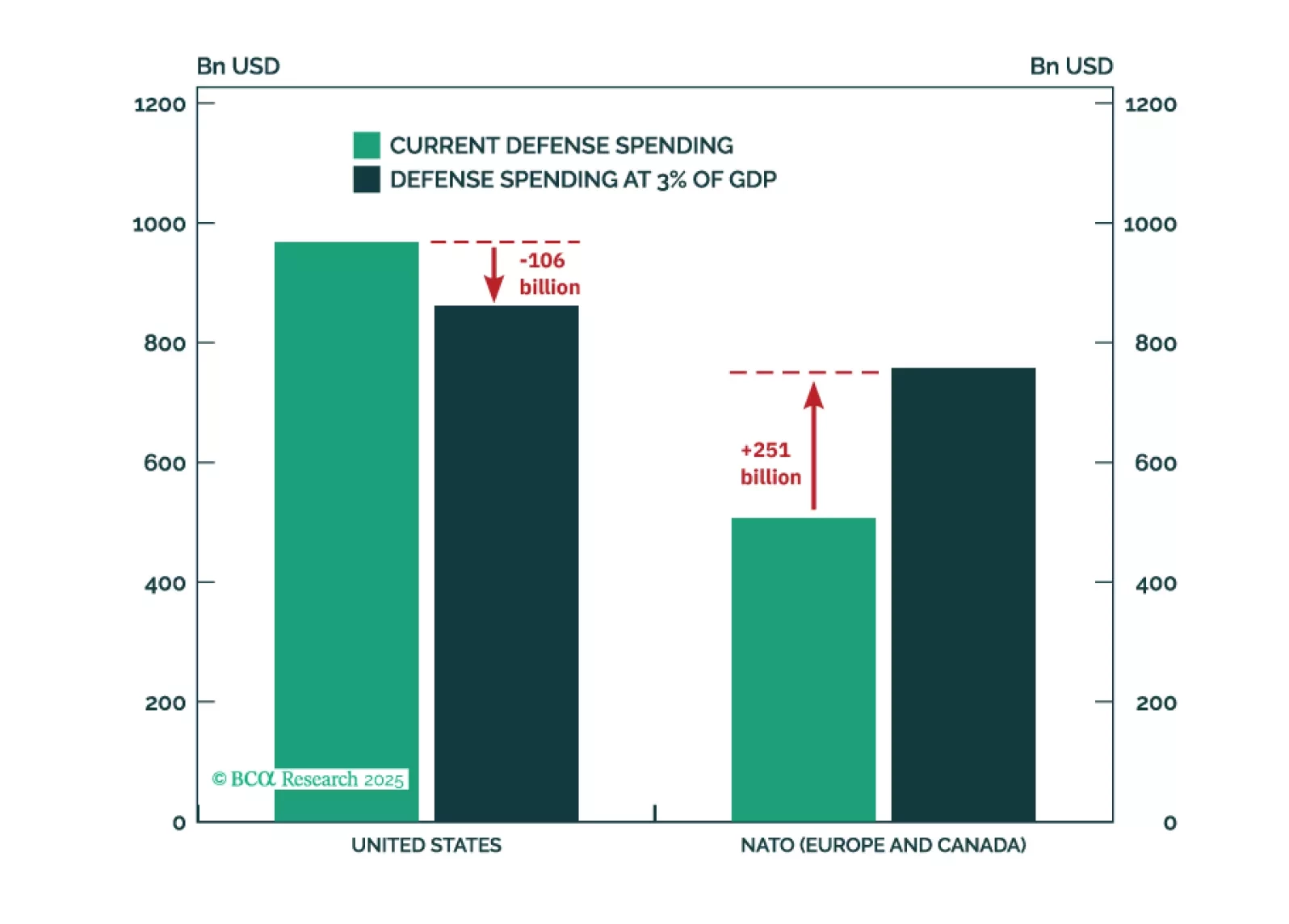

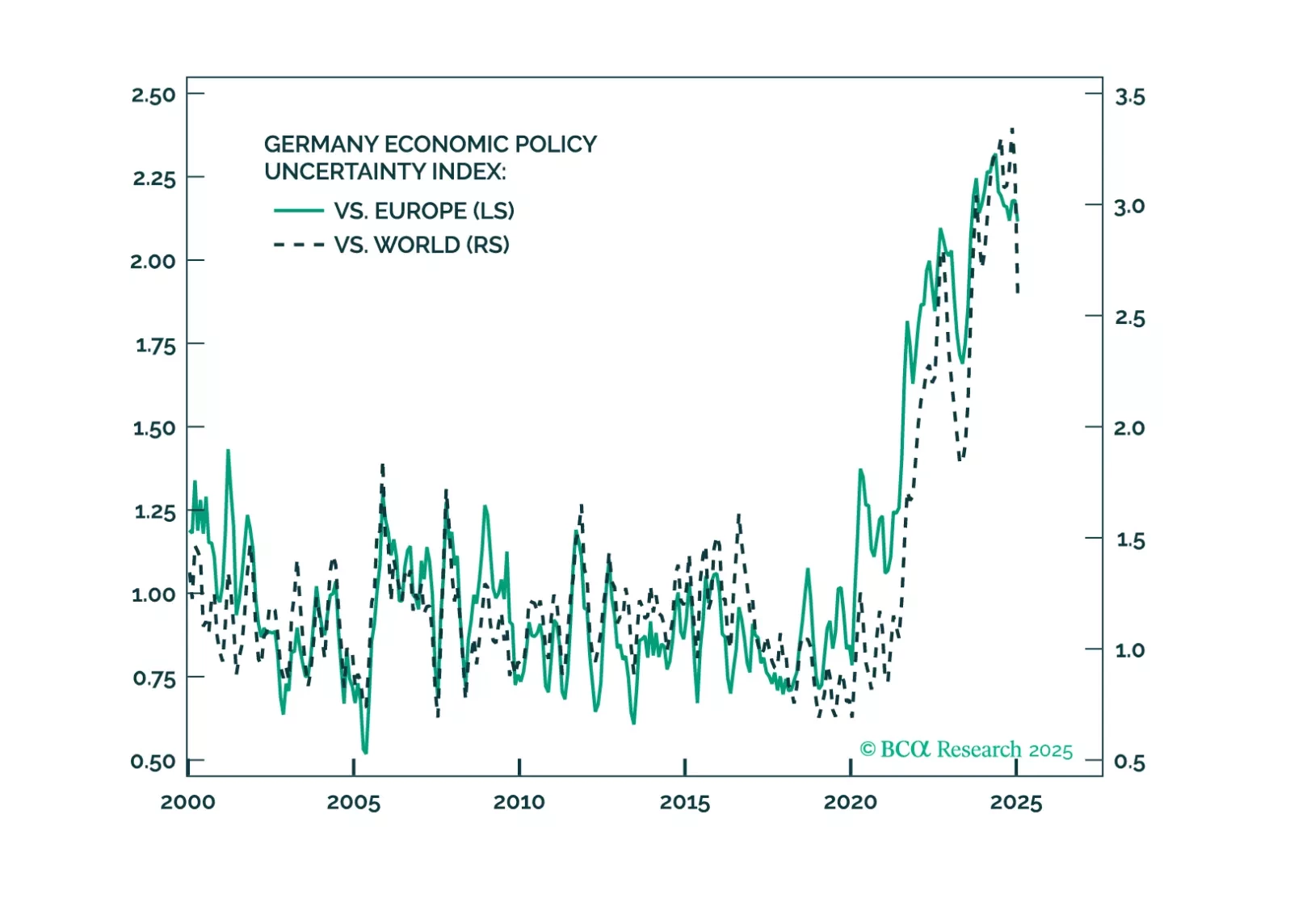

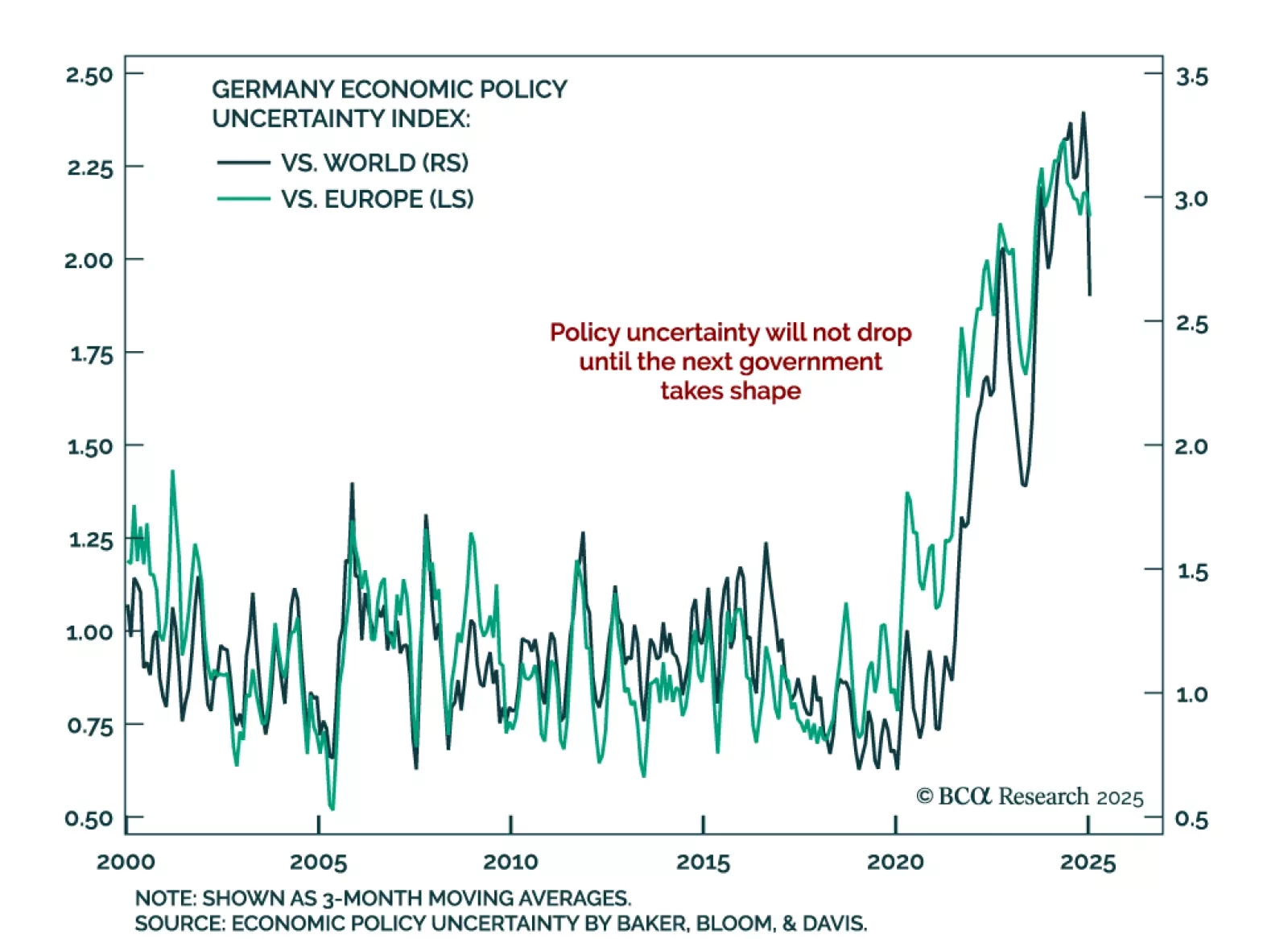

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

This week’s report discusses the questions we were asked most frequently when we met with investors in the Midwest two weeks ago. We reiterate our pessimistic fundamental take and our neutral asset allocation recommendations.

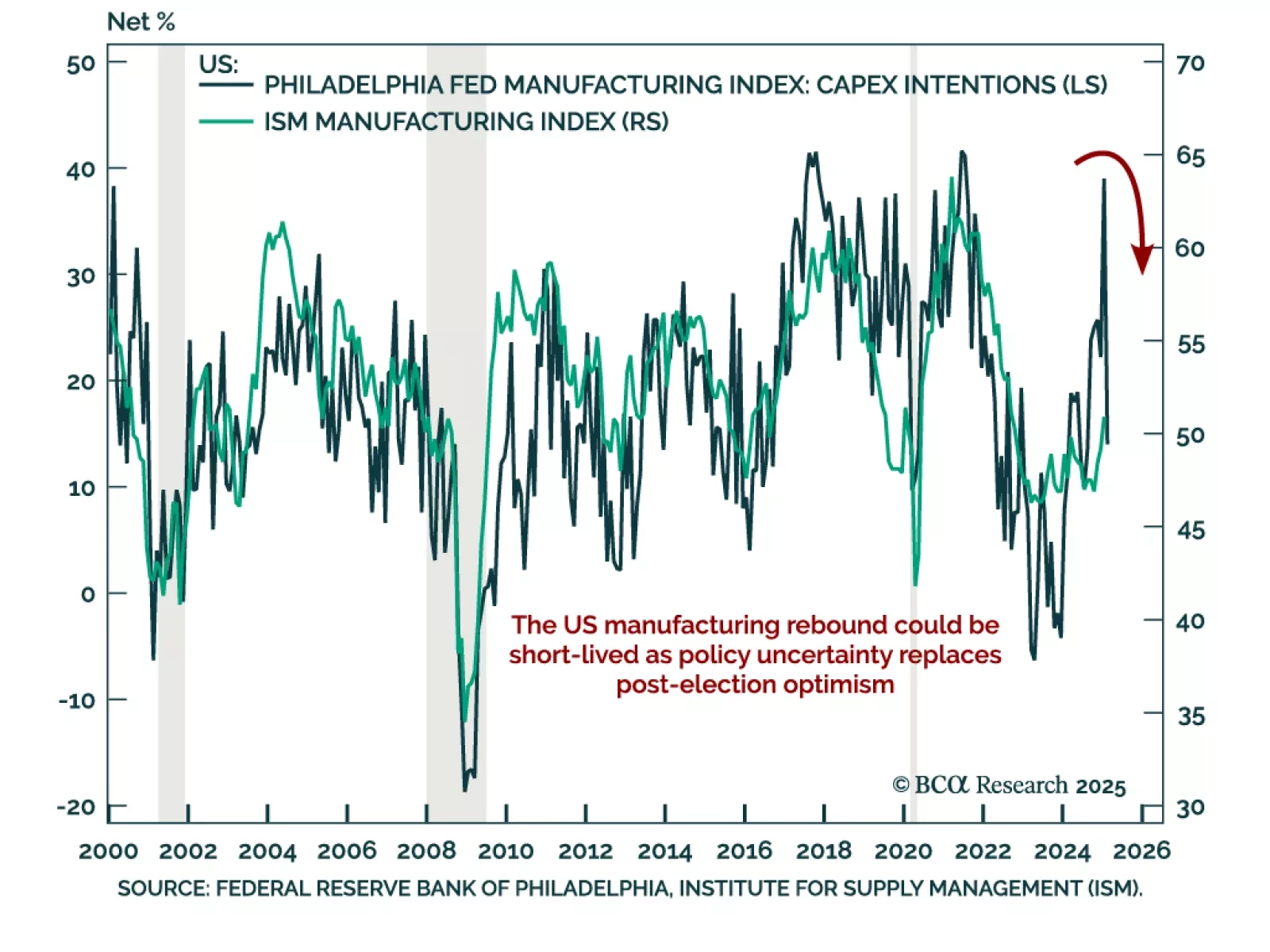

The February Philadelphia Fed Manufacturing index beat expectations, but retreated to 18.1 from last month’s lofty 44.3 reading. All activity subcomponents pulled back, except for delivery times. The Philly Fed index is volatile…

Our Geopolitical Strategy team reviewed possible outcomes for Sunday's German election as the far-right is playing an expanding role in mainstream German politics. German voters have shifted to the right, weakening the ruling…

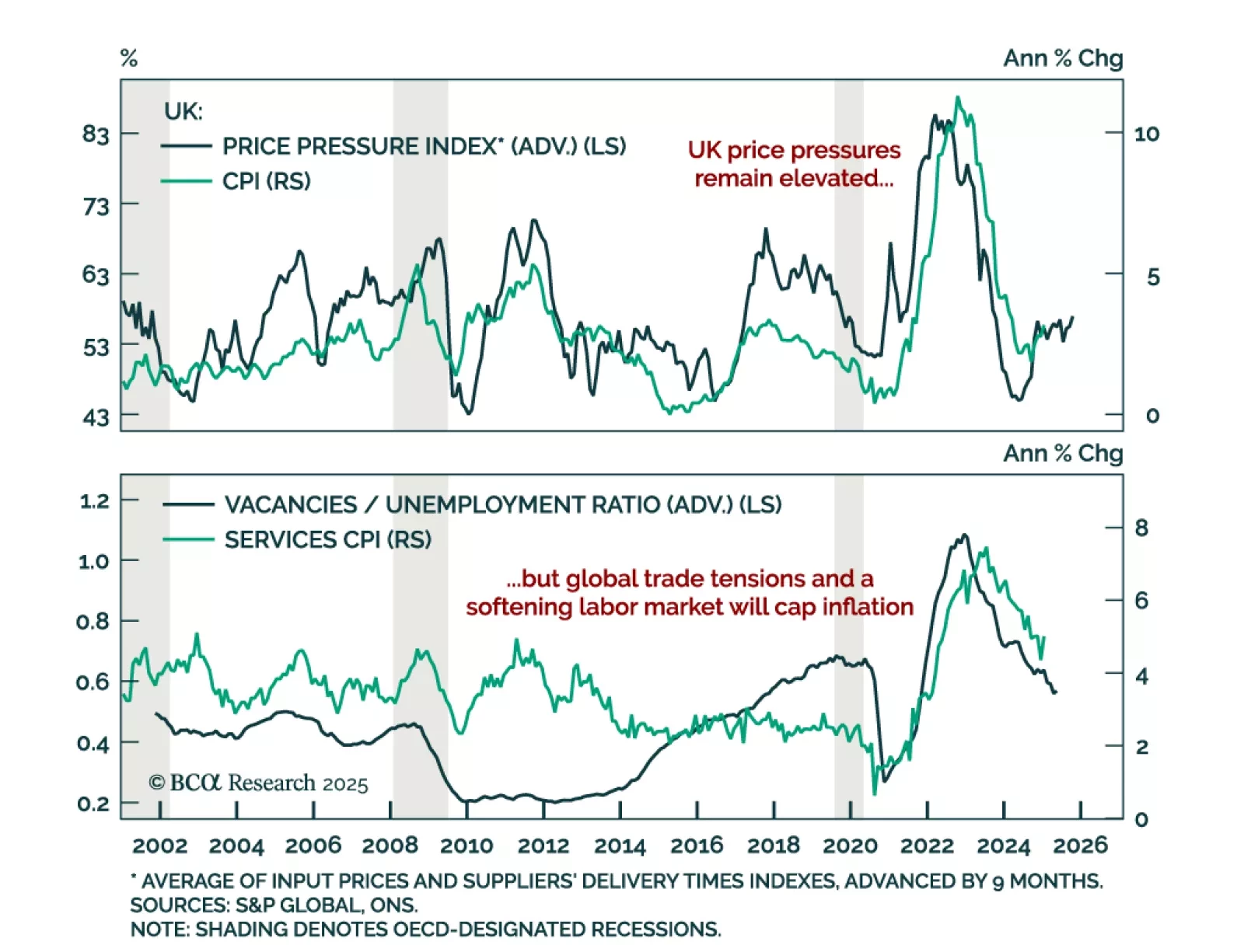

The January UK CPI was slightly hotter than expected. Headline inflation beat estimates, rising to 3.0% y/y from 2.5% in December. Core inflation also jumped but was in line with expectations at 3.7%. Services were strong, albeit…

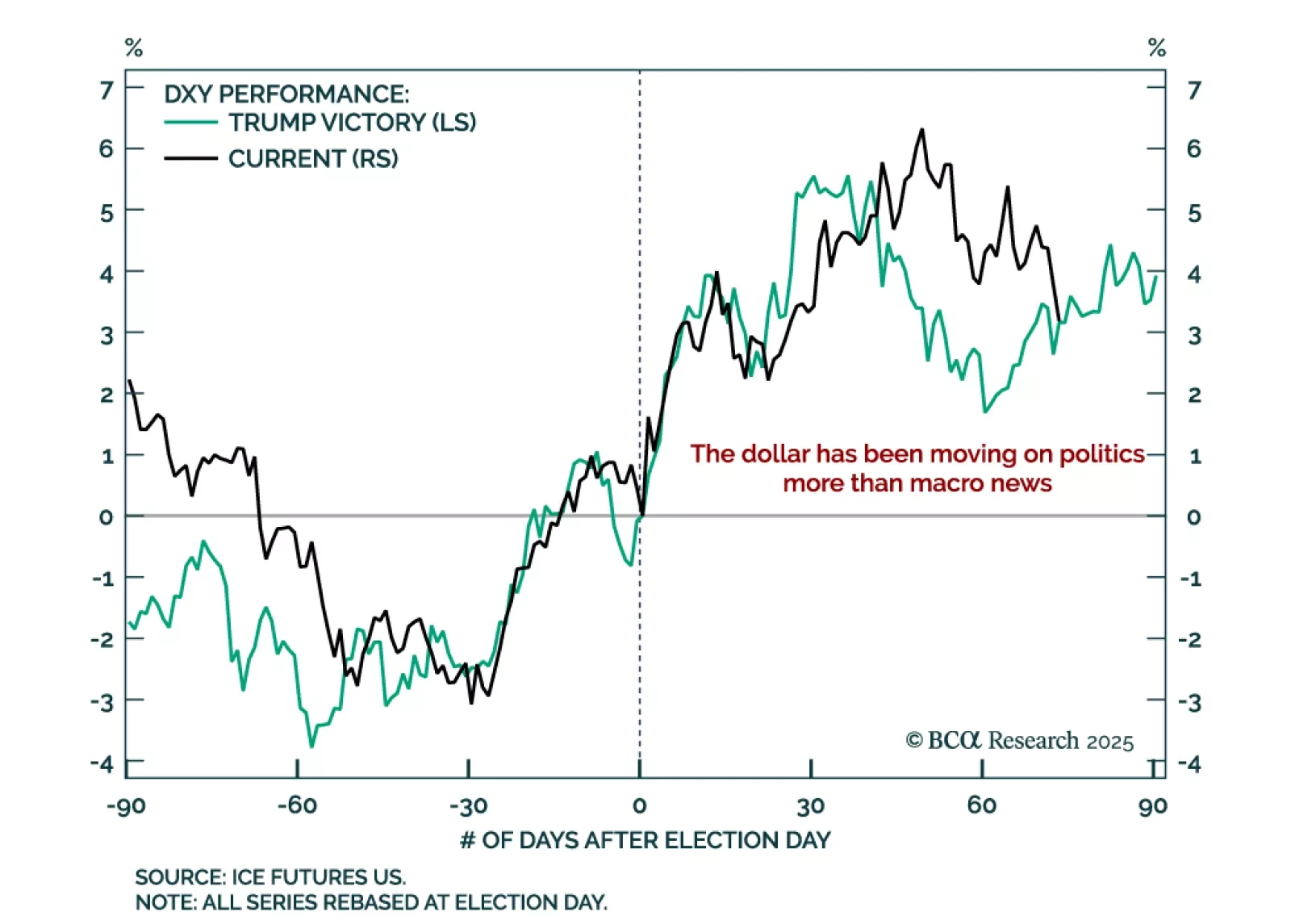

Our Foreign Exchange strategists reviewed the rationale to their short US dollar position as the DXY has been in a trading range with resistance near 110 and support around 100. The widening US budget deficit caps the dollar’s…

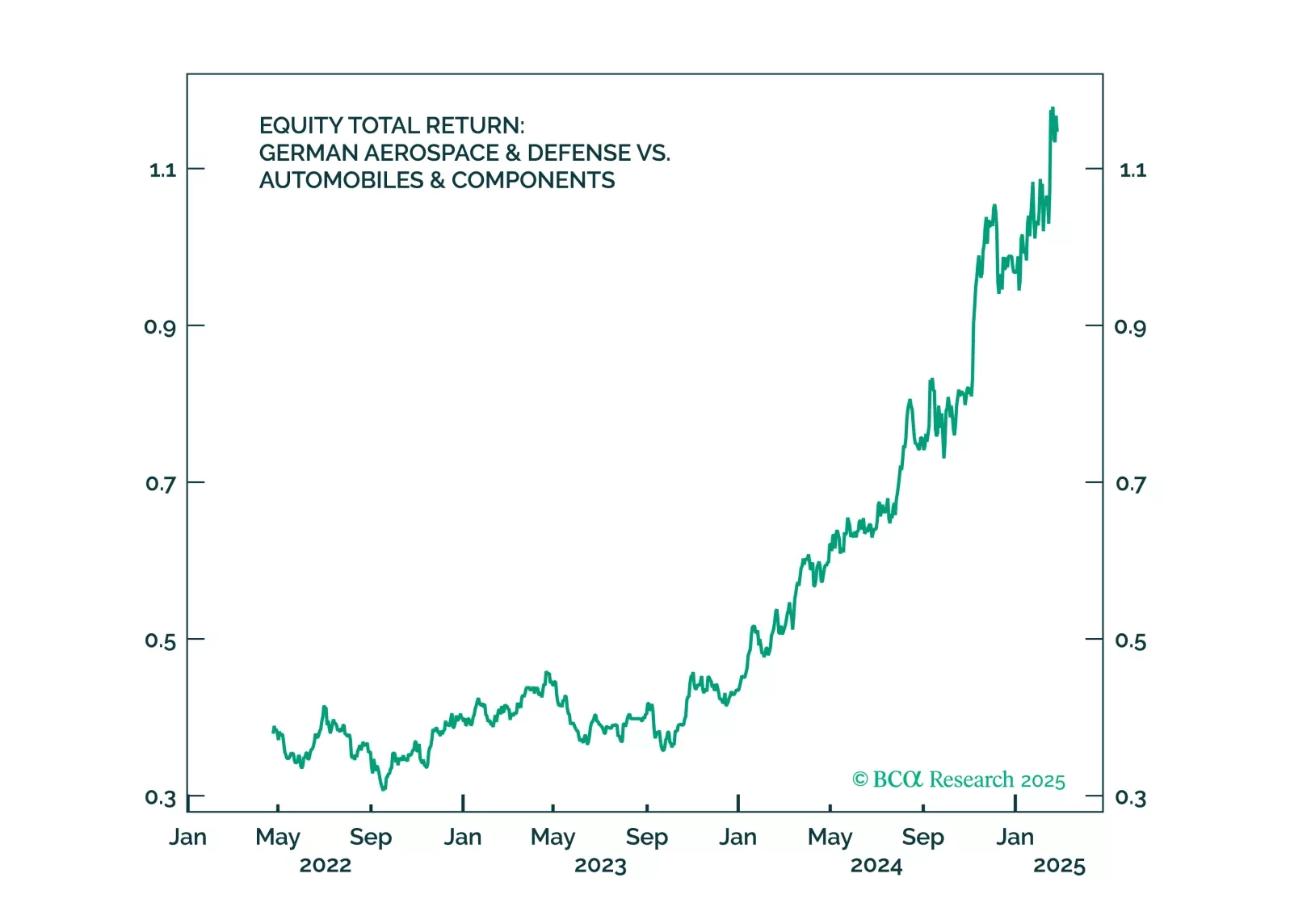

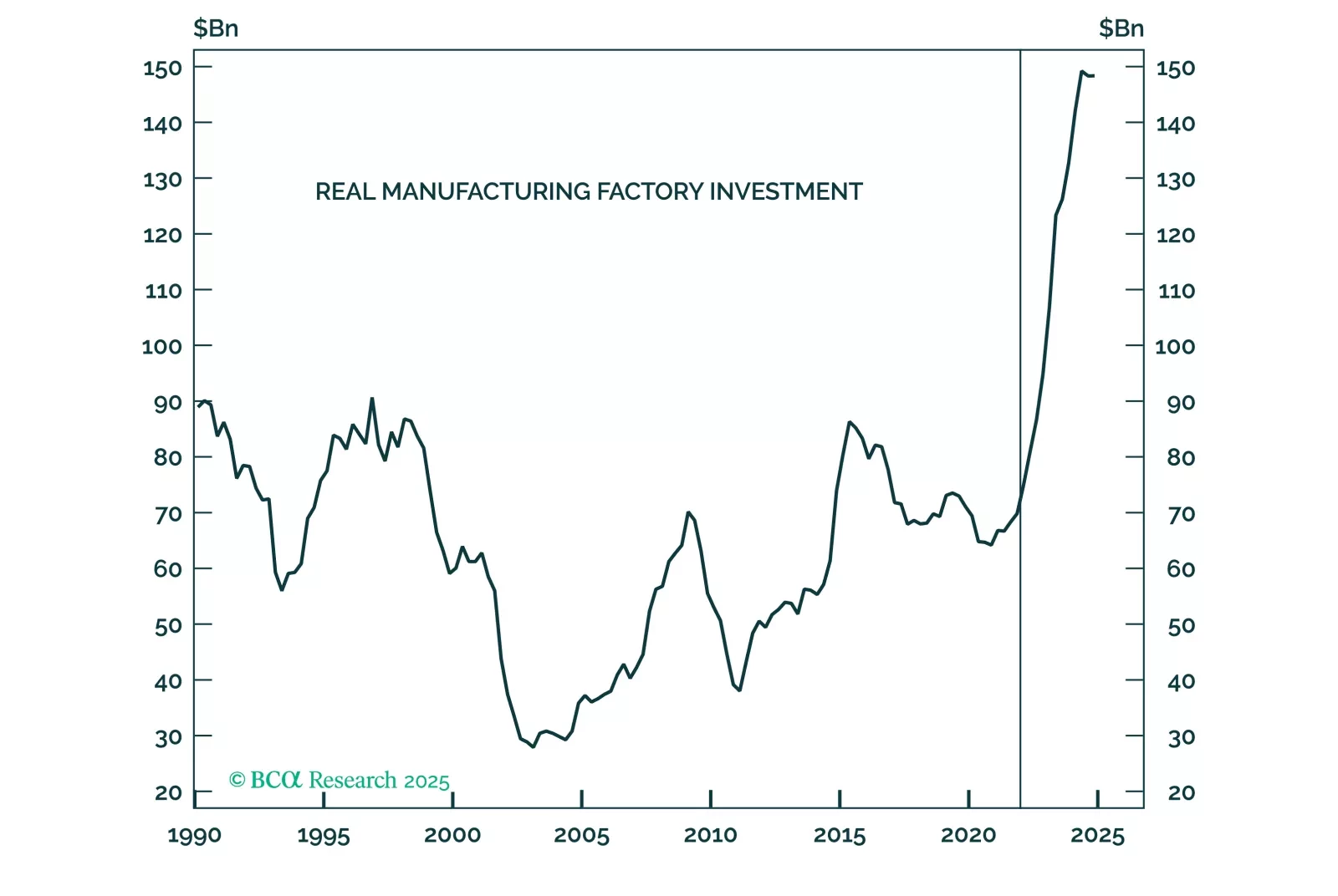

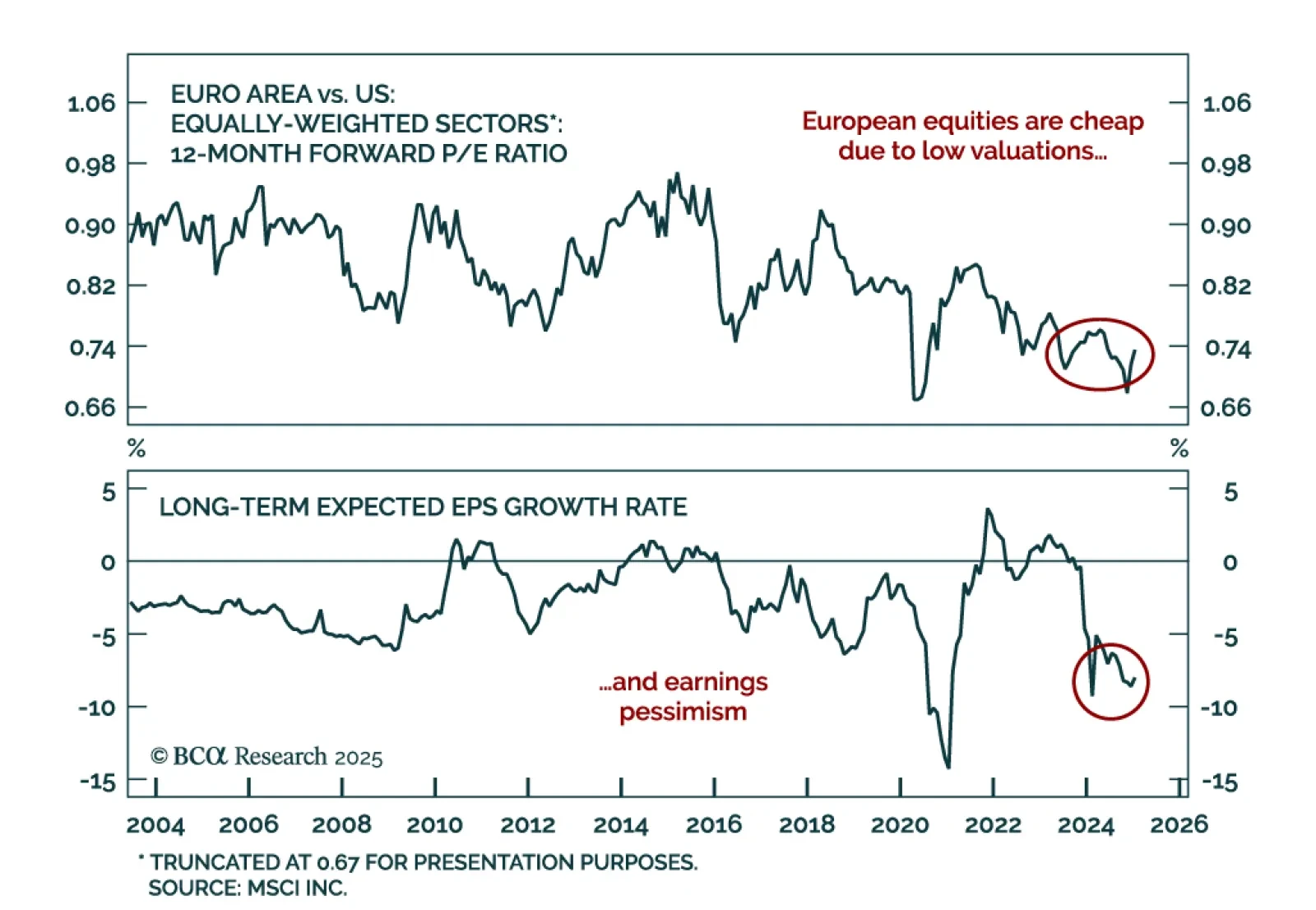

Our European strategists look at European equities after they garnered attention due to their low valuations. European equities are attracting interest primarily due to low valuations rather than strong growth expectations. Key…

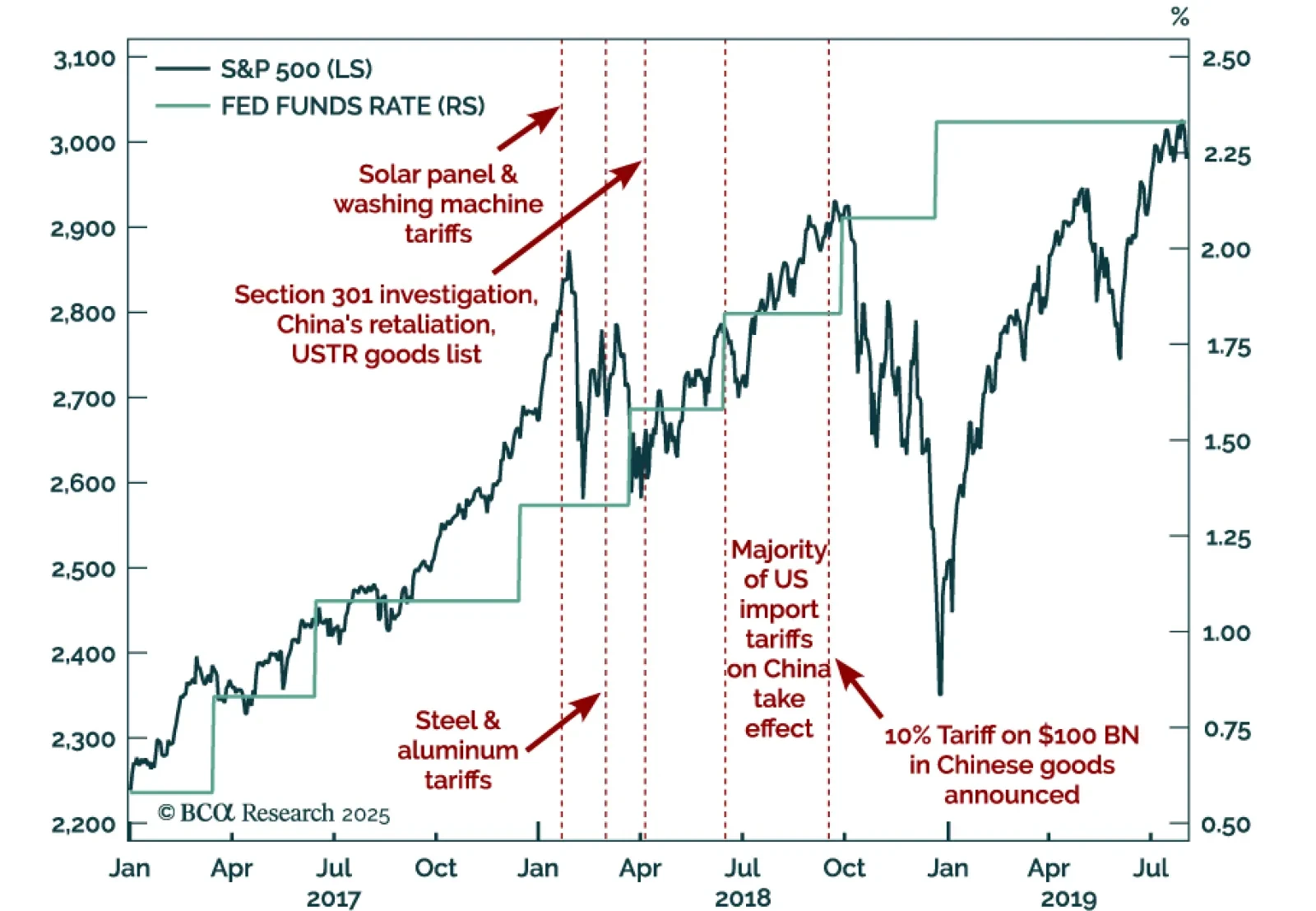

Our Chart Of The Week comes from Jonathan LaBerge, Chief Strategist for our Special Reports Unit. Jonathan asks whether investors should be encouraged by the fact stocks are shrugging off US tariffs. The answer is no, because…