Despite our bearish predisposition towards stocks, we are open-minded to anything that could challenge our thesis. As such, in this report, we review five upside scenarios for equities.

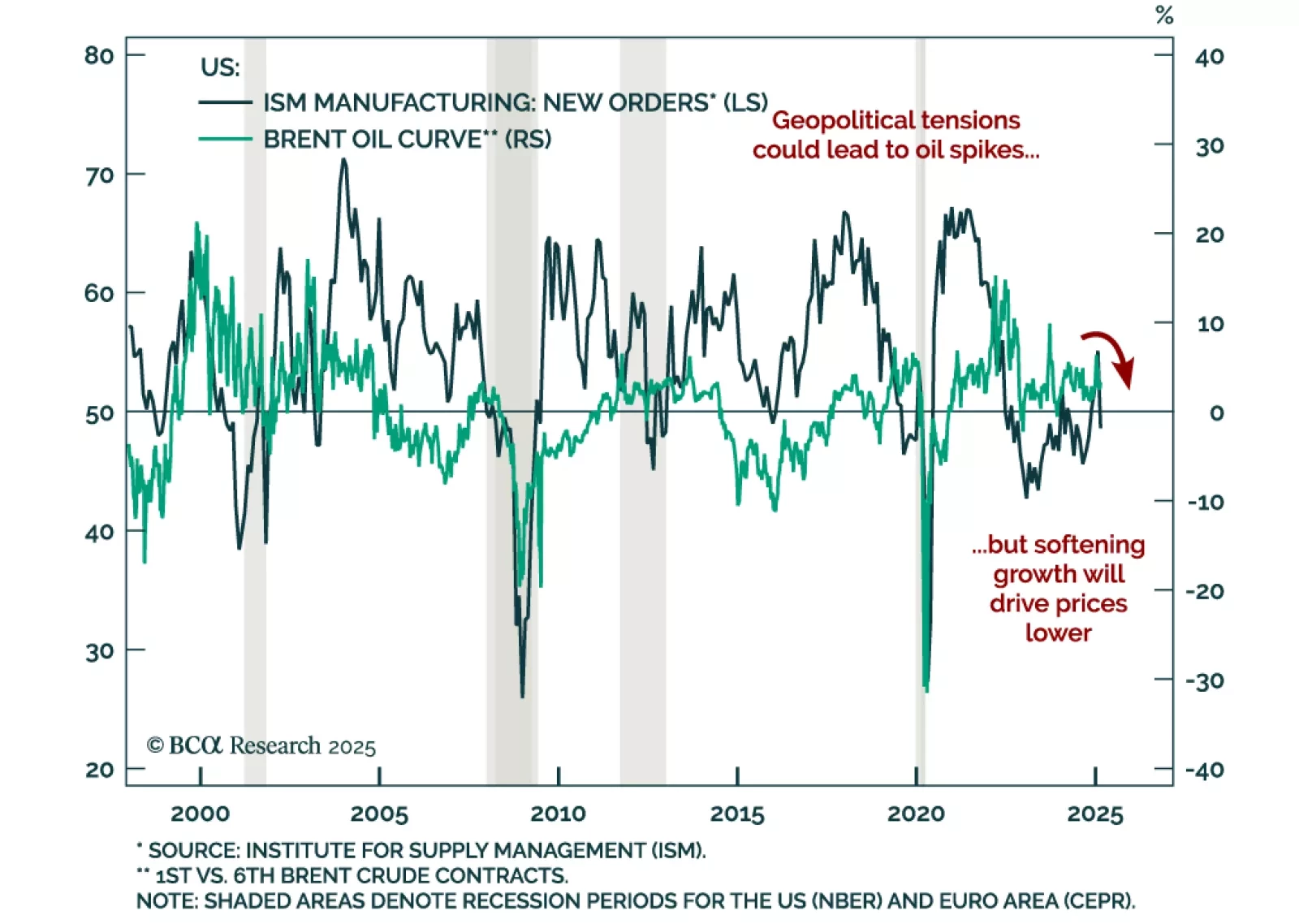

Our Commodities strategists assessed the outlook for oil as crude remains pulled between geopolitical and fundamentals forces. OPEC+’s decision to raise oil supply is driven more by geopolitics than economics. A sustained…

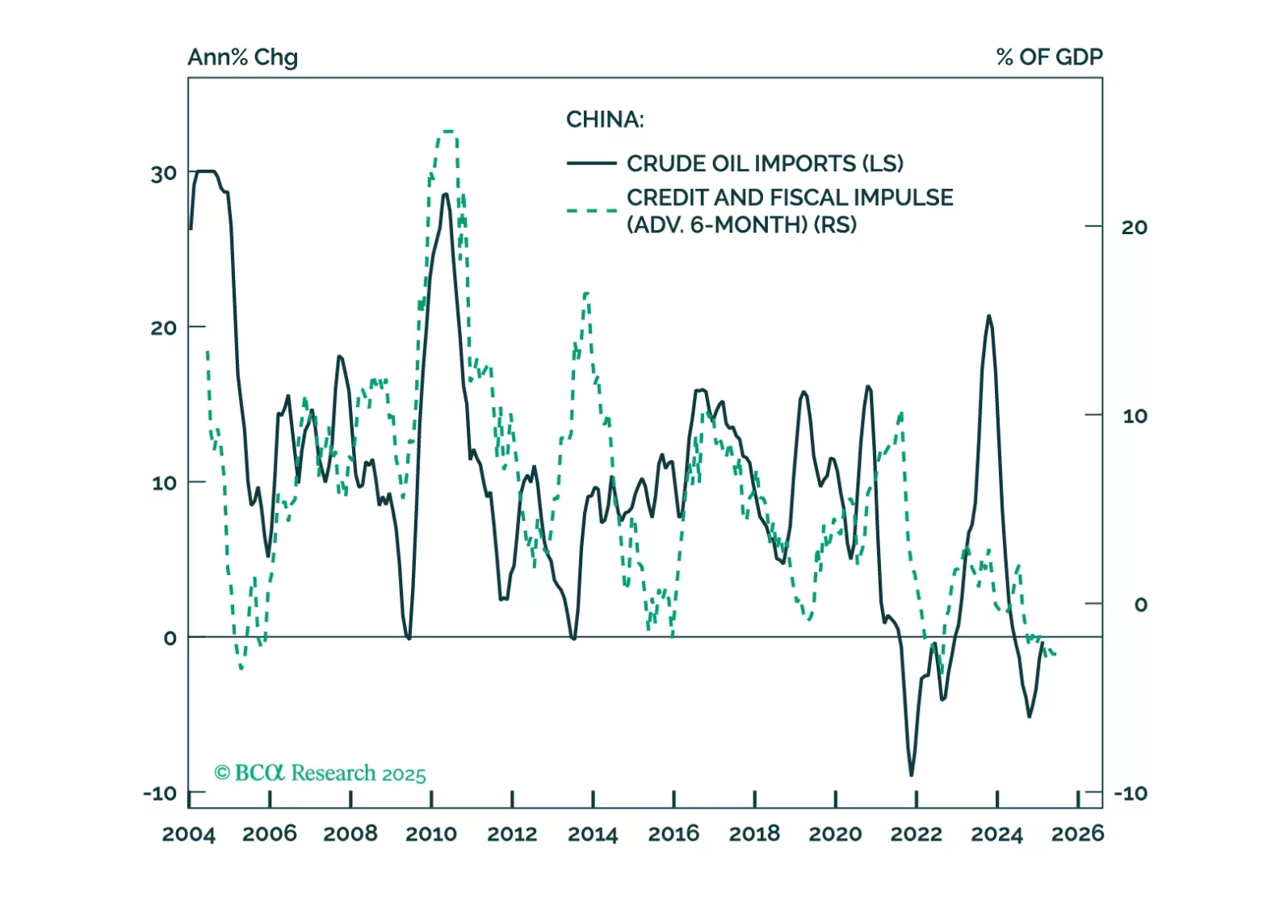

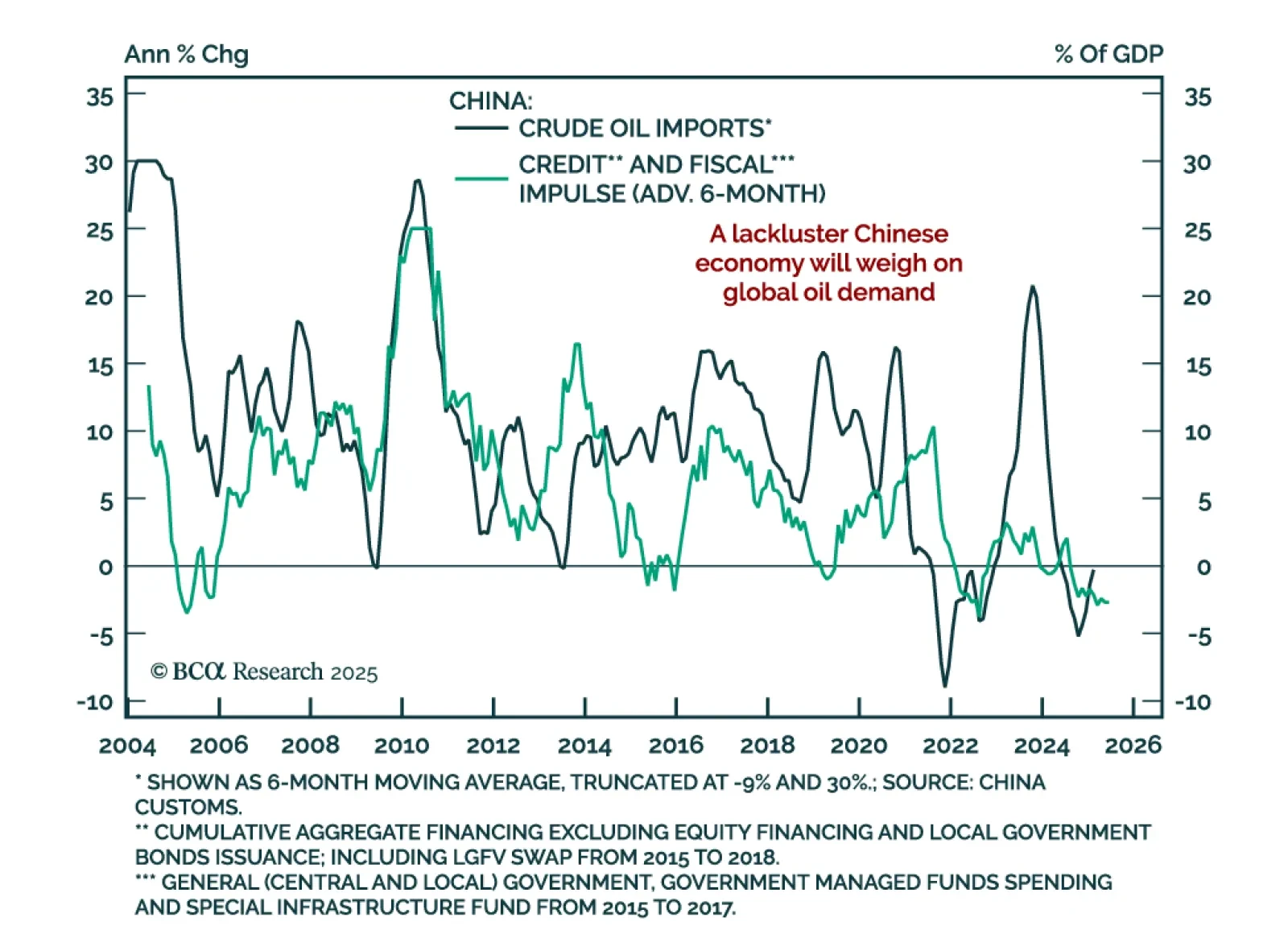

OPEC+ is planning to boost its crude oil output at a time of lingering demand weakness. What is driving this decision? And will Chinese oil consumption – historically a key contributor to global oil demand growth – reaccelerate…

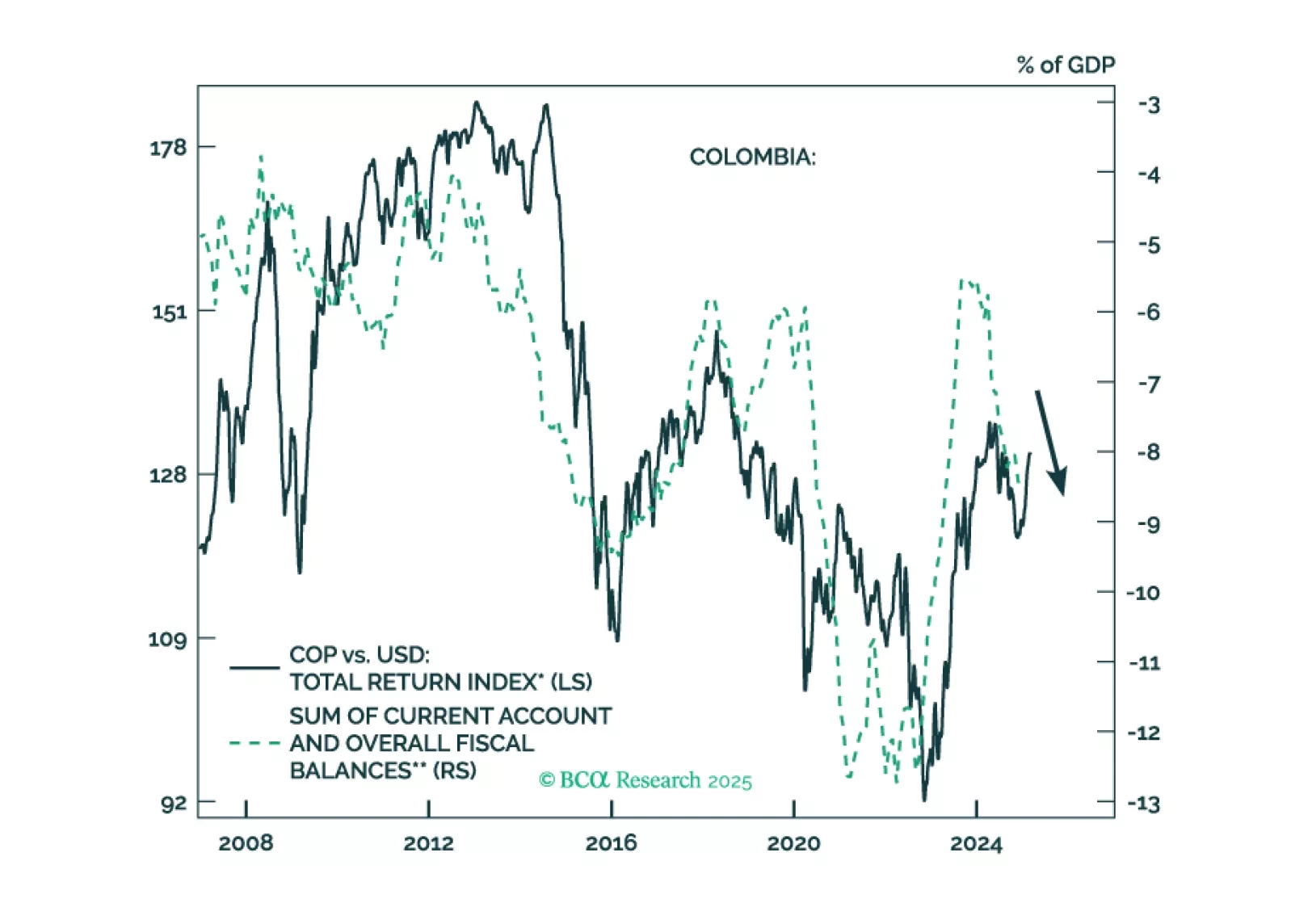

Colombian financial markets have rallied on the expectation that a right-wing government will be elected in 2026. We take a contrarian bearish stance on the nation's financial markets. Colombia is suffering from two…

After range-bound trading late last year, oil prices began the year rising to resistance levels, before falling and testing support on the downside. Oil remains caught between conflicting supply and demand risks. Increased…

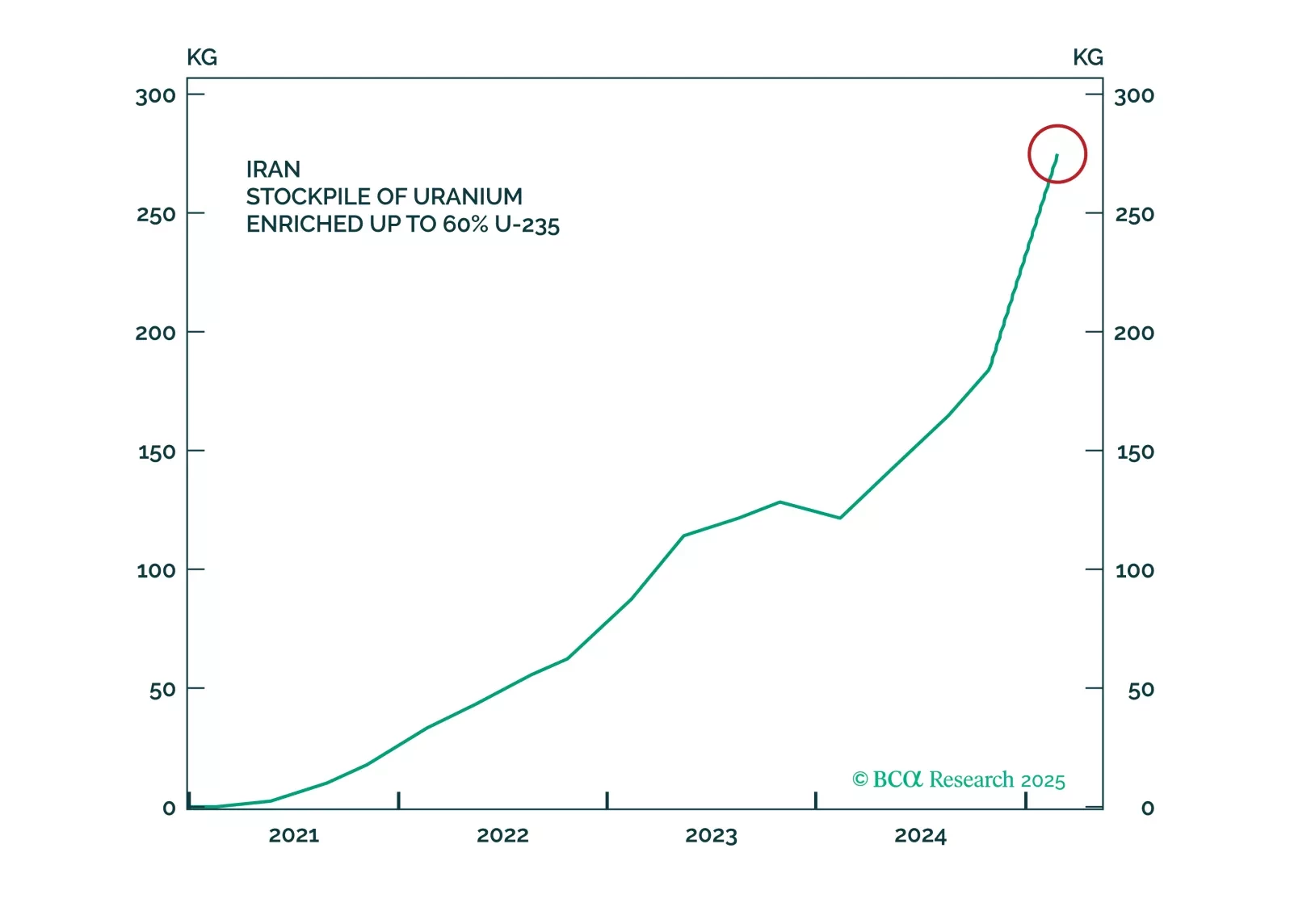

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

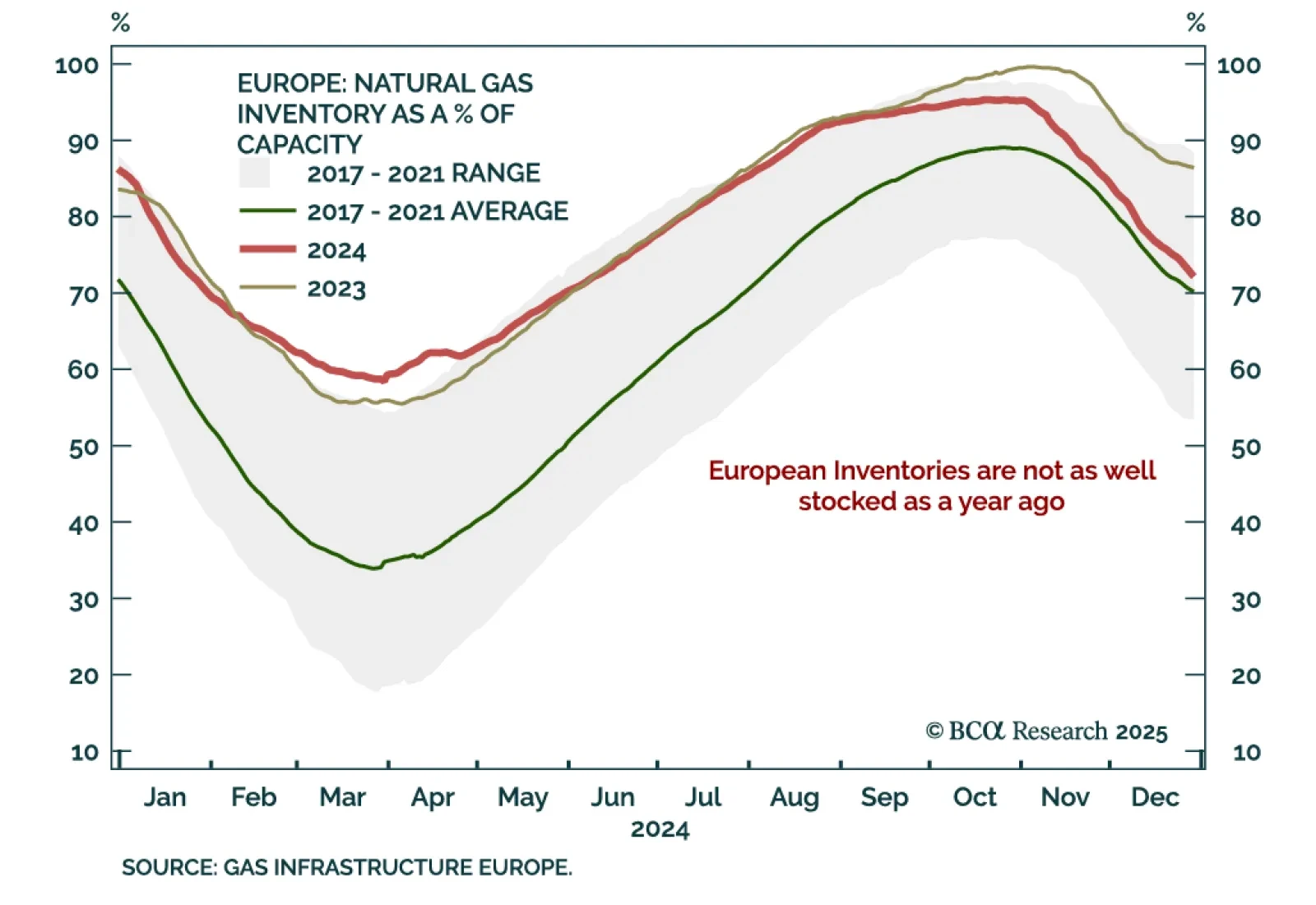

As a push for Russia-Ukraine peace talks emerges, energy prices are easing. Reduced geopolitical risk and the potential lifting of sanctions on Russia would be a headwind for oil and European natural gas prices. Should investors bet…

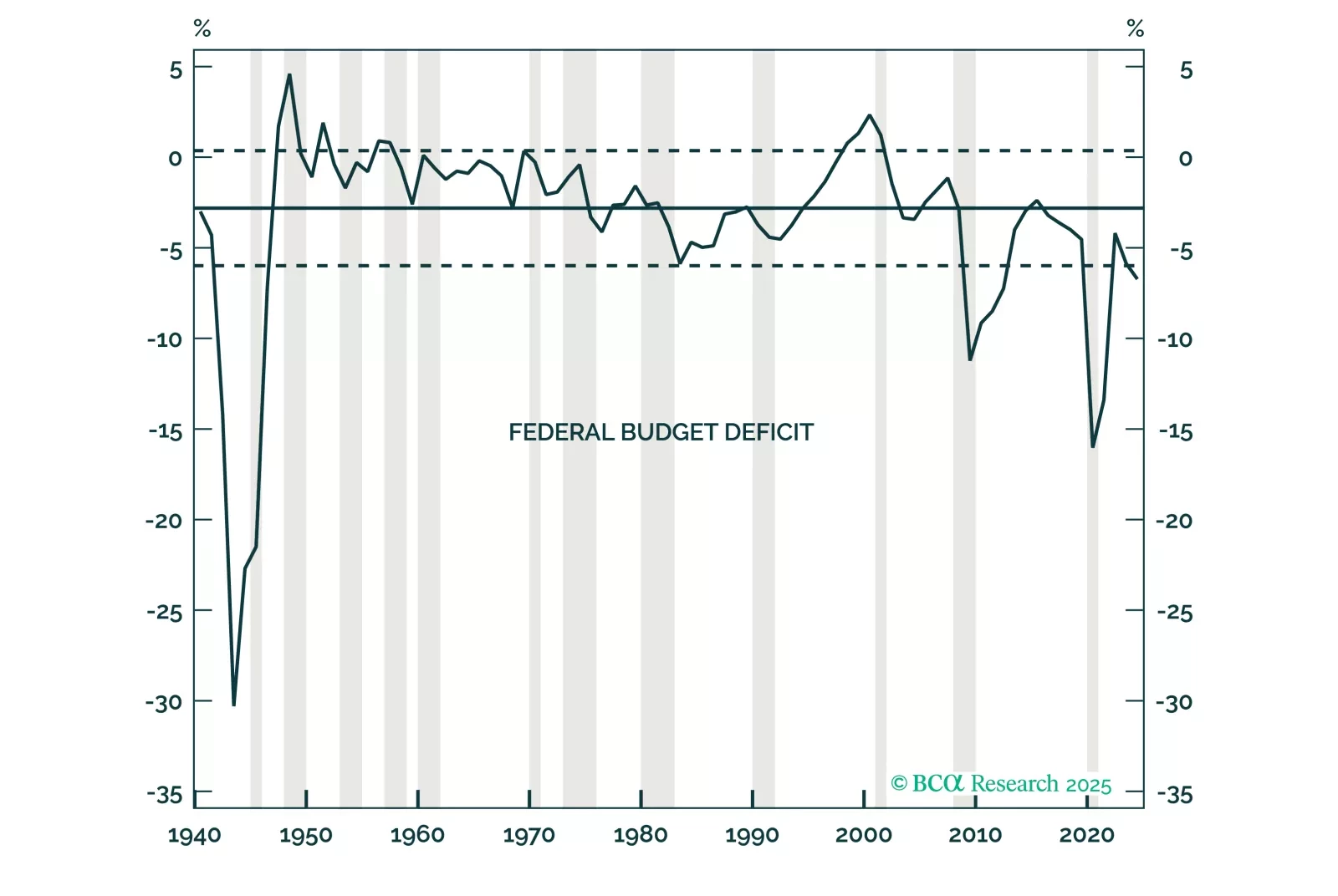

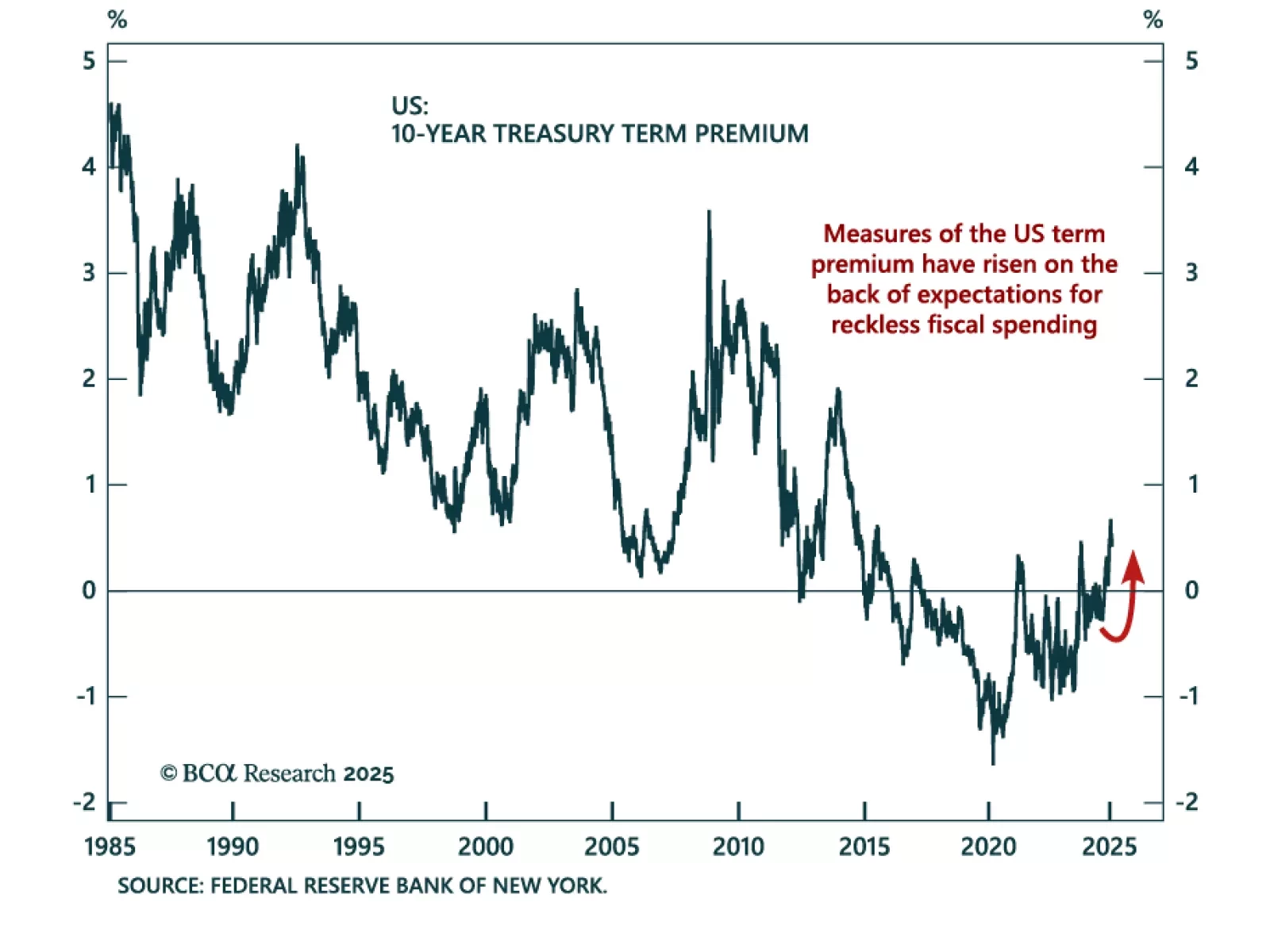

The 3-3-3 plan pitched by Treasury Secretary Scott Bessent will need several improbabilities to break its way if it is to meet its goals. We think it is much more likely that the plan will disappoint. Defensive asset allocations will…

Treasury Secretary Scott Bessent commented that one of the Trump administration’s priority was lowering 10-year bond yields. Bessent’s 3/3/3 plan, boosting growth to 3% from deregulation, increasing US oil production by 3 mmb/d, and…

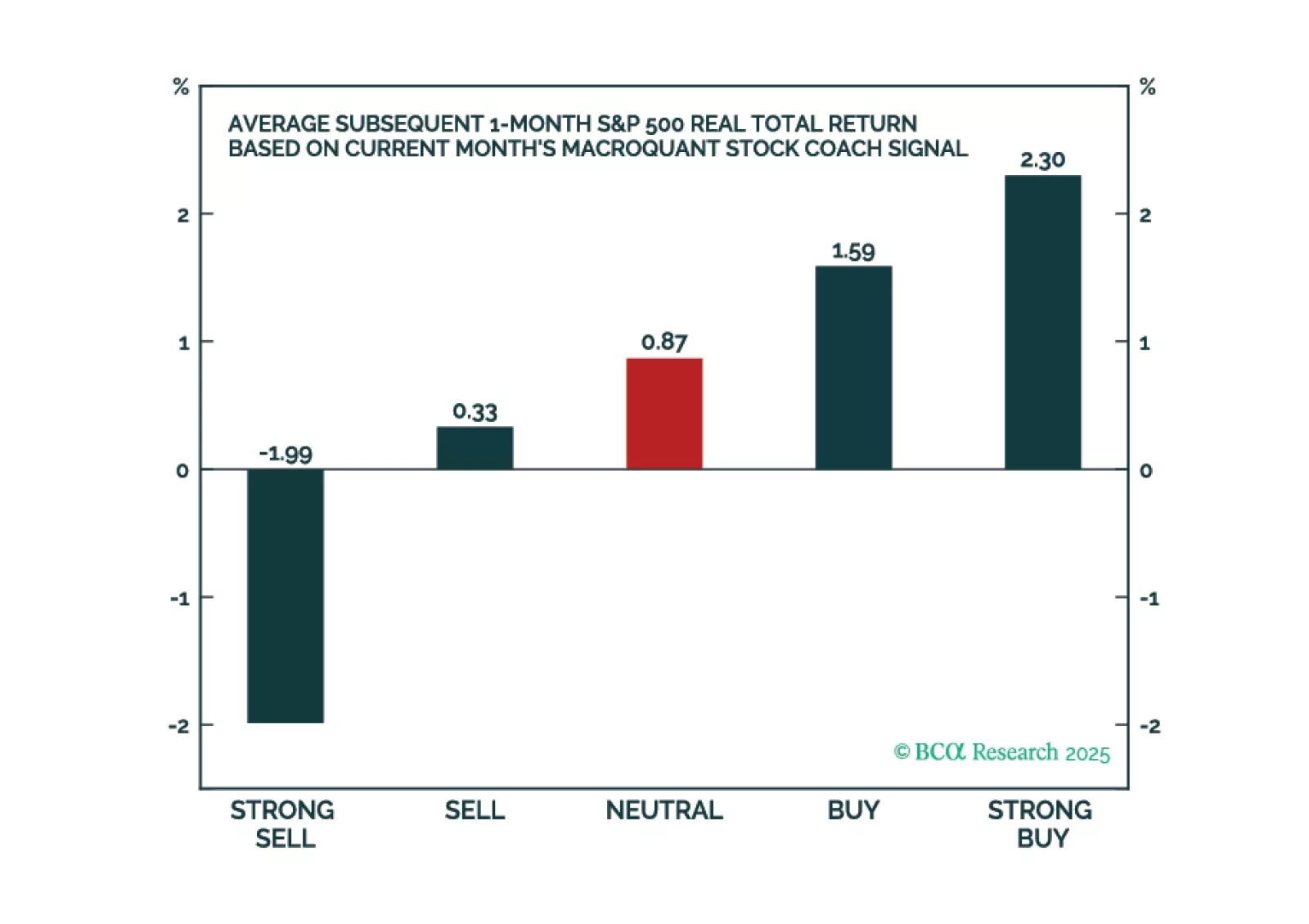

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.