Supply and demand shocks in markets critical to the renewable-energy and defense industries will continue to play havoc with prices, which will negatively impact capex. In the short run, this benefits China given its already-dominant…

Executive Summary Euro Natgas Soars; LME Nickel Squeezed Russian Energy Minister Alexander Novak's threat to halt shipmentsof natgas on Nord Stream 1 to Europe lifted European gas prices 25% overnight, and will…

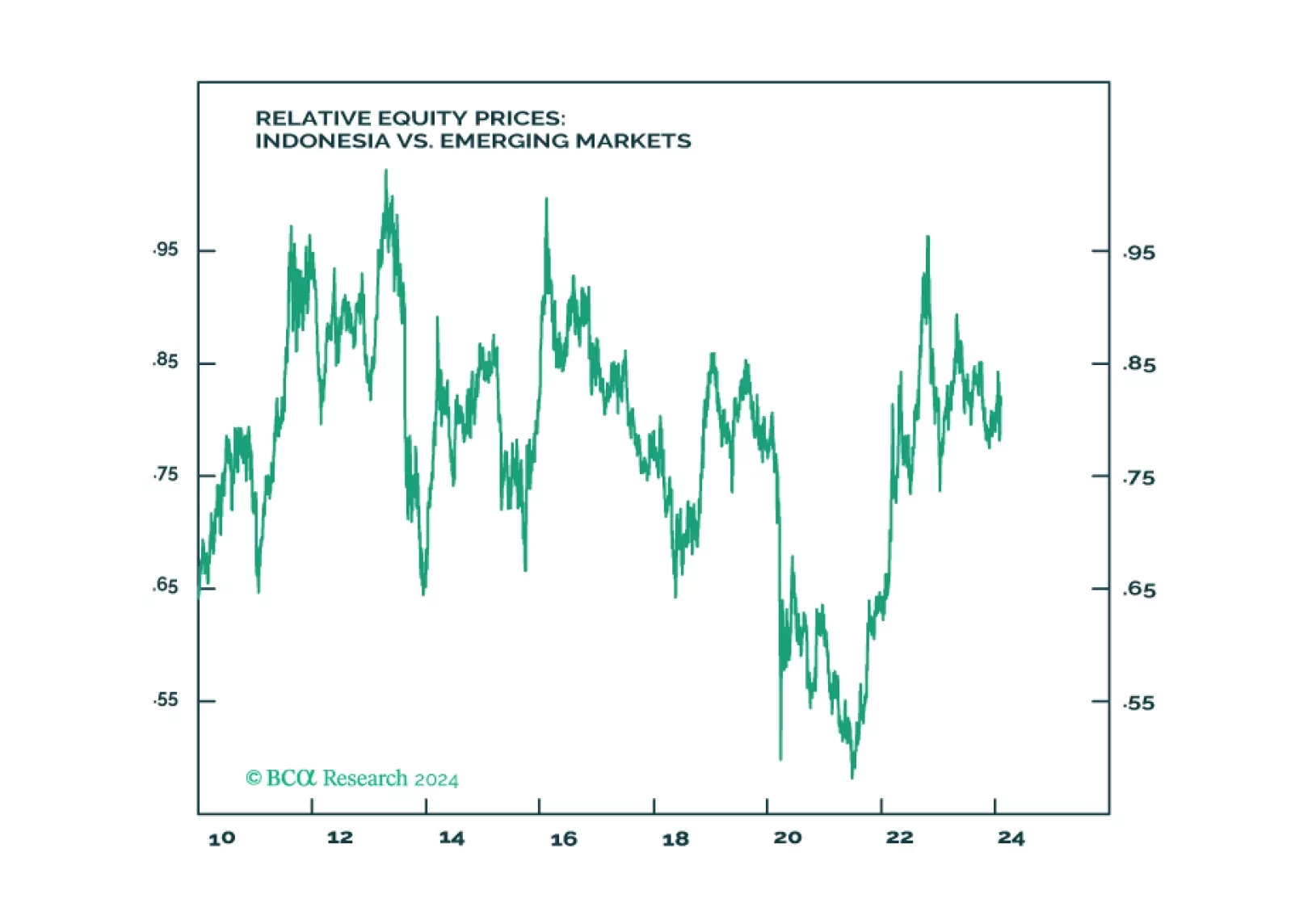

Highlights The faster-than-expected oil-demand recovery from the COVID-19 omicron variant points to higher EM trade volumes this year and next, which, along with a weaker USD, will boost base-metals demand and prices (Chart of the Week…

Highlights In the short term, the US stock market price will track the 30-year T-bond price, with every 10 bps move in the yield moving the stock market and bond price by 2.5 percent. We think that the bond market will not allow the…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

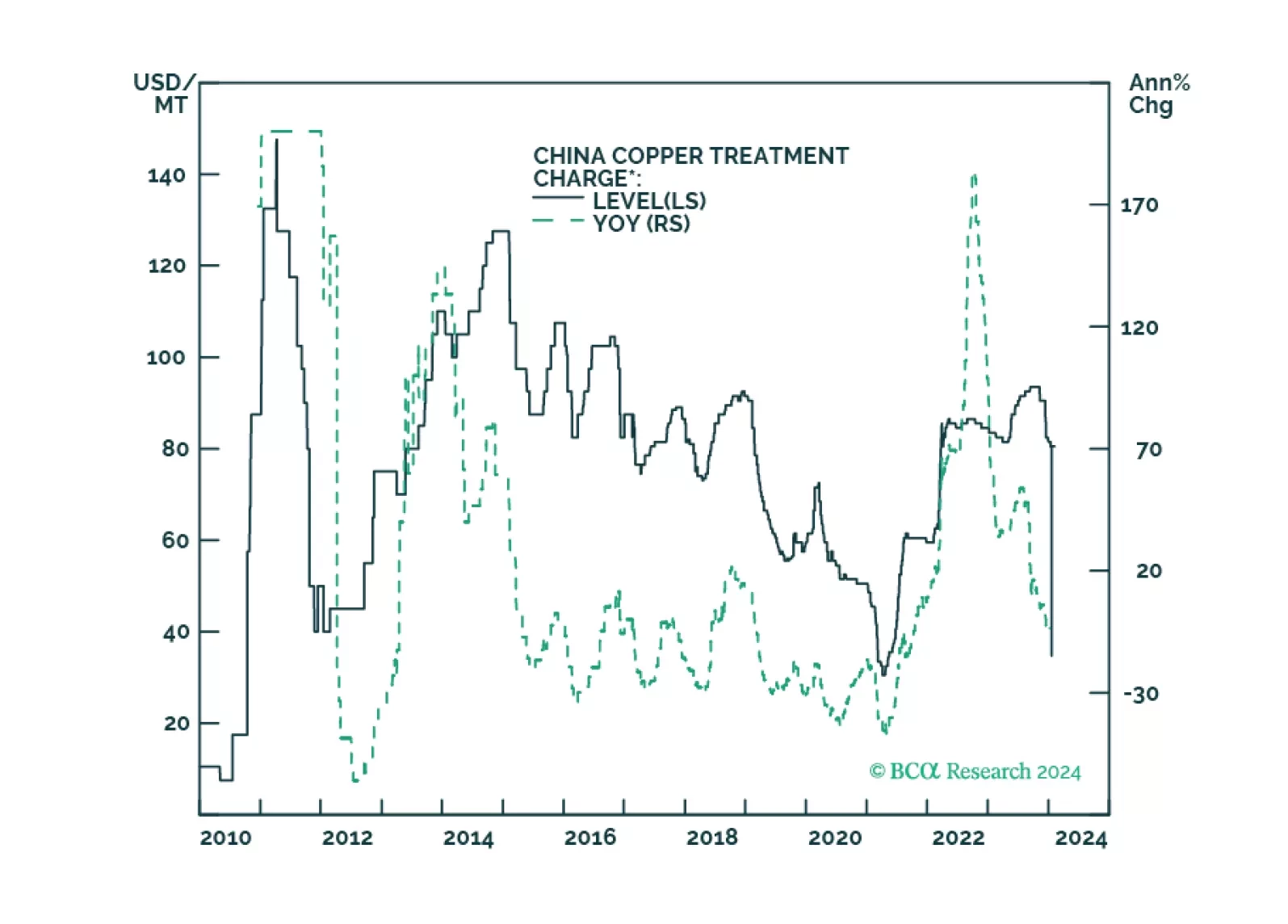

Highlights Political and corporate climate activism will increase the cost of developing the resources required to produce and deliver energy going forward – e.g., oil and gas wells; pipelines; copper mines, and refineries. Over…

Highlights Over the 2021-22 period, renewable capacity will account for 90% of global electricity-generation additions, per the IEA's latest forecast. This will follow the 45% surge (y/y) in renewable generation capacity added last…