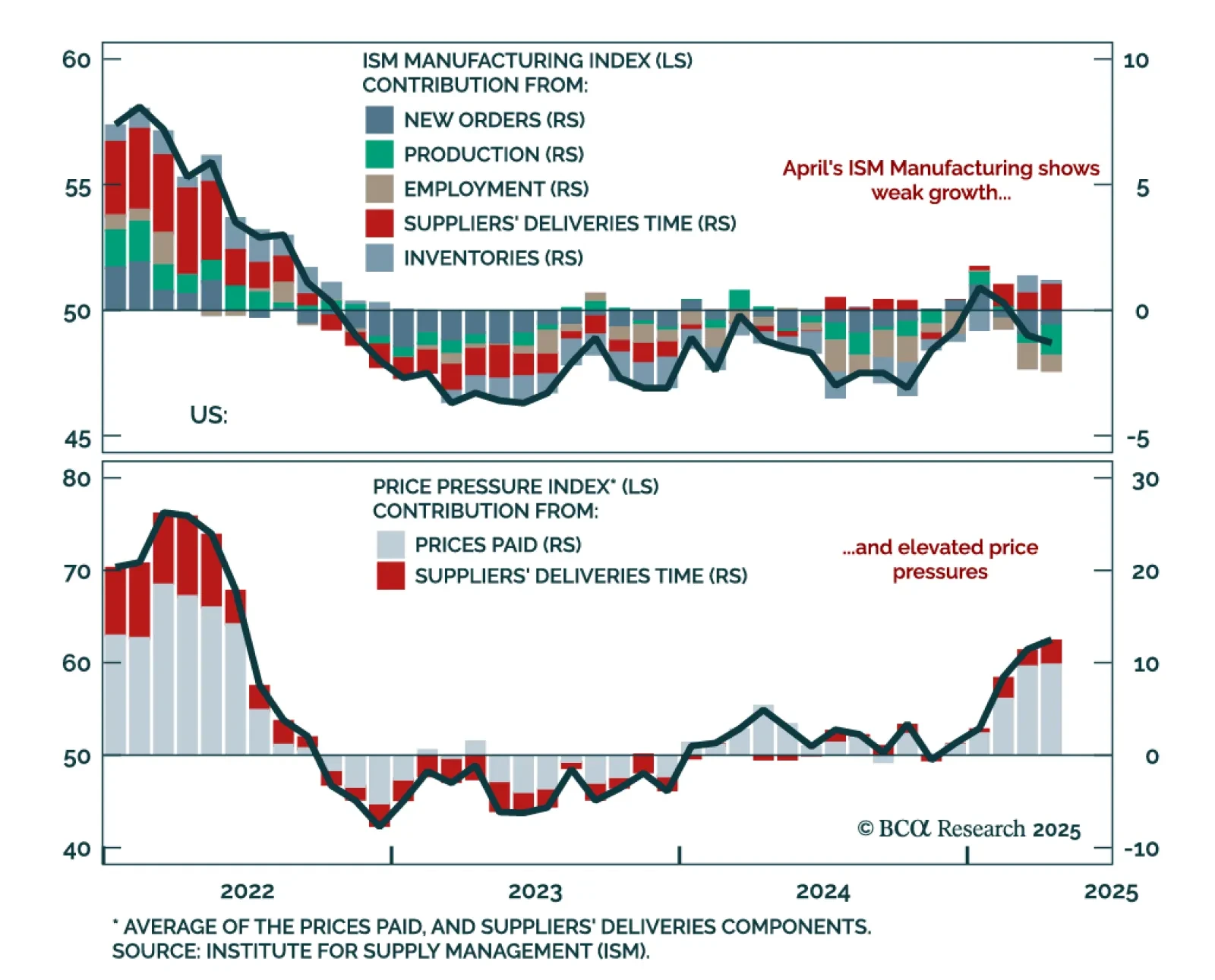

The April ISM Manufacturing adds to recession risks: Collapsing export orders and weak domestic momentum reinforce our defensive positioning. The index slipped to 48.7 from 49.0, with new orders still contracting and new export…

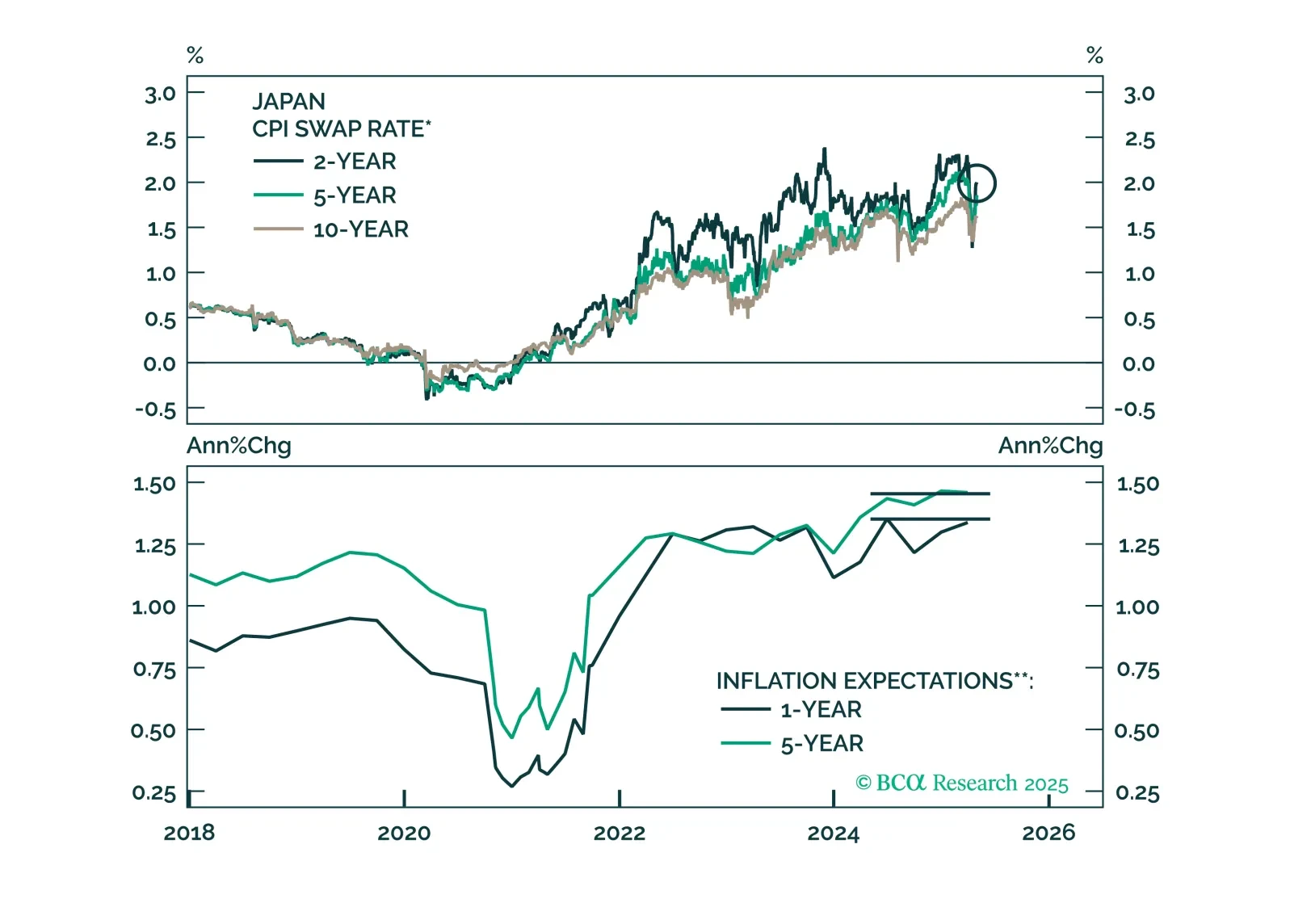

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen…

This year’s corporate bond sell off has hit high-yield more than investment grade, and high-yield spreads have turned relatively more attractive as a result.

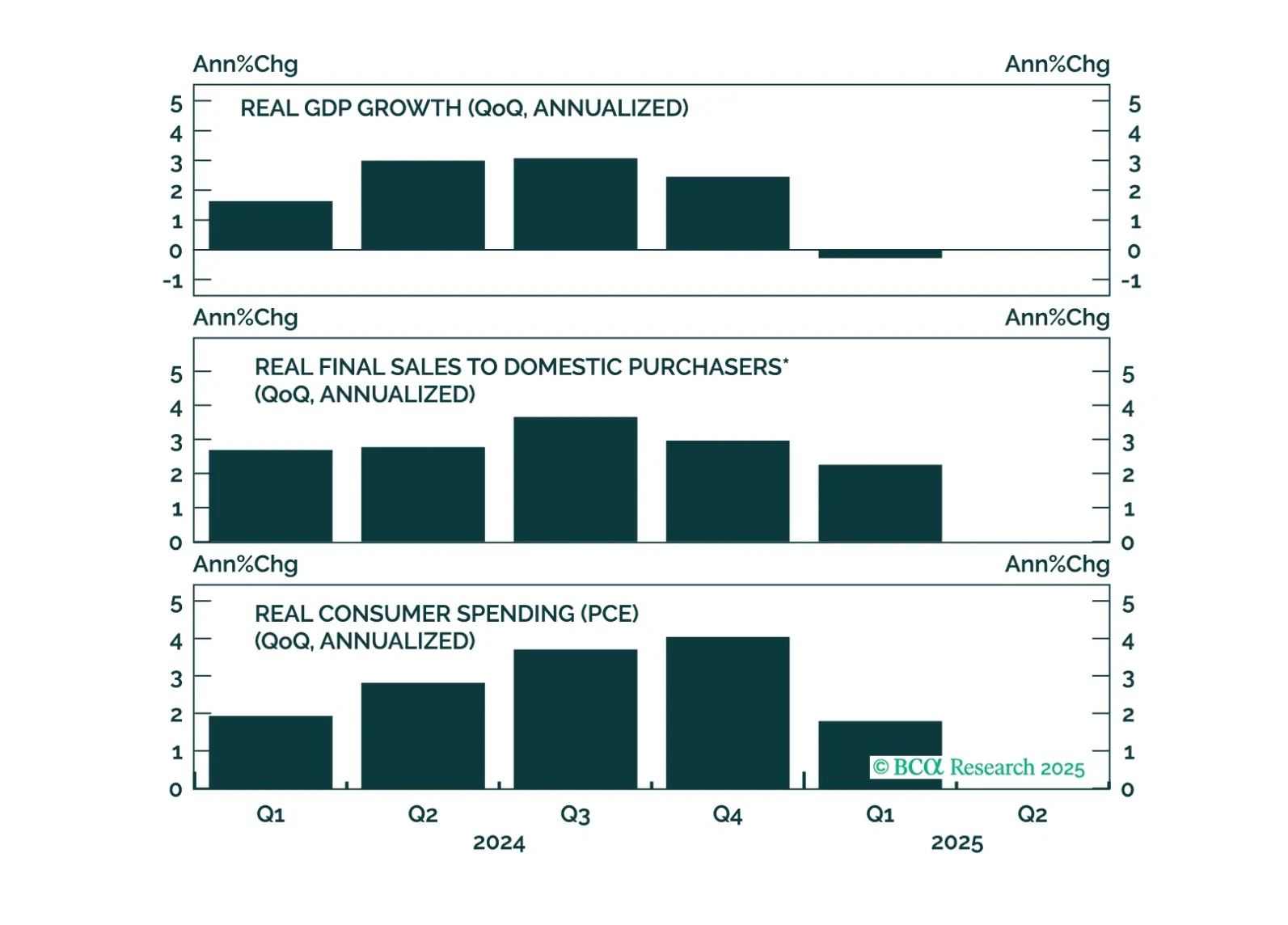

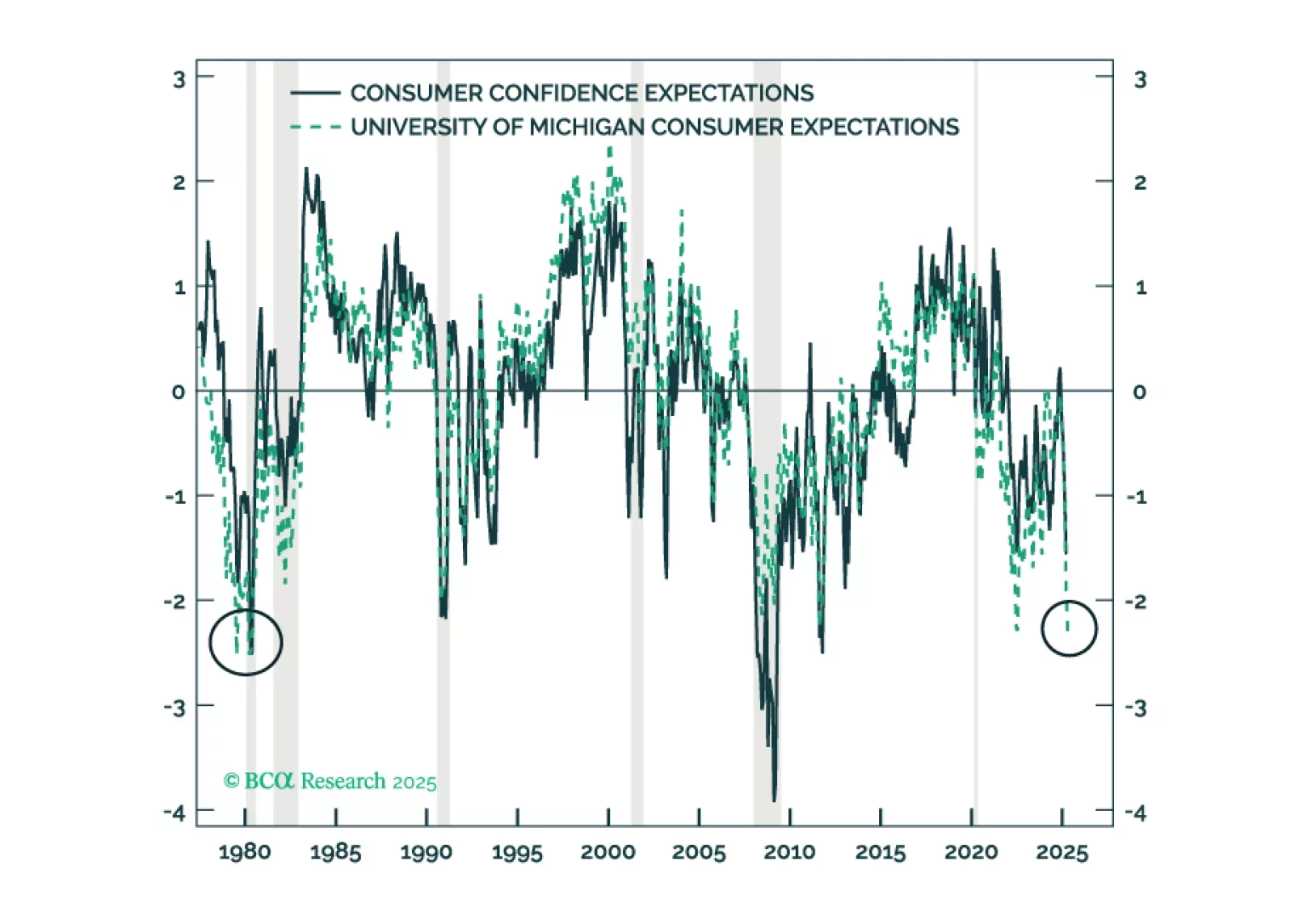

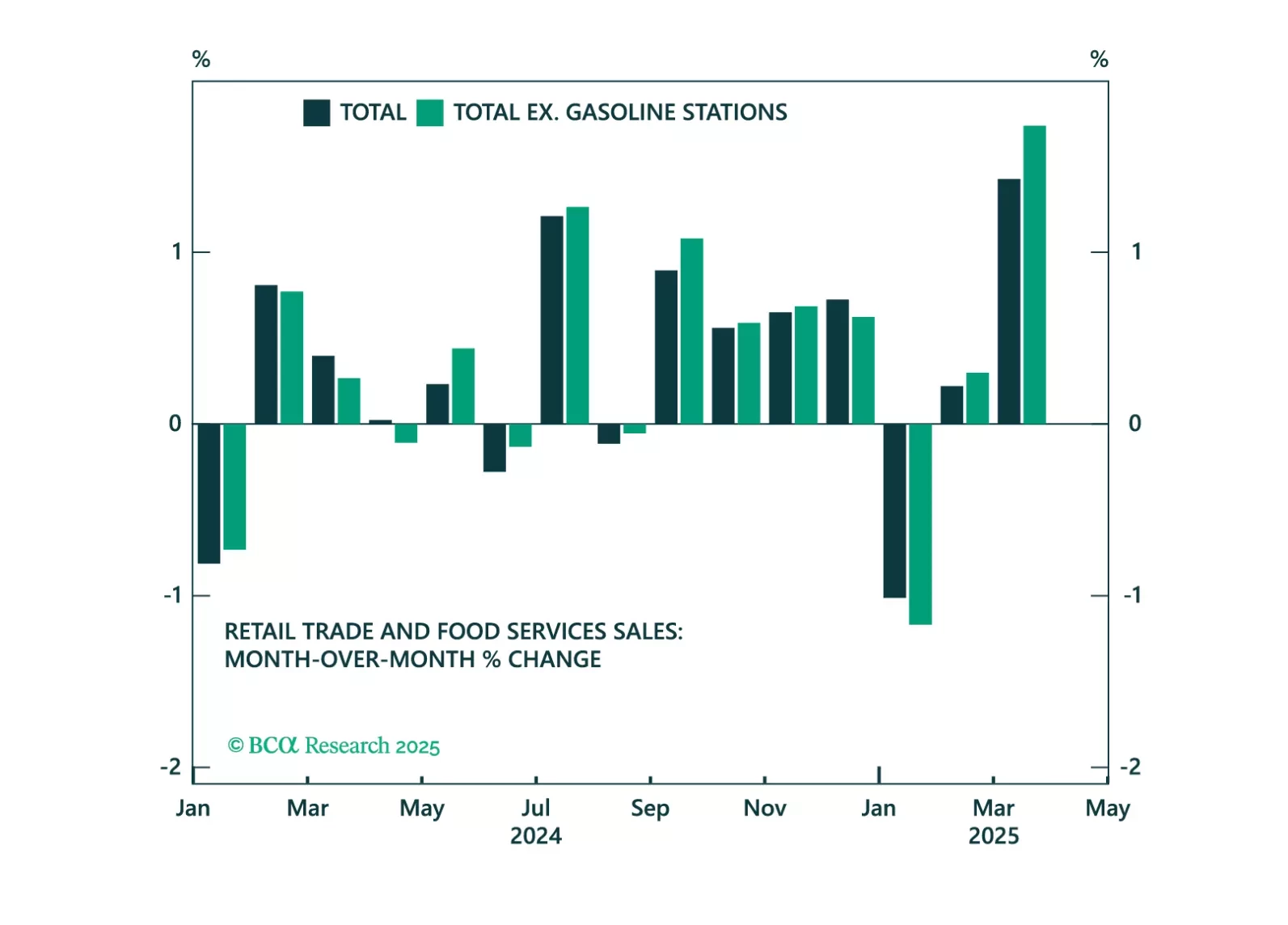

The collapse in soft data points to rising recession risks, but markets are still only priced for a mild slowdown, reinforcing our defensive positioning. As policy uncertainty and market volatility surged, consumers and businesses…

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our…

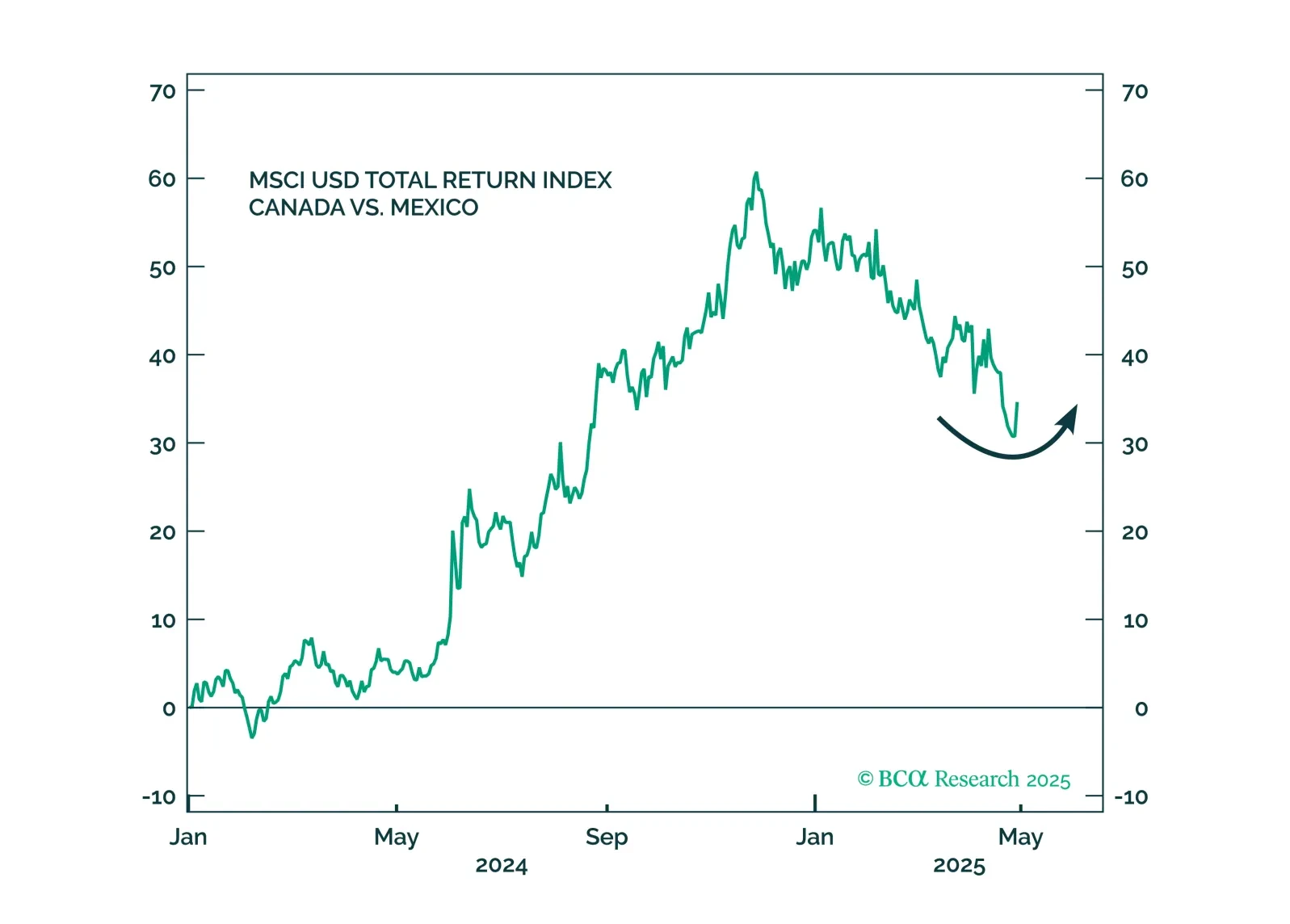

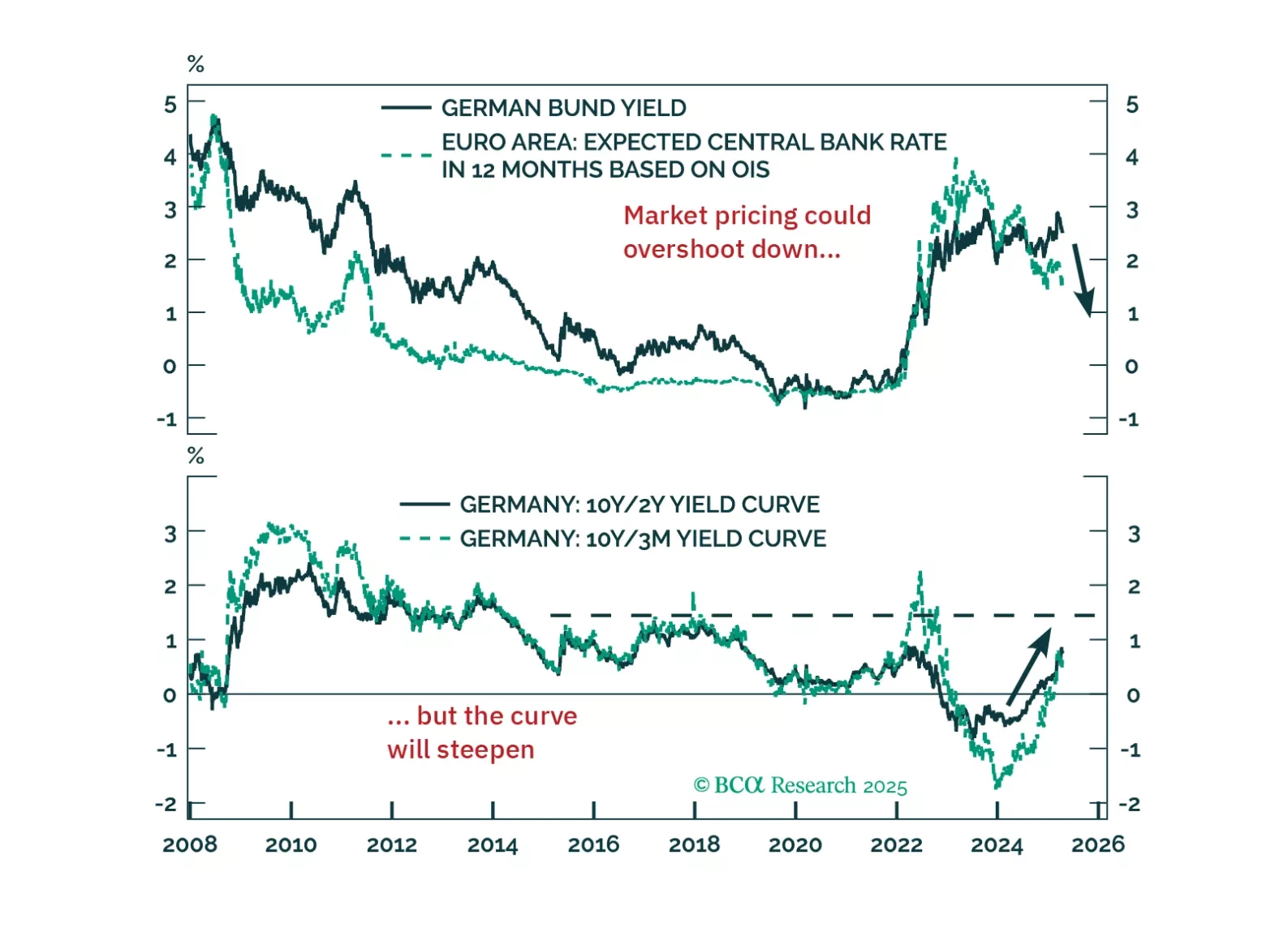

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.