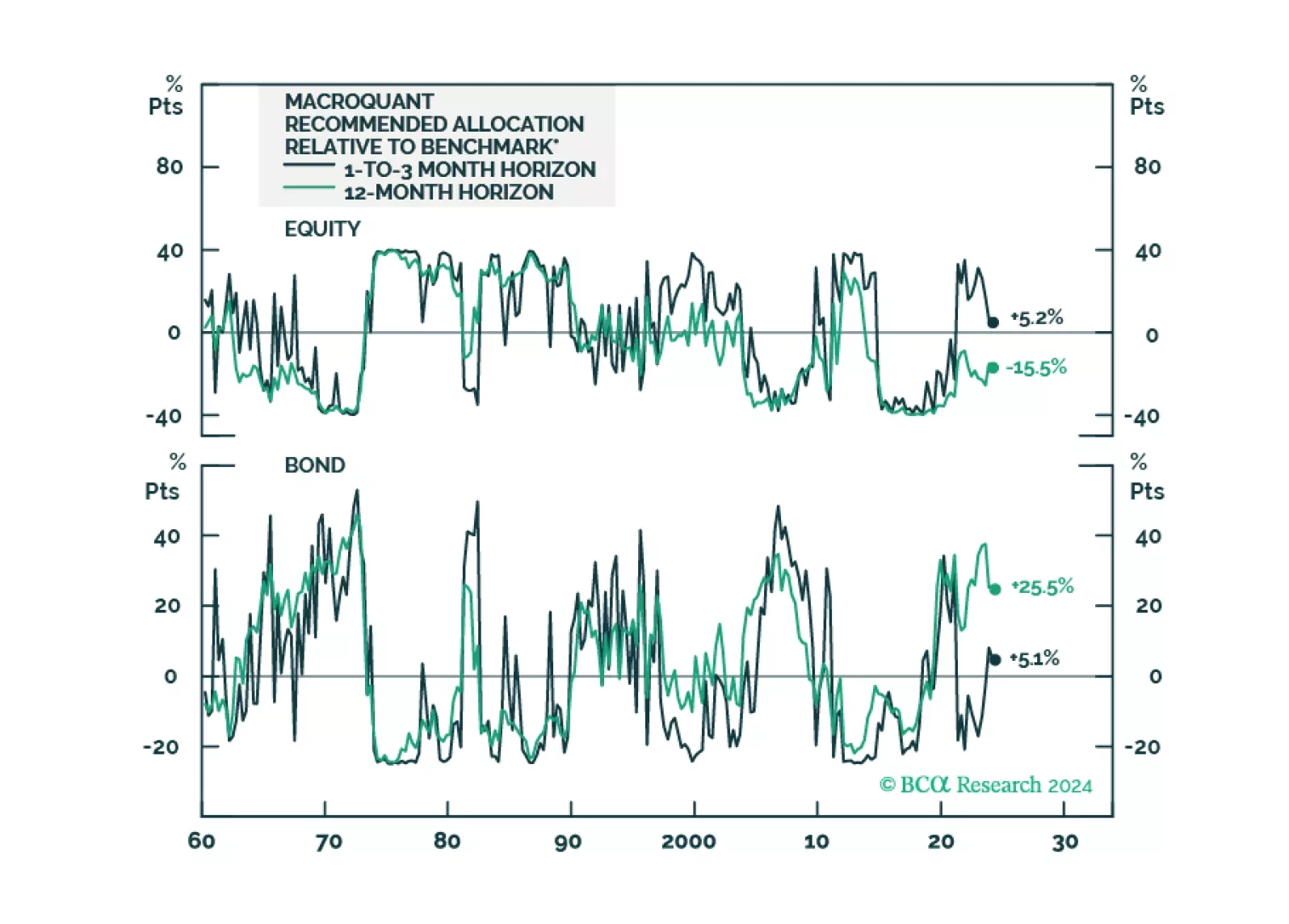

Following the release of the white paper yesterday, today we are sending you the inaugural issue of the MacroQuant Monthly, a report summarizing the output of our next-generation MacroQuant 2.0 model.

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

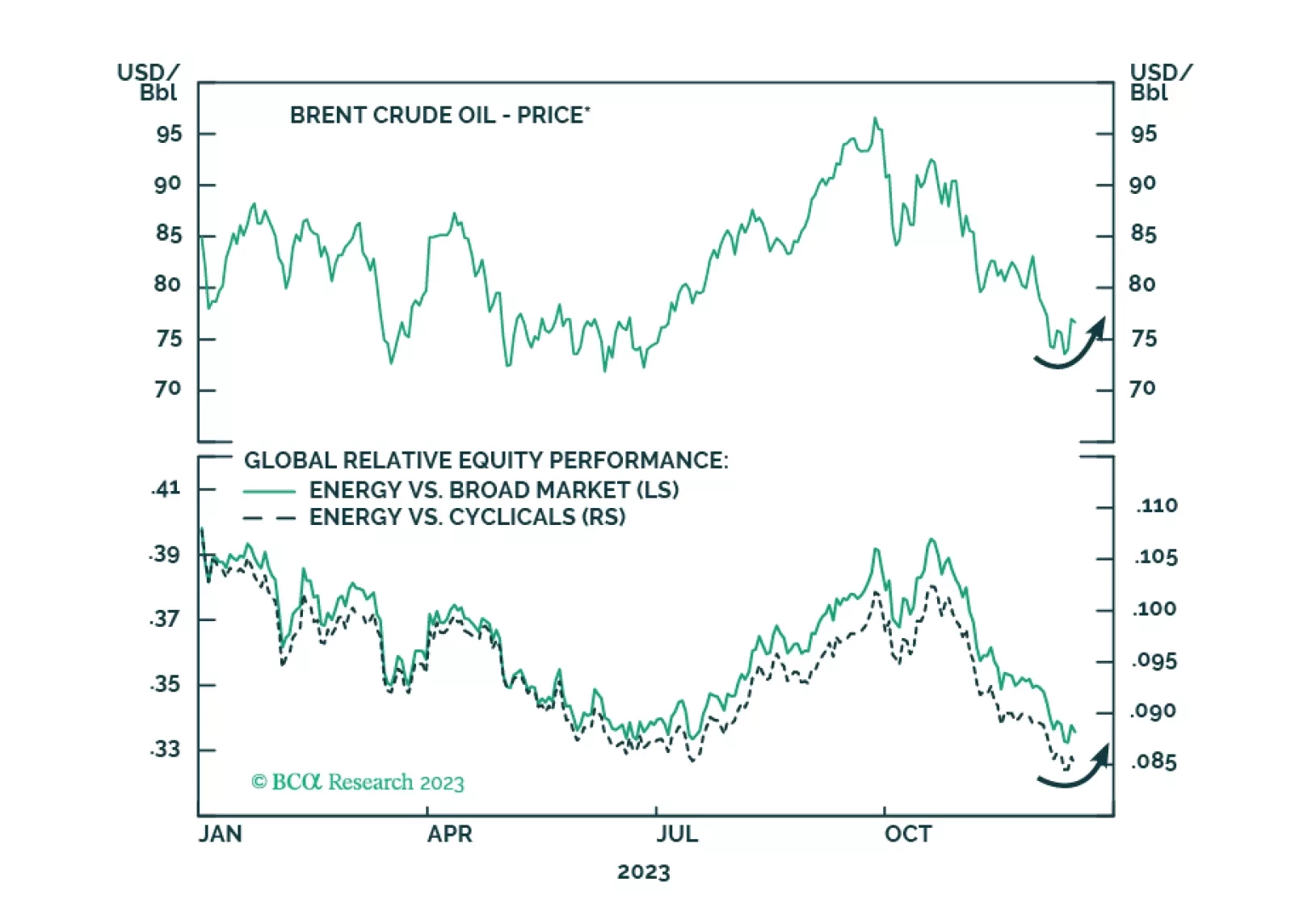

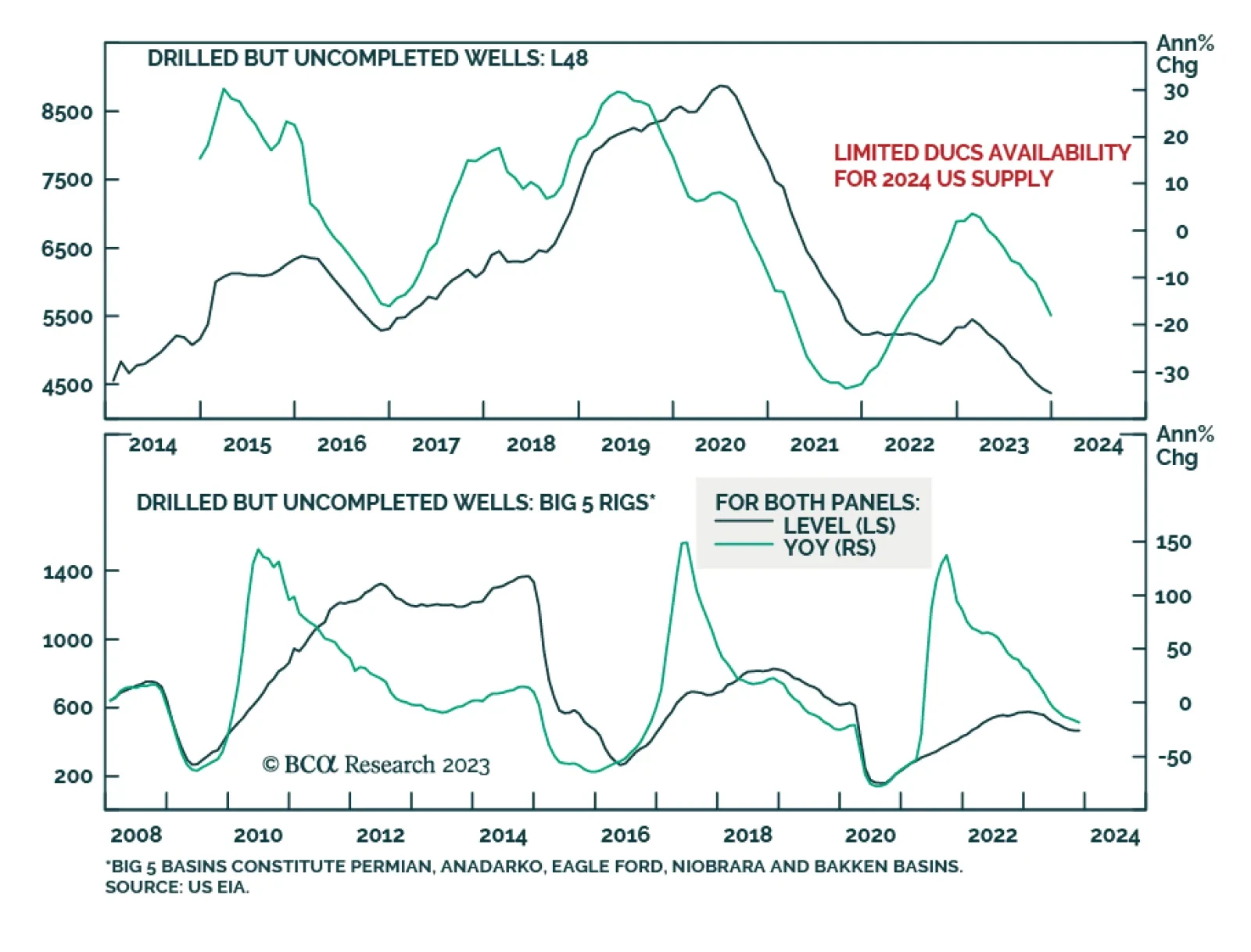

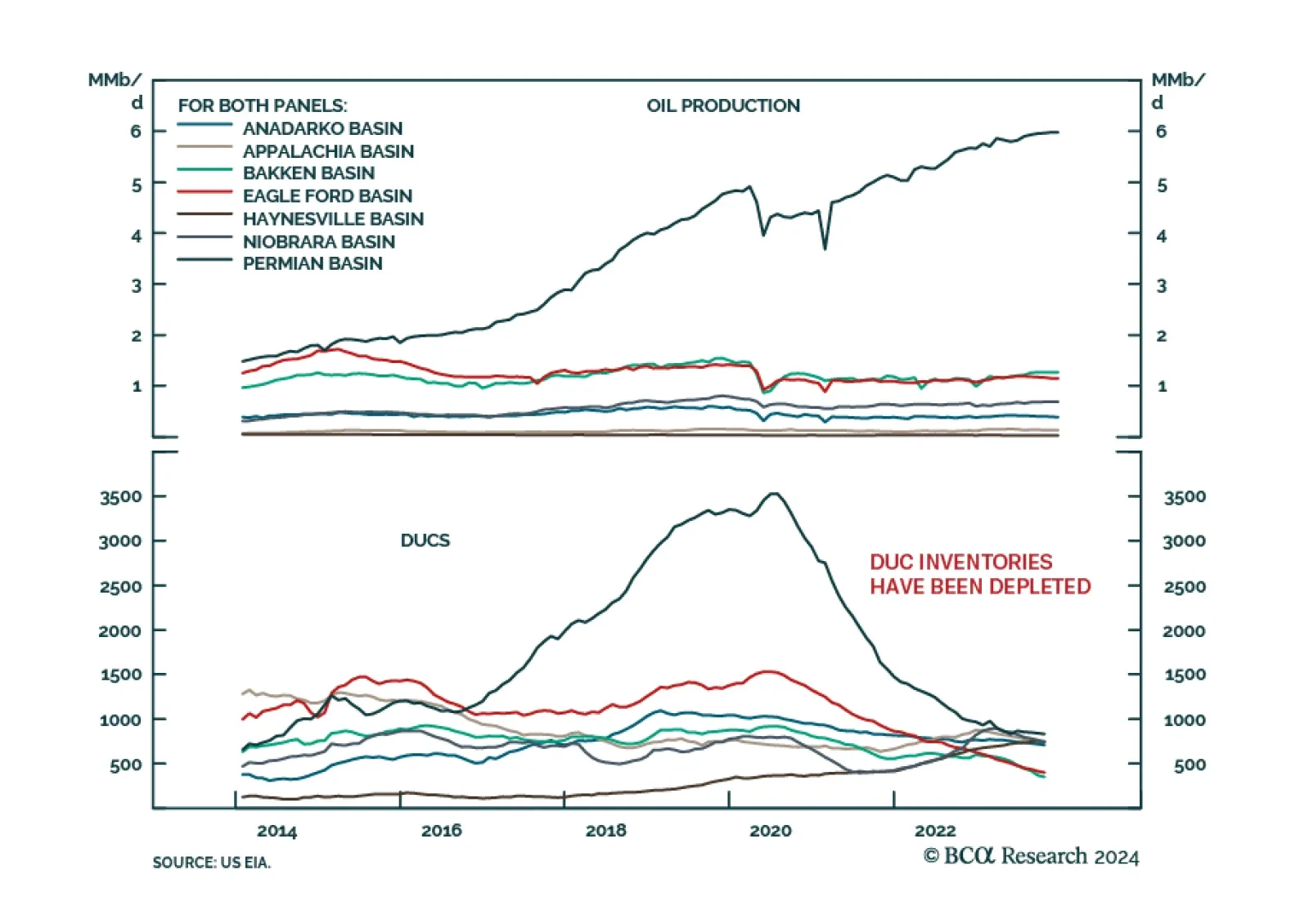

The 1mm b/d surge in US crude oil production last year was the result of a flood of low-cost drilled-but-uncompleted (DUCs) shale-oil wells coming online, mostly in 2H23 in the Permian Basin, which our colleagues in BCA's…

The risk markets will be surprised by another 1mm b/d increase in crude oil supplies this year or next from the US is low, given the depletion of the unfinished-well inventory that drove shale output higher. Demand remains strong,…

In this brief Insight we examine the expanding Middle East conflict and update the situation in the Taiwan Strait on the eve of elections. The Houthis are a distraction and China is not likely to invade Taiwan in the near term, but…

Crude oil prices weakened following the release of the US EIA’s weekly report on Wednesday, reversing gains earlier in the session and ultimately ending the day lower. The data release showed commercial crude inventories…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

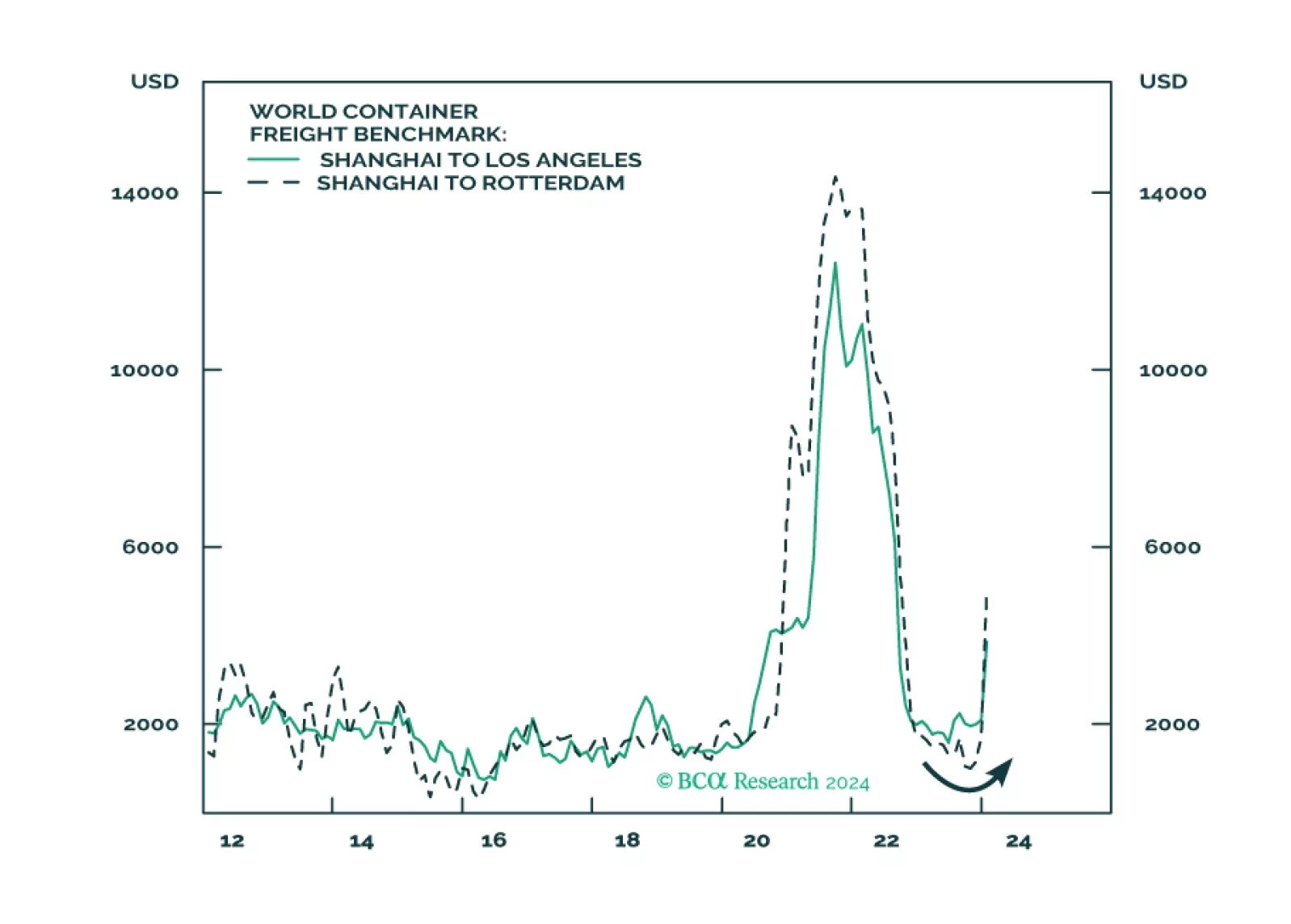

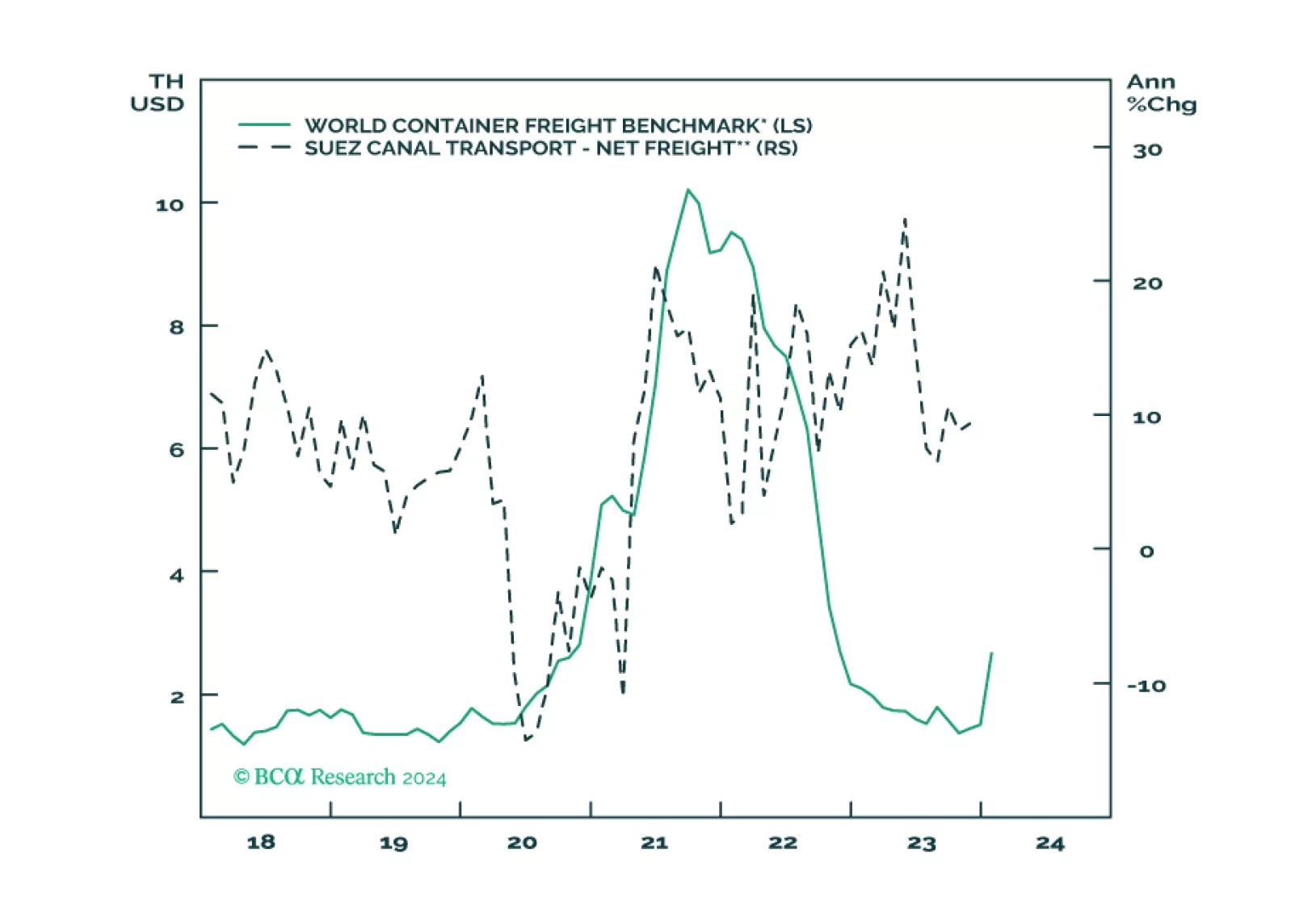

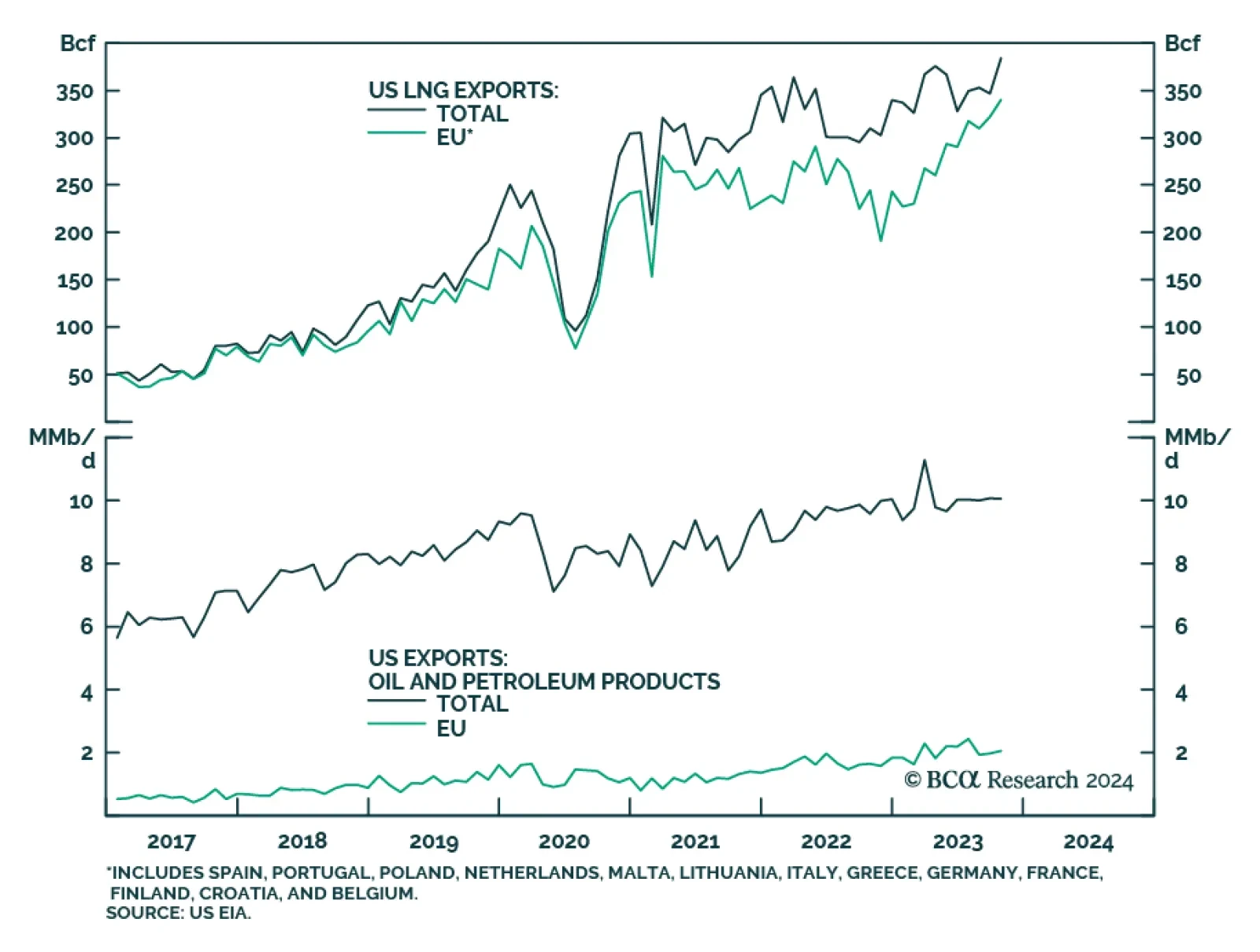

According to BCA Research’s Commodity & Energy Strategy service, attacks on commercial tankers transiting the Bab el-Mandeb Strait by Iran’s proxies in Yemen, the Houthis, are an inflation risk. Just under 9%…

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…