Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

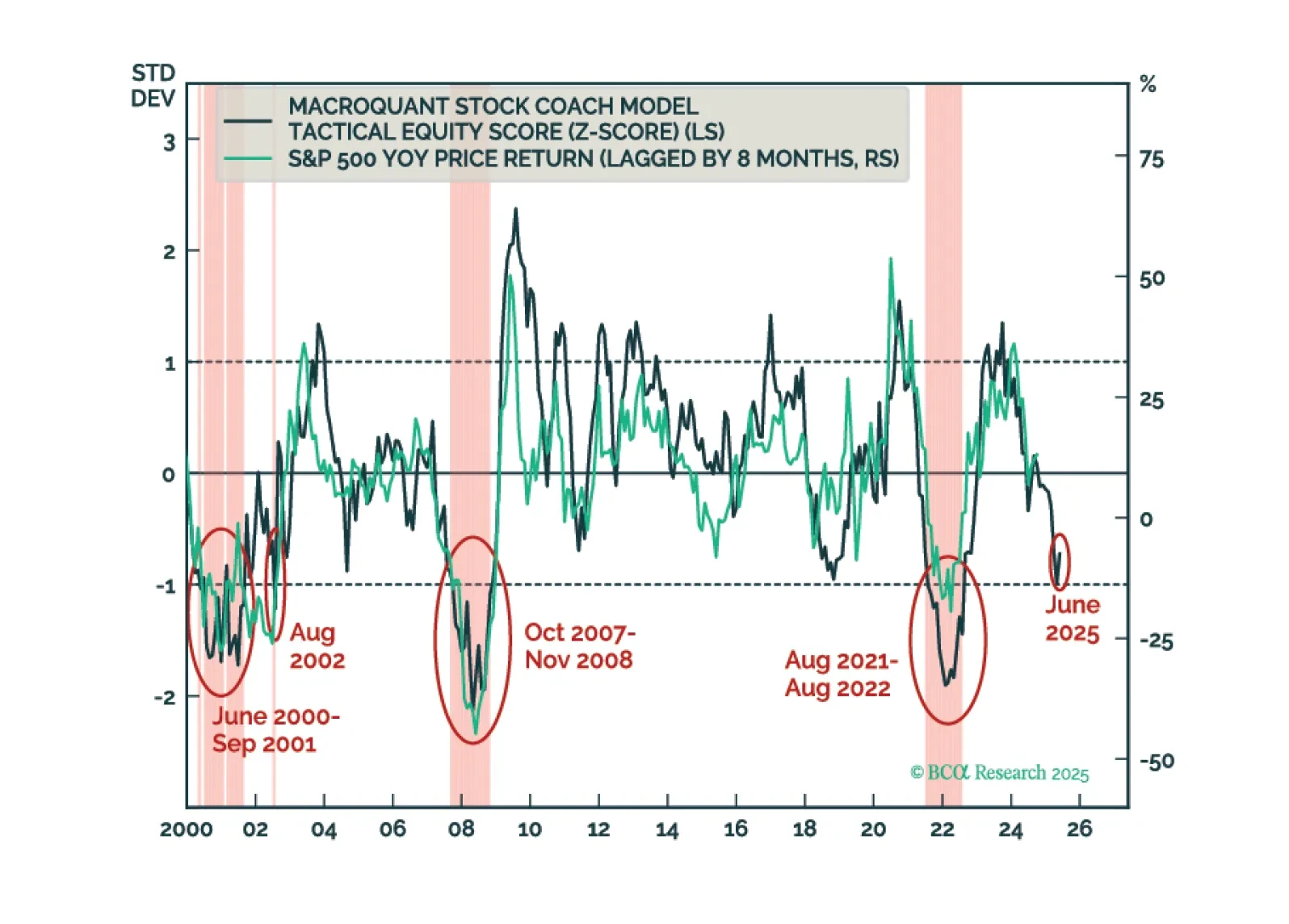

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

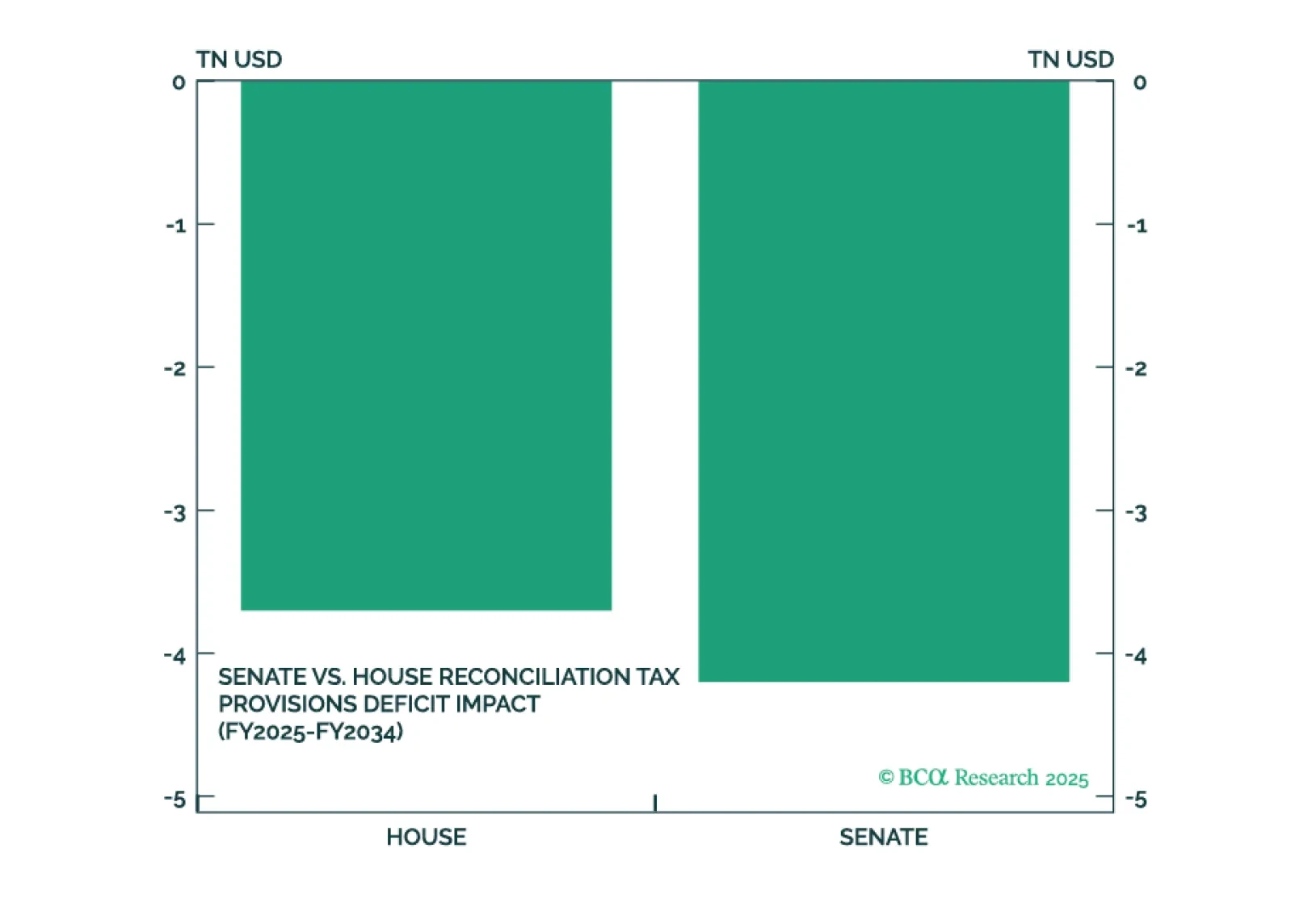

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

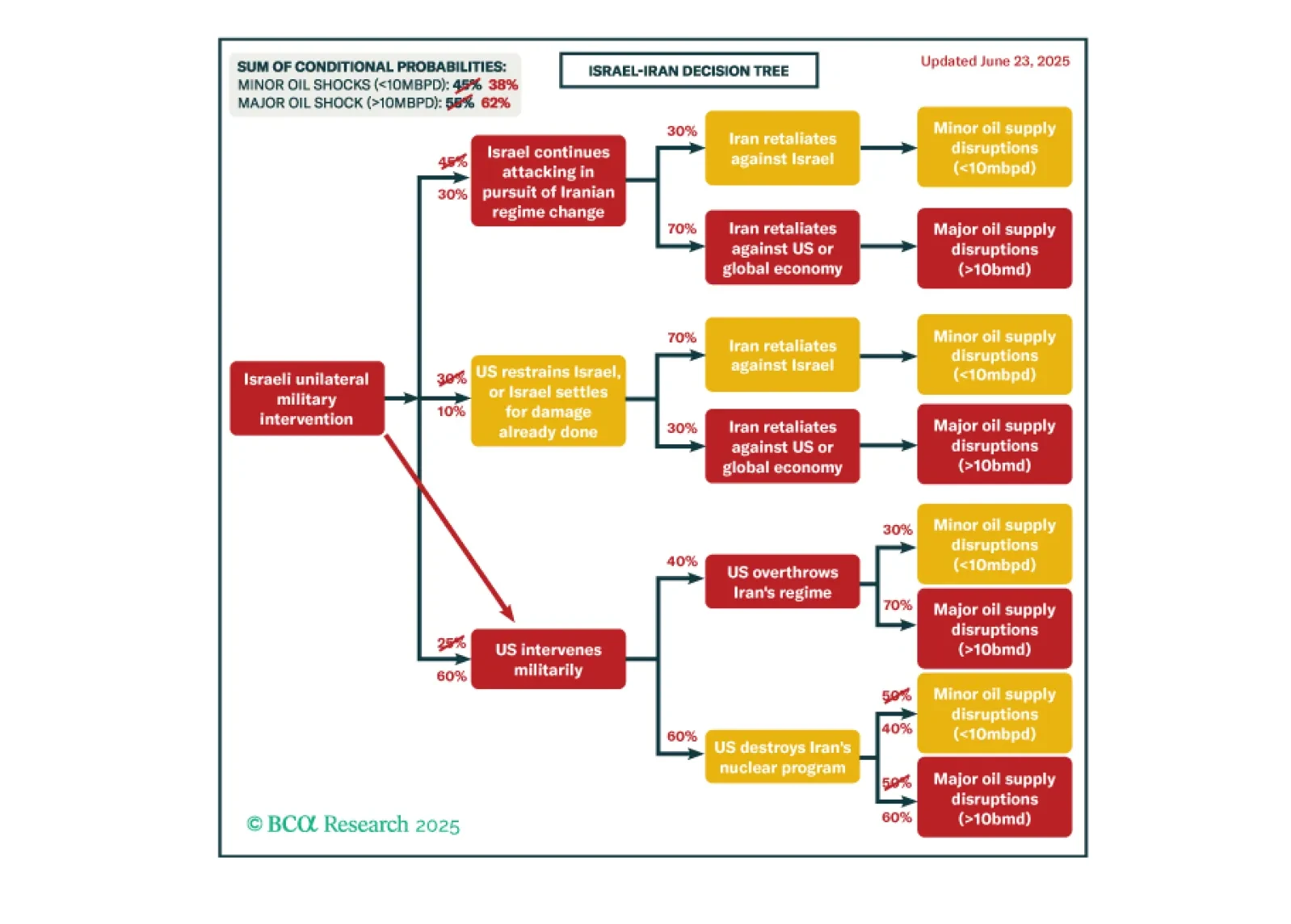

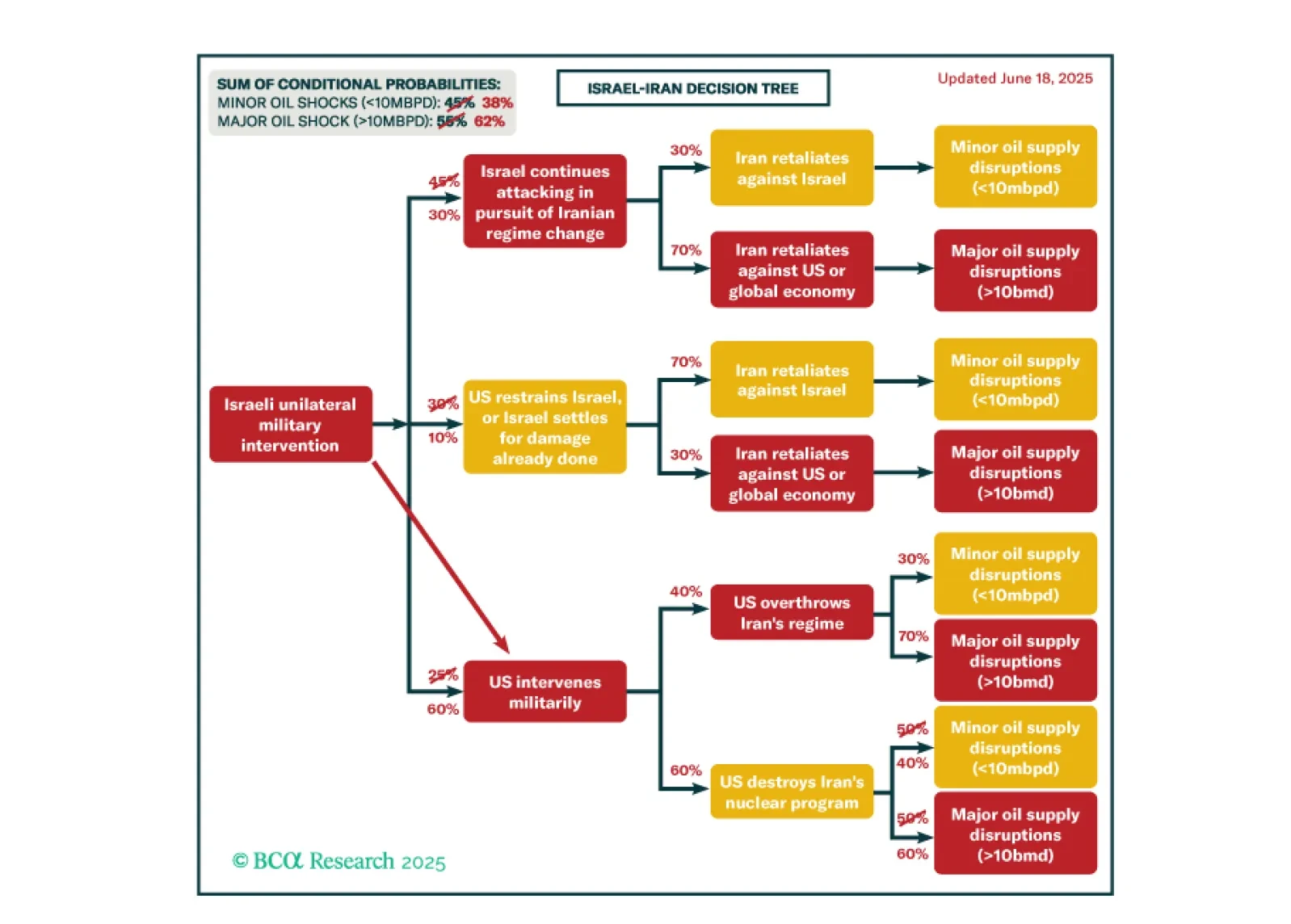

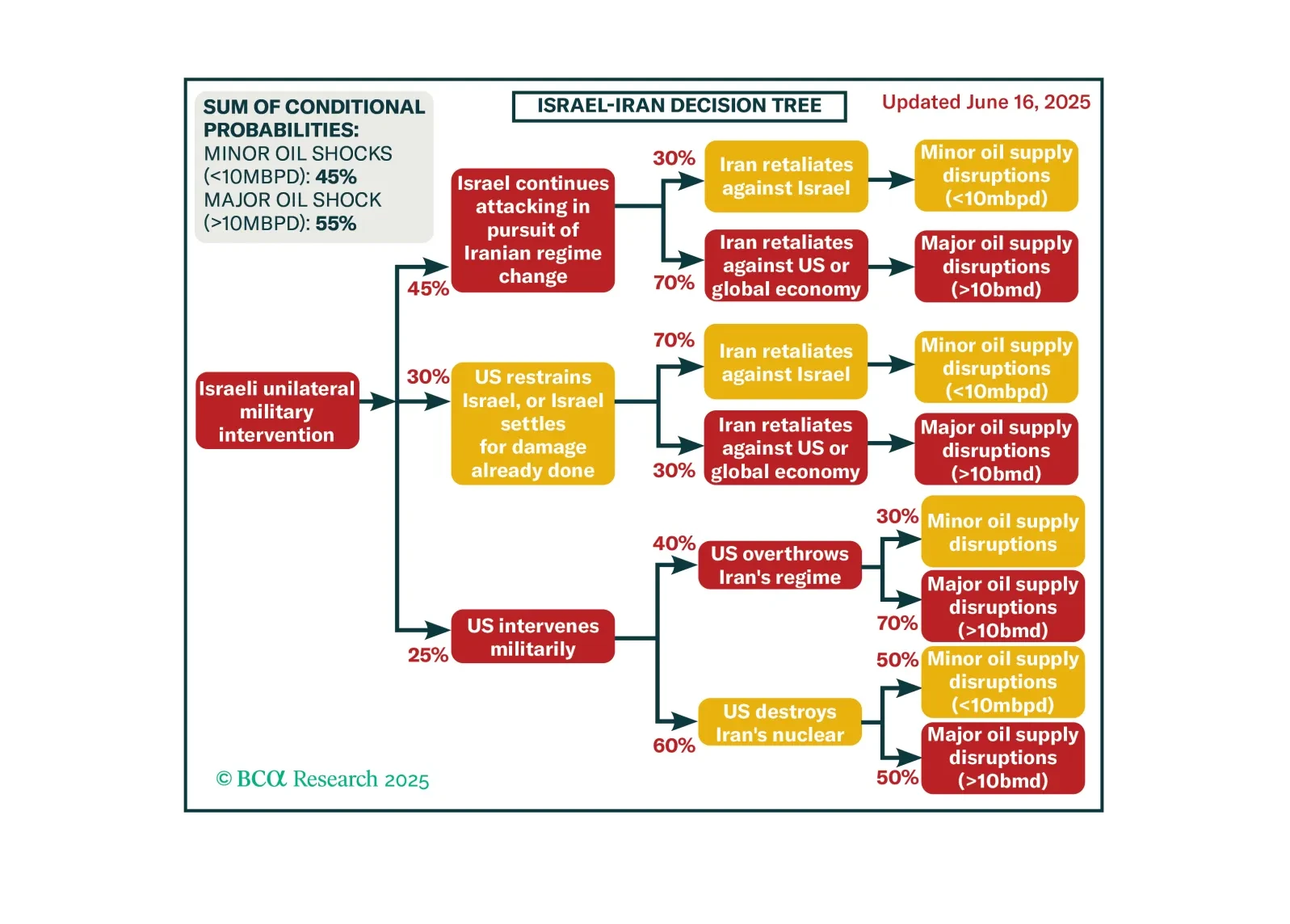

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

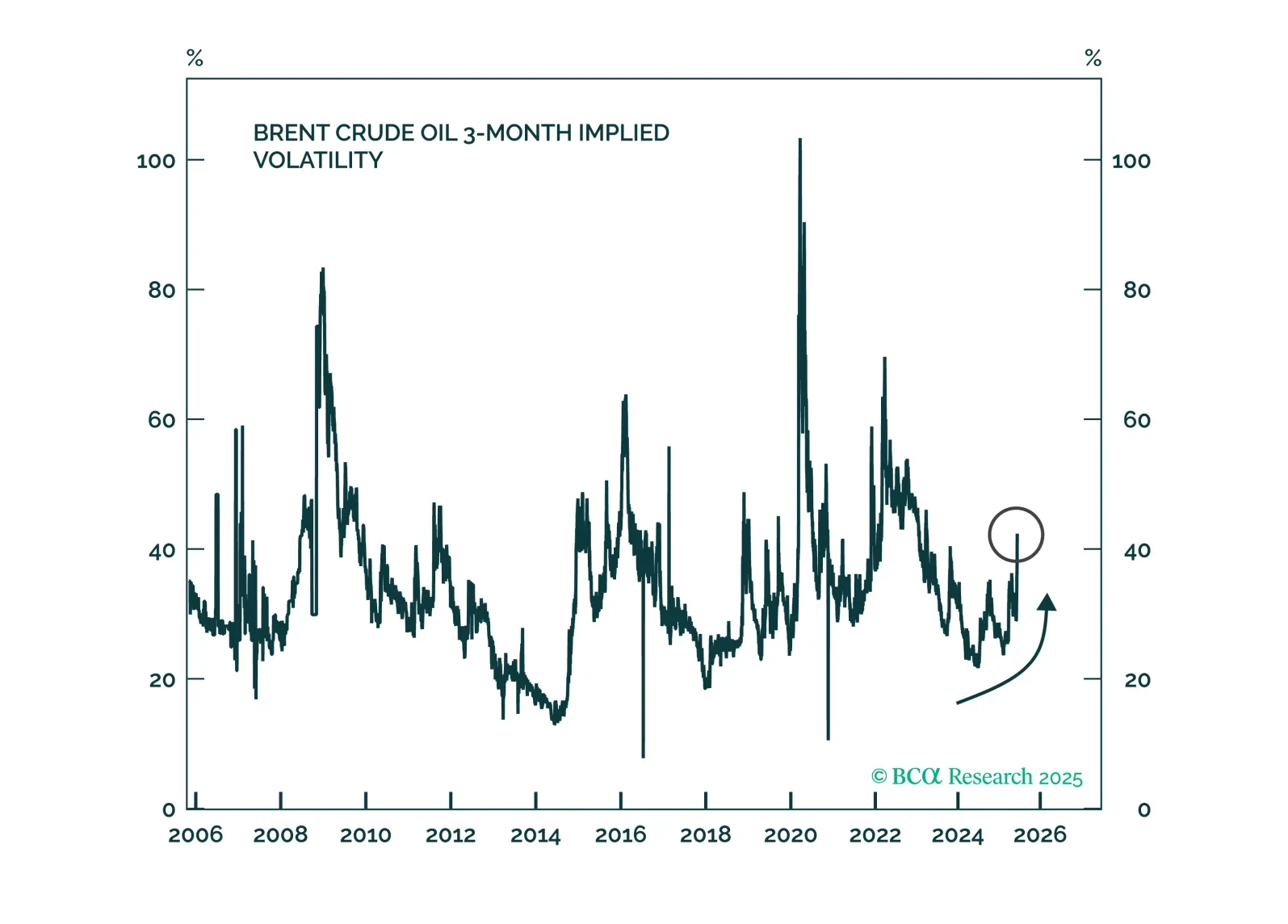

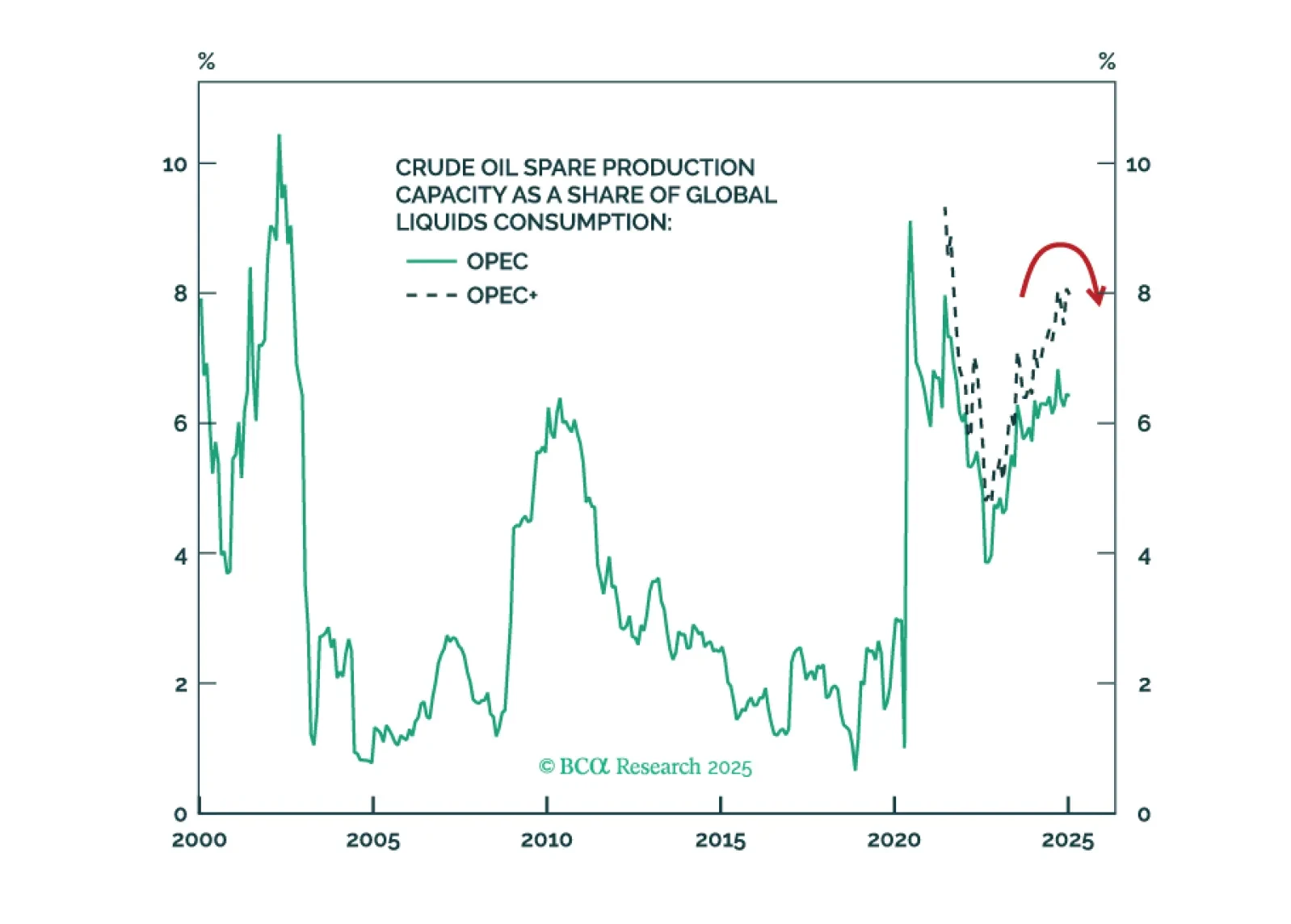

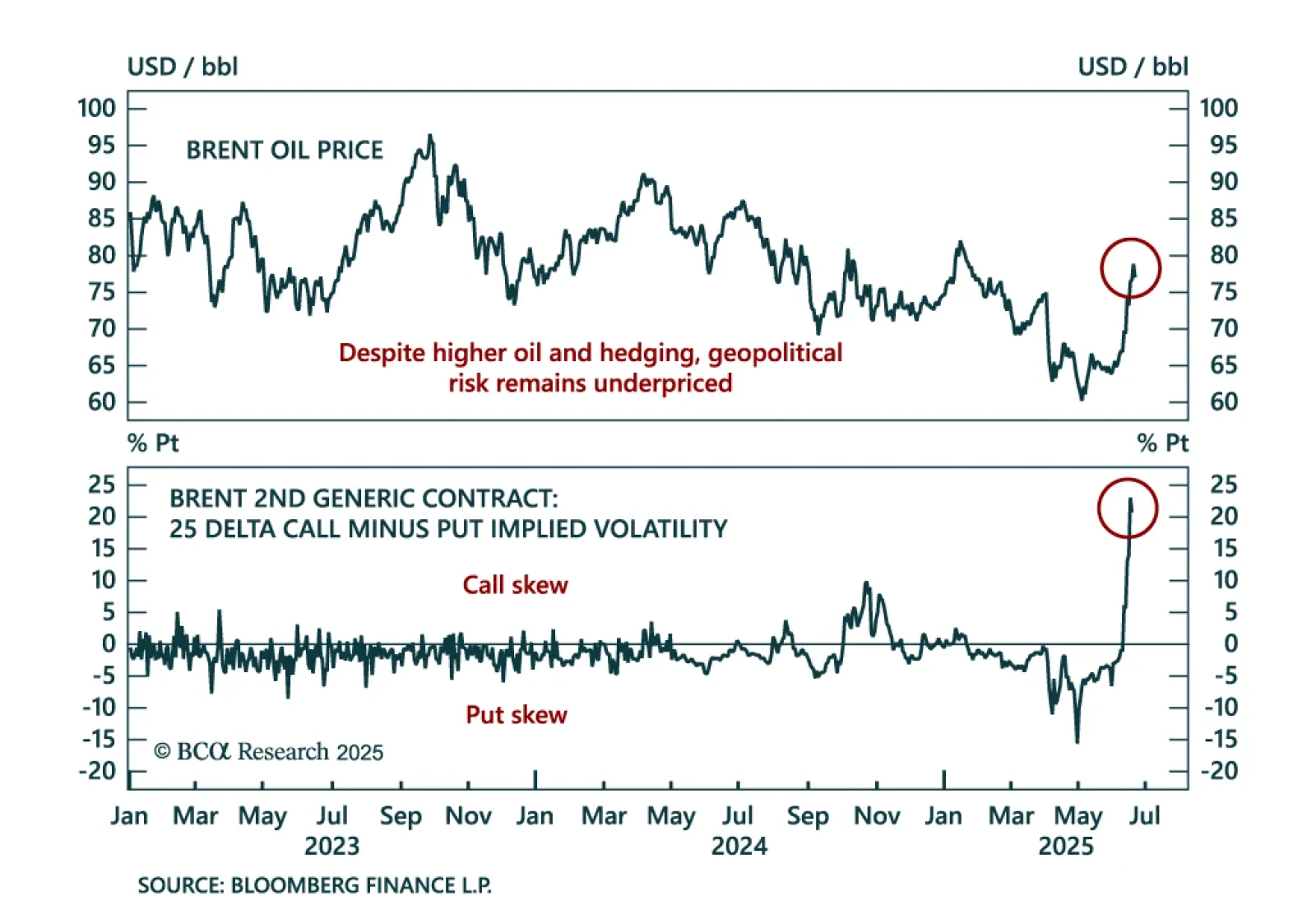

Elevated market complacency contrasts with high geopolitical risk as oil disruption remains a key threat. Middle East tensions escalated over the weekend after the US struck Iran’s nuclear capabilities, yet markets have reacted…

The escalating Israel-Iran conflict has boosted oil prices. We are positioning for further geopolitical escalation, uncertainty, and the economic fallout through two strategies that benefit from both near- and long-term upside.

Even if Iran tries to revive talks, the US has an irresistible opportunity to dismantle its nuclear program. Tactically, investors should favor Treasuries over the S&P, defensive sectors over cyclicals, energy stocks over…

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.