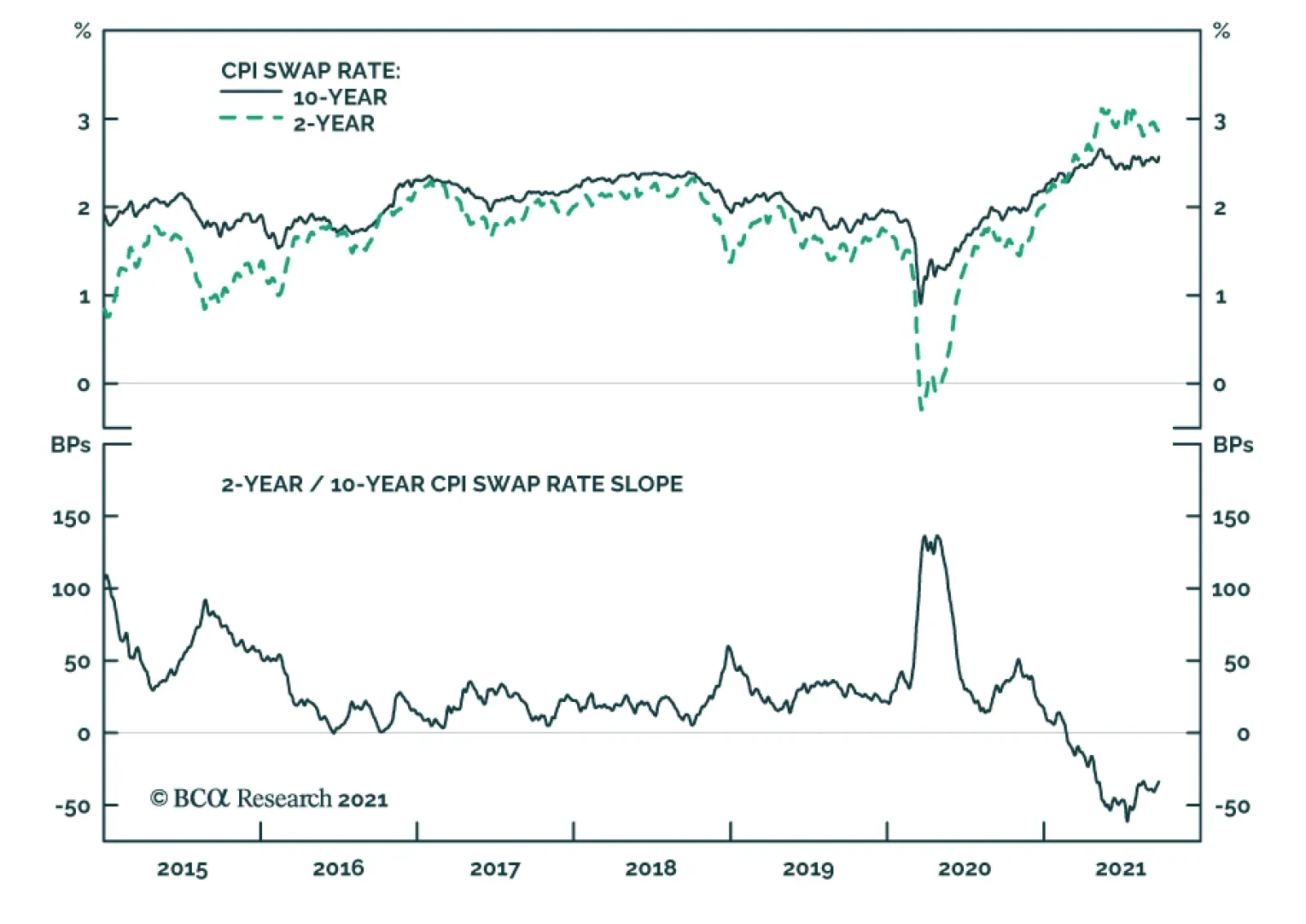

BCA Research’s US Bond Strategy services recommends investors enter 2/10 steepeners on the inflation compensation curve and/or 2/10 flatteners on the real (TIPS) curve. The increase in the 10-year nominal yield since last…

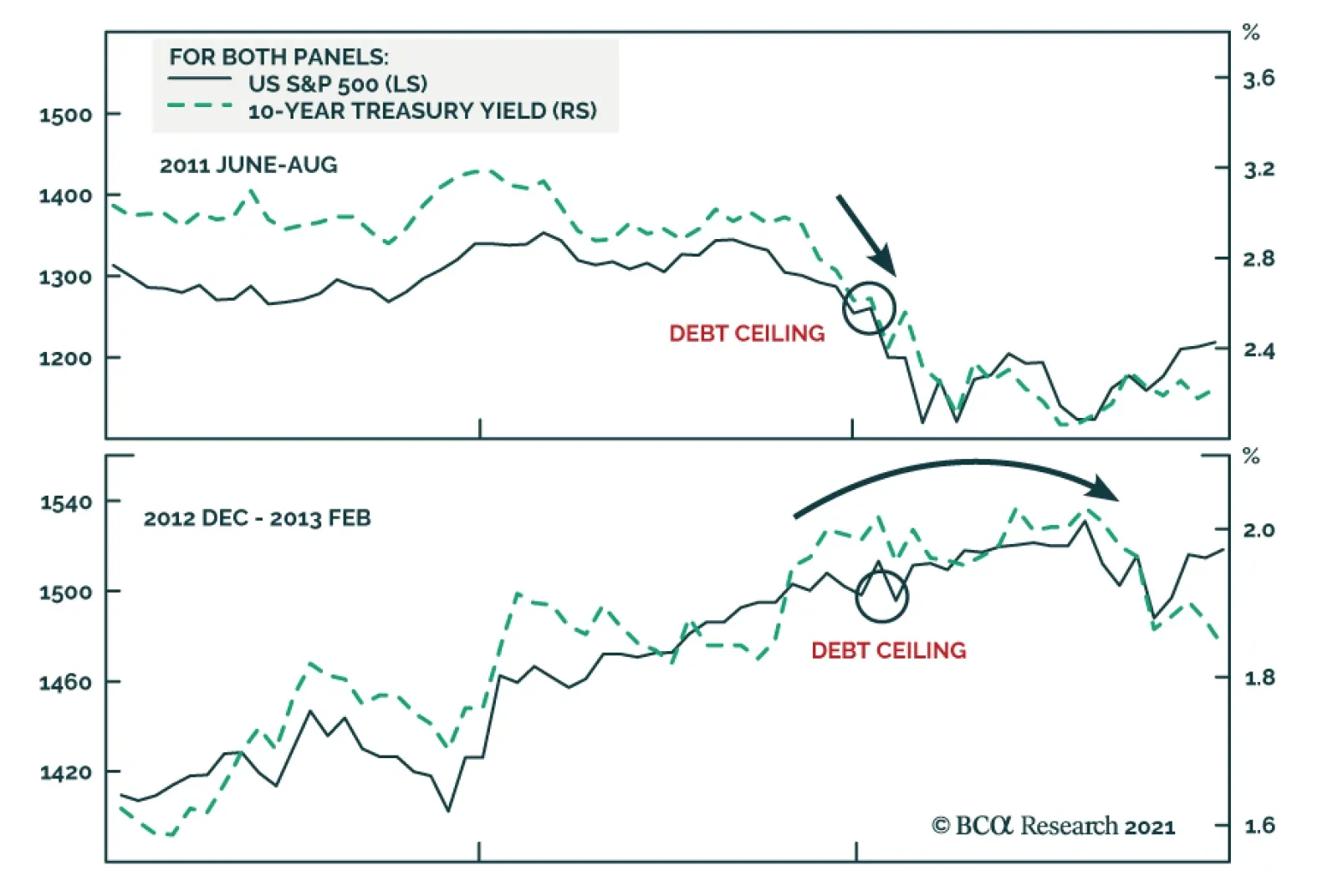

On Monday, Senate Republicans blocked a bill that would have extended federal funding to early December, provided emergency relief, and suspended the debt ceiling until December 2022. Democrats are now facing a tight deadline.…

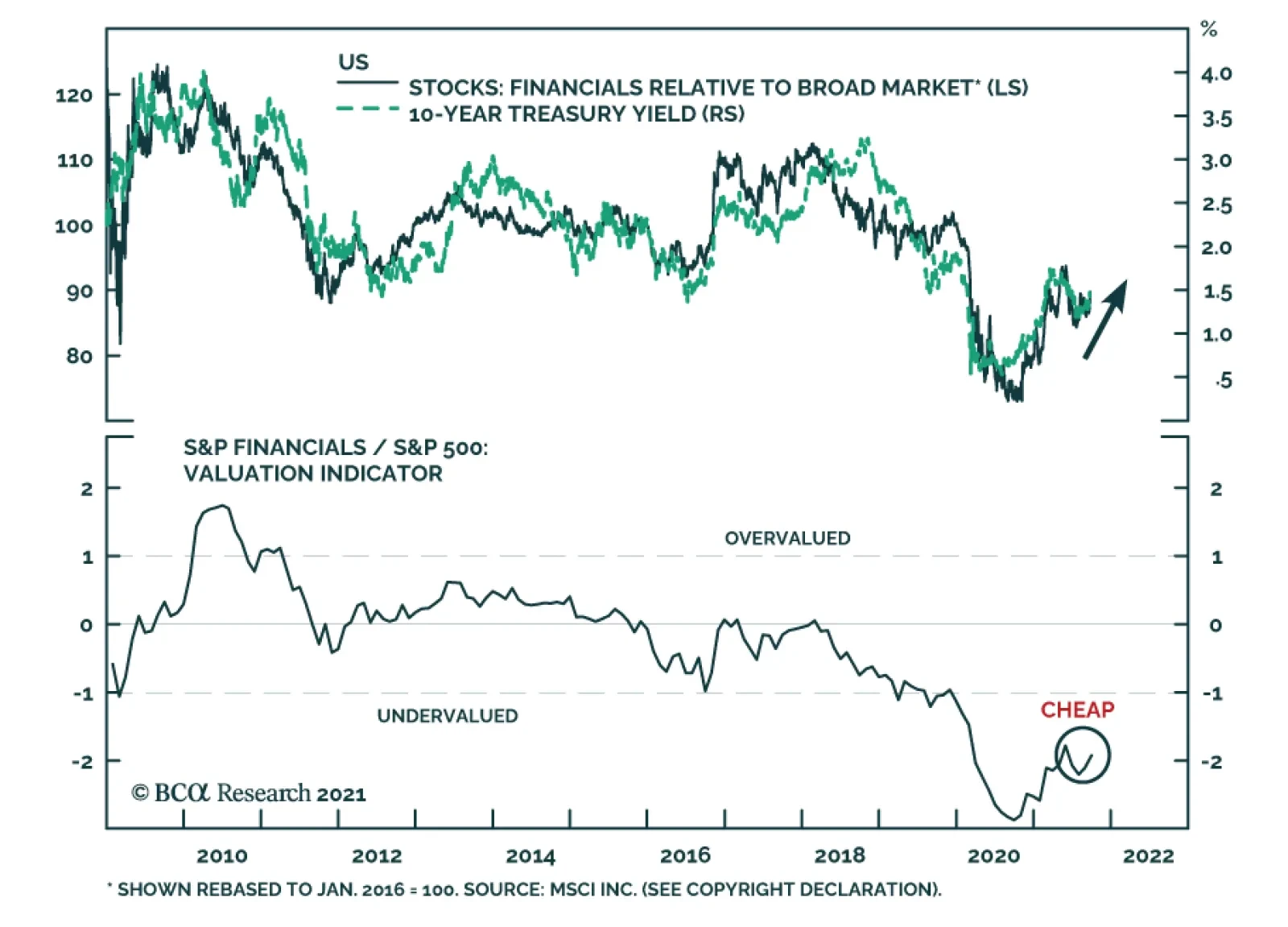

US Financials is among the best performing US equity sectors over the past three months. We expect these positive relative gains to continue. Financials will benefit from rising US bond yields over the coming year. Not only…

Highlights Monetary Policy: It’s all but certain that tapering will begin next month and conclude by the middle of next year, but the FOMC is currently split right down the middle on whether it will be appropriate to lift rates…

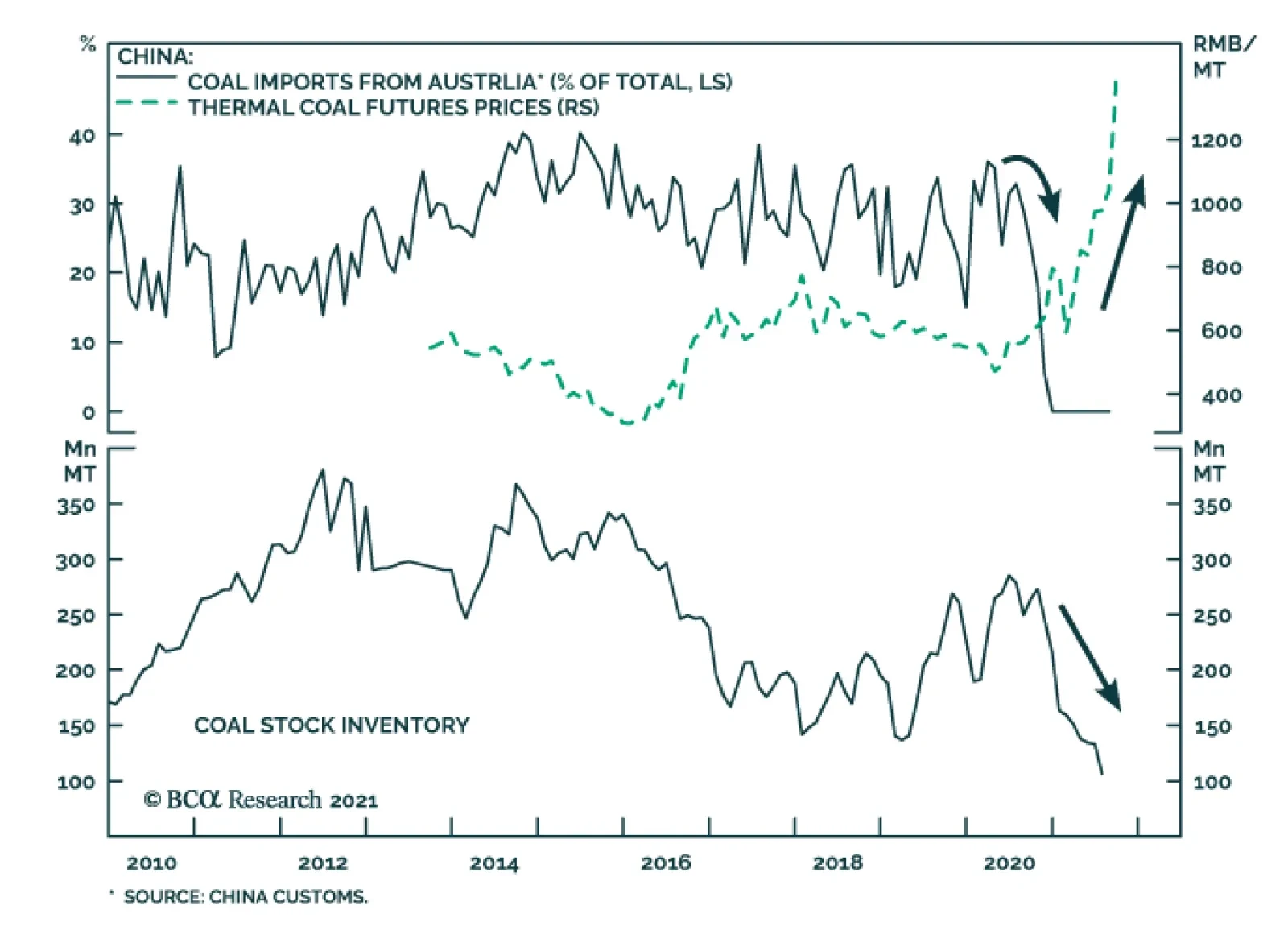

Power shortages are the latest source of risk clouding the Chinese economic outlook. An intensification of electricity supply issues is forcing factories in several key manufacturing hubs to curtail production. To reduce…

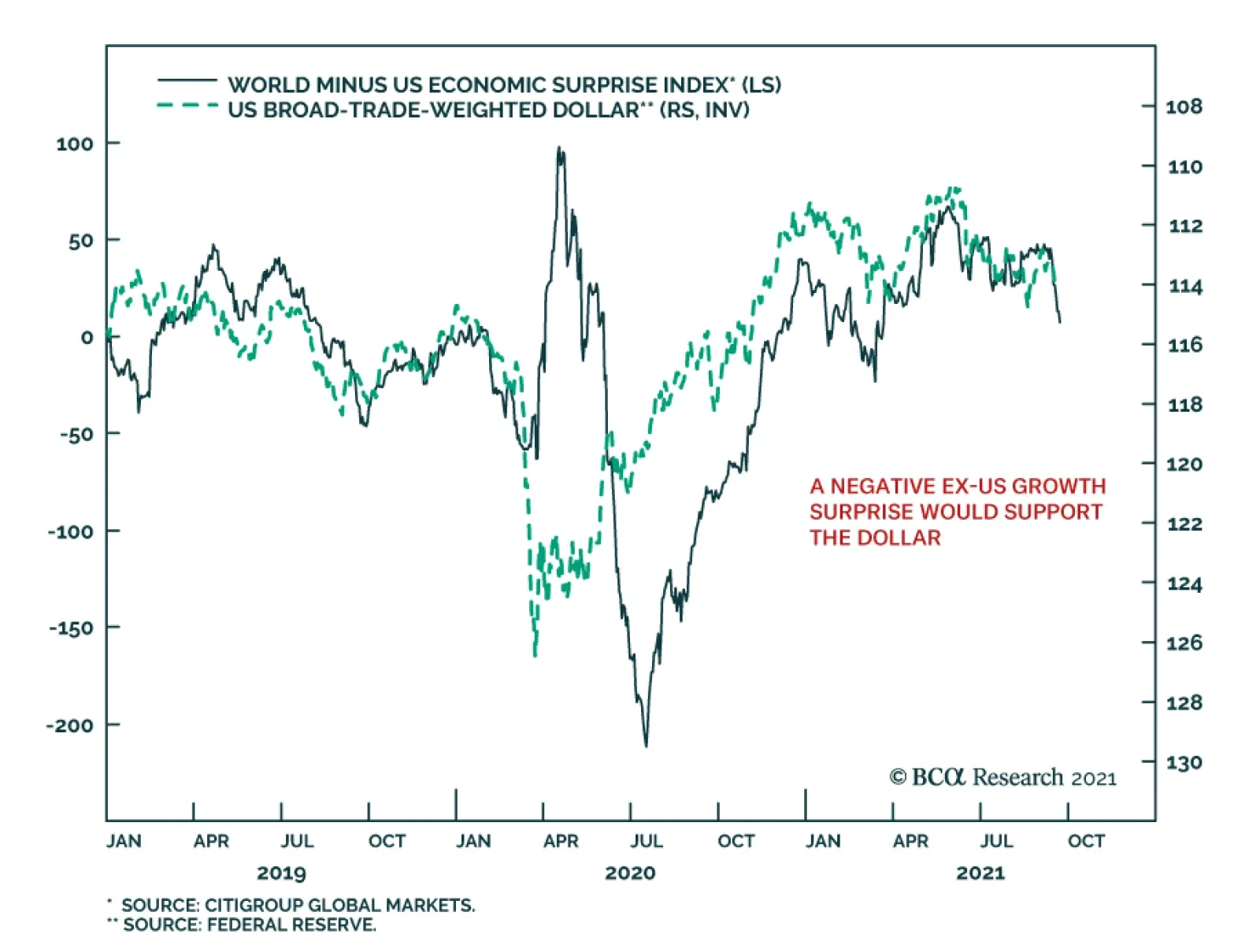

Although the US dollar has appreciated this year, our foreign exchange strategists highlight that from a big picture perspective, dynamics remain tilted against the dollar. True, the DXY is off its May low of 89.6. However, it…

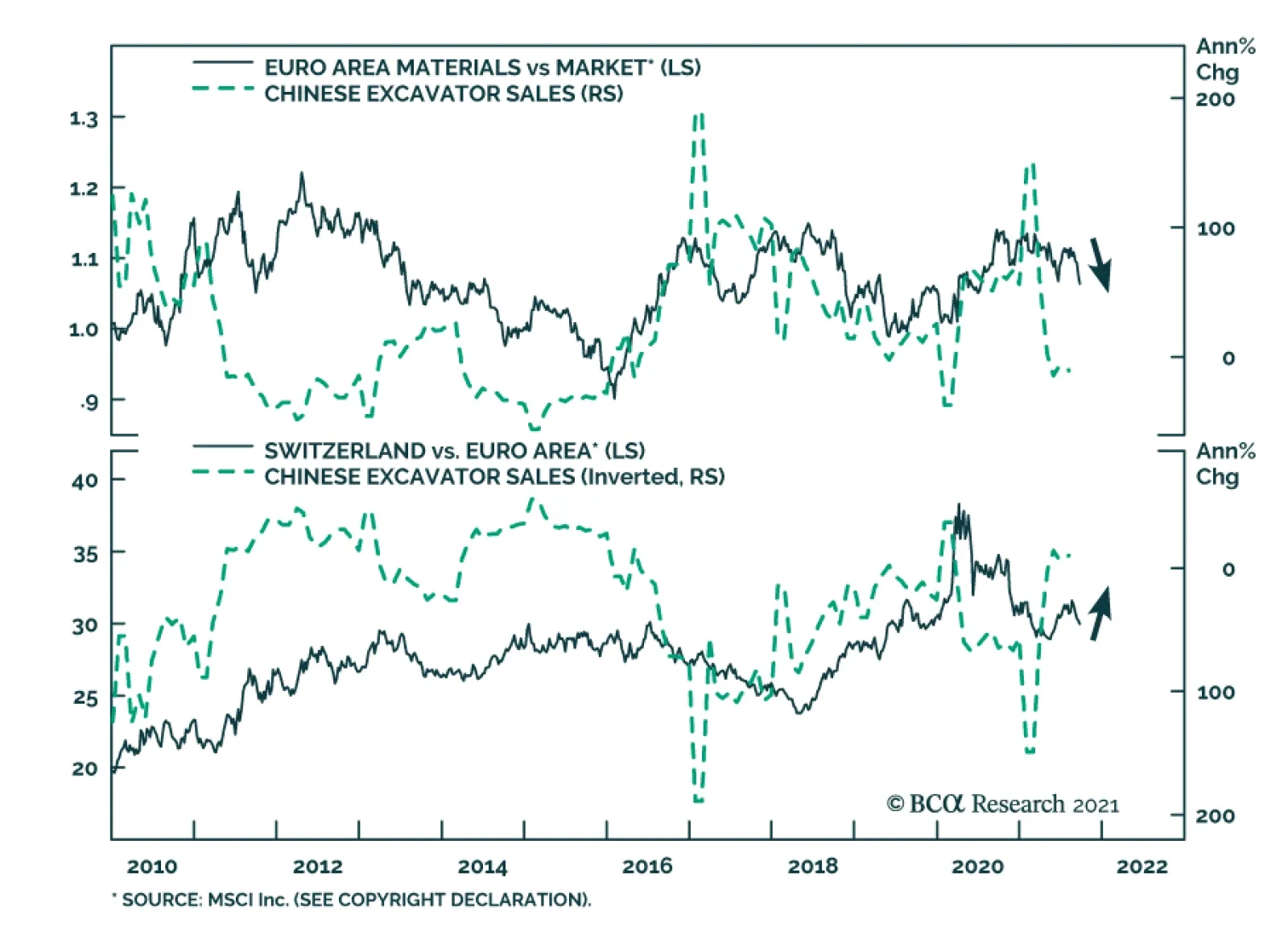

According to BCA Research’s European Investment Strategy service, the tactical environment is dangerous for European cyclicals in general, and materials in particular. The fallout from Evergrande’s problem will extend to the…

Highlights Economy – We find the leading arguments for why households’ excess savings won’t be spent to be wanting: US households do not commonly demonstrate the detached foresight that Ricardian equivalence takes as…

Highlights The Evergrande crisis is not China’s Lehman moment. Nonetheless, Chinese construction activity will decelerate further in response to this shock. Global equities are frothy enough that a weaker-than-expected Chinese…

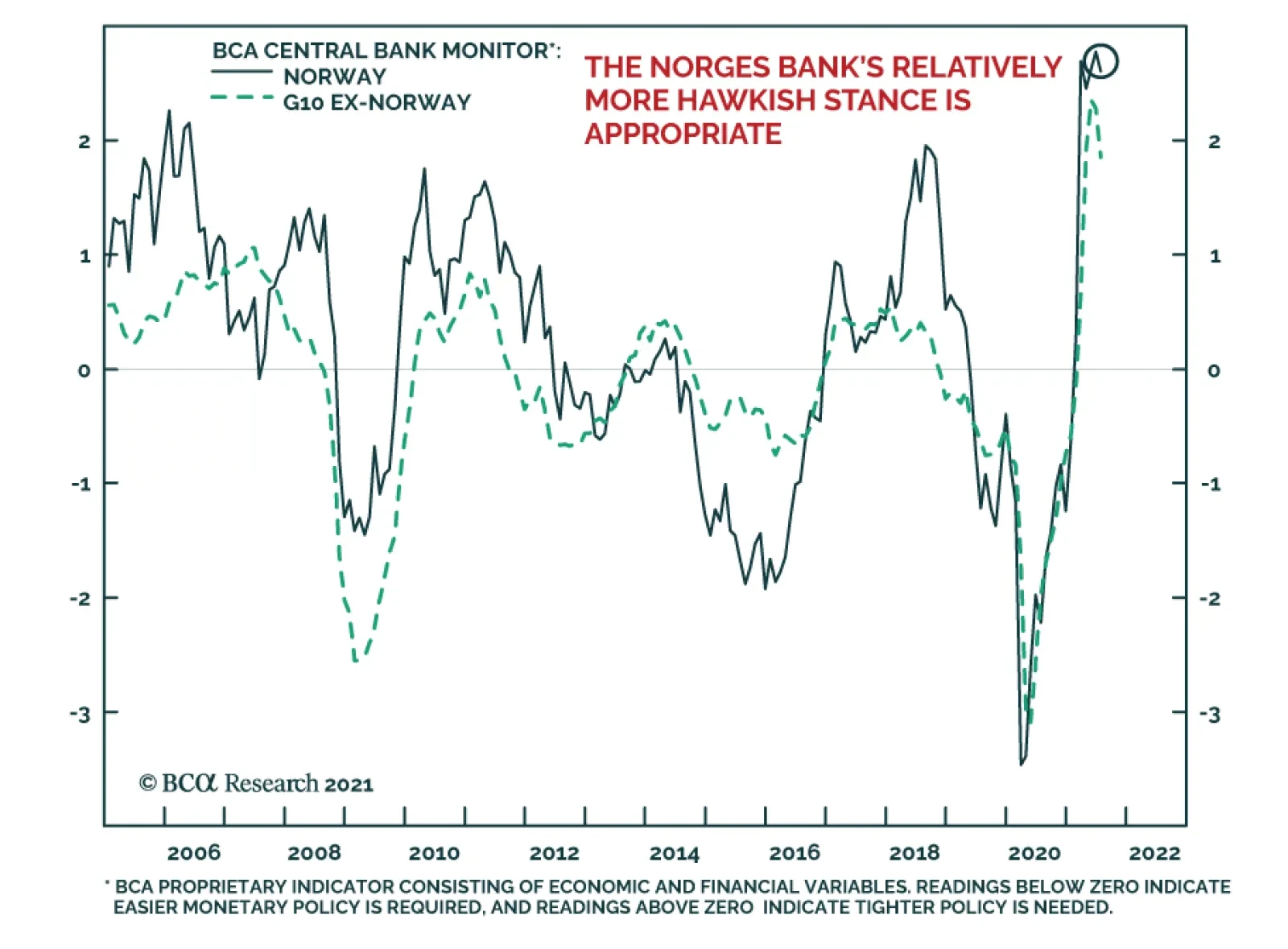

As expected, the Norges Bank delivered its first rate hike on Thursday, bringing its benchmark policy rate to 0.25%. It is the first developed market central bank to raise rates in the post-COVID-19 crisis period. The central…