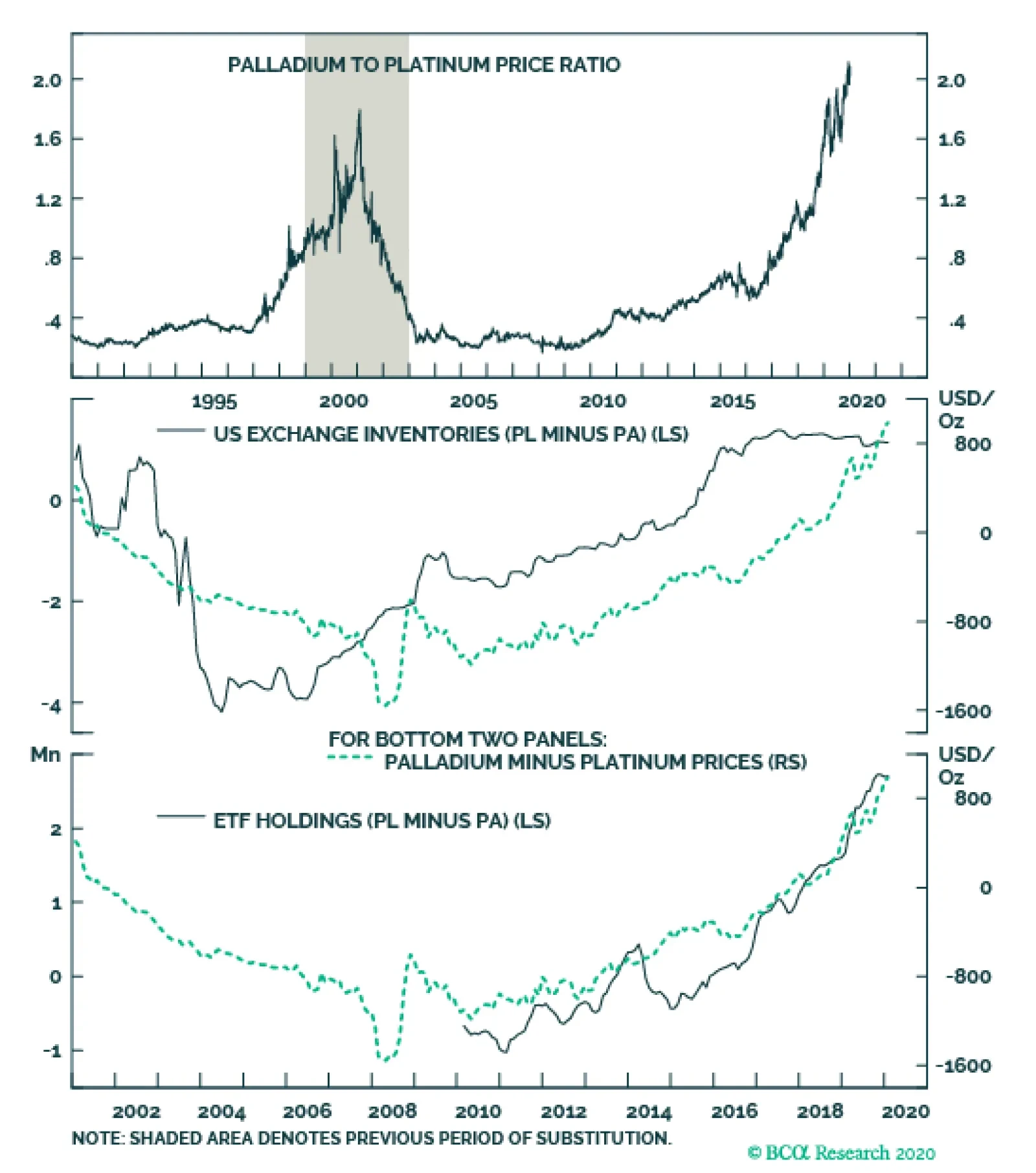

The platinum-to-palladium ratio is at a level that would incentivize substitution in the pollution-control technology in gasoline-powered engines, and supports higher platinum content in diesel catalyzers. Nonetheless, swapping…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

… quick’s the word and sharp’s the action. Jack Aubrey1 Idiosyncratic supply-demand adjustments – some induced by head-spinning reversals of policy (e.g., the U.S. about-face on Iran oil export sanctions)…

Highlights As the Fed proceeds with its policy tightening this year, higher real rates and a stronger USD will weigh on silver and platinum prices, and, to a lesser extent, palladium prices. Offsetting these downward pressures, silver,…

Highlights Expanding trade volumes - led by EM growth - will continue to support commodity demand, particularly for base metals. In the first four months of this year, EM import growth averaged 8.4% year-on-year (yoy), led by an…

Refiners will reduce run rates over the next month or so to clear unintended inventory accumulation, but it's not like they've never had to deal with this situation.

Against a backdrop of continuing supply destruction, particularly in the U.S., and a pick-up in crude demand, markets will remain in balance this quarter and go into a deficit in 2016H2.

The pace of U.S. oil supply destruction accelerated at the end of April, as yoy losses increased to 470 thousand barrels per day (Mb/d) for the week ended April 29.

These general themes - along with our assessment that markets were overestimating downside price risk and underestimating upside risks arising from supply destruction and geopolitical instability - supported the best-performing…

We differ markedly with the U.S. EIA's assessment of the near-term evolution of oil supply and demand.