While our bullish take on refiners got to a slippery start, it has recovered all the losses and this position is now in the black. Factors are falling into place for additional gains in the coming months and we recommend investors stick…

Highlights Portfolio Strategy Soft housing demand, the trough in interest rates, new home price deflation and weak industry employment prospects suggest that an underweight stance is now warranted in the S&P homebuilding index.…

That upgrade was based on the dramatic divergence between improving fundamentals and a zealously pessimistic sell-side. While the index has moved sideways since we made the change, our thesis has been reinforced by industry…

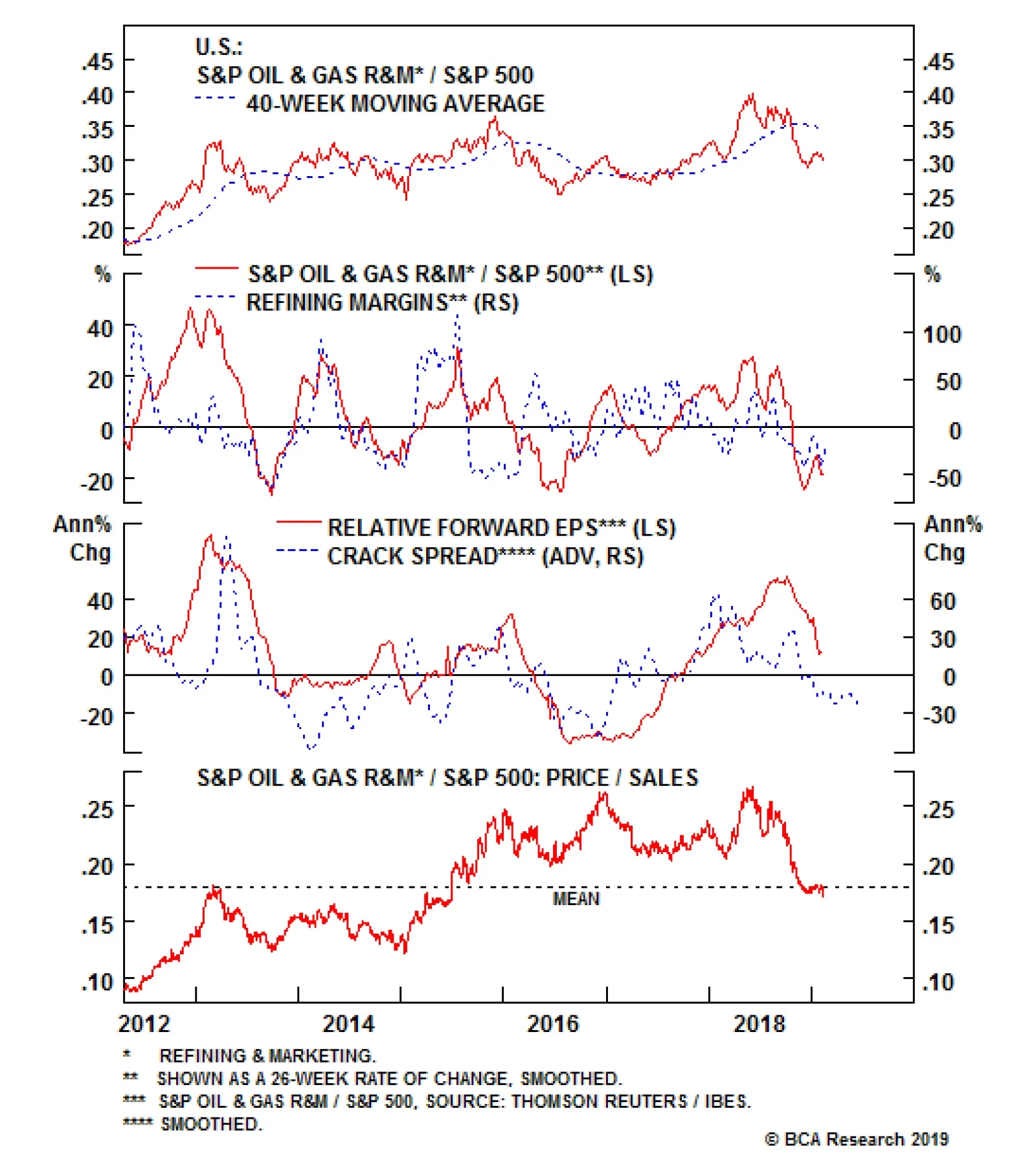

Overweight We upgraded the S&P oil & gas refining & marketing index last month all the way from underweight to overweight based on the dramatic divergence between improving fundamentals and a zealously…

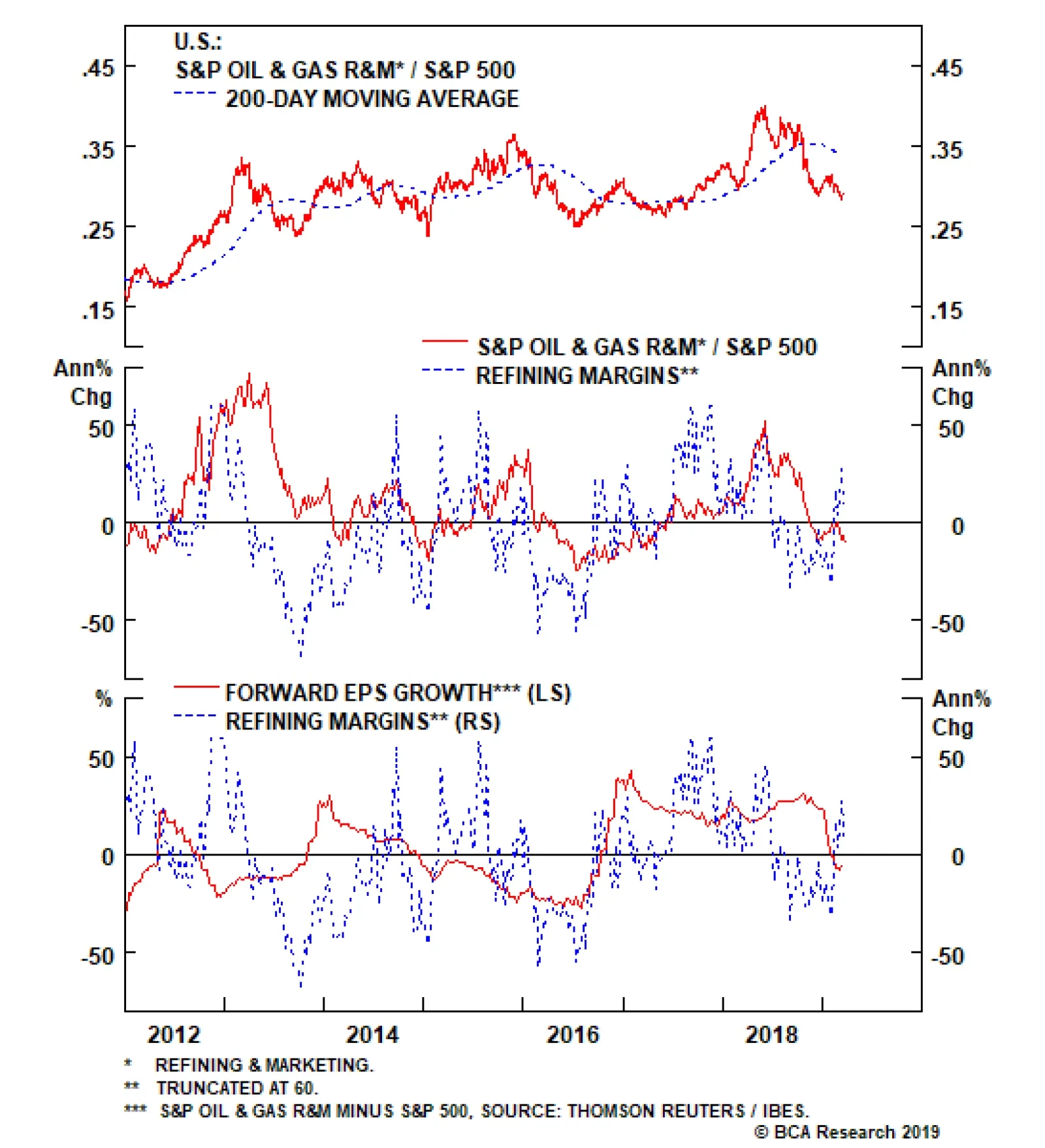

Relative share prices are no longer rising by 50% / annum. Instead, momentum has collapsed and is now contracting. Sell-side analyst exuberance has turned into outright pessimism: refiners’ profits are expected to trail the…

Overweight Last summer we took refiners down to a below benchmark allocation as all of the good news was perfectly reflected in soaring relative share prices (top panel), at a time when cracks were forming. Today, refiners…

Highlights Portfolio Strategy As growth becomes scarce, investors flock to sectors that are slated to outgrow the broad market and shy away from the ones that are forecast to trail the SPX’s growth rate. This week we rank…

Highlights The global shipping-fuels market will tighten as UN-mandated fuel standards kick in next year. This will keep ship fuels, known as bunkers, and other distillate prices – e.g., diesel and jet fuel – elevated…

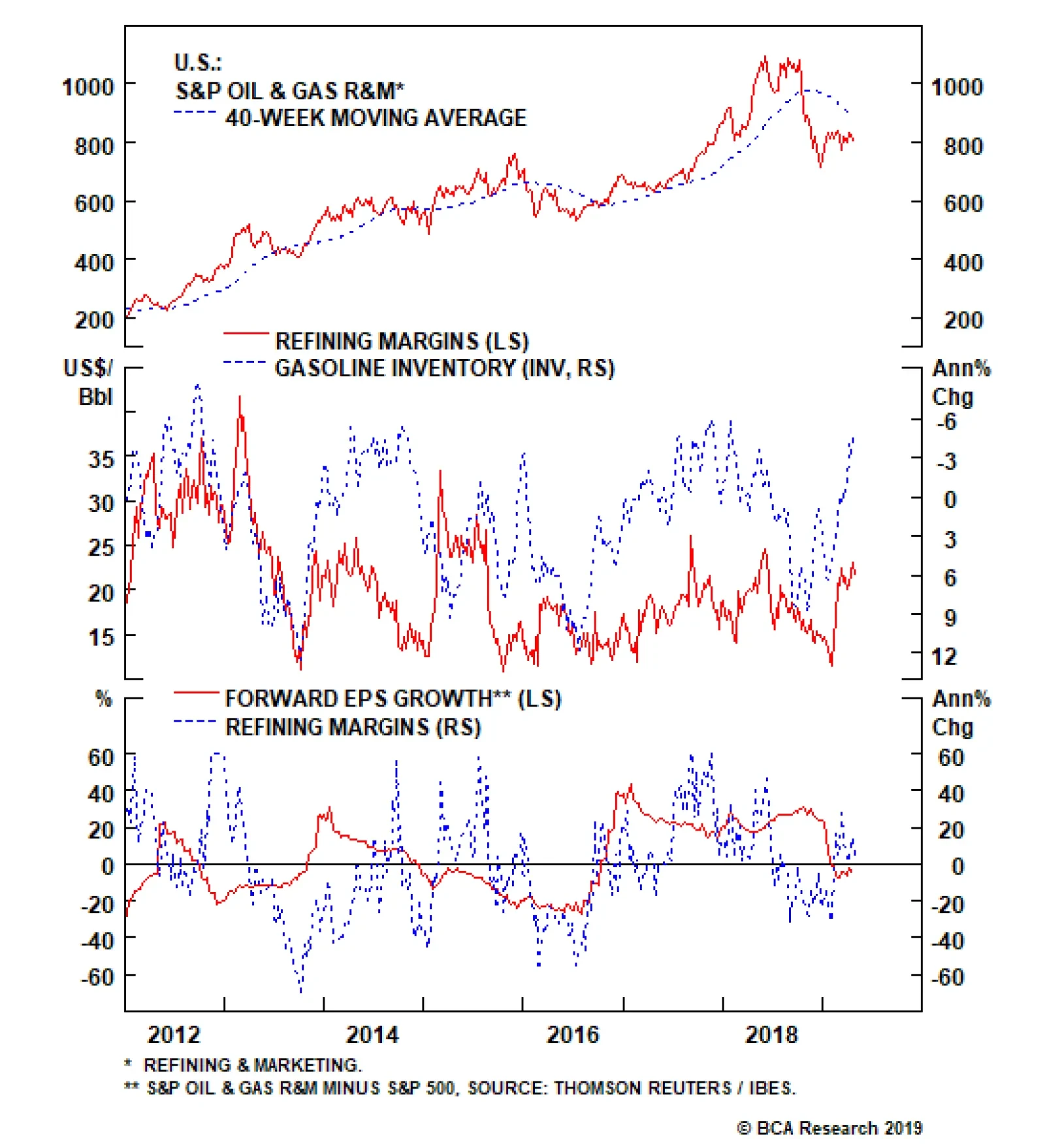

The S&P oil & gas refining & marketing index has typically performed in line with the profitability of its components; the absolute price of inputs and outputs are far less important than the spread between them and…

Underweight The S&P oil & gas refining & marketing index has typically performed in line with their profitability (second panel); the absolute price of inputs and outputs are far less important than the spread…