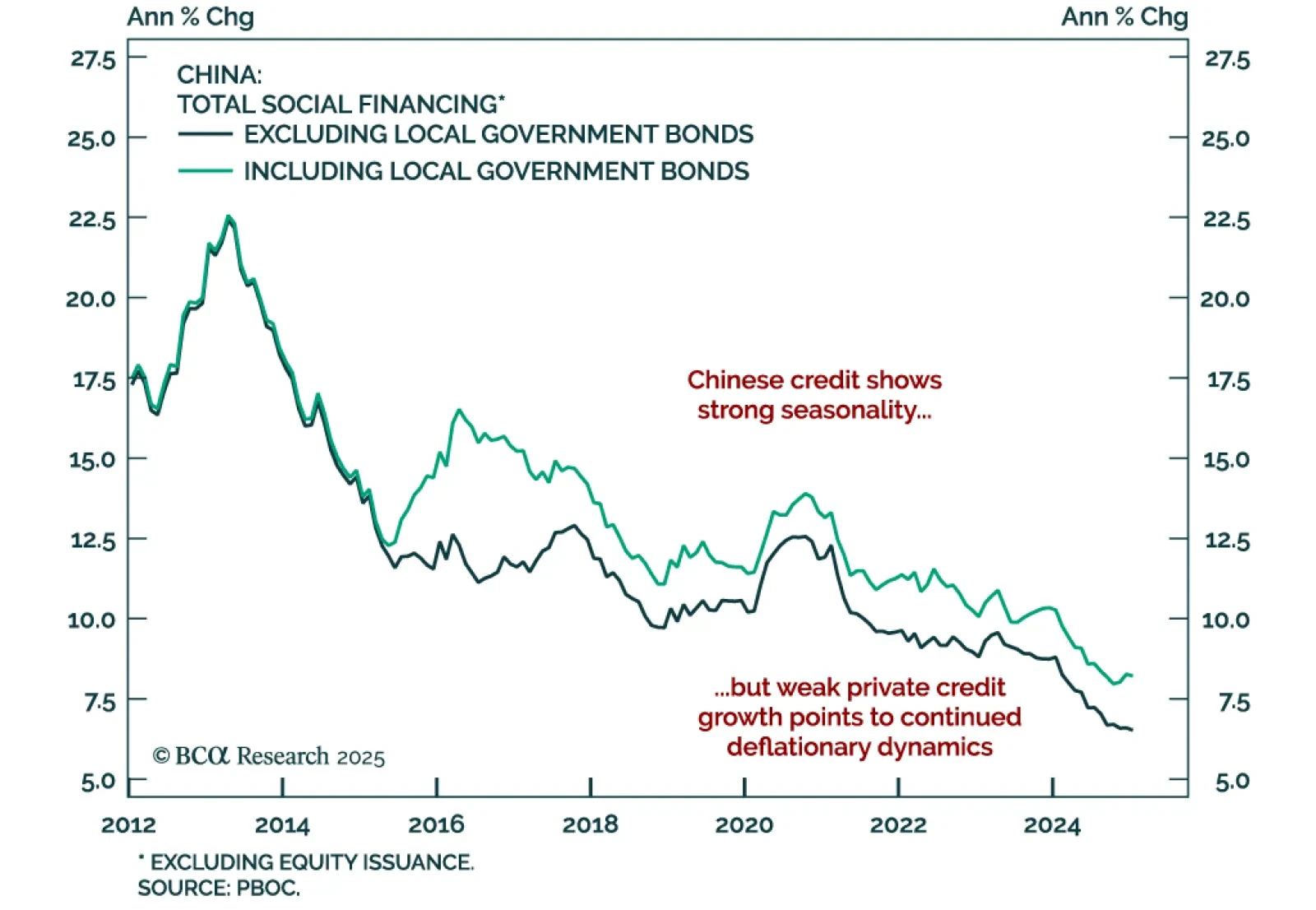

China’s January monetary and credit data was solid. New yuan loans increased by CNY 5.1 trillion, while aggregate financing was up by 7.1 trillion. M1 also increased after contracting 1.4% y/y in December. Seasonality plays a…

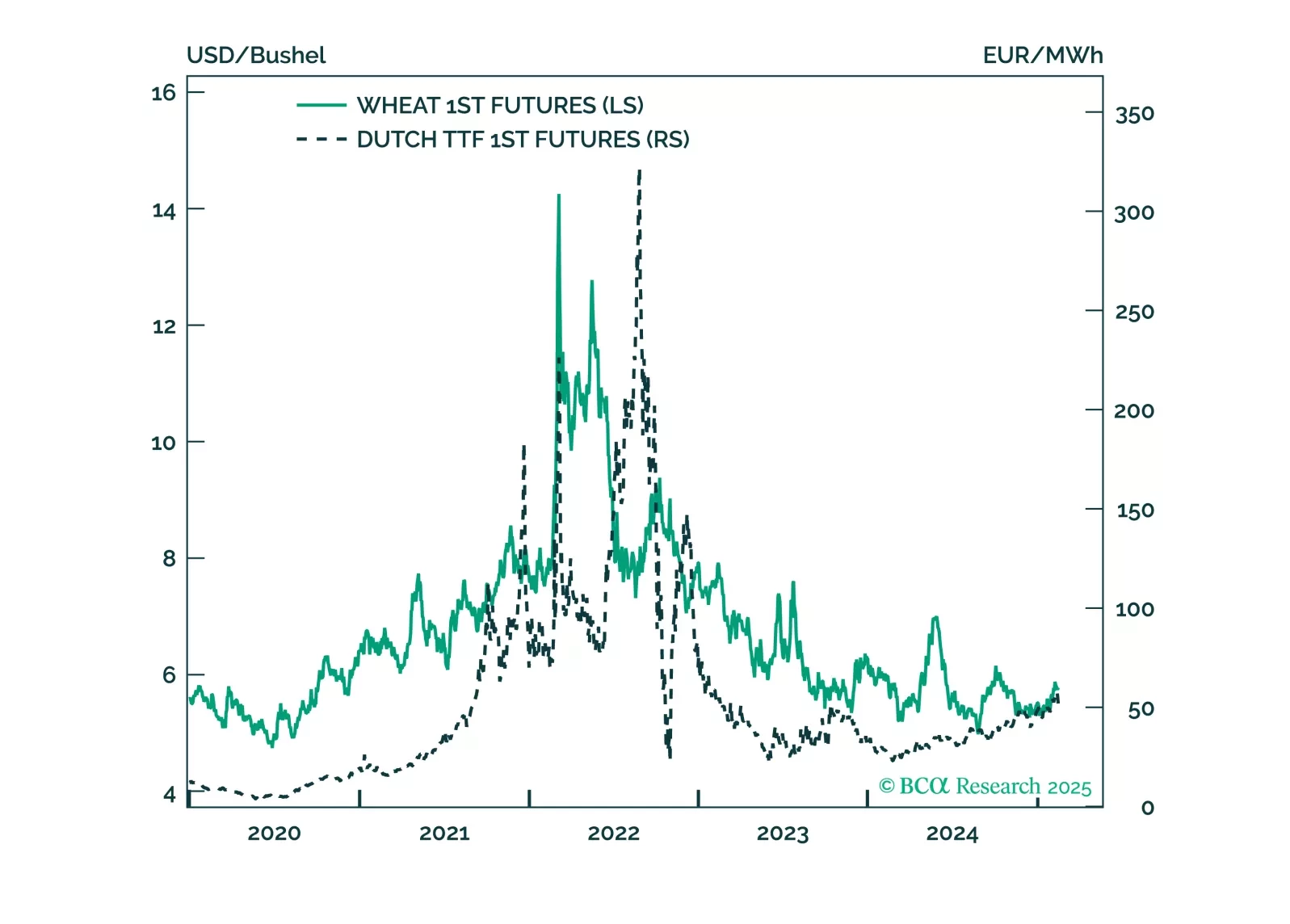

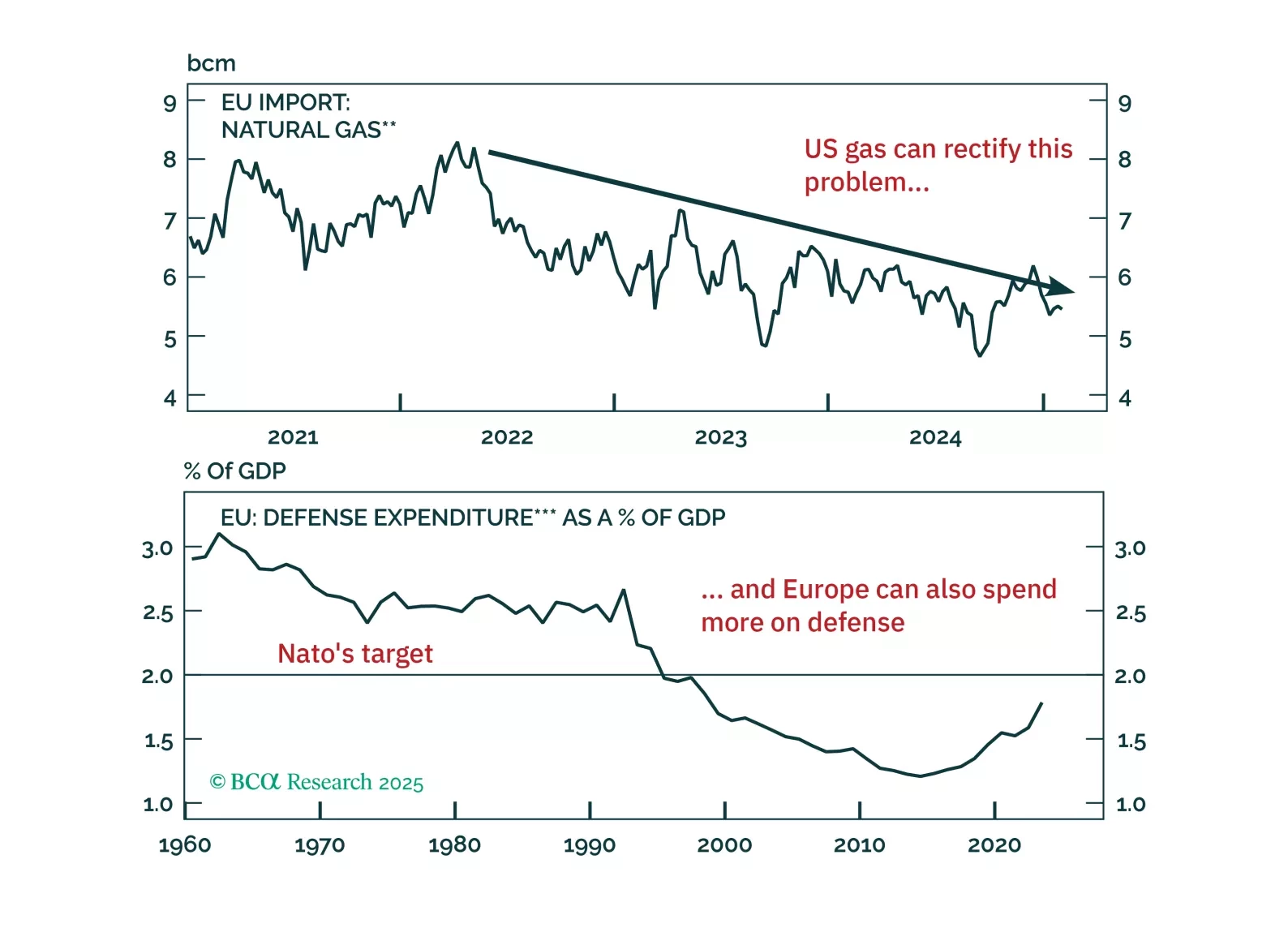

President Trump is negotiating a ceasefire in Ukraine. This will be a marginal headwind to some commodities which benefitted from the conflict like natural gas and wheat, and will be a marginal tailwind for European assets,…

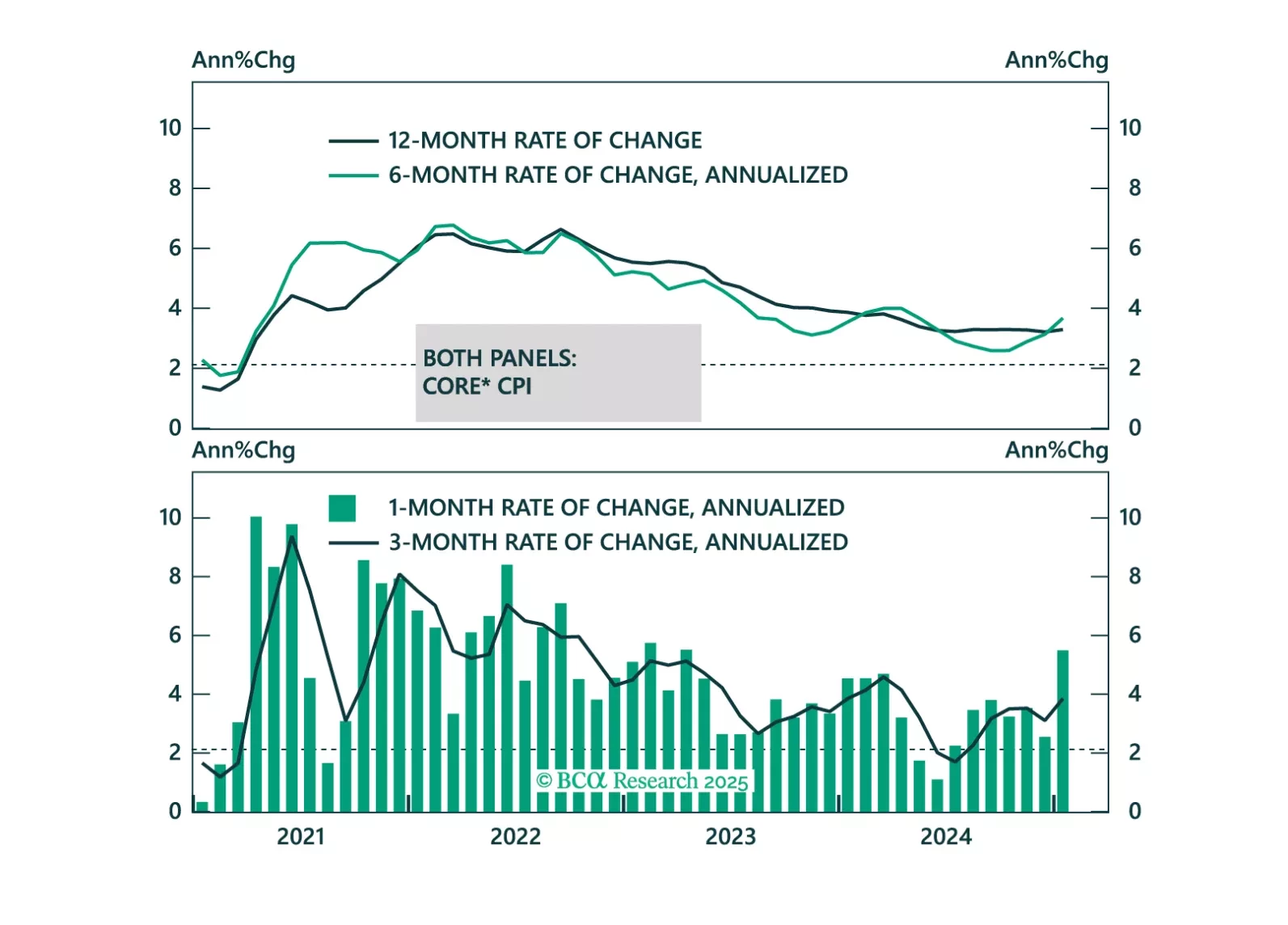

Some thoughts on this morning’s CPI report and its implications for the Fed and Treasury yields.

Our Emerging Market strategists published a follow-up piece to their Bessenomics note where they assess the new Treasury Secretary plan’s impact on markets. Lower interest rates are central to Bessenomics. The Trump…

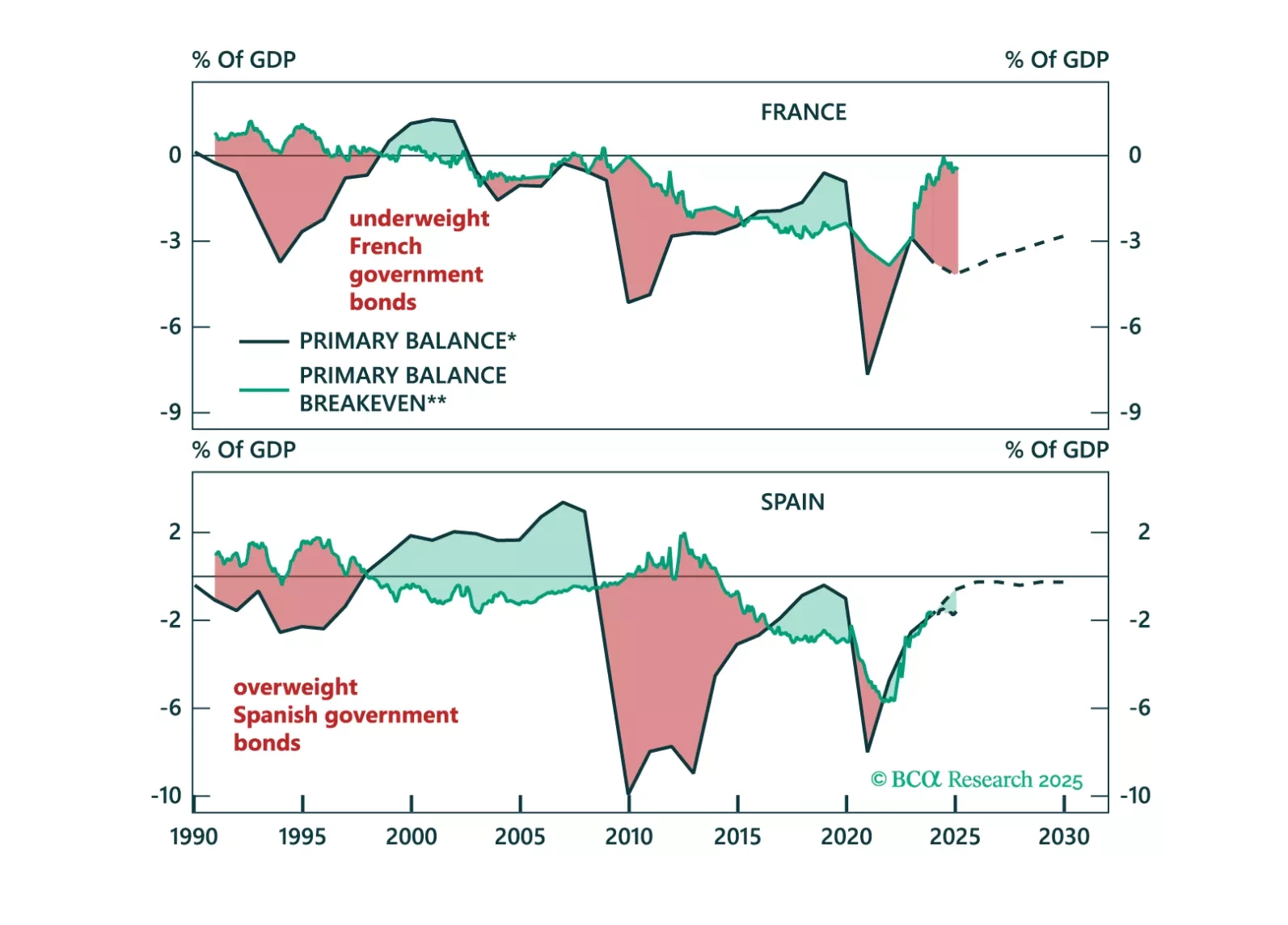

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

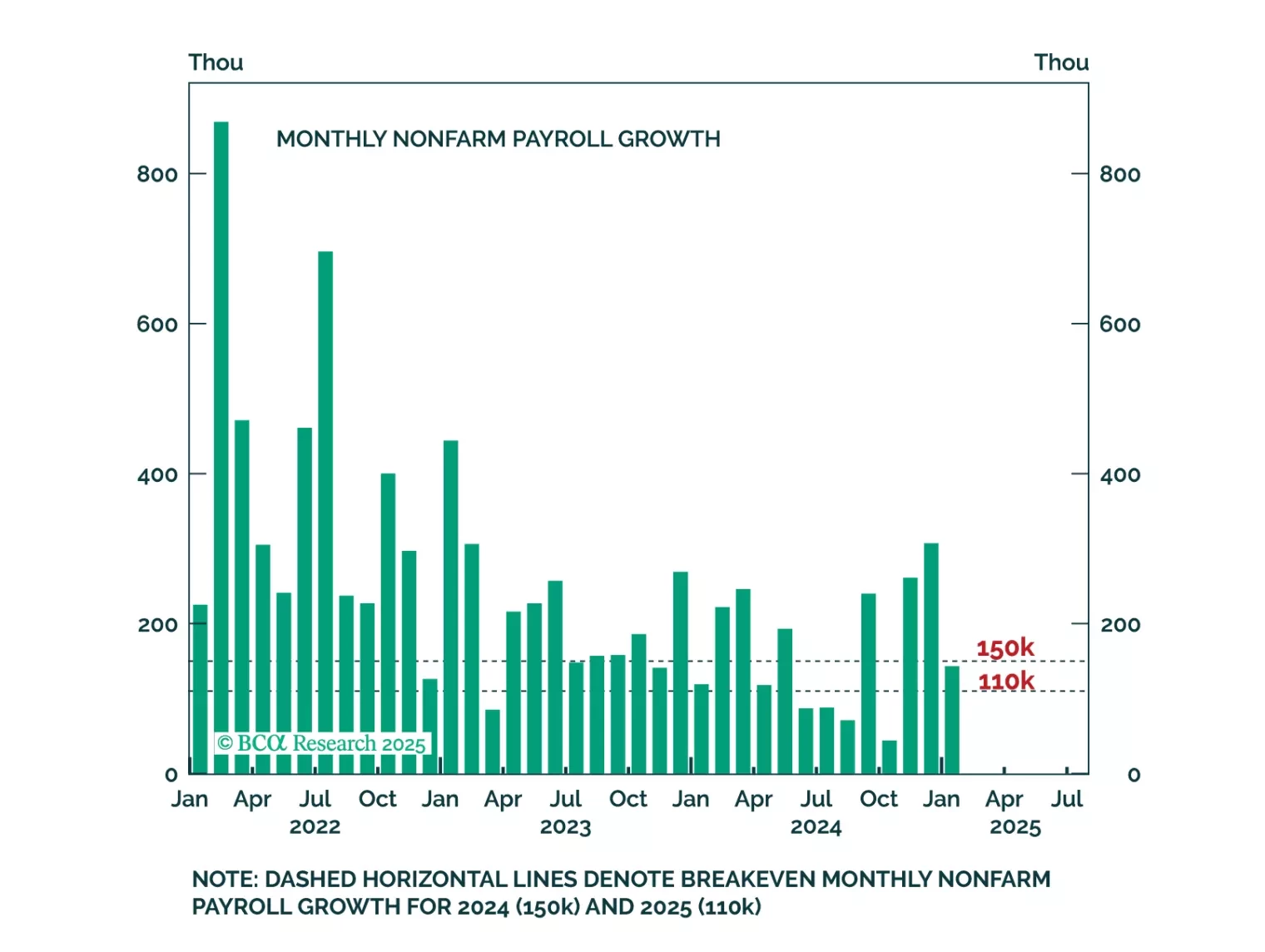

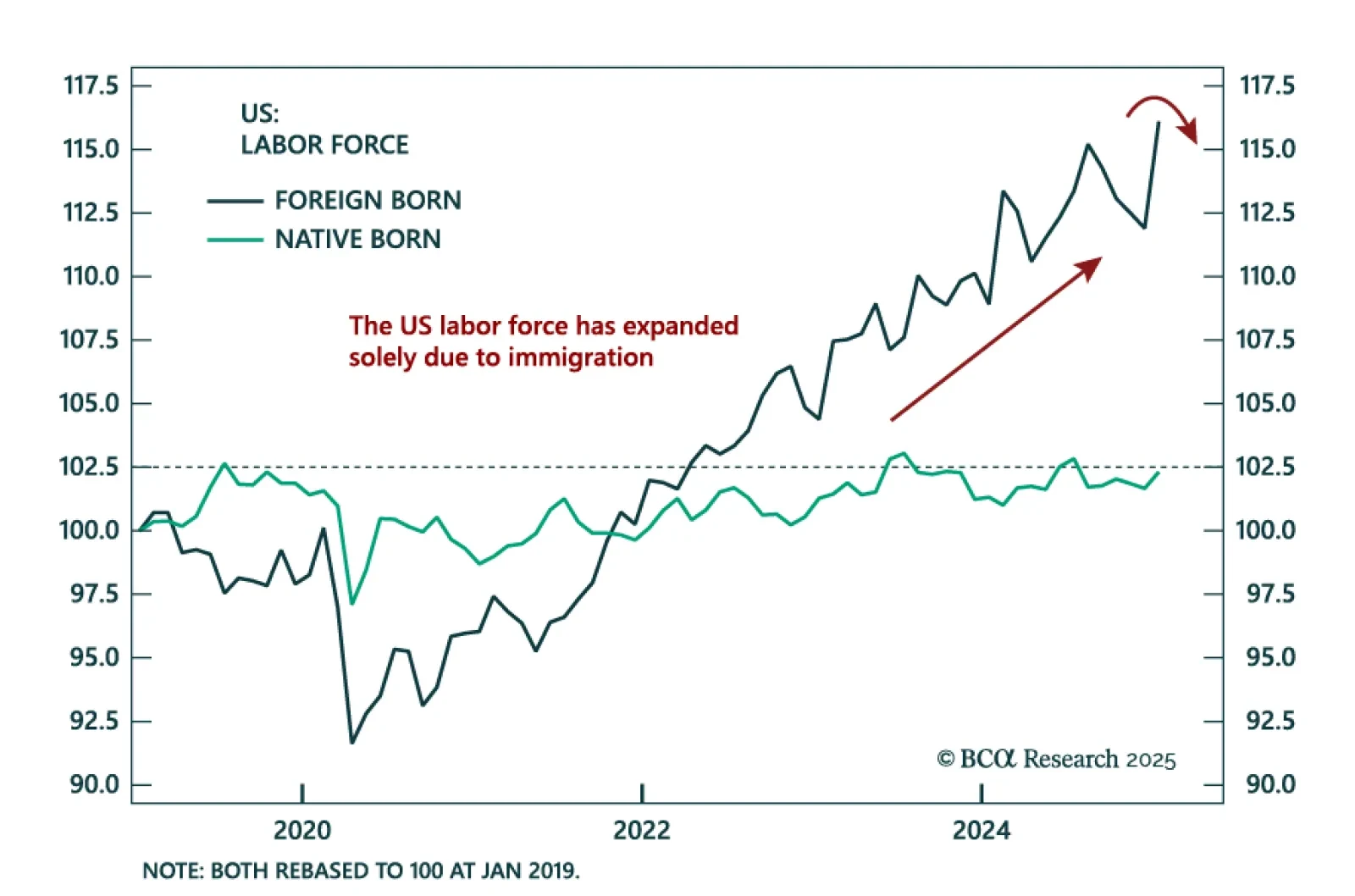

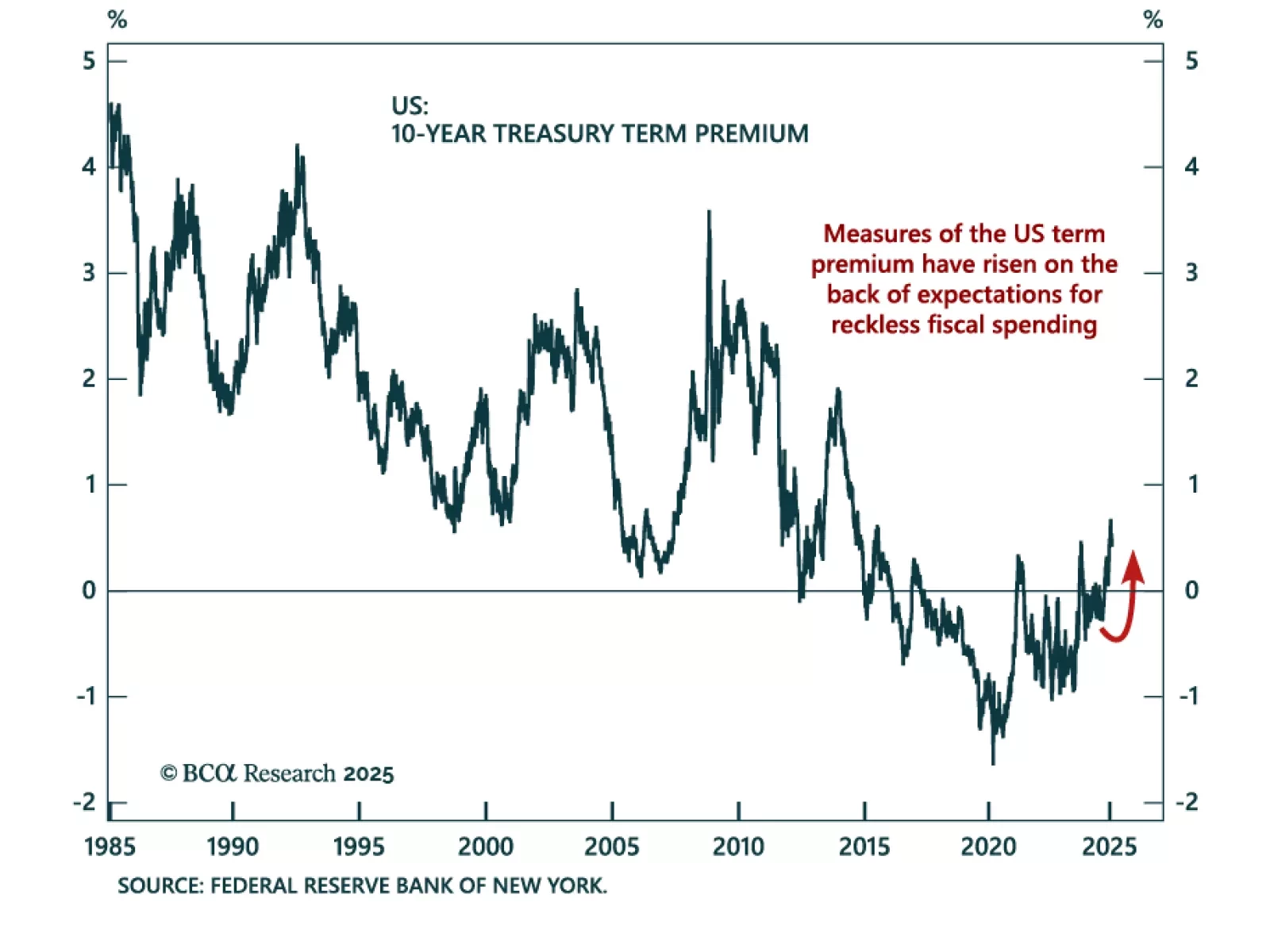

Some thoughts on this morning's employment data and Treasury Secretary Bessent's recent attempts to talk down the 10-year Treasury yield.

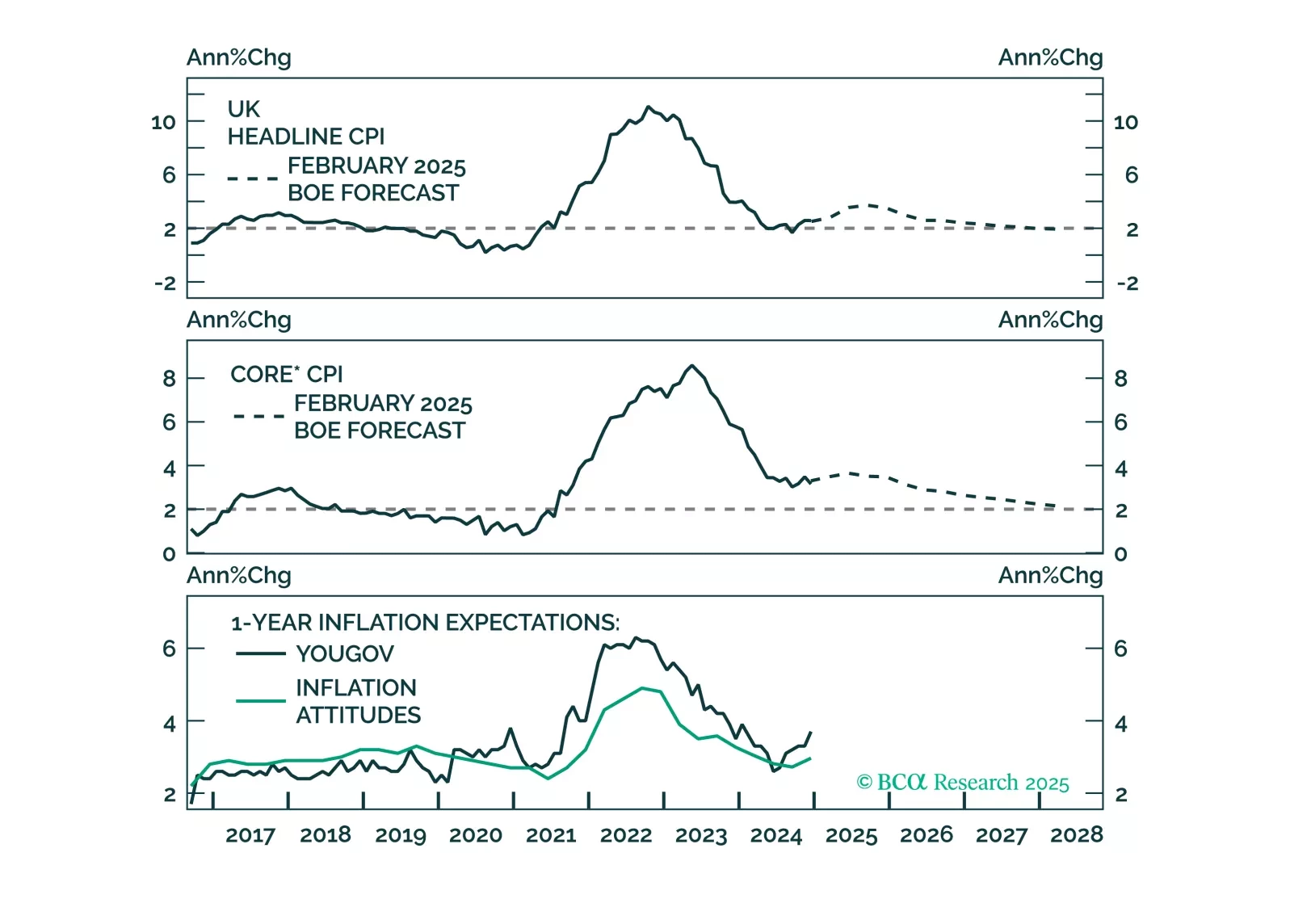

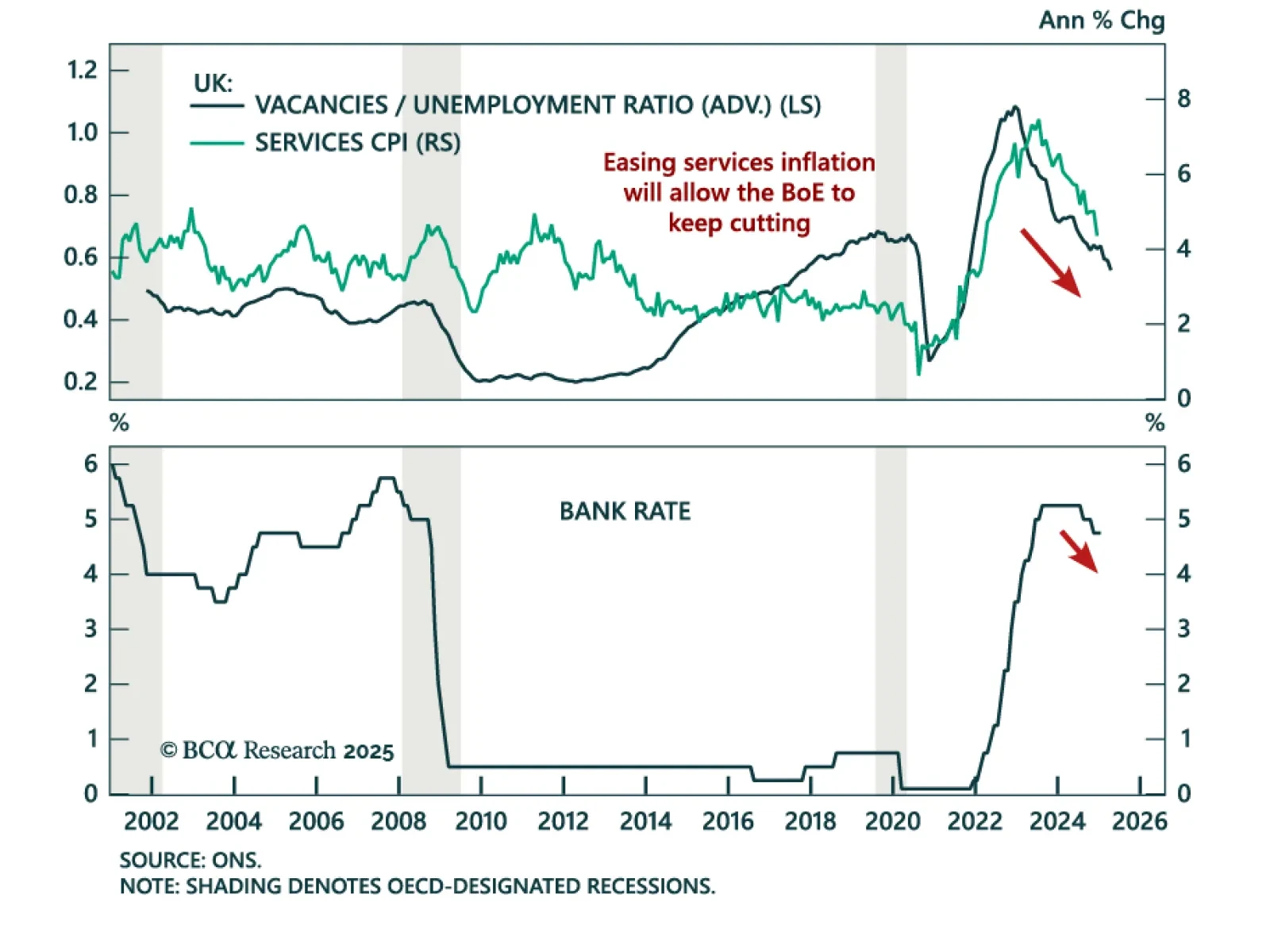

The Bank of England cut its policy rate by 25 bps to 4.5%, with two members of the MPC voting to cut 50 bps instead. The BoE acknowledged “substantial progress on disinflation”, driven by a tight policy stance and stabilized…

Treasury Secretary Scott Bessent commented that one of the Trump administration’s priority was lowering 10-year bond yields. Bessent’s 3/3/3 plan, boosting growth to 3% from deregulation, increasing US oil production by 3 mmb/d, and…

Following today’s Bank of England’s policy meeting, at which the policy rate was cut by 25 bps, we discuss our outlook for monetary policy in the UK. We expect the gradual easing to continue and discuss the investment implications…