Highlights Our top five “black swan” risks for 2022: Social unrest in China; Russian invasion of all of Ukraine; unilateral Israeli strikes on Iran; a cyber attack that goes kinetic; and a failure of OPEC 2.0. Too early…

Market participants have aggressively increased their rate hike expectations for Canada over the coming year. Recent data supports this shift. Canada’s headline inflation rate rose to a fresh 30-year high of 4.8% in…

Highlights US Vs. Europe: Growth and inflation momentum remains stronger in the US versus Europe. The latter is taking the bigger economic hit from more severe Omicron economic restrictions and a greater exposure to slowing Chinese…

Highlights Duration: A look at past rate hike cycles shows that Treasury returns are generally low, though not always negative. For the current cycle, we continue to recommend a below-benchmark portfolio duration stance as we don…

Dear Client, Next week there will be no regular strategy report. Instead, we will hold our quarterly webcast which will discuss the outlook for the European economy and assets in 2022. I look forward to this interaction. Best…

Highlights It’s true that rising rates often precipitate bear markets, but it takes a while, … : We subscribe to the view that expansions are more likely to be murdered by the Fed than die of old age. It’s hard to…

Highlights The most important question is whether the Fed will hike interest rates by more than what is currently discounted in markets, or less. More hikes will trigger a set of cascading reactions. US bond yields will initially jump…

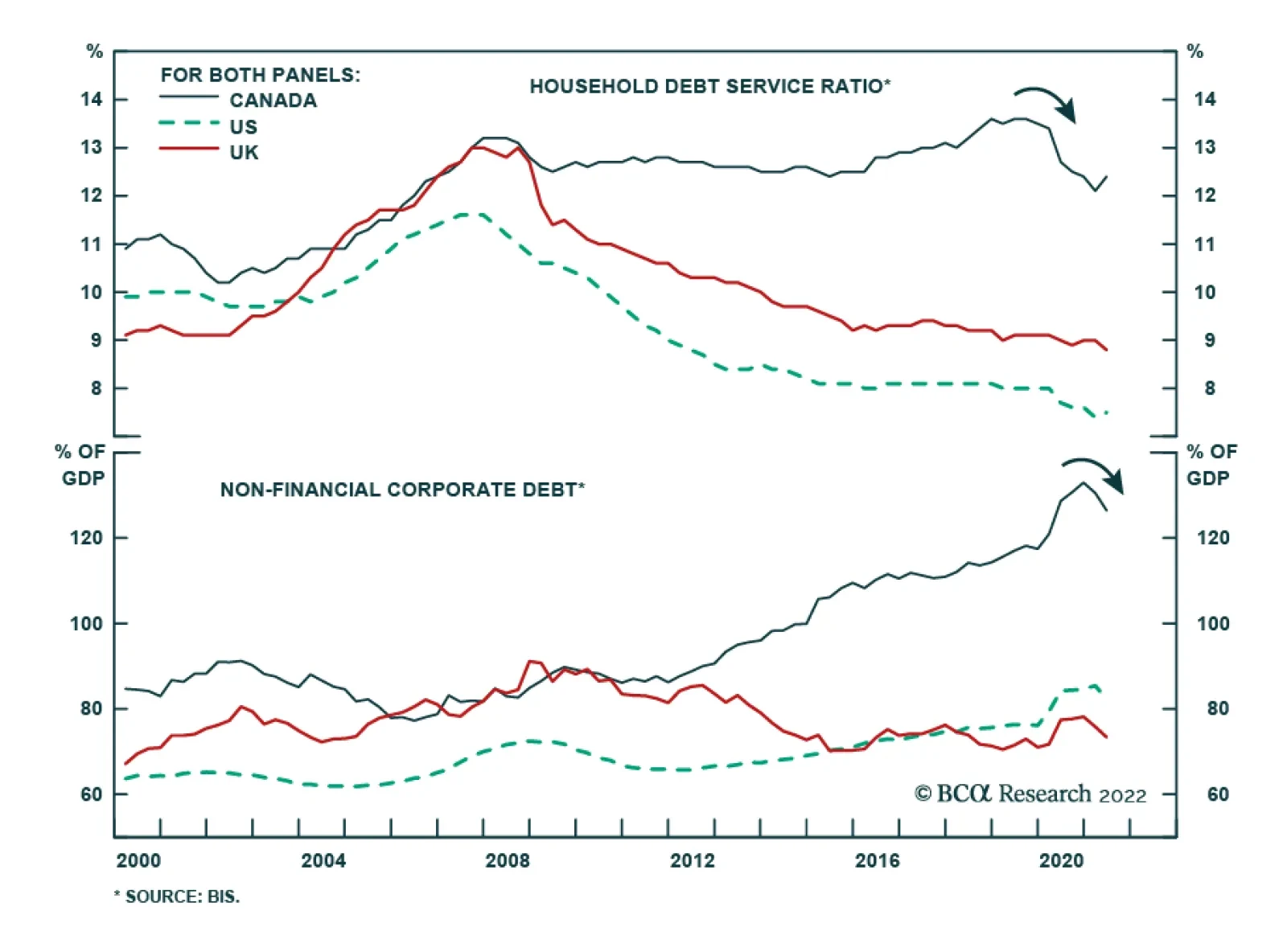

Highlights The neutral rate of interest in the US is 3%-to-4% in nominal terms or 1%-to-2% in real terms, which is substantially higher than the Fed believes and the market is discounting. The end of the household deleveraging cycle,…

Highlights This week we highlight key charts for US Political Strategy themes and views in the New Year. For H1 2022, we maintain a pro-cyclical, risk-on approach. We favor industrials, energy, infrastructure, and cyclicals. Foreign…

Highlights 2022 Key Views & Allocations: Translating our 2022 global fixed income Key Views into recommended positioning within our model bond portfolio results in the following conclusions to begin the year. Target a moderate…