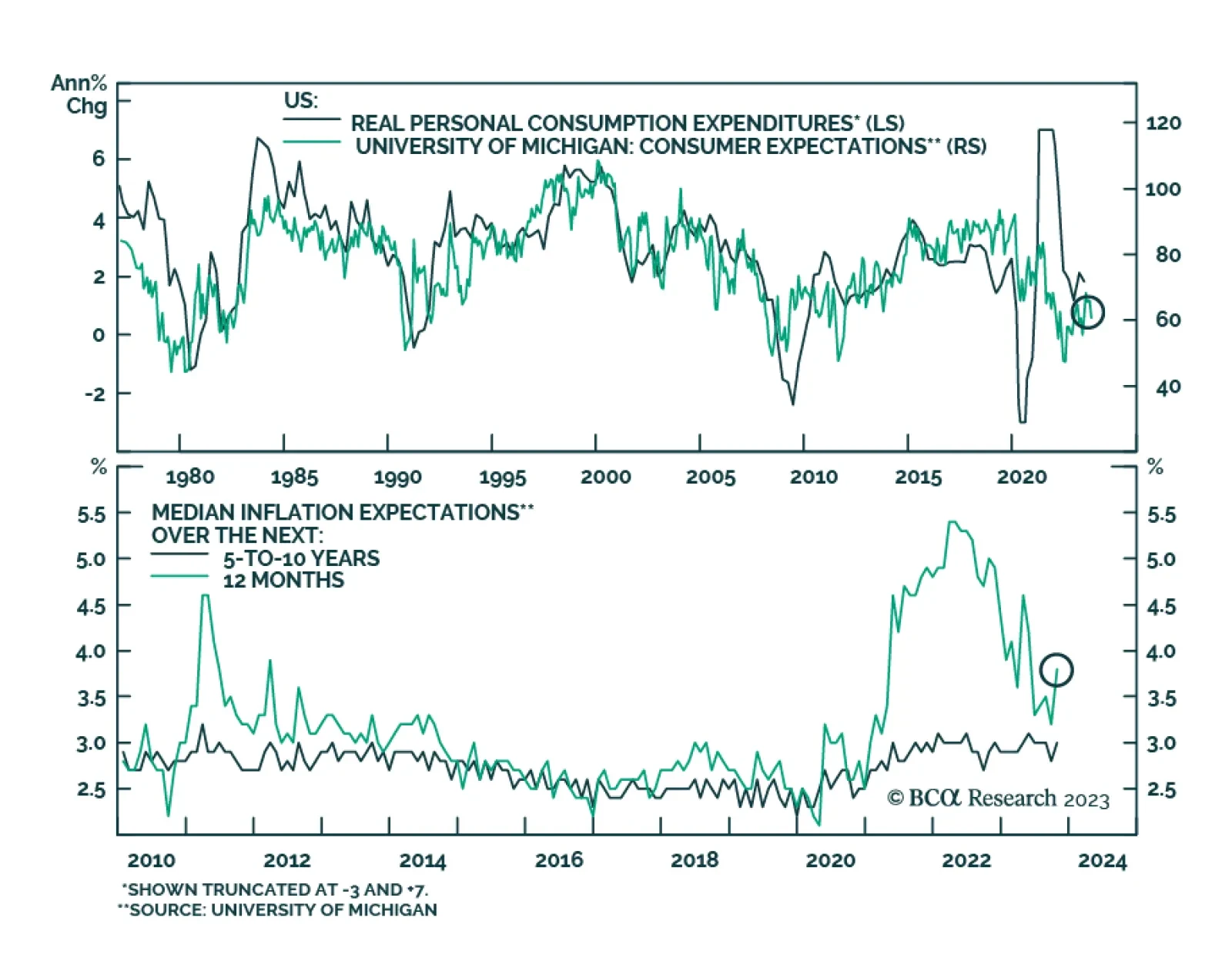

The preliminary release of the University of Michigan’s Consumer Sentiment survey delivered a negative surprise on Friday. A bigger-than-anticipated drop pushed the headline sentiment index down to a five-month low of 63.…

This week's Insight gauges the potential of a dollar breakout or breakdown and suggests a few trade ideas.

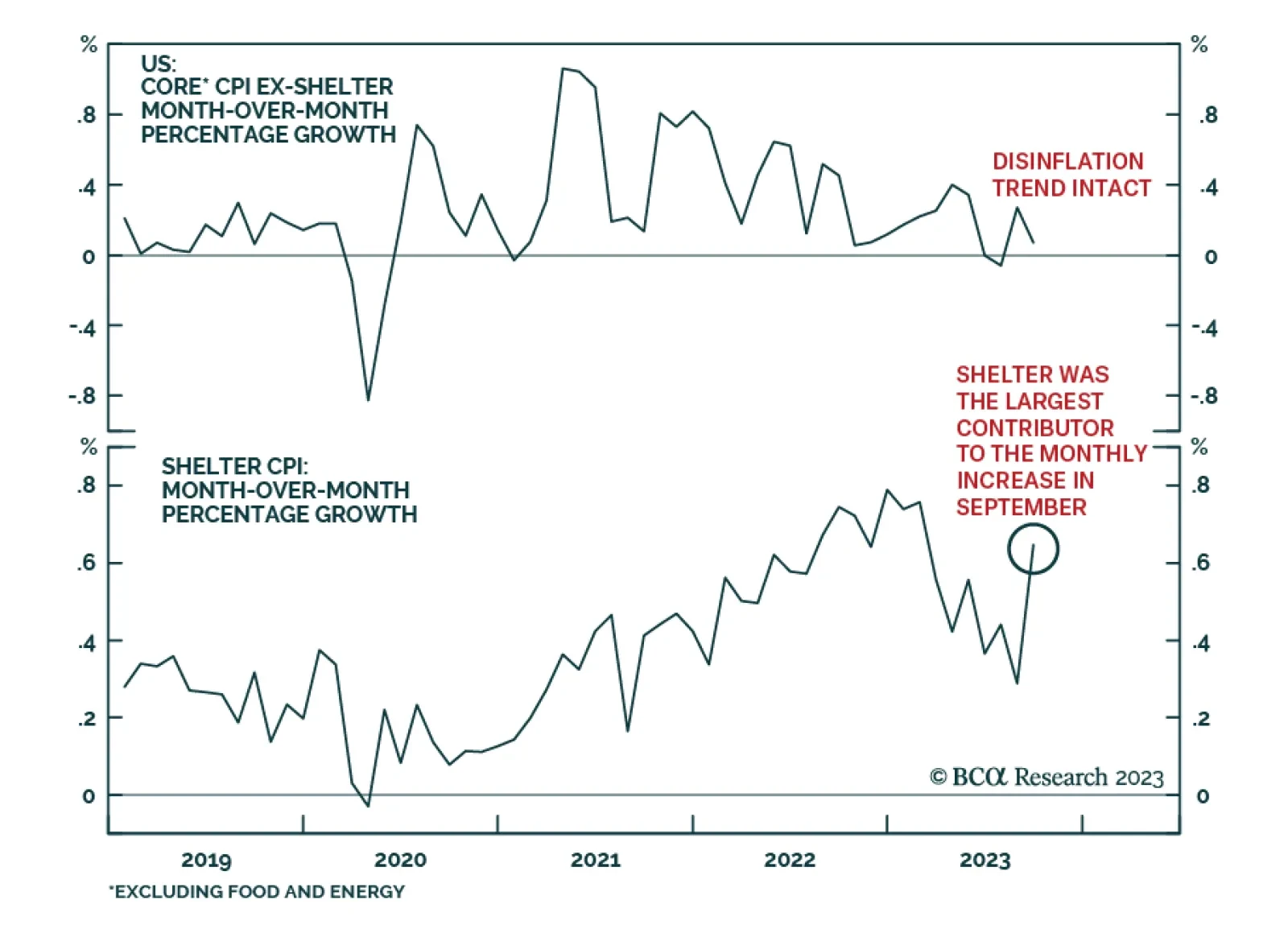

The US CPI report shows inflation was higher than anticipated in September. Although the headline index decelerated from 0.6% m/m to 0.4% m/m, it is above expectations of 0.3% m/m. The annual rate of change remains at 3.7% y/y…

Comments on recent Fedspeak, bond market moves and this morning’s CPI report.

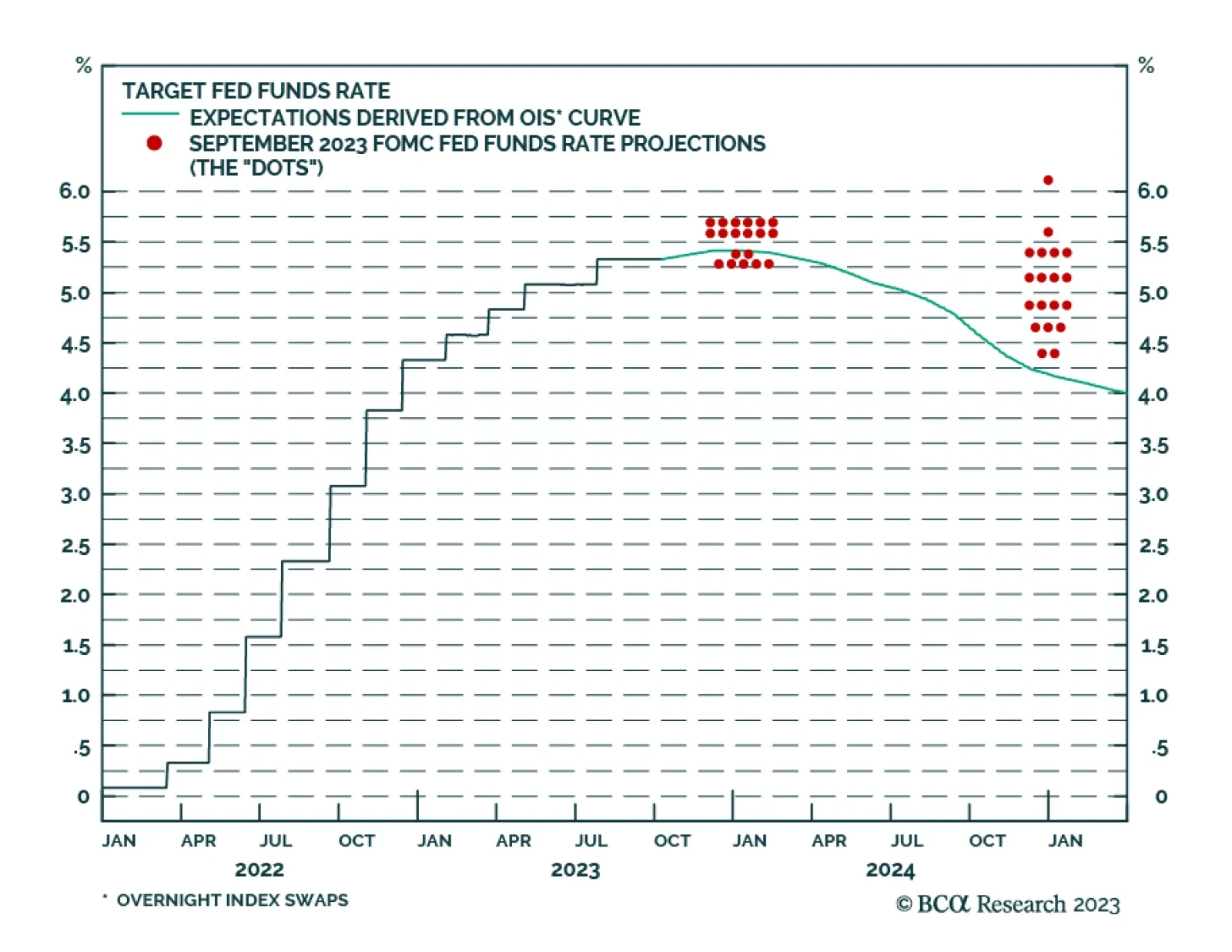

The minutes of the September FOMC meeting confirmed that the Fed intends to maintain restrictive monetary policy for longer. Although inflation has been moderating, participants continue to view it as unacceptably high and…

The sharp sell-off in long duration bonds (ticker TLT) has reached the collapsed 130-day complexity that implies a probable and playable rebound. More strategically, long-duration bonds yielding close to 5 percent are an excellent…

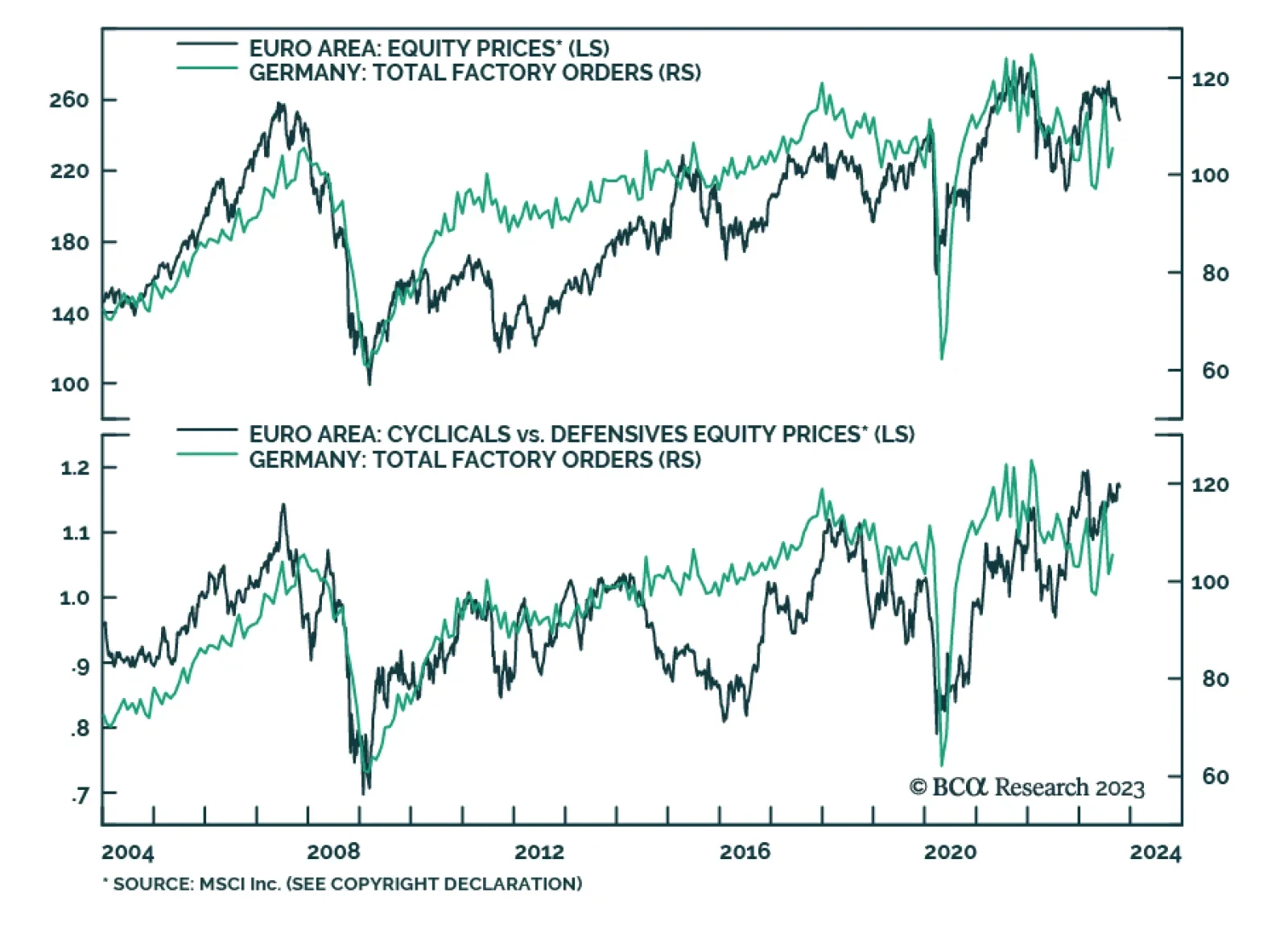

As we highlighted in a recent Insight, the stronger-than-anticipated improvement in German factory orders should be viewed with some degree of caution. Germany is the European economy most exposed to the global manufacturing…

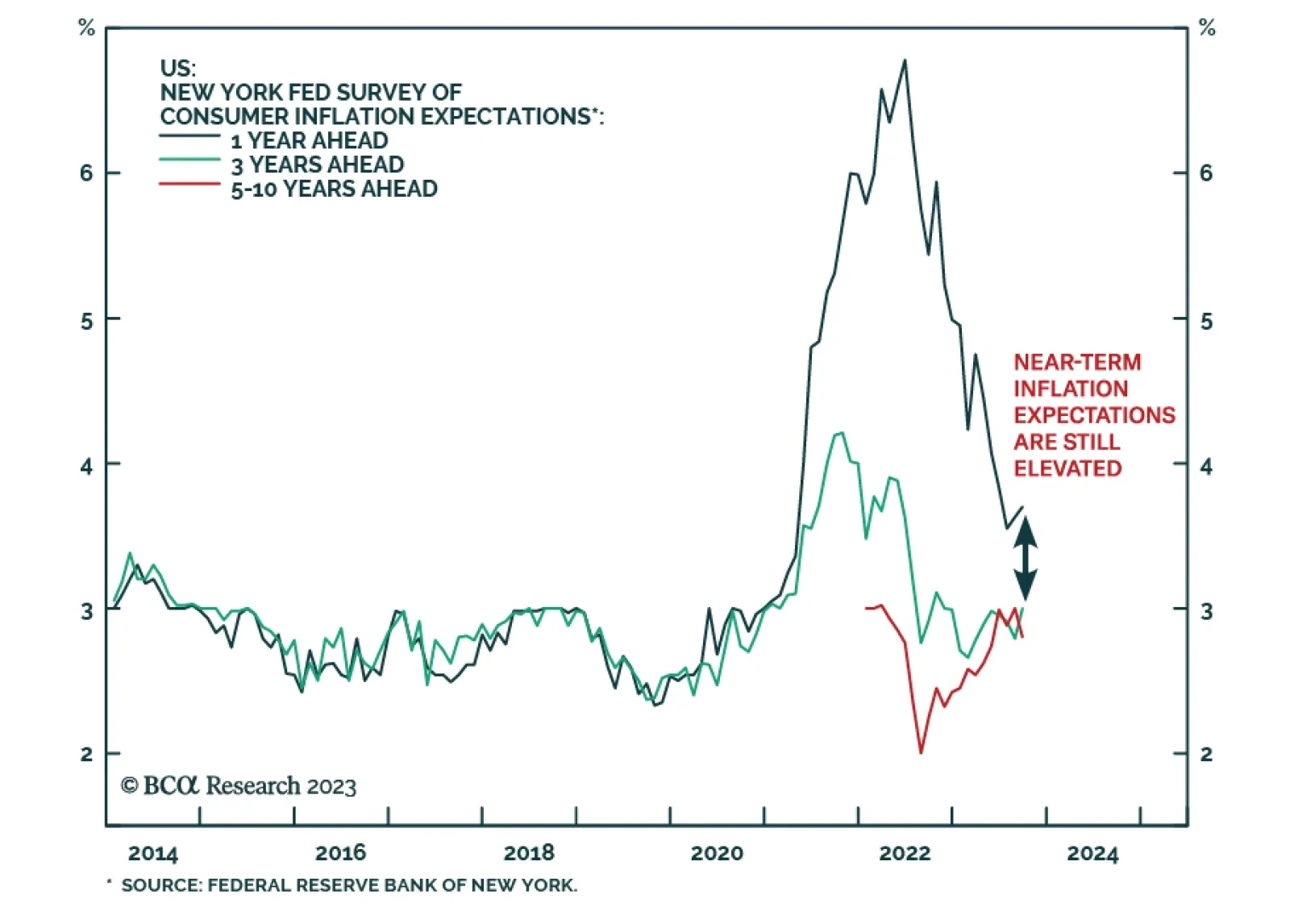

Results of the New York Fed’s survey show American consumers’ near-term inflation outlook ticked up in September. Respondents’ one-year ahead inflation expectations rose from 3.6% to 3.7%, and the three-year…

Dovish comments by several Fed officials contributed to a Treasury rally and improvement in sentiment towards risk assets on Tuesday. Globally, rumors that Beijing is planning to unleash more stimulus supported Chinese financial…

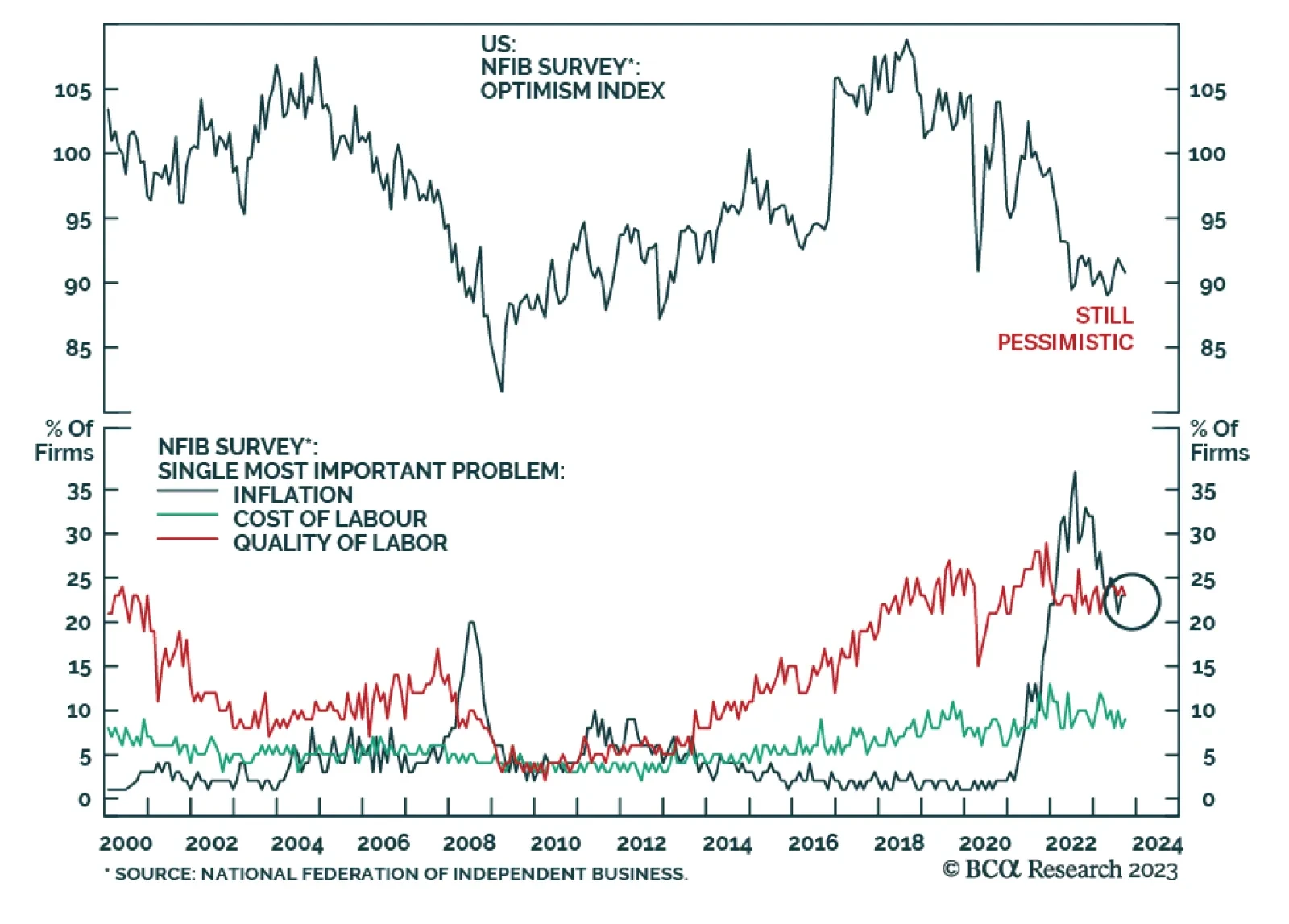

US small business optimism deteriorated for the second consecutive month in September. The NFIB index weakened by 0.5 points to 90.8, slightly below expectations of a more muted decline to 91.0. The latest move brings the index…