Financial markets appear unphased by the increase in Mideast tensions that occurred with Iran’s retaliatory attack on Israel over the weekend. Most notably, crude oil prices declined on Monday, suggesting that investors are…

Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.

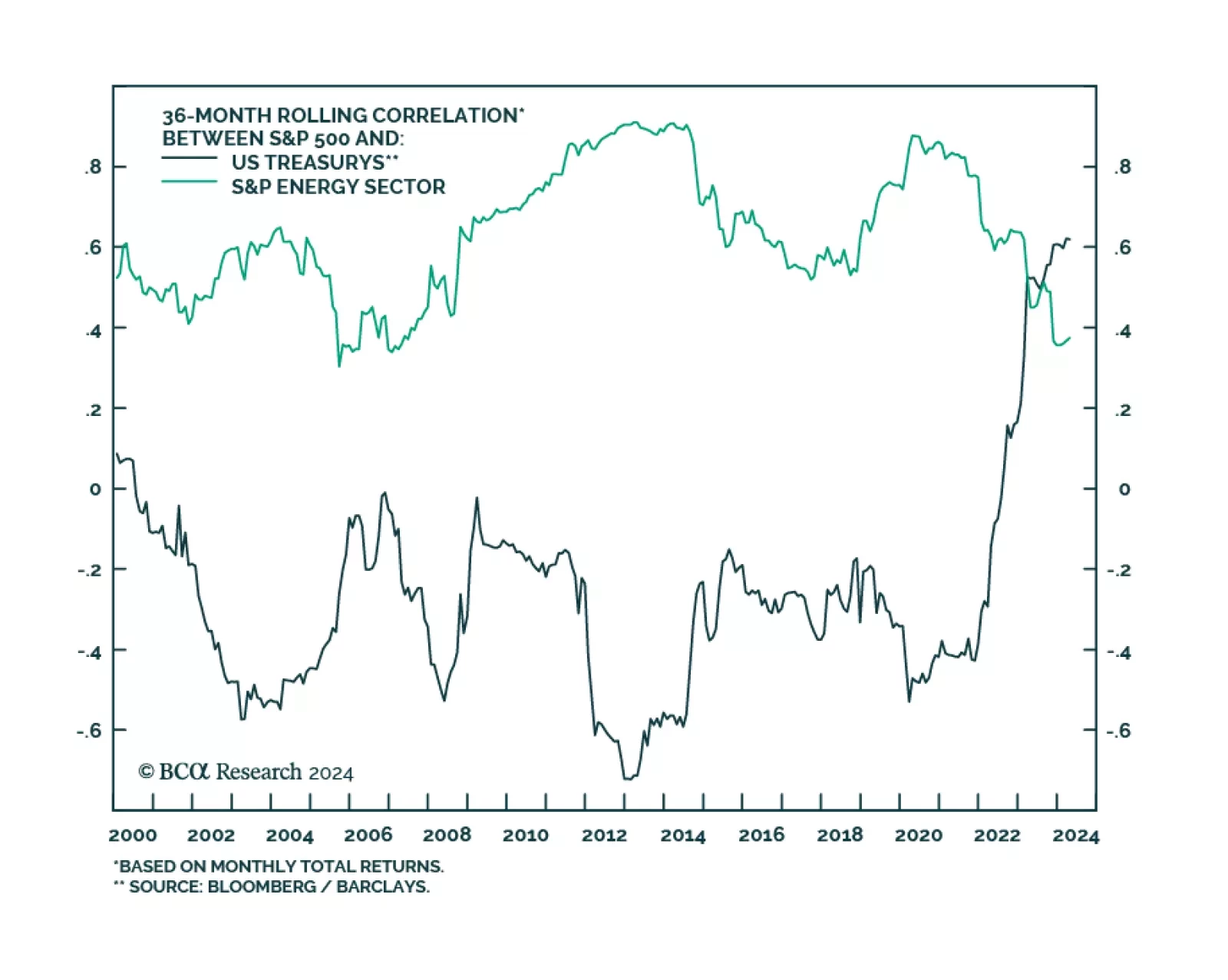

Traditionally, equity managers have thought of oil equities as cyclical. This is because, in the past, oil equities had a strong positive correlation to the overall market. But US oil equities have increasingly become more…

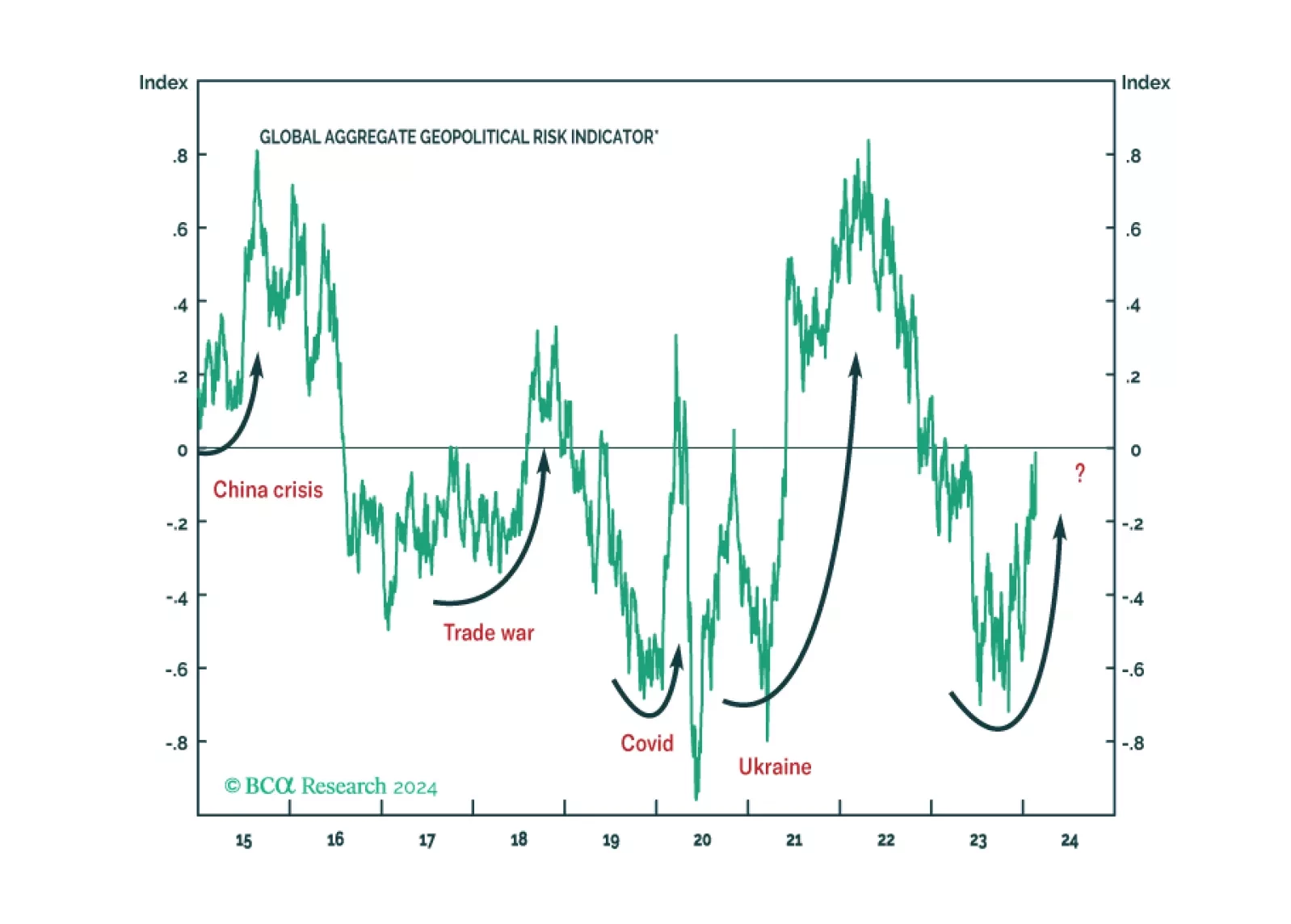

Oil prices surged over the past two days on the back of heightened geopolitical risks to supply following increased tensions in the Middle East. Both Iran’s Supreme Leader Ayatollah Ali Khamenei and President Ebrahim Raisi…

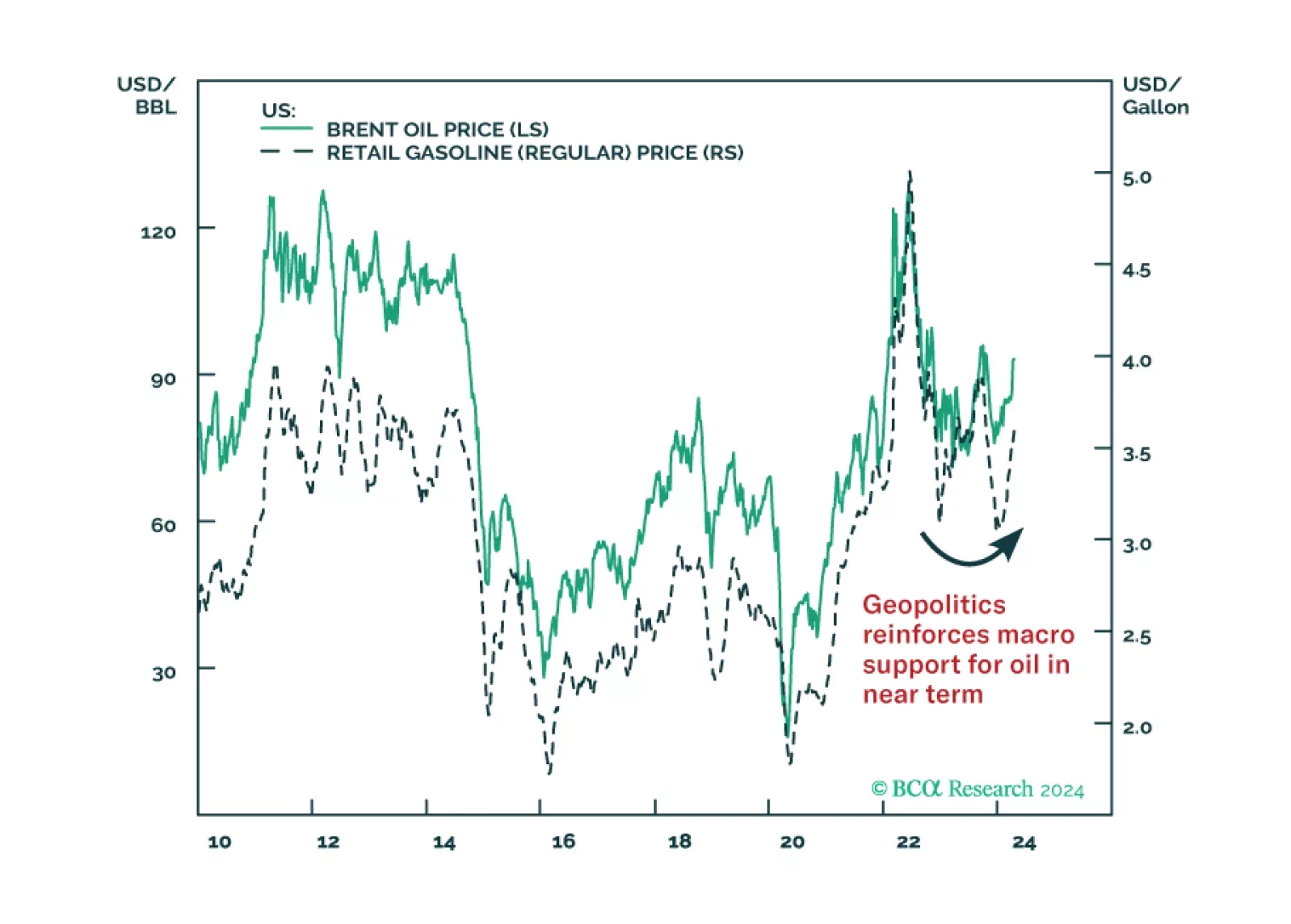

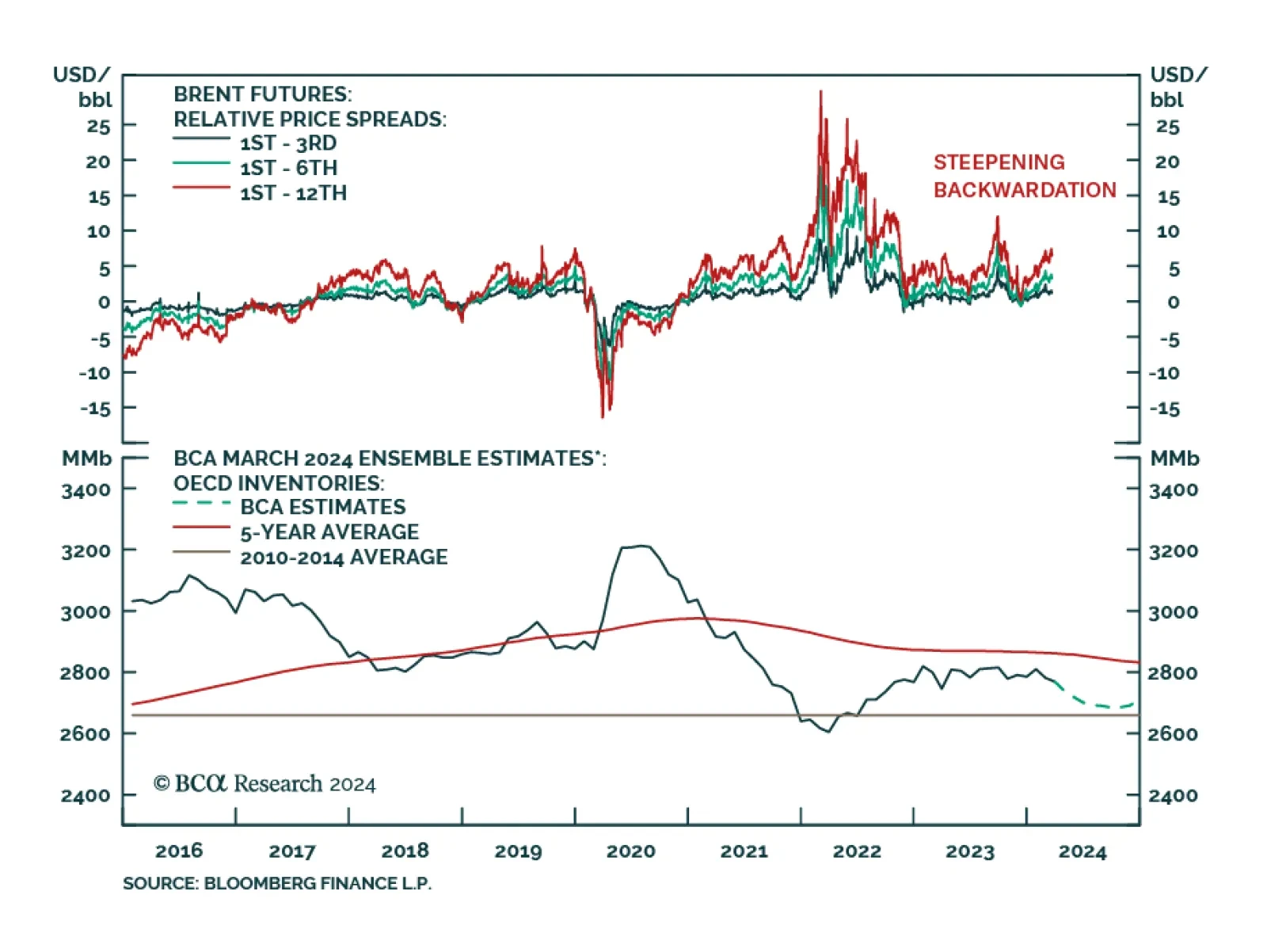

Crude oil prices have been steadily rising since mid-December with Brent rising to its highest level since November 2023. Both demand and supply-side forces are behind this move. The catalyst for the month-to-date gain is a…

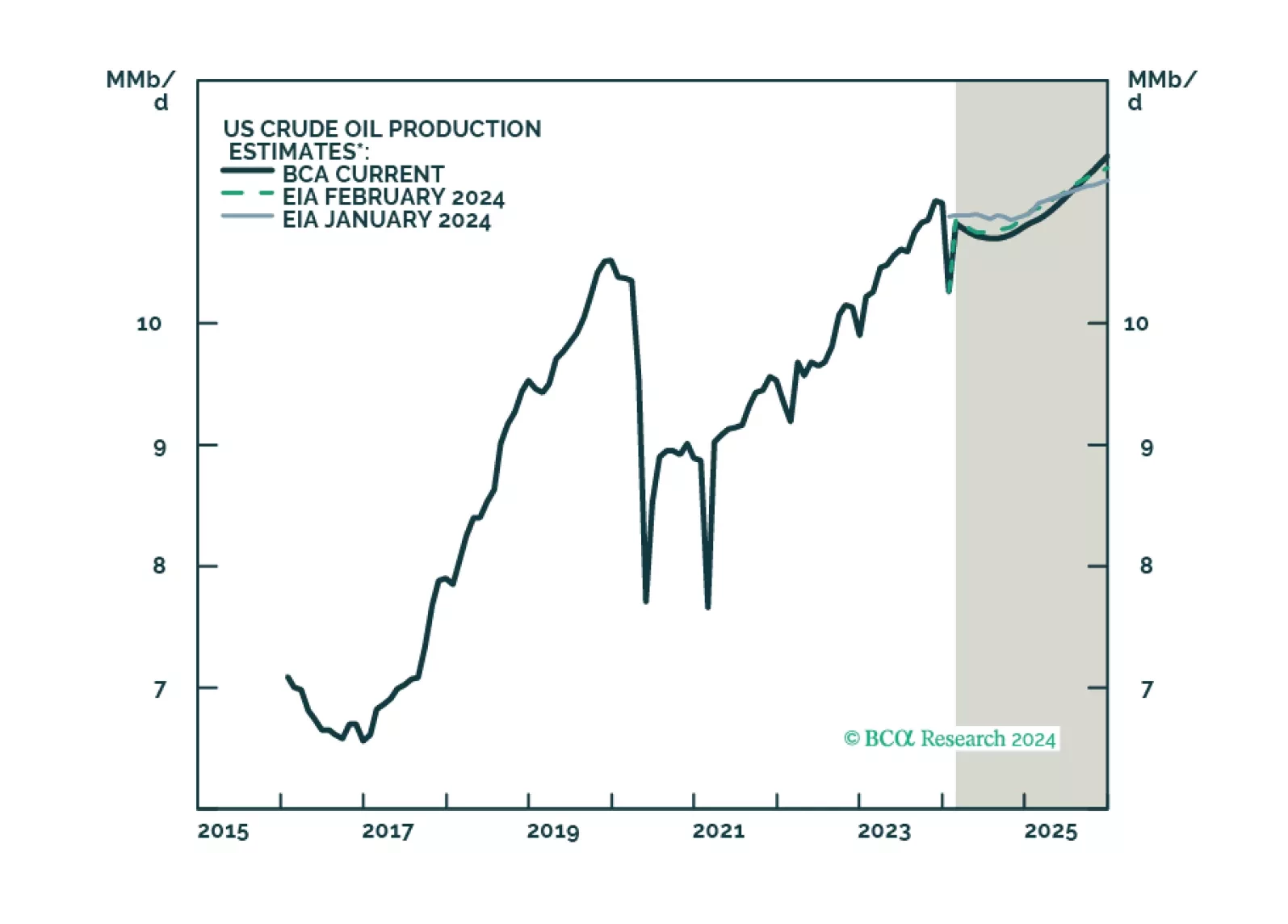

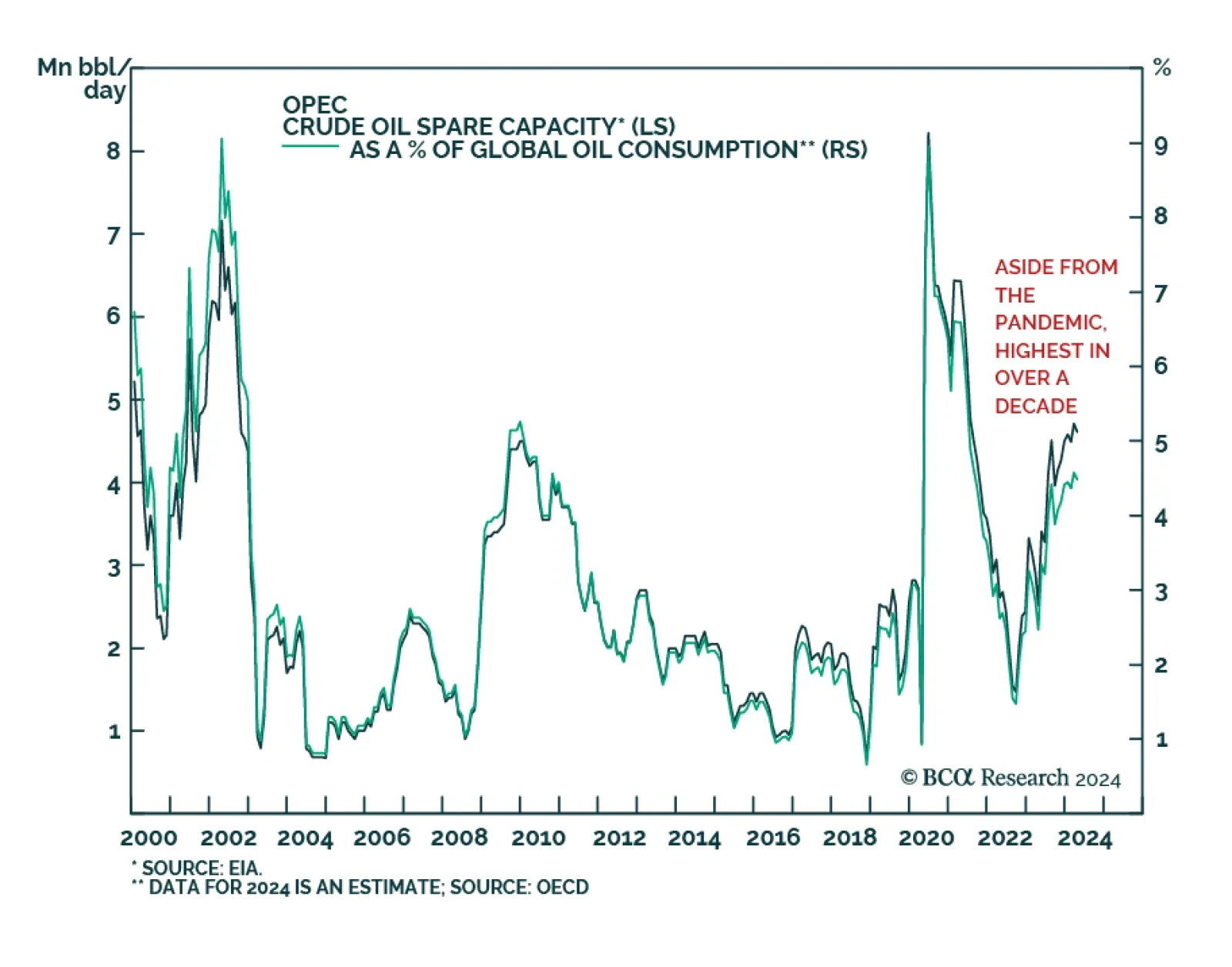

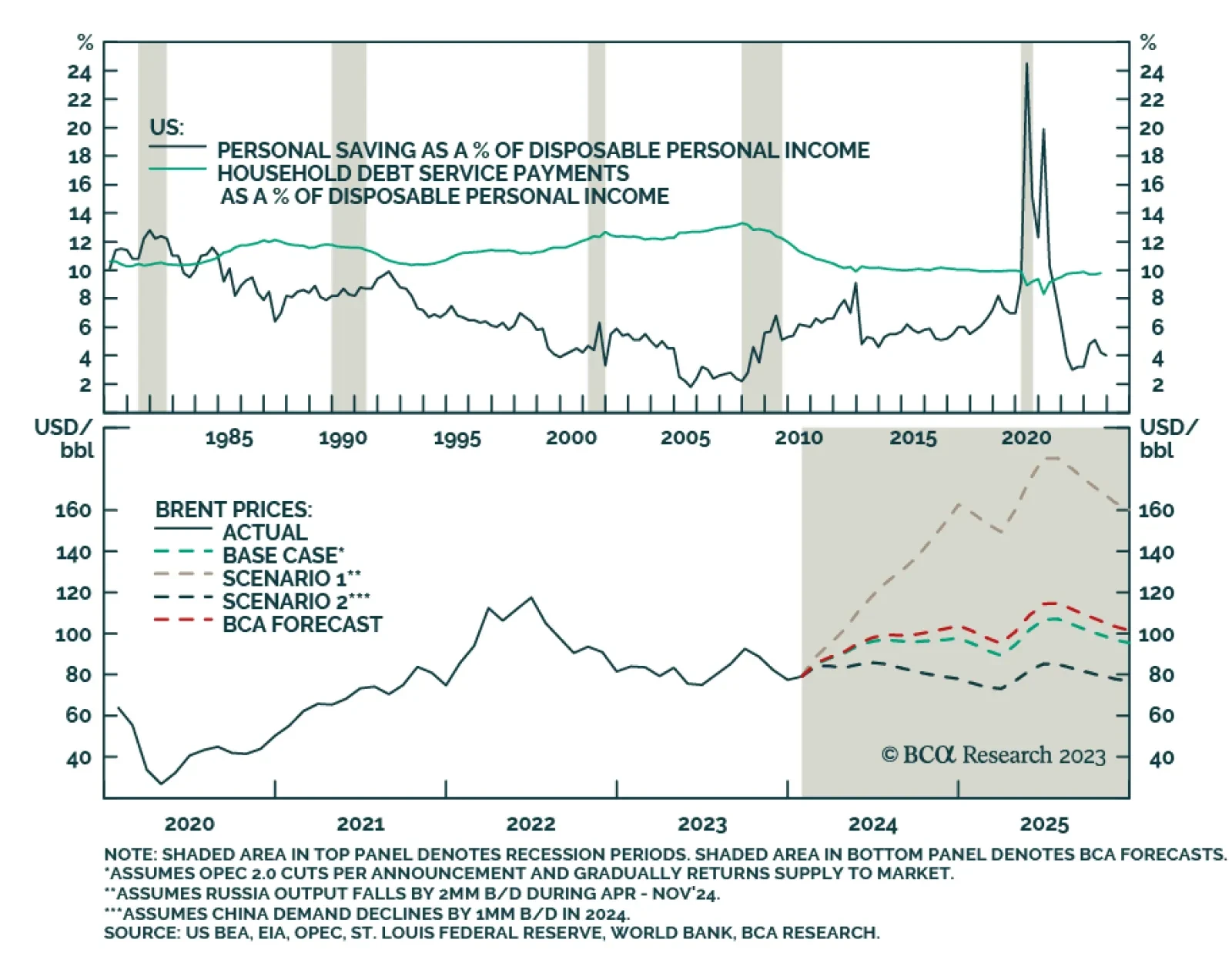

We expect oil-demand growth to increase this year – to 1.7mm b/d from 1.4mm b/d (0.30% of total demand) – and anticipate tighter supply at the margin. Our balances estimates are unchanged, leaving our Brent price forecasts for 2024…

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

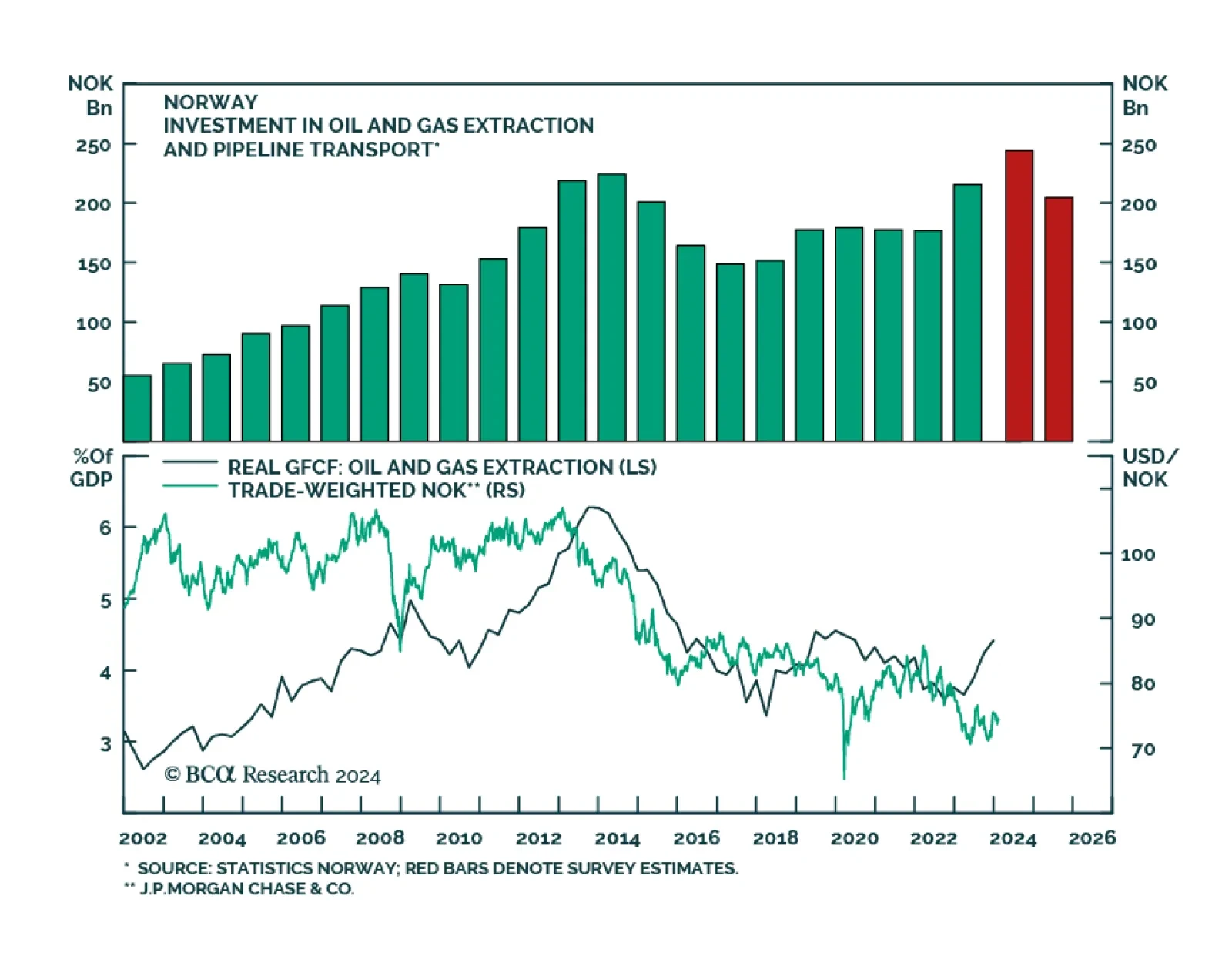

Energy security is a focus of many governments, especially since the onset of the Russia-Ukraine conflict. One producer that is benefitting from diversification away from Russian oil and gas is Norway. This is buffeting the trade…

Our Commodity & Energy colleagues see oil markets balanced in the short run, which keeps their Brent price forecasts at $95/bbl and $105/bbl for 2024 and 2025. That said, they note the odds are increasing demand…

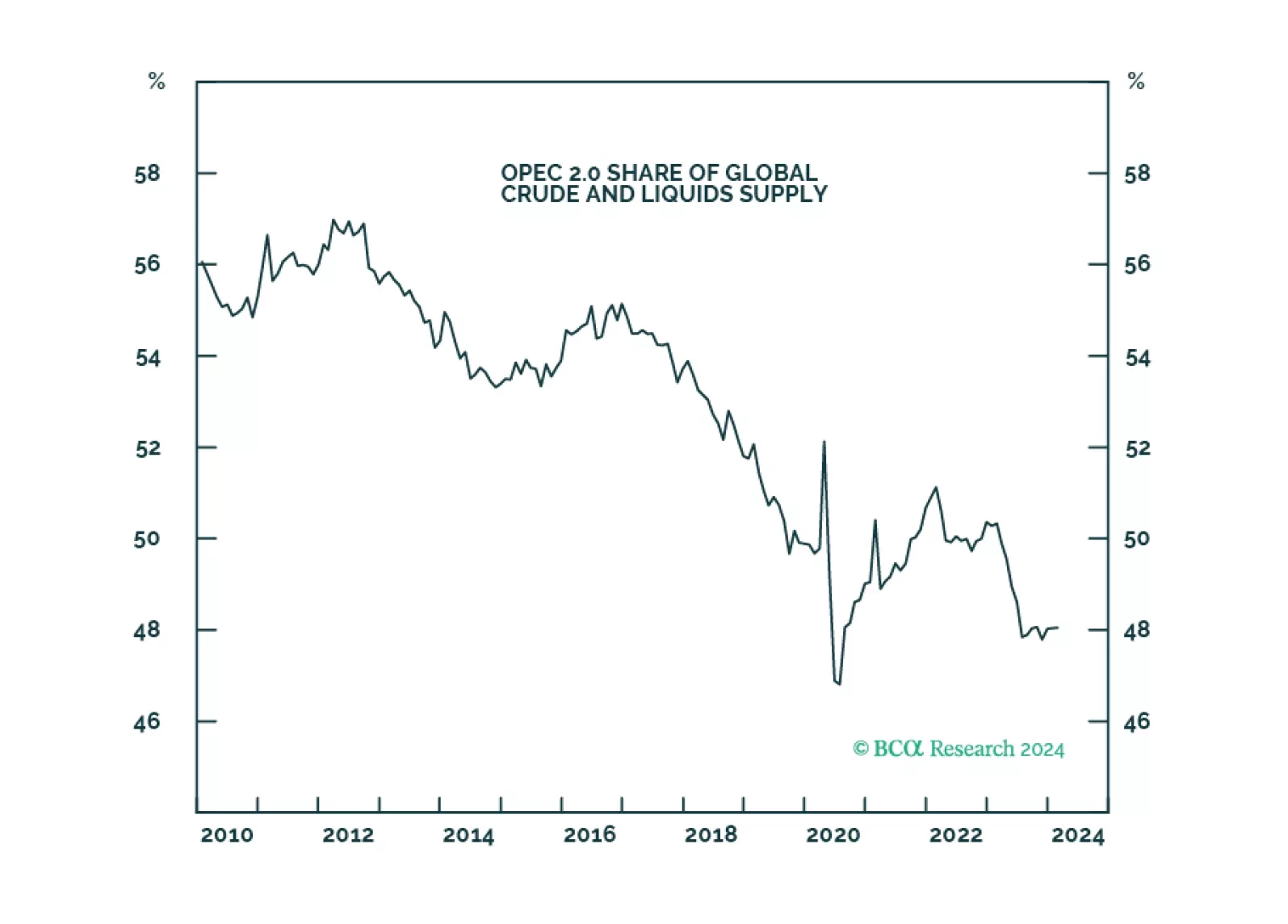

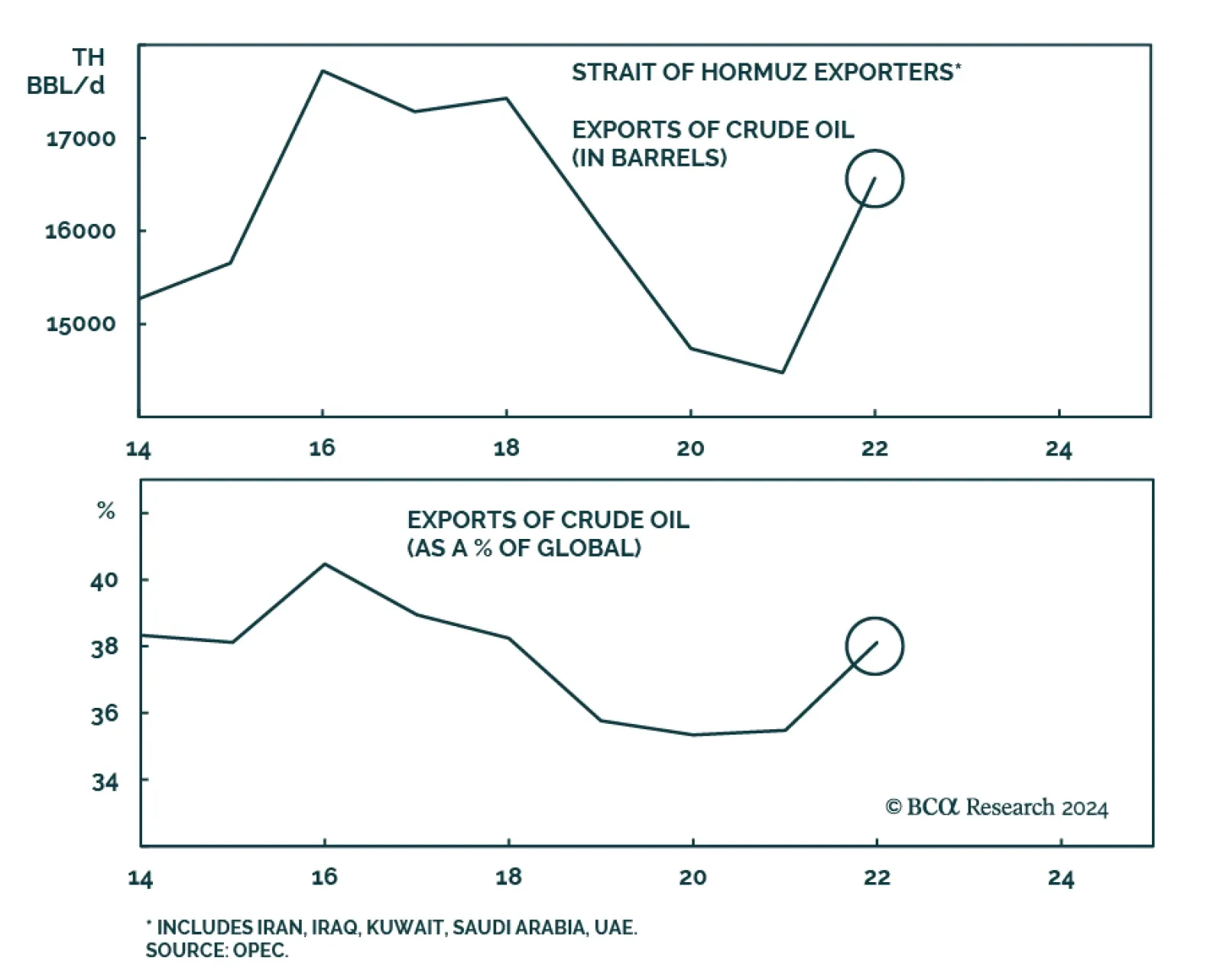

Energy markets are balanced in the short run, which keeps our Brent price forecasts at $95/bbl and $105/bbl in 2024 and 2025. Structurally, we see an upward bias to inflation, as geoeconomic fragmentation fundamentally alters supply…