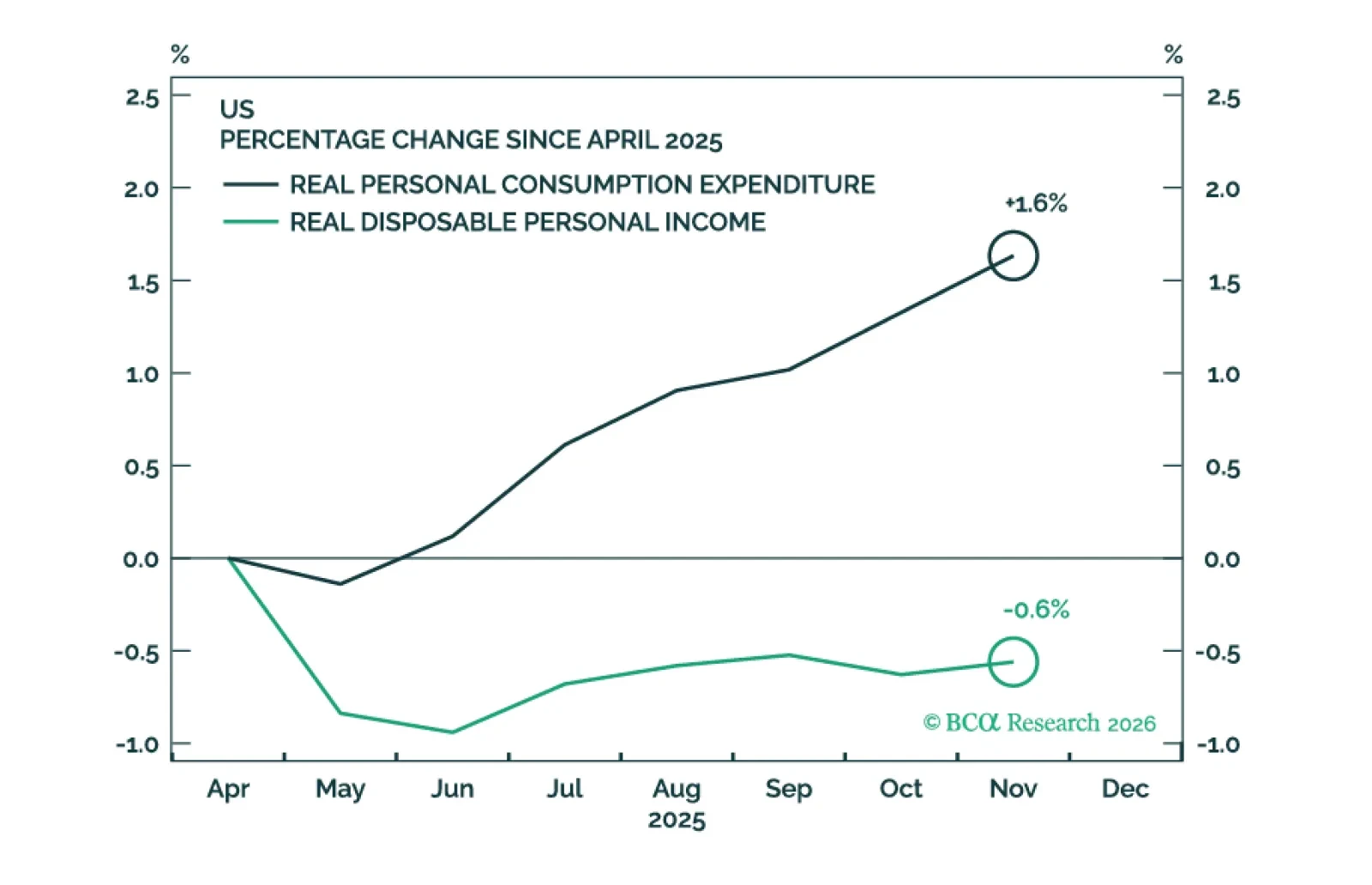

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

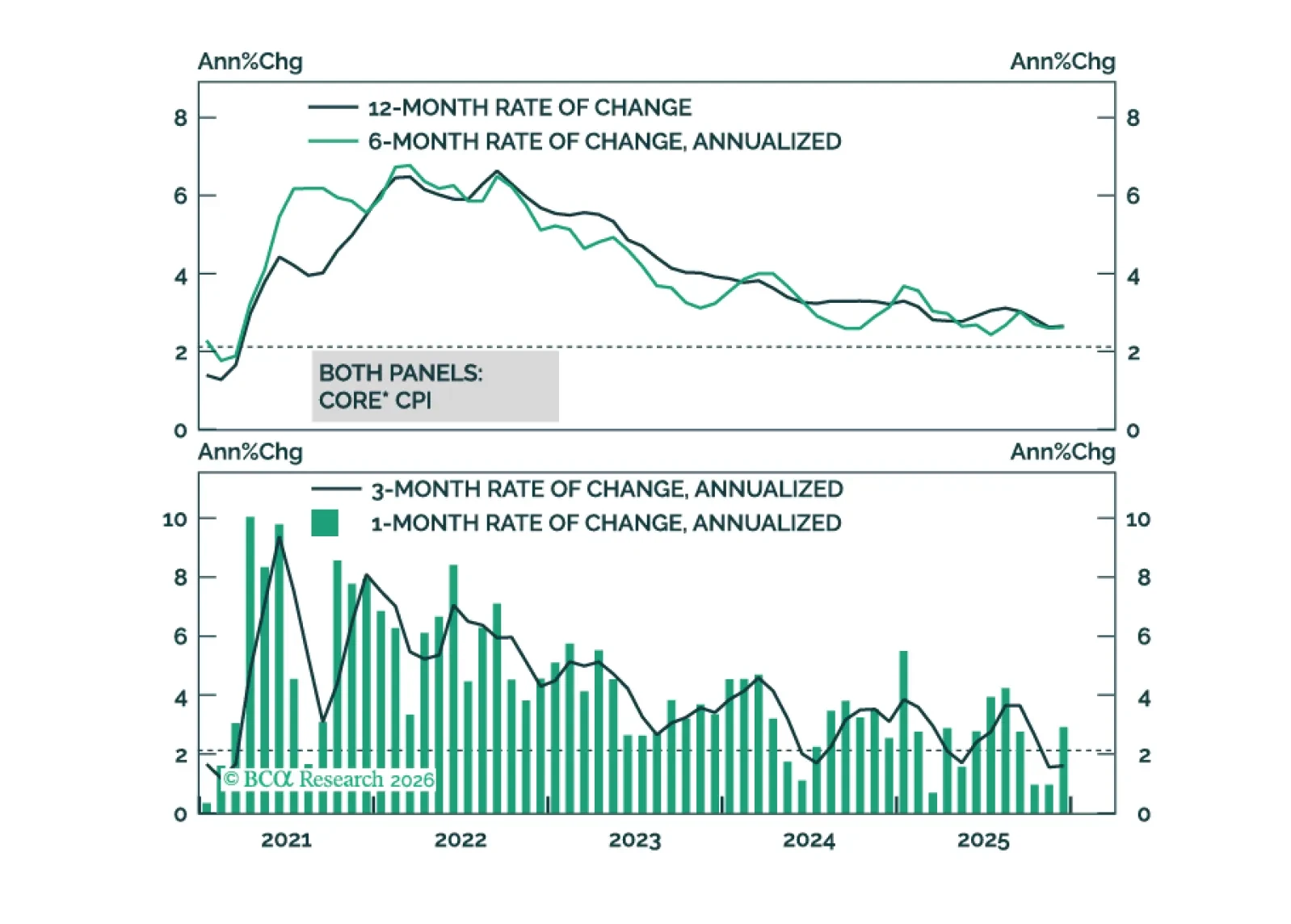

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

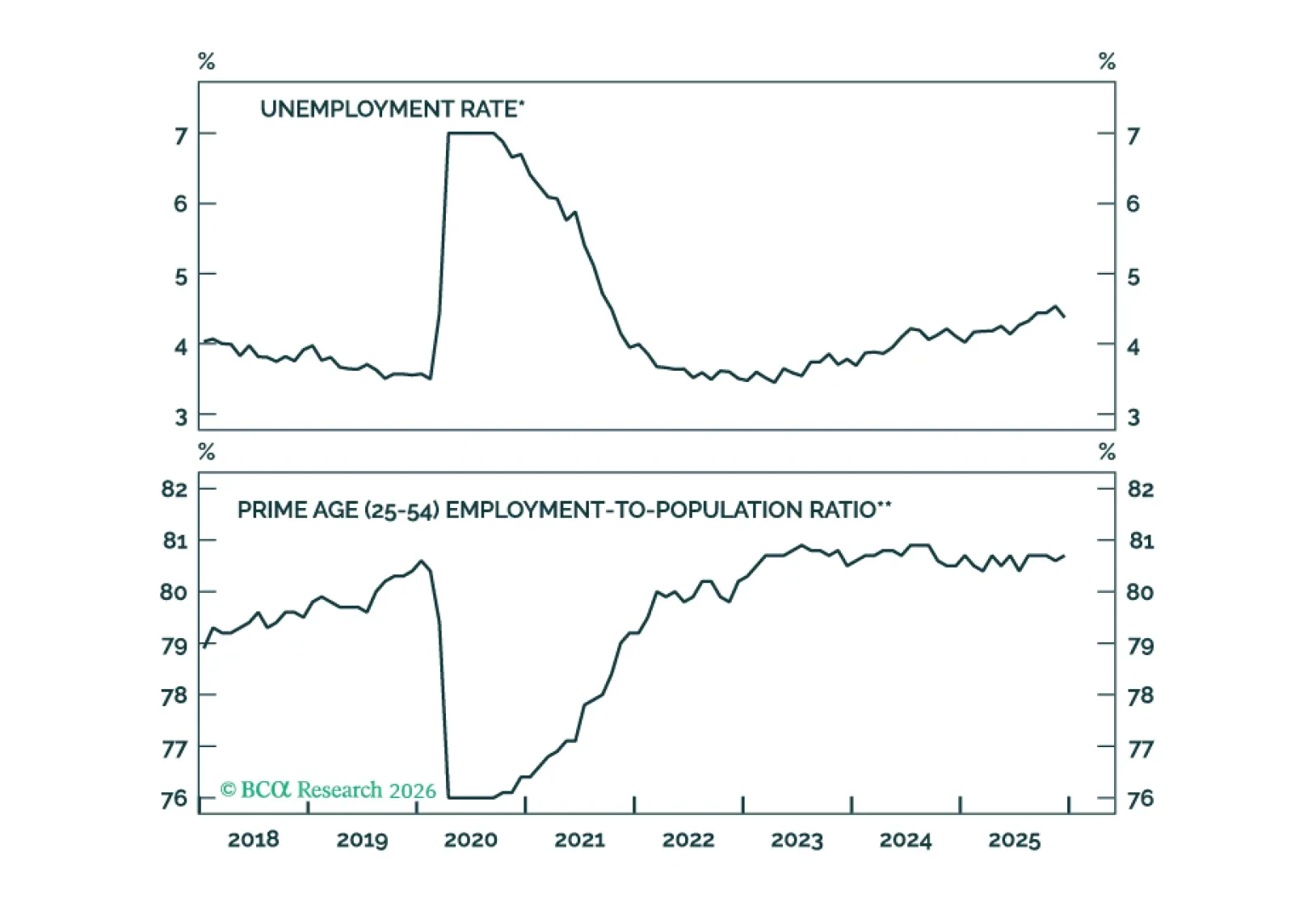

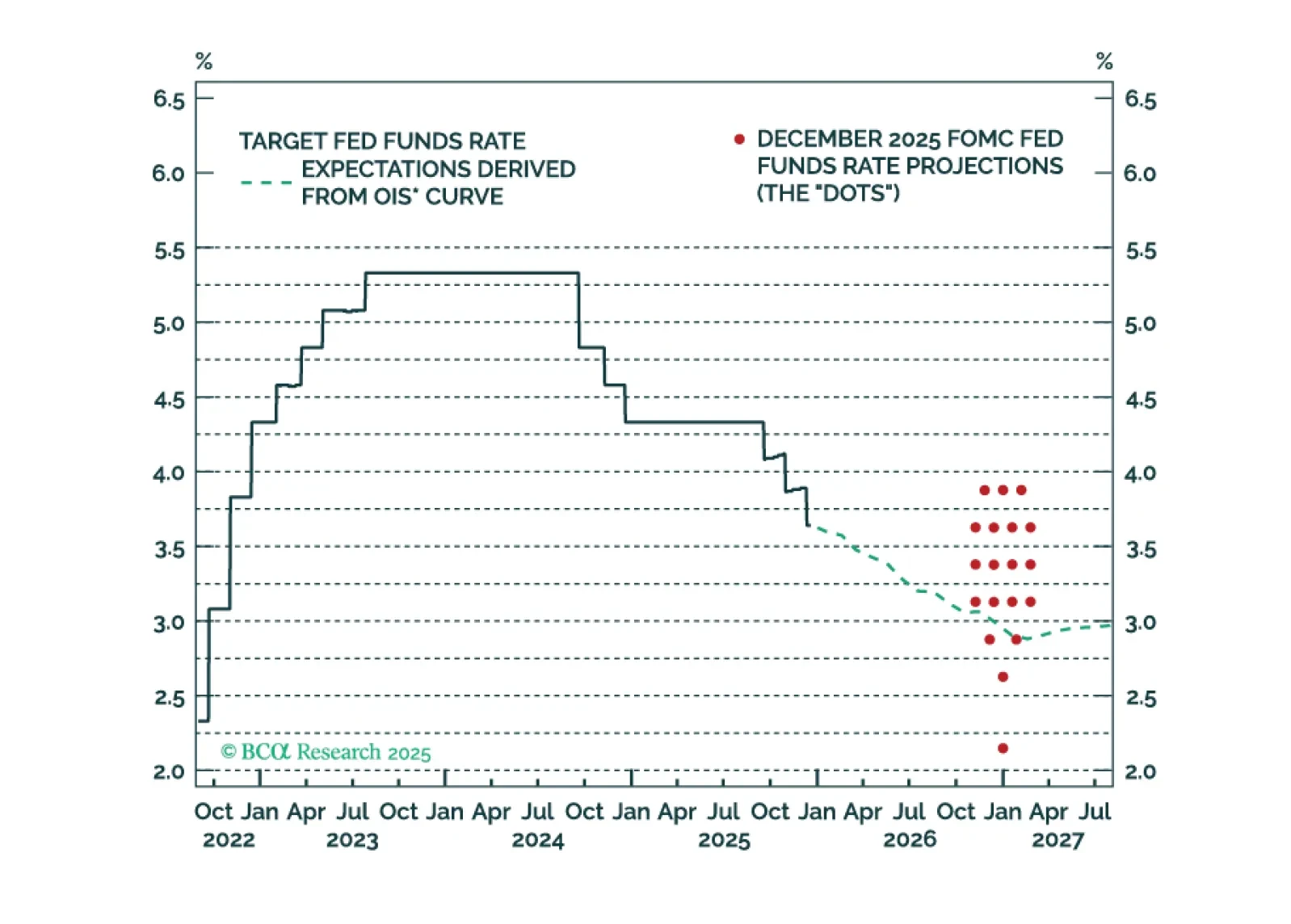

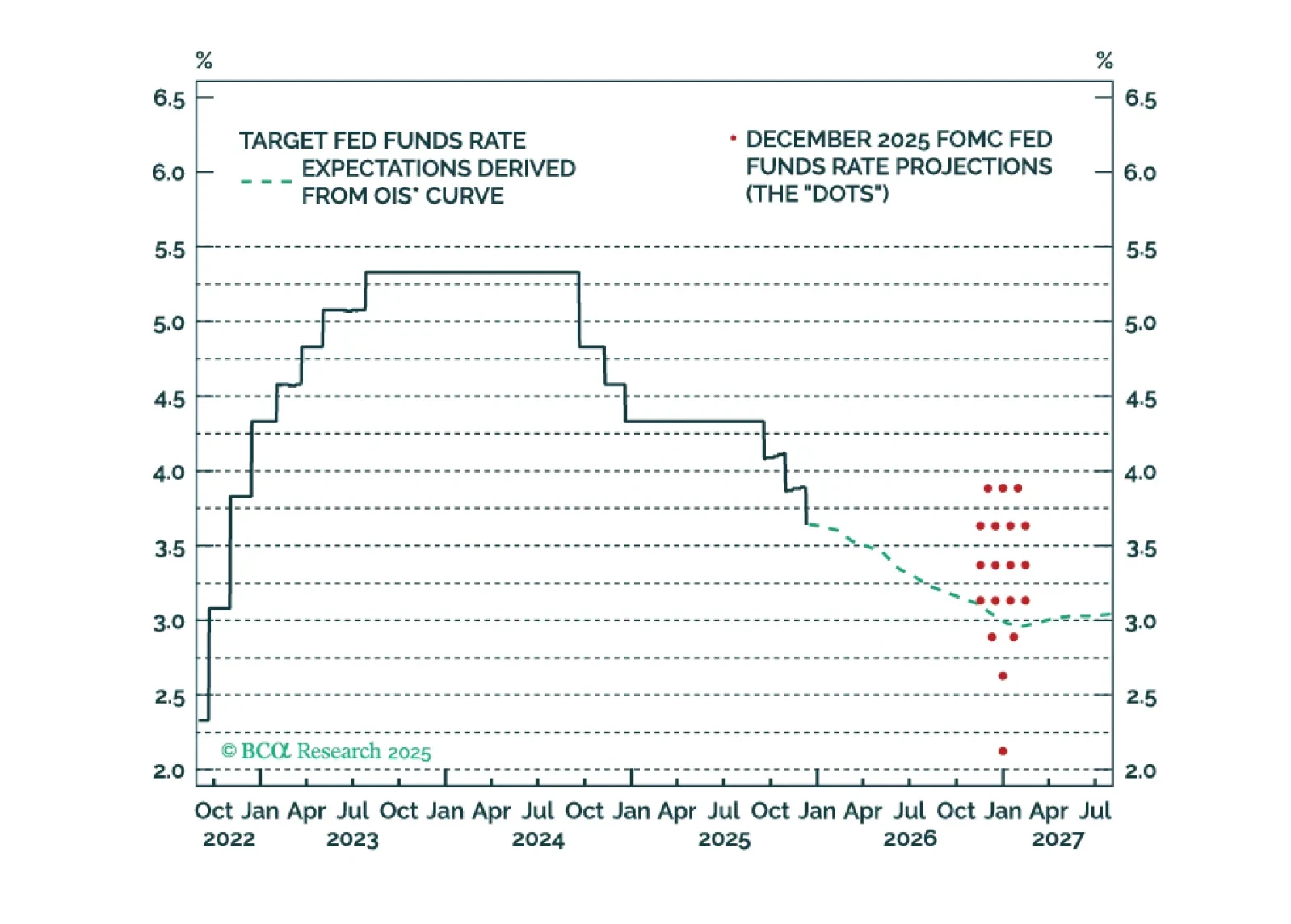

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

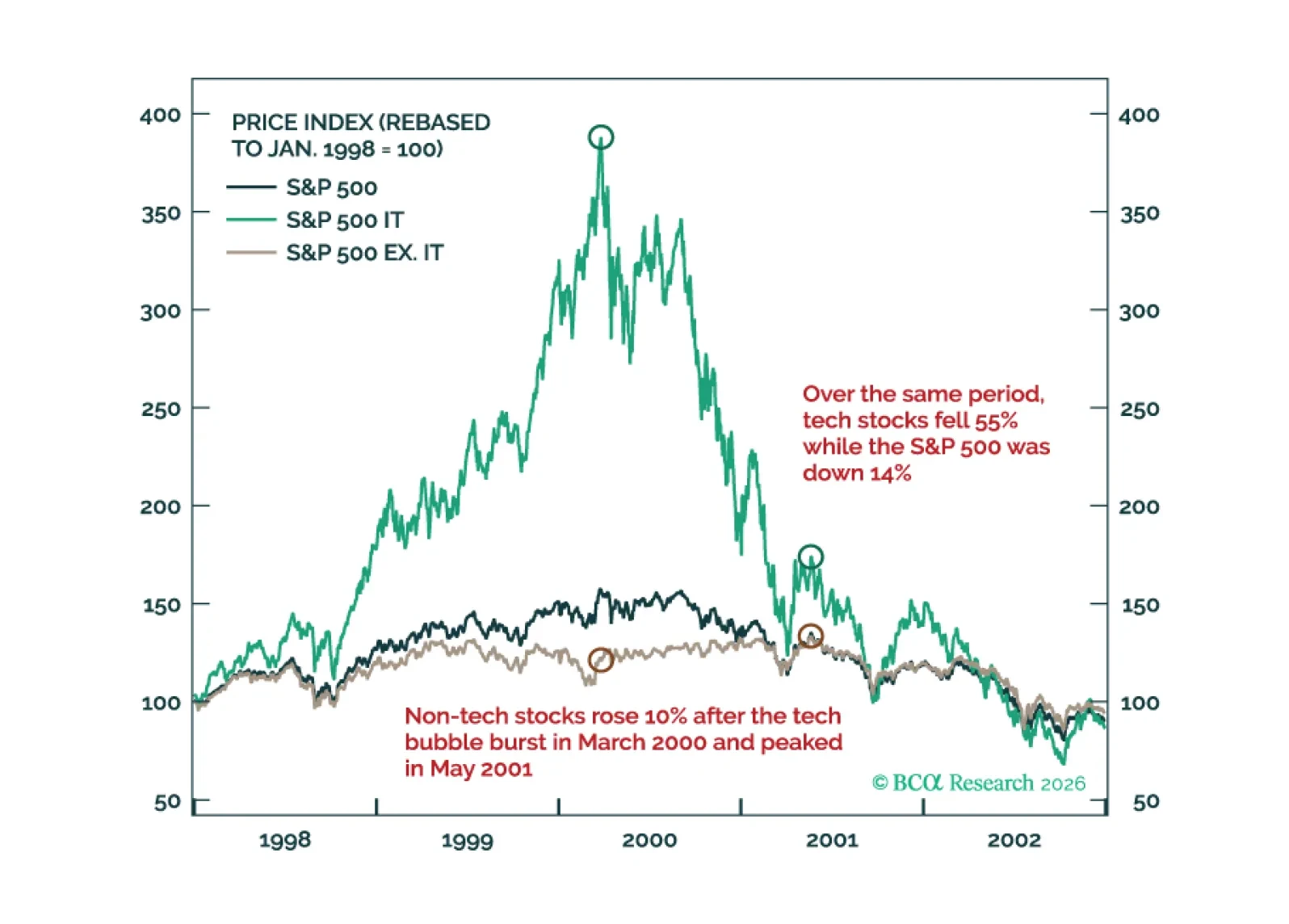

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

2026 will see geopolitical risk move sideways globally as the US pursues a ceasefire in the proxy war with Russia and a tariff truce with China ahead of midterm elections that will produce gridlock.

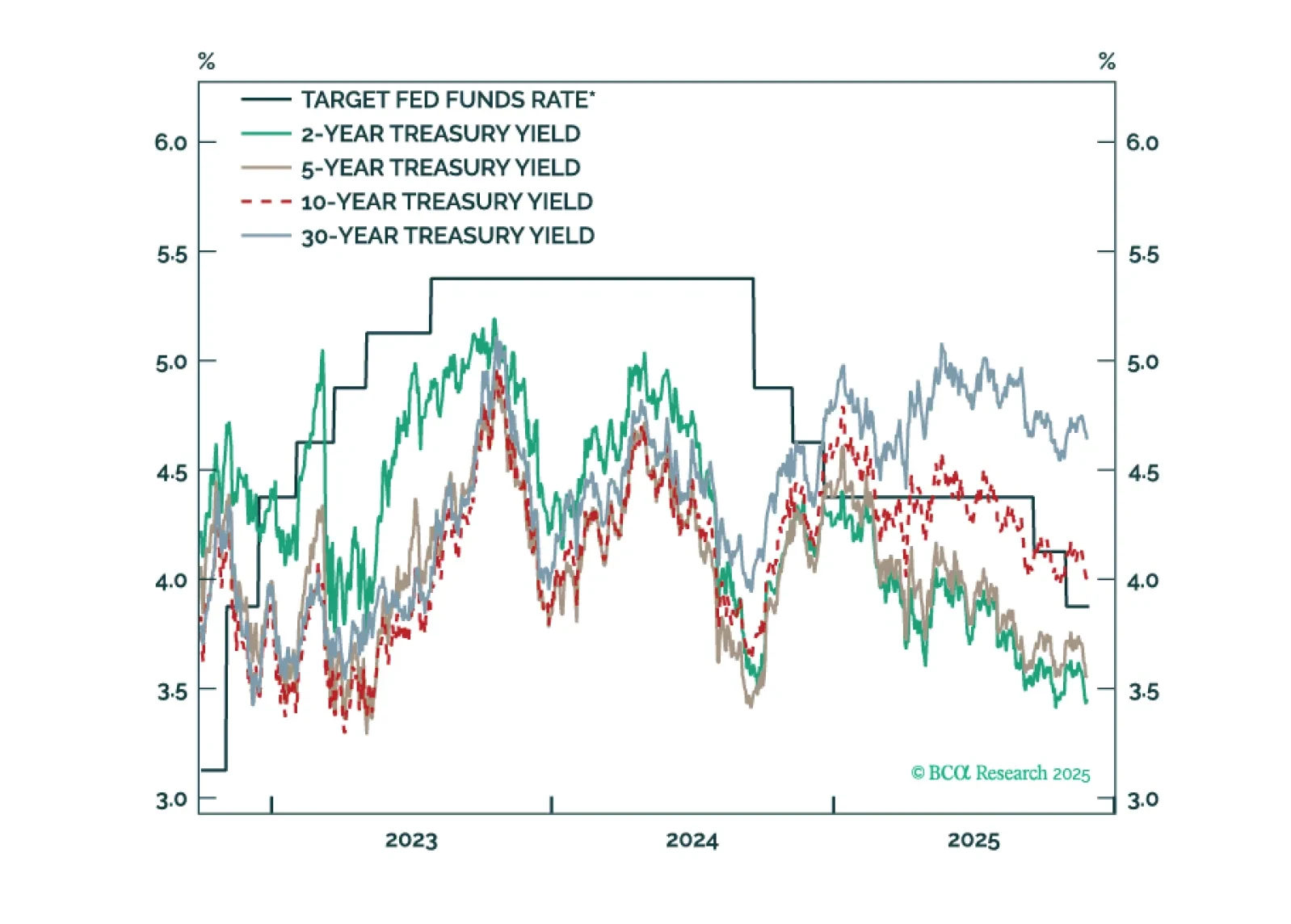

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.

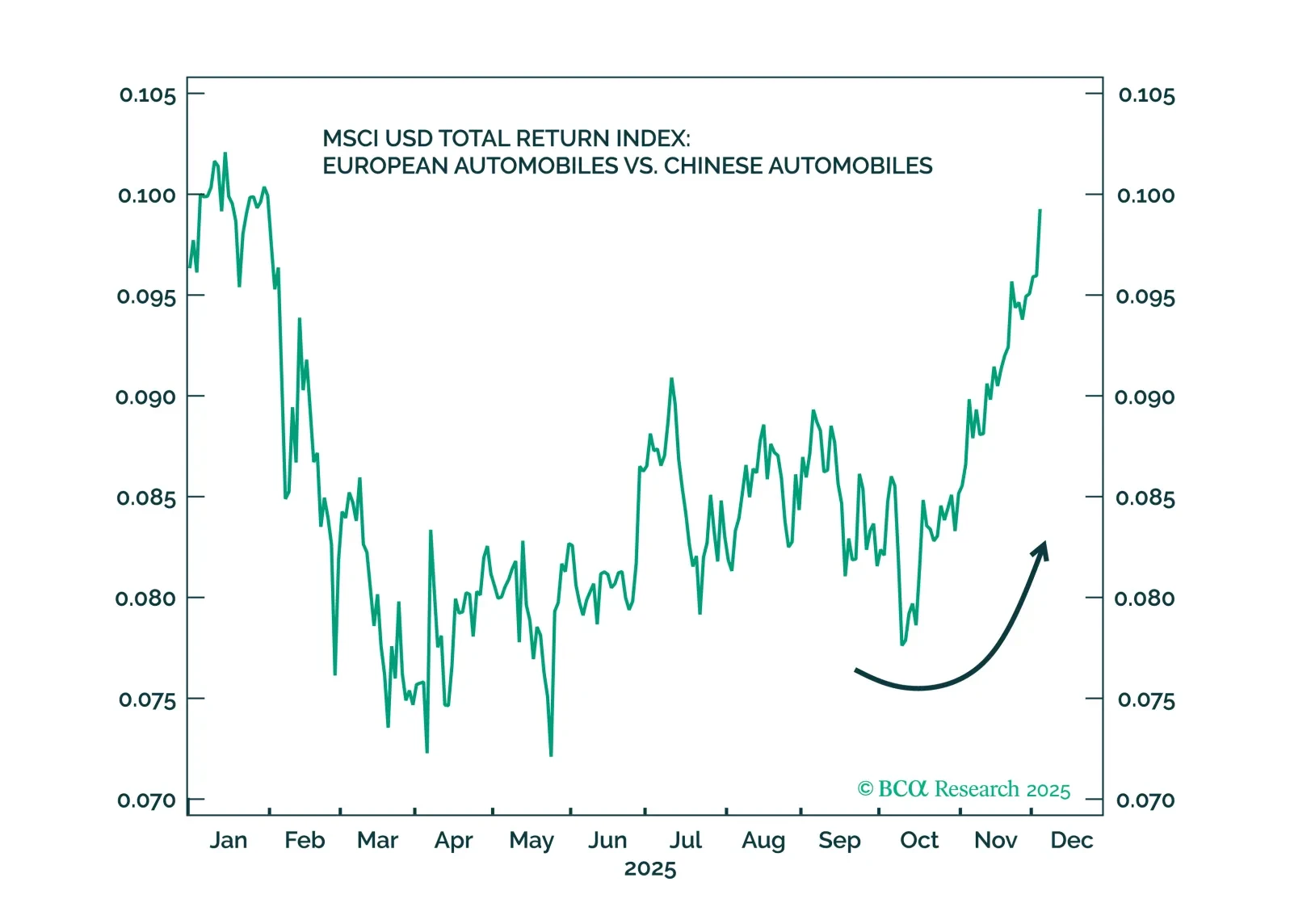

We got Trump's tariff shock and backtracking correct and predicted Israel's attack on Iran. But we missed the China rally — and there is still no Ukraine ceasefire.

Our Portfolio Allocation Summary for December 2025.