Highlights The market pricing of the ECB is too aggressive. More so than in the US, temporary factors explain the European inflation surge. Energy, taxes, and base effects account for the bulk of the price increases. In contrast to…

Highlights Short-term inflation risk will escalate further if politics causes new supply disruptions. Long-term inflation risk is significant as well. There is a distinct risk of a geopolitical crisis in the Middle East that would…

Highlights Major cryptocurrencies have failed to break above important technical levels. Meanwhile, the appeal of fiat money is increasing as many central banks are reining in monetary stimulus. Cryptocurrencies continue to seriously…

Highlights Increasing consumption should be a lot easier than increasing savings. After all, most people like to spend! It is getting them to work that should be challenging. Yet, the conventional wisdom is that deflation is a much…

Highlights The 26th Conference of the Parties (COP26) will open this weekend in Glasgow, Scotland, amid a global crisis induced in no small measure by policies and regulations that led to energy-market failures. Price-distorting…

In lieu of next week’s report, I will be presenting the quarterly Counterpoint webcast titled ‘Where Is The Groupthink Wrong? (Part 2)’. I do hope you can join. Highlights If a continued surge in the oil price…

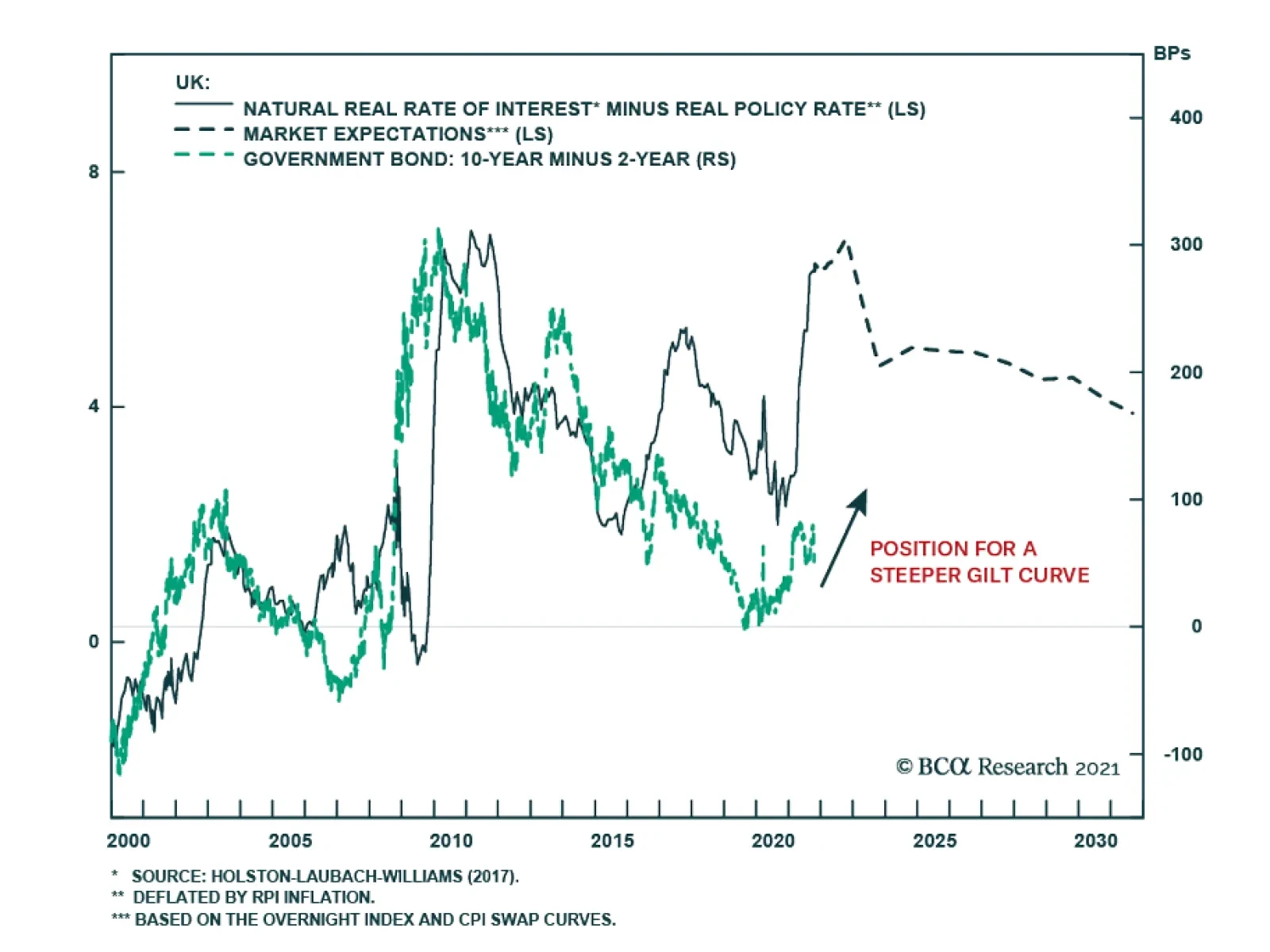

UK 10-year government bond yield fell by 12.8 bps on Wednesday, leading the rally in global long-dated sovereign bonds. The proximate cause of the decline in long-dated Gilt yields is the release of the UK budget which revealed…

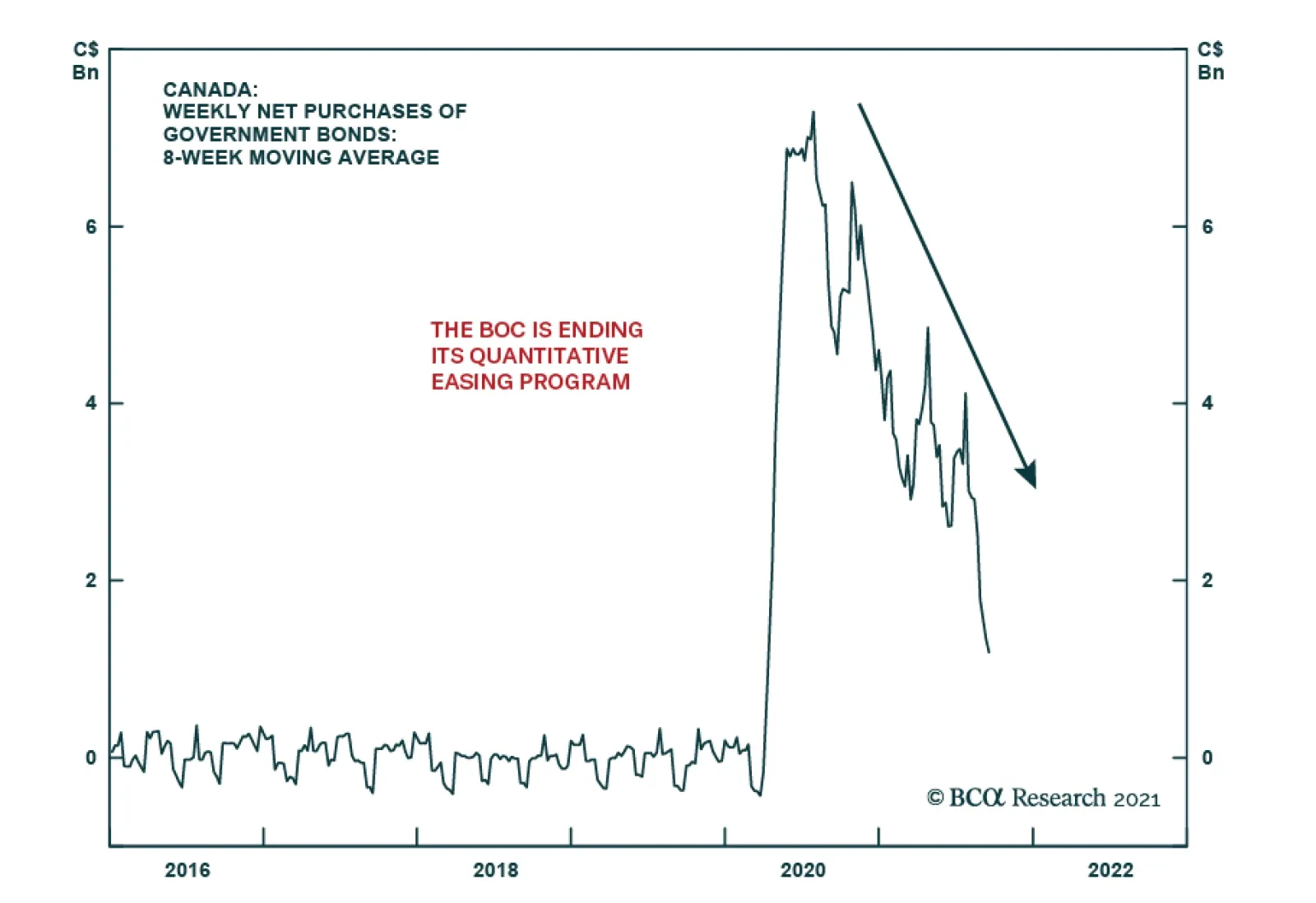

The Bank of Canada delivered a hawkish surprise on Wednesday. It announced the end of its quantitative easing program. Instead it is shifting to the reinvestment phase whereby it will only purchase bonds to replace maturing ones…

Highlights Democrats are backing off from corporate tax hikes, a positive surprise for the earnings outlook. However, the reconciliation bill will be even more stimulating than expected at a time when the output gap is closed. Short-…