Highlights Fed/BoE: Both the Fed and the Bank of England found ways to talk down 2022 rate hike expectations discounted in US and UK bond markets. This is only a temporary reprieve, however, as the near-term uncertainties over the…

Highlights Fed: Chair Powell’s remarks after the November FOMC meeting suggest that the Fed will not panic and move quickly toward tightening in the face of high inflation. Rather, the Fed will stay the course and will only lift…

Highlights Supply-side pressures should abate over the coming months as semiconductor availability improves, transportation bottlenecks ease, energy prices recede, and more workers enter the labor force. The respite from inflation…

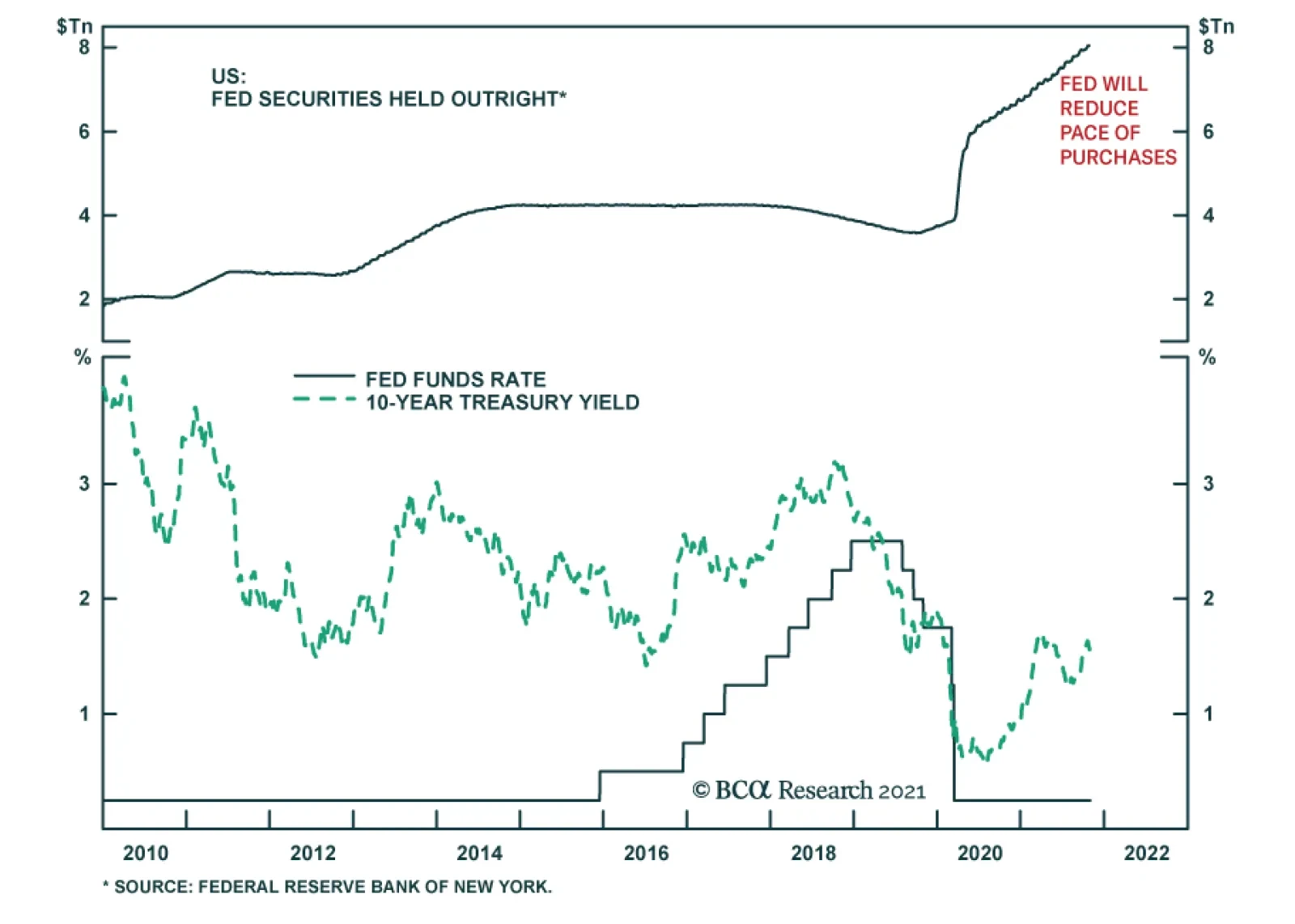

As expected, the Fed announced that beginning later this month, it will start reducing the monthly pace of its asset purchases by $10 billion for Treasury securities and by $5 billion for agency mortgage-backed securities in…

Highlights Duration & Country Allocation: Global bond yields have been driven by growth and inflation expectations over the past year, but shifting policy expectations are now the more important driver. Tighter monetary policies…

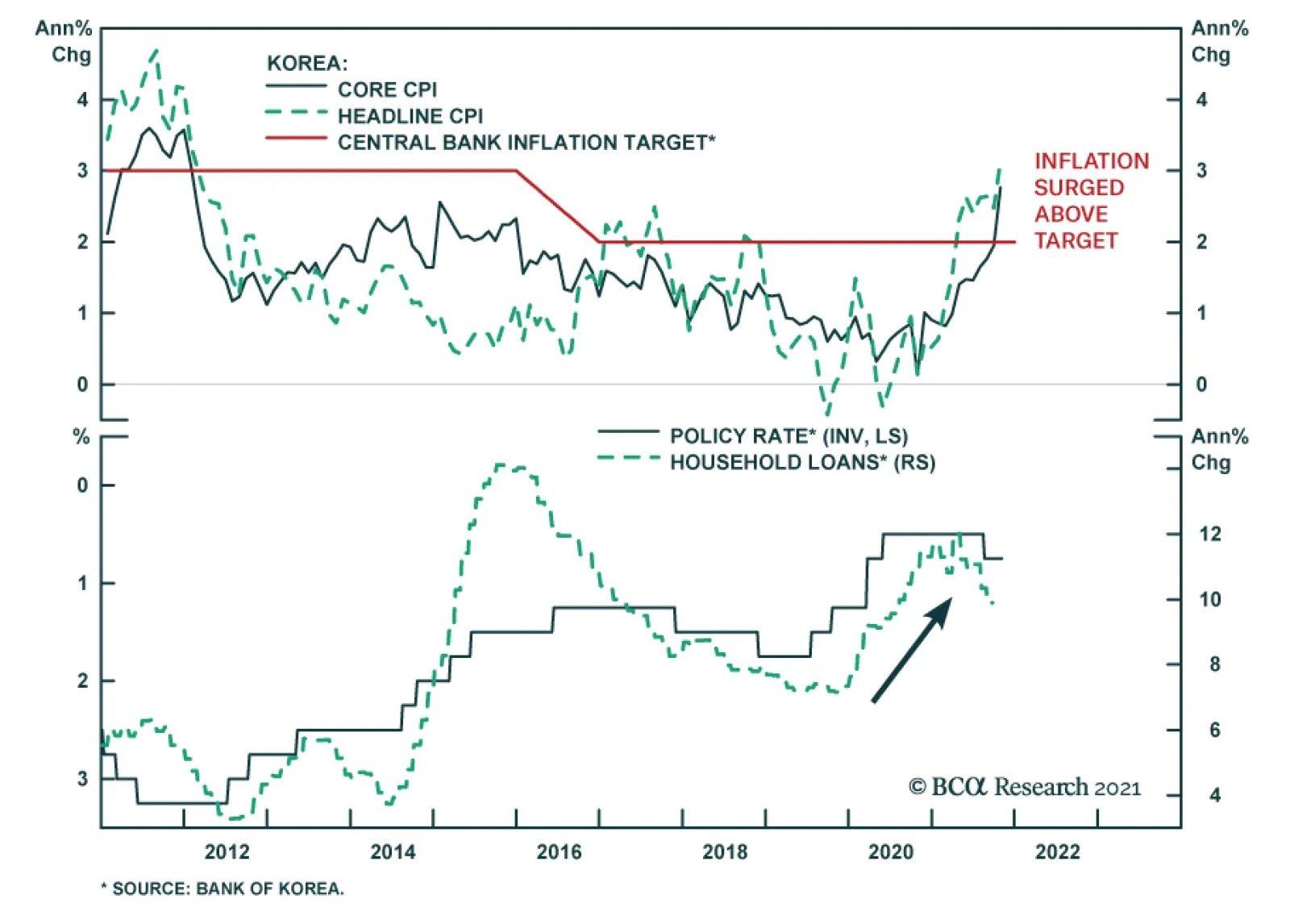

Korean CPI inflation surged in October. The headline figure accelerated to 3.2% y/y from 2.5% – the fastest annual pace of increase since January 2012. Similarly, the core measure jumped to 2.8% y/y from 1.9%. These…

Highlights Chart 1Buy The 2-Year, Sell The 10-Year Treasury yields have been volatile of late, but the biggest move has been a flattening of the yield curve led by a sell-off at the front-end. Our recommended yield curve…

The markets were deluged by a lot of information in late October. Several central banks made surprise moves towards tightening (the Bank of Canada, for example, ended asset purchases, and the Reserve Bank of Australia…