Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

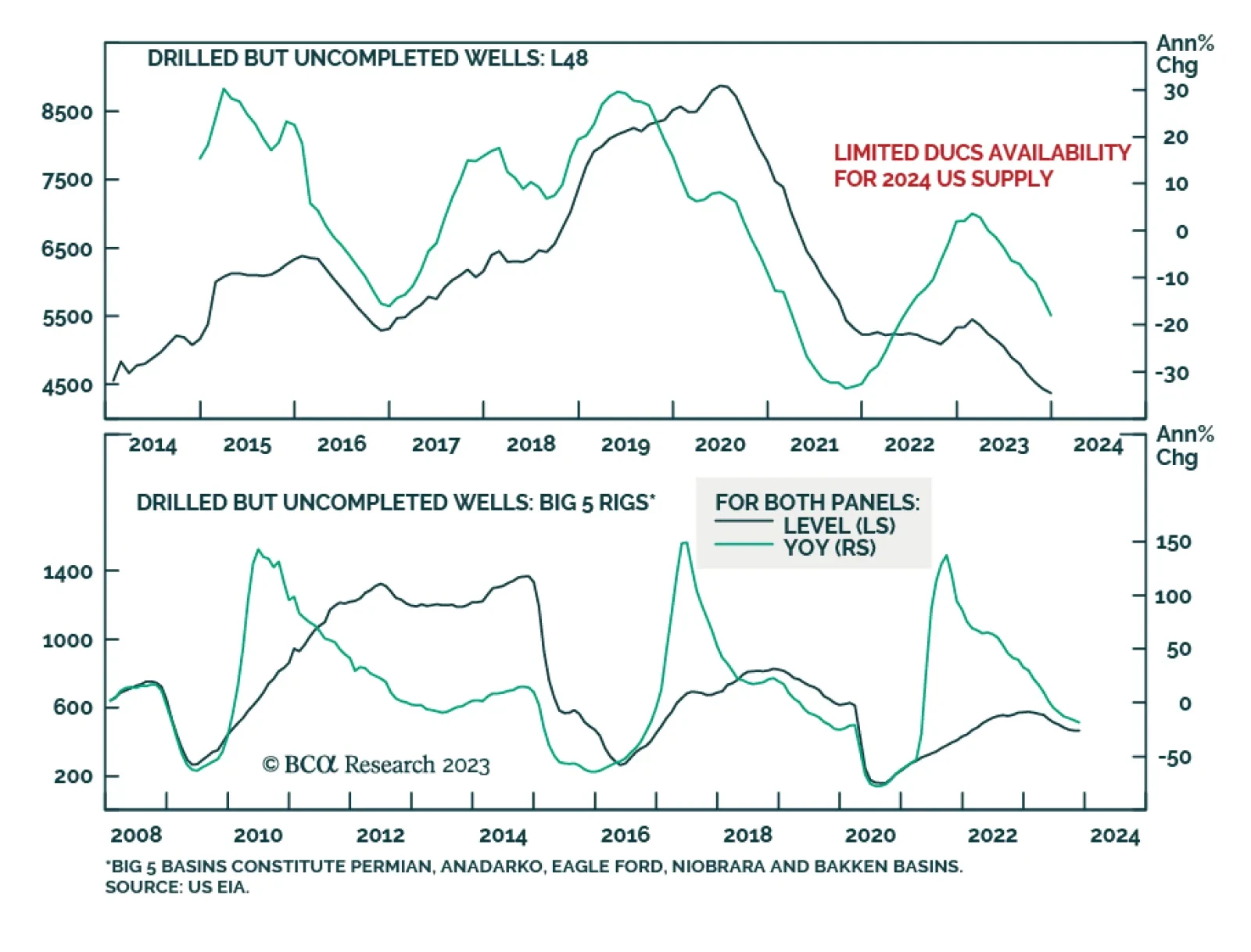

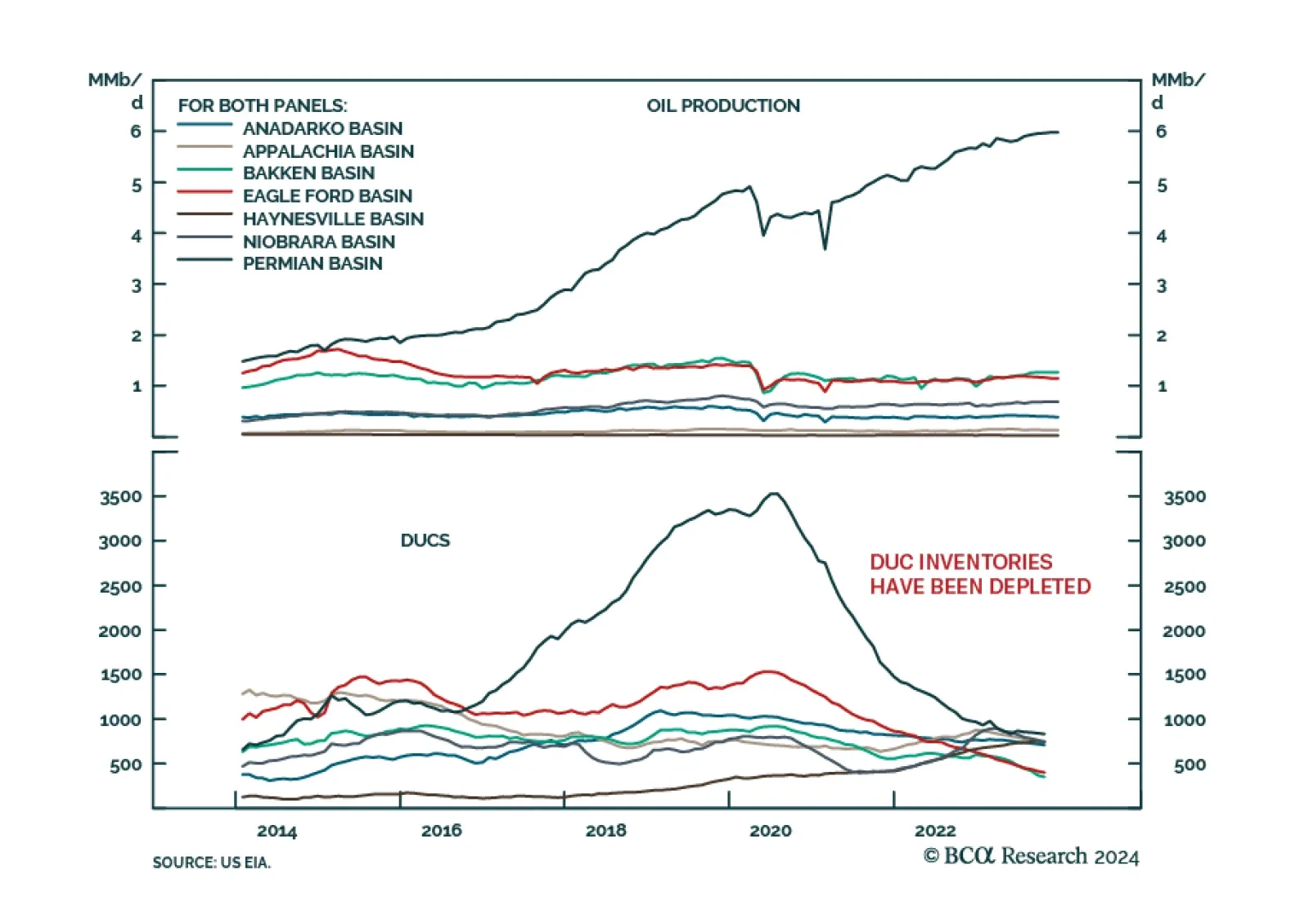

The 1mm b/d surge in US crude oil production last year was the result of a flood of low-cost drilled-but-uncompleted (DUCs) shale-oil wells coming online, mostly in 2H23 in the Permian Basin, which our colleagues in BCA's…

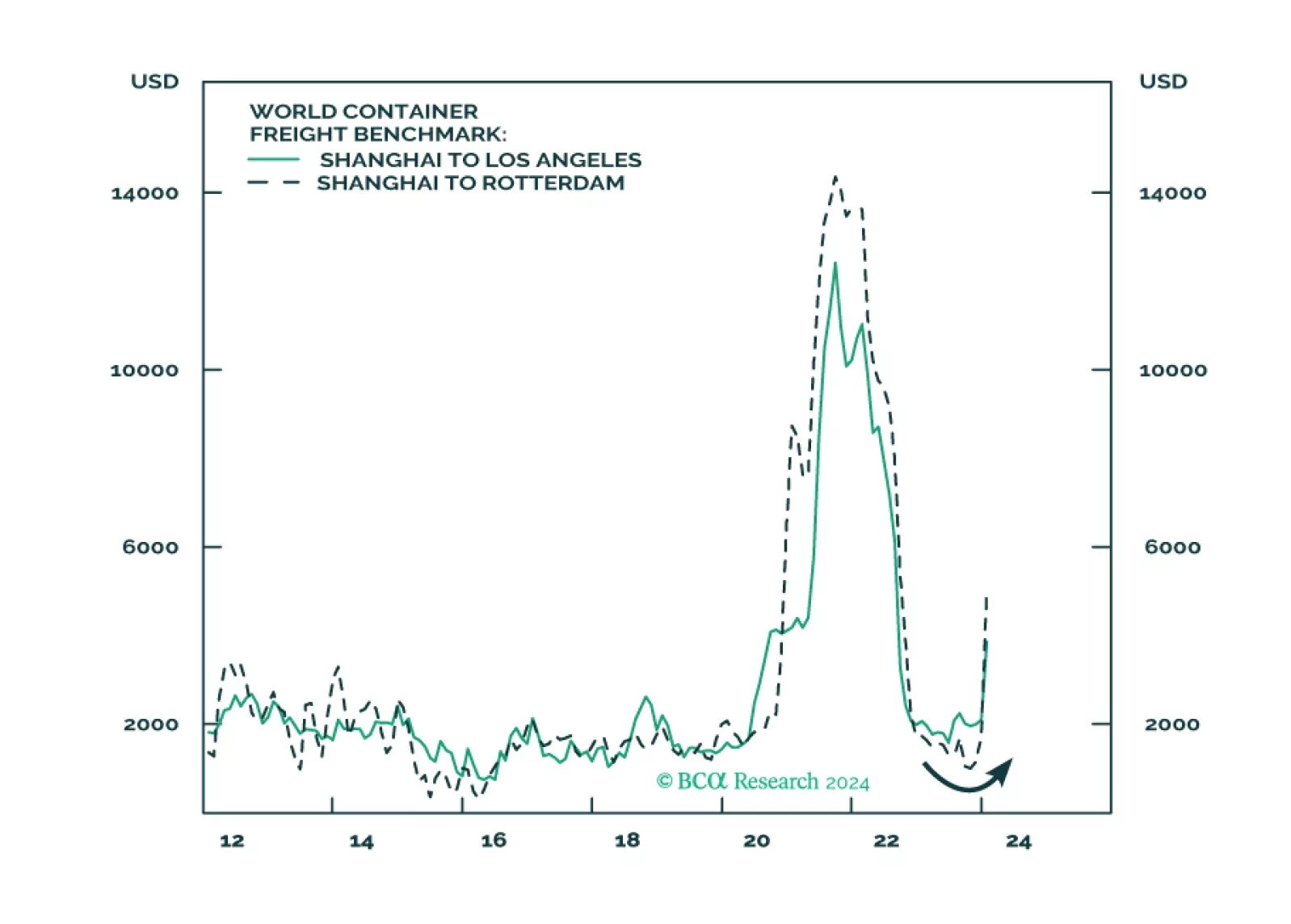

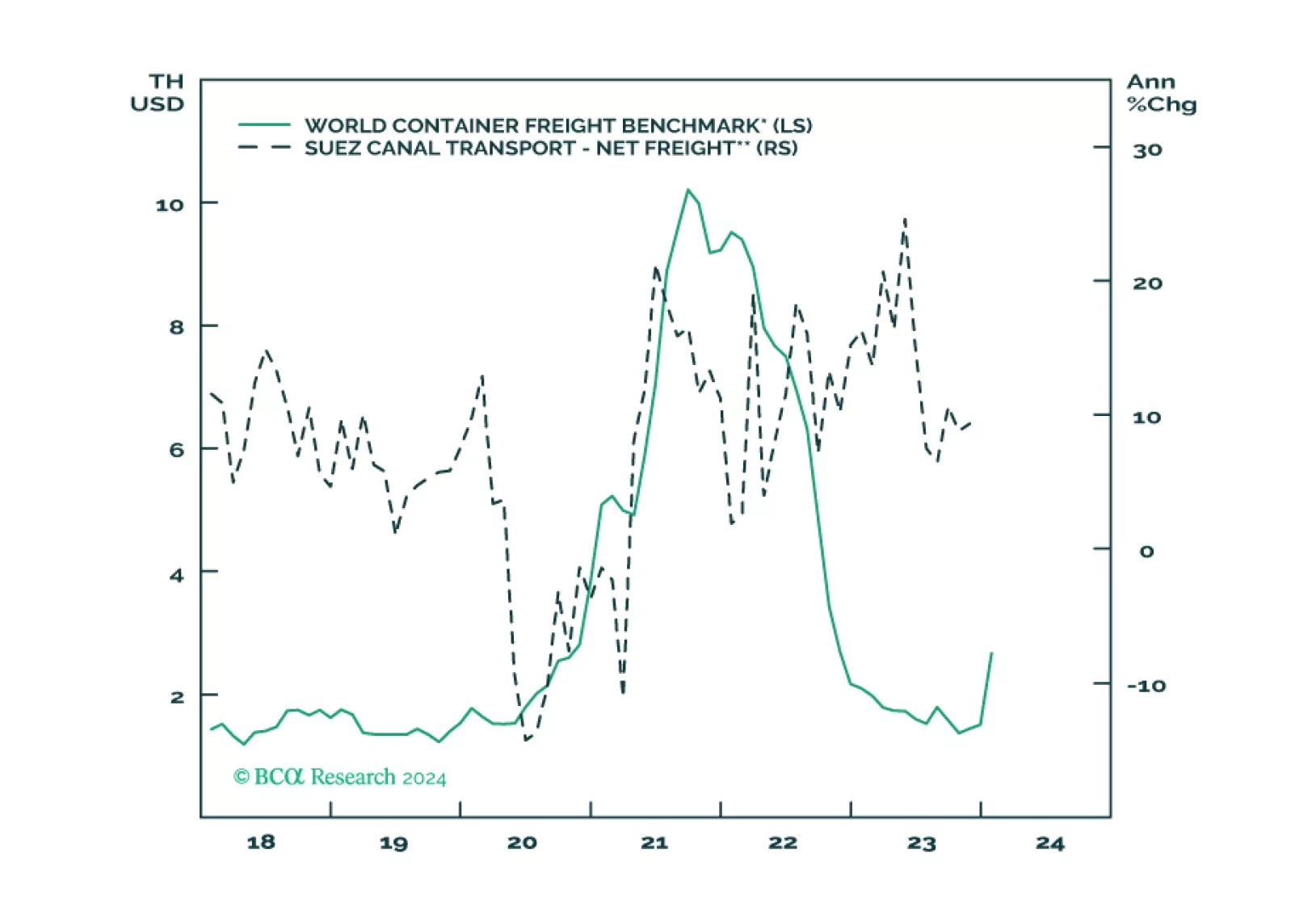

In this brief Insight we examine the expanding Middle East conflict and update the situation in the Taiwan Strait on the eve of elections. The Houthis are a distraction and China is not likely to invade Taiwan in the near term, but…

Crude oil prices weakened following the release of the US EIA’s weekly report on Wednesday, reversing gains earlier in the session and ultimately ending the day lower. The data release showed commercial crude inventories…

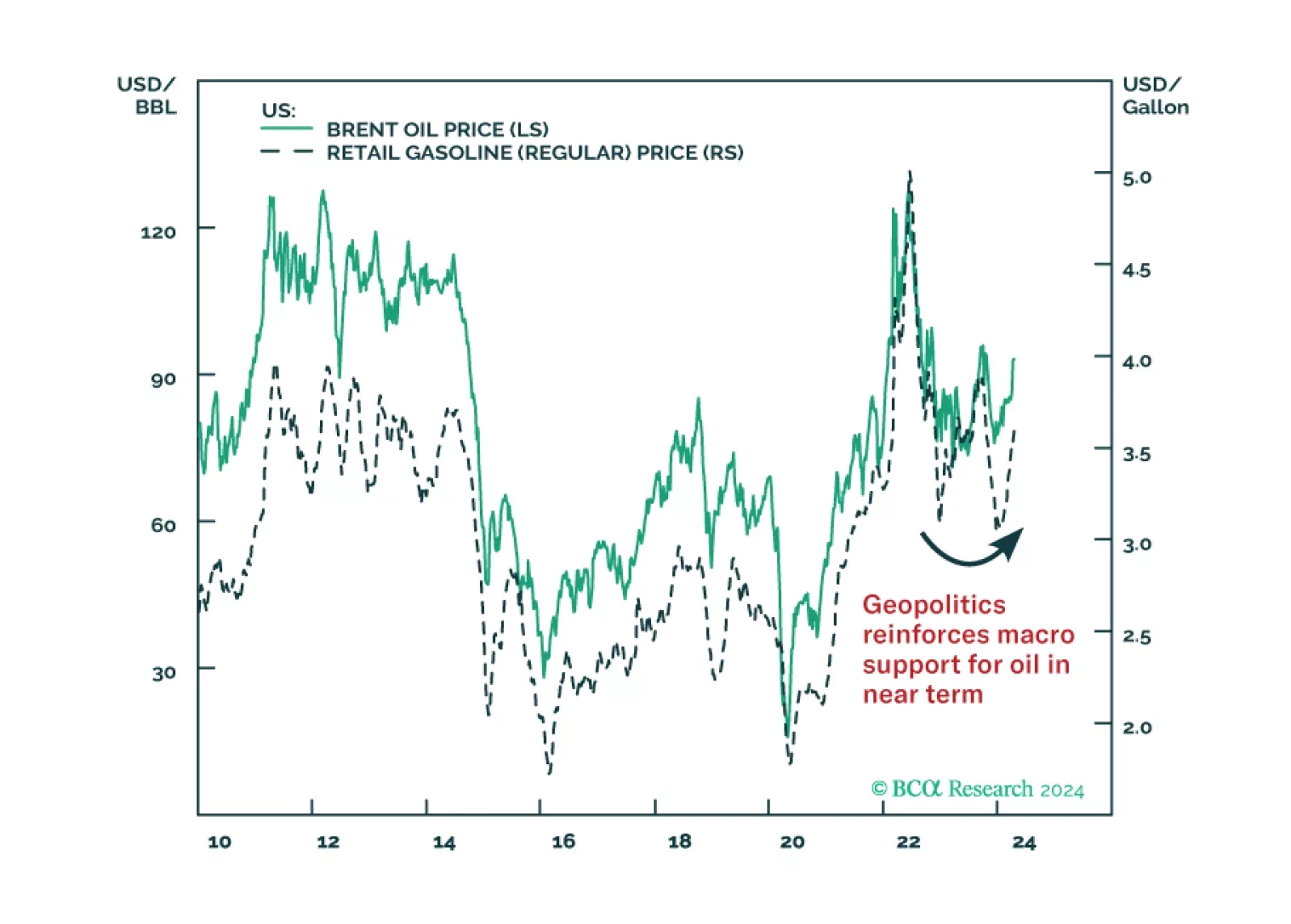

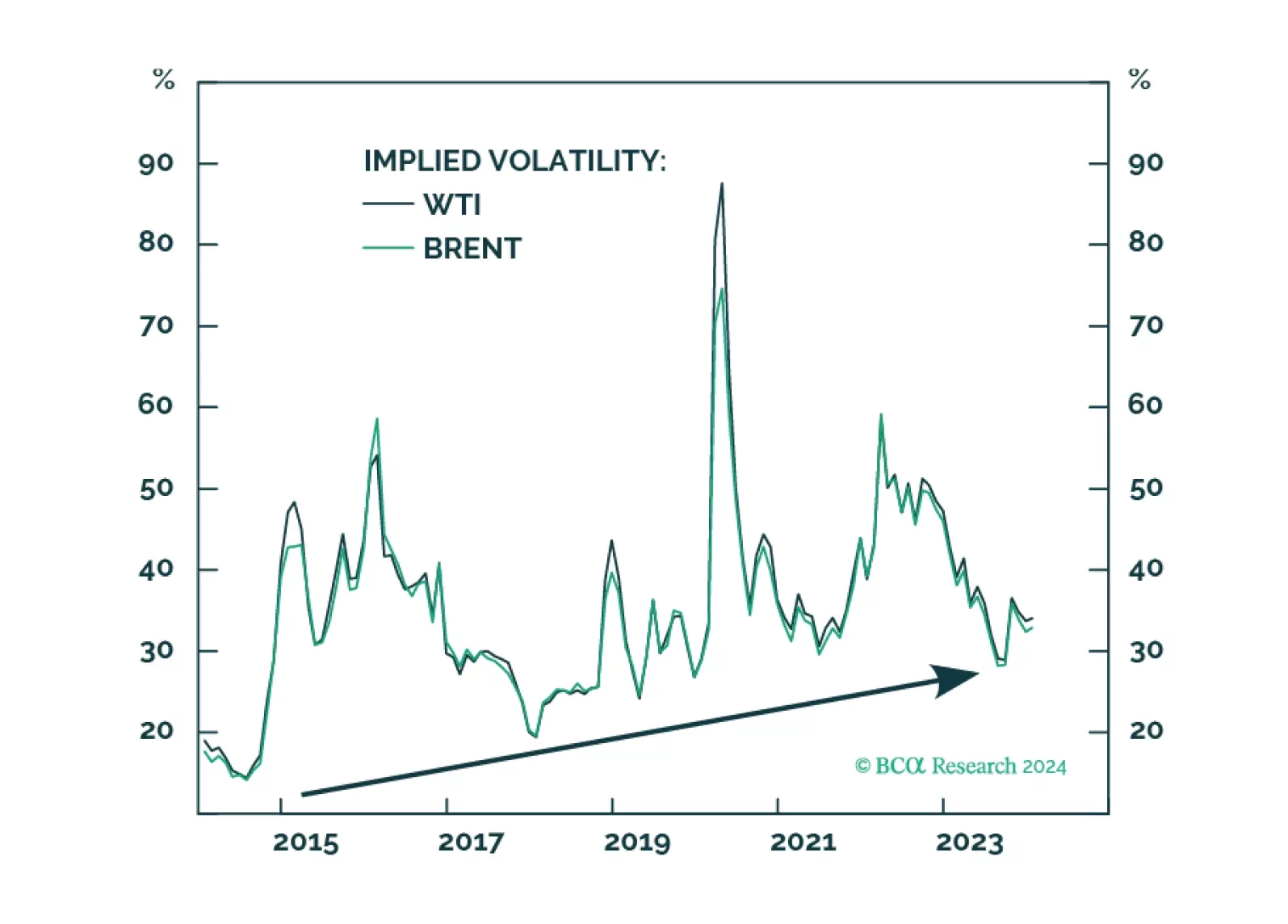

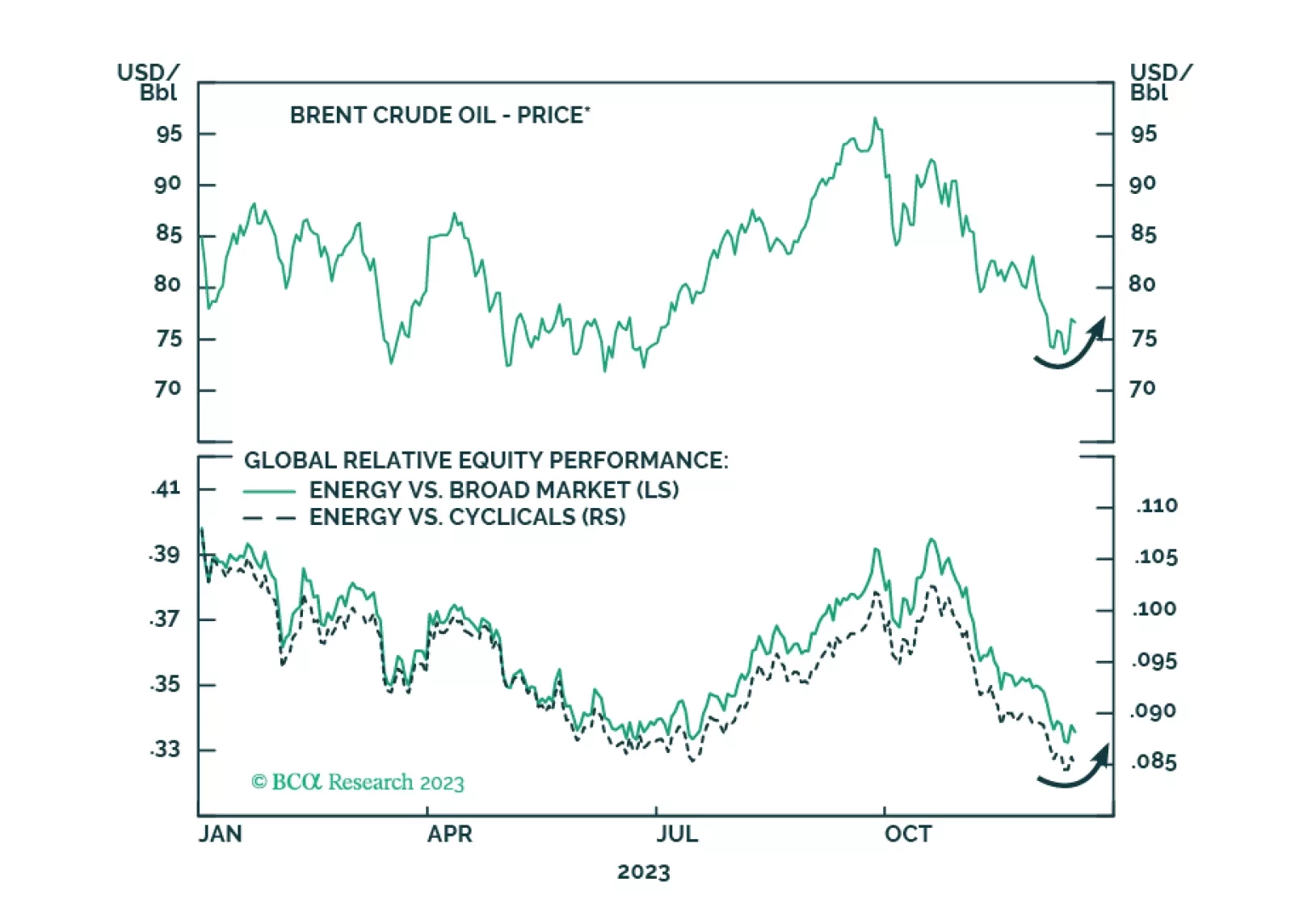

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…

The attempted coup in Russia produced subdued short-covering rallies in oil, gas, and grains markets, as markets over time have observed that coups, rarely result in loss of production and exports. Markets await Putin’s next move.…

The OPEC 2.0 supply cuts announced over the weekend will be fundamentally bullish international crude oil prices. According to our model, brent will cross the USD 100/bbl mark by August this year. We believe the cohort is pre-…