Dear Client, We are sending you our Strategy Outlook today, where we outline our thoughts on the macro landscape and the direction of financial markets for the rest of 2021 and beyond. Next week, please join me for a webcast on…

Highlights Recommended Allocation The global economy will continue to grow at an above-trend rate over the next 12 months and central banks will remove accommodation only slowly.But the second year of a bull market is often…

Highlights The fourth quarter will be volatile as China still poses a risk of overtightening policy and undermining the global recovery. US political risks are also elevated. A debt default is likely to be averted in the end. Fiscal…

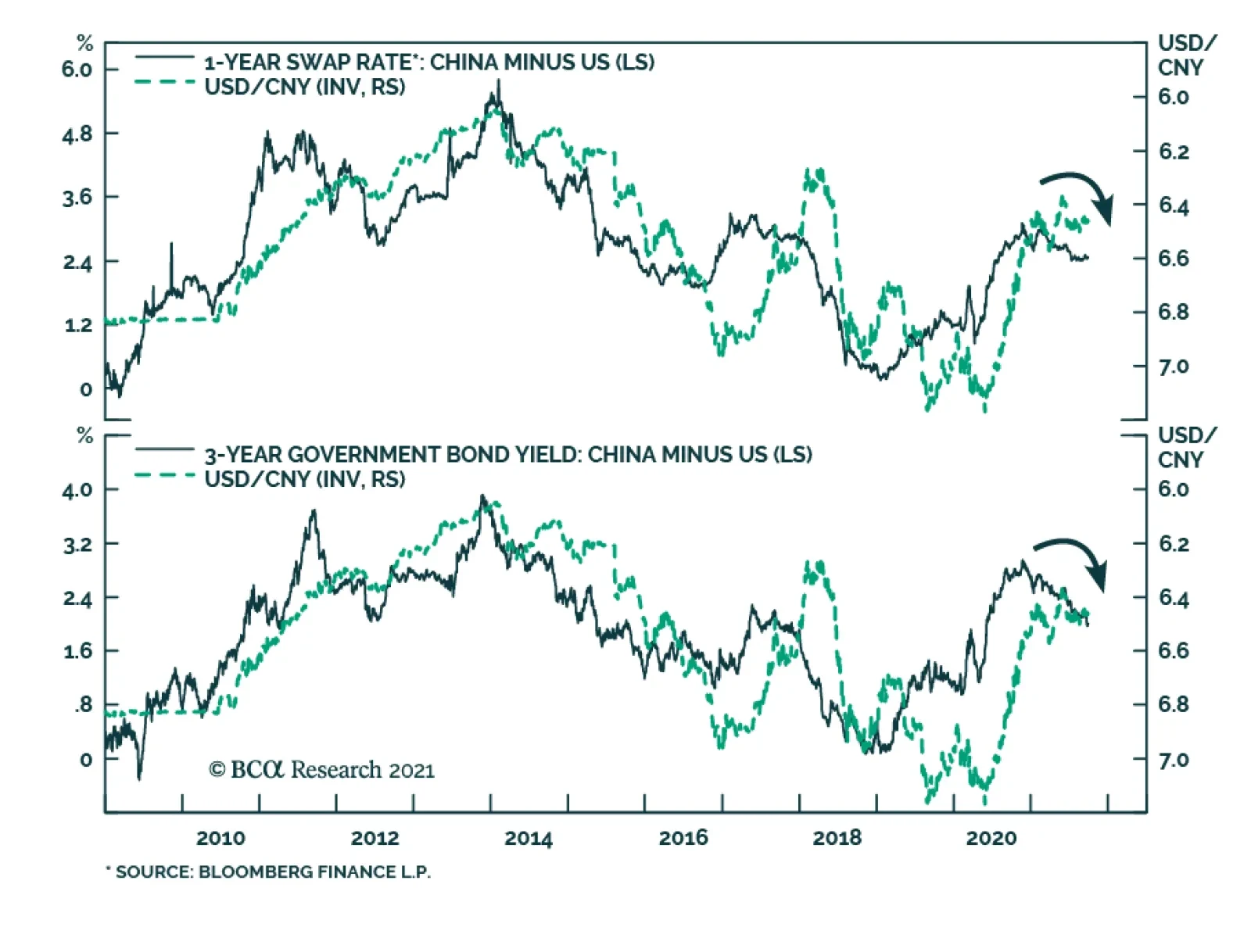

The performance of USD/CNY can often be explained by relative rates. The widening of the China-US yield differential in the second half of last year coincided with a sharp appreciation in the CNY vis-à-vis the USD. However, this…

Japanese stocks have recently been one of the best performing global equity markets. MSCI Japan gained 2% in September, while the US and All Country World Indices each fell more than 4%. The outperformance reflects domestic…

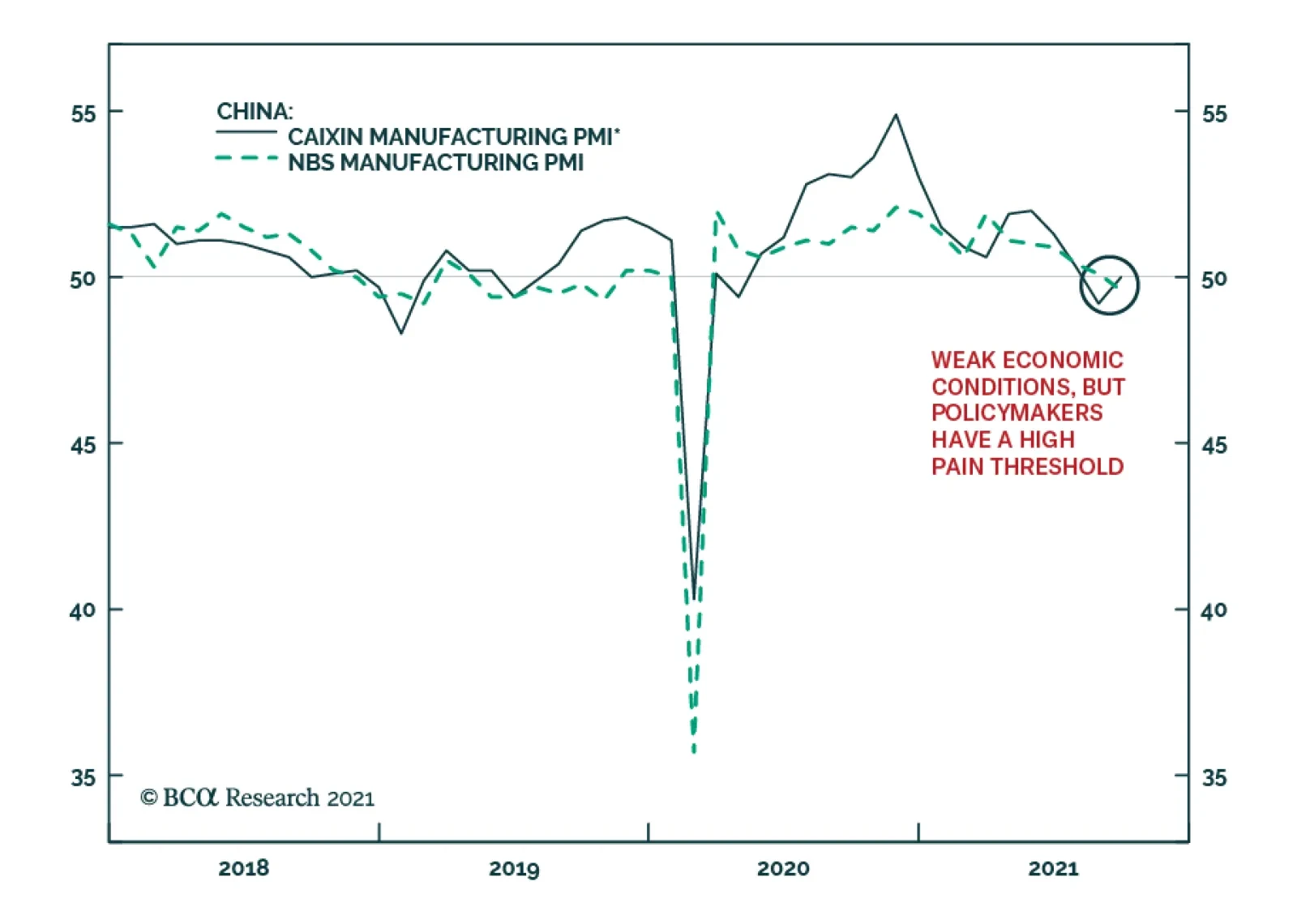

China’s NBS and Caixin Manufacturing PMIs sent a contradictory signal for September. The official manufacturing index slipped into contractionary territory after declining 0.5 points to 49.6. Consensus estimates anticipated a…

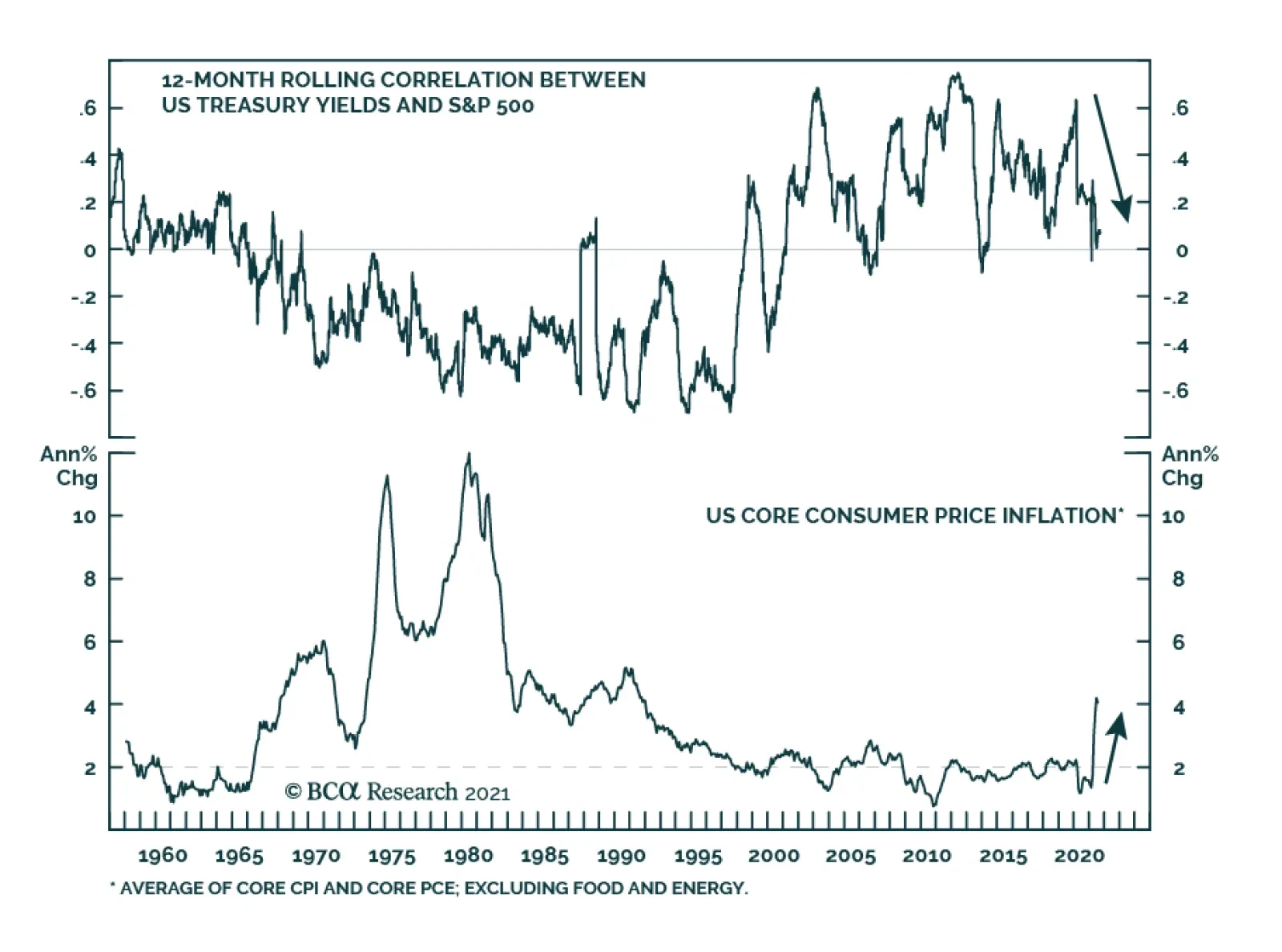

Highlights The current burst of inflation in developed economies is due to a (negative) supply shock rather than a (positive) demand shock. Consumer complaints of “poor buying conditions” mean that higher prices will cause…

BCA Research’s Global Fixed Income Strategy service recommends investors underweight government bonds where markets are discounting a path for future policy rates over the next two years that is too flat: the US, UK, Canada…

The decline in US government bond yields between April and August was largely put down to oversold conditions in the Treasury market and concerns amid signs that economic growth is moderating in the US. The stock market…

Highlights Monetary Policy: Last week’s numerous central bank meetings across the world confirmed that the overall direction for global monetary policy is shifting in a more hawkish direction. The main reason: growing fears that…