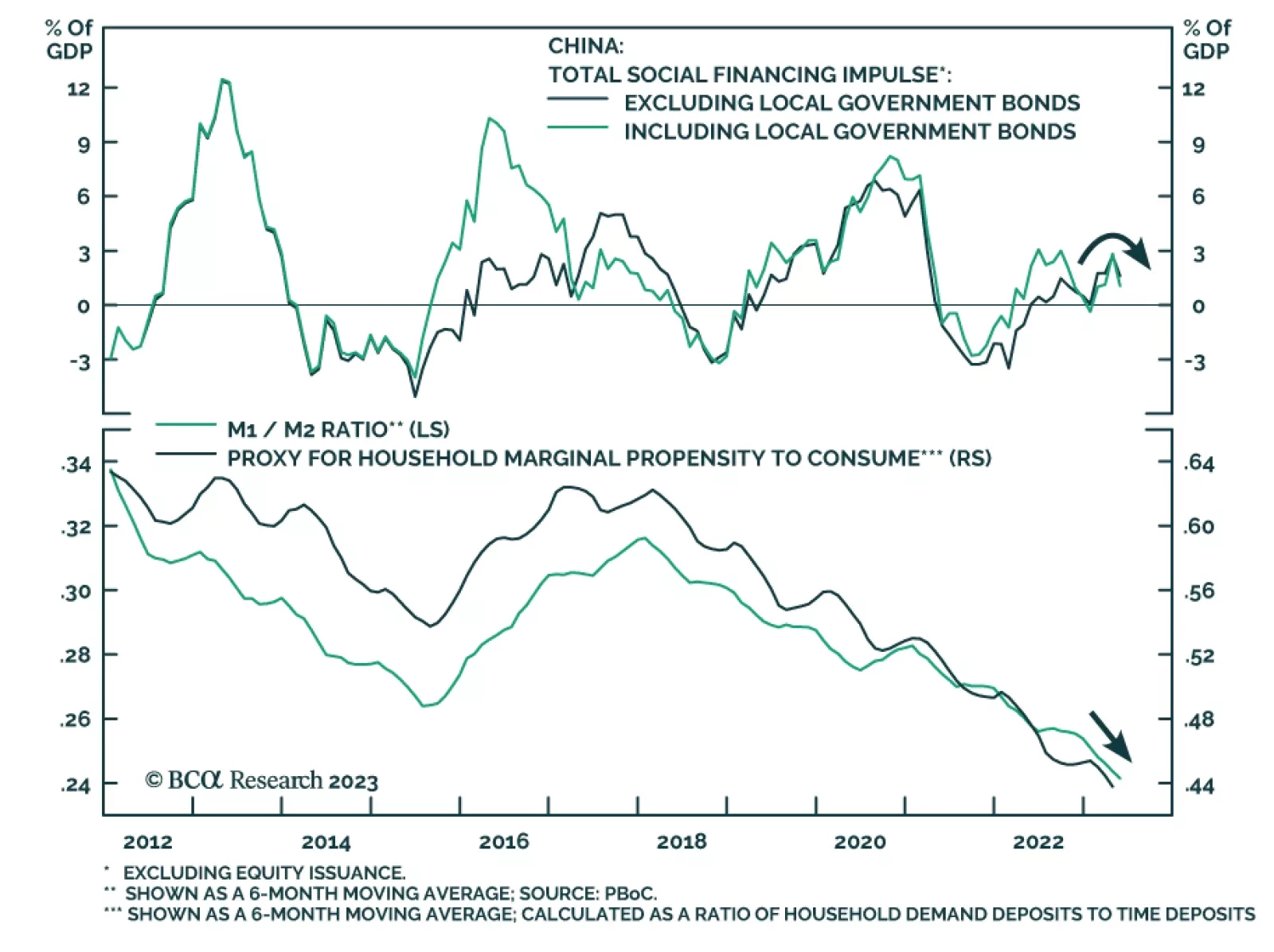

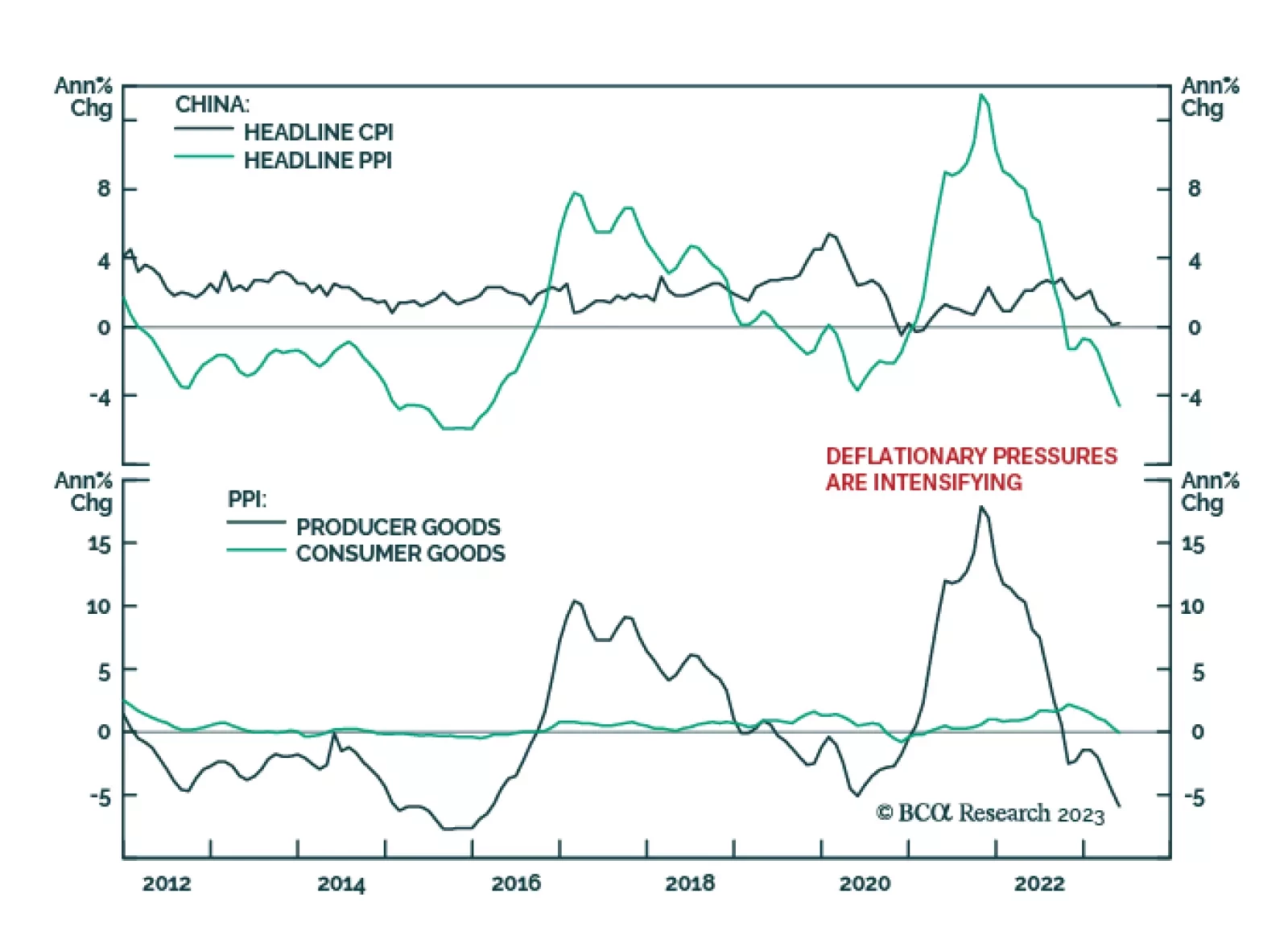

China’s money and credit update for May continues a string of disappointing Chinese data releases. The CNY 1.56 trillion increase in total social financing fell below expectations of a CNY 1.90 trillion rise. Similarly, the…

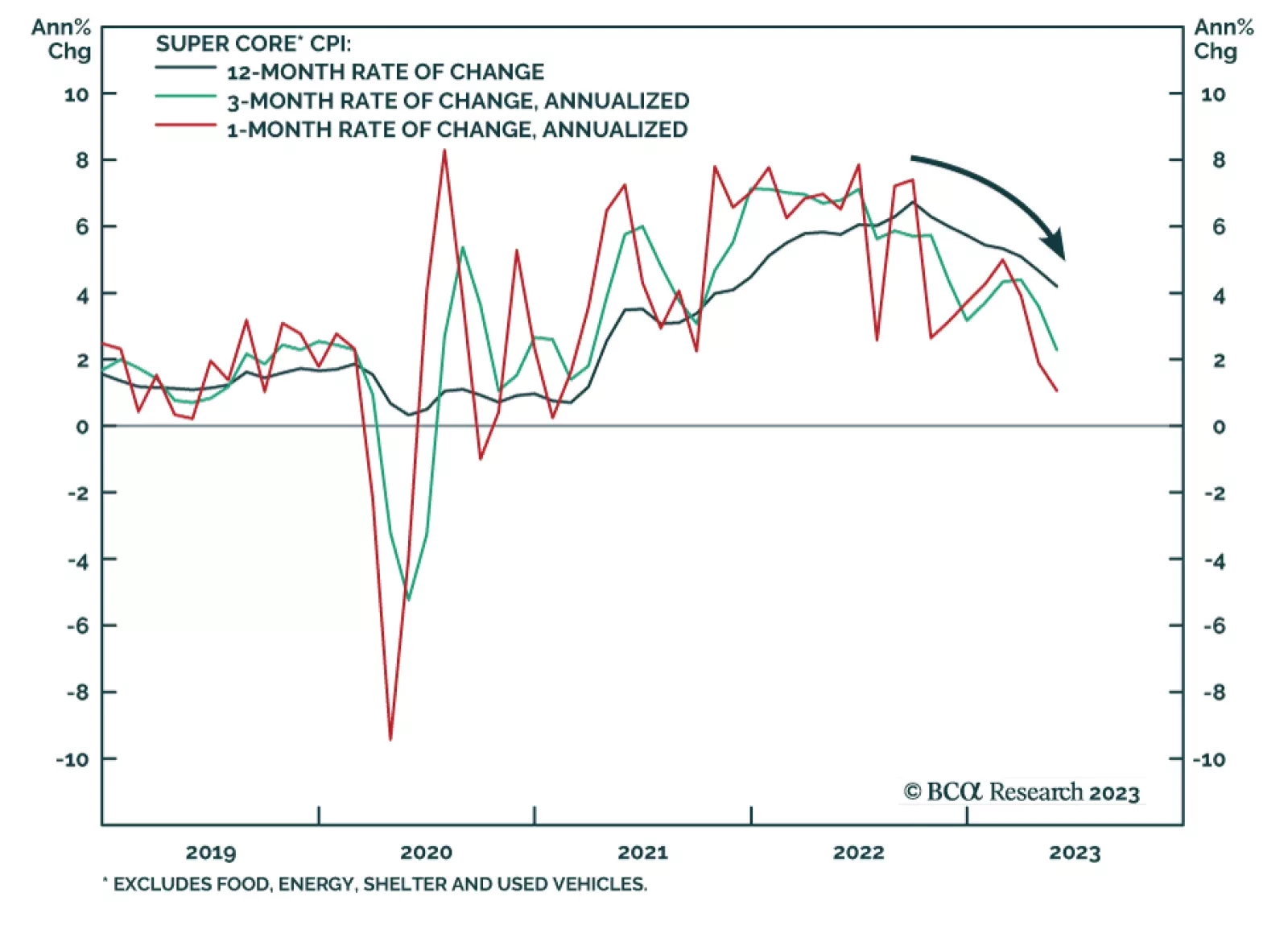

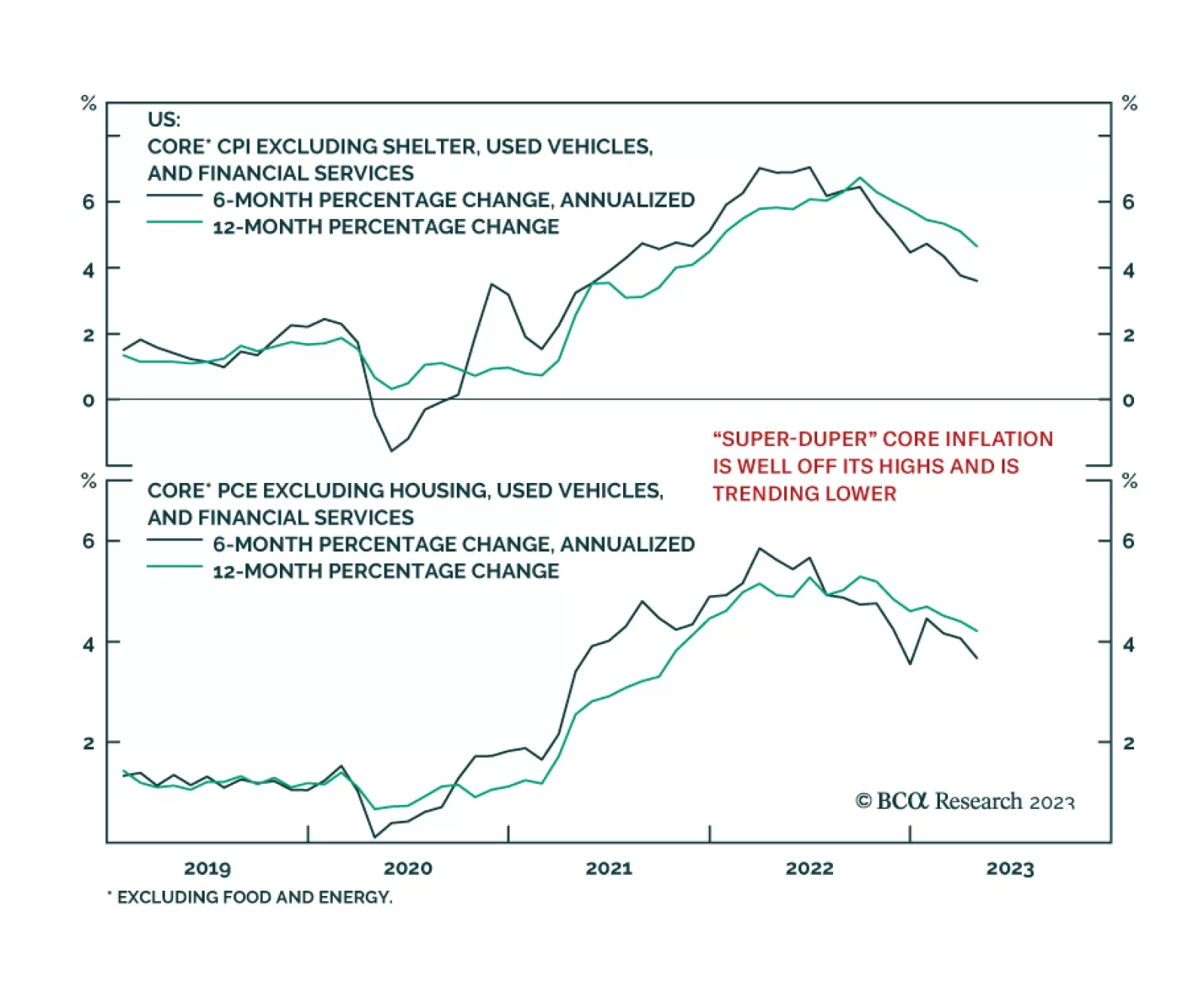

With the 1-year CPI swap rate trading at 2.3%, the market was already priced for a significant drop in inflation heading into yesterday’s May CPI release. The results of the report should only reinforce those expectations…

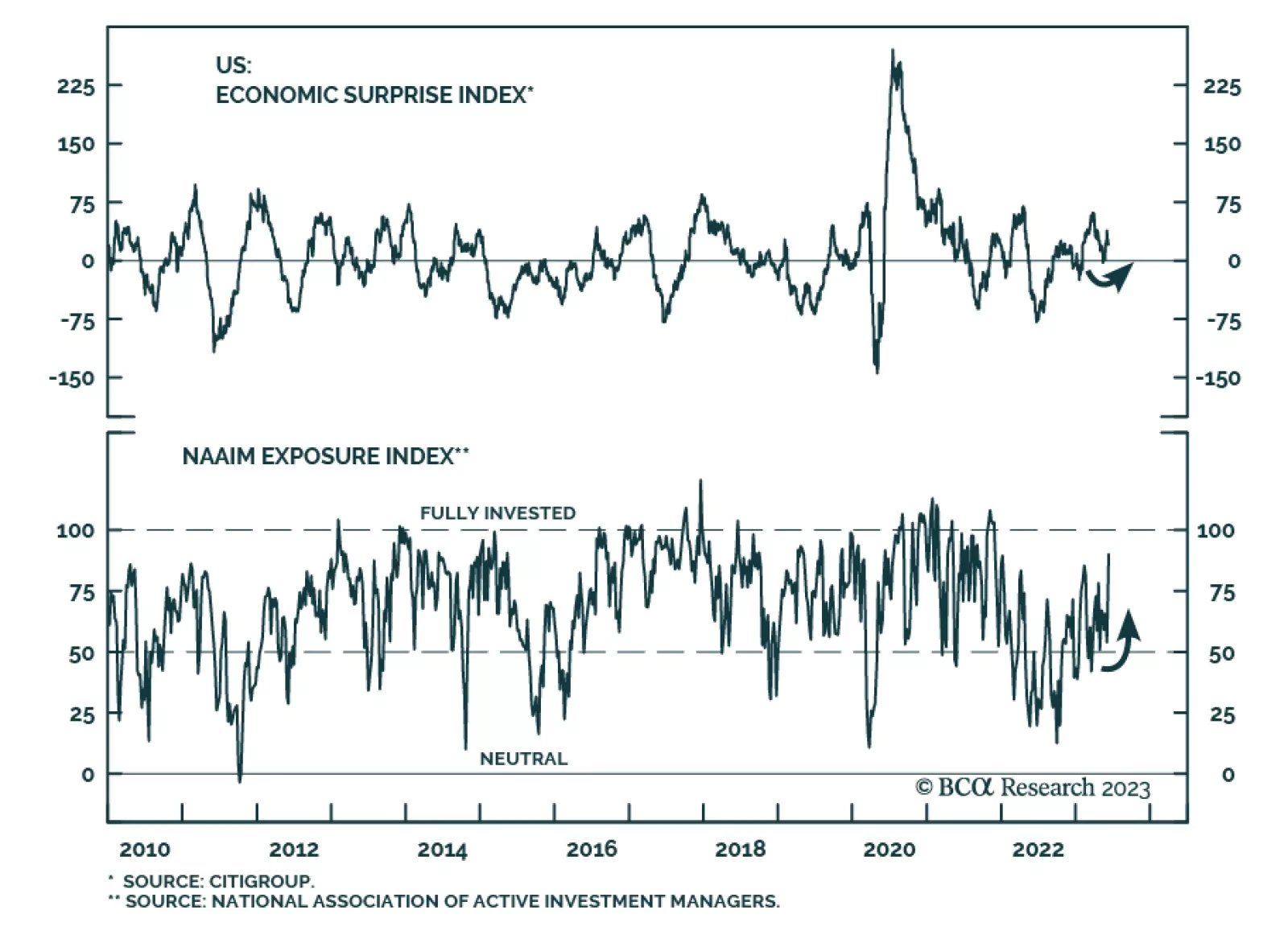

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

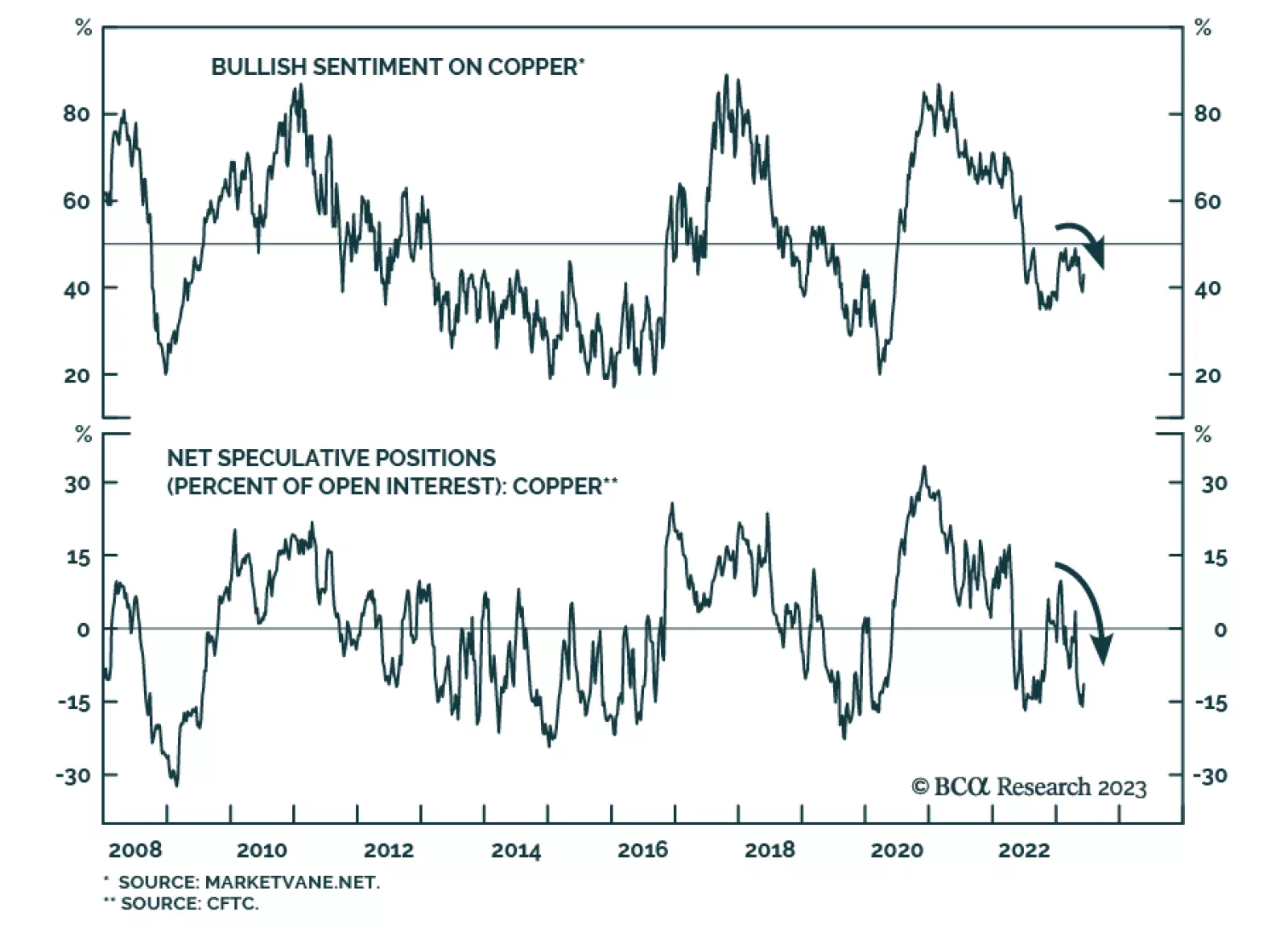

In our May In Review Insight, we highlighted that last month, industrial metals generated the largest abnormal losses among the major global financial assets we track. This continues a downtrend that started at the beginning of…

According to the Exposure Index compiled by the National Association of Active Investment Managers (NAAIM), active risk managers are increasing their net exposure to equities. The range of responses to the weekly survey…

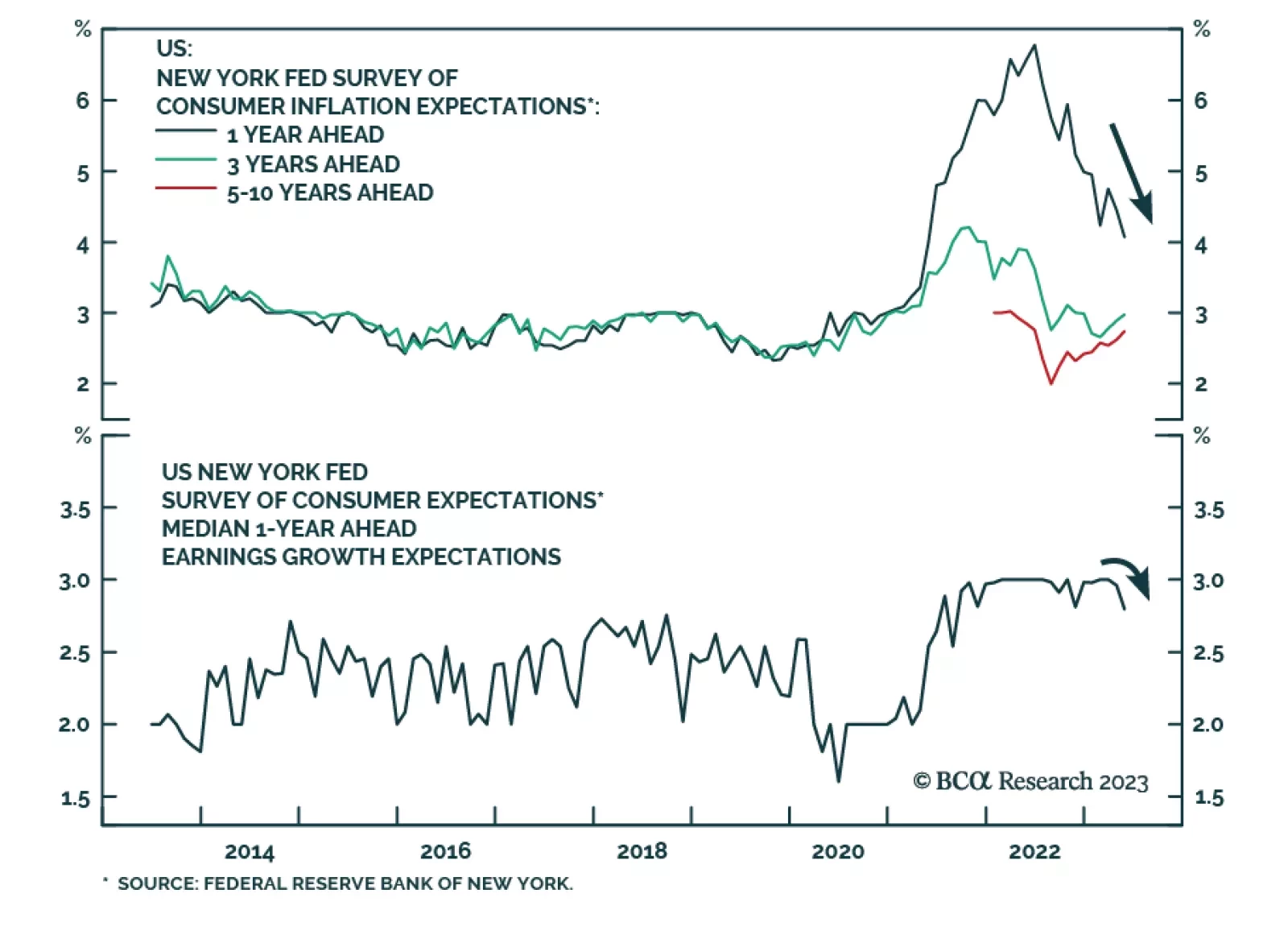

Results of the New York Fed’s Survey of Consumer Expectations sent a positive signal about short-term inflation expectations. Median one-year-ahead inflation expectations dropped by 0.3 percentage point to a two-year low of…

According to BCA Research’s Global Investment Strategy service, the leading indicators of inflation continue to point down, suggesting that the Fed may be able to finally go on hold after hiking one last time in July.…

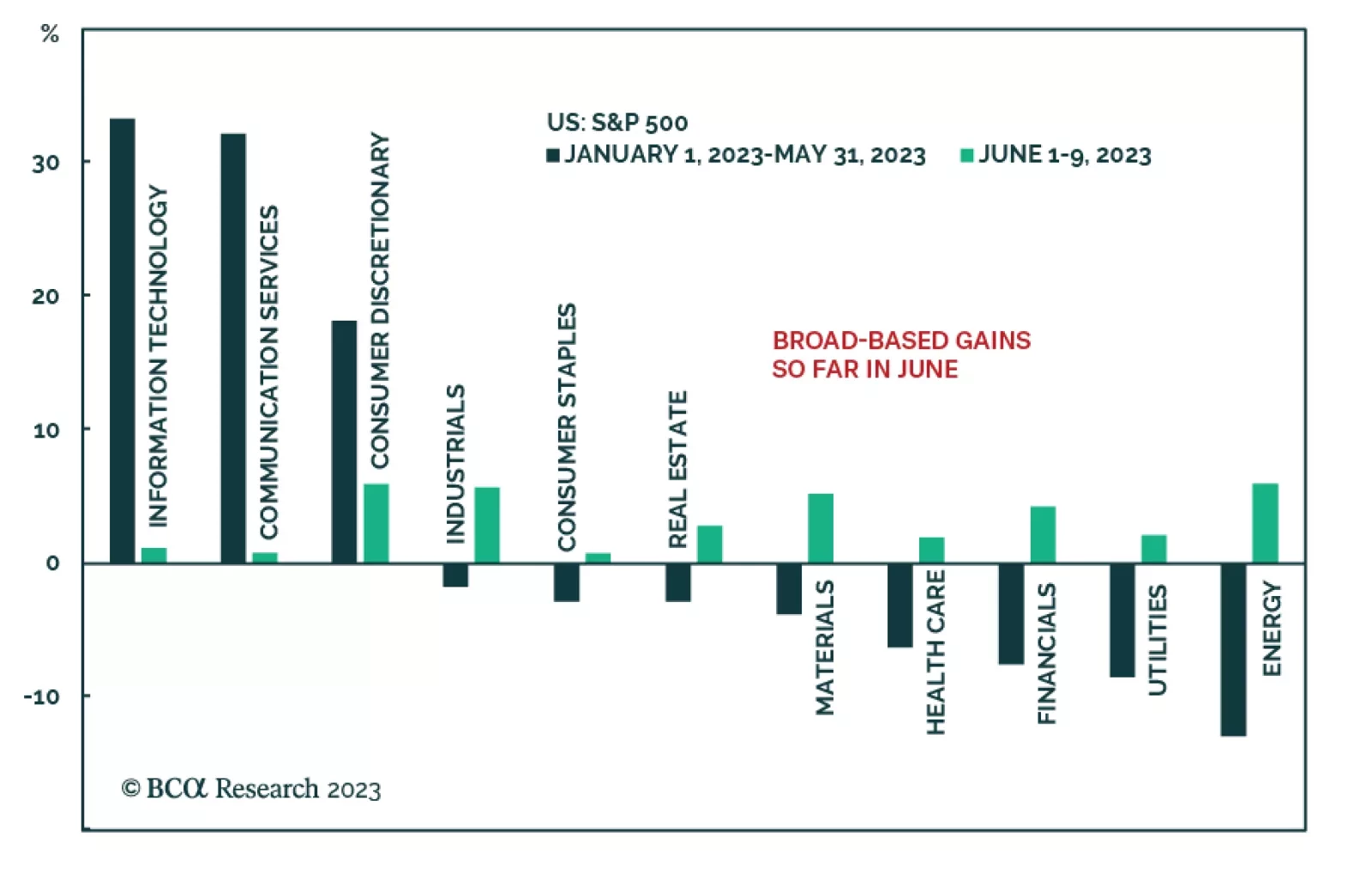

As we’ve highlighted in recent Insights, the S&P 500’s year-to-date rally has been concentrated among a few mega cap stocks. In particular, companies that benefit from the AI craze have driven the gains. This…

Chinese producer prices sent a disappointing signal about the domestic economy on Friday. The pace of decline in producer prices accelerated from -3.6% in April to -4.6% in May – worse than expectations of a -4.3% drop. The…

A preview of what to expect from next week’s FOMC meeting.