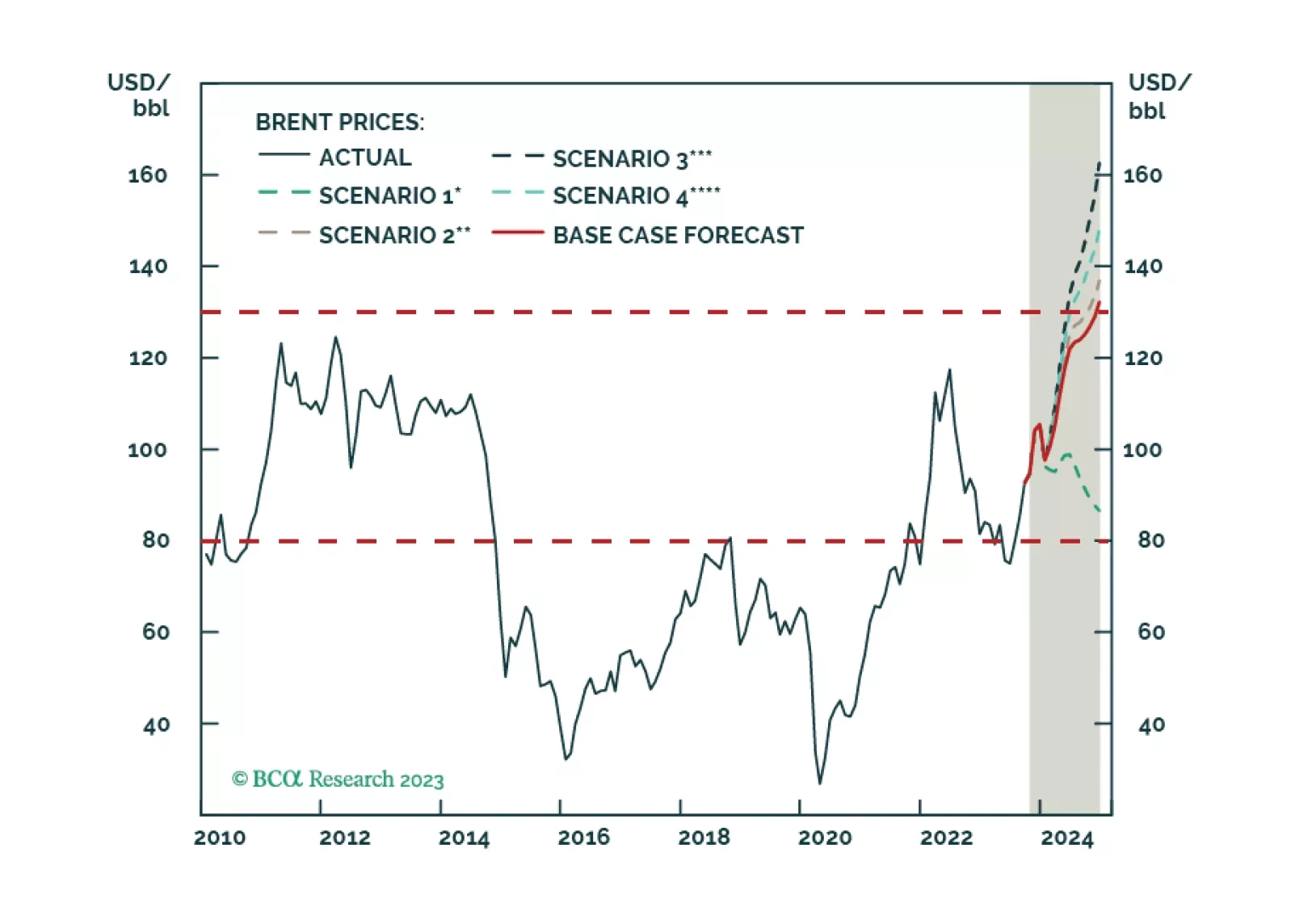

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

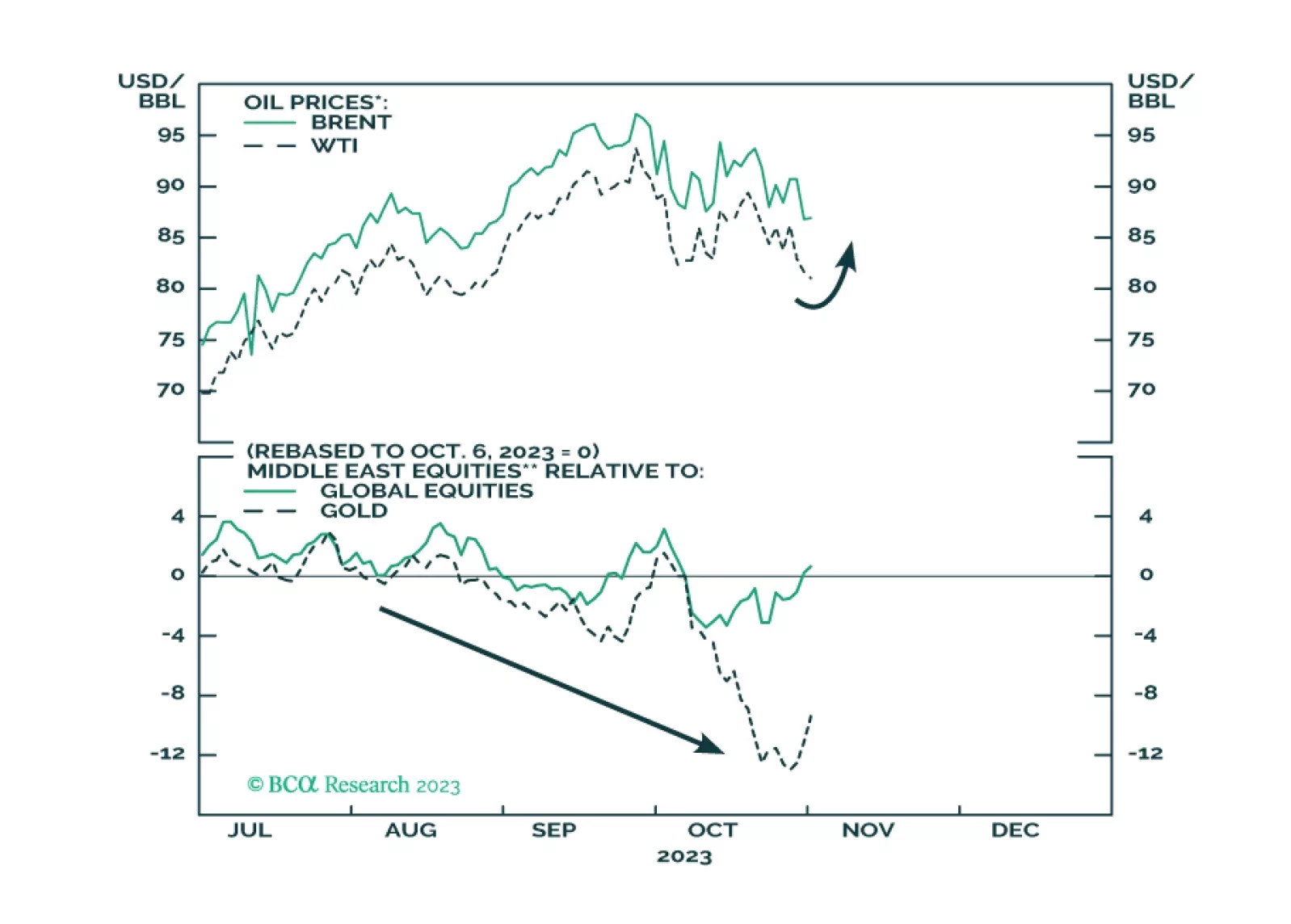

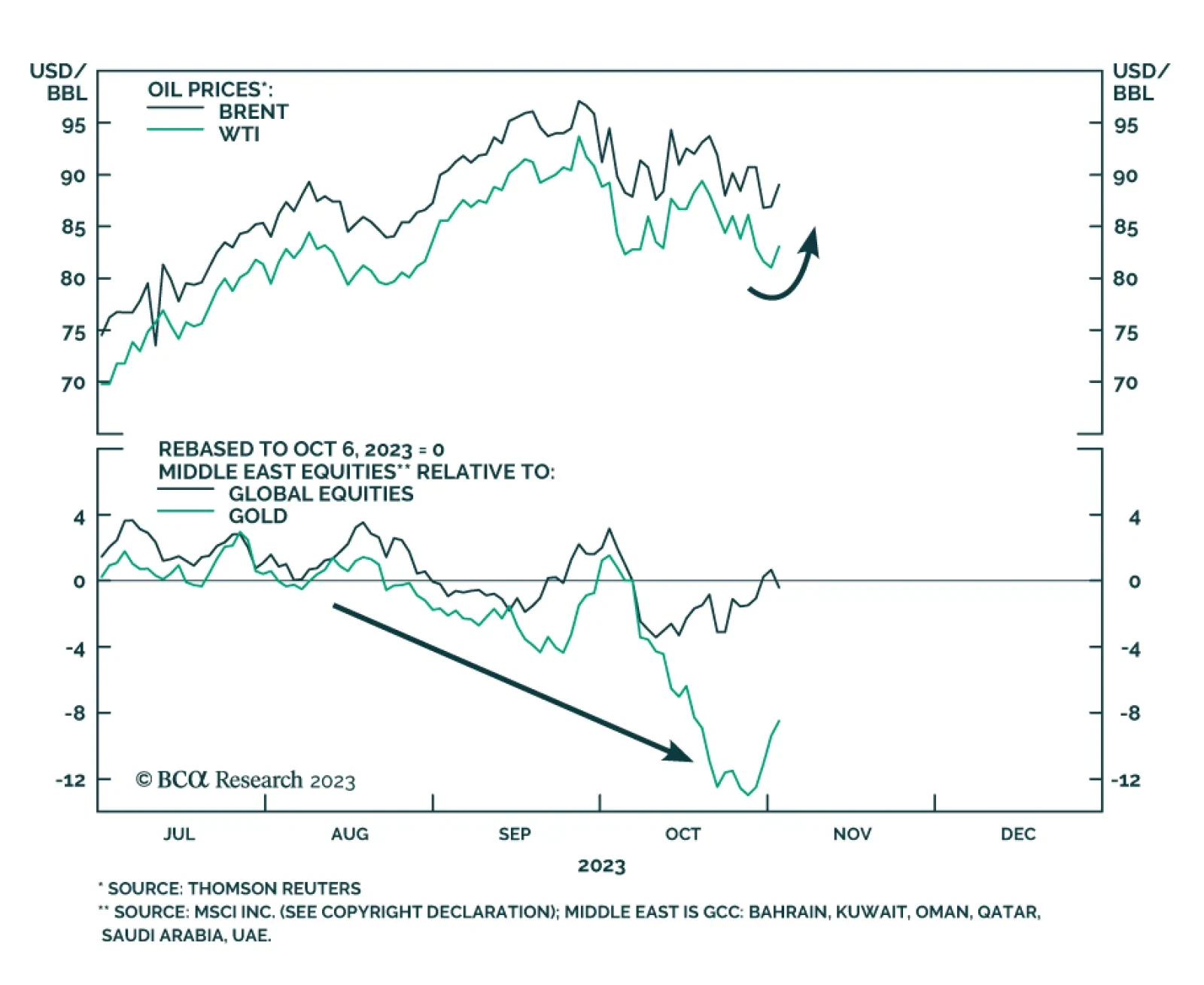

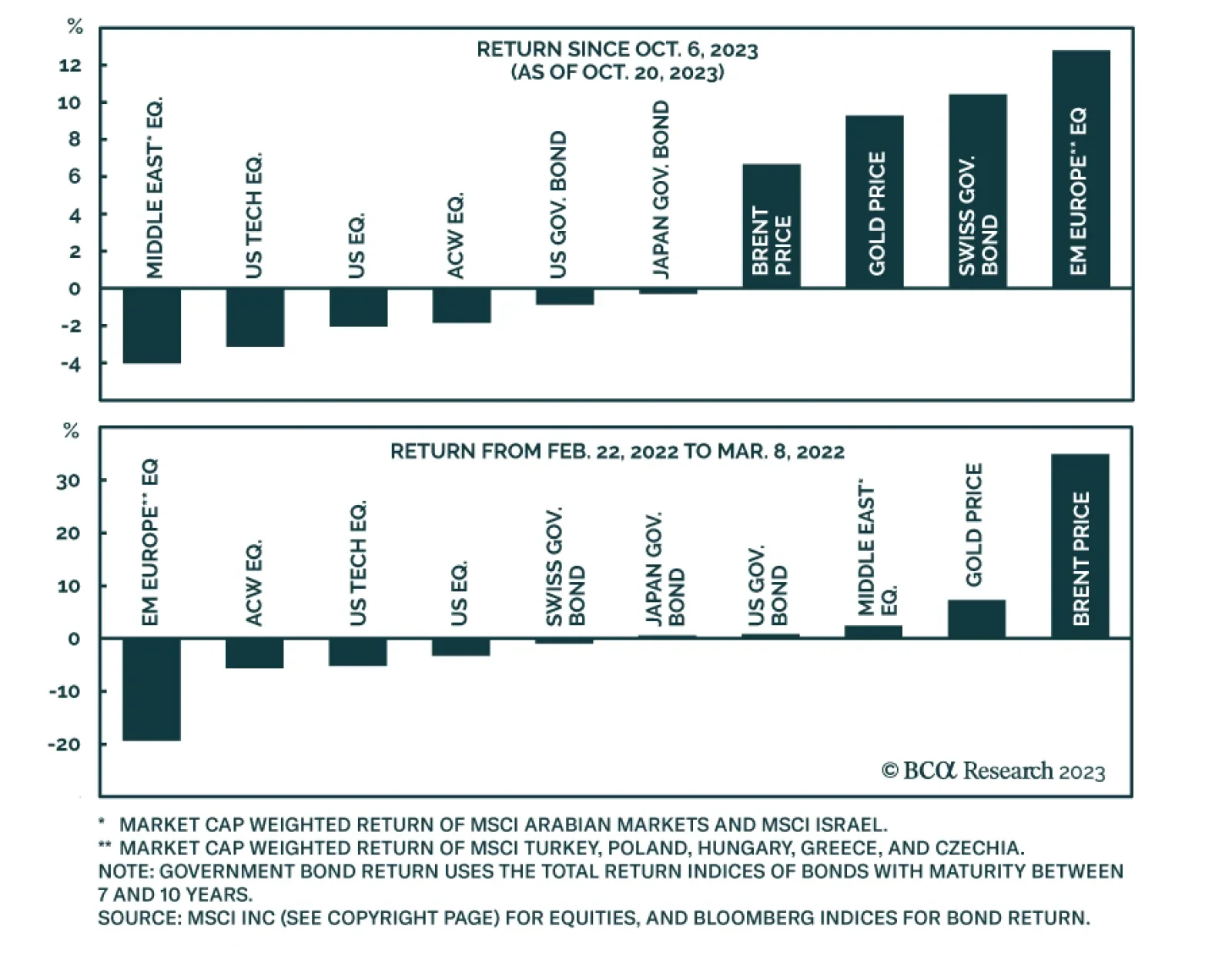

According to BCA Research's Geopolitical Strategy service, investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the…

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

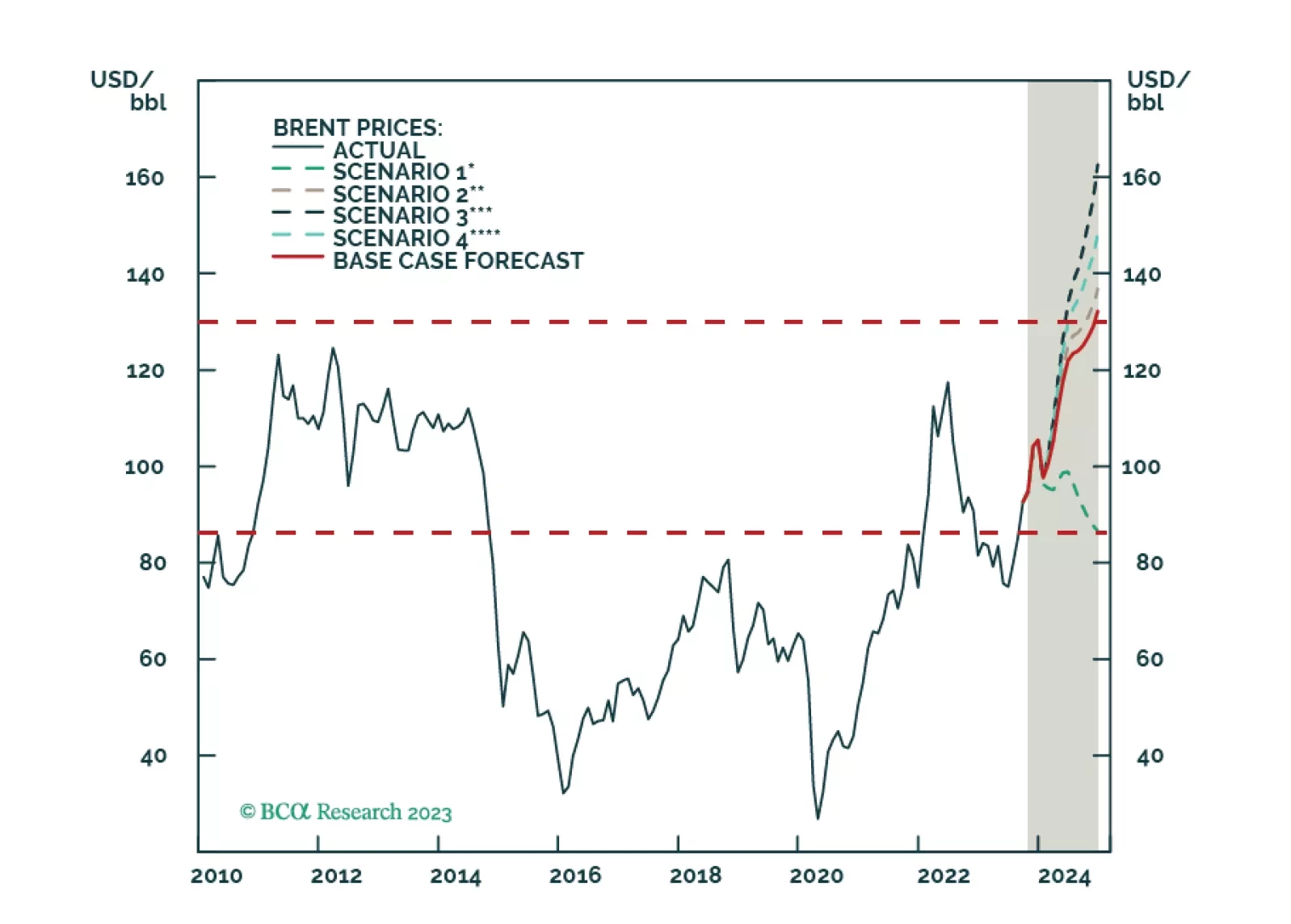

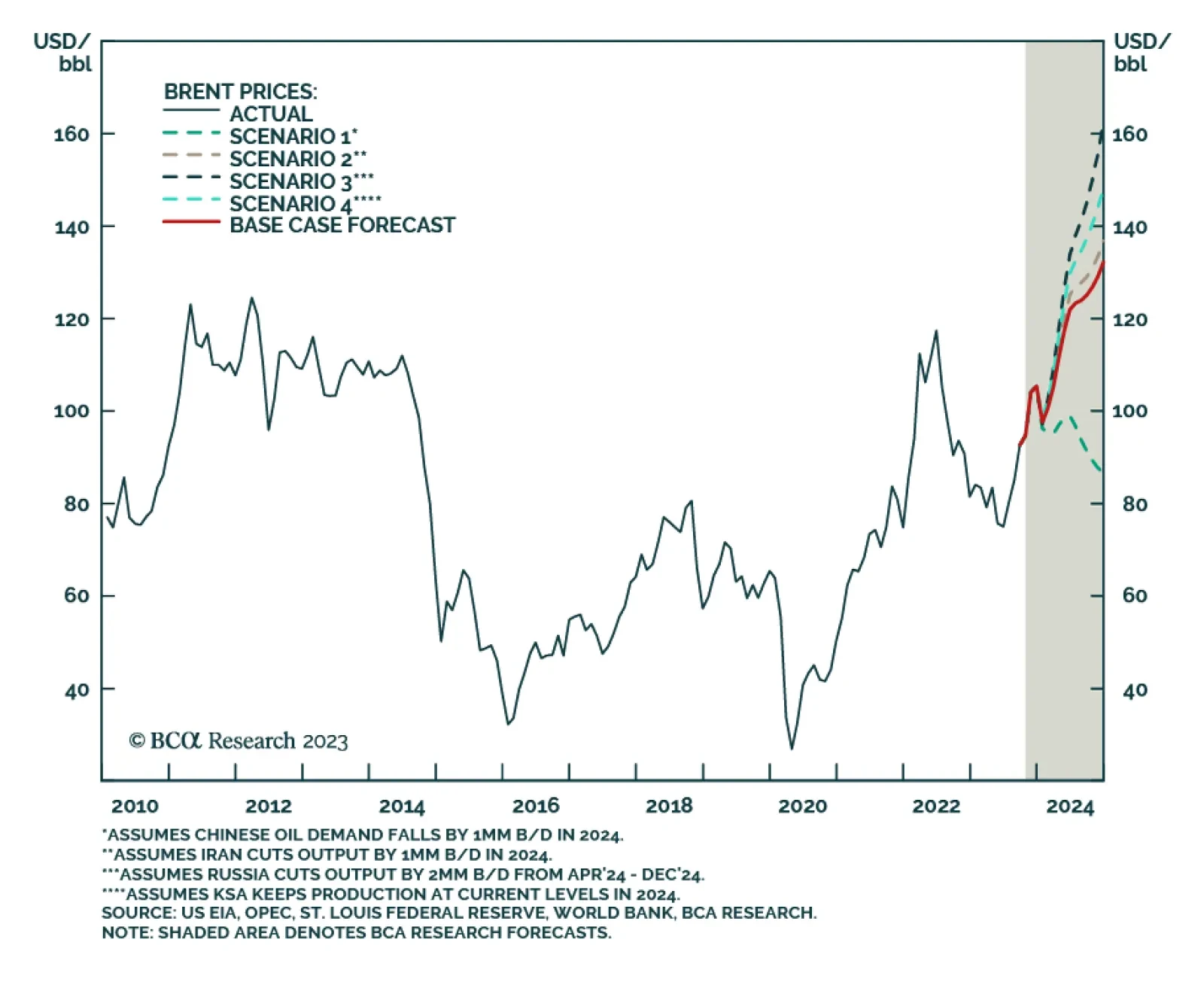

The US and core OPEC 2.0 are – wittingly or not – laying the groundwork for a price band with a floor and cap on oil prices – at $79/bbl and $130/bbl, respectively – “at least” to May 2024. This accommodates multiple goals for both…

Geopolitical risk is returning to the market after a hiatus for most of 2023. Global investors are now realizing what our geopolitical strategists have argued all year: that the rise in geopolitical risk is a secular trend…

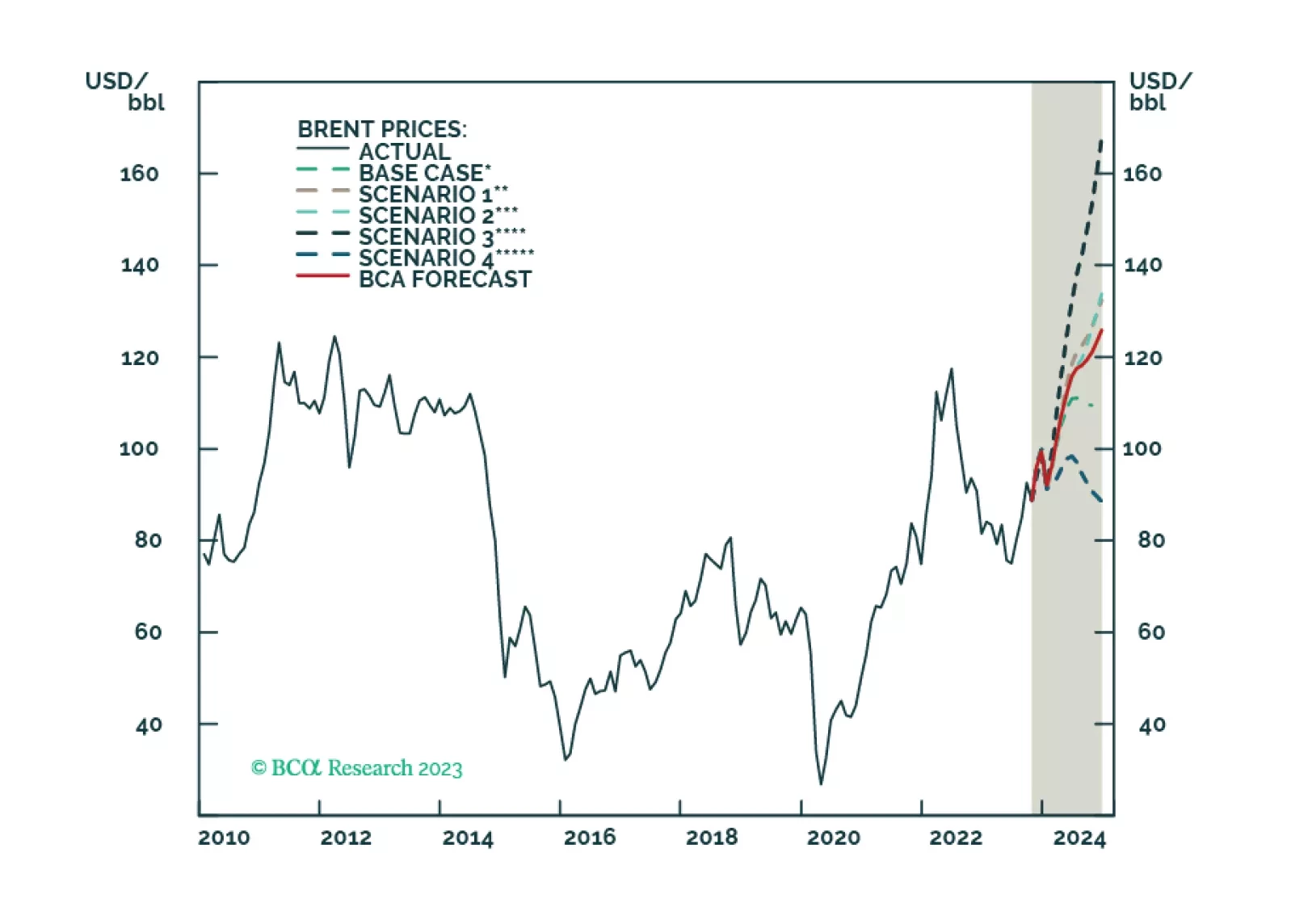

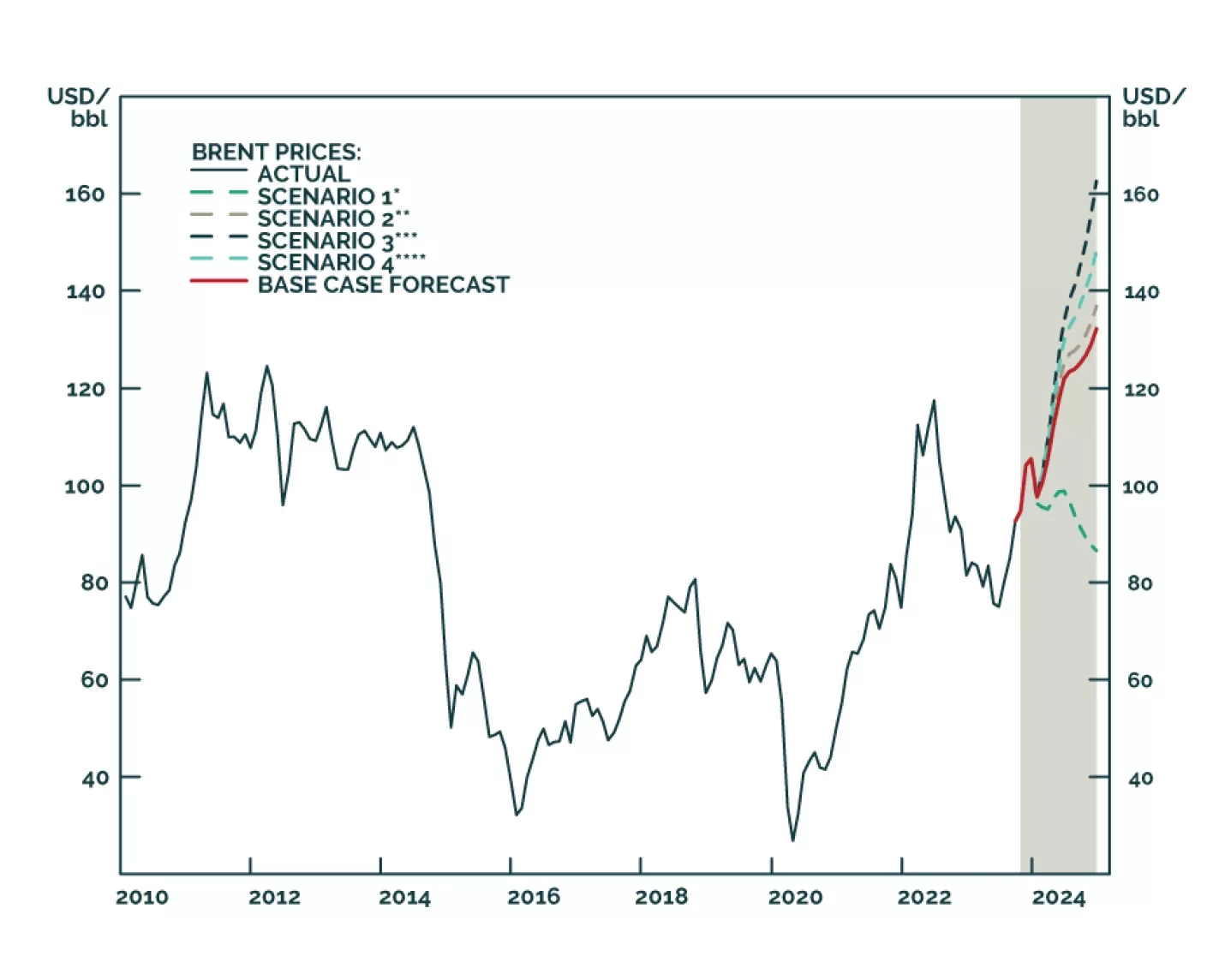

Our Commodity & Energy Strategy colleagues (CES) left their 2024 Brent crude oil price forecast unchanged at $118/bbl. This is not because nothing’s changed in the market. Rather, higher levels of…

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

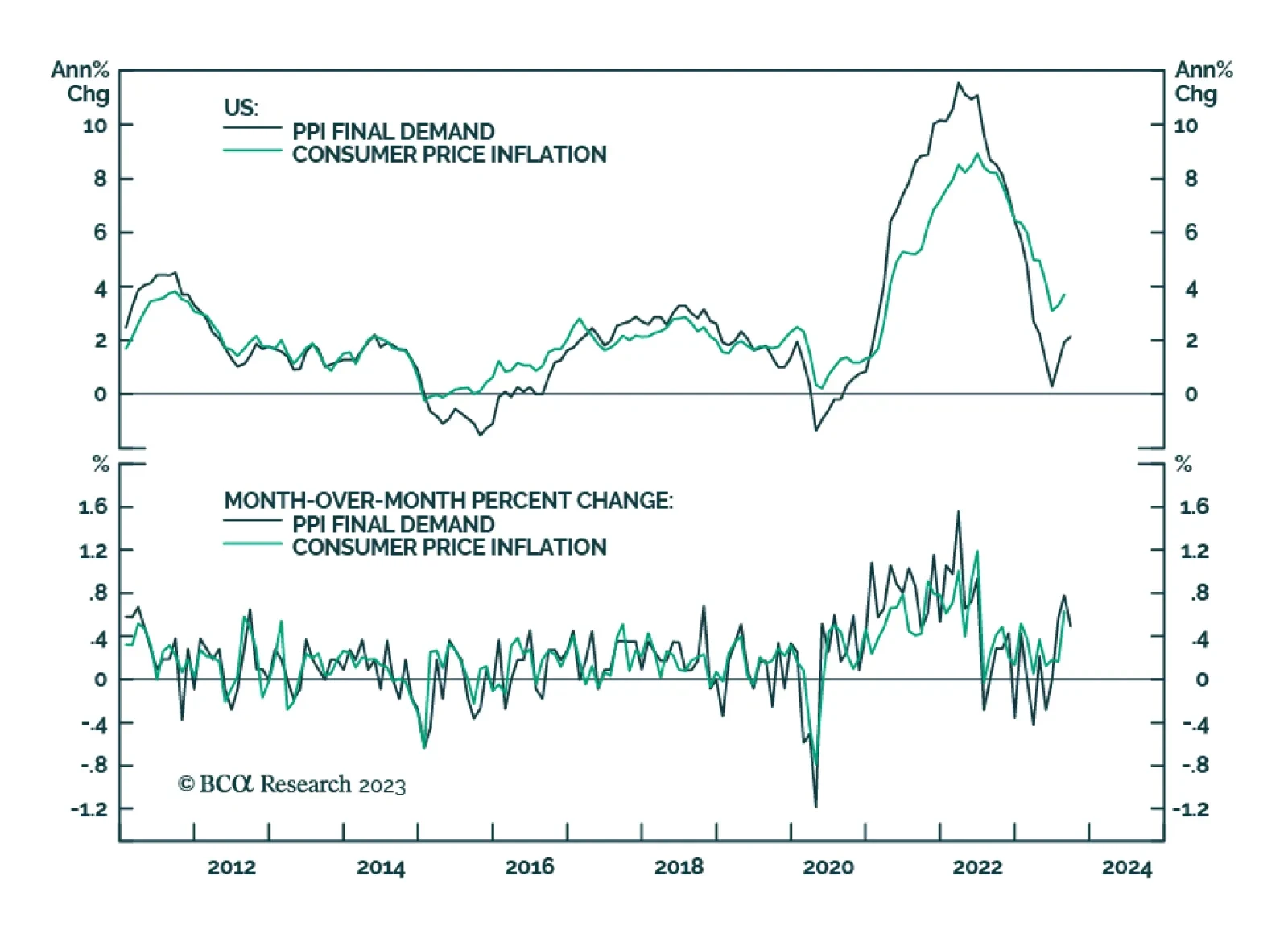

The US PPI report came in hotter-than-anticipated in September. Although the headline index decelerated from 0.7% m/m to 0.5% m/m, it remains above expectations of a more pronounced moderation to 0.3% m/m. In particular, a 3.3% m…