Highlights Remain neutral on the US dollar. A breakout of the dollar would cause a shift in strategy. Russia’s conflict with the West is heating up now that Germany has delayed the certification of the Nord Stream II pipeline.…

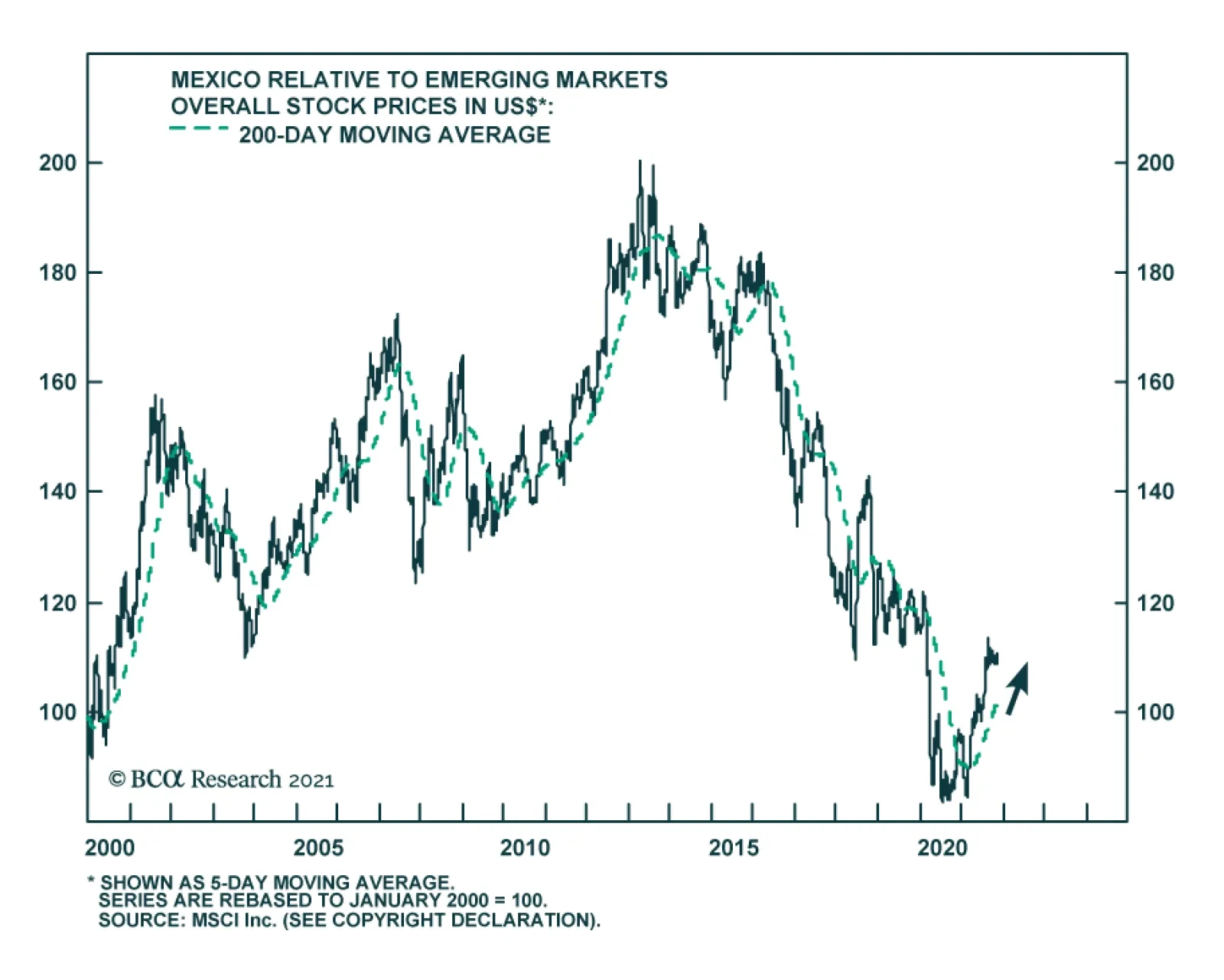

The Bank of Mexico raised rates by 25 bps on Thursday, marking the fourth consecutive rate increase this year and bringing the benchmark rate to 5%. These hikes come as the central bank attempts to temper rising inflation. At 6.…

Highlights US growth will slow next year, not because demand will falter, but because supply-side constraints will prevent the economy from producing as much output as households and businesses want to buy. If aggregate demand…

Highlights Geopolitical conflicts point to energy price spikes and could add to inflation surprises in the near term. However, US fiscal drag and China’s economic slowdown are both disinflationary risks to be aware of. …

Dear client, This week, we are introducing our new “Currency Month-In-Review” report. The new format should dovetail nicely with the historical back sections you have become accustomed to, but with a more holistic approach to…

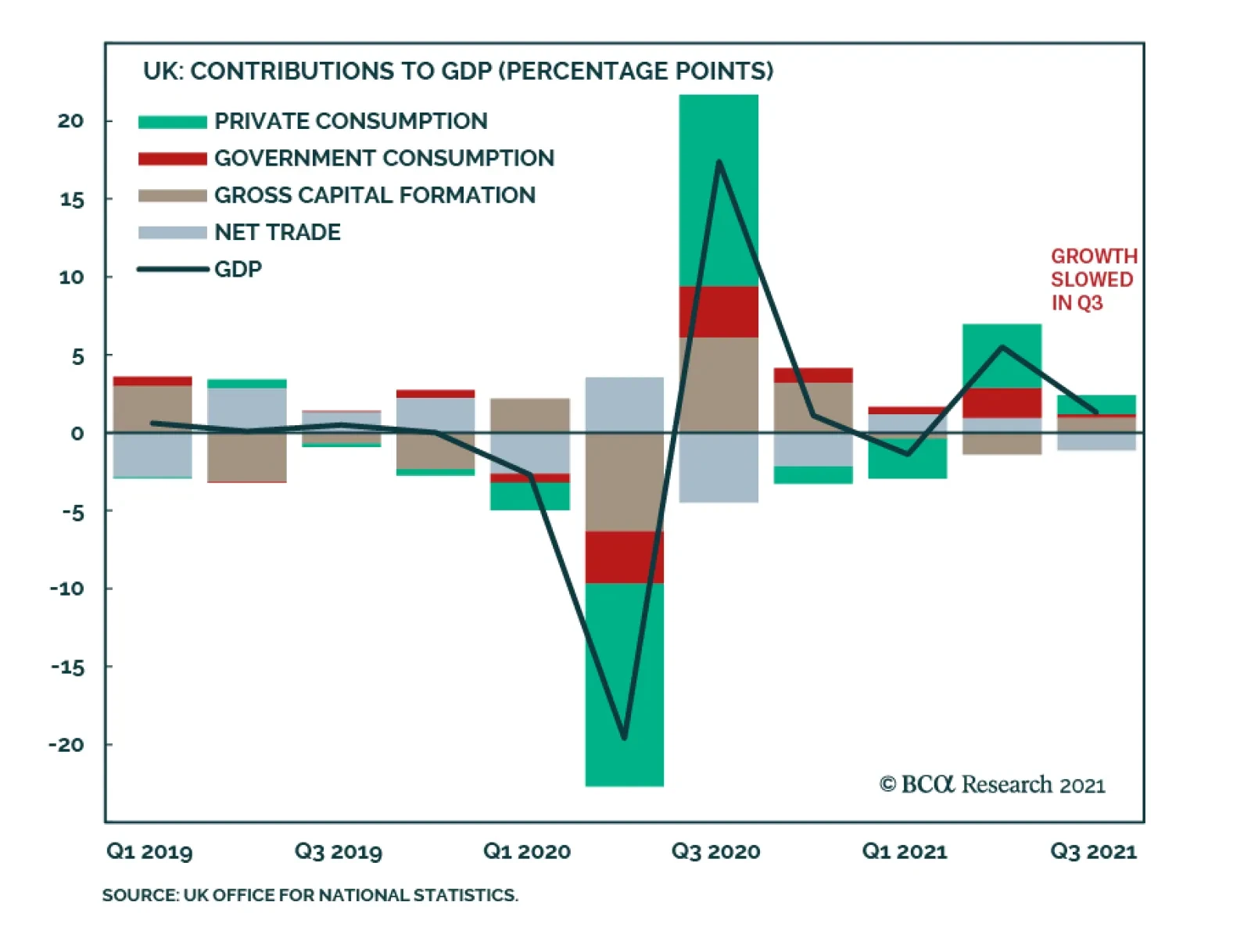

The UK economy decelerated in Q3 with the GDP print falling below expectations. Economic growth slowed from 5.5% to 1.3% q/q versus an anticipated 1.5% rate. Similarly, year-over-year growth moderated to 6.6% from 23.6%. However…

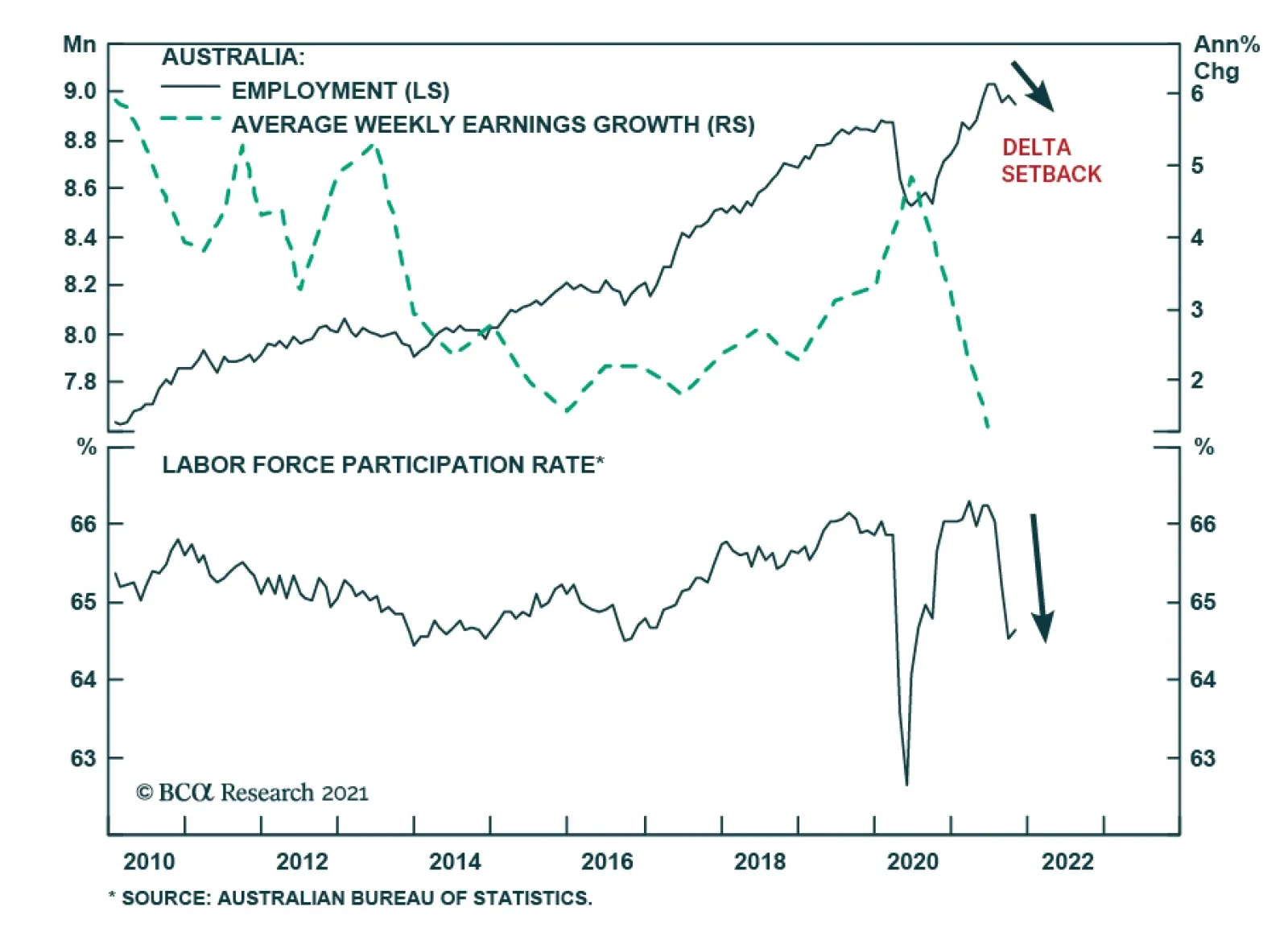

Rising inflationary pressures are seeping into Aussie inflation expectations which according to the Melbourne Institute reached 4.6% in November. Nevertheless, the RBA pushed back against market rate hike expectations at last…

Highlights There is a high risk of a global demand shortfall in 2022. This is because consumer demand for services will remain well below its pre-pandemic trend… …while the recent booming demand for goods is crashing…

Highlights The bipartisan Infrastructure Investment and Jobs Act will increase US government non-defense spending to around 3% of GDP, a level comparable to the 1980s-90s and larger than the 2010s. Democrats are…