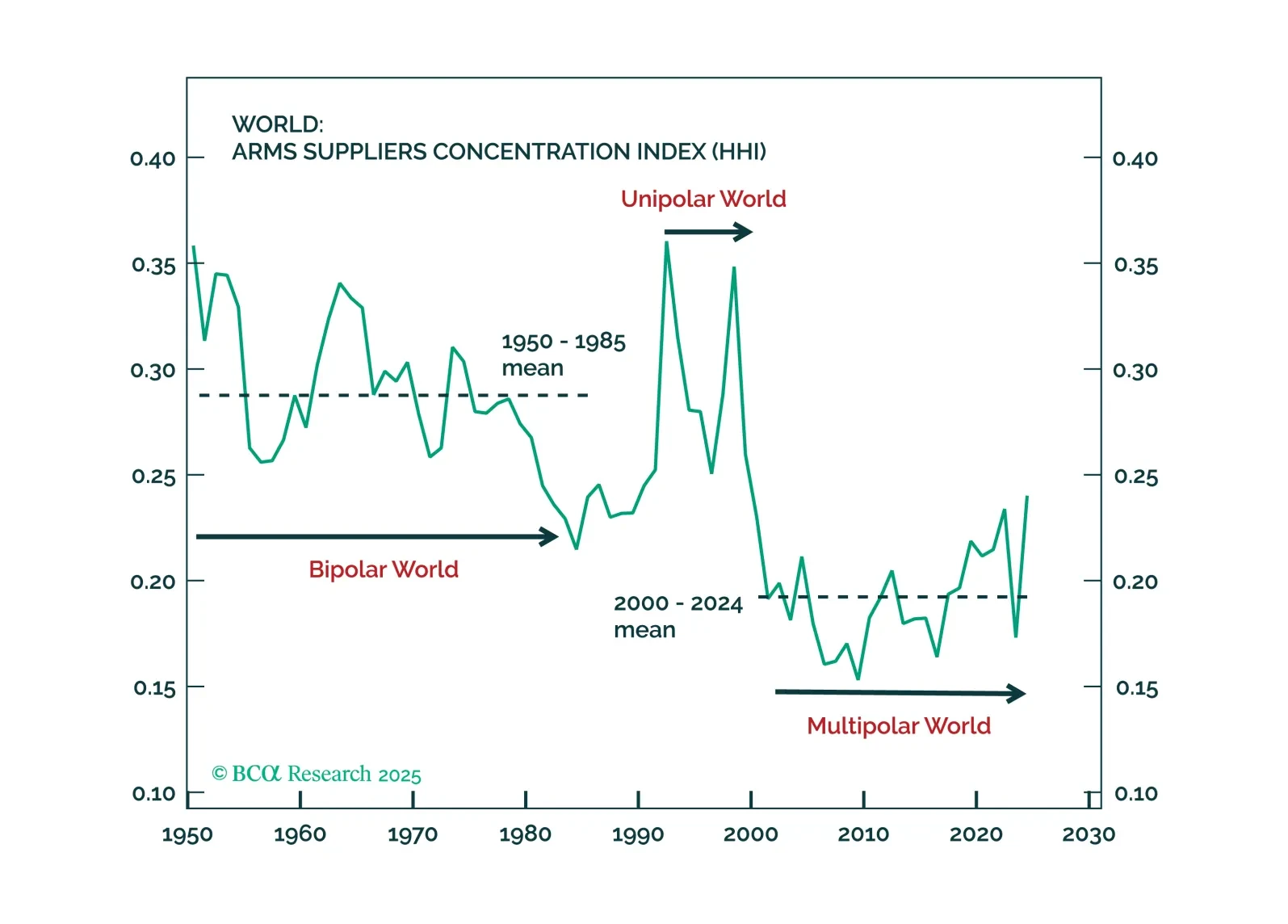

In our Beta report, we focus on our decade view. Many of our global allocator clients are scrambling to incorporate geopolitics into their strategic asset allocation. For most, this means thinking about war… or about future end-…

Executive Summary Biden Taps China-Bashing Consensus House Speaker Nancy Pelosi’s visit to Taiwan reflects one of our emerging views in 2022: the Biden administration’s willingness to take foreign policy risks…

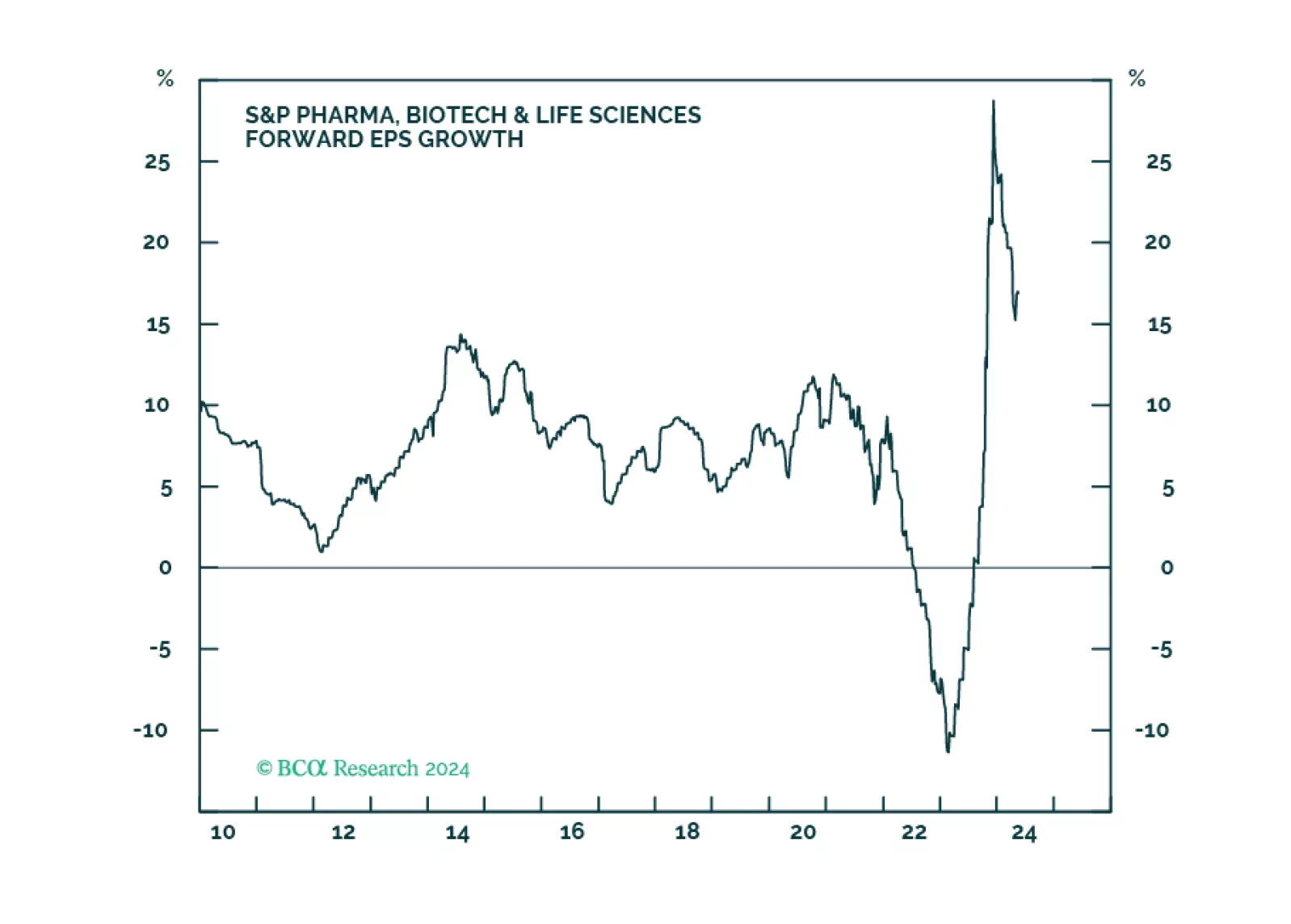

Highlights Upgrade The Health Care Sector To An Overweight: Expressed through an overweight position in Health Care Equipment and Services, and an equal weight position in Pharmaceuticals and Biotech The Sector Faces A Few Tailwinds…

This Monday we closed both our cyclical and high-conviction S&P pharmaceuticals underweights for a combined gain of 23%, since inception. We did not wish to overstay our welcome in this defensive industry as not only is…

Highlights Portfolio Strategy Firming operating metrics, a capex upcycle, rock bottom valuations and deeply oversold conditions all suggest that it no longer pays to be bearish Big Pharma. Upgrade to neutral, today. A looming M&A…

Highlights Stronger global growth in the wake of continued and expected fiscal and monetary stimulus, and progress against COVID-19 are boosting oil demand assumptions by the major data suppliers for this year. We lifted our…

Underweight (High-Conviction) Pharmaceutical stocks are melting in line with the broader macro-economic rebound, and given our cyclical and structural bullish market outlooks, we continue to recommend investors fade this…

Dear client, Next Monday December 14, 2020 we will be hosting our last webcasts for the year “From Alpha To Omega With Anastasios”, one at 10am EST for our US, European and Middle Eastern clients and one at 8pm EST for our…

Your feedback is important to us. Please take our client survey today Highlights Portfolio Strategy An easy Fed, the drubbing in the US dollar, the opening up of the global economy, poor pharma operating metrics and the specter of a…