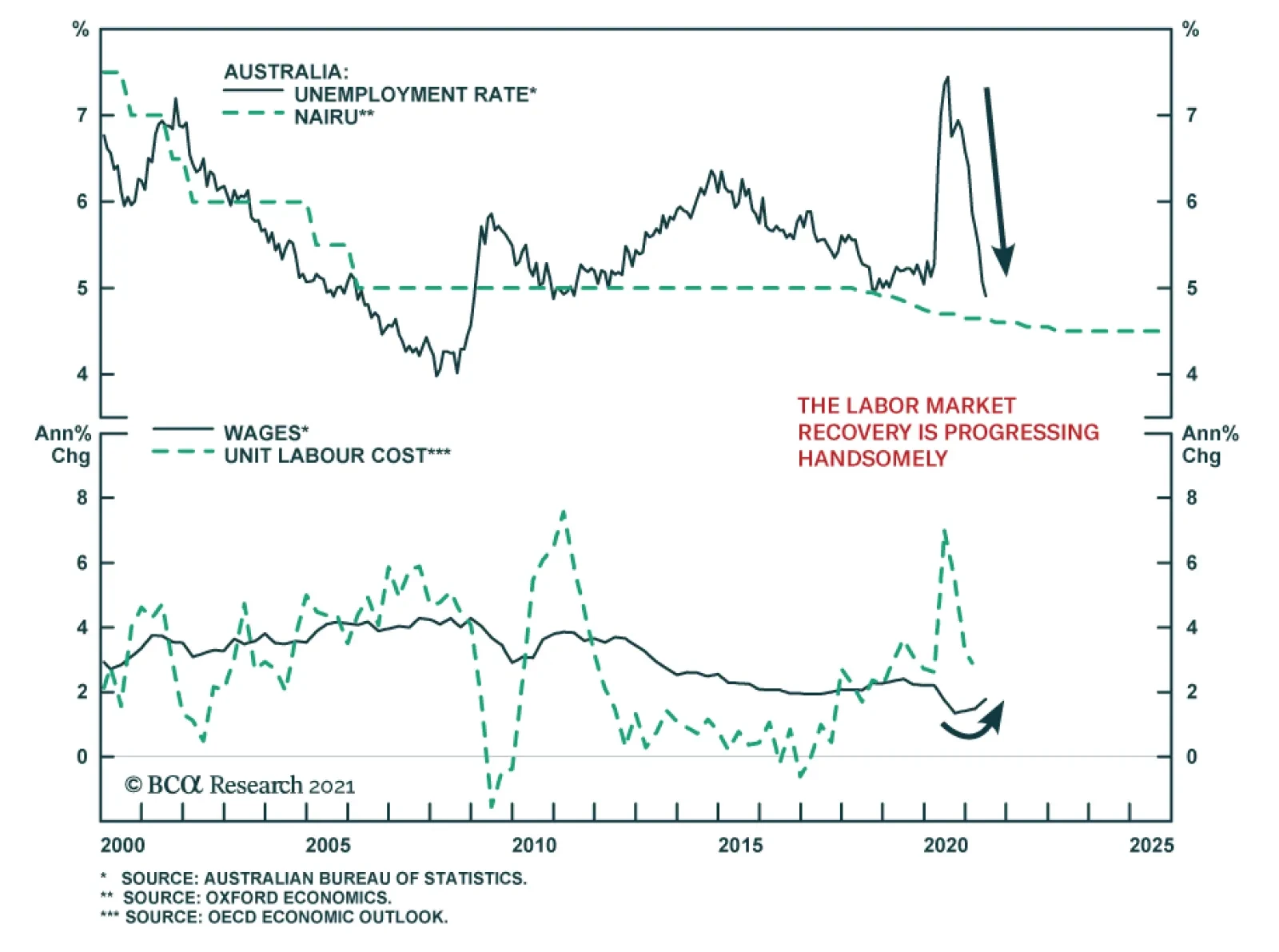

The Reserve Bank of Australia maintained its benchmark cash rate target unchanged at 0.1% at its meeting on Tuesday. Instead, the central bank announced a reduction in the pace of its asset purchases to AUD 4 billion a week from…

Highlights A trio of ECB hawks raised the prospect of an ECB taper. In the past, the current set of economic conditions in the Euro Area would have prompted the ECB to tighten policy. A potential economic deceleration this fall, the…