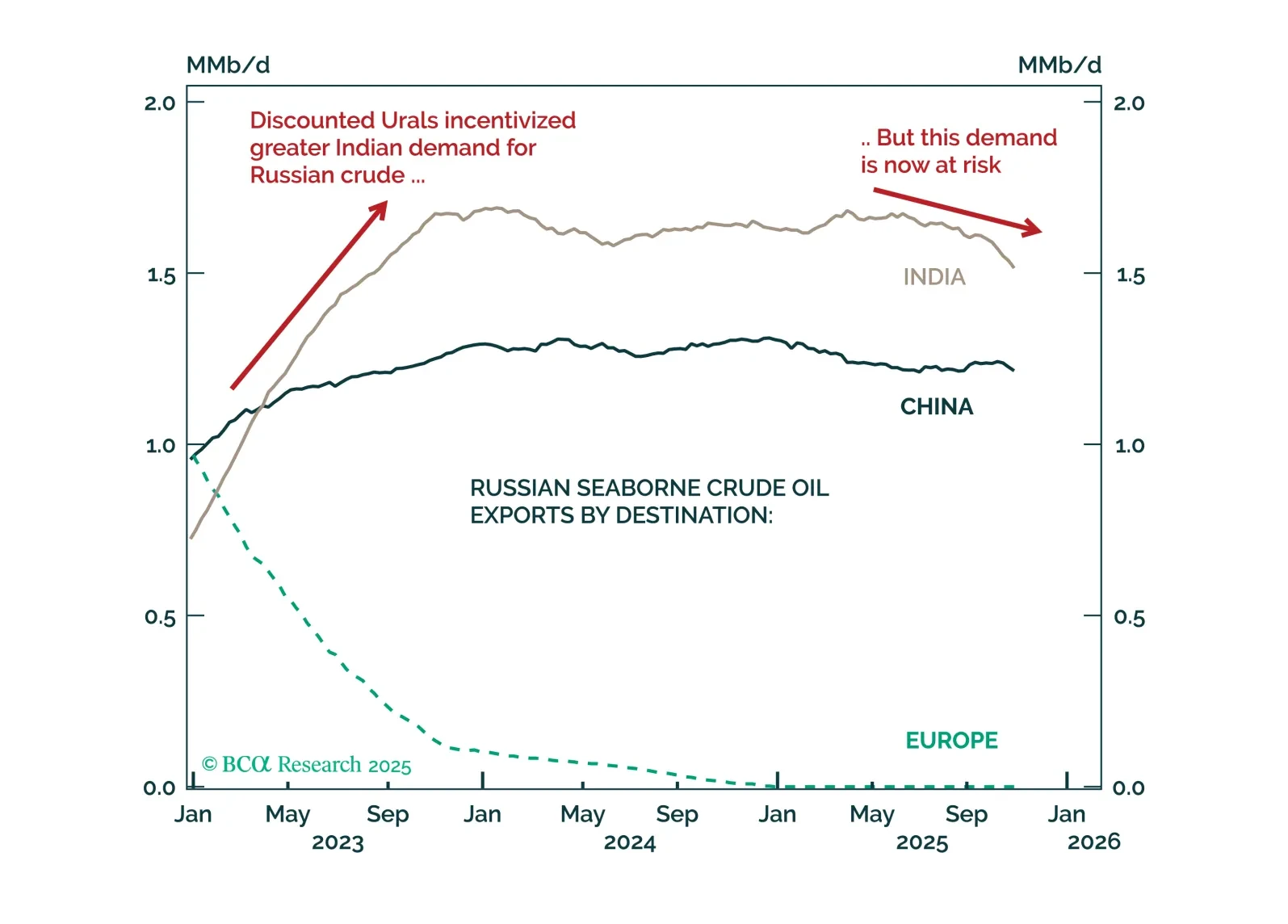

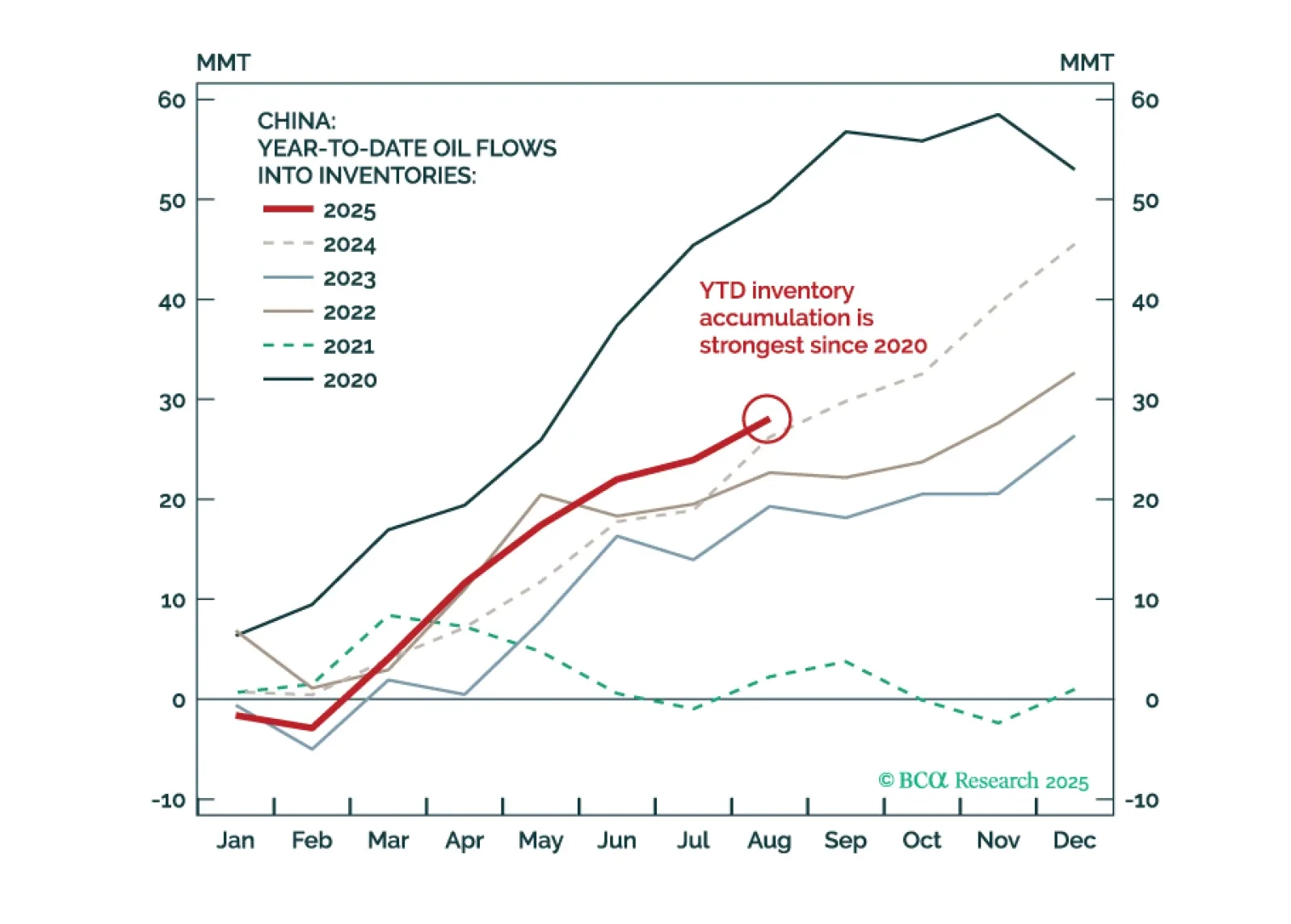

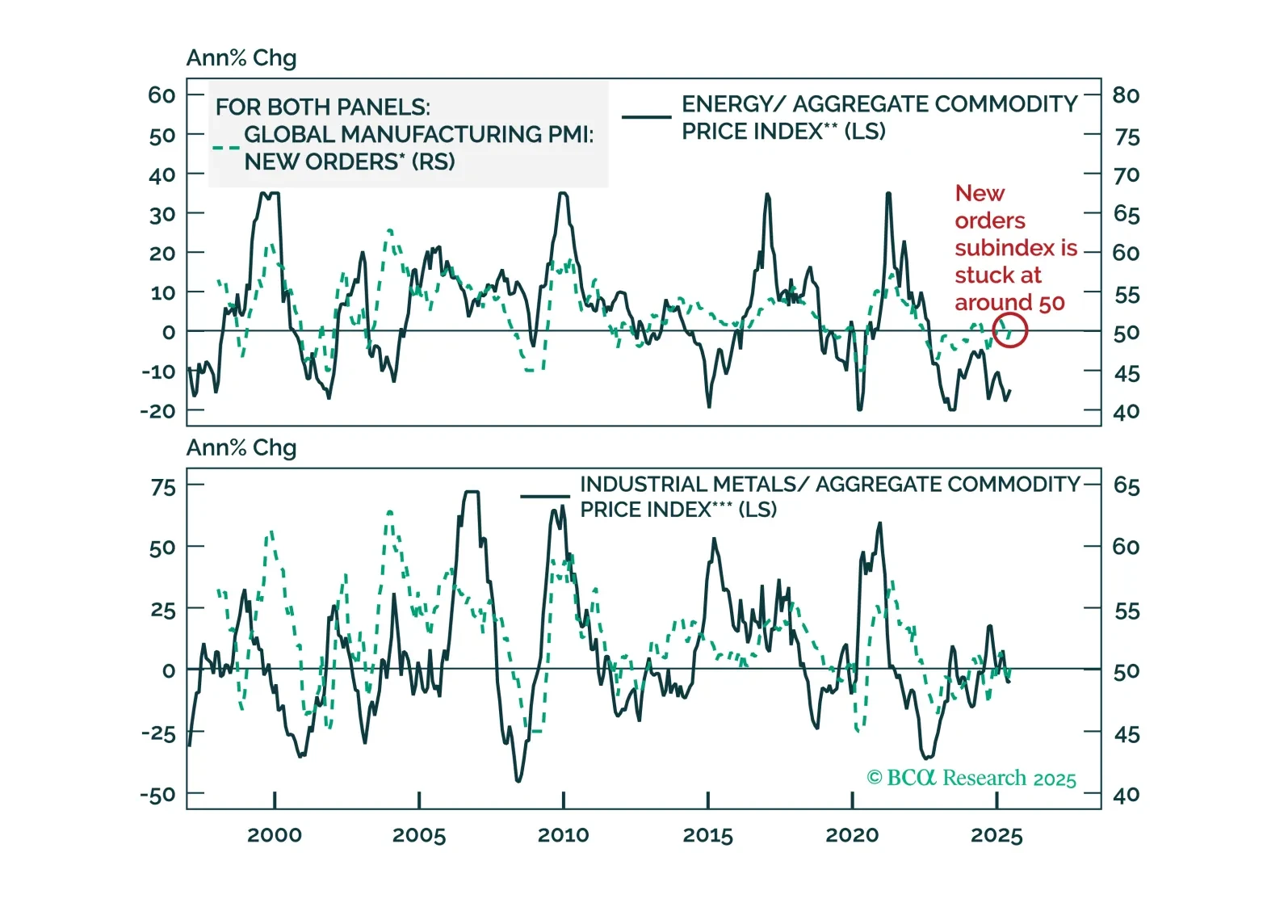

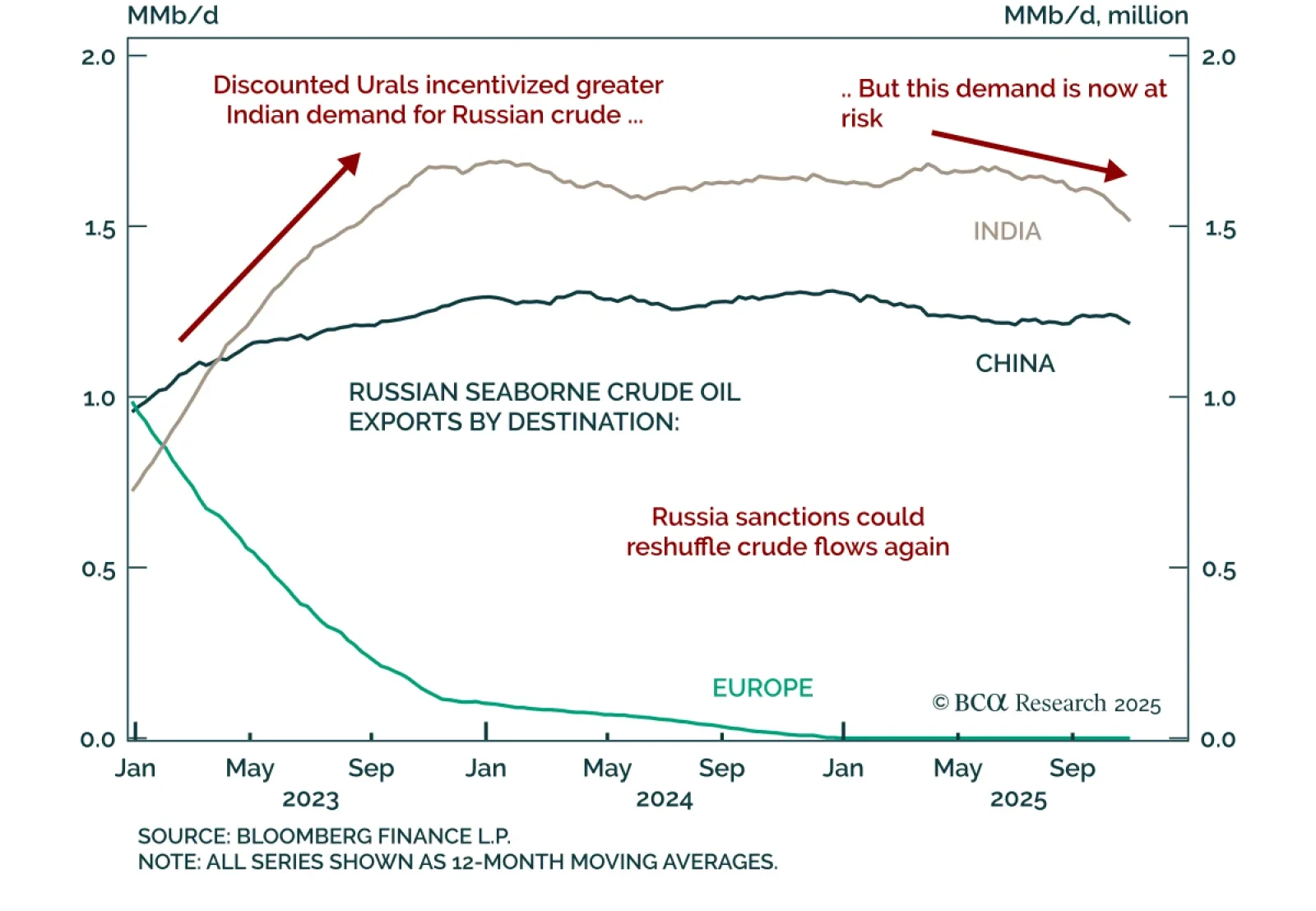

Our Commodity strategists advise staying short Brent, with a stop-loss at $73/bbl, as US sanctions on Russian crude are unlikely to meaningfully impact prices over a cyclical horizon. While new restrictions on Rosneft and Lukoil…

US restrictions on Russian crude exports could disrupt global oil supplies and trade flows over the near term. However, they are unlikely to have a meaningful impact on crude prices over a cyclical timeframe. Stay short Brent.…

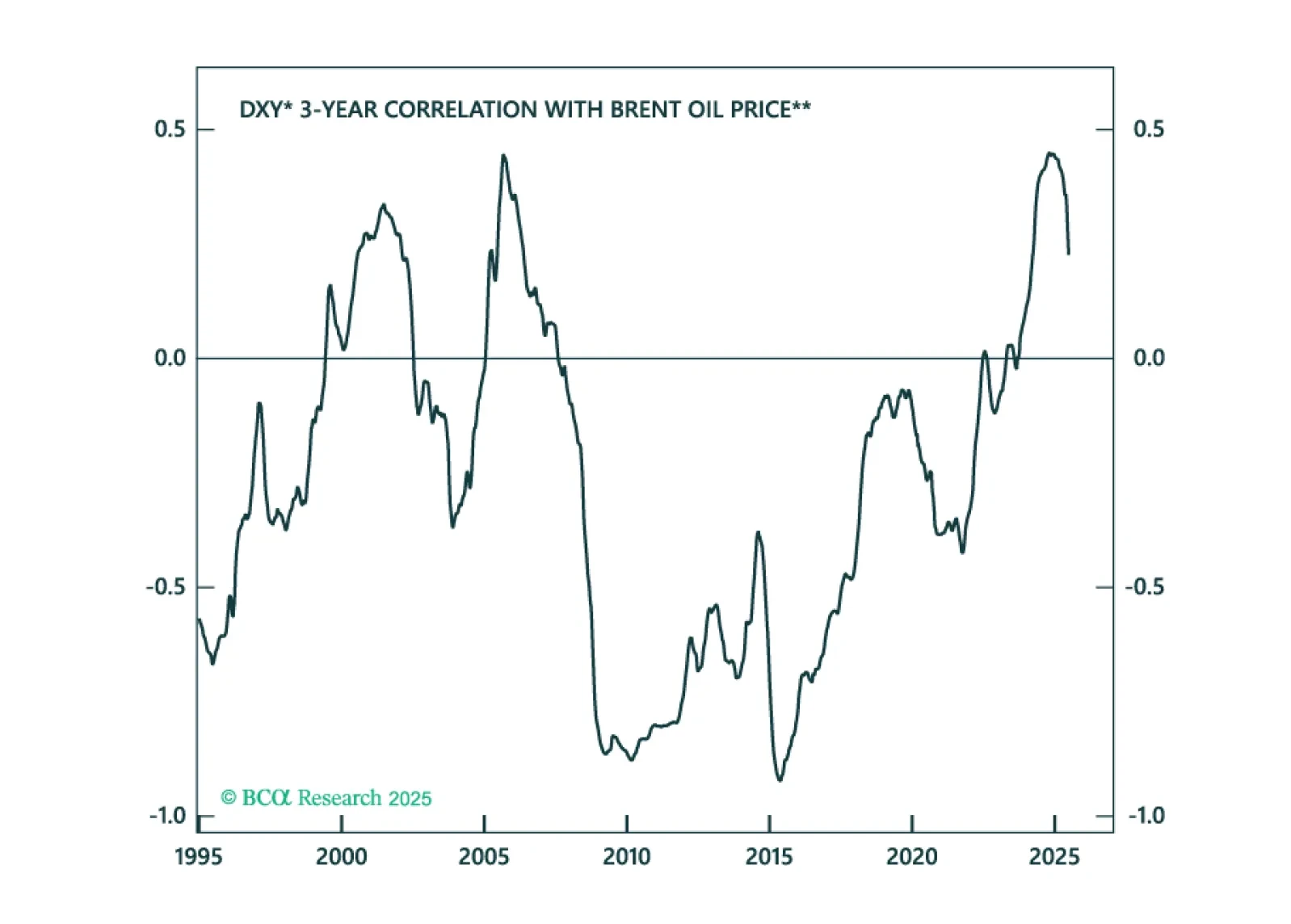

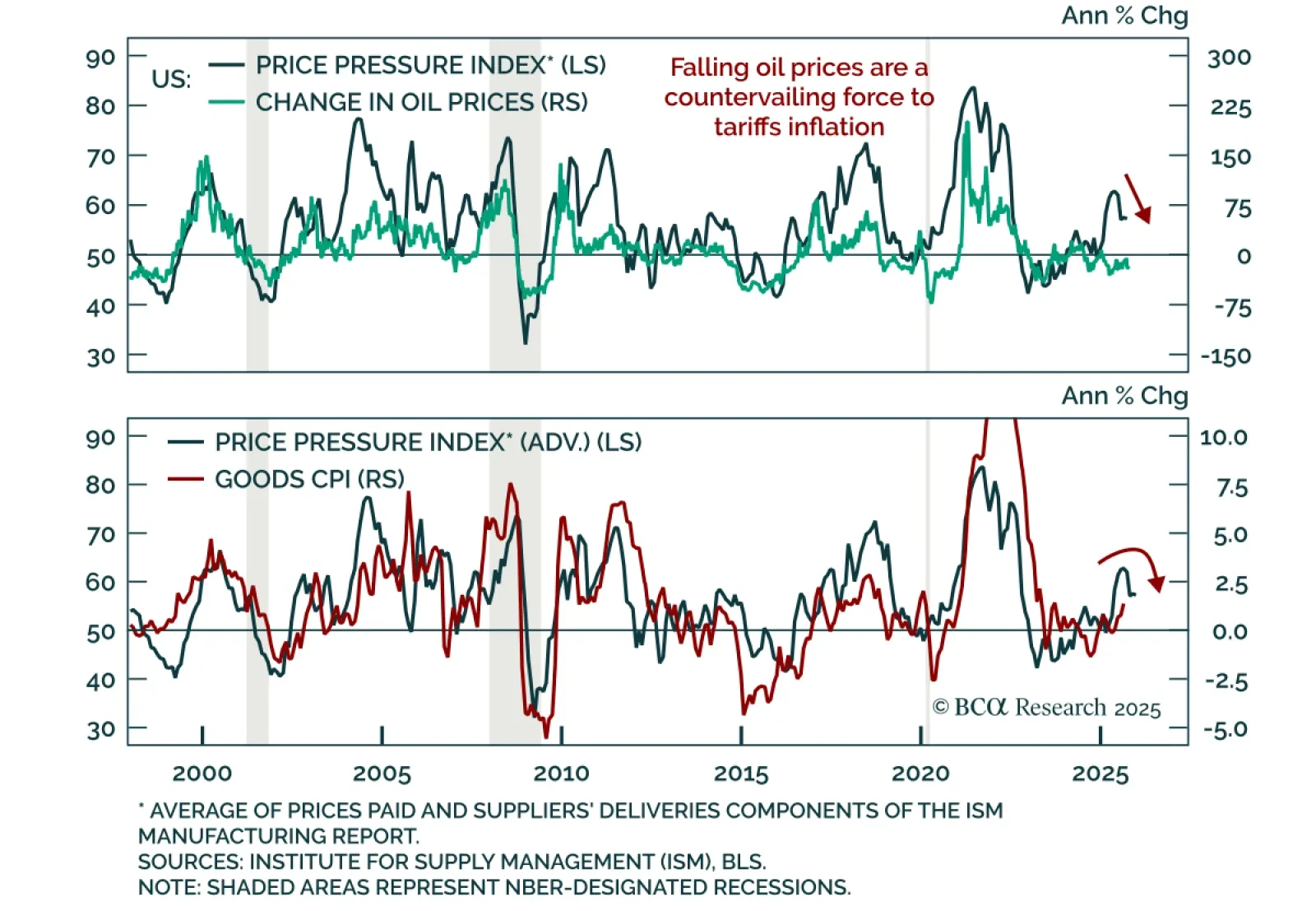

Falling oil prices are countering tariff-driven inflation which, along with a weakening labor market, is reinforcing a long duration stance. Brent crude broke below the $65/bbl support level held since June and WTI is now down 16%…

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

We remain cyclically short Brent but are tightening the stop loss to $73/bbl to guard against a geopolitics-driven upside break.

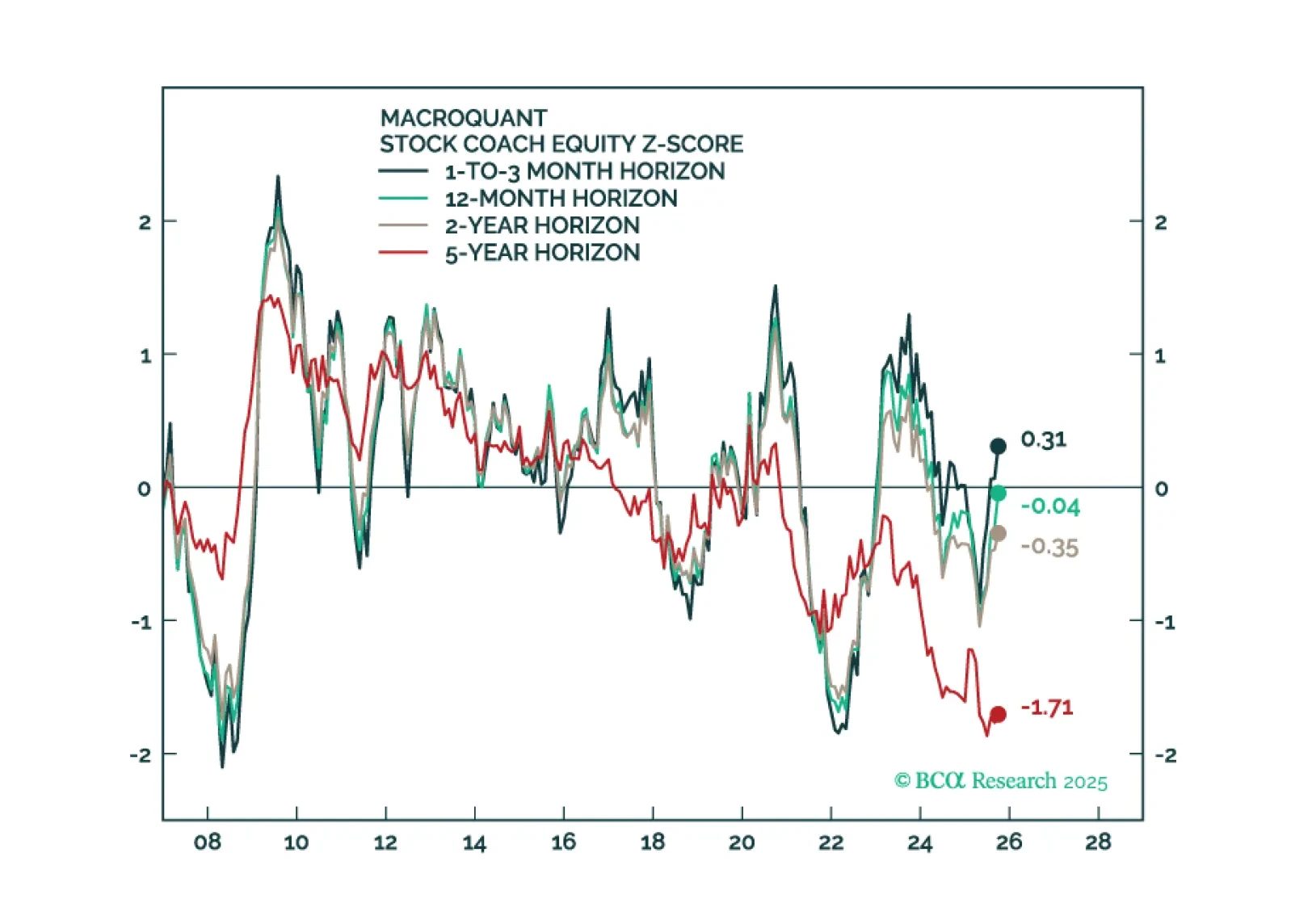

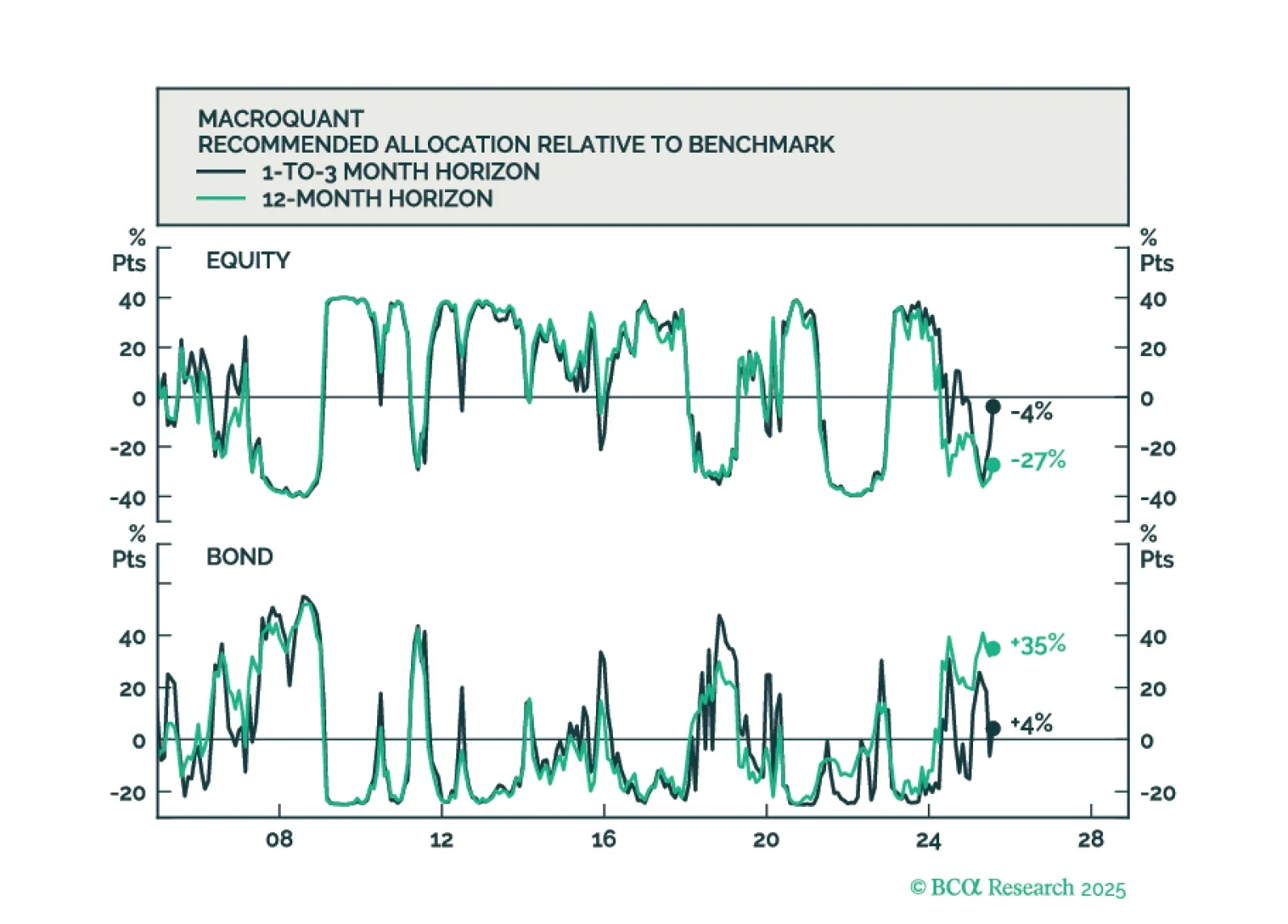

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

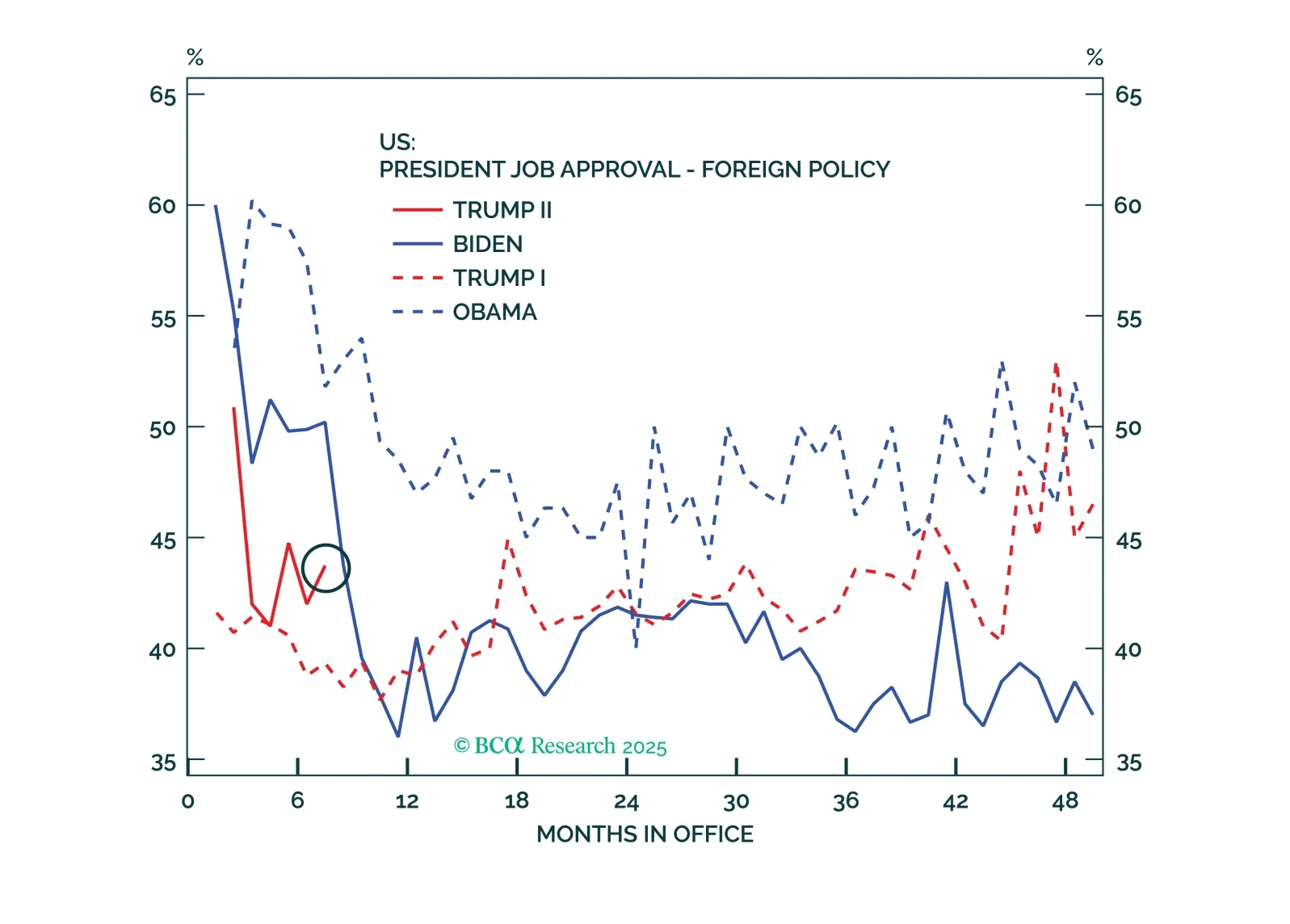

Trump, the Fed, the Russo-China bloc, Venezuela, and France are all seeing developments that imply some contrarian tactical views: Long USD, overweight US versus Europe, overweight Europe versus China, and short oil.

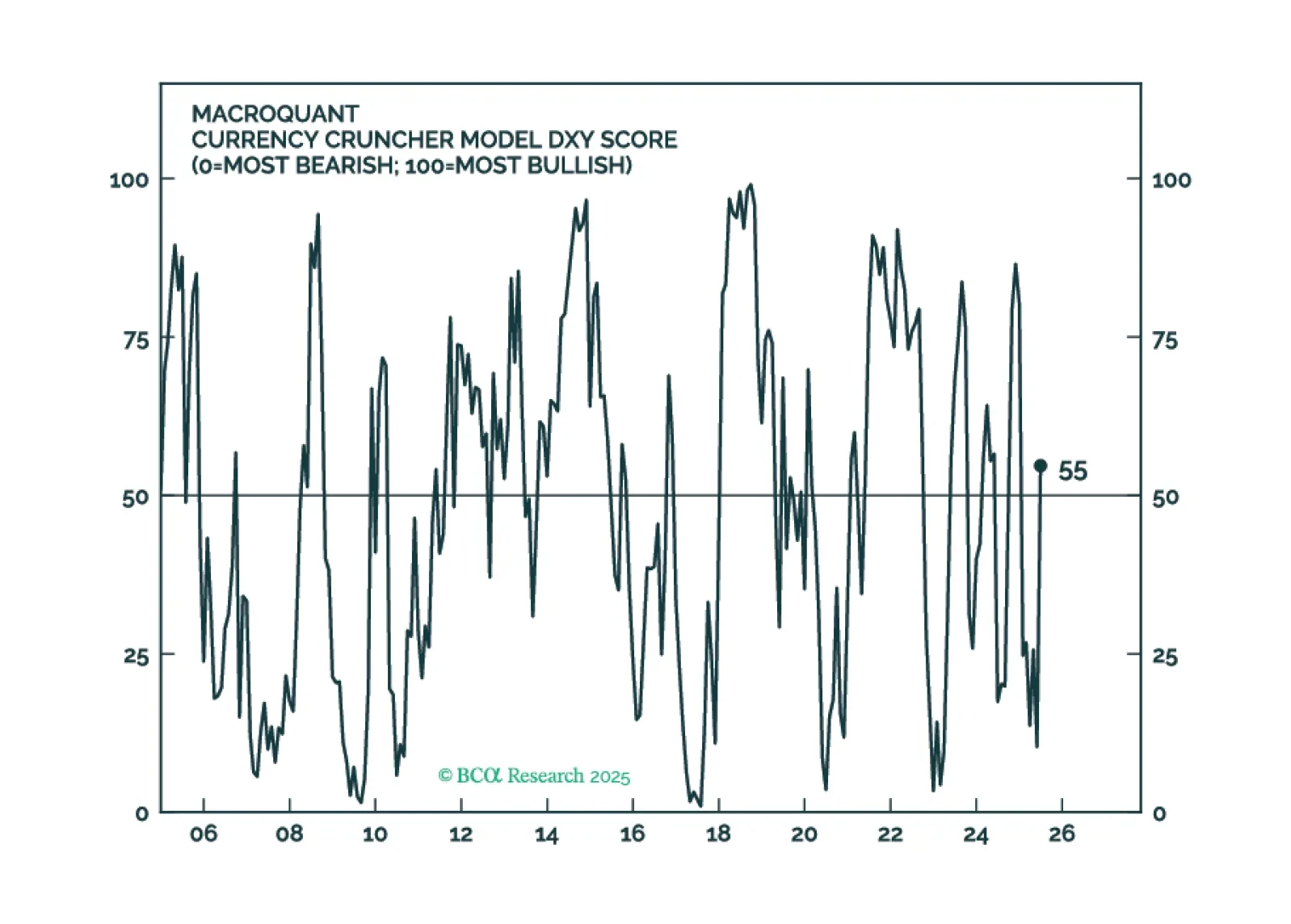

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

An update on the key themes and views that will shape commodity markets through the remainder of 2025.

The dollar is breaking down, as capital leaves the US. The important question investors must answer is how much downside is left for the greenback, and whether depreciation will continue in a straight line over the coming months or pause (…