Emergency pandemic fiscal and monetary policy measures buffered households and nonfinancial corporate businesses in ways that have acted to lengthen the lags between monetary policy changes and their effect on the economy. We believe…

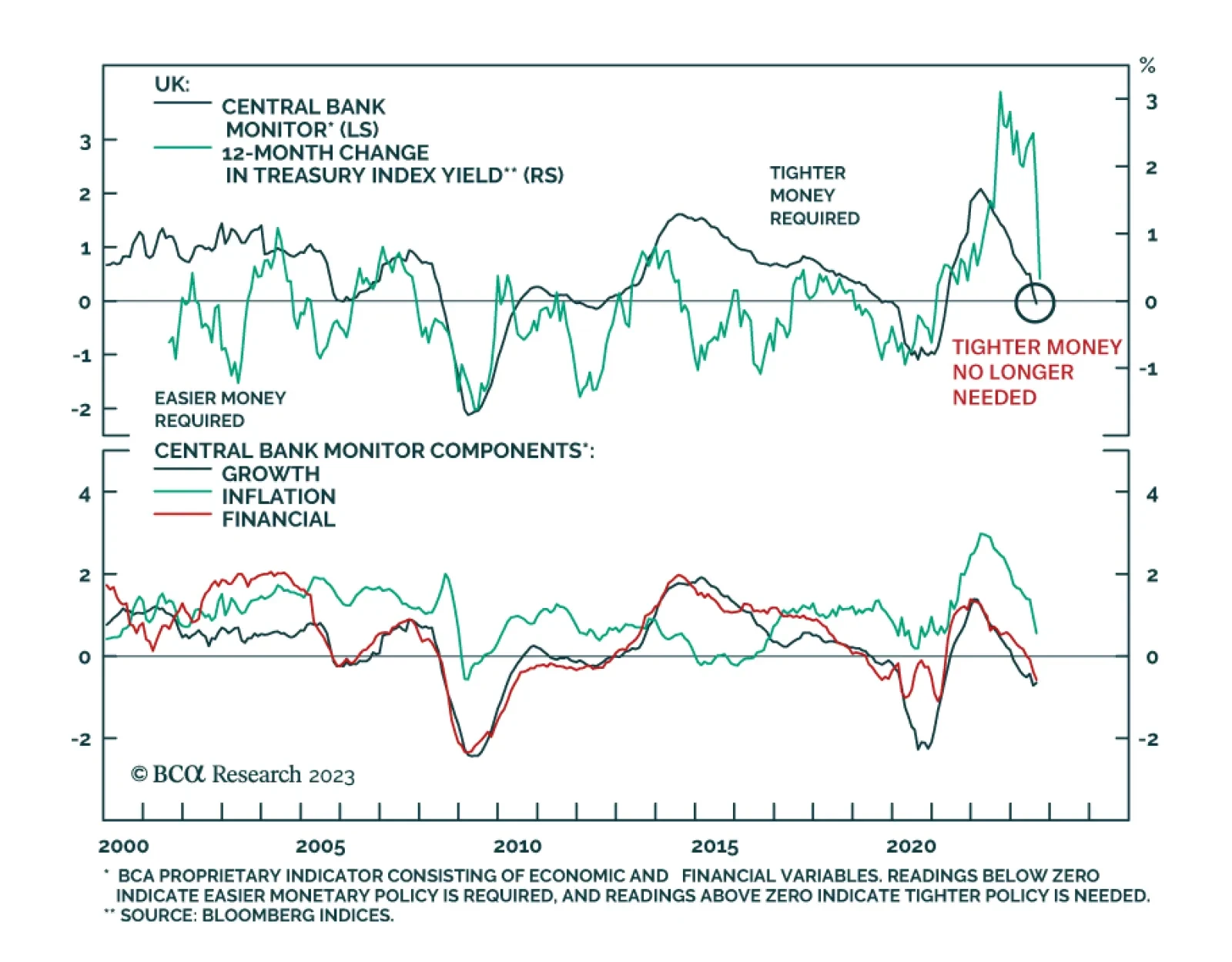

The Bank of England’s Monetary Policy Committee voted 5-4 in favor of maintaining its bank rate at 5.25% on Thursday. The four members that voted against the pause all preferred a 25-basis point rate increase. The tight…

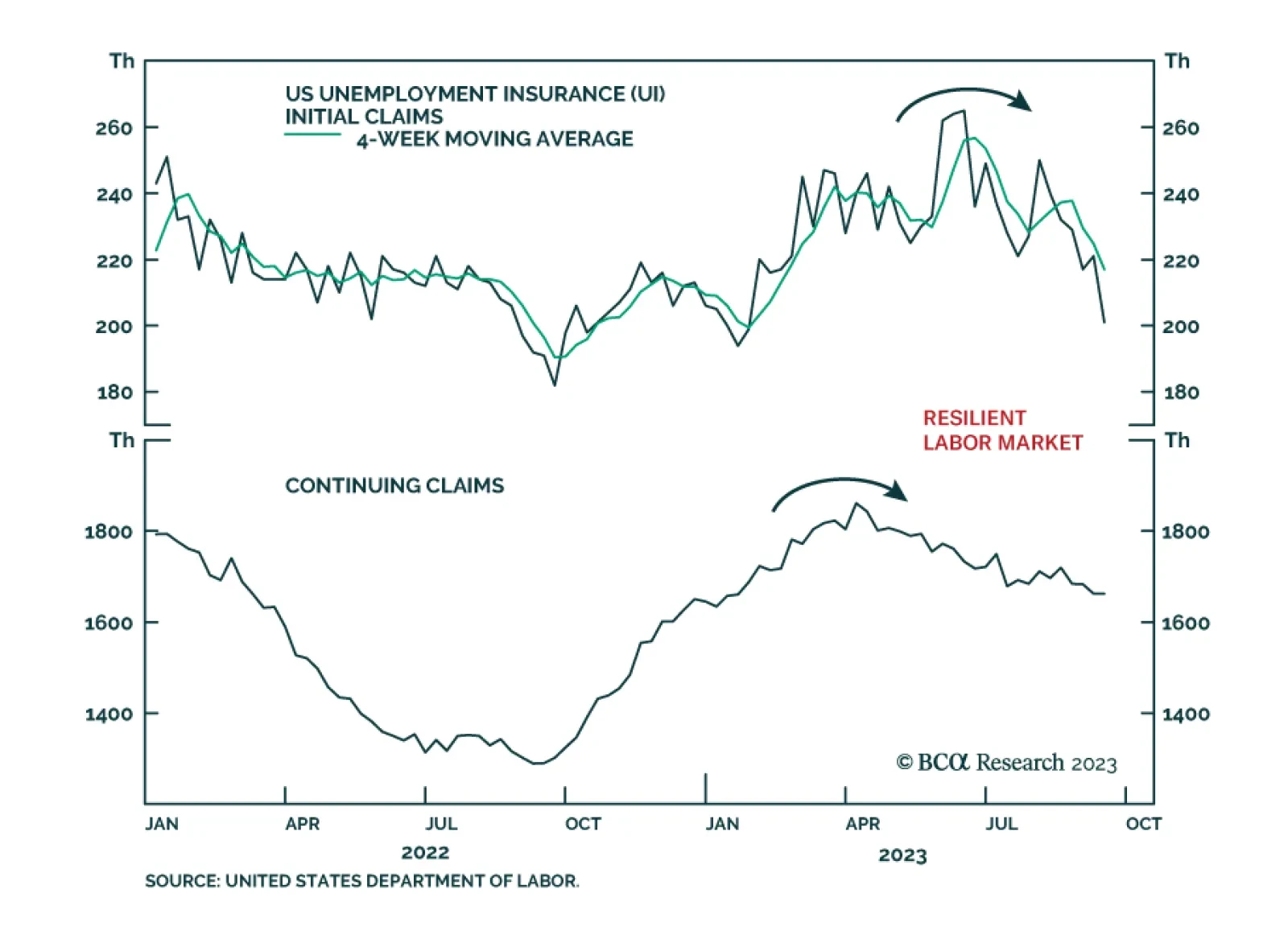

Thursday’s release of US weekly jobless claims and continuing claims delivered a positive surprise about labor market conditions. The decline in initial jobless claims to an eight-month low of 201 thousand came in below…

We continue to expect Brent crude to trade just above $101/bbl in 4Q23, and to average $118/bbl in 2024. Higher volatility looms. We expect Russia will cut oil production next year as part of a concerted effort to undermine Biden’s…

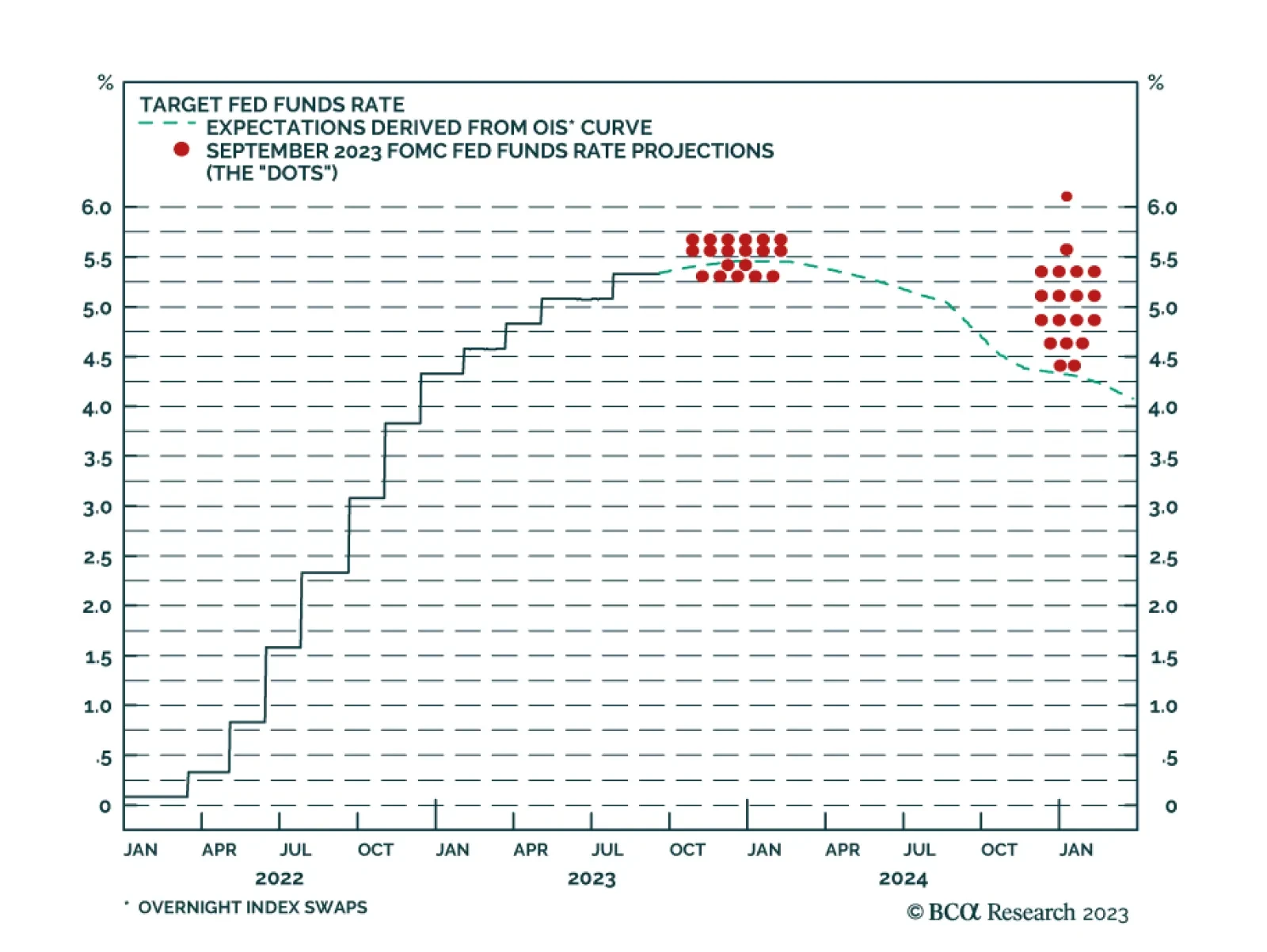

According to BCA Research’s US Bond Strategy service, the 2006/07 roadmap remains a good one for bond investors. The Fed held the funds rate steady this afternoon and made no material changes to its policy statement.…

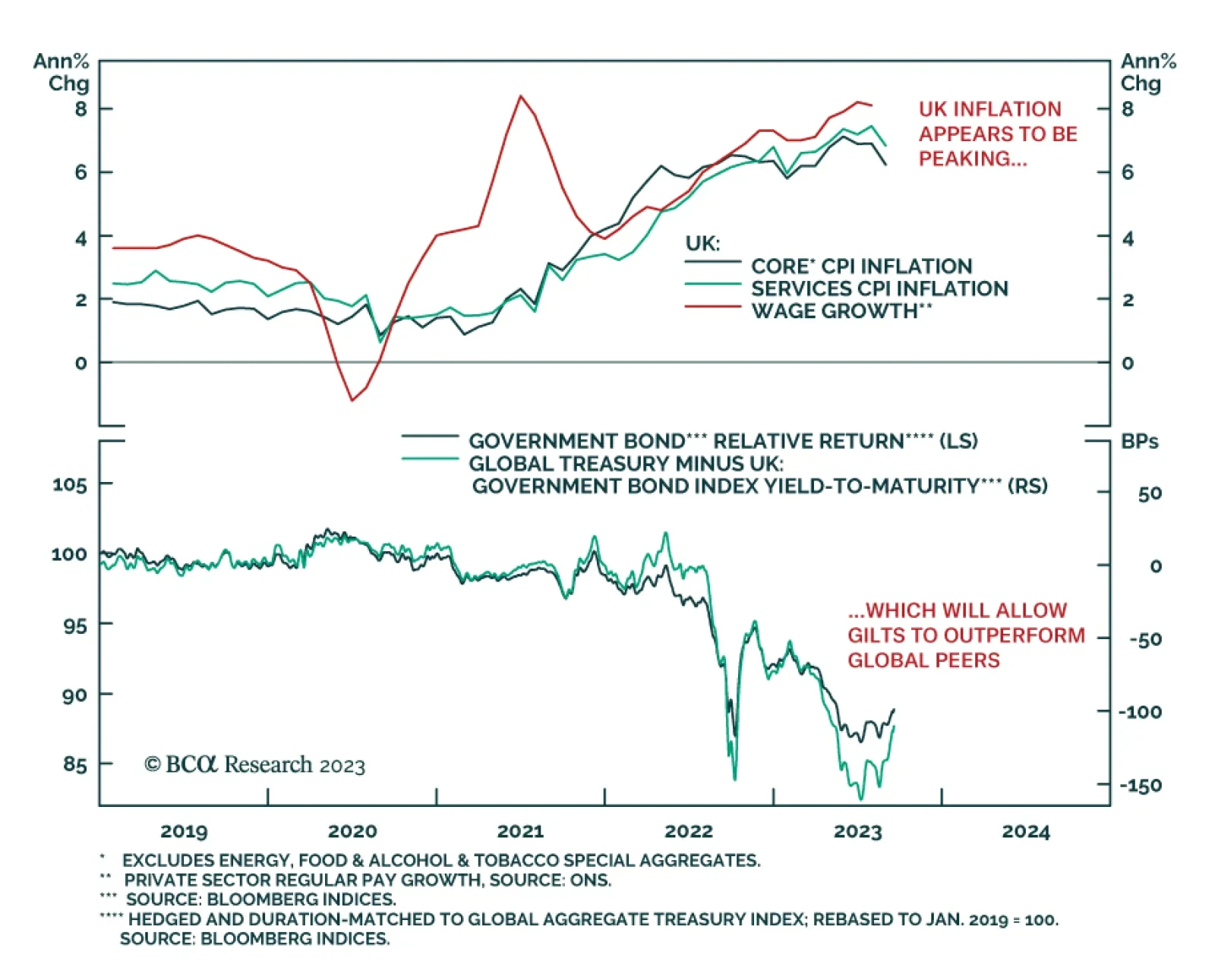

The August UK inflation report produced a large downside surprise. Headline CPI rose +0.3% month-on-month, versus expectations of a +0.7% increase. Year-over-year headline CPI inflation slowed to 6.7% from 6.8%, a sizeable miss…

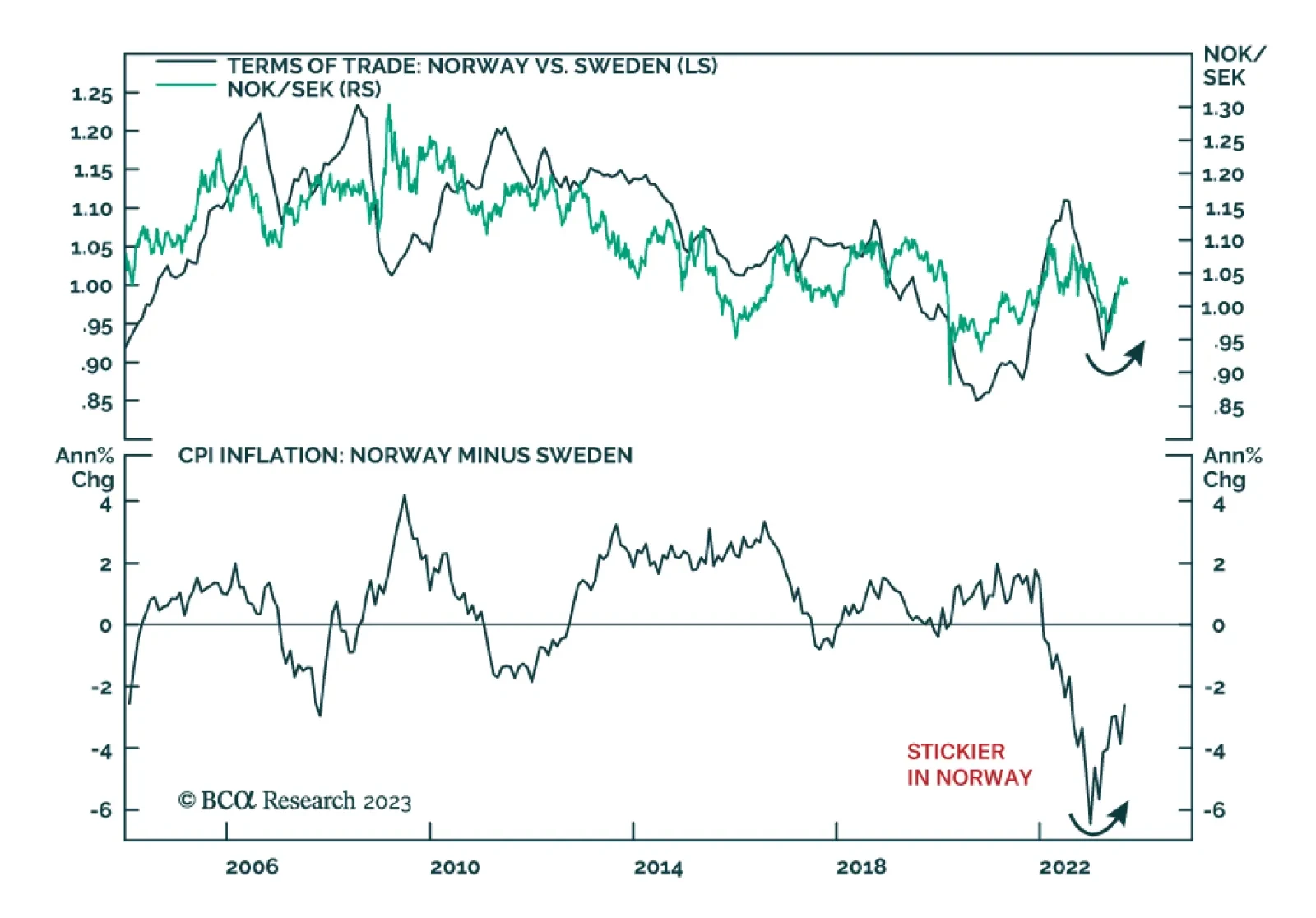

Scandinavian currencies are bearing the brunt of the recent US dollar strength. The Swedish krona and Norwegian krone are the worst performing G10 currencies since the DXY’s mid-July bottom, losing 8.6% and 7.6% of their…

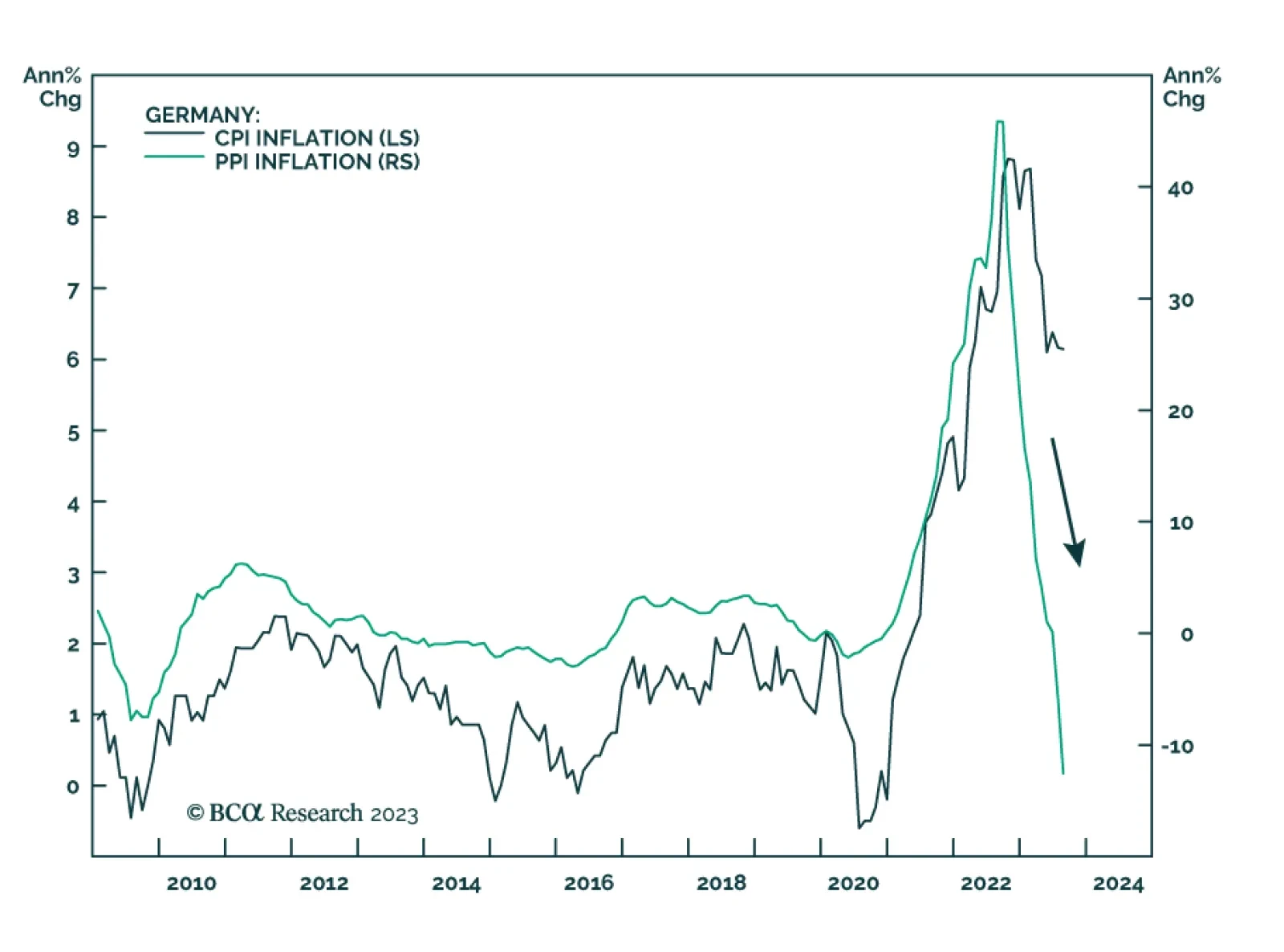

Collapsing German producer prices continue to indicate that inflationary pressures are moderating in the Eurozone. Total PPI declined by a record 12.6% y/y in August following a 6.0% y/y drop in July. While the annual decline…

A discussion of today’s FOMC meeting and its investment implications.

The biggest misunderstanding in the markets right now is that to keep expected inflation well-anchored at 2 percent, inflation must undershoot 2 percent for some time. This implies that interest rate futures curves are mispriced, and…