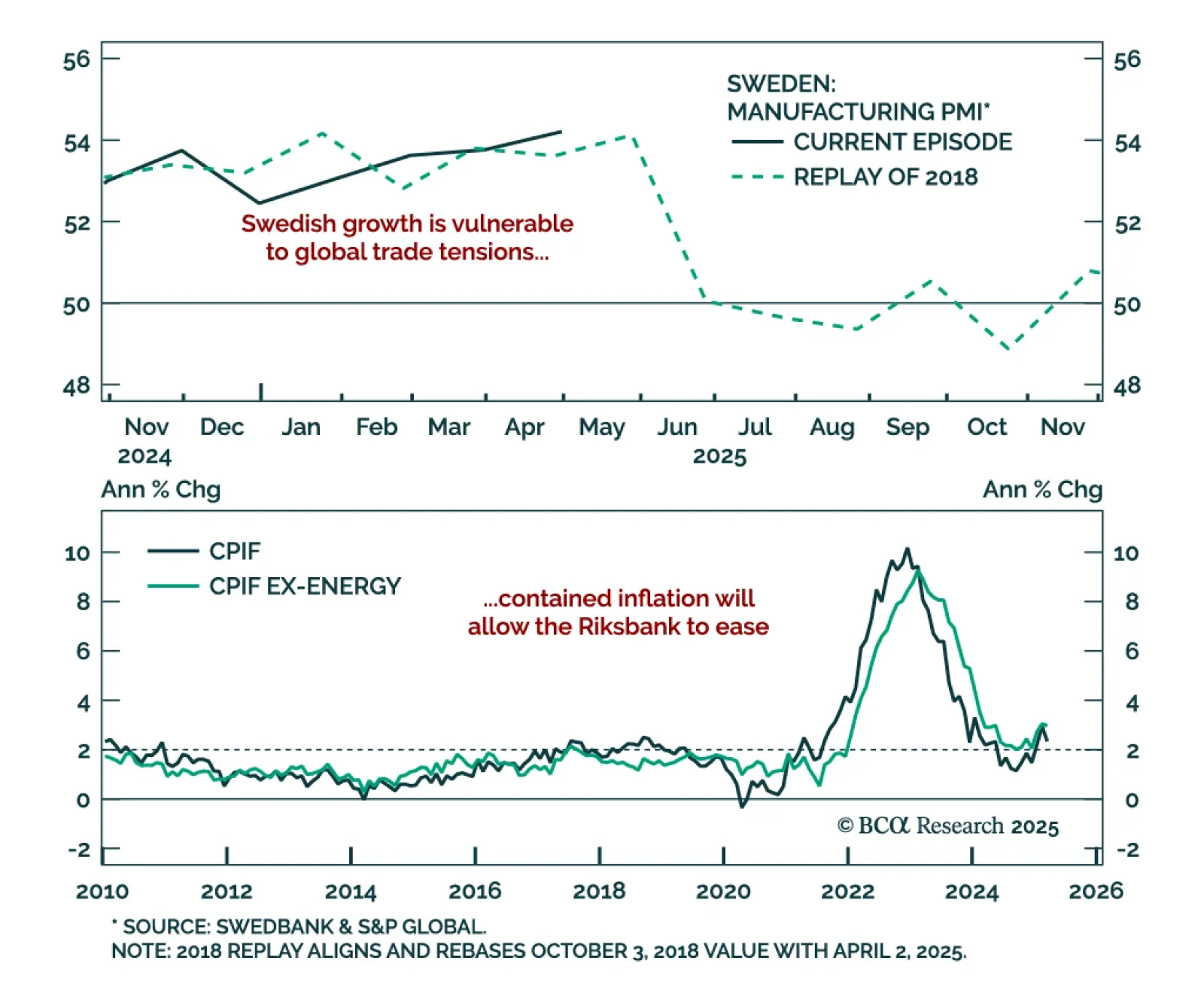

The Riksbank’s cautious stance sets up a dovish pivot, reinforcing our long Swedish bonds view and SEK fade vs. USD. The central bank held rates at 2.25% for the second time this year, with Governor Thedéen describing policy as well-…

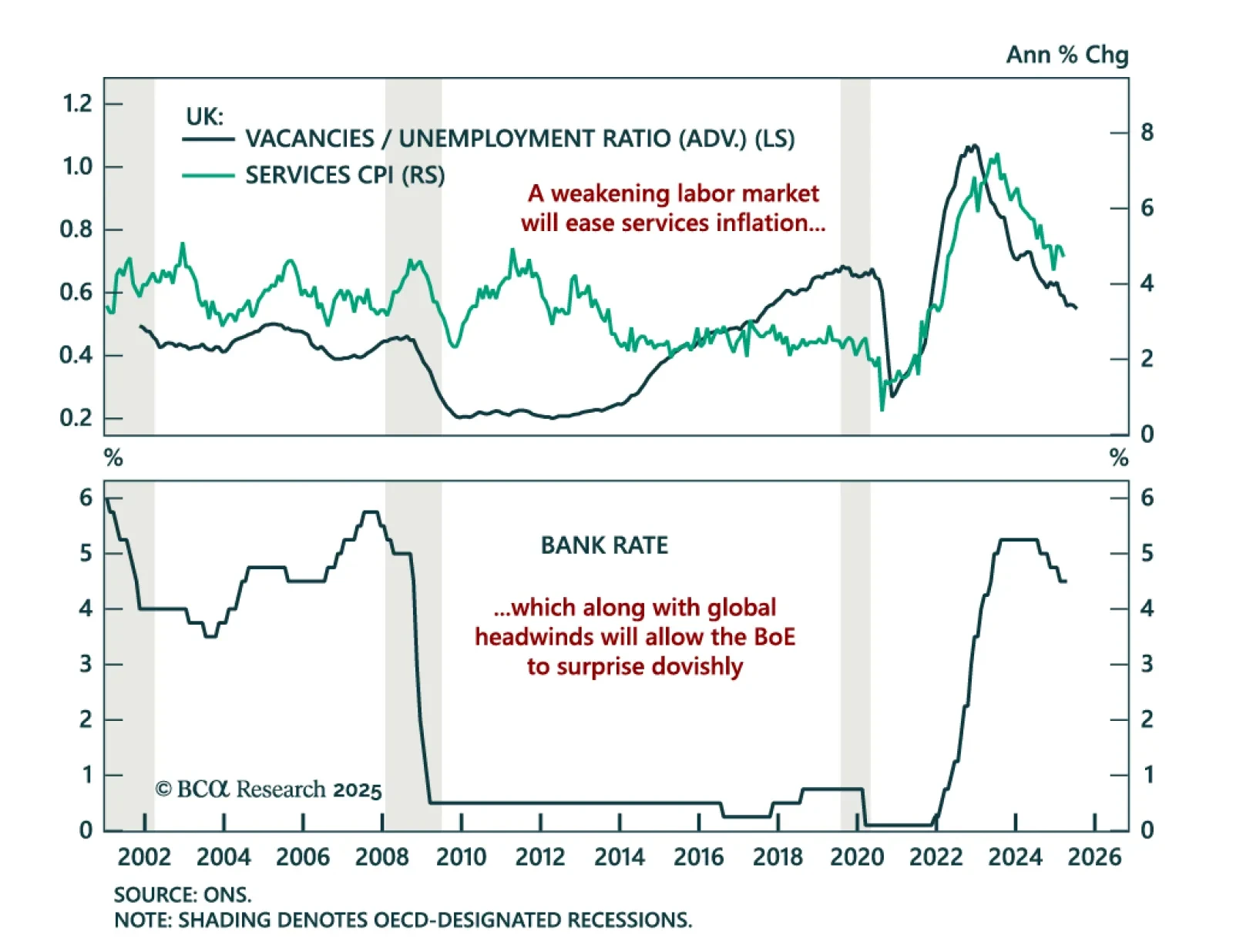

The Bank of England’s hawkish cut reinforces our Gilts overweight and tactical short GBP view as global headwinds persist. The BoE lowered rates by 25 bps to 4.25% as expected, but the MPC vote was more split than expected. Five…

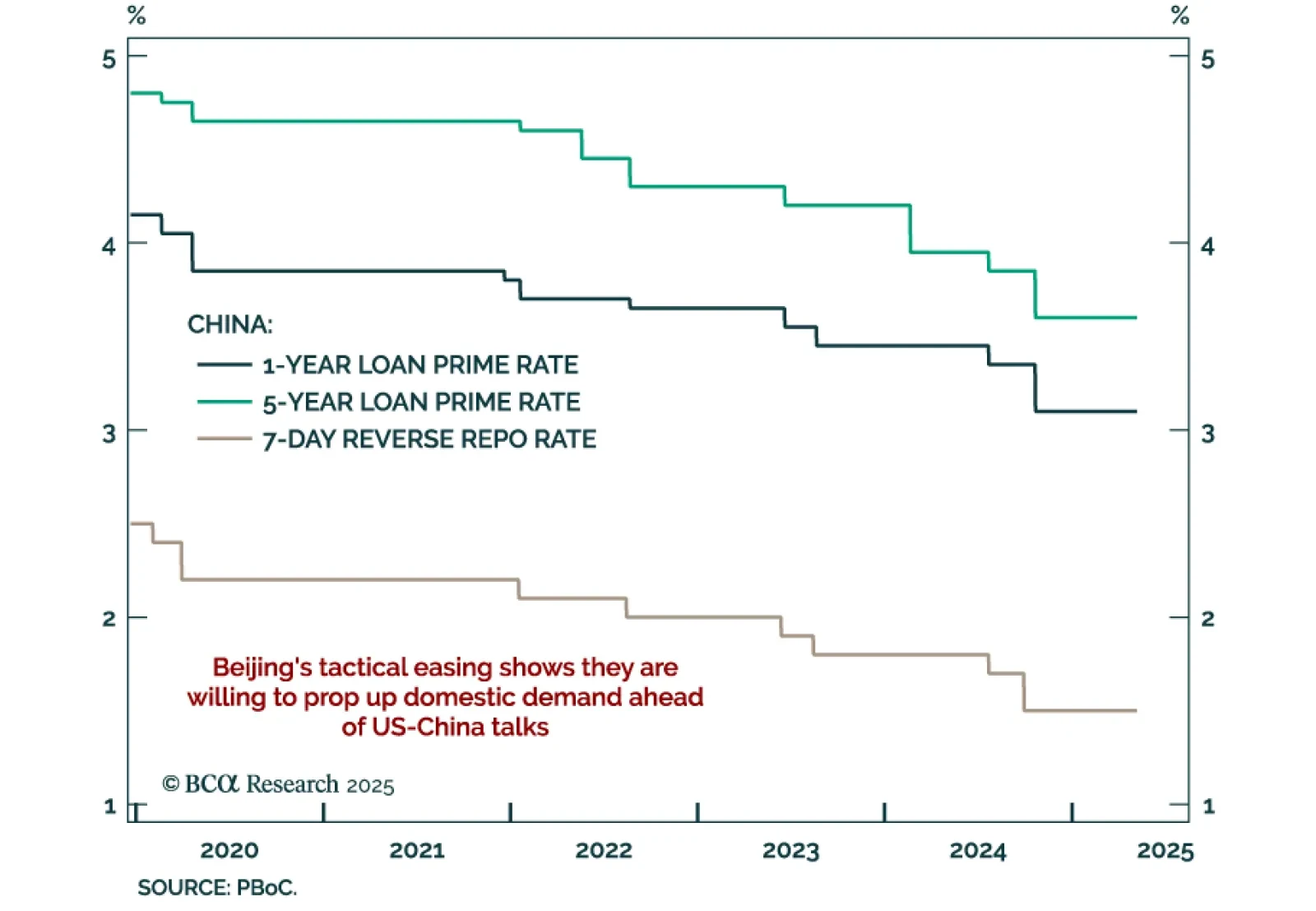

The PBoC’s latest easing aims to cushion growth risks and strengthen Beijing’s position ahead of US trade talks. In a rare pre-announced decision, China’s central bank cut its policy rate by 10 bps and the reserve requirement…

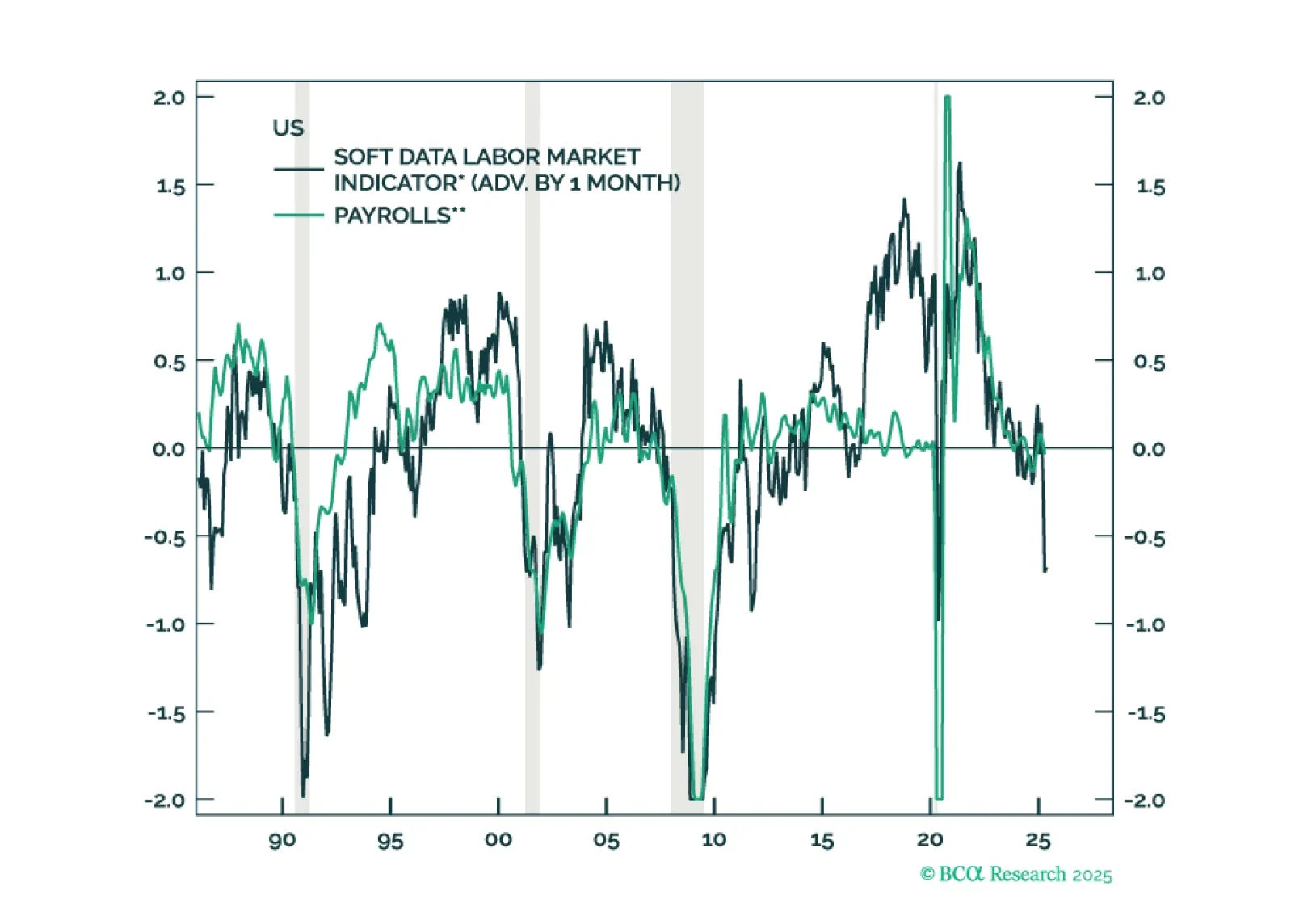

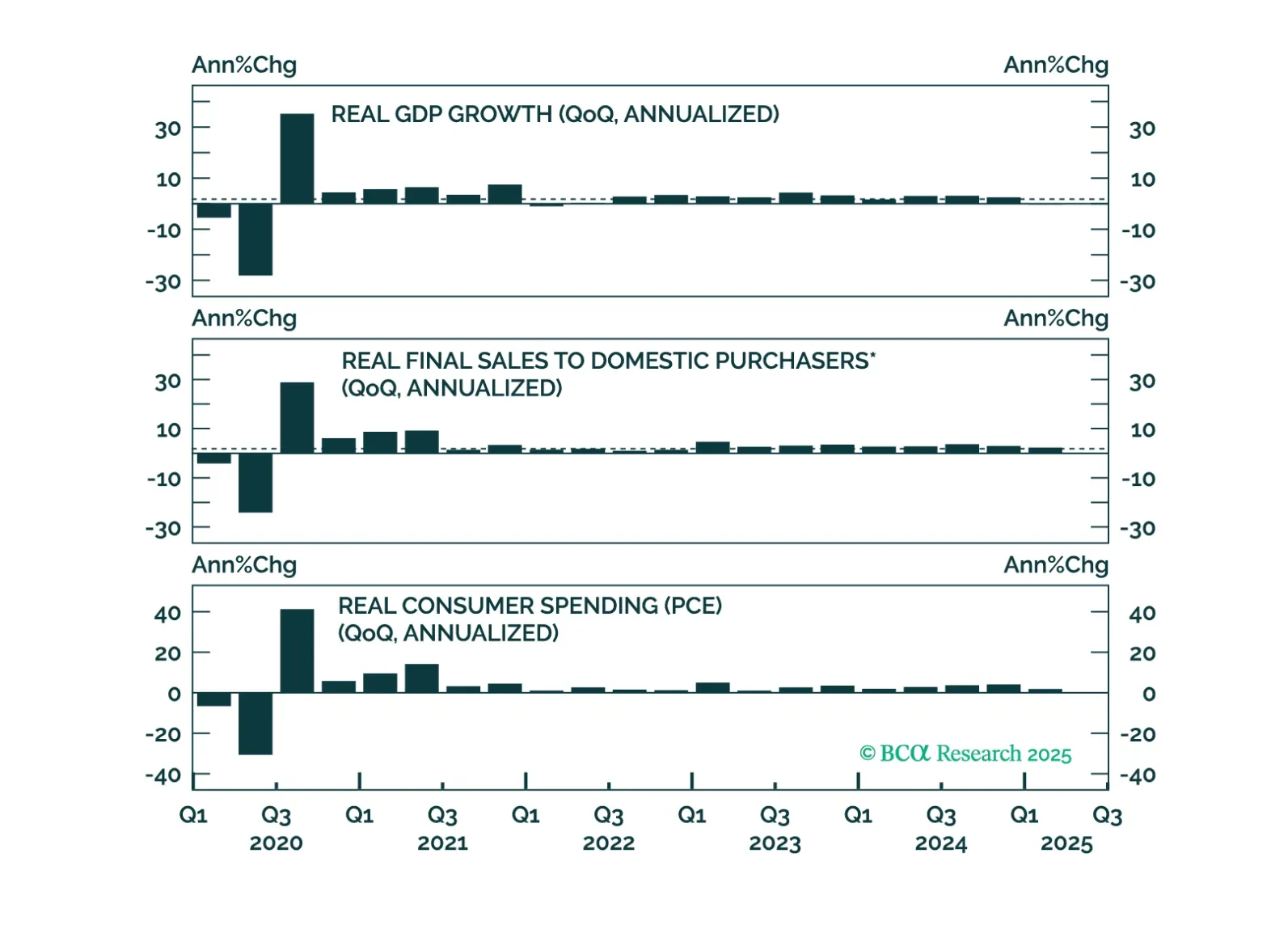

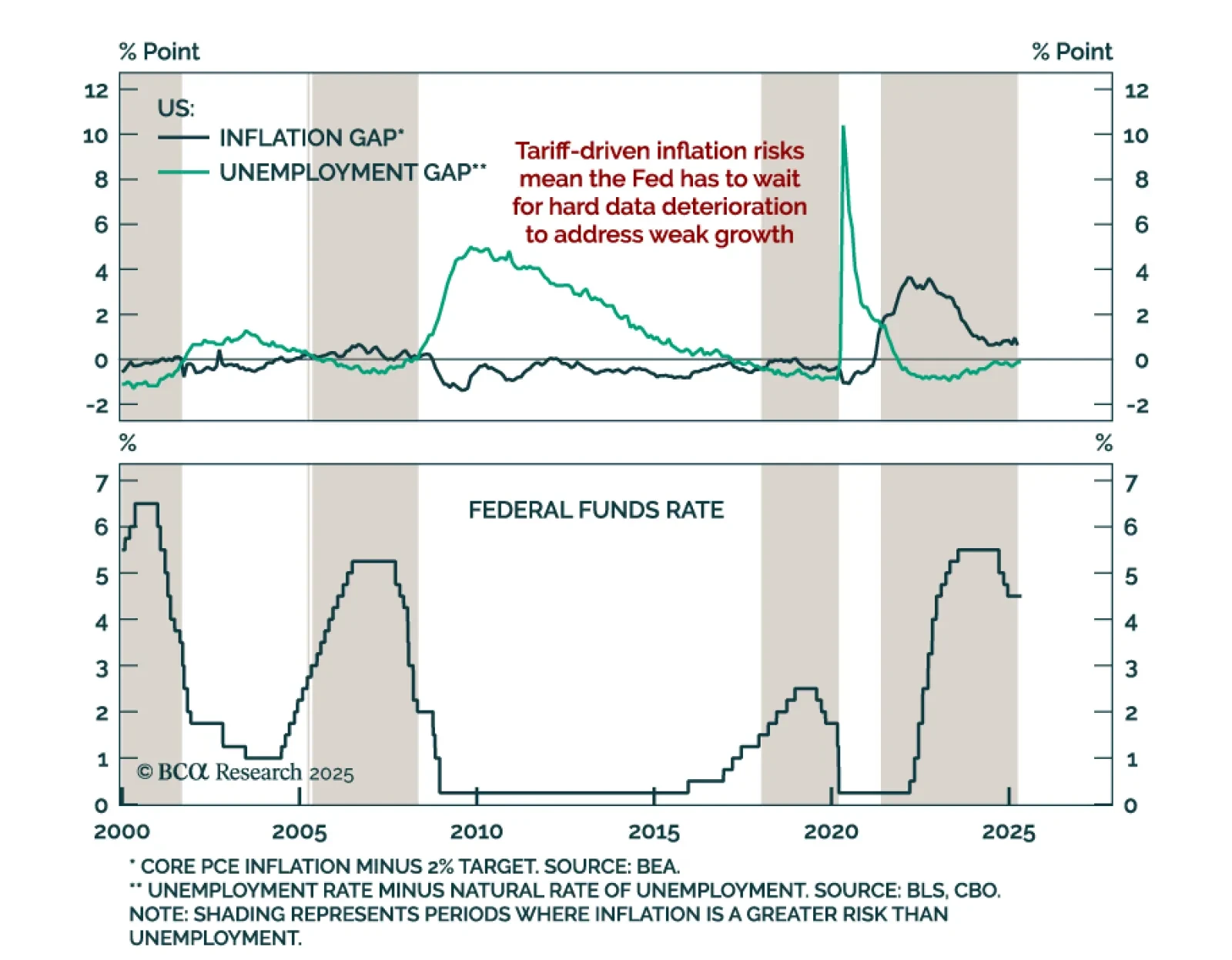

The Fed’s tight policy stance and focus on hard data reinforce our US Bond strategists’ call for above-benchmark duration and Treasury curve steepeners. As expected, the Fed held rates between 4.25% to 4.5% and flagged heightened…

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

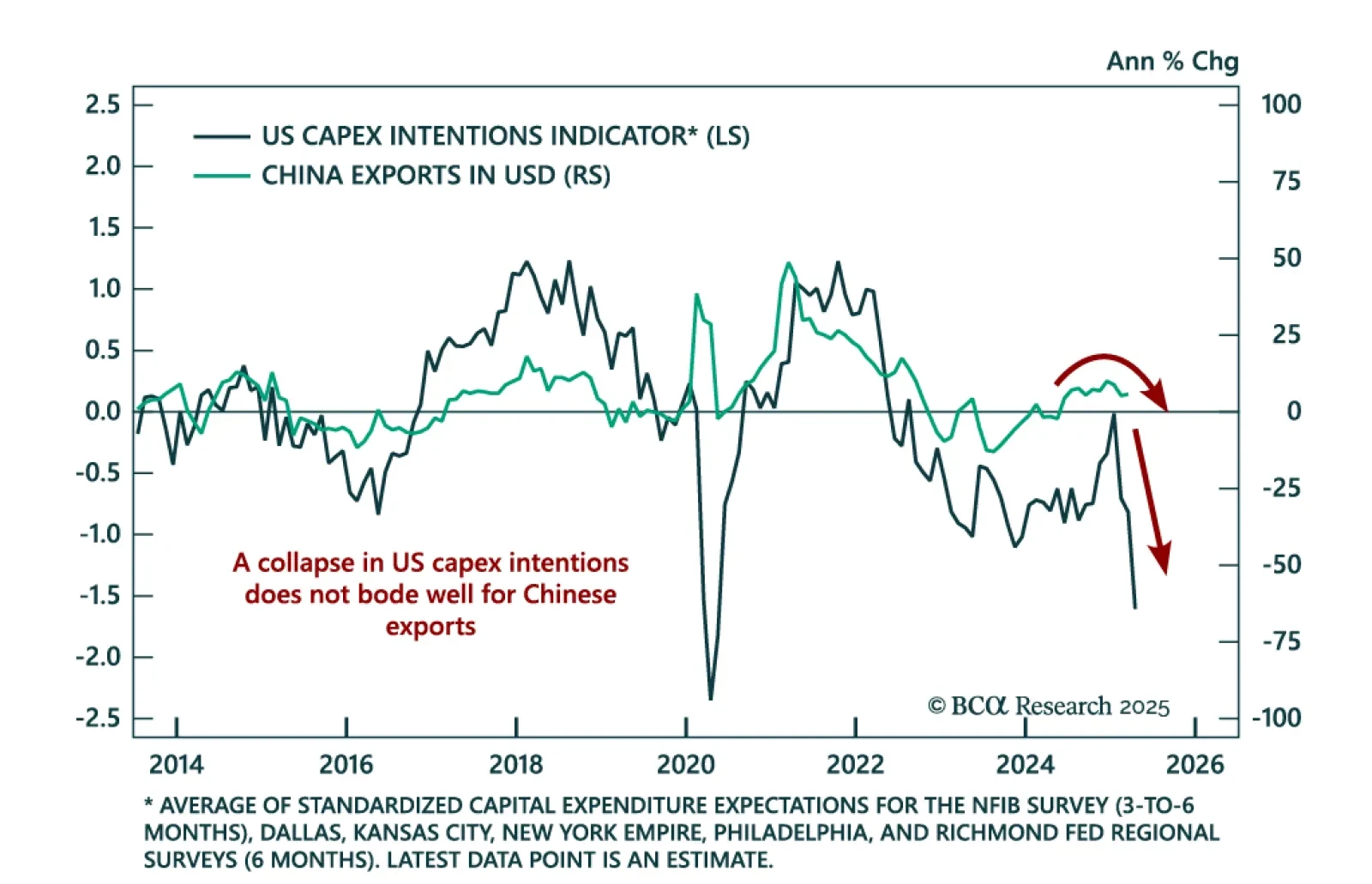

BCA’s China Investment Strategists remain defensive as China’s growth outlook is still weak. Even if some US tariff rates are rolled back, export headwinds and lagging stimulus will continue to weigh on Chinese equities. The…

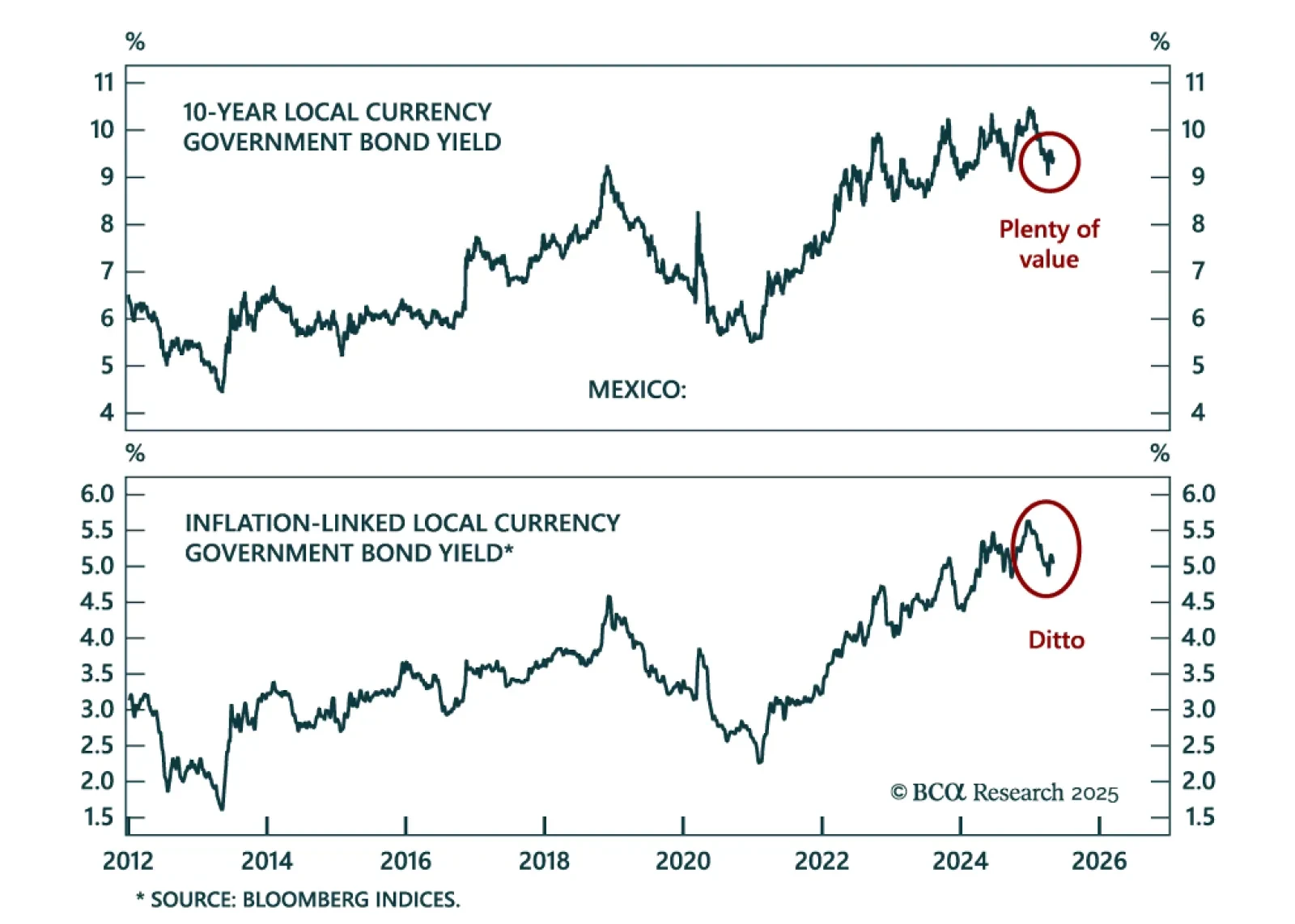

Mexico will be one of the biggest winners of the global trade war, creating a structural tailwind for its assets. Mexican risk assets and the peso are uniquely positioned to outperform while EM assets suffer as global growth slumps.…