In Section I, we note that the recent surge in long-maturity government bond yields is symptomatic of a sharp reduction in market expectations for a soft-landing economic outcome. This underscores that the US and other developed…

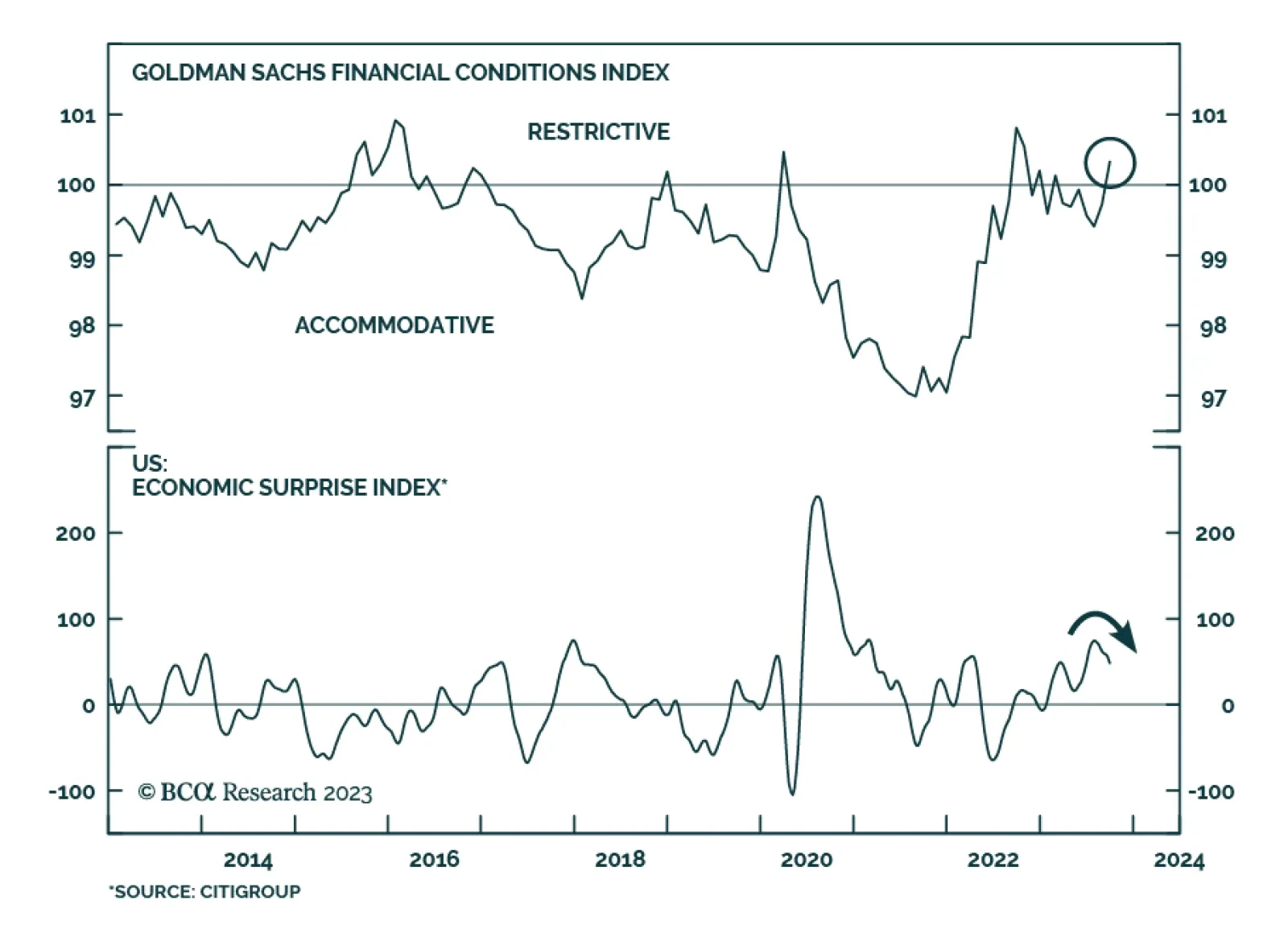

Financial conditions tightened meaningfully in the first three quarters of 2022 as market participants anticipated an aggressive monetary tightening cycle. However, this tightening phase ended in late-2022. Indeed, economic…

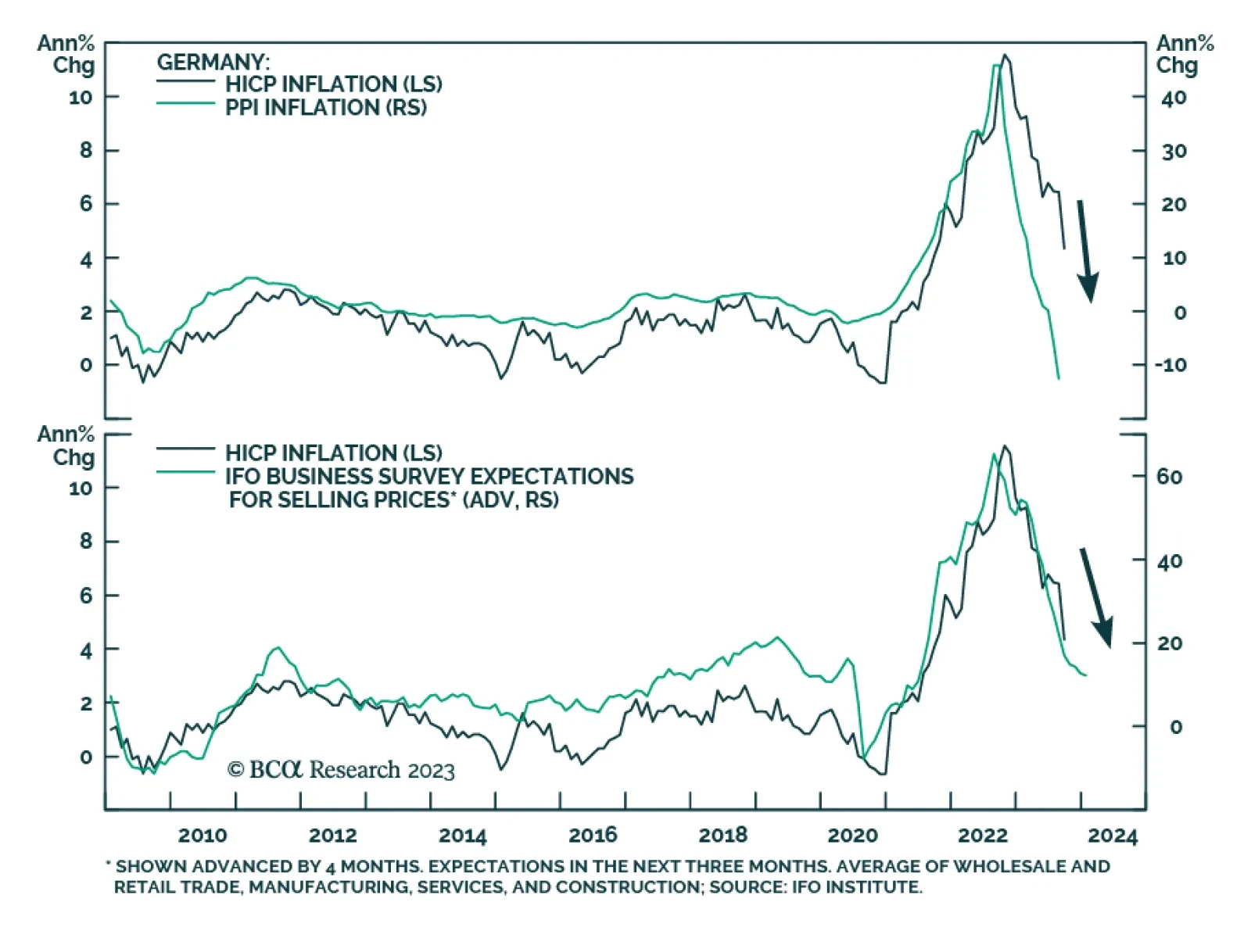

German inflation delivered an optimistic signal about the disinflation trend on Thursday. The headline CPI EU harmonized index collapsed from 6.4% y/y to 4.3% y/y in September– its lowest level since September 2021 and…

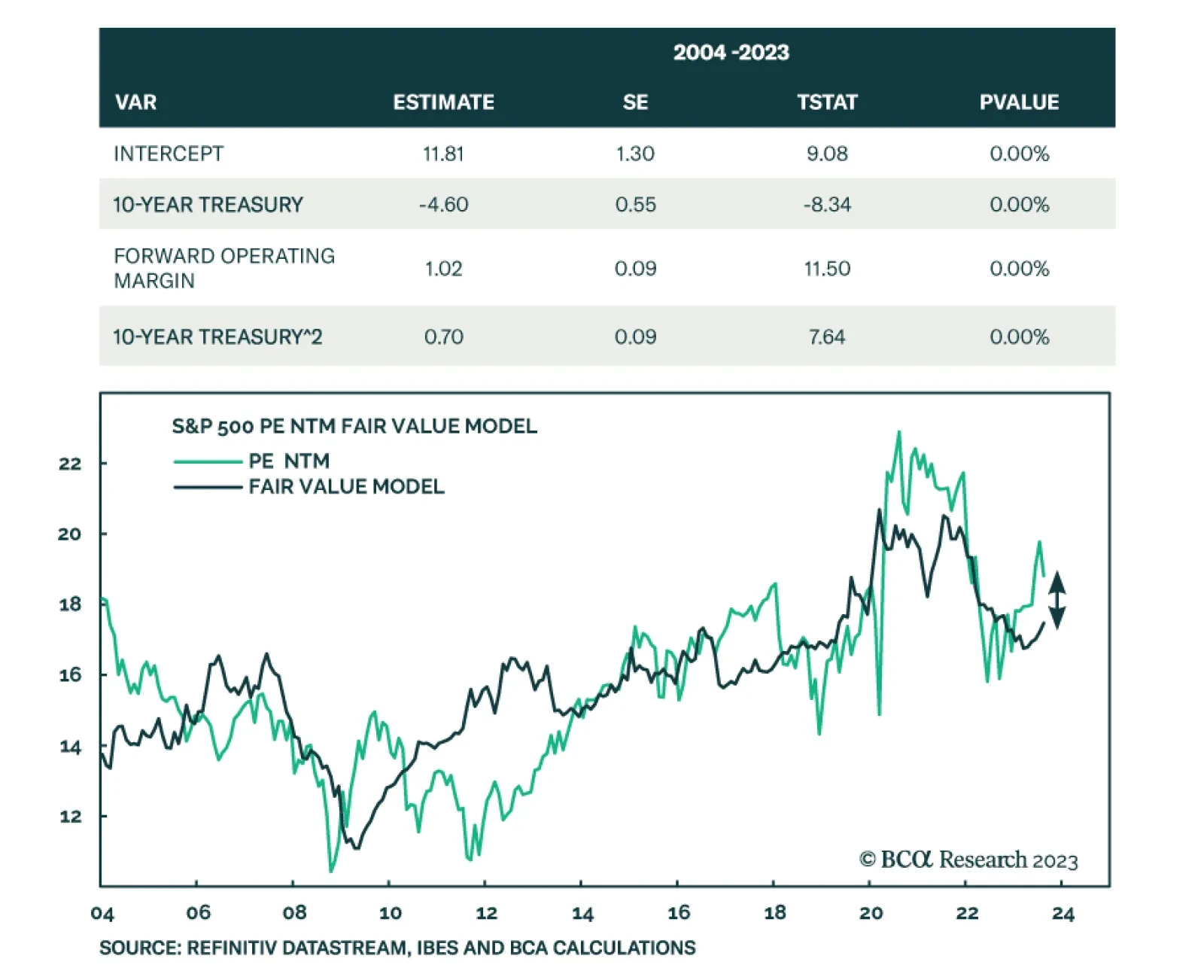

One of the few things US equity investors agree upon these days is that the S&P 500 is expensive whether it is relative to history, other asset classes, or the level of interest rates. But how overvalued is the market? To…

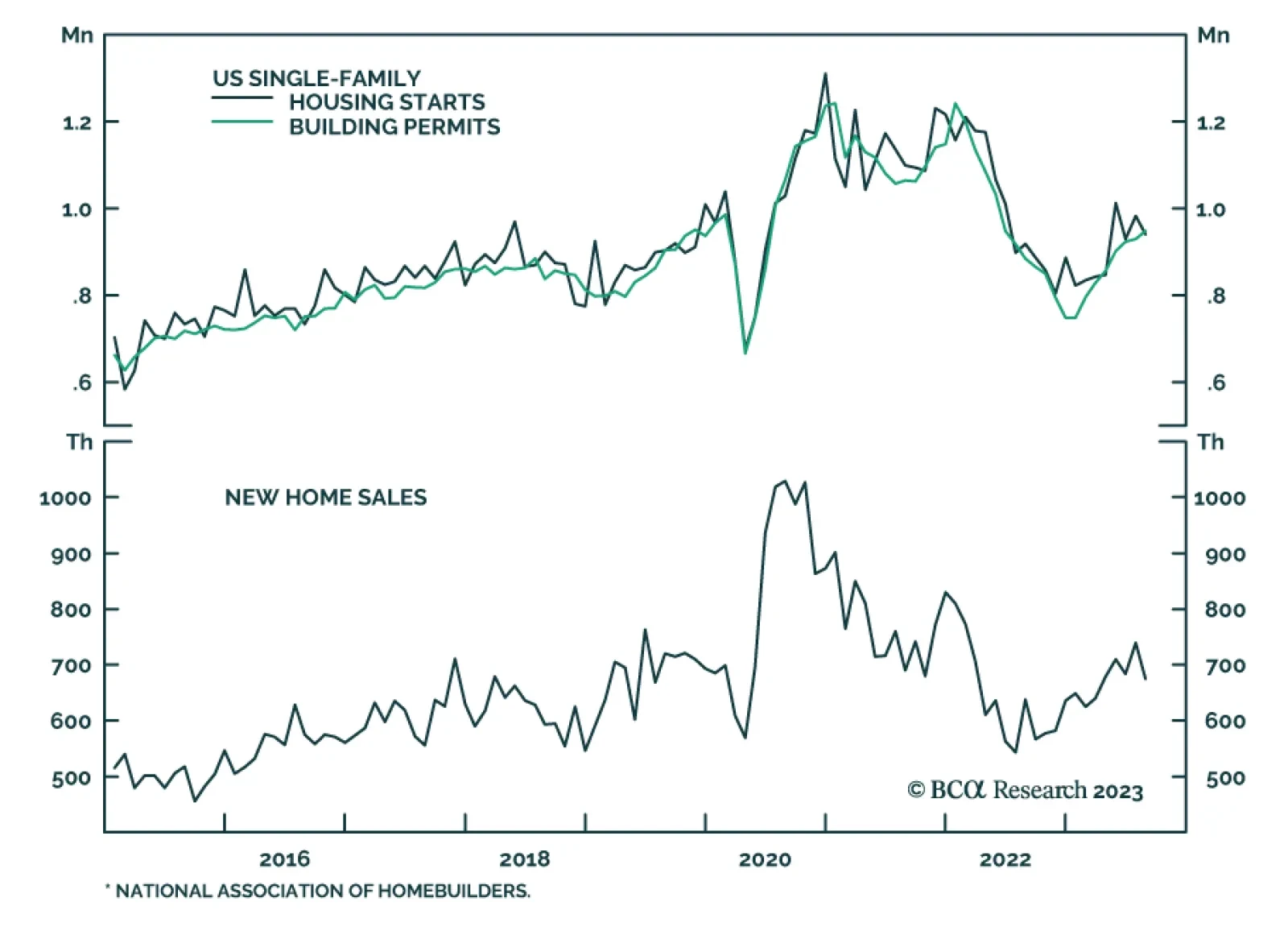

On the surface, US housing market data is sending conflicting signals. On the one hand, both the FHFA as well as the S&P CoreLogic gauges of US house prices surprised to the upside in July and are now expanding on both a…

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

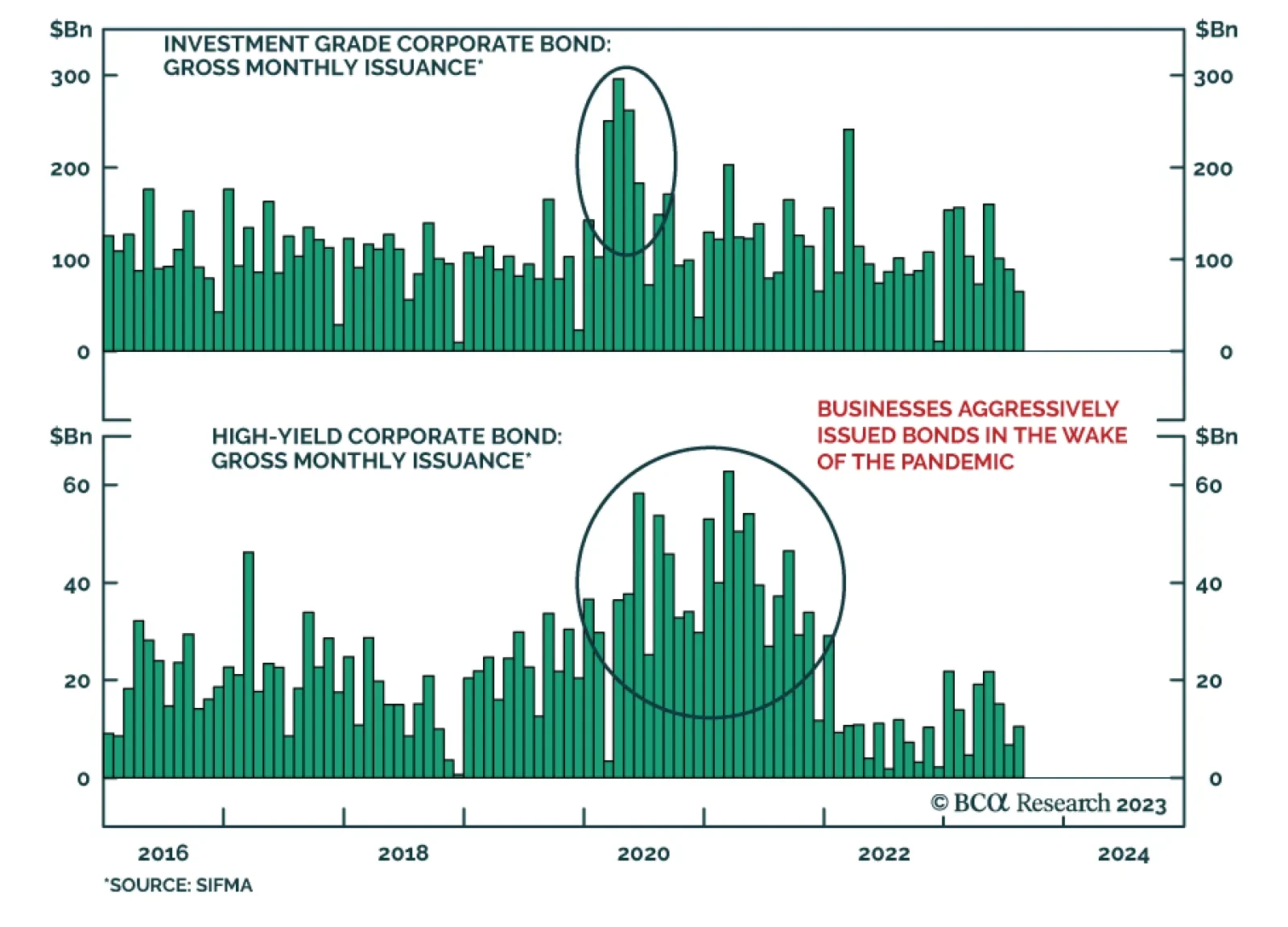

According to BCA Research’s US Investment Strategy service, nonfinancial corporate businesses have been more insulated from rising interest rates than they typically are during major rate-hike campaigns, but the buffer is…

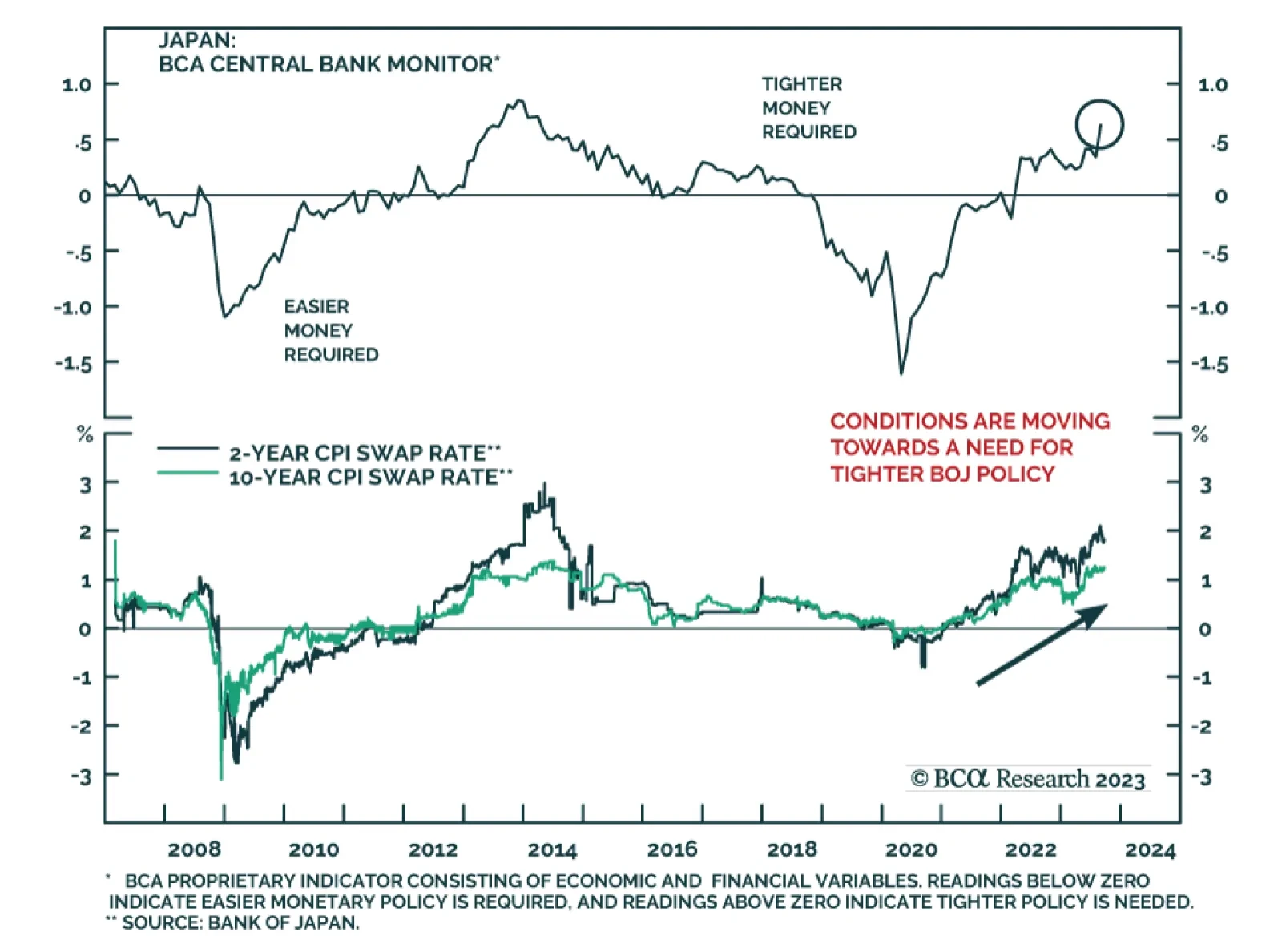

As expected, the Bank of Japan voted unanimously to keep policy unchanged on Friday. The policy rate remains at -0.1% and the central bank maintains Yield Curve Control (YCC) on 10-year JGB yields. To the extent that the BoJ…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.