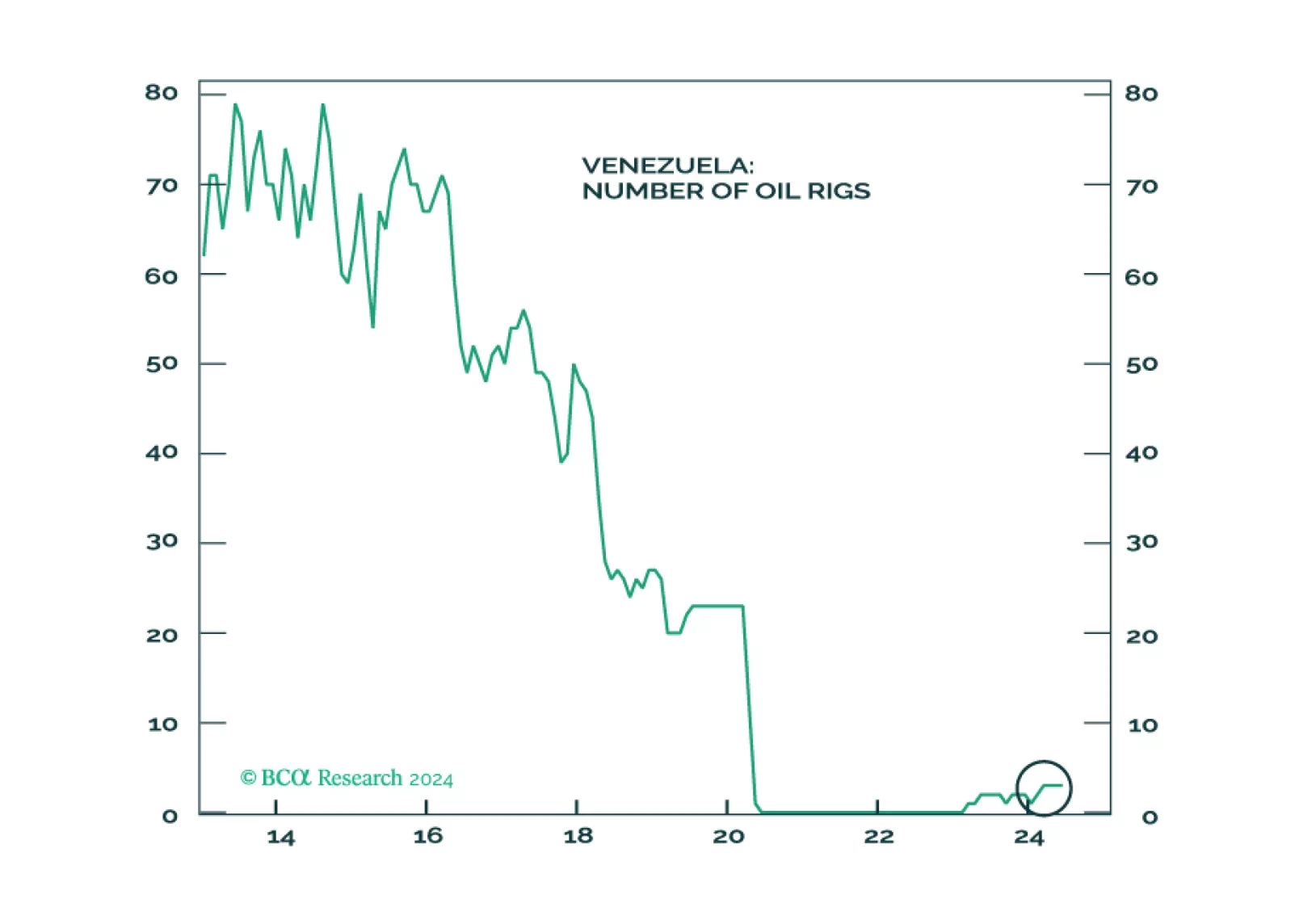

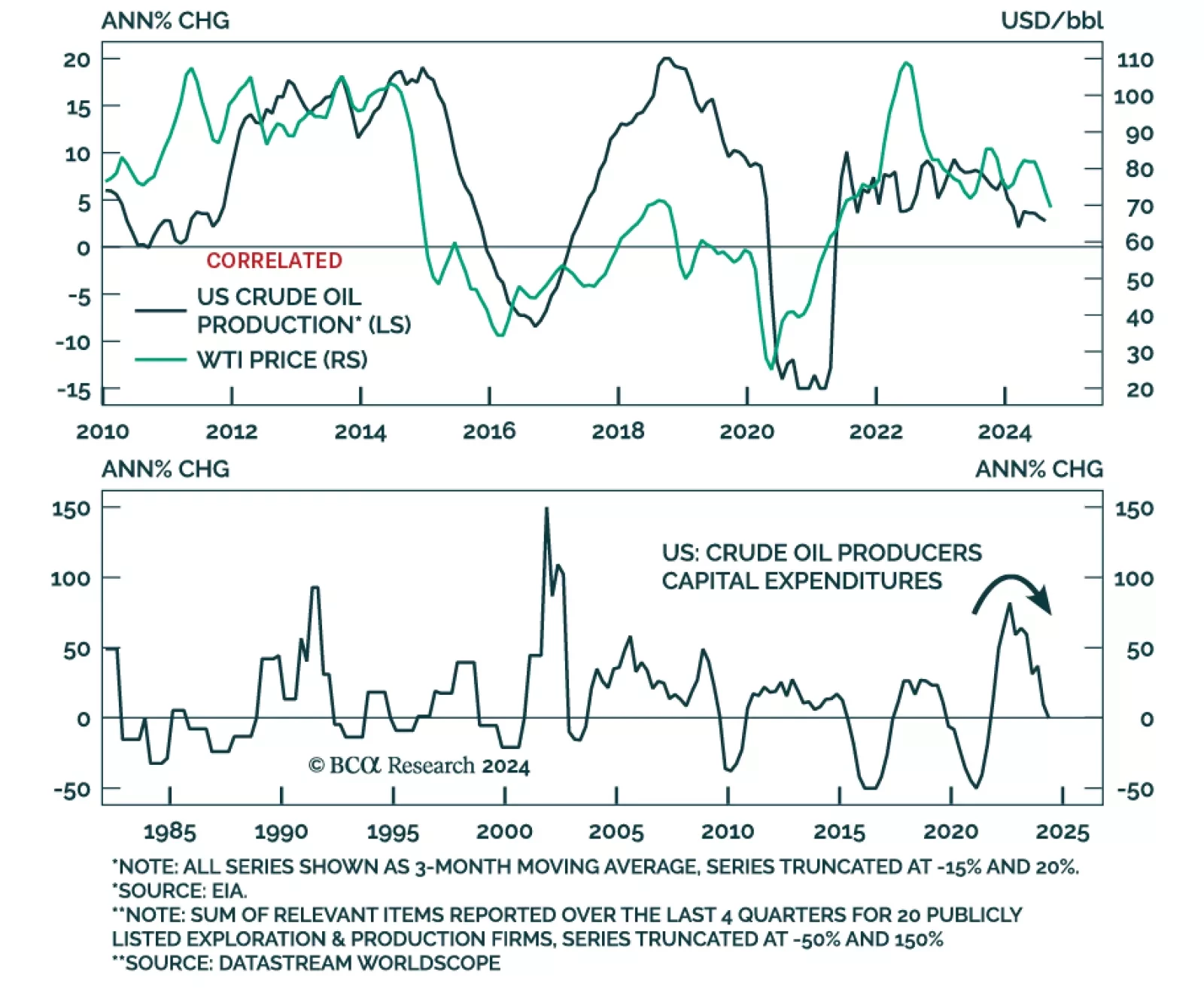

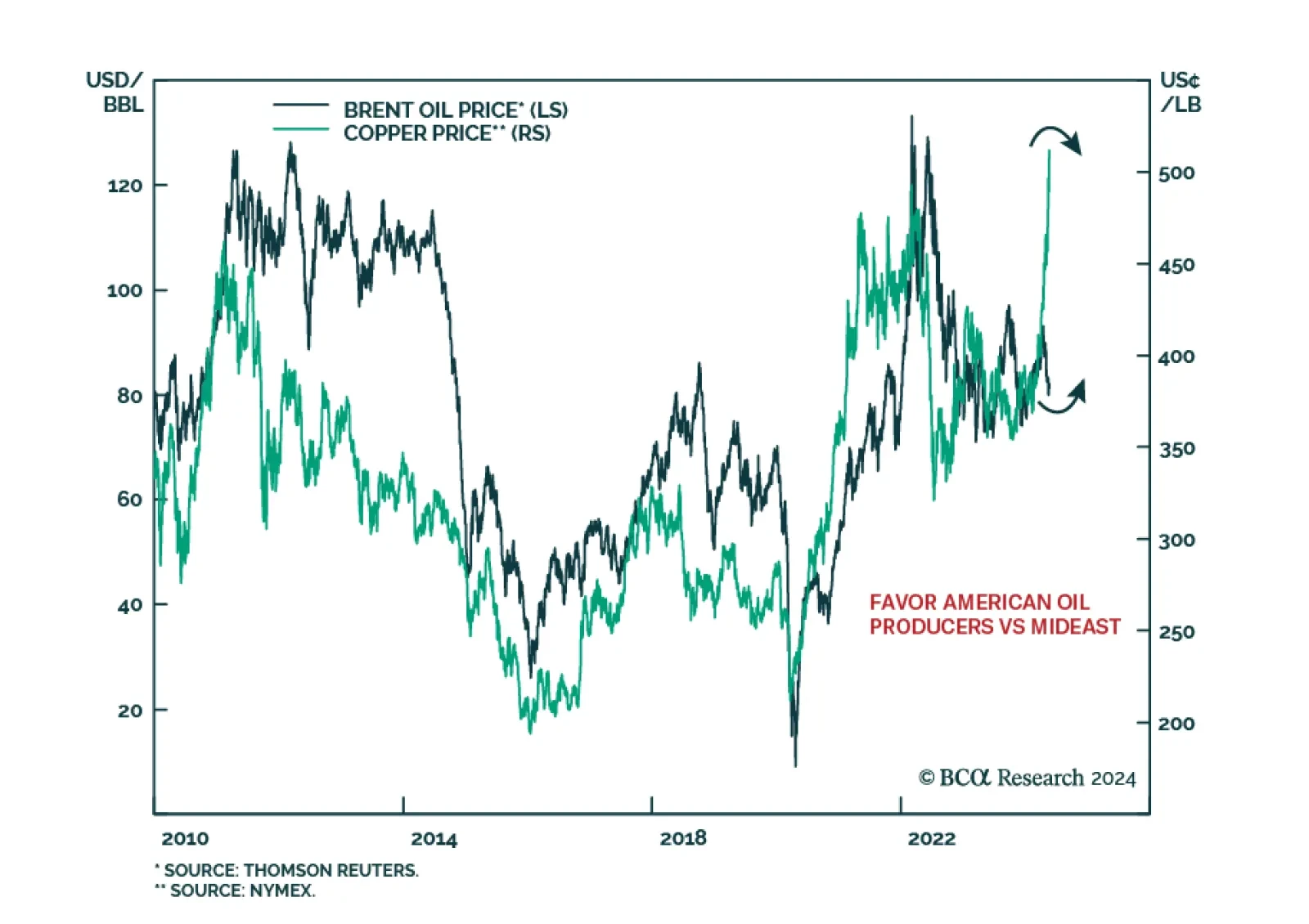

According to BCA Research’s Commodity and Energy strategy service, even though US crude output will continue rising, a meaningful growth acceleration is unlikely. US producers adjust their output in response to market…

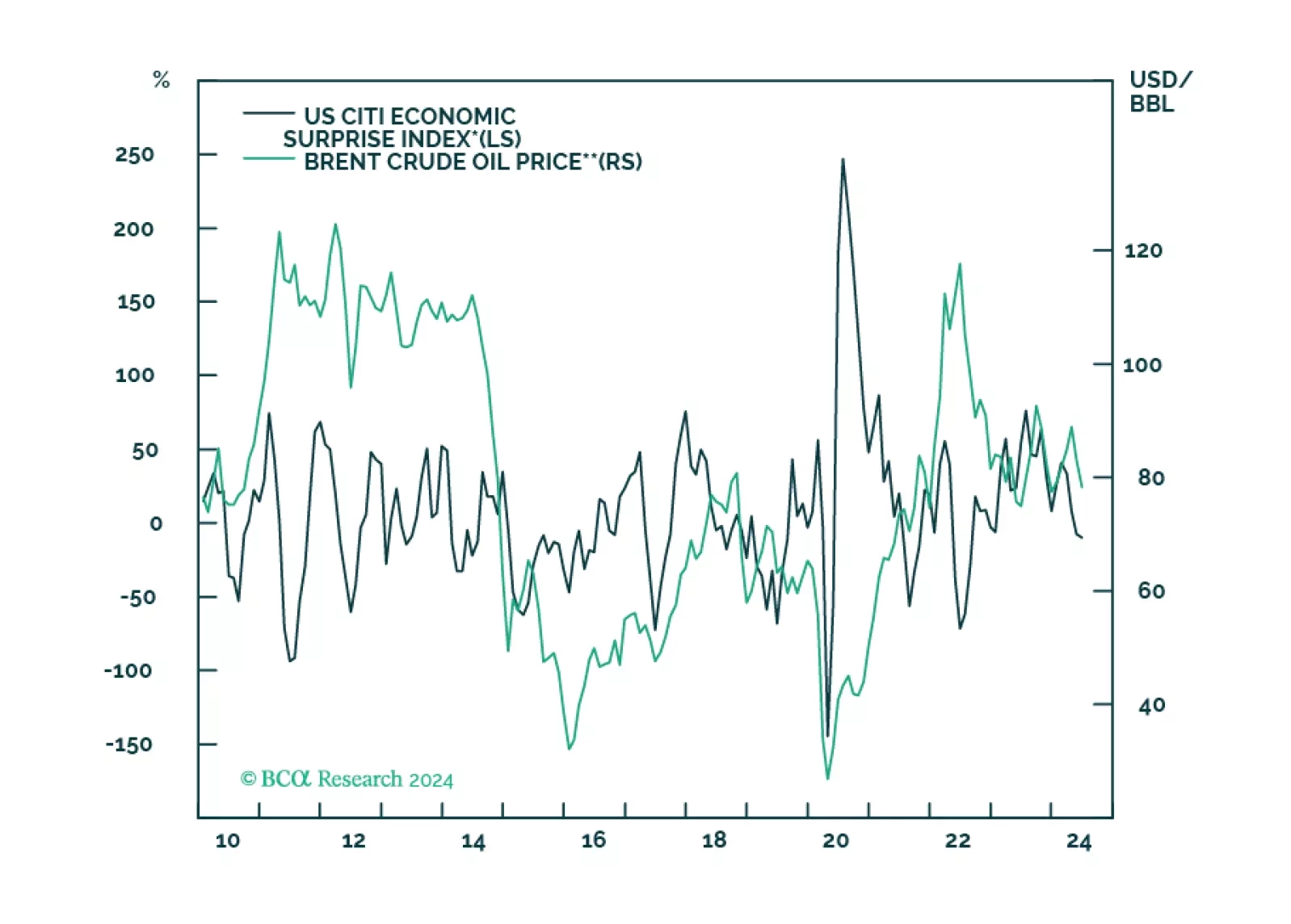

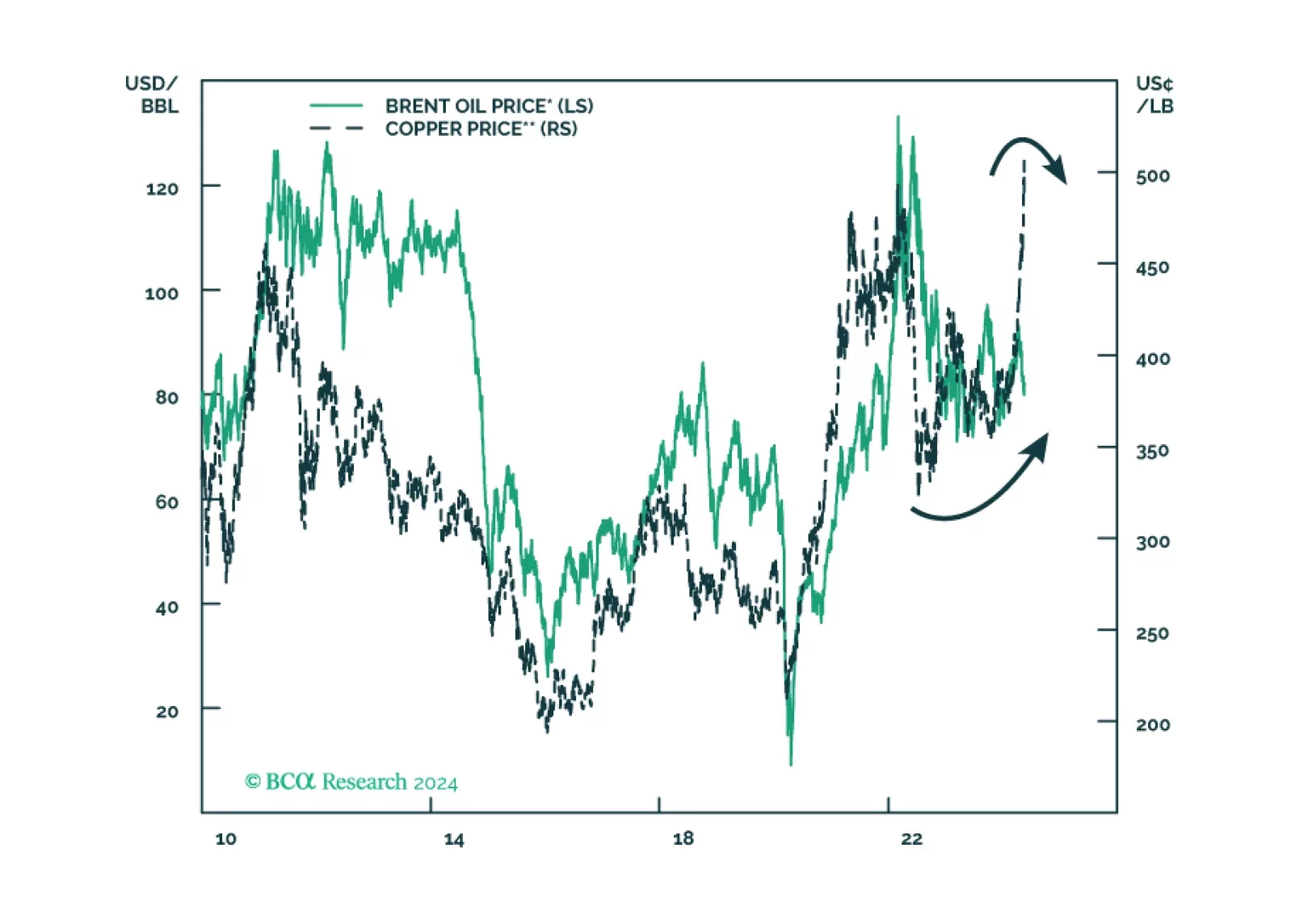

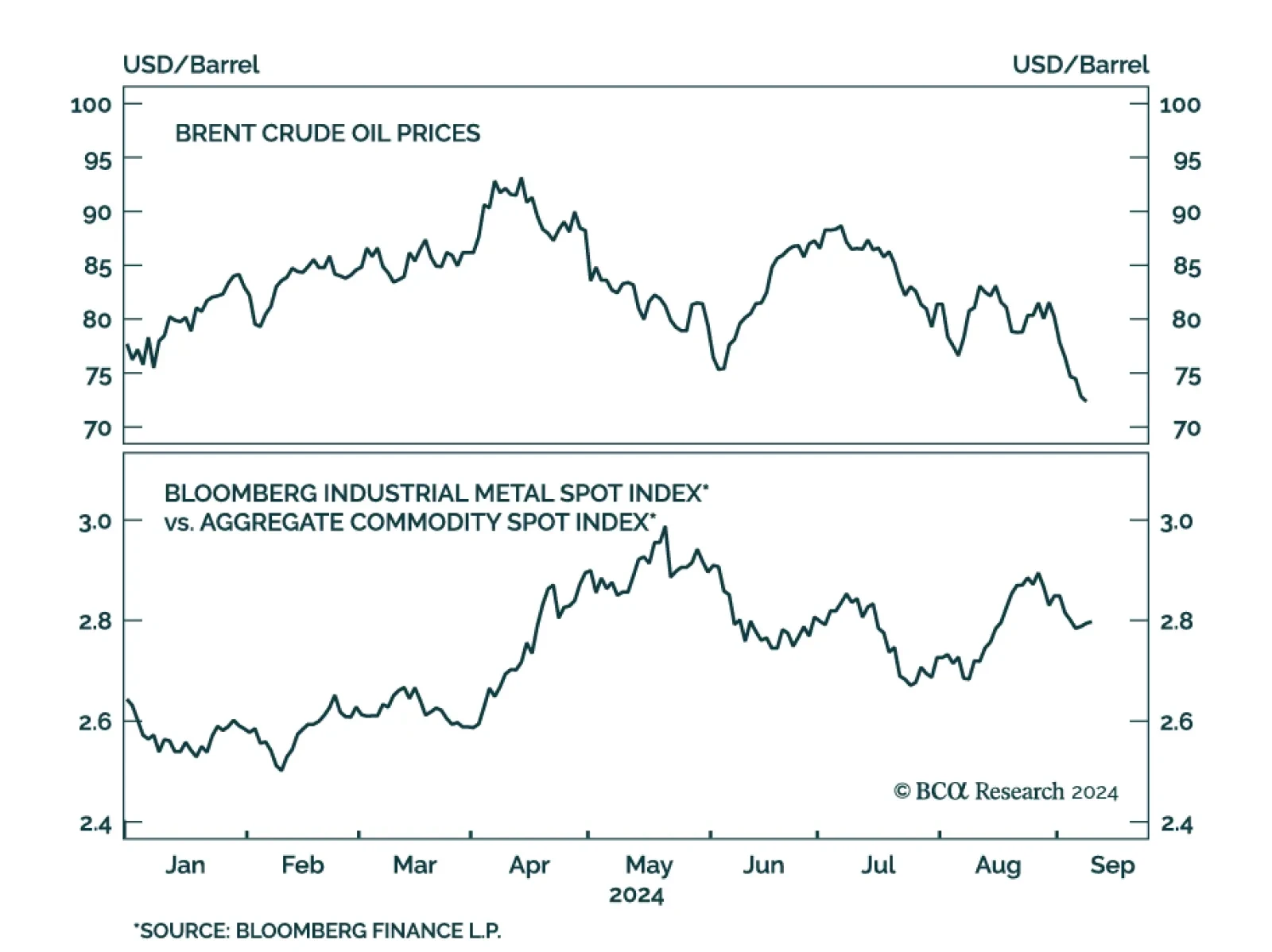

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

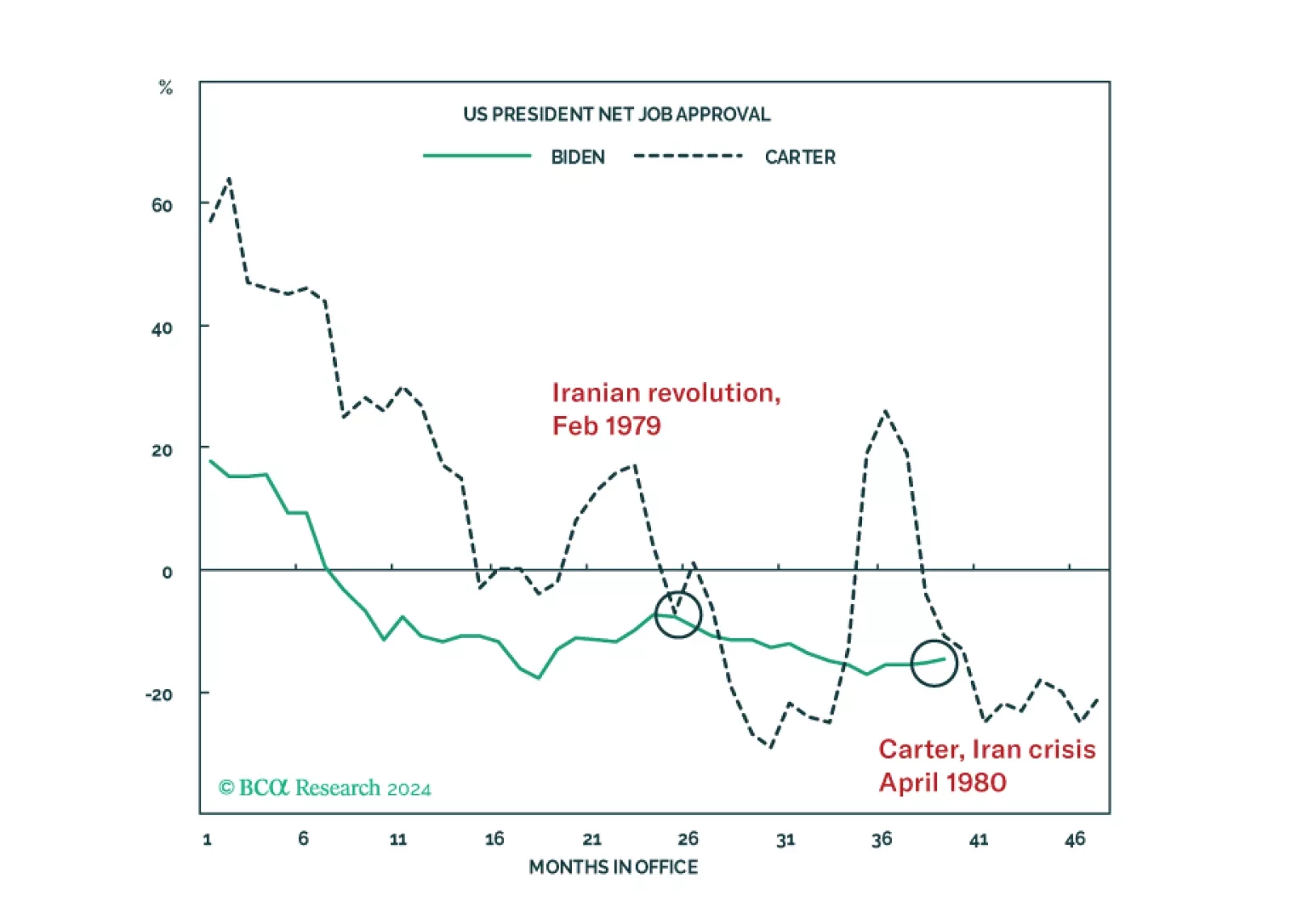

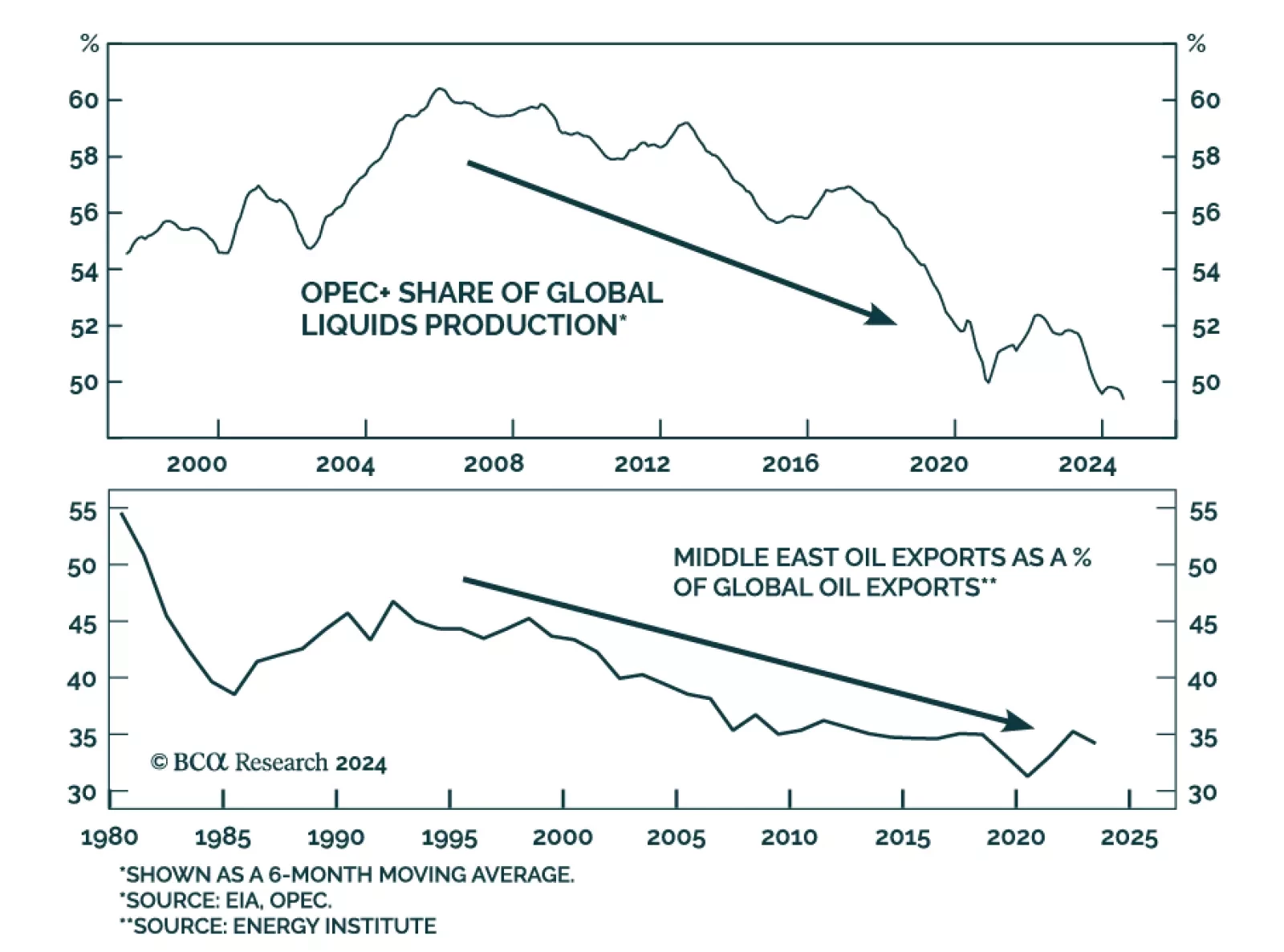

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran…

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

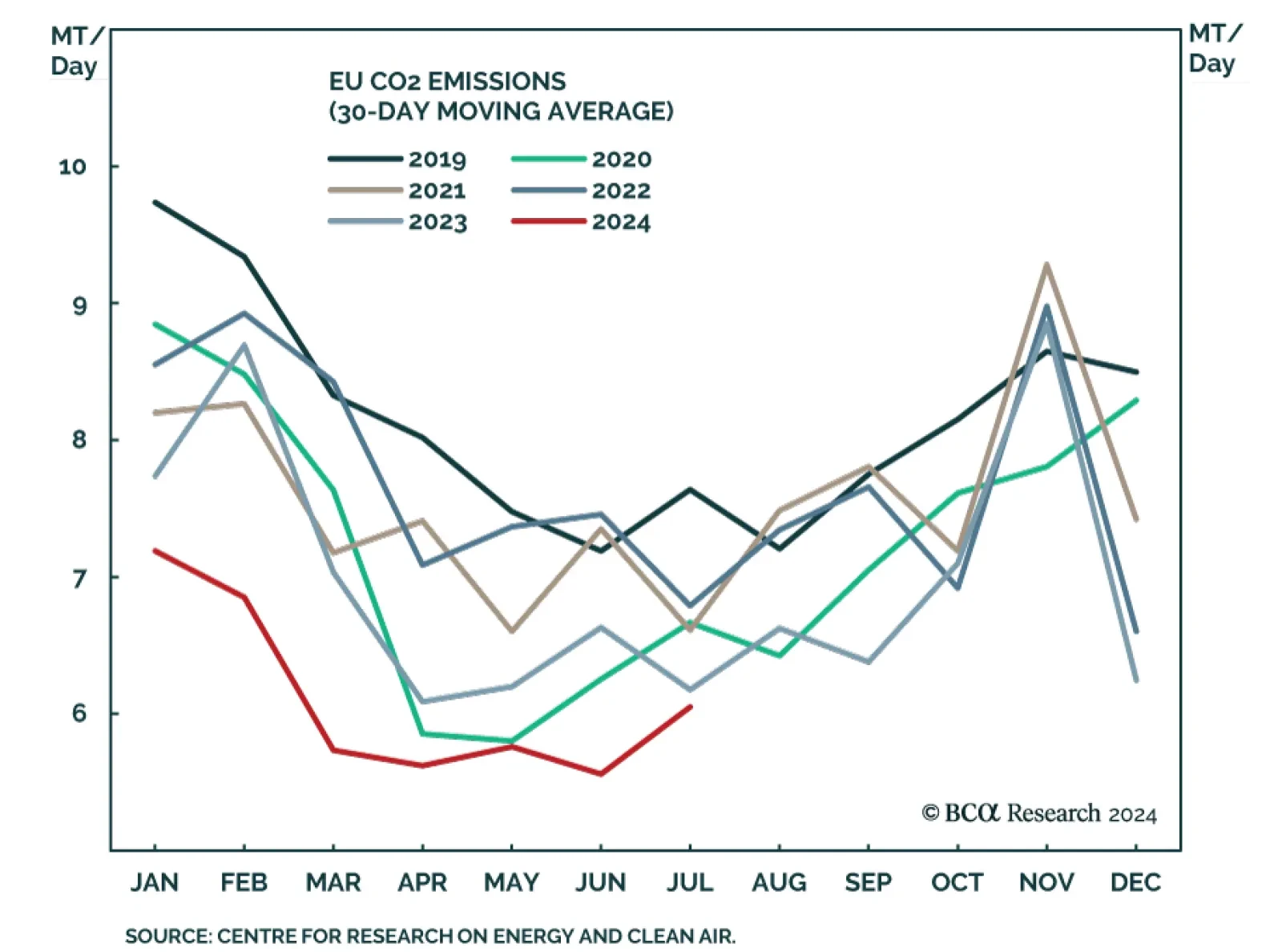

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

According to BCA Research’s Geopolitical Strategy service, the death of Iran’s President Ebrahim Raisi in a helicopter crash underscores the instability of Iran and the Middle East, which is getting worse, not better…

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

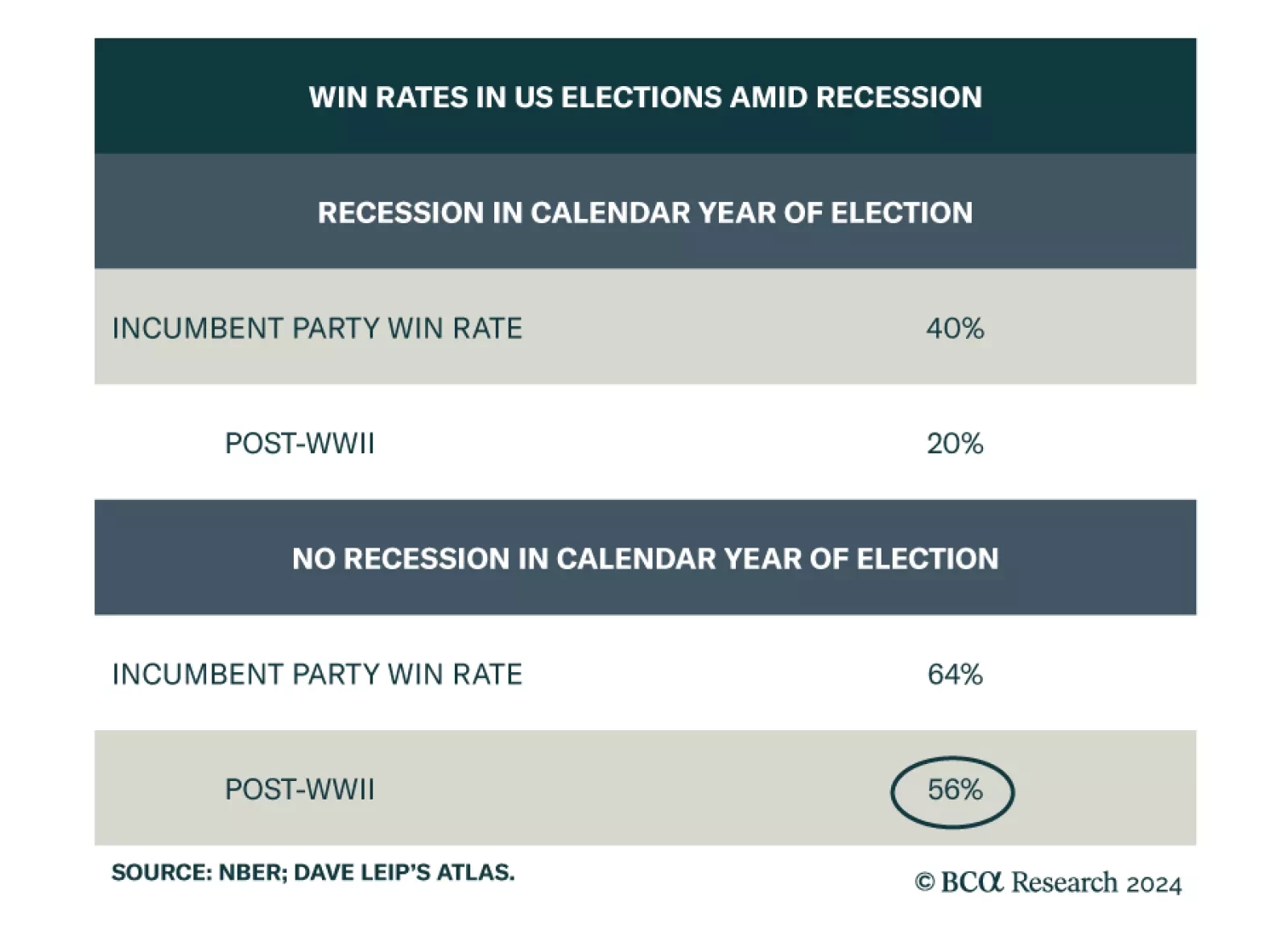

Our quant models suggest Democrats are still slightly favored for the White House. Our Senate model favors Republican control, though Montana and Ohio are the weak links that could deliver Democrats a de facto Senate majority in the…