Highlights Cross-Atlantic Policy Divergence: A steadily tightening US labor market means that the Fed remains on track to formally announce tapering next month. Meanwhile, the ECB is signaling that they are in no hurry to do the same…

Highlights Spread Product: Investors should stay overweight spread product versus Treasuries for now (with a preference for high-yield corporates over investment grade). But recent shifts in the yield/spread correlation suggest that…

Highlights Gold prices will continue to be challenged by conflicting information flows regarding US monetary policy; higher inflationary impulses from commodity prices and supply-chain bottlenecks; global economic policy uncertainty,…

Highlights Equity valuations are extremely stretched versus bonds, so there is little wiggle room for bonds to sell off before pulling down large tracts of the stock market. We estimate that bond yields can rise by no more than 30 bps…

Highlights Q3/2021 Performance Breakdown: Our recommended model bond portfolio outperformed the custom benchmark index by +8bps during the third quarter of the year. Winners & Losers: The government bond side of the portfolio…

Highlights Chart 1Bond Yields Still Track The "Re-Opening" Trade Bond yields rose notably in September, with the bulk of the move coming in the days after the Fed teased an upcoming tapering of its…

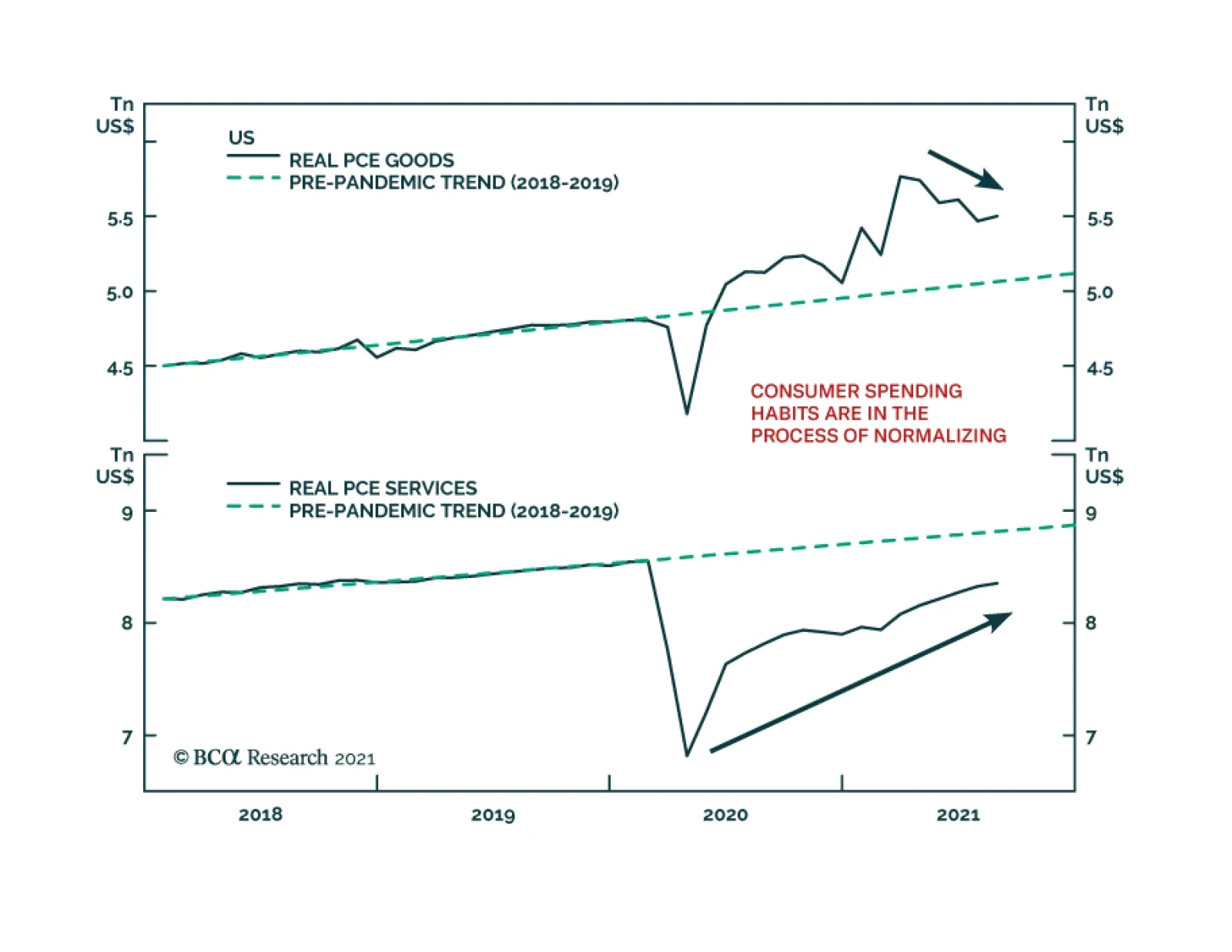

The August US Personal Income and Outlays report was broadly in line with expectations. Personal income rose 0.2% m/m following the prior month’s 1.1% m/m increase. Meanwhile, real personal spending grew 0.4% m/m after a…

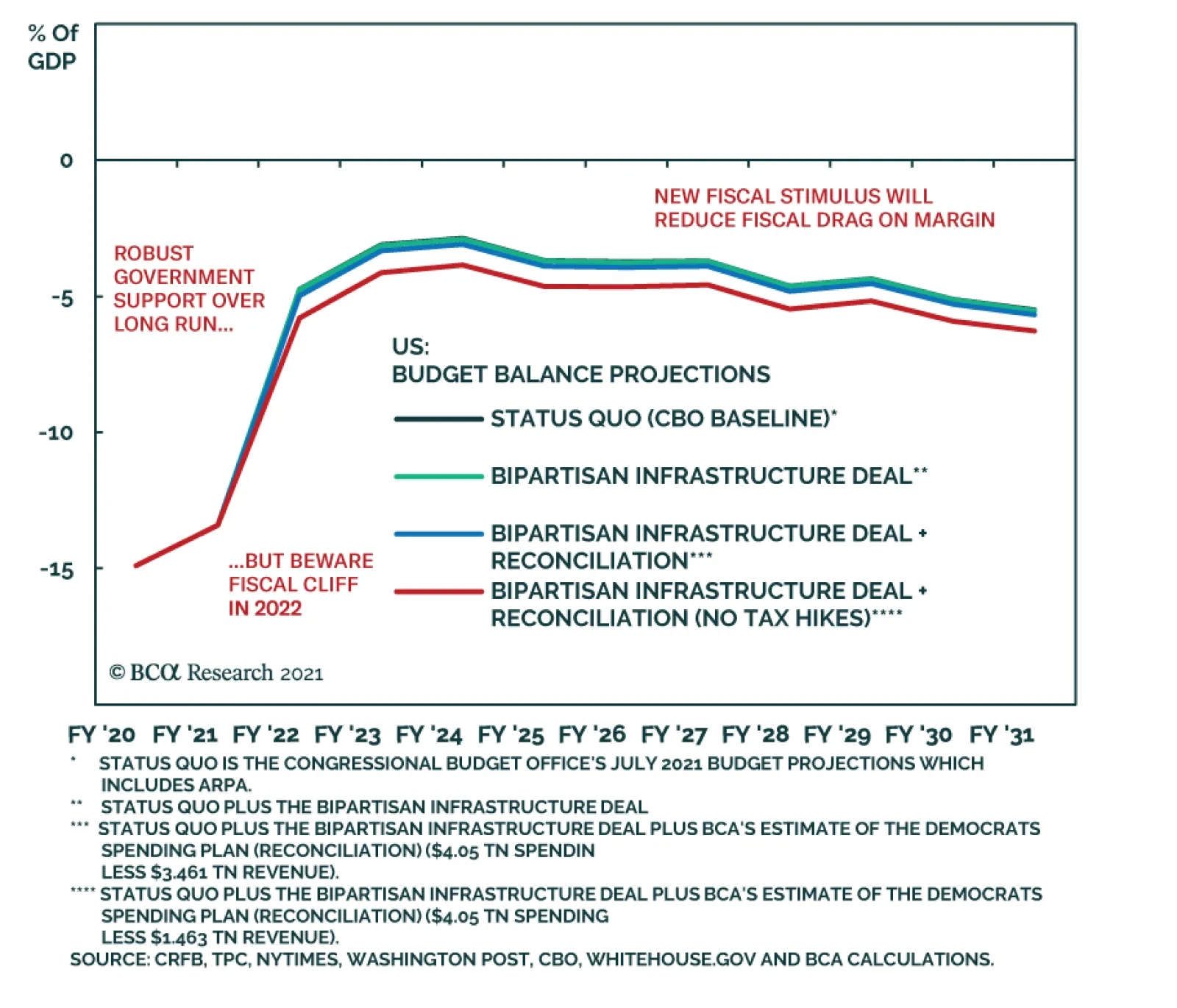

According to BCA Research’s Geopolitical Strategy service fiscal drag is probably overstated as governments are likely to increase deficit spending on the margin. US Congress is likely to pass Biden’s $550 billion bipartisan…