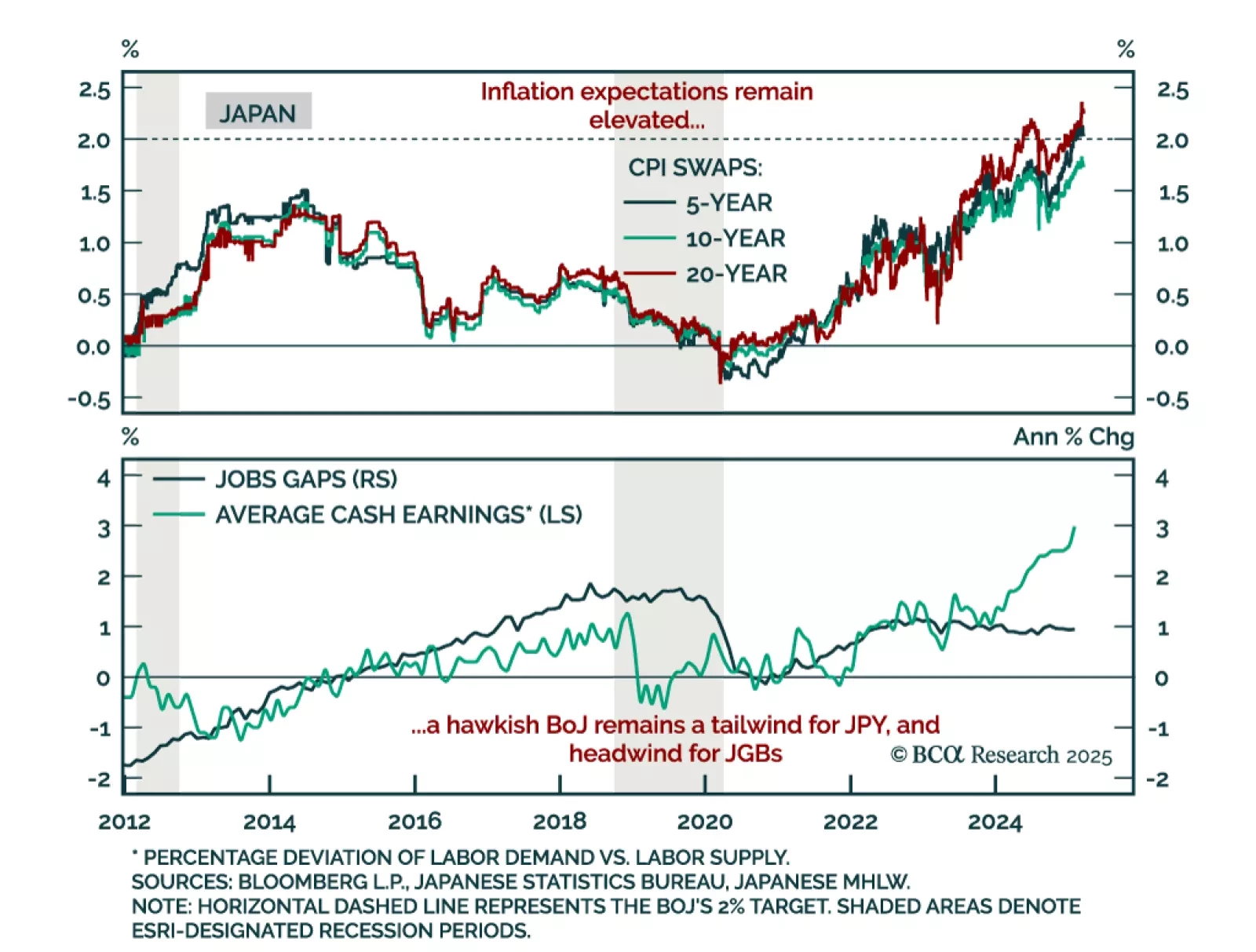

The Bank of Japan left rates unchanged at 0.50%, but maintained a hawkish bias, making it the only G10 central bank in a hiking cycle, as the hot labor market creates sustained domestic price pressures. More rate increases are…

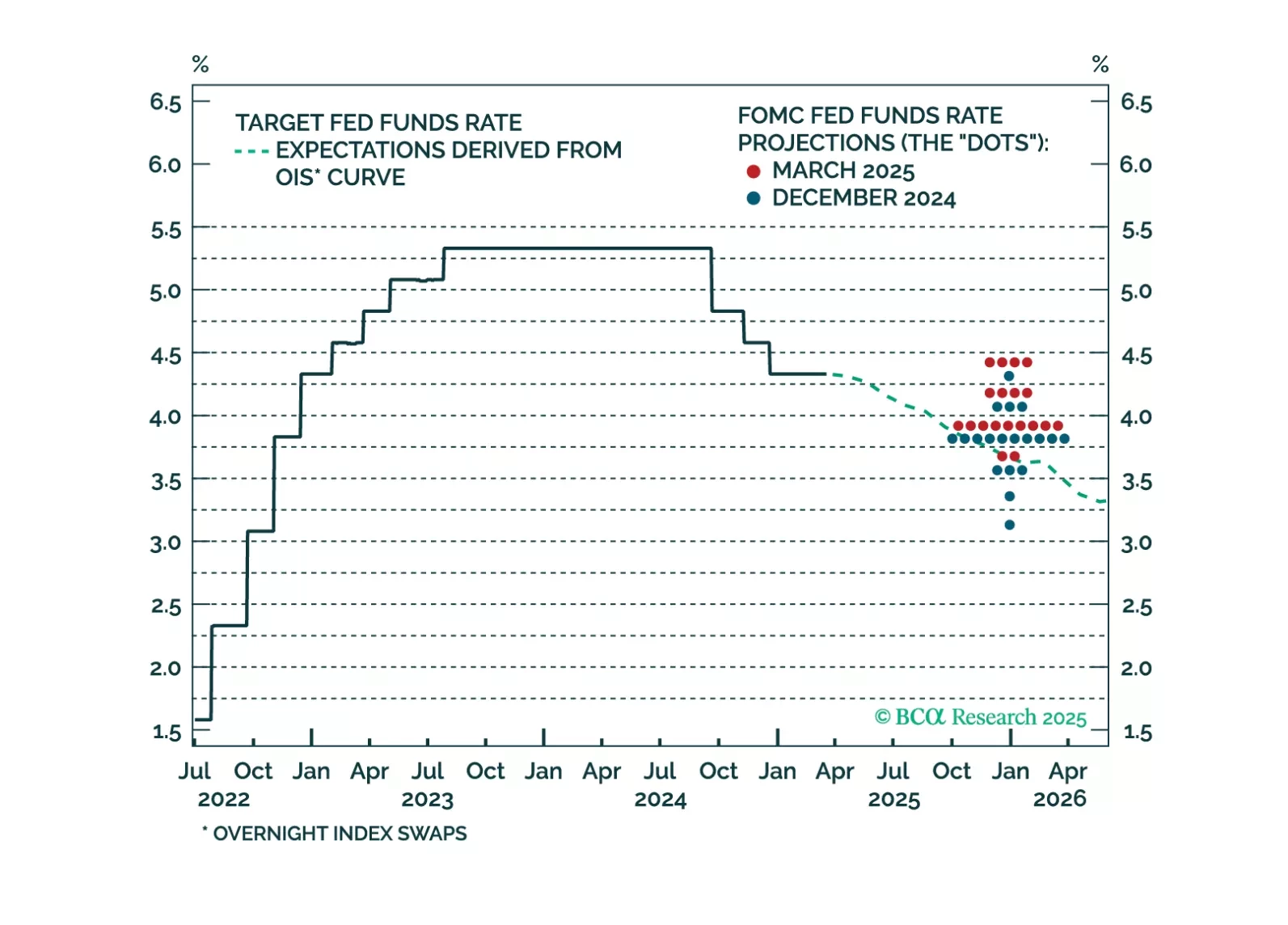

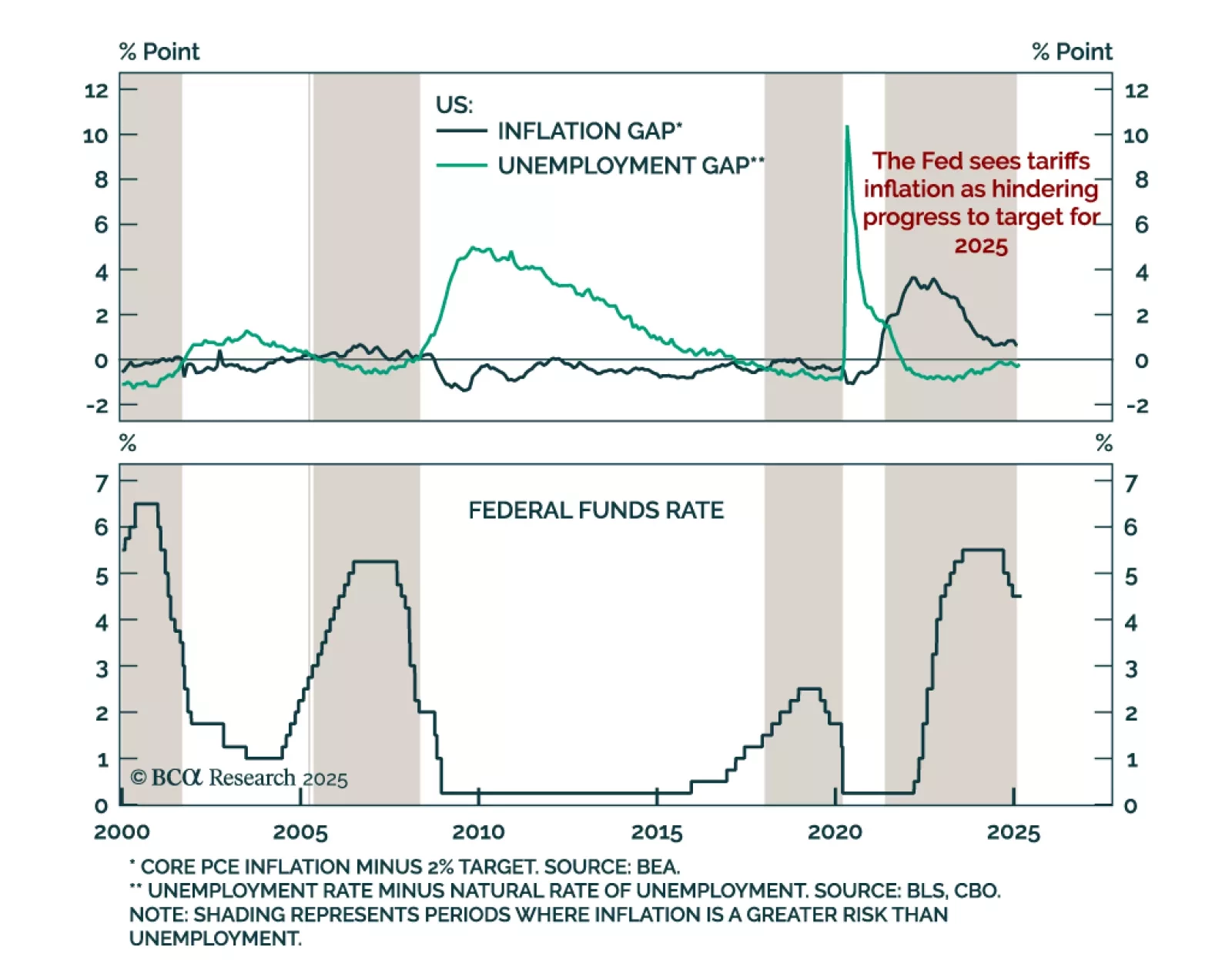

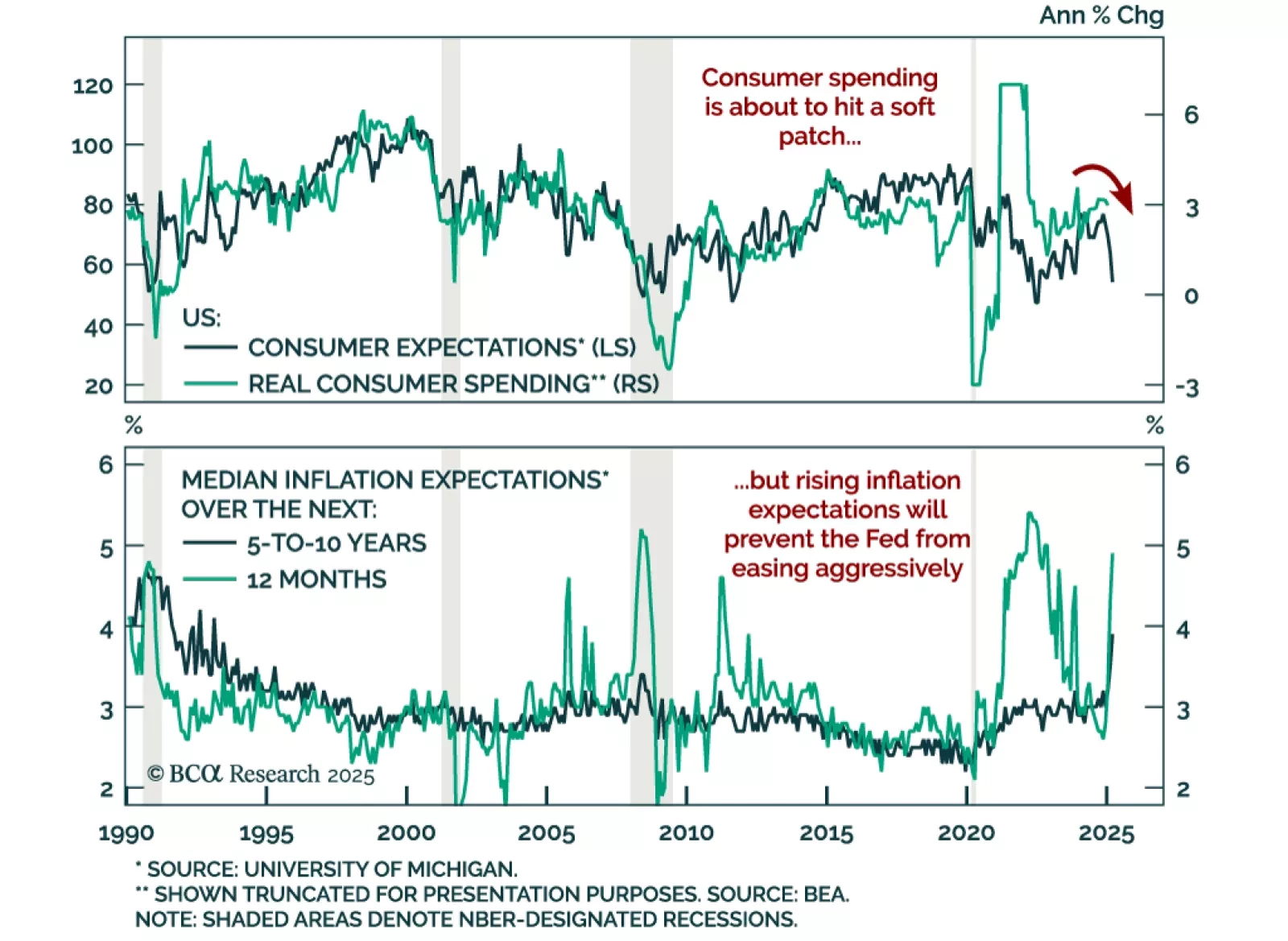

The Federal Reserve held rates at 4.25%-to-4.5% as expected, and slowed down the pace of quantitative tightening. The FOMC remains comfortable waiting and assessing the impact of recent and upcoming policy changes. The dots reflected…

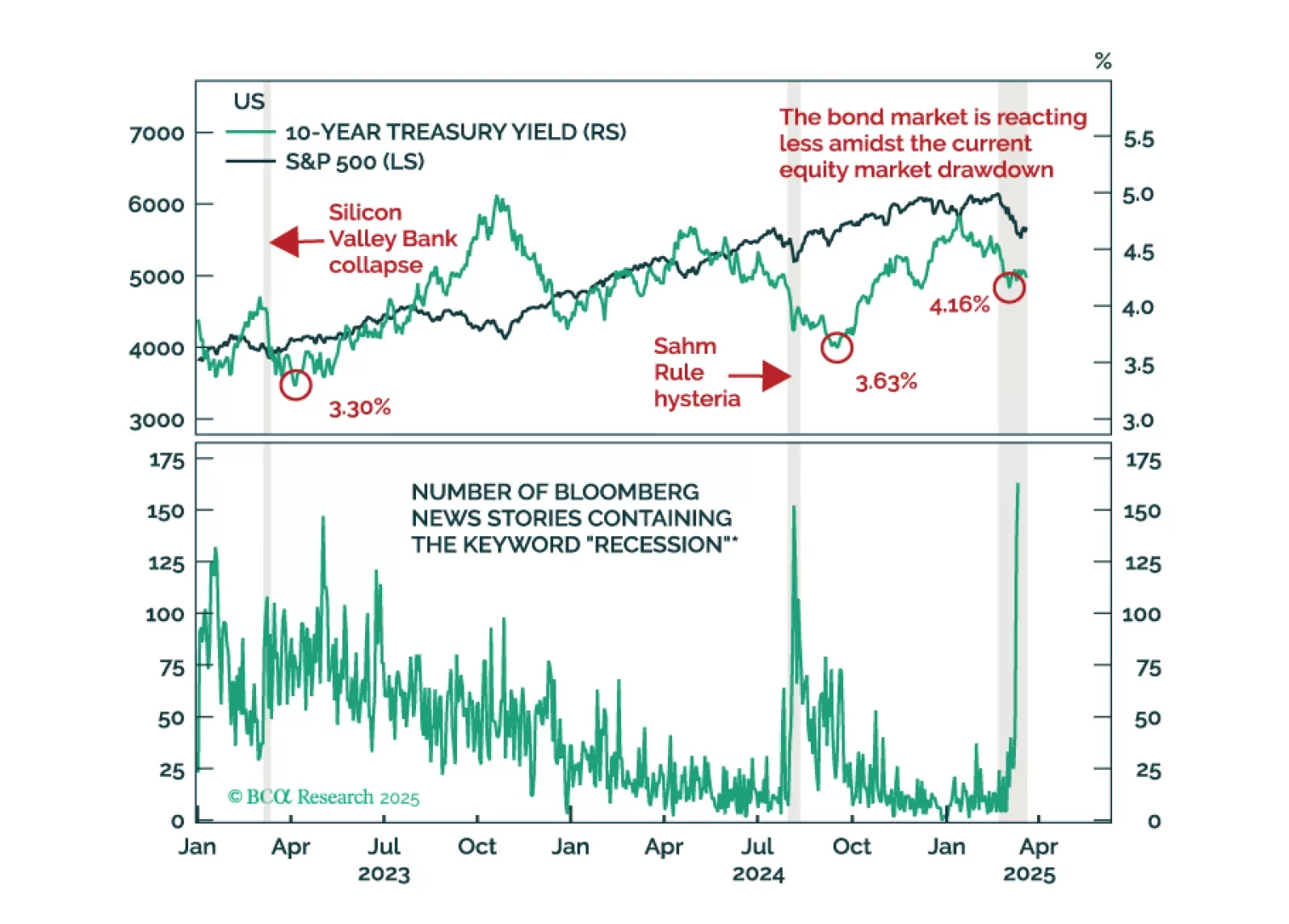

The market reaction to this afternoon’s Fed meeting looks overdone. Investors could be in for a hawkish surprise when it becomes apparent that the Fed won’t ease policy into higher tariff-driven inflation prints.

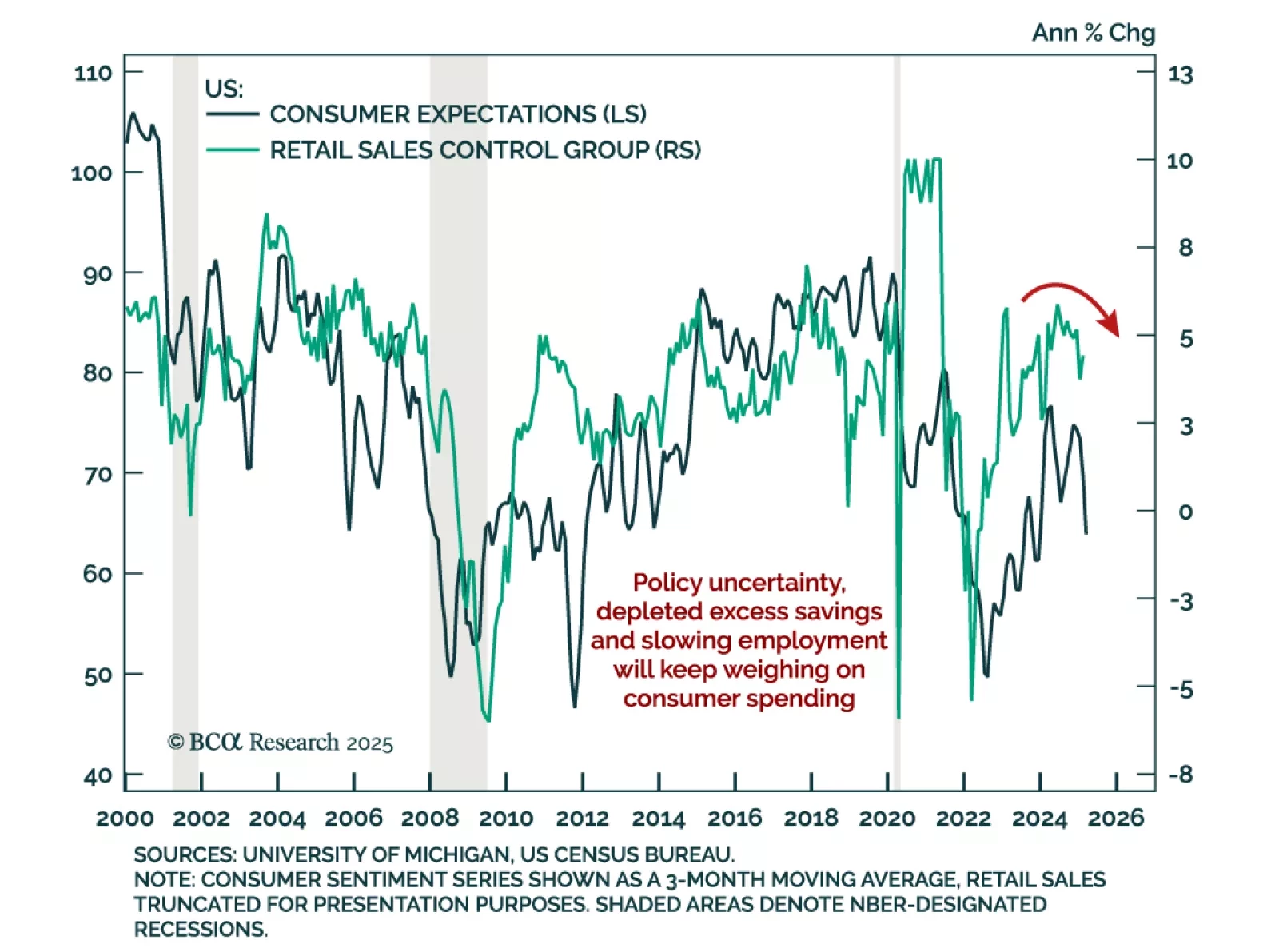

February US retail sales were mixed, with the headline number missing expectations at only 0.2% m/m. January’s reading was revised down to -1.2%. Core measures (excluding gas & autos) were roughly in line with estimates, but the…

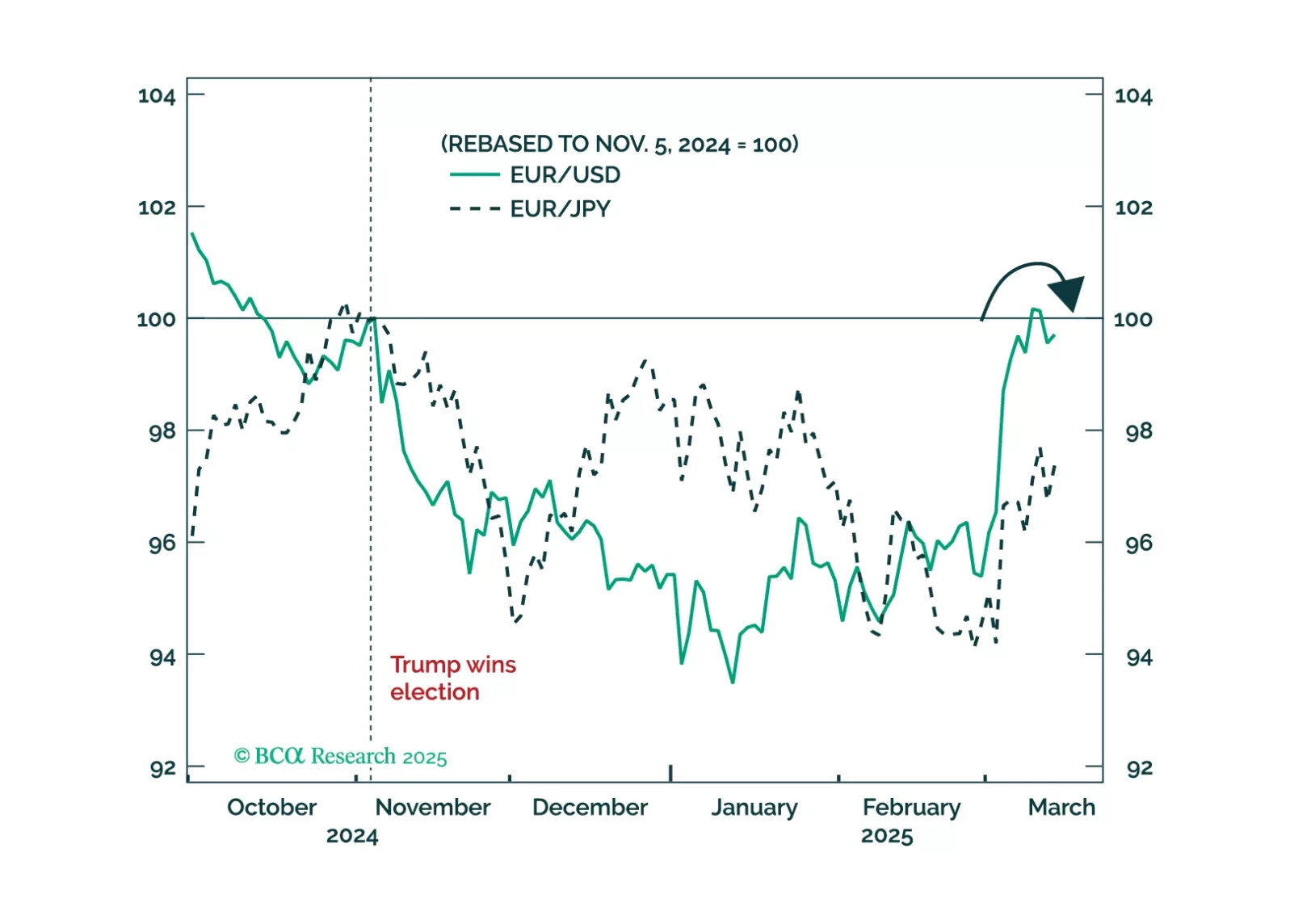

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

Despite our Global Investment strategists’ bearish stance, their latest report reviews scenarios that could be bullish for equities. Our colleagues remain bearish on equities, expecting a US recession this year. However, several…

The preliminary March University of Michigan Consumer Sentiment Index missed estimates, falling to 57.9 from 64.7. The decrease came from both the assessment of current conditions and expectations, with the latter falling almost 10…

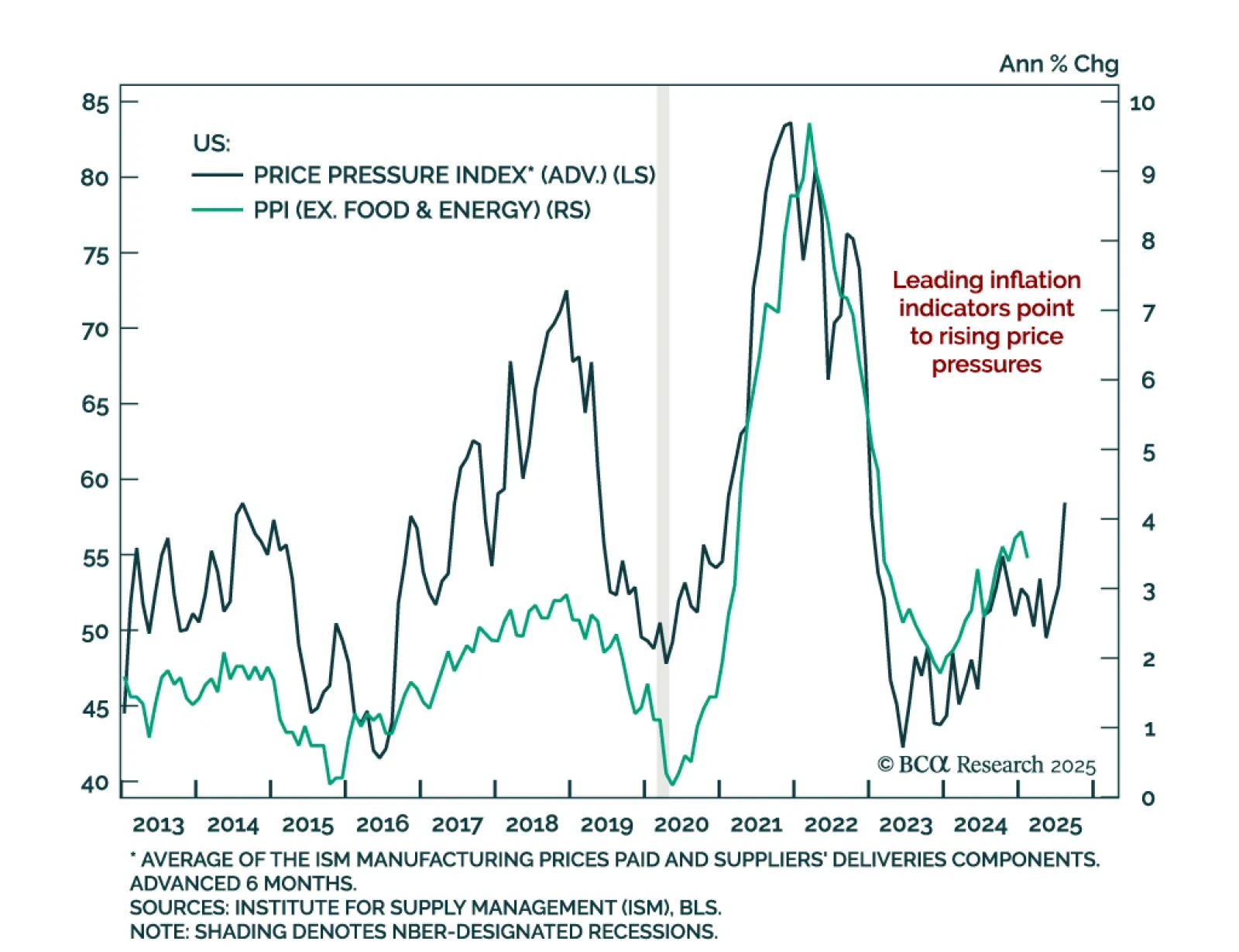

The February US Producer Price Index came in below estimates, with the headline measure showing no monthly change and standing at 3.2% y/y. Core PPI (excluding food, energy, and trade services) was also cooler than expected, coming…

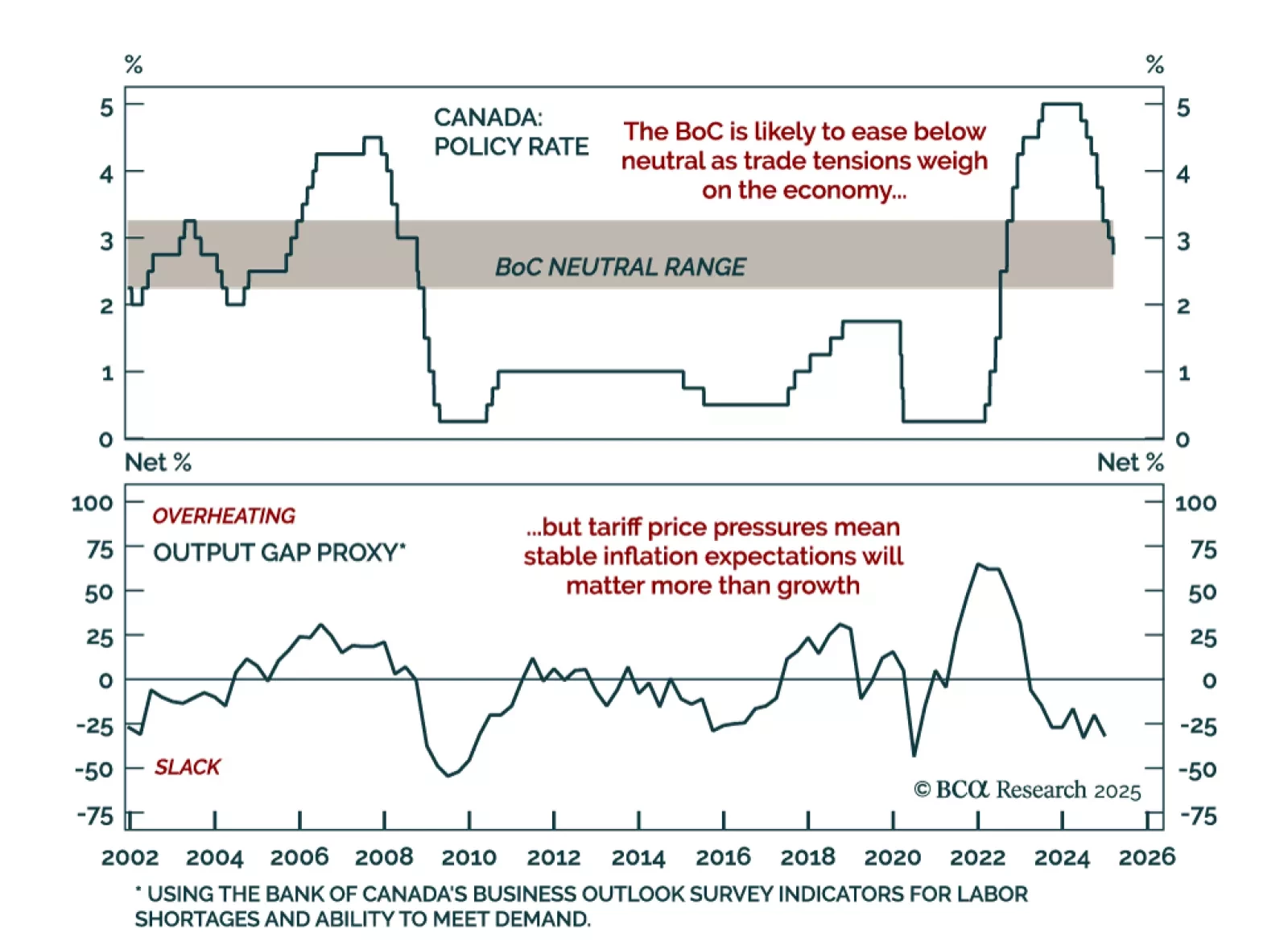

The Bank of Canada cut by 25 bps to 2.75% as expected. This seventh consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range. The BoC is in a tough place. The trade war…