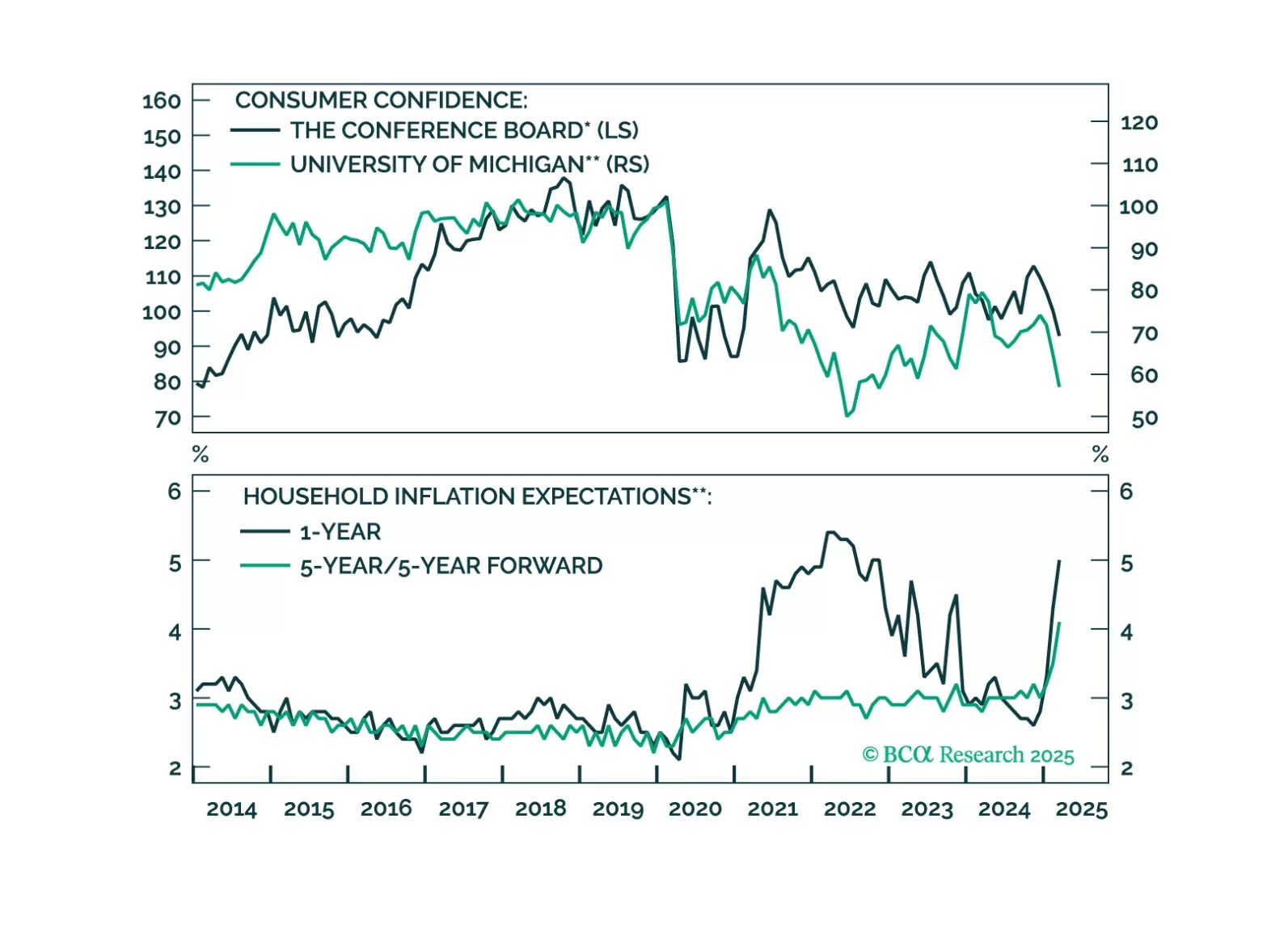

This morning’s weak consumer spending and strong inflation data reinforce our sense that the US economy is heading toward recession.

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

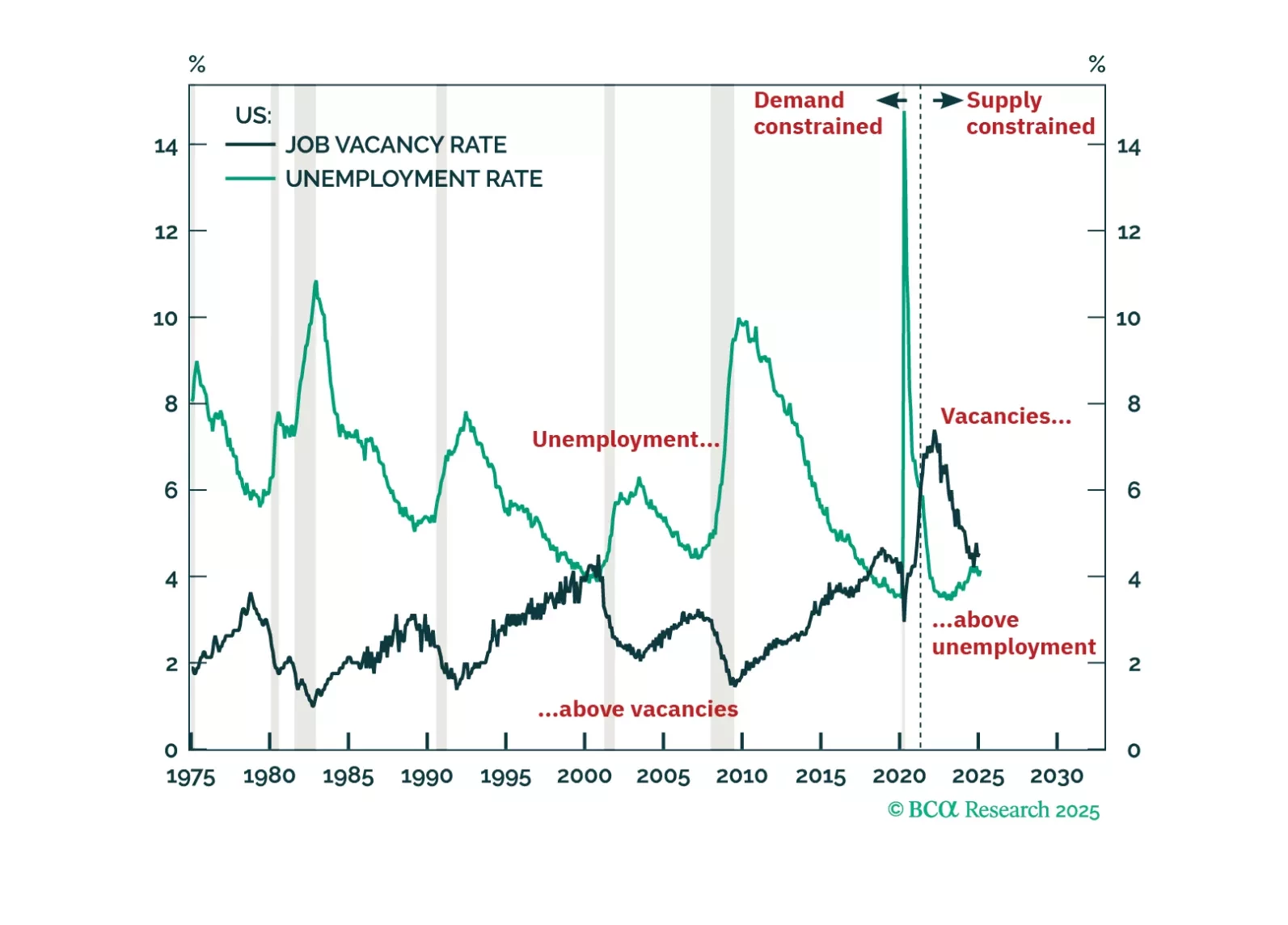

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

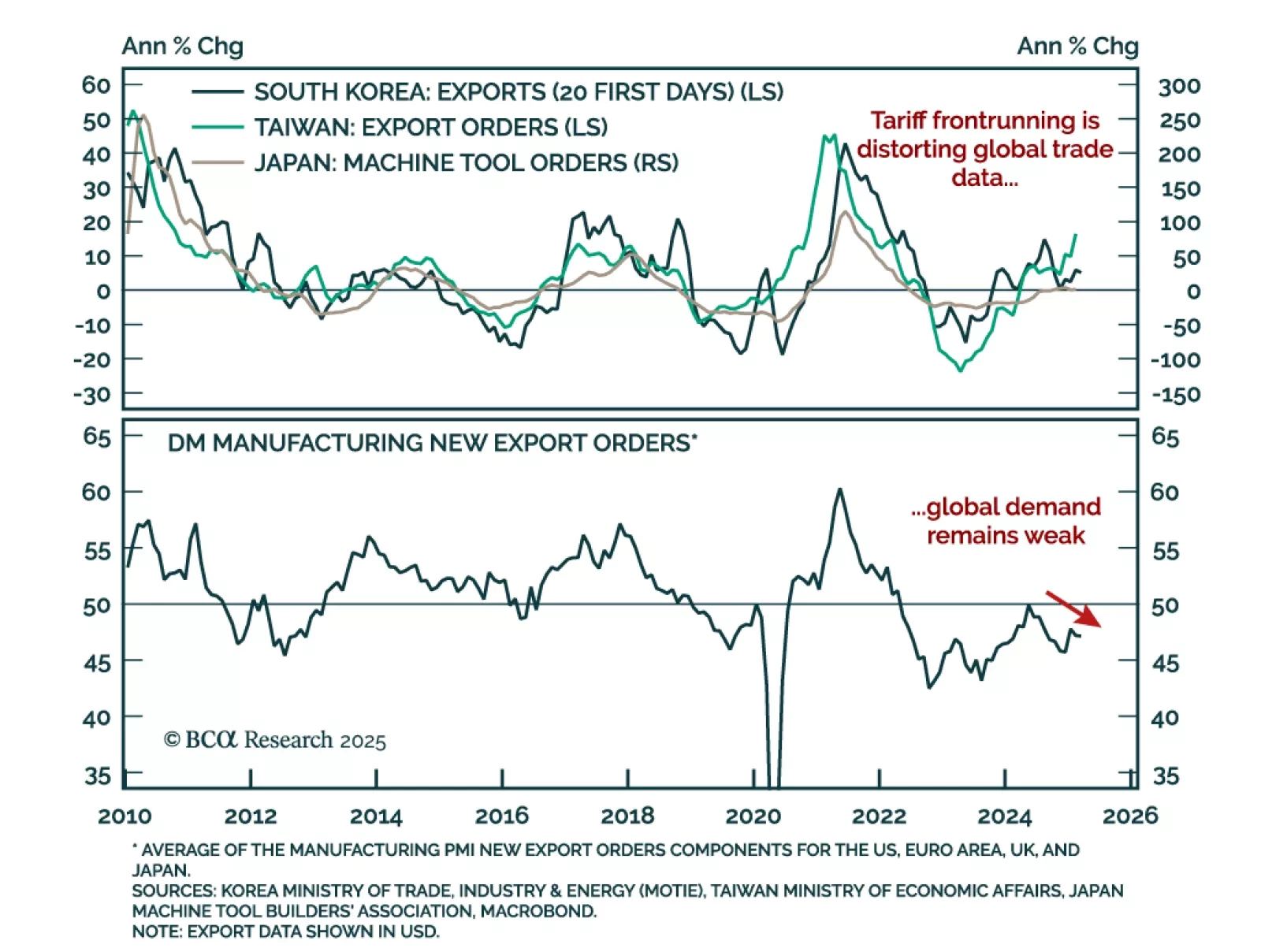

East Asian trade data has been disappointing. Preliminary February data for Japanese machine tool orders showed a slowdown to 3.5% y/y from 4.7% in January. Broader machinery orders were down 3.5% m/m in January. Taiwanese exports…

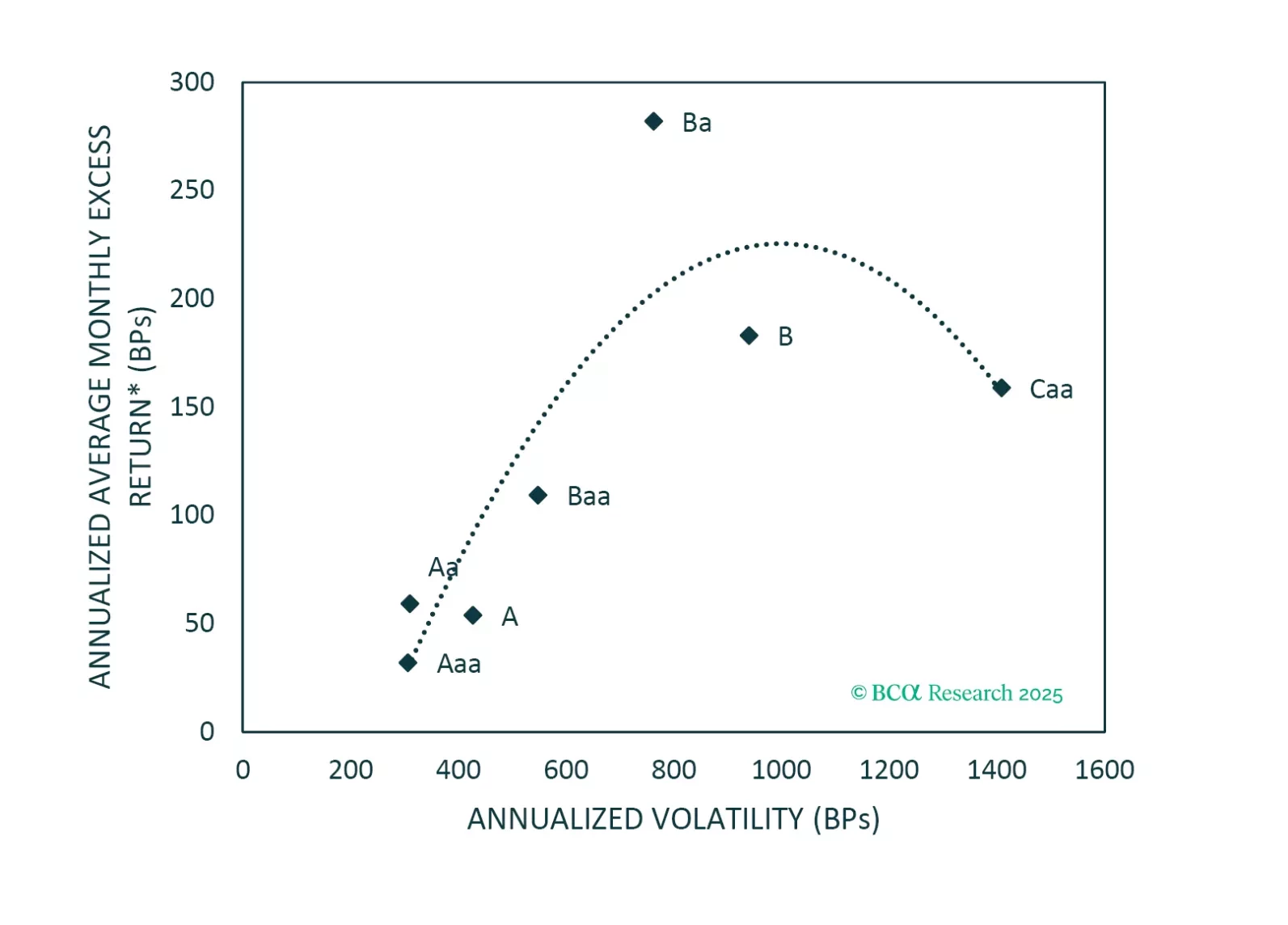

An analysis of historical data shows that Ba-rated bonds outperform other corporate credit tiers in the long-run on a risk-adjusted basis. That said, today’s fragile macro environment warrants a more cautious allocation.

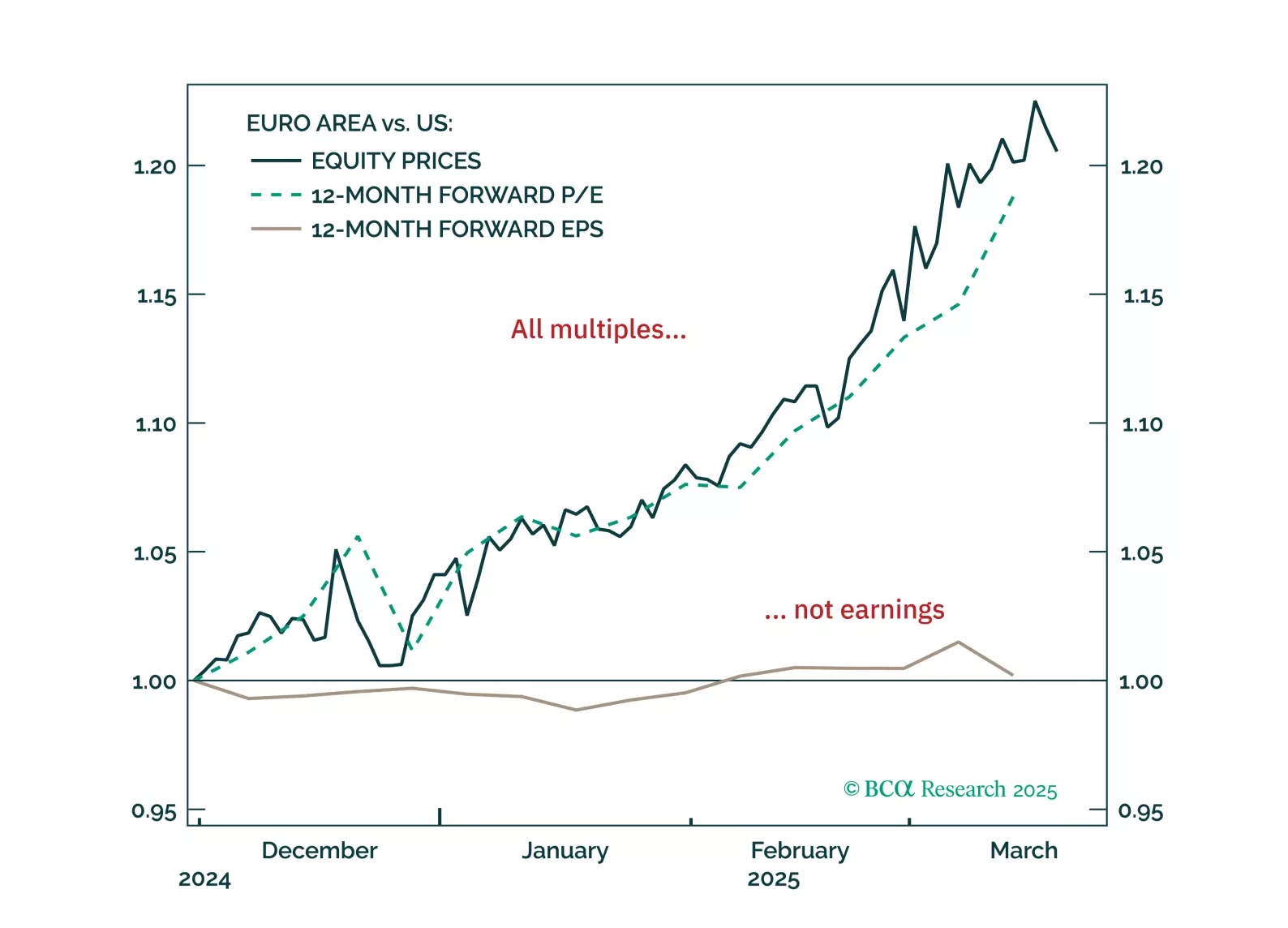

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

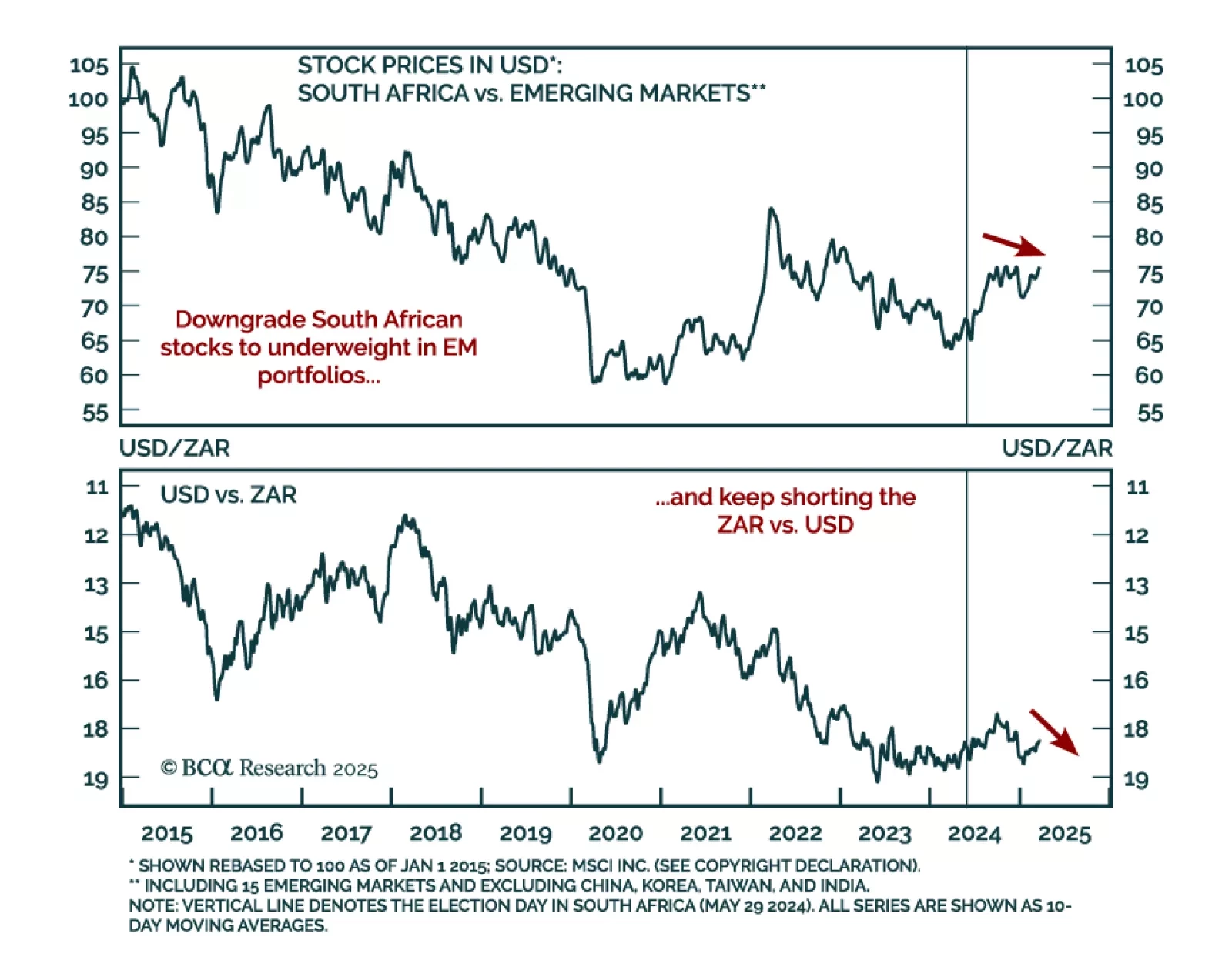

Our Emerging Market strategists reviewed their recommendations on South African assets as economic prospects start fading. South Africa’s fiscal tightening will suppress growth without achieving the necessary 4.2% primary…

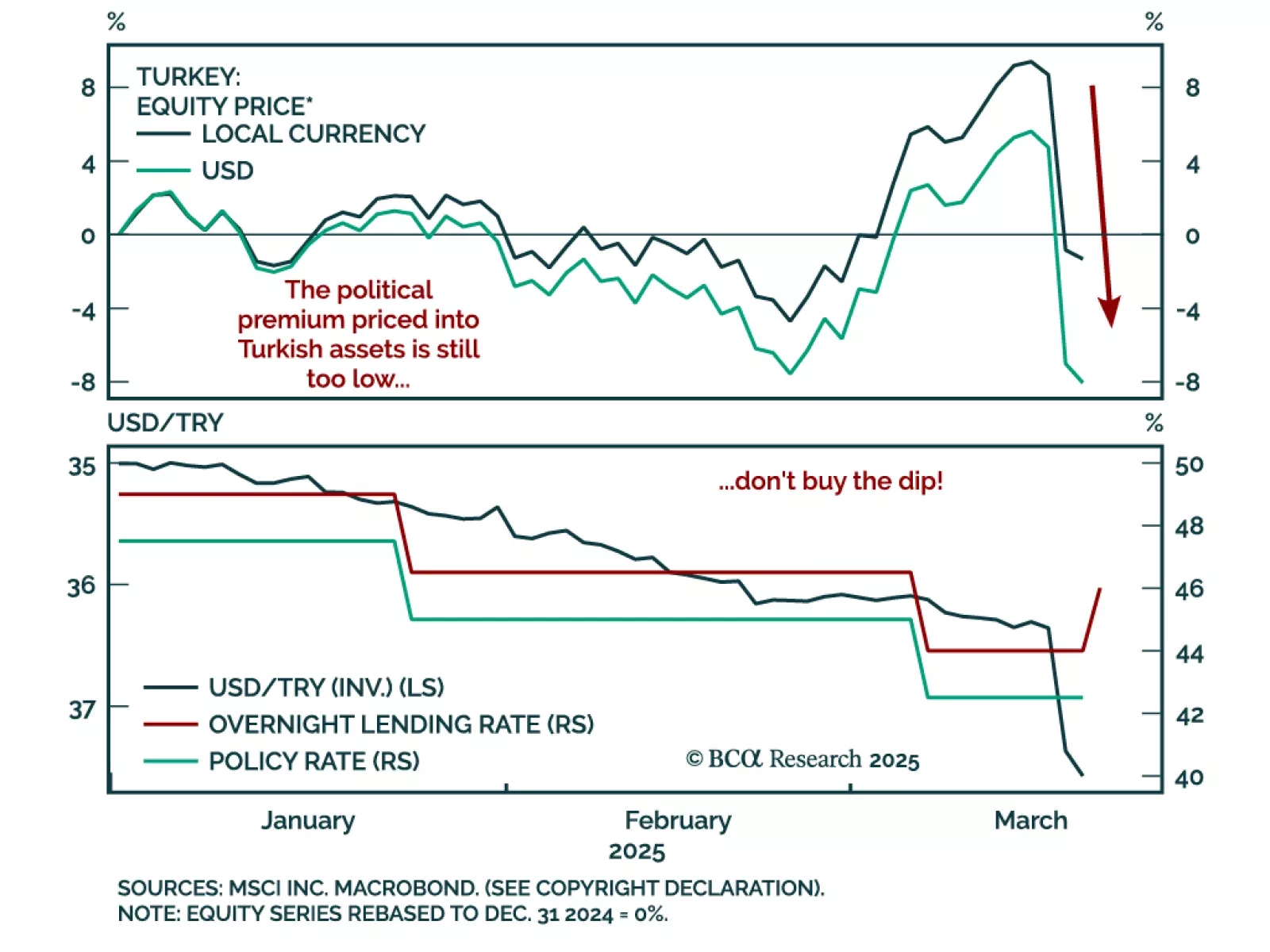

After a period of relative stability and progress towards policy orthodoxy, politics are again haunting Turkish assets. President Erdogan jailed Istanbul mayor Ekrem Imamoglu, a political rival from the opposition party gaining…

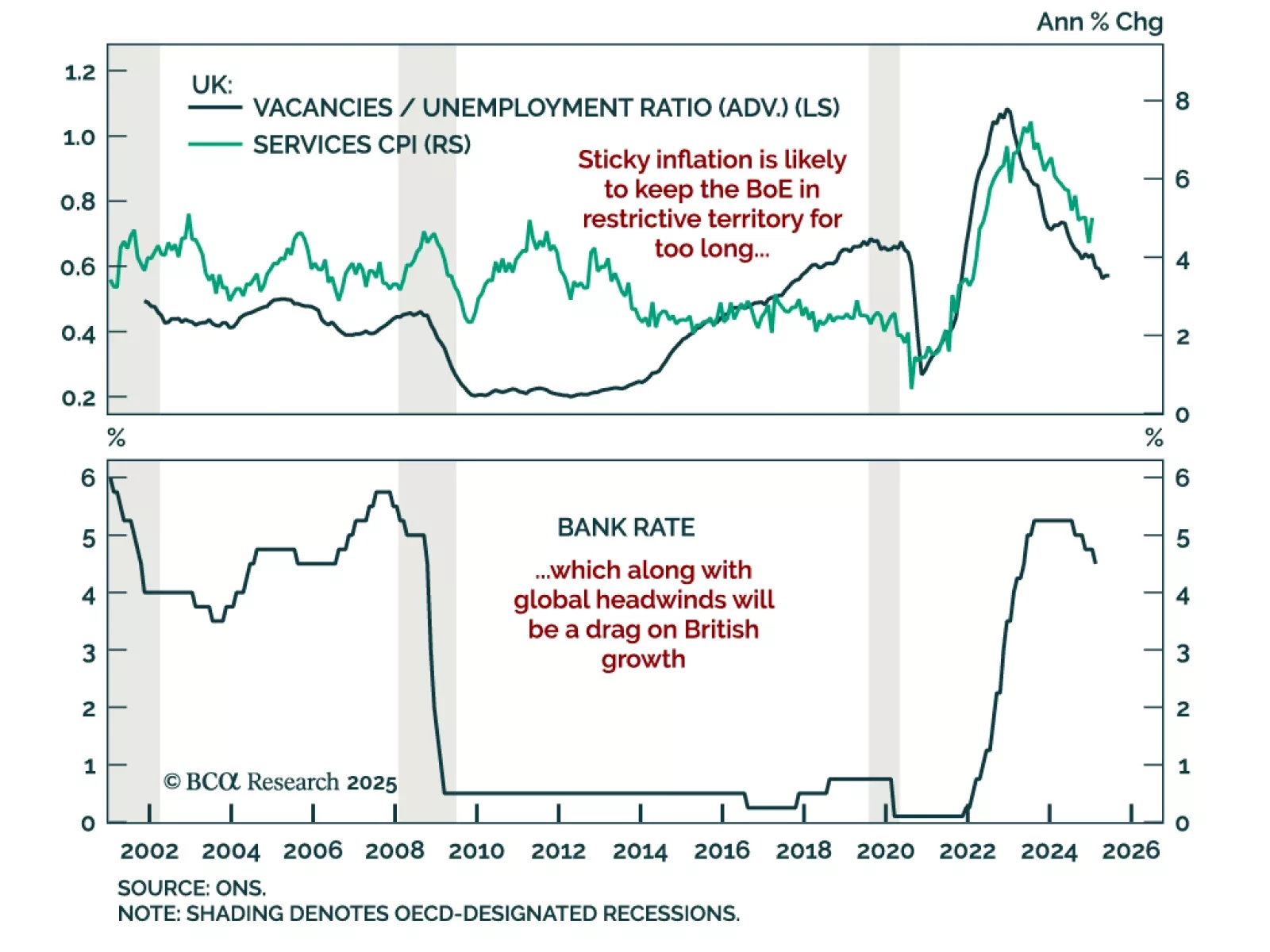

The Bank of England held its policy rate at 4.5%, with only one MPC member dissenting to cut 25 bps. The BoE signaled a slower pace of easing, as inflation remains elevated while global growth becomes increasingly uncertain. …