Highlights Kim Jong Un’s sickness or death is a matter of speculation and it is best to remain skeptical for now. If Kim dies or is incapacitated, it is a serious concern for North Korean and hence regional stability – and…

Highlights The pandemic has a negative impact on households and has not peaked in the US. But a depression is likely to be averted. Our market-based geopolitical risk indicators point toward a period of rising political turbulence…

Highlights So What? Tariffs and currency depreciation will likely lead to military saber-rattling in Asia Pacific. Why? President Trump is not immune to the market’s reaction to his trade war escalation. Yet China’s…

Highlights So What? Economic stimulus will encourage key nations to pursue their self-interest – keeping geopolitical risk high. Why? The U.S. is still experiencing extraordinary strategic tensions with China and Iran…

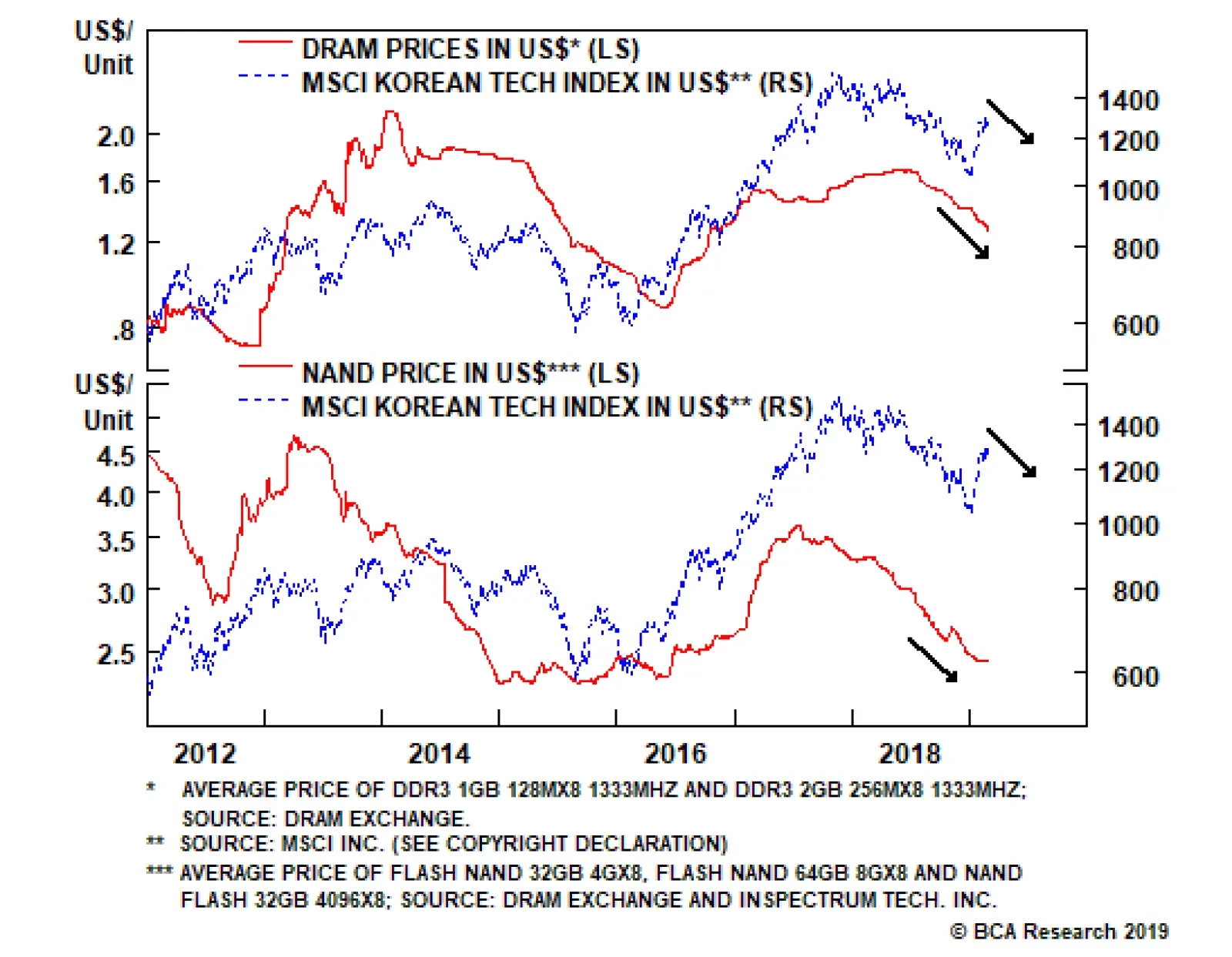

Korea’s dependence on the semiconductor sector has risen considerably in the past several years: Semiconductor exports have risen from under 10% to slightly above 20% of total goods exports. On the demand front, memory…

Highlights BCA's Geopolitical Power Index (GPI) confirms that we live in a multipolar world; Most of President Trump's policies are designed to strike out against this structural reality; Trade war with China is real and…

Highlights Divergence between U.S. and global economic outcomes is bullish for the U.S. dollar and bad for EM assets; Maximum Pressure worked with North Korea, but it may not with Iran, putting upside pressure on oil; An election is…

Highlights The protectionist option in U.S. policy is here to stay; President Trump is likely to impose punitive measures on China before the U.S. midterm elections; The U.S. Section 301 investigation into China's intellectual…