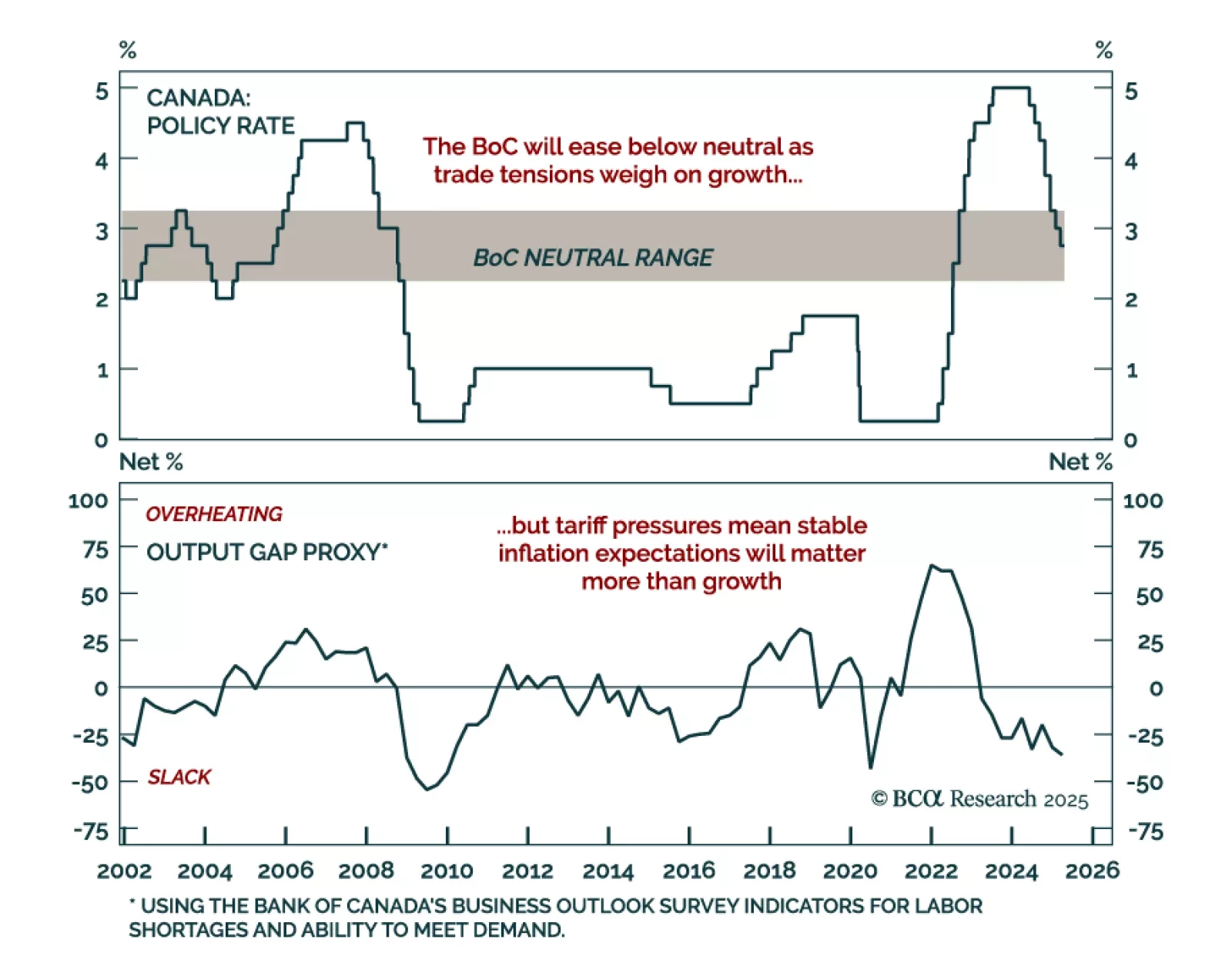

After seven consecutive cuts brought policy into neutral territory, the BoC held its deposit rate at 2.75% reinforcing our neutral-to-negative stance on Canadian government bonds. With policy now within the 2.25%-3.25% neutral range…

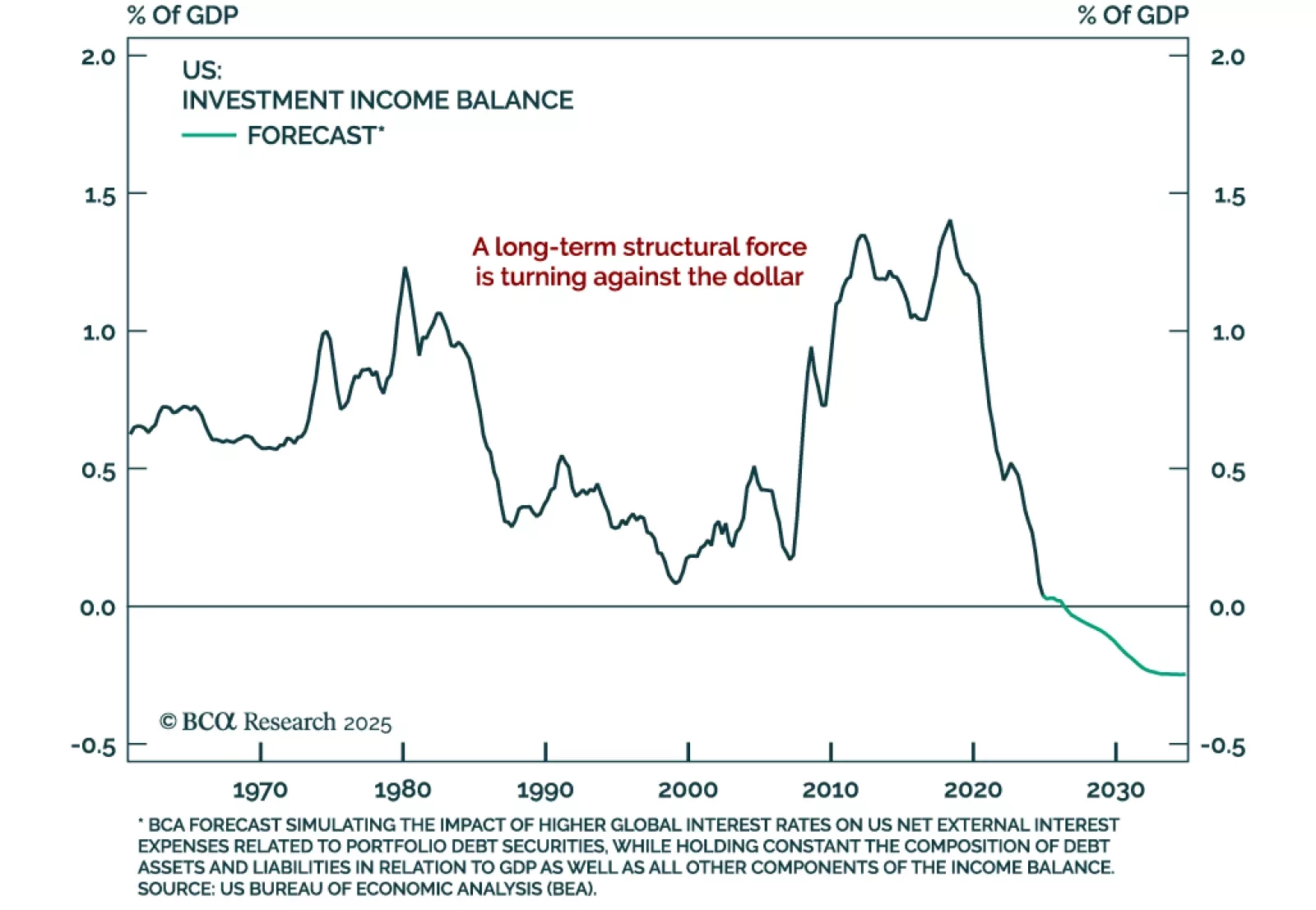

The US dollar’s reserve status is not done, but its foundations are starting to crack. Our Chart Of The Week comes from Juan Correa, Chief Global Asset Allocation Strategist. Most defensive currencies, like the yen and the Swiss…

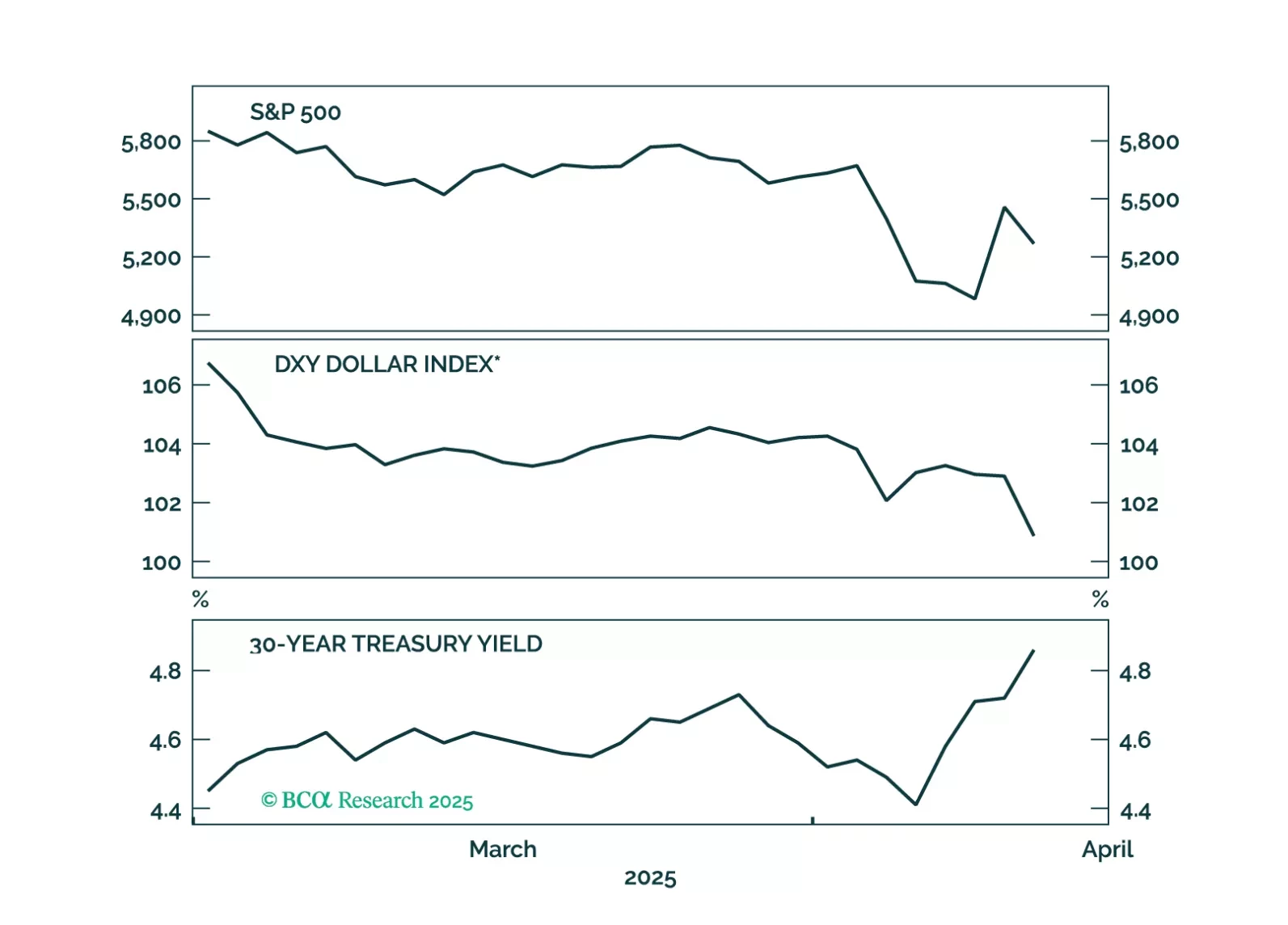

Our Global Investment Strategists remain defensive, expecting a global recession in the coming months unless the trade war de-escalates meaningfully. They maintain a year-end S&P 500 target of 4450, with downside risk to 4200.…

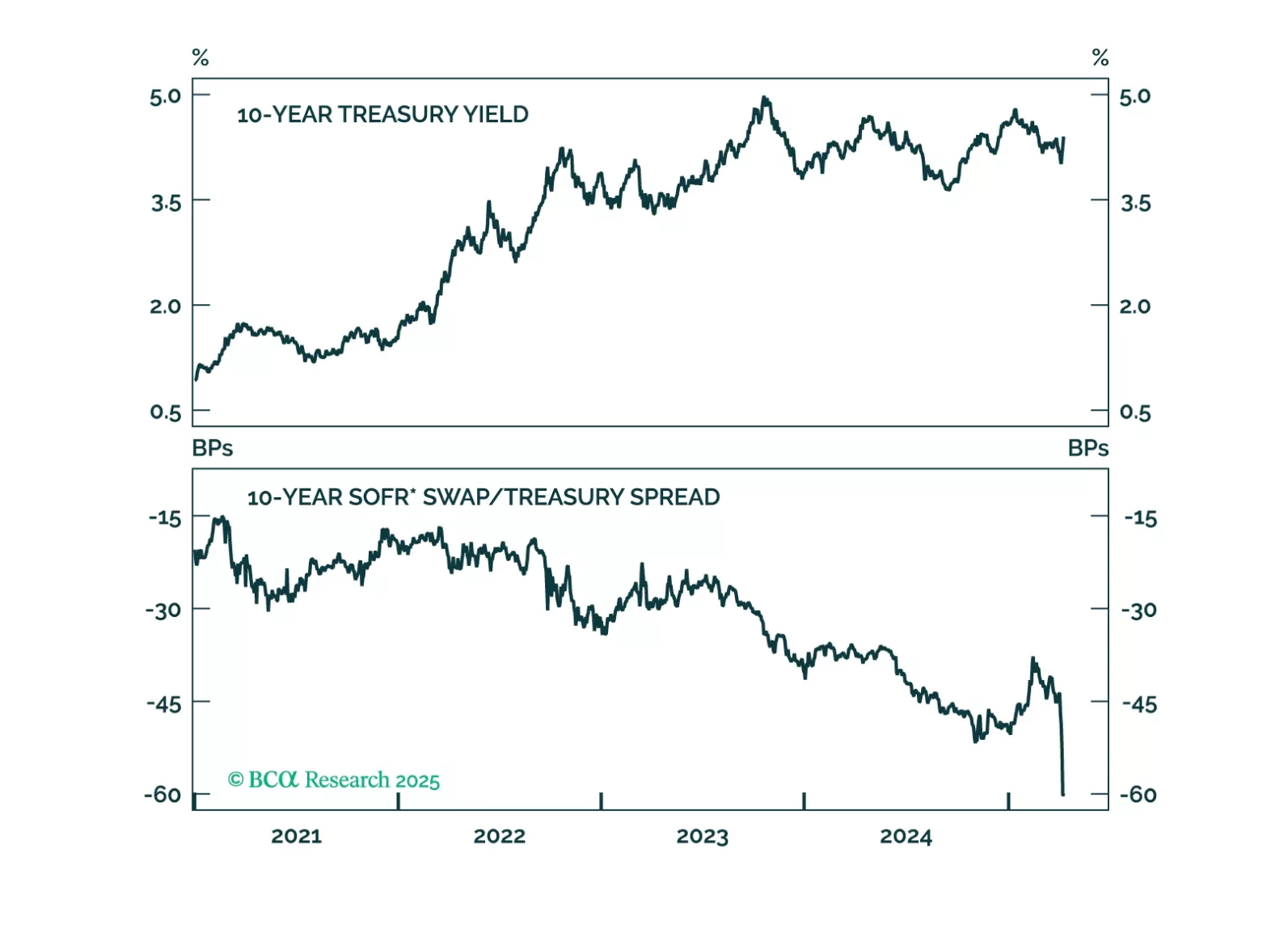

The combination of dollar weakness and rising US yields suggests global investors are questioning the safe-haven status of US Treasuries.

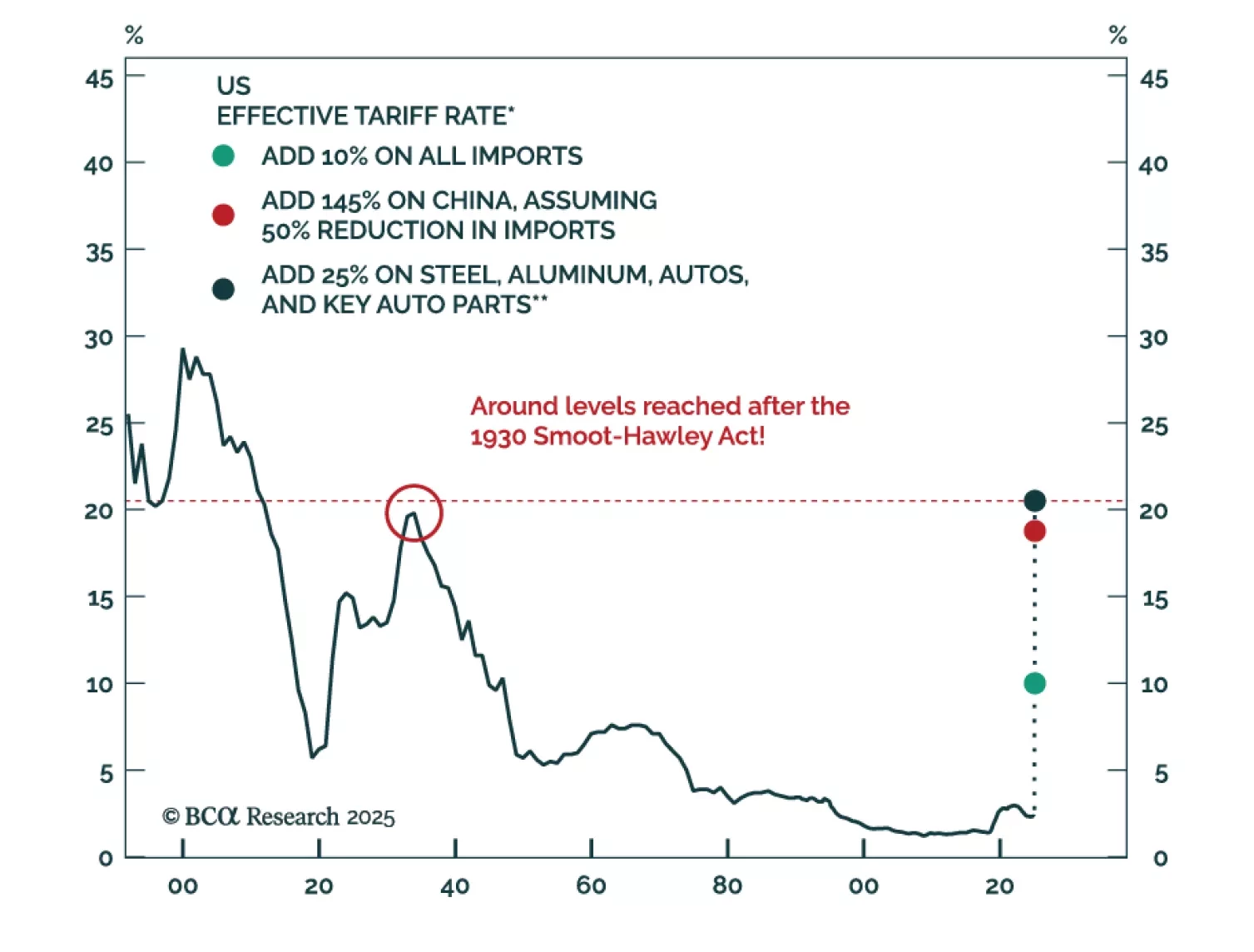

Barring a dramatic further de-escalation of the trade war, the US and much of the rest of the world will enter a recession over the next few months. Investors should remain defensively positioned for now.

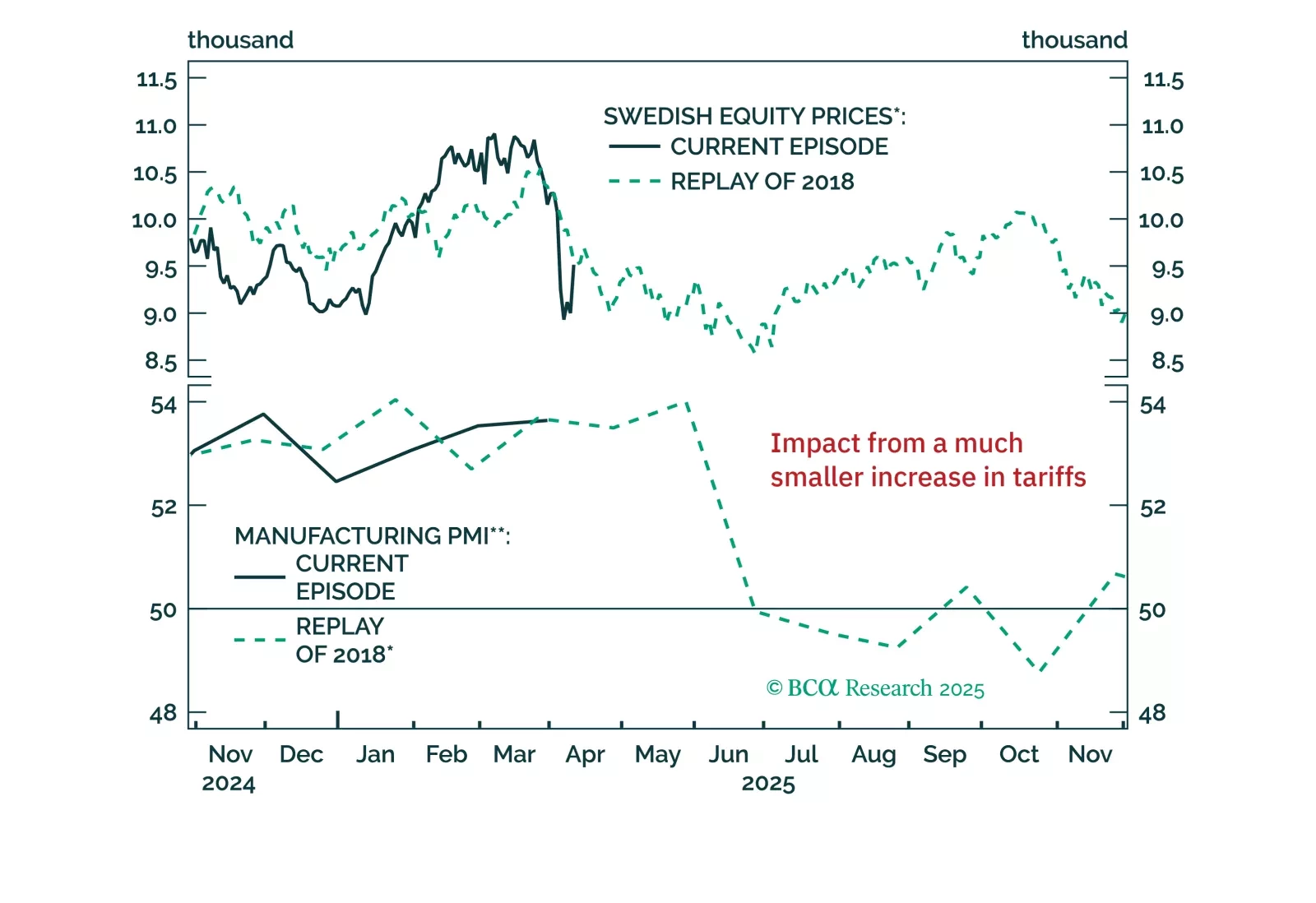

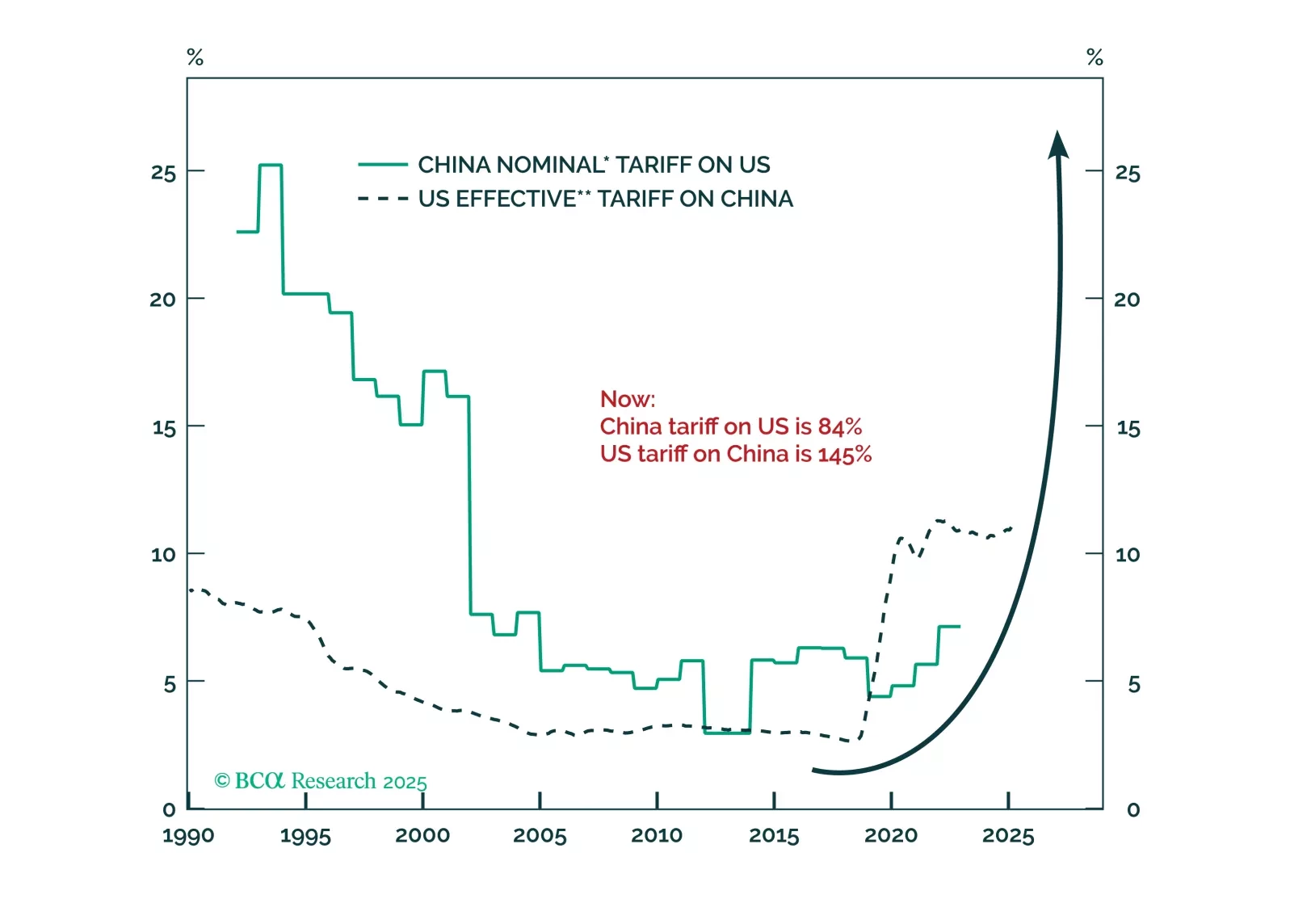

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

Our Portfolio Allocation Summary for April 2025.

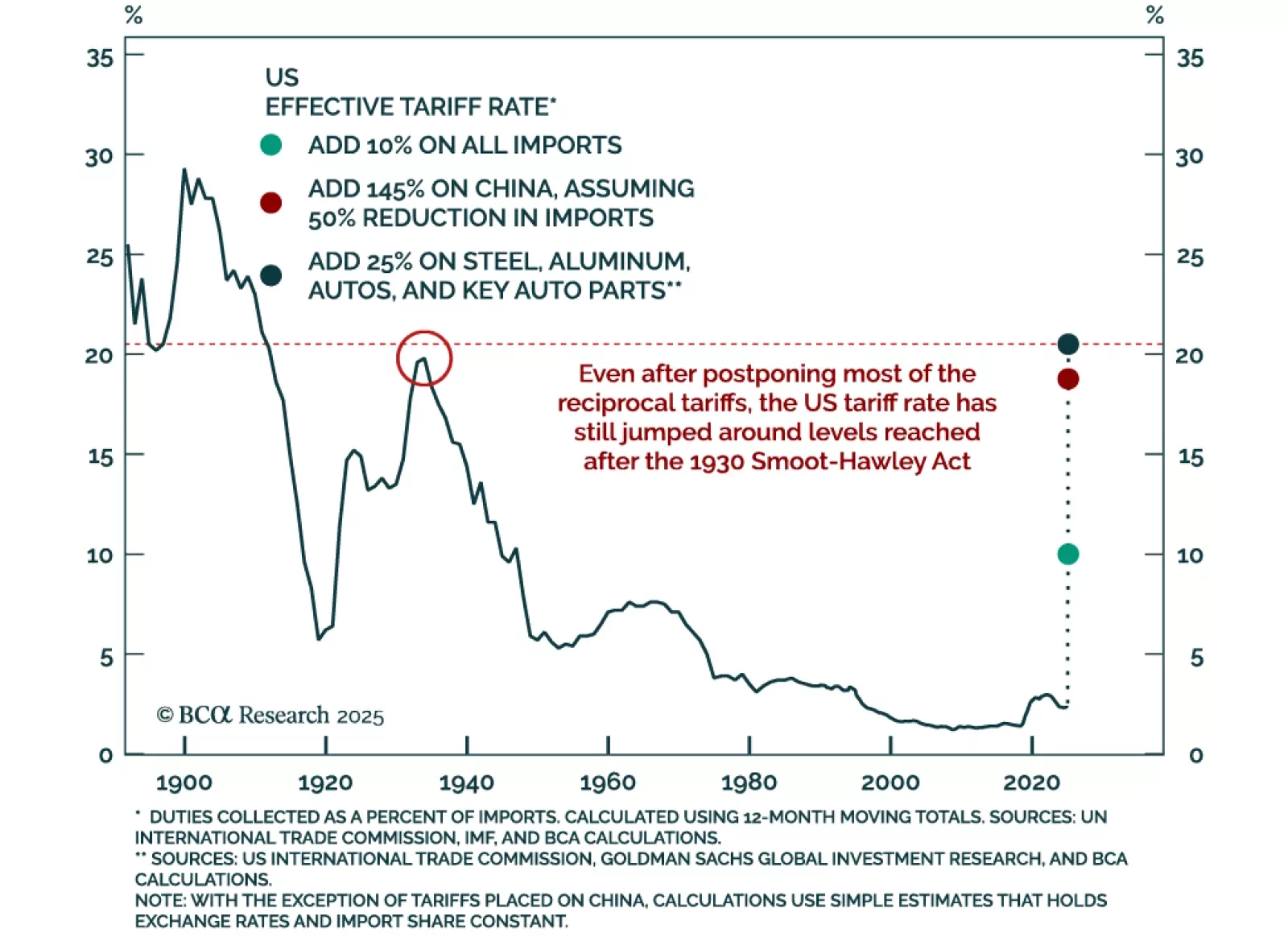

President Trump imposed tariffs on the world in his first 100 days, as we expected. Tariffs may have catalyzed a recession in the US, given the weakness in consumer sentiment and demand. Trump will soon backpedal and grant exemptions…

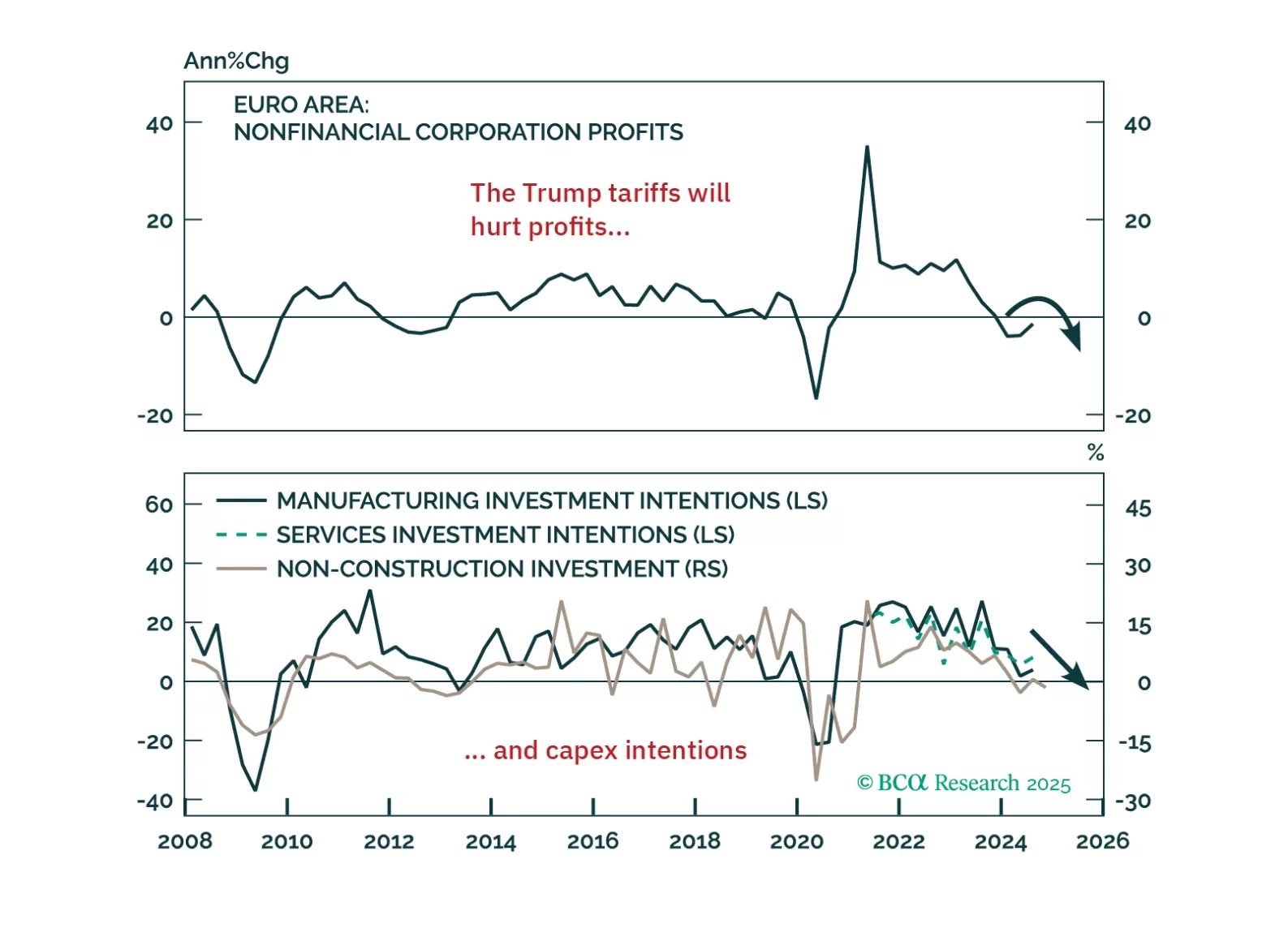

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…