Our US bond team’s thoughts on this afternoon’s FOMC meeting and yesterday’s CPI release.

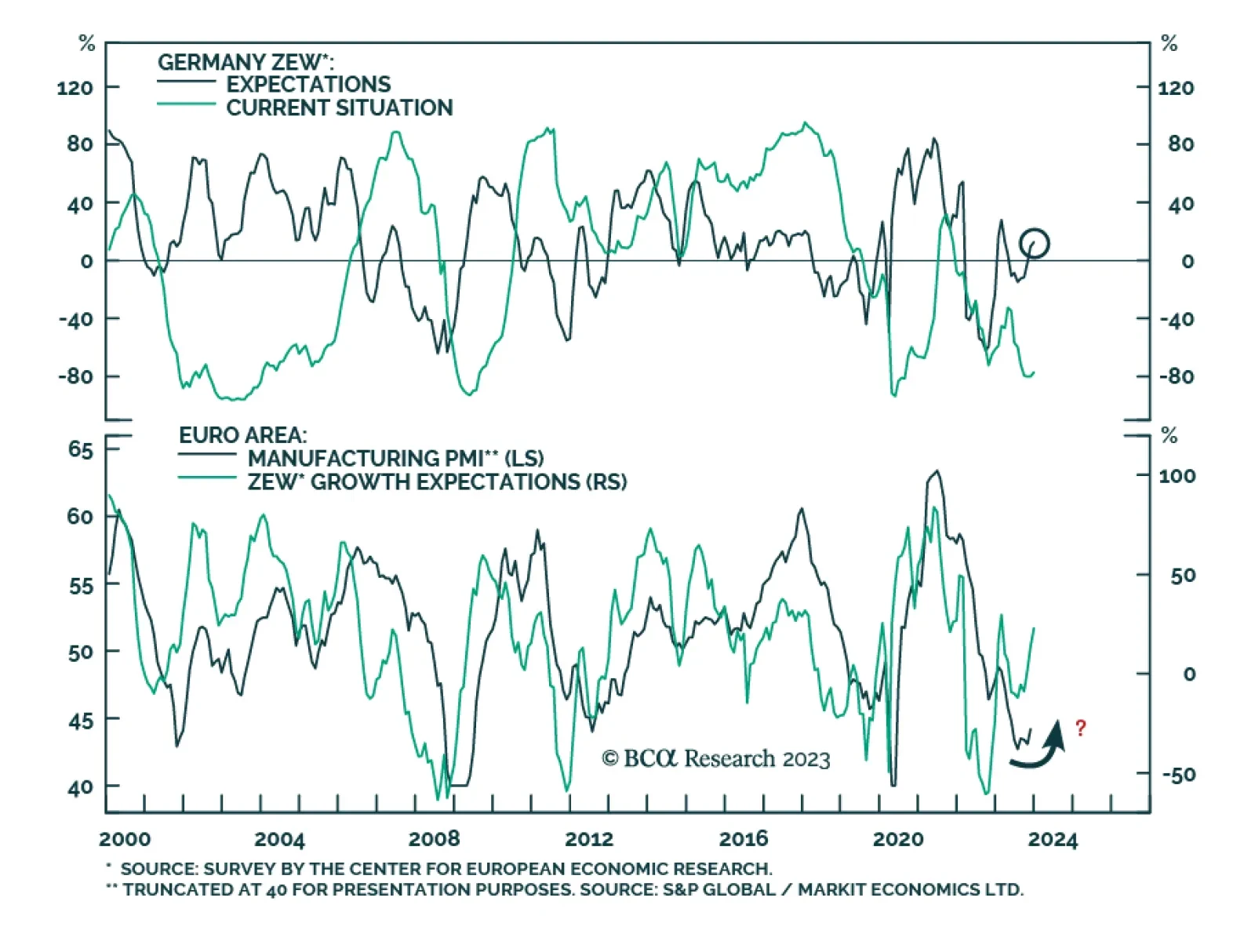

The continued improvement in German investor morale captured by the ZEW survey corroborates other indicators pointing to near-term support for Eurozone stocks. Economic sentiment jumped three points to a 9-month high of 12.8 in…

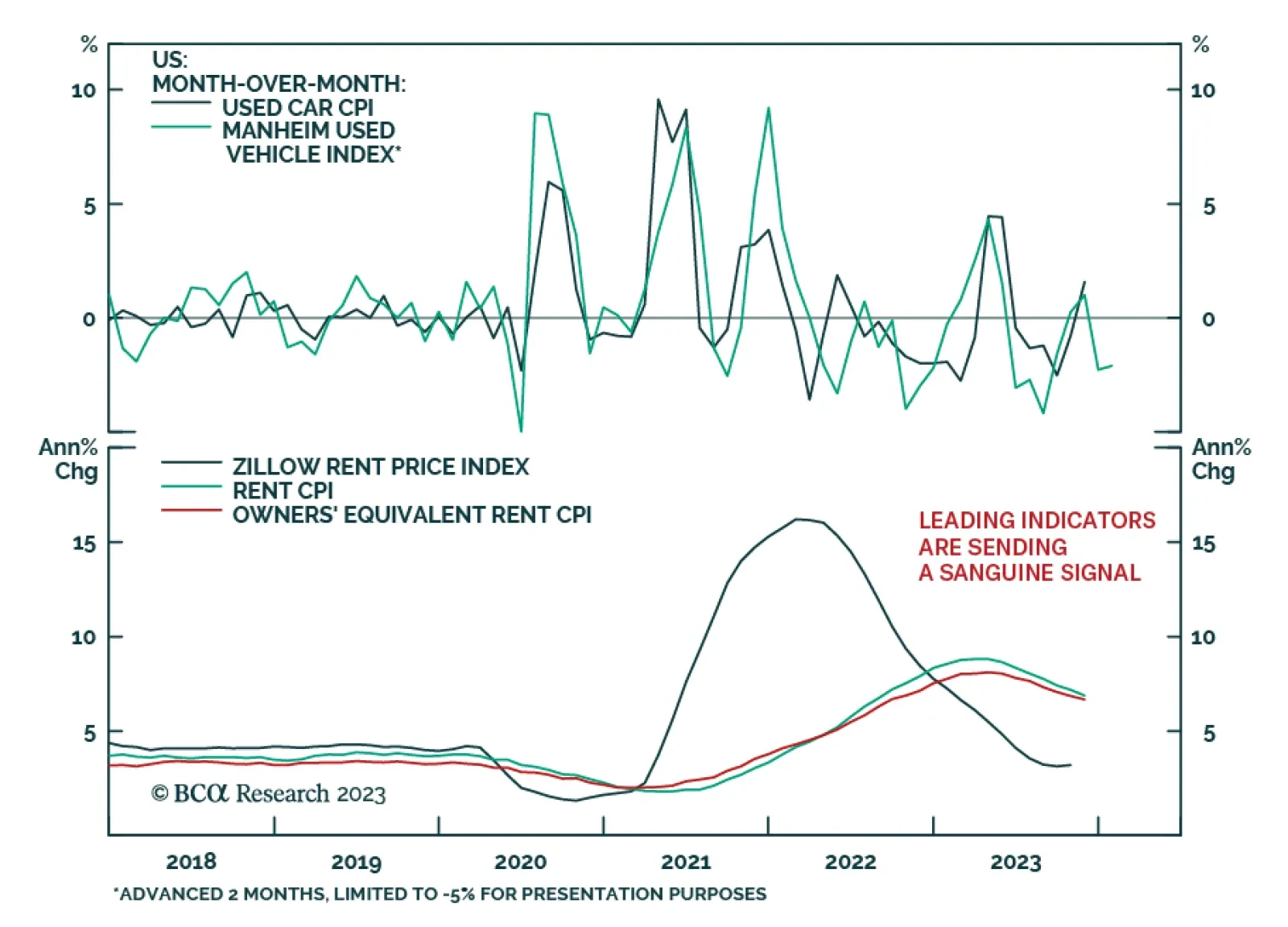

The November US CPI release came in broadly in line with consensus expectations on Tuesday. On an annual basis, headline CPI inflation eased from 3.2% y/y to 3.1% y/y while core inflation was unchanged at 4.0% y/y. On a monthly…

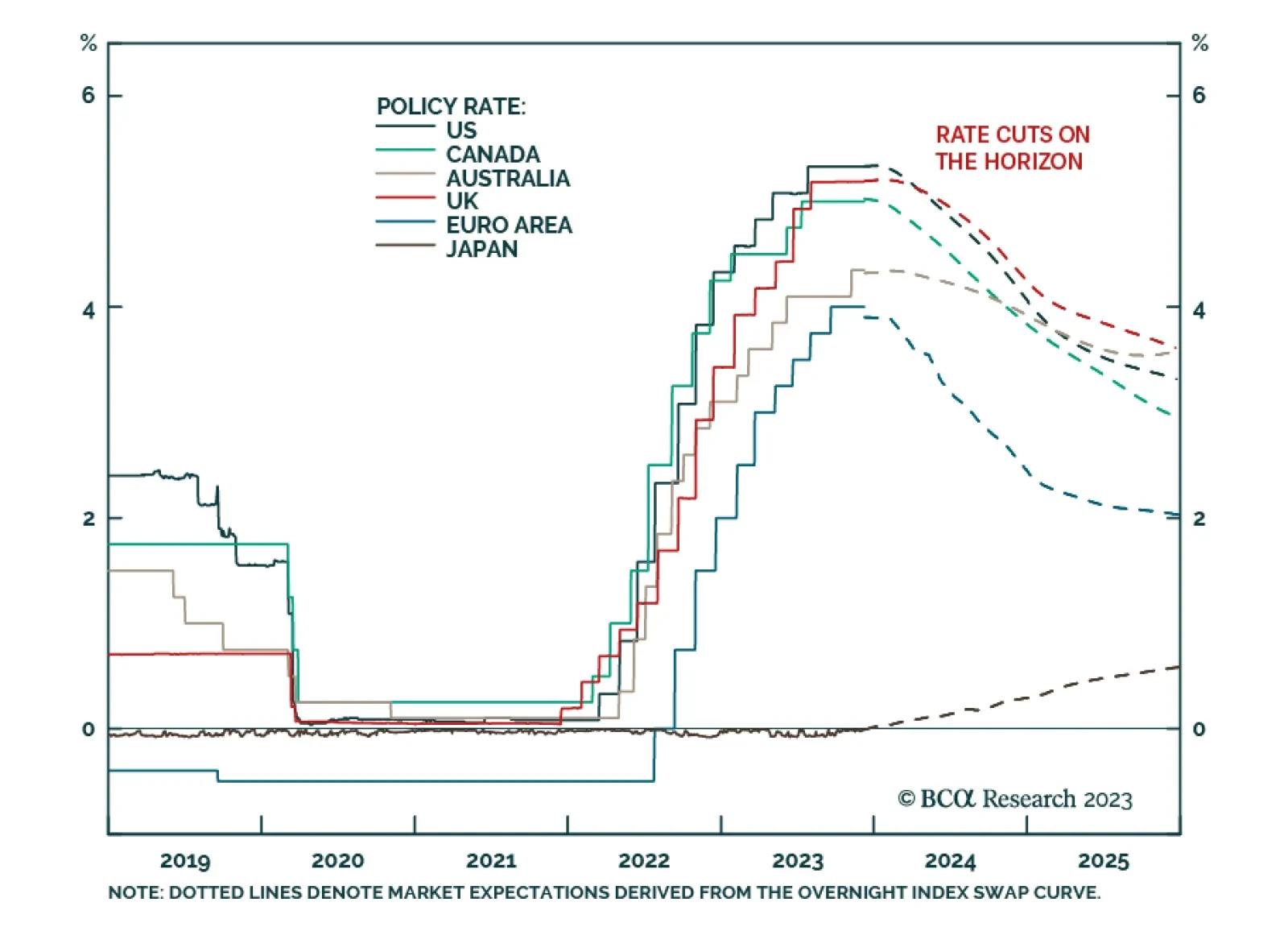

Multiple major DM central banks are scheduled to decide on monetary policy this week. The US Fed will meet on Wednesday, followed by the ECB, BoE, and Norges Bank on Thursday. It comes after the BoC and RBA both opted to keep…

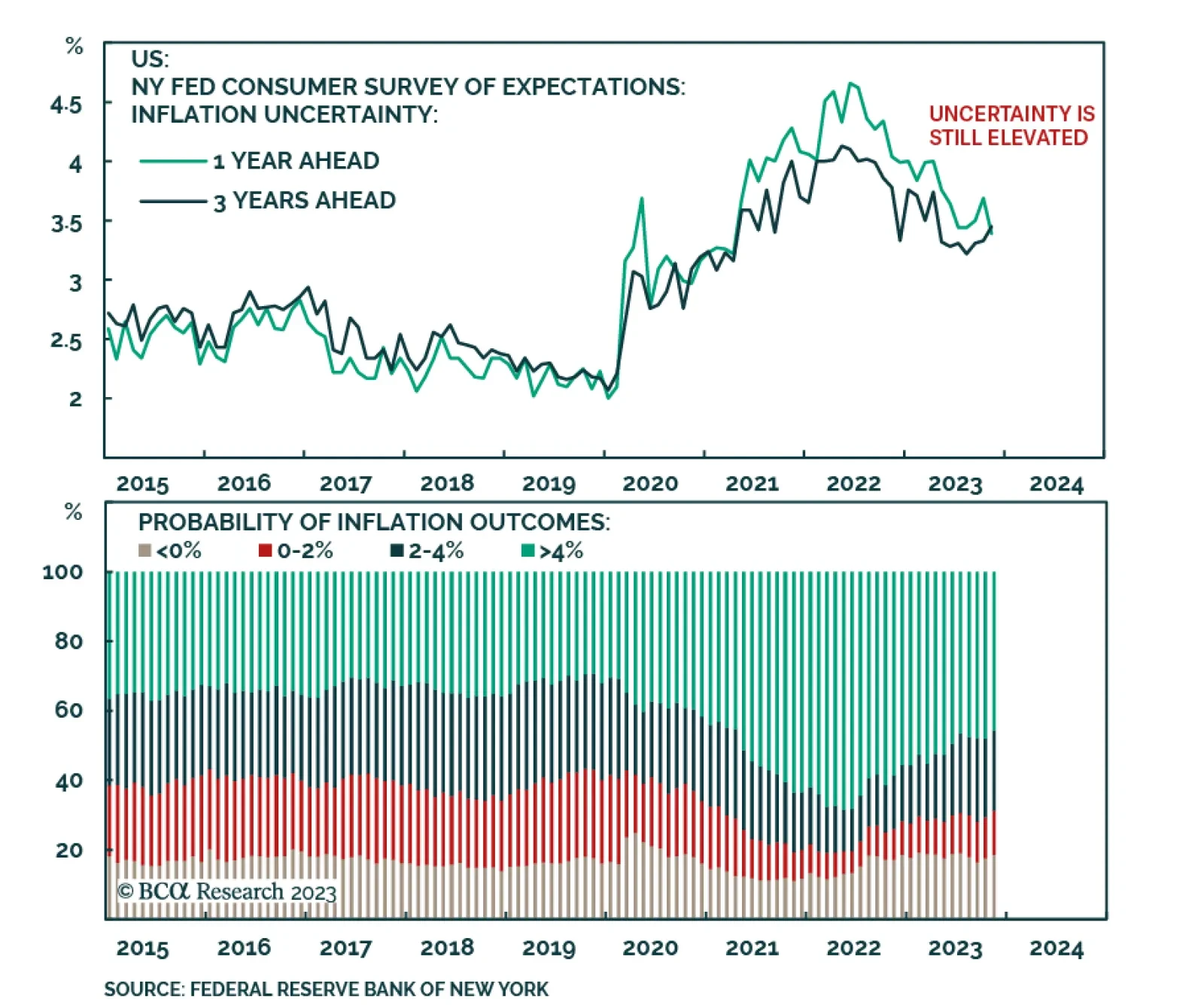

Results of the New York Fed’s November Survey of Consumer Expectations corroborate the signal from the University of Michigan’s preliminary results that inflation expectations are receding. The 0.2 percentage point…

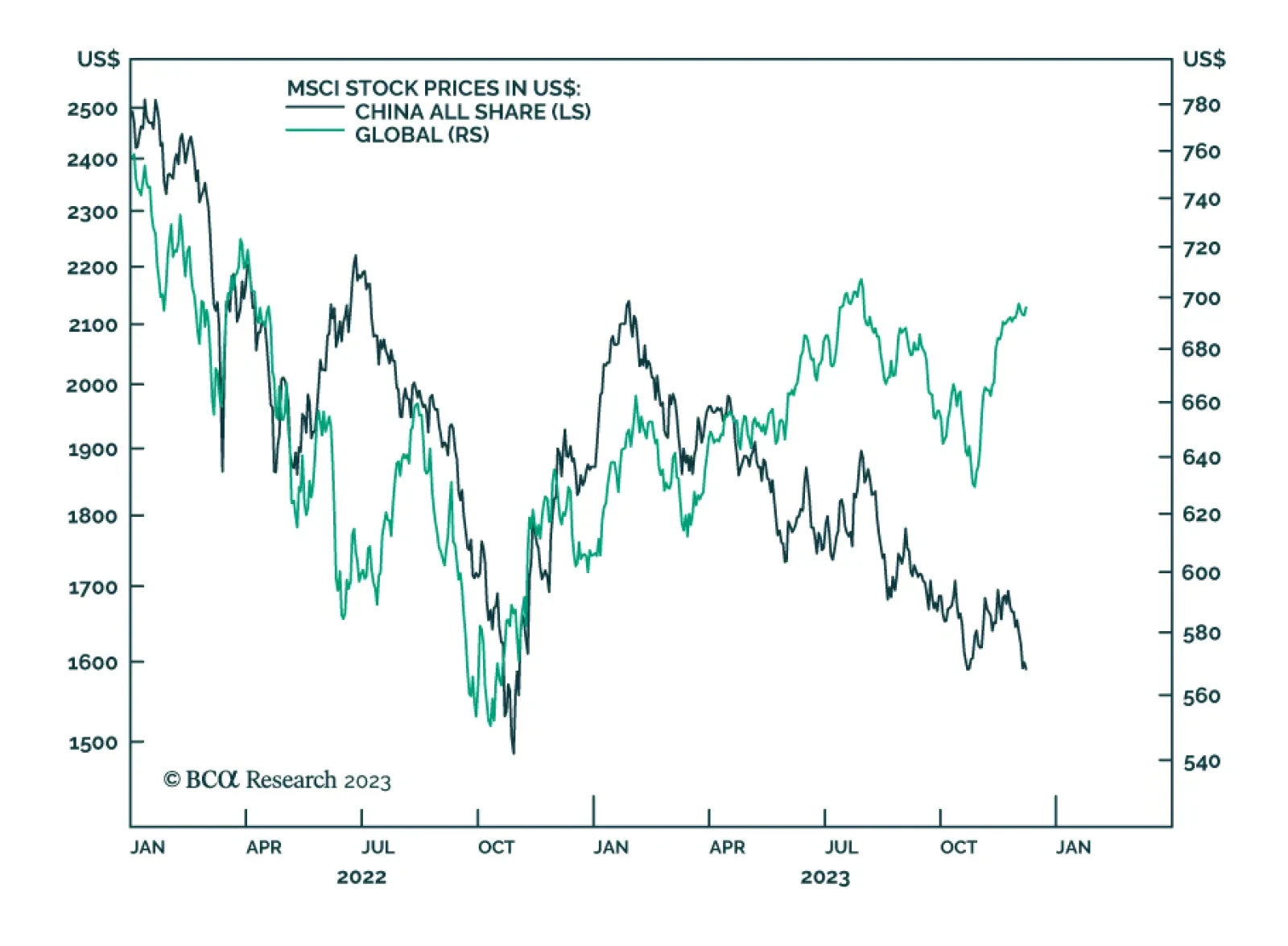

China’s CPI and PPI releases delivered a negative signal about the domestic economy. The rate of contraction in the CPI index accelerated to -0.5% y/y in November, the sharpest rate of decline in 3 years and disappointing…

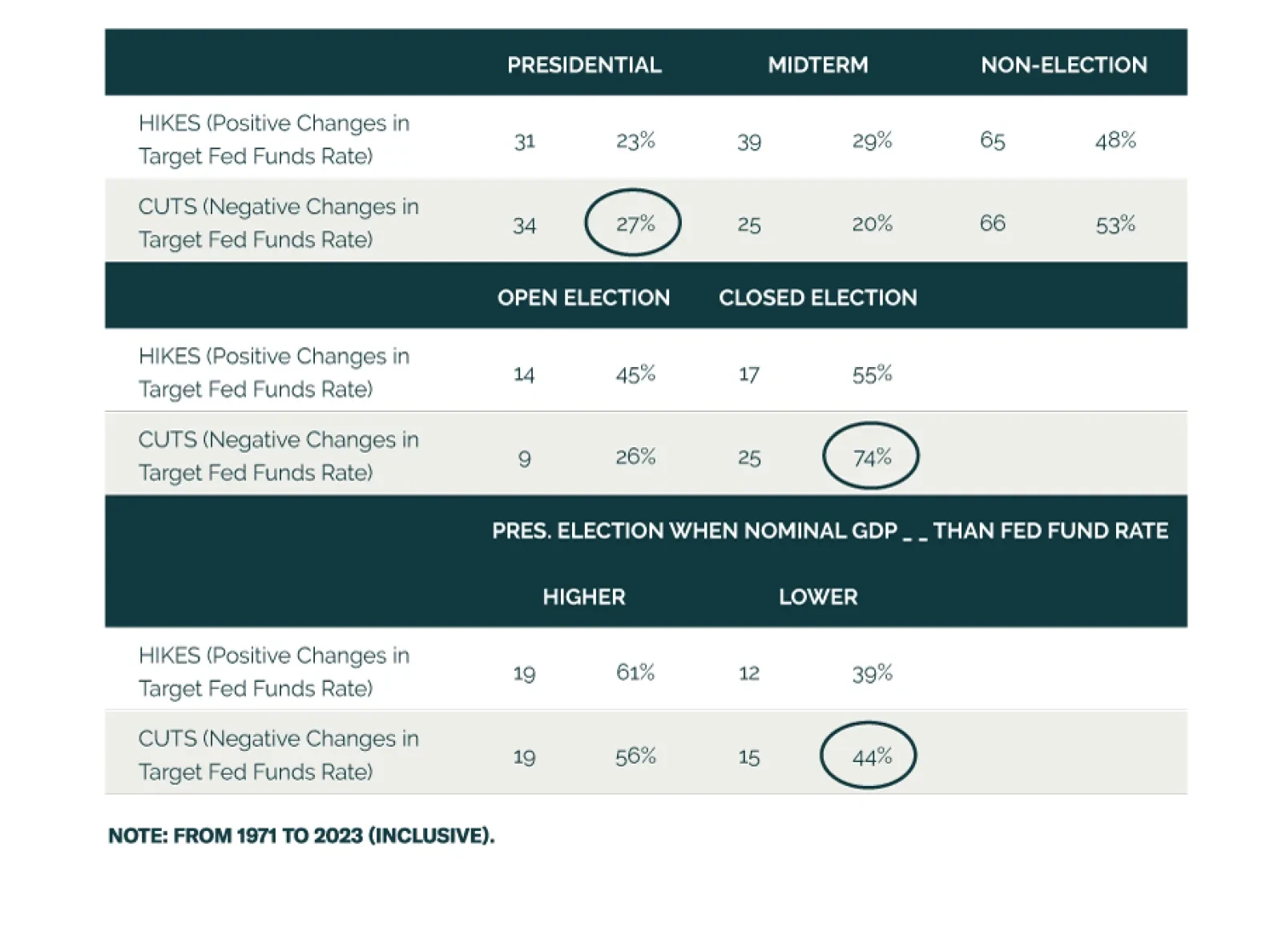

According to BCA Research’s US Political Strategy service, the Fed will be surprisingly dovish in 2024 but it has a poor track record of avoiding recessions once monetary policy is restrictive. The independence of the…

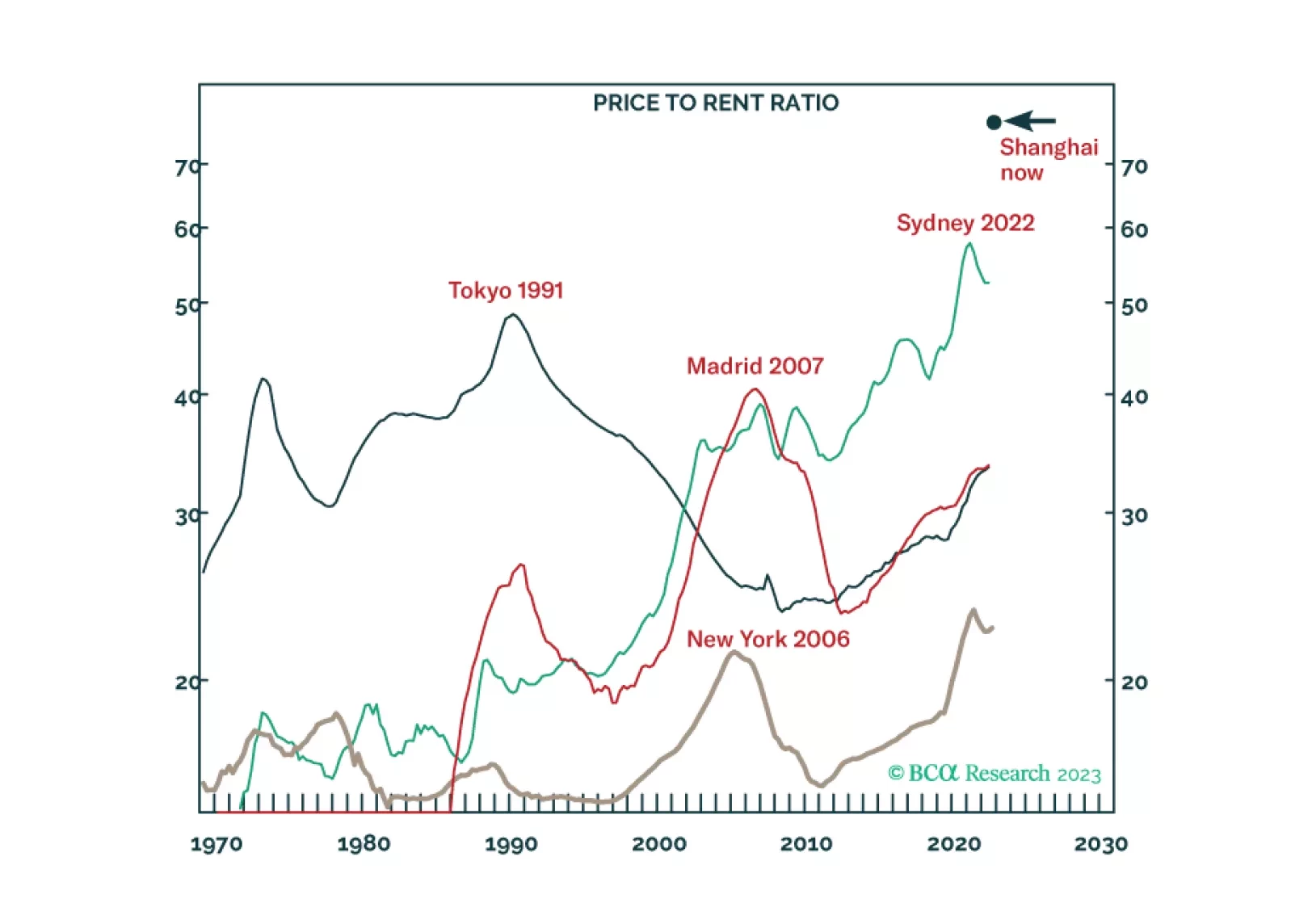

The global investment community has become well aware of many problems facing the Chinese economy including real estate excesses, policymakers’ reluctance to stimulate, as well as elevated debt levels among local…